What Are the Positions at Vc Firms?

Venture capital (VC) firms play a pivotal role in the startup ecosystem, providing funding, mentorship, and strategic guidance to emerging companies. Within these firms, a variety of positions exist, each contributing uniquely to the investment process and portfolio management. From entry-level analysts to senior partners, the hierarchy is structured to ensure efficient deal sourcing, due diligence, and value creation for portfolio companies. Understanding the roles within a VC firm is essential for aspiring professionals looking to break into the industry or entrepreneurs seeking to collaborate with investors. This article explores the key positions at VC firms, their responsibilities, and the skills required to excel in each role.

What Are the Positions at VC Firms?

Venture Capital (VC) firms are structured with various roles that contribute to the success of the firm and its portfolio companies. Each position has distinct responsibilities, and understanding these roles can provide insight into how VC firms operate. Below, we explore the key positions within a VC firm and their functions.

See Also How Are Hours Like When You Work for a Vc is There a Work Life Balance

How Are Hours Like When You Work for a Vc is There a Work Life Balance1. General Partners (GPs)

General Partners are the senior leaders of a VC firm. They are responsible for making investment decisions, managing the fund, and overseeing the overall strategy. GPs often have significant experience in entrepreneurship, finance, or a specific industry. They also play a crucial role in fundraising and maintaining relationships with limited partners (LPs).

2. Venture Partners

Venture Partners are typically experienced professionals who work with the firm on a part-time or project basis. They assist in sourcing deals, conducting due diligence, and providing mentorship to portfolio companies. Venture Partners often have deep industry expertise and networks that benefit the firm.

See AlsoWhy Doesn't Amazon Have a Venture Fund?3. Principals

Principals are mid-level professionals who play a key role in deal sourcing, evaluation, and execution. They often lead due diligence processes and work closely with portfolio companies post-investment. Principals are usually on track to become General Partners and are heavily involved in the day-to-day operations of the firm.

4. Associates

Associates are typically entry-level or junior professionals who support the investment team. Their responsibilities include market research, financial analysis, and assisting in due diligence. Associates often come from backgrounds in investment banking, consulting, or entrepreneurship and are looking to build a career in venture capital.

See Also What is the Best Deal Flow Management Tool for Venture Capital Firms

What is the Best Deal Flow Management Tool for Venture Capital Firms5. Analysts

Analysts are usually the most junior members of the team, focusing on data analysis, market research, and administrative tasks. They support the investment team by preparing reports, analyzing potential investments, and maintaining databases. Analysts often use this role as a stepping stone to more senior positions within the firm.

| Position | Key Responsibilities | Typical Background |

|---|---|---|

| General Partners (GPs) | Investment decisions, fund management, strategy oversight | Entrepreneurship, finance, industry expertise |

| Venture Partners | Deal sourcing, due diligence, mentorship | Industry expertise, extensive networks |

| Principals | Deal sourcing, due diligence, portfolio management | Mid-level experience, on track to become GPs |

| Associates | Market research, financial analysis, due diligence support | Investment banking, consulting, entrepreneurship |

| Analysts | Data analysis, market research, administrative tasks | Junior professionals, stepping stone role |

What are the positions in a VC firm?

1. General Partners (GPs)

General Partners are the senior leaders in a venture capital (VC) firm who oversee the firm's operations and investment decisions. They are responsible for raising funds, making investment decisions, and managing portfolio companies. Key responsibilities include:

- Fundraising: GPs are responsible for securing capital from limited partners (LPs) such as institutional investors, family offices, and high-net-worth individuals.

- Investment Decisions: They evaluate and decide which startups or companies to invest in, often based on market potential, team strength, and innovation.

- Portfolio Management: GPs actively work with portfolio companies to provide strategic guidance, mentorship, and connections to help them grow.

2. Venture Partners

Venture Partners are experienced professionals who work with VC firms on a part-time or project basis. They often bring industry expertise and networks to the firm. Their roles include:

- Deal Sourcing: They identify and bring potential investment opportunities to the firm.

- Due Diligence: Venture Partners assist in evaluating the viability and potential of startups.

- Mentorship: They provide guidance and support to portfolio companies, leveraging their industry experience.

3. Principals

Principals are mid-level professionals in a VC firm who play a critical role in the investment process. They are often seen as future General Partners. Their responsibilities include:

- Deal Execution: Principals lead the process of evaluating, negotiating, and closing investment deals.

