How to Dissolve an LLC in Colorado

Dissolving a Limited Liability Company (LLC) in Colorado involves a structured legal process to ensure compliance with state regulations and avoid potential liabilities. Whether due to shifting business priorities, financial challenges, or retirement, properly closing an LLC requires careful attention to detail. Key steps include filing formal dissolution documents with the Colorado Secretary of State, settling outstanding debts, notifying creditors, distributing remaining assets to members, and addressing tax obligations. Failure to follow the correct procedures may result in penalties, ongoing fees, or legal complications. This guide outlines the essential requirements and actionable steps to dissolve an LLC in Colorado efficiently, safeguarding personal and business interests while adhering to state laws.

Steps to Dissolve an LLC in Colorado

1. Determine the Reason for Dissolution

To dissolve an LLC in Colorado, members must first agree on the reason for dissolution. Common reasons include achieving business goals, financial challenges, or member disputes. The LLC’s operating agreement may outline dissolution procedures. If not, follow Colorado state law (Colorado Revised Statutes § 7-80-109). Ensure all members consent or meet the required voting threshold specified in the agreement.

See AlsoHow to Dissolve an LLC in South Carolina| Key Considerations | Details |

| Operating Agreement | Review dissolution clauses. |

| Member Vote | Confirm majority or unanimous approval. |

| State Law Compliance | Follow CRS § 7-80-109 if no agreement exists. |

2. Vote to Dissolve the LLC

Hold a formal vote among LLC members to approve dissolution. Document the decision in meeting minutes or a written consent form. Colorado requires a majority vote unless the operating agreement specifies otherwise. Retain records as proof of compliance.

| Action Item | Requirement |

| Voting Threshold | Majority or per operating agreement. |

| Documentation | Meeting minutes or written consent. |

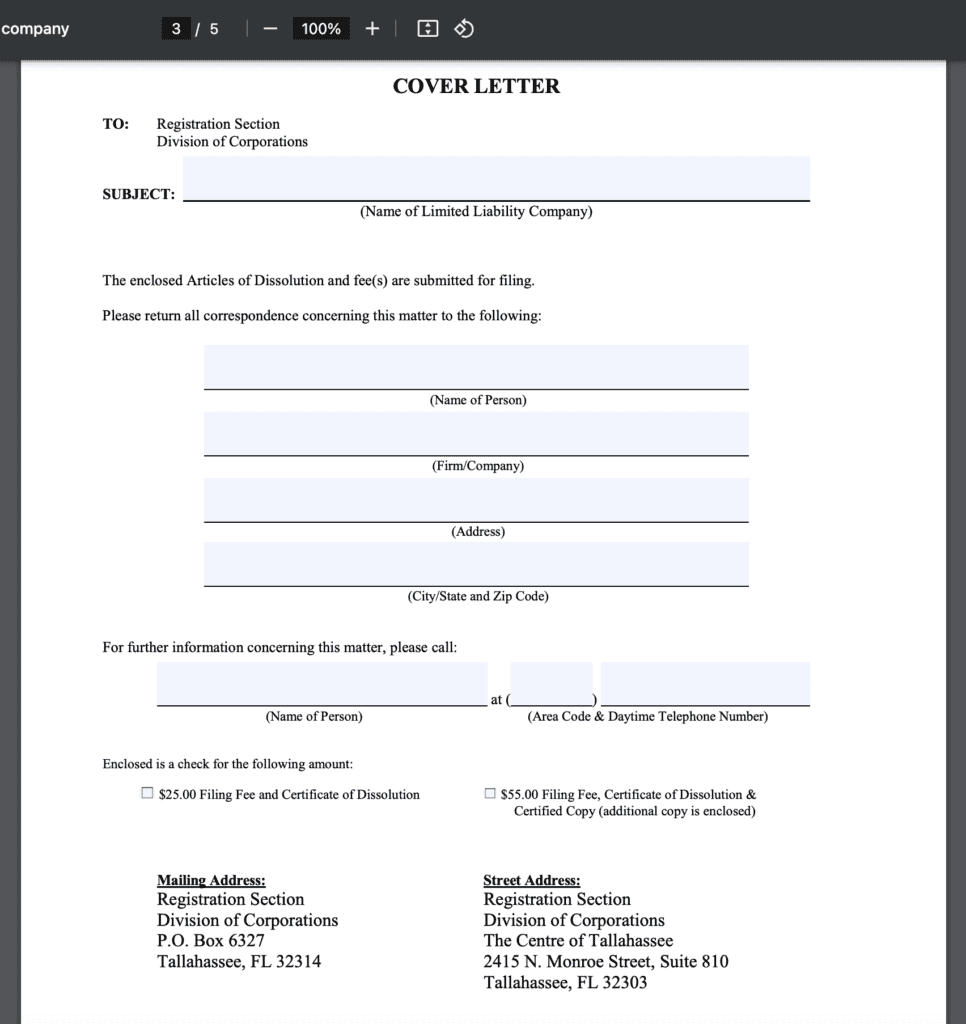

3. File Articles of Dissolution

Submit Articles of Dissolution (Form LLC 110) to the Colorado Secretary of State. This legally terminates the LLC. Include the LLC name, dissolution date, and member approval details. Pay the $25 filing fee. File online, by mail, or in person.

