How to Dissolve an LLC in Minnesota

Dissolving a limited liability company (LLC) in Minnesota requires careful adherence to state-specific procedures to ensure compliance and avoid potential legal or financial complications. Whether due to business closure, restructuring, or a shift in entrepreneurial goals, properly winding down an LLC involves multiple steps, including member voting, filing dissolution documents with the state, settling outstanding debts, and addressing tax obligations. Minnesota’s statutes outline clear guidelines for this process, but overlooking details can lead to penalties or lingering liabilities. This article provides a step-by-step overview of how to legally dissolve an LLC in Minnesota, ensuring stakeholders fulfill all requirements while safeguarding personal assets and maintaining regulatory compliance.

How to Dissolve an LLC in Minnesota

Understanding the Legal Requirements for Dissolution

To dissolve an LLC in Minnesota, you must follow state-specific legal requirements. First, review the LLC’s operating agreement for dissolution provisions, such as member voting rules. If the agreement is silent, Minnesota law requires majority approval from members. Next, file Articles of Dissolution with the Minnesota Secretary of State to formally terminate the LLC. Ensure all tax obligations and outstanding debts are settled before filing to avoid complications.

See AlsoHow to Dissolve an LLC in Louisiana| Step | Description |

| Member Approval | Obtain majority vote unless the operating agreement specifies otherwise. |

| File Articles of Dissolution | Submit the form to the Minnesota Secretary of State with a $50 fee. |

| Tax Clearance | Settle state taxes and file final tax returns with the Minnesota Department of Revenue. |

Filing Articles of Dissolution with the State

The Articles of Dissolution is the primary document for dissolving an LLC in Minnesota. It requires the LLC’s name, date of dissolution, and a statement confirming member approval. File the form online or by mail with the Minnesota Secretary of State, along with a $50 filing fee. Expedited processing is available for an additional cost. Once approved, the state issues a Certificate of Dissolution, legally ending the LLC’s existence.

| Requirement | Details |

| Filing Method | Online, mail, or in-person submission. |

| Fee | $50 standard fee; $15-$35 for expedited service. |

| Processing Time | 7-10 business days (standard), 24 hours (expedited). |

Settling Tax Obligations and Final Filings

Before dissolving, Minnesota requires LLCs to resolve all tax liabilities. File a Final Minnesota Tax Return with the Department of Revenue, including sales tax, withholding tax, and corporate franchise tax (if applicable). Request a Tax Clearance Letter to confirm no outstanding taxes. Failure to do so may delay dissolution or result in penalties.

See Also What Are the Documents I Need to Present to a Potential Angel Investor to Get Funded Besides My Business Plan

What Are the Documents I Need to Present to a Potential Angel Investor to Get Funded Besides My Business Plan| Tax Type | Action Required |

| Sales Tax | File final sales tax return and pay balances. |

| Withholding Tax | Submit final withholding report and payments. |

| Franchise Tax | File final return (if applicable) and settle dues. |

Notifying Creditors and Settling Debts

Minnesota law requires LLCs to notify creditors and settle outstanding debts before dissolution. Send written notices to known creditors and publish a dissolution announcement in a local newspaper (if required). Retain sufficient funds to cover claims, and resolve disputes through mediation or payment. Document all communications for legal protection.

| Step | Details |

| Notify Creditors | Send written notices via certified mail. |

| Publish Notice | Check county requirements for newspaper publication. |

| Hold Funds | Retain assets to cover unresolved claims for 120 days. |

Distributing Remaining Assets to Members

After settling debts, distribute remaining assets to members according to the operating agreement or Minnesota’s default rules (based on ownership percentages). Document distributions to avoid disputes. If the LLC has no assets, file a Statement of No Assets with the state. Ensure compliance with federal tax guidelines for asset transfers.

See Also What is It Like to Be an Analyst at a Venture Capital Firm?

What is It Like to Be an Analyst at a Venture Capital Firm?| Consideration | Guidance |

| Operating Agreement | Follow profit-sharing terms outlined in the agreement. |

| Tax Implications | Report asset distributions on members’ personal tax returns. |

| Documentation | Maintain records of distributions for 7 years. |

How much does it cost to dissolve an LLC in Minnesota?

State Filing Fees for Dissolving an LLC in Minnesota

The primary cost to dissolve an LLC in Minnesota is the state filing fee for submitting the Articles of Dissolution. The fee is $50 as of 2023, payable to the Minnesota Secretary of State. This form officially terminates the LLC’s legal existence.