- Market Research: They conduct in-depth research on industries and trends to identify promising investment opportunities.

- Portfolio Support: They work closely with portfolio companies to ensure their success and growth.

4. Associates

Associates are entry-level or junior professionals in a VC firm who support the investment team. They are often involved in analytical and operational tasks. Their duties include:

- Deal Screening: Associates review and filter potential investment opportunities before they reach senior team members.

- Data Analysis: They analyze financial data, market trends, and competitive landscapes to support decision-making.

- Administrative Support: Associates assist in preparing reports, presentations, and other materials for internal and external use.

5. Analysts

Analysts are typically the most junior members of a VC firm, often hired straight out of undergraduate or graduate programs. They focus on research and data-driven tasks. Their responsibilities include:

- Market Research: Analysts gather and analyze data on industries, competitors, and market trends.

- Financial Modeling: They build financial models to evaluate the potential returns of investments.

- Supporting Due Diligence: Analysts assist in the due diligence process by compiling and organizing relevant information.

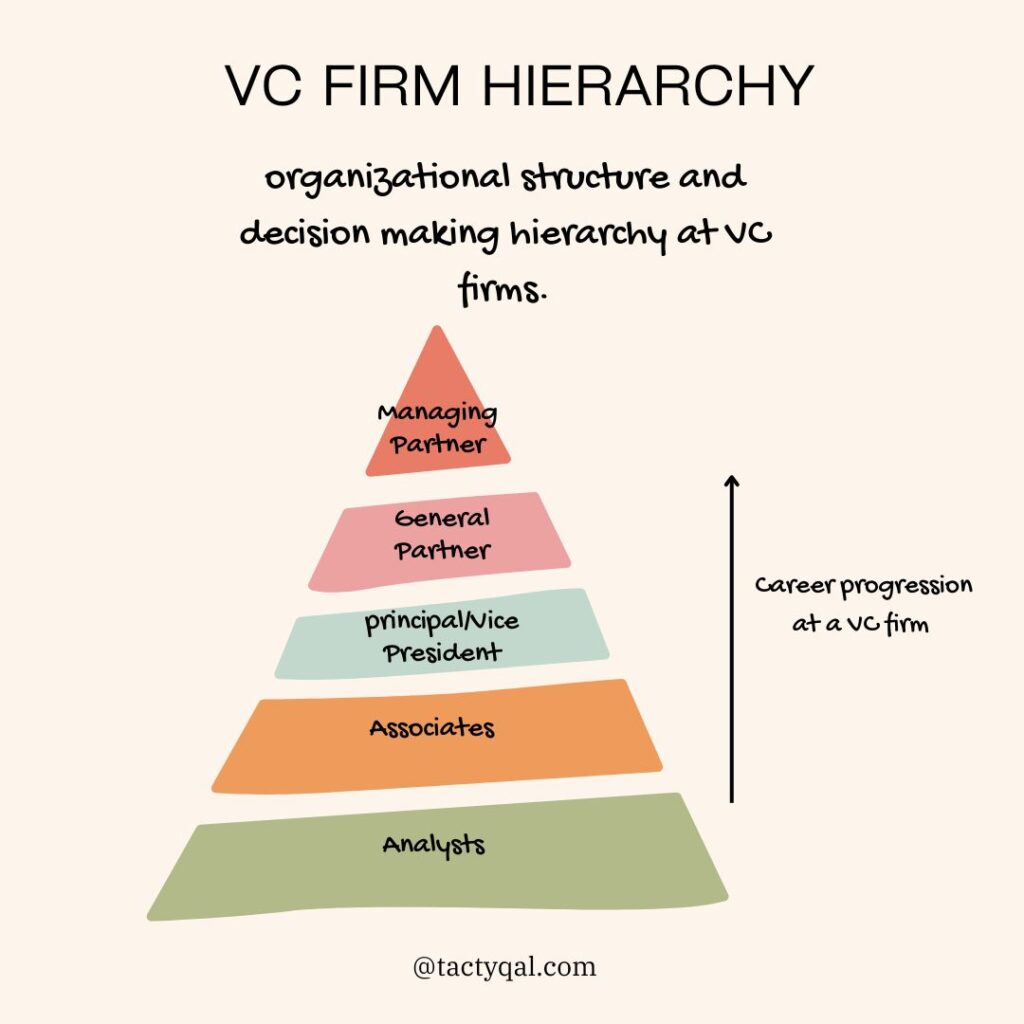

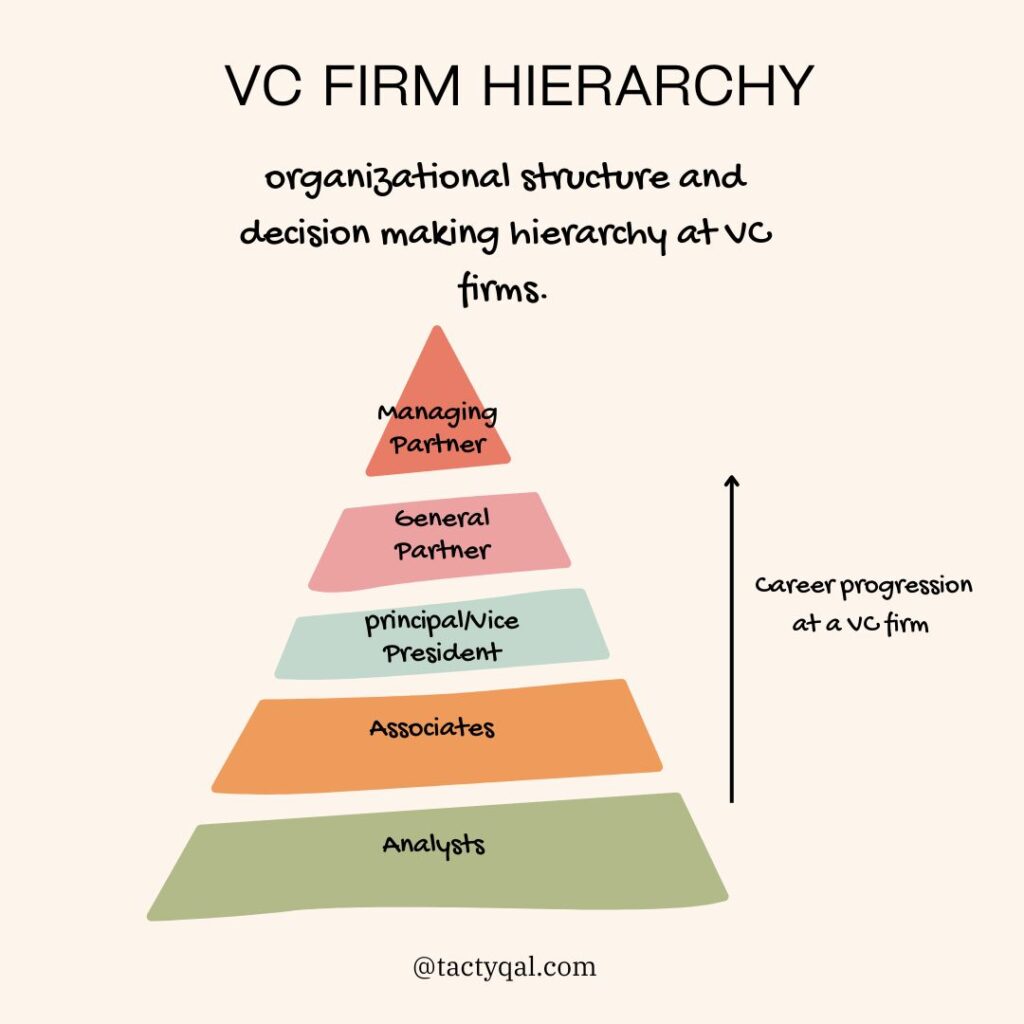

What is the hierarchy of a VC firm?

Overview of a VC Firm's Structure

A venture capital (VC) firm typically operates with a structured hierarchy to manage investments, decision-making, and operations efficiently. The hierarchy ensures that responsibilities are clearly defined, from sourcing deals to managing portfolio companies. Below is a detailed breakdown of the key roles within a VC firm:

- General Partners (GPs): The top decision-makers responsible for fund management, investment decisions, and overall strategy.

- Limited Partners (LPs): Investors who provide the capital but do not participate in day-to-day operations.

- Principals: Mid-level professionals who analyze deals, conduct due diligence, and support GPs in decision-making.

- Associates: Junior team members who assist with research, deal sourcing, and administrative tasks.

- Analysts: Entry-level roles focused on market research, financial modeling, and supporting senior team members.

Role of General Partners (GPs)

General Partners are the backbone of a VC firm, holding the highest level of authority and responsibility. They are involved in critical activities such as:

- Fundraising: GPs secure capital from Limited Partners to create investment funds.