See AlsoHow to Dissolve an LLC in Louisiana| Form LLC 110 Requirements | Details |

| Filing Fee | $25 (non-refundable). |

| Processing Time | Immediate online; 3-7 days by mail. |

4. Notify Creditors and Settle Debts

Colorado requires LLCs to settle all outstanding debts before dissolution. Notify creditors in writing and resolve claims. Distribute remaining assets only after debts are paid. Failure to do so may result in personal liability for members.

| Debt Settlement Steps | Description |

| Creditor Notification | Formal written notice of dissolution. |

| Asset Liquidation | Use LLC assets to pay debts. |

5. Distribute Remaining Assets

After settling debts, distribute remaining assets to members according to the operating agreement or Colorado’s default rules (proportionate to ownership). File final tax returns and cancel licenses/permits.

See AlsoHow to Dissolve an LLC in Minnesota| Distribution Process | Guidelines |

| Tax Filings | File federal, state, and local tax returns. |

| Licenses/Permits | Cancel business-specific registrations. |

How do I shut down my LLC in Colorado?

Steps to Dissolve an LLC in Colorado

To officially dissolve an LLC in Colorado, follow the state’s legal requirements. Begin by obtaining member approval as outlined in your operating agreement. Next, file Articles of Dissolution with the Colorado Secretary of State. Ensure all taxes, debts, and obligations are settled, and notify creditors, employees, and clients.

See AlsoHow to Dissolve an LLC in Oregon- Review your LLC operating agreement for dissolution procedures.

- File Articles of Dissolution (Form LLC 110) online or by mail with a $25 fee.

- Pay outstanding taxes, including state and federal obligations.

Member Approval and Voting Process

Dissolving an LLC requires unanimous or majority member consent, depending on the operating agreement. Document the decision formally to avoid disputes.

- Hold a formal meeting to discuss dissolution.

- Record the voting results in meeting minutes.

- Update internal records to reflect the dissolution resolution.

Filing Articles of Dissolution

The Articles of Dissolution legally terminate your LLC’s existence in Colorado. File this form online via the Secretary of State’s website or by mail.

- Complete Form LLC 110 with details like LLC name and dissolution date.

- Pay the $25 filing fee via credit card or check.

- Await confirmation (Certificate of Dissolution) from the state.

Settling Debts and Tax Obligations

Before dissolving, settle all debts, taxes, and liabilities to avoid legal or financial issues.

- Notify creditors in writing and settle outstanding debts.

- File final tax returns with the Colorado Department of Revenue and IRS.

- Cancel business licenses and permits tied to the LLC.

Notifying the IRS and Closing Accounts

Inform the IRS of your LLC’s dissolution to close federal tax accounts and avoid future filings.

- File IRS Form 966 if applicable (corporate tax dissolution).

- Close EIN accounts by mailing a letter to the IRS.

- Submit final employment tax forms (e.g., Form 940/941).

Winding Up Business Affairs

After dissolution, wind up operations by distributing assets and retaining records.

- Distribute remaining assets to members per the operating agreement.

- Notify clients and vendors of the LLC’s closure.

- Maintain records for at least three years post-dissolution.

How do I officially close an LLC?

Steps to Officially Close an LLC

To officially close an LLC, follow these steps:

- Vote to dissolve the LLC according to the operating agreement or state law.

- File Articles of Dissolution (or Certificate of Cancellation) with the state where the LLC was formed.

- Settle debts, notify creditors, and pay outstanding taxes.

- Distribute remaining assets to members as outlined in the operating agreement.

- Cancel licenses, permits, and business registrations tied to the LLC.

Filing Articles of Dissolution

The Articles of Dissolution legally terminate the LLC’s existence. Requirements vary by state, but generally involve:

- Completing state-specific forms (often available on the Secretary of State’s website).

- Paying filing fees, which range from $50 to $200 depending on the state.

- Submitting the form by mail, online, or in person to the state agency.

Settling Debts and Tax Obligations

Before dissolving, ensure all financial and tax responsibilities are resolved:

- Notify creditors in writing and settle outstanding debts.

- File final federal, state, and local tax returns, marking them as “final.”

- Cancel the LLC’s EIN with the IRS using Form 966 if required.

Distributing Remaining Assets

After paying debts, distribute remaining assets to LLC members:

- Follow the operating agreement for asset distribution guidelines.

- Adhere to state laws if the operating agreement lacks instructions.

- Document distributions to avoid future disputes among members.

Canceling Licenses and Closing Accounts

Finalize the closure by terminating all business-related agreements:

- Cancel business licenses, permits, and fictitious business names (DBAs).

- Close bank accounts and credit lines under the LLC’s name.