See AlsoHow to Dissolve an LLC in Ohio- Submit the Articles of Dissolution (form MN LLC 705) online, by mail, or in person.

- Pay the $50 filing fee via credit card, check, or money order.

- Expedited processing costs an additional fee (e.g., $20 for 24-hour service).

Outstanding Taxes and Penalties

Before dissolving, Minnesota requires LLCs to settle all outstanding taxes and file final tax returns. Unpaid taxes or penalties may delay dissolution or incur fines.

- File a final income tax return with the Minnesota Department of Revenue.

- Resolve any sales tax or payroll tax obligations.

- Request a Certificate of Tax Clearance (if applicable) to confirm no debts exist.

Legal and Professional Service Costs

Hiring an attorney or business service provider can add to dissolution costs, but ensures compliance with state requirements.

- Legal fees typically range from $200 to $1,000+ depending on complexity.

- Online legal services charge $100–$300 for dissolution document preparation.

- Consult a CPA to finalize tax filings ($150–$500).

Outstanding Debts and Contract Obligations

LLCs must settle debts and notify creditors before dissolving to avoid personal liability for members.

- Notify creditors in writing about the dissolution.

- Pay or negotiate outstanding loans and invoices.

- Terminate leases, licenses, or contracts to prevent future claims.

Reinstatement Fees for Improper Dissolution

Failure to follow Minnesota’s dissolution process may result in reinstatement fees or penalties.

- Reinstating a dissolved LLC costs $25 (filing fee) plus any unpaid taxes or reports.

- Late Annual Renewal fees ($0 for dissolution, but $0 if dissolved mid-year).

- Address compliance issues promptly to avoid administrative dissolution by the state.

How do I officially close an LLC?

Understanding the Legal Requirements for Closing an LLC

To officially close an LLC, you must first comply with state-specific legal requirements. This typically involves a formal vote by LLC members to dissolve the business, as outlined in the operating agreement. Failure to follow these steps may result in penalties or continued liability.

- Review your LLC’s operating agreement for dissolution procedures.

- Hold a formal vote among members to approve dissolution, documenting the decision in writing.

- Check state-specific rules, such as filing articles of dissolution or a certificate of termination with the state agency.