- Deal Sourcing: They identify and evaluate potential investment opportunities.

- Decision-Making: GPs have the final say on which startups to invest in and how much capital to allocate.

- Portfolio Management: They oversee the performance of portfolio companies and provide strategic guidance.

- Exit Strategies: GPs plan and execute exits, such as IPOs or acquisitions, to generate returns for LPs.

Role of Limited Partners (LPs)

Limited Partners are the financial backbone of a VC firm, providing the capital needed for investments. Their primary responsibilities include:

- Capital Commitment: LPs commit funds to the VC firm, which are then deployed into startups.

- Passive Involvement: Unlike GPs, LPs do not participate in day-to-day operations or decision-making.

- Risk Sharing: LPs share the financial risks and rewards of the investments made by the VC firm.

- Monitoring Performance: They track the performance of the fund and expect regular updates from GPs.

- Legal Agreements: LPs enter into agreements outlining their rights, obligations, and profit-sharing terms.

Role of Principals in a VC Firm

Principals act as a bridge between senior leadership and junior team members, playing a crucial role in deal execution and analysis. Their responsibilities include:

- Deal Evaluation: Principals assess the viability of potential investments through market research and financial analysis.

- Due Diligence: They conduct in-depth investigations into startups' business models, teams, and financials.

- Deal Structuring: Principals help negotiate terms and structure investment agreements.

- Mentorship: They guide Associates and Analysts in their professional development.

- Reporting: Principals prepare reports and presentations for GPs to aid in decision-making.

Role of Associates and Analysts

Associates and Analysts form the foundation of a VC firm, handling essential tasks that support the investment process. Their duties include:

- Market Research: They analyze industry trends and identify emerging opportunities.

- Financial Modeling: Associates and Analysts create models to evaluate the financial potential of startups.

- Deal Sourcing: They assist in identifying potential investment targets through networking and research.

- Administrative Support: These roles handle scheduling, documentation, and other operational tasks.

- Learning and Growth: Associates and Analysts gain valuable experience and insights to advance their careers in venture capital.

Importance of Hierarchy in a VC Firm

The hierarchical structure of a VC firm ensures efficiency, accountability, and specialization. Key benefits include:

- Clear Roles: Each team member has defined responsibilities, reducing overlap and confusion.

- Efficient Decision-Making: The hierarchy streamlines the process of evaluating and approving investments.

- Scalability: A structured organization allows the firm to manage multiple funds and portfolio companies effectively.

- Knowledge Transfer: Senior members mentor junior staff, fostering professional growth and continuity.

- Investor Confidence: A well-defined hierarchy reassures LPs and other stakeholders about the firm's professionalism and stability.

What are venture capital firms employees called?

What Are Venture Capital Firms Employees Called?

Employees of venture capital firms are typically referred to as venture capitalists or VC professionals. These individuals are responsible for identifying, evaluating, and investing in high-potential startups and businesses. Their roles can vary widely depending on their seniority and specialization within the firm.

- Venture Capitalists: These are the primary decision-makers who evaluate investment opportunities and manage portfolios.

- Analysts: Junior employees who conduct market research and due diligence on potential investments.

- Associates: Mid-level professionals who support senior team members in deal sourcing and execution.

Roles Within a Venture Capital Firm

Venture capital firms have a structured hierarchy with distinct roles and responsibilities. Each position contributes to the firm's overall success in identifying and nurturing promising startups.

- Partners: Senior members who lead the firm and make final investment decisions.

- Principals: Experienced professionals who manage deals and mentor junior staff.

- Analysts and Associates: Entry-level and mid-level employees who handle research and operational tasks.

Key Responsibilities of Venture Capital Employees

The responsibilities of venture capital employees vary based on their roles, but they generally revolve around sourcing, evaluating, and managing investments.

- Deal Sourcing: Identifying potential investment opportunities through networking and market research.

- Due Diligence: Conducting thorough analysis of startups' financials, market potential, and team capabilities.

- Portfolio Management: Supporting portfolio companies with strategic guidance and resources.

Skills Required for Venture Capital Professionals

Working in venture capital requires a unique set of skills to navigate the fast-paced and high-stakes environment of startup investing.

- Analytical Skills: Ability to assess financial data and market trends.

- Networking Skills: Building relationships with entrepreneurs, investors, and industry experts.

- Strategic Thinking: Making informed decisions to maximize returns on investments.