- Keep records for at least 3–7 years, as required by state and federal laws.

Is dissolving an LLC hard?

Dissolving an LLC (Limited Liability Company) is not inherently difficult, but it requires careful adherence to legal and administrative steps. The complexity depends on factors like state regulations, pending obligations, and the company’s structure. Below are key considerations and processes involved.

What Are the Steps to Dissolve an LLC?

Dissolving an LLC involves a structured process to ensure compliance with state laws and avoid future liabilities. Key steps include:

- Member approval: Members or managers must formally agree to dissolve the LLC, as outlined in the operating agreement.

- File Articles of Dissolution: Submit this document to the state agency (e.g., Secretary of State) to terminate the LLC legally.

- Settle debts and obligations: Pay off creditors, resolve lawsuits, and distribute remaining assets to members.

- Notify tax authorities: File final federal, state, and local tax returns and close tax accounts.

- Cancel licenses and permits: Terminate business-specific registrations to avoid recurring fees or penalties.

What Are Common Challenges When Dissolving an LLC?

While dissolving an LLC is straightforward in theory, several challenges may arise:

- Unresolved debts: Creditors may file claims even after dissolution if liabilities are overlooked.

- Tax compliance issues: Missing deadlines for final tax filings can lead to penalties or audits.

- Member disputes: Disagreements over asset distribution or dissolution terms can delay the process.

- State-specific requirements: Some states mandate publishing dissolution notices or obtaining tax clearances.

How Do State Laws Affect LLC Dissolution?

State regulations significantly influence the dissolution process. For example:

- Filing fees and forms: Costs and required documents vary by state (e.g., California’s $20 fee vs. New York’s $60).

- Publication requirements: States like Arizona require dissolving LLCs to publish a notice in local newspapers.

- Tax clearance certificates: Some states, like Pennsylvania, mandate proof of tax compliance before dissolution.

What Tax Obligations Exist During LLC Dissolution?

Tax responsibilities are critical to address during dissolution:

- Final federal tax return: File Form 1065 (for multi-member LLCs) and issue Schedule K-1s to members.

- State and local taxes: Settle sales tax, payroll tax, and franchise tax obligations.

- Asset distribution taxes: Members may face taxes on distributed assets, reported via Form 1099 if applicable.

- Penalties for non-compliance: Late filings or unpaid taxes can result in fines or legal action.

What Legal and Financial Considerations Are Involved?

Dissolving an LLC demands attention to legal and financial details:

- Outstanding contracts: Terminate leases, vendor agreements, or client contracts to avoid breaches.

- Licenses and permits: Cancel these to prevent automatic renewals or liabilities.

- Pending lawsuits: Resolve or transfer legal disputes before dissolution.

- Document retention: Keep records (e.g., tax filings, dissolution paperwork) for 3–7 years post-closure.

- Professional guidance: Consult attorneys or accountants to navigate complex scenarios.

Frequently Asked Questions About LLCs (FAQs)

What Are the Steps to Dissolve an LLC in Colorado?

To dissolve an LLC in Colorado, you must follow a formal process. First, review your LLC’s operating agreement for any dissolution-specific requirements. Next, obtain member approval (if required) and settle all debts, taxes, and obligations. File Articles of Dissolution with the Colorado Secretary of State, either online or by mail, and pay the $25 filing fee. Notify creditors, liquidate remaining assets, and distribute funds to members as outlined in the operating agreement. Finally, file final tax returns with the Colorado Department of Revenue and the IRS, and close federal and state tax accounts.

Do I Need to Pay Taxes When Dissolving an LLC in Colorado?

Yes, you must resolve all tax obligations before dissolving your LLC. File a final state income tax return (Form DR 0106) and settle any outstanding sales, payroll, or unemployment taxes. Colorado requires a Tax Clearance Certificate to confirm all taxes are paid, which can be requested from the Colorado Department of Revenue. Additionally, ensure federal taxes are settled, including filing Form 966 with the IRS if applicable. Failure to address taxes may result in penalties or legal issues.

Can a Dissolved LLC Be Reinstated in Colorado?

If your LLC was administratively dissolved by the state (e.g., for non-compliance), you may apply for reinstatement within two years. Submit a Statement of Correction or Articles of Reinstatement to the Colorado Secretary of State, along with any overdue fees or reports. However, if the LLC voluntarily dissolved, reinstatement is generally not permitted. You would need to form a new LLC instead. Always consult the Secretary of State’s office for specific requirements.

What Happens to Debts or Liabilities After Dissolving an LLC in Colorado?

Dissolving an LLC does not automatically eliminate debts or liabilities. Members must ensure all obligations are settled during the winding-up process. Creditors may still pursue claims against the LLC’s remaining assets. If debts are discovered after dissolution, members could face personal liability if proper dissolution procedures were not followed. To mitigate risks, publish a notice of dissolution in a local newspaper and maintain records of debt settlements for at least three years.

Leave a Reply

Our Recommended Articles