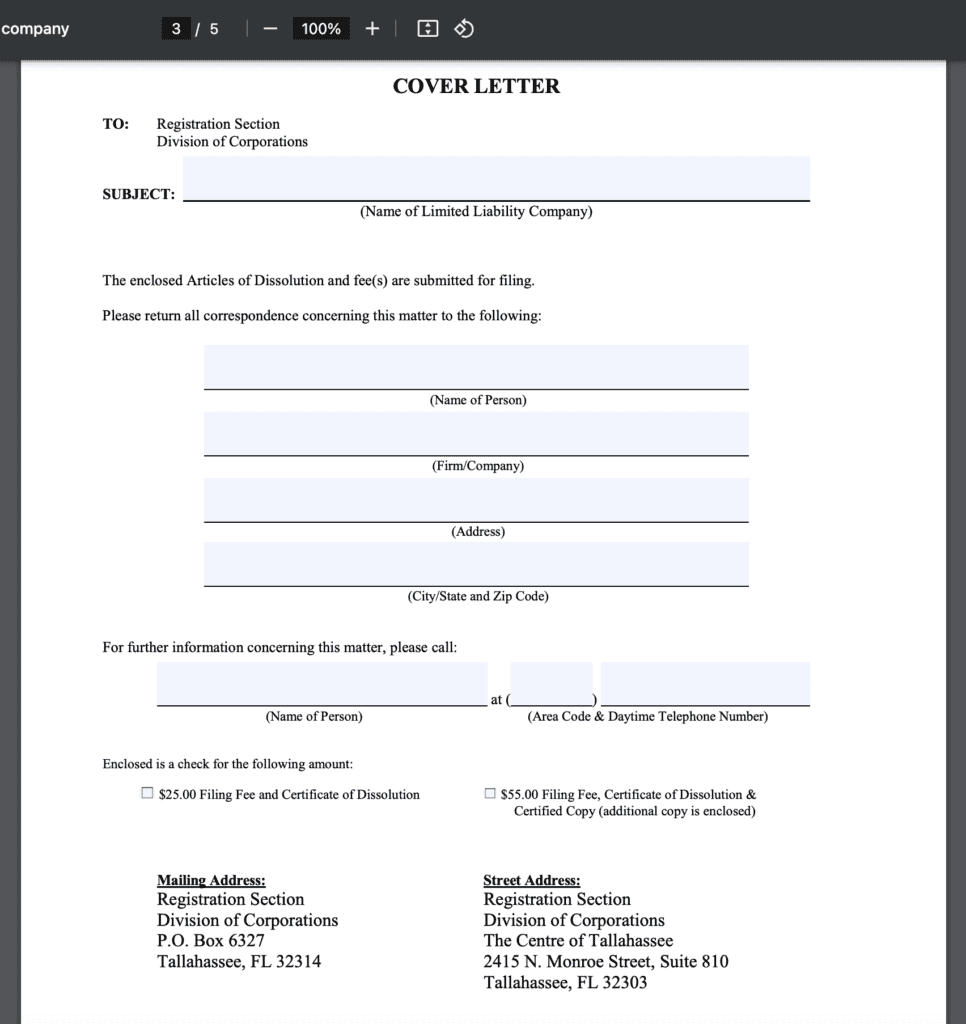

Filing Articles of Dissolution

Filing articles of dissolution (or a similar document) is a critical step to legally terminate an LLC. This form notifies the state that the business is ceasing operations.

- Obtain the correct dissolution form from your state’s Secretary of State website or office.

- Complete the form, including details like LLC name, reason for dissolution, and member approval.

- Submit the form with the required filing fee, which varies by state.

Settling Debts and Obligations

Before closing, all debts, taxes, and legal obligations must be resolved to avoid future claims against the LLC or its members.

- Notify creditors in writing and settle outstanding debts.

- Pay final state and federal taxes, including payroll and sales taxes.

- Resolve pending contracts, leases, or lawsuits to prevent lingering liabilities.

Liquidating Assets and Distributing Remaining Funds

After settling debts, remaining assets must be liquidated or distributed according to the LLC’s operating agreement or state law.

- Inventory and appraise all business assets, such as equipment or property.

- Liquidate assets or distribute them to members as outlined in the operating agreement.

- Ensure distributions comply with tax regulations to avoid penalties.

Filing Final Tax Returns and Closing Accounts

LLCs must file final tax returns and close all business-related accounts to complete the dissolution process.

- File a final federal tax return (Form 1065 or Schedule C) and check the “final return” box.

- Submit final state tax returns and terminate sales tax permits or licenses.

- Close business bank accounts and cancel Employer Identification Number (EIN) with the IRS.

Should I dissolve my LLC or leave it as inactive?

Deciding whether to dissolve your LLC or keep it inactive depends on factors like future business plans, costs, and legal obligations. Dissolving terminates the LLC permanently, eliminating ongoing fees and compliance requirements but forfeiting the business name and structure. Leaving it inactive allows you to resume operations later but may require continued filings, fees, and tax responsibilities. Consider potential liabilities, administrative burdens, and the likelihood of restarting the business when choosing.

Factors to Consider Before Dissolving an LLC

Weighing the decision to dissolve an LLC involves evaluating financial, legal, and strategic aspects.

- Ongoing costs: Inactive LLCs may still incur annual fees, taxes, or compliance expenses.

- Future plans: Dissolving may complicate restarting the business under the same name or structure.

- Liabilities: Dissolution legally settles debts and obligations, reducing personal liability risks.

Pros and Cons of Dissolving an LLC

Dissolving an LLC offers finality but requires careful planning.

- Pros: Eliminates compliance burdens, stops fees, and resolves liabilities conclusively.

- Cons: Loss of business credit history, branding, and potential reinstatement costs if restarting.

- Process complexity: Requires formal paperwork, creditor notifications, and asset distribution.

Pros and Cons of Keeping an LLC Inactive

Leaving an LLC inactive preserves flexibility but demands maintenance.

- Pros: Retains business name, licenses, and tax ID for future use; avoids re-formation costs.

- Cons: Continued state fees, tax filings, and potential penalties for non-compliance.

- Liability risks: Inactive LLCs may still face lawsuits or unresolved debts.

Tax Implications of Dissolving vs. Inactive Status

Tax obligations vary significantly between dissolution and inactivity.

- Dissolution: Triggers final tax returns, possible asset taxation, and closure of federal/state tax accounts.

- Inactive status: May require annual tax filings (e.g., franchise taxes) even without income.

- State-specific rules: Some states impose fees or taxes on inactive LLCs.

