How to Dissolve an LLC in Wisconsin

Dissolving a limited liability company (LLC) in Wisconsin requires careful adherence to state-specific legal and administrative procedures to ensure compliance and avoid future liabilities. Whether due to business closure, restructuring, or relocation, properly winding down an LLC involves multiple steps, including member approval, settling debts, and filing dissolution documents with the Wisconsin Department of Financial Institutions (DFI). Understanding the process—from tax obligations to notifying creditors—is essential to protect personal assets and maintain good standing. This guide outlines the key actions needed to dissolve an LLC in Wisconsin efficiently, helping business owners navigate legal requirements, minimize costs, and finalize their business affairs with confidence.

Step-by-Step Guide to Dissolving an LLC in Wisconsin

To dissolve an LLC in Wisconsin, you must follow specific legal procedures outlined by the state. This includes settling debts, filing dissolution documents, and notifying relevant parties. Failure to comply with statutory requirements may result in penalties or lingering liabilities. Below is a detailed breakdown of the process, including critical subtopics and actionable steps.

See AlsoWisconsin LLC Filing FeeUnderstanding Legal Requirements for Dissolving an LLC in Wisconsin

Dissolving an LLC in Wisconsin requires adherence to state laws under Wisconsin Statutes Chapter 183. Key steps include obtaining member approval (as per the LLC operating agreement), settling outstanding debts, and filing Articles of Dissolution with the Wisconsin Department of Financial Institutions (DFI). Ensure compliance with tax obligations, including final state tax filings.

| Member Approval | Vote to dissolve as specified in the LLC agreement. |

| Articles of Dissolution | File Form 512 with the DFI ($20 filing fee). |

| Debt Settlement | Pay creditors and resolve liabilities before dissolution. |

| Tax Clearance | Submit final tax returns to the Wisconsin Department of Revenue. |

| Publication | Some counties require publishing a dissolution notice. |

Filing Articles of Dissolution in Wisconsin

The Articles of Dissolution (Form 512) formally terminates the LLC’s existence. Submit the form online or by mail to the DFI, along with the $20 fee. Indicate whether the LLC has debts or remaining assets. If assets remain, outline plans for distribution.

See AlsoHow to Dissolve an LLC in Minnesota| Form 512 | Mandatory dissolution document filed with the DFI. |

| Filing Fee | $20, payable online or via check. |

| Processing Time | Typically 5-7 business days. |

| Effective Date | Dissolution is effective upon DFI approval. |

Tax Obligations When Closing a Wisconsin LLC

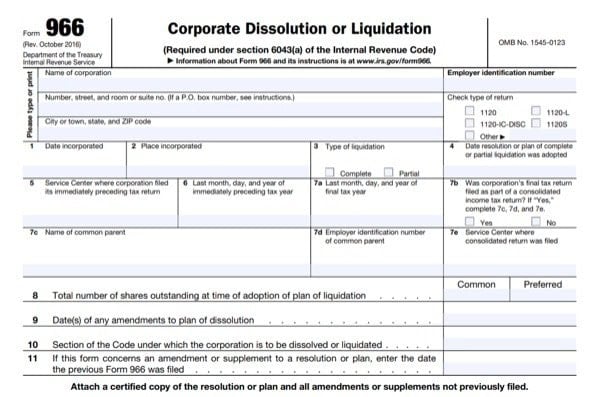

Before dissolving, file final federal and state tax returns. Notify the IRS and the Wisconsin Department of Revenue by submitting Form 966 (federal) and a Final Sales Tax Return (state). Cancel EINs and business licenses to avoid future liabilities.

| Federal Taxes | File IRS Form 966 for corporate LLCs. |

| State Taxes | Submit final income and sales tax returns. |

| EIN Cancellation | Notify the IRS to close your Employer Identification Number. |

| Unemployment Taxes | Report final wages to the Wisconsin DWD. |

Notifying Creditors and Settling Debts

Wisconsin law requires LLCs to notify known creditors of dissolution. Settle all debts or establish a plan for repayment. Unresolved debts may expose members to personal liability. Publish a dissolution notice if required by local county regulations.

See AlsoHow to Dissolve an LLC in Ohio| Creditor Notice | Send written notice to all known creditors. |

| Debt Resolution | Pay debts or set aside funds for unresolved claims. |

| Publication Requirement | Check county rules for public notice mandates. |

| Liability Protection | Proper dissolution shields members from future claims. |

Reinstating a Dissolved LLC in Wisconsin

If an LLC is dissolved administratively (e.g., for non-compliance), it may be reinstated within 2 years by filing Form 15 with the DFI, paying $40, and resolving outstanding issues like unpaid taxes or fees.

| Reinstatement Form | File Form 15 with the Wisconsin DFI. |

| Reinstatement Fee | $40 processing fee. |

| Compliance | Address all compliance issues (e.g., taxes, reports). |

| Time Limit | Must apply within 2 years of dissolution. |

How much does it cost to dissolve an LLC in Wisconsin?