Career Path in Venture Capital

A career in venture capital often follows a structured progression, with opportunities for advancement based on experience and performance.

- Analyst: Entry-level role focused on research and data analysis.

- Associate: Mid-level role involving deal execution and portfolio support.

- Partner: Senior role with decision-making authority and leadership responsibilities.

What is the difference between an associate and an analyst in VC?

Roles and Responsibilities of an Associate in VC

An Associate in venture capital (VC) typically holds a more senior position compared to an Analyst. Their responsibilities often include:

- Deal sourcing: Identifying and evaluating potential investment opportunities.

- Due diligence: Conducting in-depth research and analysis on startups, including financials, market potential, and competitive landscape.

- Portfolio management: Supporting portfolio companies with strategic advice and monitoring their progress.

- Networking: Building relationships with entrepreneurs, other investors, and industry experts.

- Deal execution: Assisting in structuring and closing investment deals.

Roles and Responsibilities of an Analyst in VC

An Analyst in venture capital is usually an entry-level role focused on supporting the investment team. Their key responsibilities include:

- Market research: Analyzing industry trends and identifying emerging sectors.

- Data analysis: Compiling and interpreting data to support investment decisions.

- Deal screening: Reviewing pitch decks and initial startup evaluations.

- Reporting: Preparing reports and presentations for internal and external stakeholders.

- Administrative support: Assisting with scheduling, meetings, and other operational tasks.

Experience and Qualifications Required

The experience and qualifications for Associates and Analysts differ significantly:

- Associates: Typically have 2-4 years of experience in investment banking, consulting, or a related field, often holding an MBA or equivalent advanced degree.

- Analysts: Usually recent graduates with a bachelor's degree in finance, business, or a related field, often with internships or limited work experience.

- Skill sets: Associates are expected to have strong leadership and decision-making skills, while Analysts focus on analytical and research capabilities.

Career Progression in VC

The career progression for Associates and Analysts in VC follows distinct paths:

- Analyst: Often a 1-2 year role, serving as a stepping stone to more senior positions or other opportunities in finance.

- Associate: A mid-level role that can lead to positions like Senior Associate, Principal, or Partner.

- Long-term growth: Associates have a clearer path to leadership roles, while Analysts may need to transition to other roles or firms to advance.

Impact on Investment Decisions

The impact of Associates and Analysts on investment decisions varies:

- Associates: Play a direct role in shaping investment strategies and making recommendations to senior partners.

- Analysts: Provide foundational research and data that inform decisions but typically do not have final decision-making authority.

- Collaboration: Both roles work closely together, with Associates often relying on Analysts' insights to support their recommendations.

Frequently Asked Questions by our Community

What are the common positions at VC firms?

Venture capital (VC) firms typically have a structured hierarchy with several key roles. The most common positions include Analysts, Associates, Principals, Partners, and Managing Partners. Analysts and Associates are usually entry-level roles focused on market research, due diligence, and deal sourcing. Principals take on more responsibility, often leading deals and managing relationships with portfolio companies. Partners and Managing Partners are senior roles involved in decision-making, fundraising, and overall firm strategy.

What does an Analyst do at a VC firm?

An Analyst at a VC firm is typically responsible for conducting market research, analyzing investment opportunities, and supporting senior team members. They often create financial models, prepare investment memos, and assist in due diligence processes. This role is crucial for identifying emerging trends and evaluating the potential of startups. While it is an entry-level position, it provides a solid foundation for understanding the venture capital ecosystem and advancing to higher roles.

What is the role of a Partner in a VC firm?

A Partner in a VC firm holds a senior position and is heavily involved in decision-making processes. They are responsible for sourcing and closing deals, managing relationships with entrepreneurs and investors, and overseeing portfolio companies. Partners also play a key role in fundraising efforts and setting the strategic direction of the firm. Their experience and network are critical to the firm's success, as they often have the final say on which startups receive funding.

How does one become a Managing Partner at a VC firm?

Becoming a Managing Partner at a VC firm typically requires extensive experience in venture capital, entrepreneurship, or a related field. Most Managing Partners have a proven track record of successful investments and a deep network within the industry. They often start in junior roles, such as Analyst or Associate, and gradually move up to Principal and Partner positions. Leadership skills, strategic vision, and the ability to raise funds are essential qualities for this top-tier role, which involves overseeing the entire firm and making high-stakes decisions.

Leave a Reply

Our Recommended Articles