Steps to Dissolve an LLC vs. Maintaining Inactive Status

Each option involves distinct administrative processes.

- Dissolution steps: File articles of dissolution, settle debts, notify creditors, and distribute assets.

- Inactive maintenance: Continue annual reports, pay fees, and monitor compliance requirements.

- Documentation: Keep records for taxes, legal protection, and potential reactivation.

What is the difference between terminating and dissolving an LLC?

Terminating vs. Dissolving an LLC: Core Definitions

Terminating an LLC refers to the complete cessation of its existence, including winding up operations, settling debts, and distributing assets. Dissolving, however, is a formal legal step within the termination process where the LLC officially notifies the state of its closure. Termination is the broader process, while dissolution is a specific action required to legally end the business.

- Termination involves multiple stages: dissolution, asset distribution, and filing final paperwork.

- Dissolution is the first legal step, often requiring state approval via Articles of Dissolution.

- Failure to dissolve properly may result in ongoing taxes or penalties, even if operations cease.

Legal and Procedural Steps for Termination

To terminate an LLC, owners must follow state-specific protocols. This includes voting to dissolve, settling debts, and filing dissolution documents. Dissolution alone does not finalize termination until all obligations are resolved.

- Members must formally approve dissolution through a vote, per the LLC operating agreement.

- Notify creditors, pay liabilities, and distribute remaining assets to members.

- File Articles of Dissolution with the state to legally dissolve the entity.

Financial Obligations During Termination

Terminating an LLC requires settling all financial responsibilities. Dissolution does not absolve the LLC from debts; liabilities must be addressed before final closure.

- Pay outstanding debts and taxes to avoid personal liability for members.

- Liquidate assets to cover obligations if necessary.

- File final federal, state, and local tax returns, marking them as “final”.

Tax Implications of Dissolution vs. Termination

Dissolution triggers tax-related steps, but termination finalizes them. The IRS and state agencies must be notified of the LLC’s closure to prevent future filings or penalties.

- File Form 966 with the IRS if the LLC is classified as a corporation.

- Cancel the LLC’s Employer Identification Number (EIN) and business licenses.

- State tax clearance may be required before dissolution is approved.

Reinstatement Possibilities After Dissolution

In some states, a dissolved LLC can be reinstated if errors are corrected or obligations are fulfilled post-dissolution. Termination, however, is typically irreversible.

- Submit a Certificate of Reinstatement and pay fees to revive the LLC.

- Address any compliance issues (e.g., unpaid taxes) that caused dissolution.

- Reinstatement deadlines vary by state, often within 1–2 years of dissolution.

Frequently Asked Questions About LLCs (FAQs)

What are the steps to dissolve an LLC in Minnesota?

To dissolve an LLC in Minnesota, you must follow a formal process. First, obtain approval from LLC members as outlined in your operating agreement or state law. Next, file Articles of Dissolution with the Minnesota Secretary of State, either online or by mail, and pay the required fee. Before filing, ensure all state taxes and fees are paid, and submit a Certificate of Tax Clearance from the Minnesota Department of Revenue. Finally, settle debts, notify creditors, distribute remaining assets to members, and close business accounts.

Is a Certificate of Tax Clearance required to dissolve an LLC in Minnesota?

Yes, Minnesota requires LLCs to obtain a Certificate of Tax Clearance before dissolution. This document confirms that all state taxes, fees, and penalties are paid. To request it, submit a Tax Clearance Request Form to the Minnesota Department of Revenue. Without this certificate, the Secretary of State will reject your Articles of Dissolution. Allow several weeks for processing, and resolve any outstanding tax issues promptly.

Can an LLC be dissolved without unanimous member approval in Minnesota?

Member approval requirements depend on the LLC’s operating agreement. If the agreement specifies dissolution procedures, follow those terms. If not, Minnesota law requires approval from a majority or all members, depending on the circumstances. For voluntary dissolution, most LLCs require a majority vote. Document the decision in meeting minutes or a written consent form to maintain legal compliance.

What happens if an LLC is administratively dissolved in Minnesota?

If the state administratively dissolves your LLC (e.g., for non-compliance or unpaid fees), it loses its good standing and legal protections. To reinstate, file Articles of Reinstatement with the Secretary of State, resolve compliance issues, and pay all fees. Note that administrative dissolution does not eliminate member liability for unresolved debts. Proactively dissolving the LLC is preferable to avoid legal and financial risks.

Leave a Reply

Our Recommended Articles