State Filing Fees for Dissolving an LLC in Wisconsin

To formally dissolve an LLC in Wisconsin, you must file Articles of Dissolution with the Wisconsin Department of Financial Institutions (DFI). The filing fee is $20 as of 2023. This fee applies whether you file online, by mail, or in person.

- Articles of Dissolution: Mandatory form with a $20 filing fee.

- Expedited processing: Costs an additional $25 for same-day or next-business-day service.

- Certified copies: Optional copies of dissolution documents cost $10 each.

Outstanding Taxes and Annual Report Fees

Before dissolving, your LLC must settle all outstanding taxes and file final annual reports. Wisconsin requires LLCs to be in good standing to dissolve.

- Annual reports: $25 per year for any unfiled reports (due annually by the end of your LLC’s registration month).

- State taxes: Resolve unpaid income, sales, or franchise taxes with the Wisconsin Department of Revenue.

- Penalties: Late fees or interest may apply for overdue taxes or reports.

Legal and Professional Service Costs

Hiring an attorney or online service can streamline dissolution but adds to the total cost.

- Attorney fees: Typically range from $200 to $1,500+, depending on complexity (e.g., resolving member disputes or debts).

- Online services: Platforms like LegalZoom charge $100–$300+ (excluding state fees).

- Registered agent fees: If using a professional agent, ensure their services are paid through the dissolution date.

Tax Clearance Certificate Requirements

Wisconsin does not require a tax clearance certificate for LLC dissolution, but confirming tax compliance is critical.

- Tax compliance check: Contact the Wisconsin Department of Revenue to verify no taxes are owed.

- Voluntary confirmation: Request a tax status letter if needed for creditors or partners (no official fee).

- Federal taxes: File final IRS Form 966 and settle federal obligations separately.

Publication and Notification Expenses

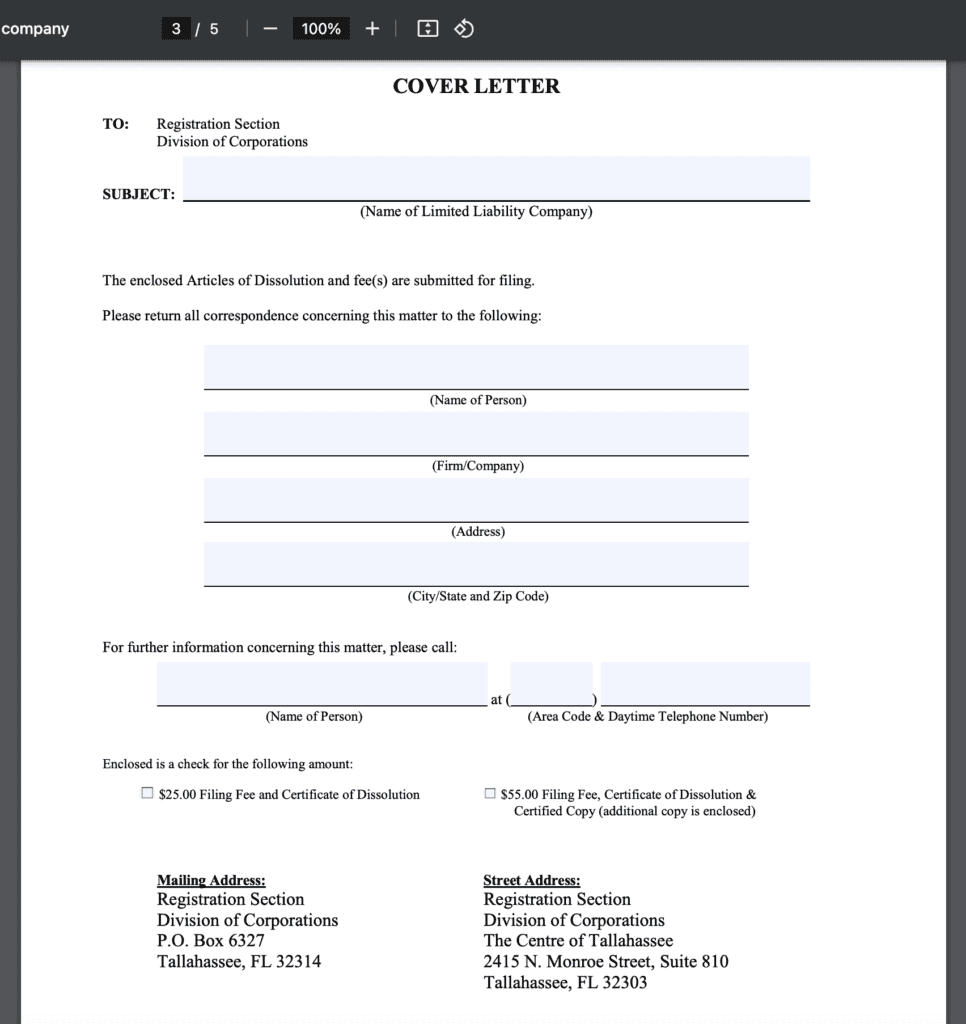

While Wisconsin does not mandate publication of dissolution notices, notifying creditors and settling debts is legally required.

- Creditor notifications: Send written notices to all known creditors (costs vary by method).

- Debt settlements: Allocate funds to pay outstanding liabilities before distributing remaining assets.

- Optional publication: Some LLCs publish dissolution notices in local newspapers for transparency (approximately $50–$200).

What form do I need to dissolve an LLC in Wisconsin?

What Form Is Required to Dissolve an LLC in Wisconsin?

To dissolve an LLC in Wisconsin, you must file the Articles of Dissolution for a Domestic Limited Liability Company (Form SBD-11025) with the Wisconsin Department of Financial Institutions (WDFI). This form officially terminates the LLC’s legal existence.

- Complete Form SBD-11025, providing details like the LLC name, date of dissolution, and a statement confirming debts and obligations are settled.

- Include the $20 filing fee (as of 2023) via check, money order, or online payment.

- Submit the form online through the WDFI’s e-file system, by mail, or in person.

Steps to Dissolve an LLC in Wisconsin

Dissolving an LLC involves more than just filing a form. Follow these steps to ensure compliance with state requirements:

- Vote to dissolve: Members must approve dissolution per the LLC’s operating agreement or state law.

- Settle debts: Pay off creditors and distribute remaining assets to members.

- File Articles of Dissolution: Submit Form SBD-11025 to the WDFI.

- Cancel licenses/permits: Notify state and local agencies to terminate business registrations.

- File final tax returns: Submit state and federal tax documents, including a Tax Clearance Request (Form TR-204) to the Wisconsin Department of Revenue.

Tax Obligations When Dissolving an LLC in Wisconsin

Before dissolving, ensure all tax obligations are met to avoid penalties or delays:

- File final state tax returns for sales tax, withholding tax, and corporate income tax.

- Request a Tax Clearance using Form TR-204 to confirm no outstanding tax liabilities.

- Close the LLC’s Employer Identification Number (EIN) with the IRS.

- Notify the Wisconsin Department of Revenue in writing about the dissolution.

Notifying Creditors and Settling Debts

Wisconsin requires LLCs to resolve financial obligations before dissolution:

- Notify creditors in writing about the dissolution and provide a deadline for claims.

- Settle valid claims by paying debts or disputing them in court.

- Distribute remaining assets to members after debts are resolved, following the LLC’s operating agreement.

Common Mistakes to Avoid When Dissolving an LLC

Avoid these errors to ensure a smooth dissolution process:

- Failing to file Articles of Dissolution, which leaves the LLC active and subject to fees.

- Ignoring tax obligations, leading to penalties or audits.

- Not notifying creditors, which could result in personal liability for members.

- Overlooking local permits, such as business licenses that require separate cancellation.

How do I officially close an LLC?

Steps to Dissolve an LLC Officially

To officially close an LLC, you must follow a structured legal process. Begin by voting to dissolve the LLC as per the operating agreement or state law. Next, file Articles of Dissolution (or a similar document) with your state’s business filing office. Ensure all taxes, debts, and obligations are settled, notify creditors, and distribute remaining assets to members.

- Review the operating agreement for dissolution procedures.

- File dissolution paperwork with the state, often called Articles of Dissolution.

- Liquidate assets and settle outstanding debts or taxes.

Tax Requirements for Closing an LLC

Closing an LLC requires fulfilling federal, state, and local tax obligations. File a final tax return with the IRS and state revenue agency, marking it as final. Cancel the LLC’s Employer Identification Number (EIN) and close any business tax accounts.

- File Form 966 with the IRS if the LLC has corporate tax status.

- Submit final employment tax returns and issue W-2s or 1099s if applicable.

- Pay outstanding sales, payroll, or franchise taxes to avoid penalties.

Notifying Creditors and Settling Debts

Legally, LLCs must inform creditors of dissolution and resolve debts. Send written notices to known creditors and publish a dissolution notice in a local newspaper if required by state law. Use remaining assets to pay liabilities before distributing funds to members.

- Identify all creditors and send certified dissolution notices.

- Follow state guidelines for public notification of dissolution.

- Prioritize debt repayment to avoid personal liability claims.

Distributing Remaining Assets

After settling debts, distribute remaining assets to LLC members according to ownership percentages or the operating agreement. Ensure compliance with state laws to prevent disputes or legal challenges.

- Liquidate physical assets (e.g., equipment, property).

- Allocate cash reserves based on member contributions or agreements.

- Document distributions in writing for legal protection.

State-Specific Dissolution Requirements

Each state has unique rules for dissolving an LLC. Check with your Secretary of State for specific forms, fees, and procedures. Some states require a certificate of good standing before allowing dissolution.

- Research state dissolution forms (e.g., Certificate of Termination).

- Pay state filing fees, which vary by jurisdiction.

- Obtain tax clearance certificates if mandated by the state.

Should I dissolve my LLC or leave it as inactive?

Factors to Consider When Deciding to Dissolve or Inactivate an LLC

Deciding between dissolving an LLC or leaving it inactive depends on several factors. Key considerations include:

- Future business plans: If you may restart the business, keeping the LLC inactive avoids re-registration costs.

- Ongoing costs: Inactive LLCs often still require annual fees, taxes, or filings, whereas dissolving ends these obligations.

- Liability protection: An inactive LLC may retain liability protection for past activities, while dissolution terminates this.

Financial Implications of Dissolving vs. Inactivating an LLC

Financial factors heavily influence this decision:

- Dissolution costs: States may charge fees to formally dissolve the LLC, but this avoids recurring expenses.

- Tax obligations: Inactive LLCs may still owe state franchise taxes or federal filing fees (e.g., Form 5472 for foreign-owned LLCs).

- Debt management: Dissolving requires settling debts, while inactive LLCs retain responsibility for unresolved liabilities.

Legal and Administrative Responsibilities for Inactive LLCs

Even inactive LLCs have obligations:

- Annual reports: Most states mandate filings and fees, regardless of business activity.

- Registered agent: Maintaining a registered agent is often required, adding to costs.

- Compliance risks: Missing deadlines can lead to penalties or involuntary dissolution by the state.

Pros and Cons of Dissolving an LLC

Pros:

- Eliminates ongoing fees and compliance burdens.

- Closes liability exposure for future claims.

Cons:

- Loss of business name rights in some states.

- Rebuilding credit history if restarting later.

How State Laws Affect LLC Dissolution or Inactive Status

State regulations vary significantly:

- Inactivity rules: Some states don’t recognize “inactive” status, requiring dissolution.

- Reinstatement processes: Reactivating a dissolved LLC may involve higher fees than maintaining inactive status.

- Tax treatment: States like California impose minimum franchise taxes even on inactive LLCs.

Frequently Asked Questions About LLCs (FAQs)

What are the steps to dissolve an LLC in Wisconsin?

To dissolve an LLC in Wisconsin, you must follow a formal process. First, review your LLC’s operating agreement for dissolution requirements, such as member voting procedures. Next, file Articles of Dissolution with the Wisconsin Department of Financial Institutions (DFI), either online or by mail. Ensure all state taxes, fees, and annual reports are up to date before filing. You must also notify creditors, settle outstanding debts, and distribute remaining assets to members according to ownership percentages or the operating agreement.

Is there a specific form required to dissolve an LLC in Wisconsin?

Yes, you must submit the Articles of Dissolution (Form 588) to the Wisconsin DFI. This form requires basic details like the LLC’s name, date of dissolution, and a statement confirming that dissolution was approved by members or as outlined in the operating agreement. Filing fees apply, and you may need to include a tax clearance certificate if the LLC has employees or sales tax obligations.

Do I need to notify creditors when dissolving an LLC in Wisconsin?

Yes, Wisconsin law requires LLCs to formally notify creditors of the dissolution. This involves sending written notices to known claimants and publishing a public notice in a newspaper in the county where the LLC’s principal office is located. Creditors typically have 120 days from the notice date to file claims. Failure to properly notify creditors could expose members to personal liability for unresolved debts.

What tax obligations remain after dissolving an LLC in Wisconsin?

Even after dissolution, your LLC must file final tax returns with the Wisconsin Department of Revenue. This includes income tax, sales tax, and payroll tax returns, if applicable. You may also need to cancel your EIN with the IRS and close state tax accounts. Outstanding tax liabilities or unfiled returns can delay dissolution or result in penalties. A tax clearance certificate may be required to confirm all obligations are met.

Leave a Reply

Our Recommended Articles