How Do You Get in Touch With Venture Capitalists?

Securing funding from venture capitalists (VCs) is a critical step for many startups aiming to scale their operations. However, reaching out to VCs requires a strategic approach, as these investors are often inundated with pitches. Understanding how to effectively connect with venture capitalists can significantly increase your chances of securing investment. This article explores practical steps to get in touch with VCs, from leveraging personal networks and attending industry events to crafting compelling pitch decks and utilizing online platforms. By following these guidelines, entrepreneurs can position themselves to stand out in a competitive landscape and build meaningful relationships with potential investors.

How Do You Get in Touch With Venture Capitalists?

Getting in touch with venture capitalists (VCs) can be a pivotal step for startups and entrepreneurs seeking funding and mentorship. VCs are investors who provide capital to early-stage, high-potential companies in exchange for equity. Building a relationship with them requires strategy, preparation, and persistence. Below, we explore effective ways to connect with venture capitalists and increase your chances of securing their interest.

See Also How to Find a Vc in Dubai

How to Find a Vc in Dubai1. Leverage Your Network for Warm Introductions

One of the most effective ways to get in touch with venture capitalists is through a warm introduction. This means having someone in your network, such as a mutual connection, advisor, or fellow entrepreneur, introduce you to the VC. VCs often prioritize introductions from trusted sources because they come with a level of credibility. To leverage your network:

- Attend industry events and conferences.

- Join startup communities and accelerators.

- Build relationships with mentors who have VC connections.

2. Research and Target the Right VCs

Not all venture capitalists are the same. Some specialize in specific industries, stages, or geographies. Researching and targeting the right VCs increases your chances of getting a response. Use platforms like Crunchbase, AngelList, or LinkedIn to identify VCs who align with your startup's vision and goals. Create a list of potential investors and tailor your pitch to their investment thesis.

See Also How Do Associates at Venture Capital Firms Source Deals?

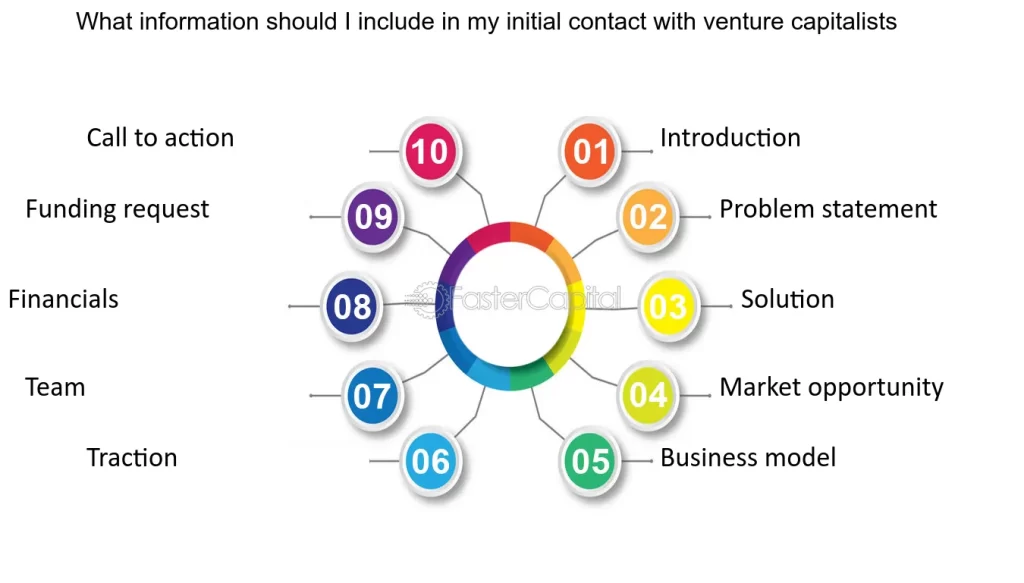

How Do Associates at Venture Capital Firms Source Deals?3. Craft a Compelling Pitch Deck

A pitch deck is your startup's story told through slides. It should be concise, visually appealing, and highlight key aspects such as the problem you're solving, your solution, market opportunity, traction, and team. A well-crafted pitch deck can grab a VC's attention and make them want to learn more. Ensure your deck includes:

- A clear value proposition.

- Data-driven insights.

- A strong call to action.

4. Attend Pitch Events and Demo Days

Pitch events and demo days are excellent opportunities to present your startup directly to venture capitalists. Many accelerators, incubators, and startup organizations host these events, where VCs scout for promising companies. Prepare a polished pitch and practice delivering it confidently. These events also provide networking opportunities to connect with VCs informally.

See Also What is a Venture Capitalists End Goal?

What is a Venture Capitalists End Goal?5. Utilize Online Platforms and Cold Outreach

If warm introductions aren't an option, consider cold outreach through email or LinkedIn. While this approach is less effective, it can still work if done correctly. Keep your message short, personalized, and focused on why the VC should be interested in your startup. Highlight any traction, unique selling points, or notable achievements. Avoid generic templates and demonstrate that you've done your homework.

| Method | Key Tips |

|---|---|

| Warm Introductions | Leverage trusted connections for credibility. |

| Research | Target VCs aligned with your industry and stage. |

| Pitch Deck | Focus on clarity, visuals, and data. |

| Pitch Events | Practice and network effectively. |

| Cold Outreach | Personalize and keep messages concise. |

How to get in contact with venture capitalists?

How Do Junior Lawyers Make the Transition to Venture Capital?

How Do Junior Lawyers Make the Transition to Venture Capital?1. Leverage Your Network for Introductions

One of the most effective ways to get in touch with venture capitalists is through personal or professional connections. Many VCs prefer warm introductions over cold outreach. Here’s how you can leverage your network:

- Identify mutual connections on platforms like LinkedIn who can introduce you to a VC.

- Attend industry events, conferences, or meetups where VCs are likely to be present.

- Ask mentors, advisors, or colleagues if they have relationships with VCs and can facilitate an introduction.

2. Attend Pitch Events and Competitions

Pitch events and startup competitions are excellent opportunities to connect with venture capitalists. These events are often attended by VCs looking for promising startups. Here’s how to make the most of them:

- Research and apply to well-known pitch events like TechCrunch Disrupt or Demo Day.

- Prepare a compelling pitch that highlights your startup’s unique value proposition.

- Network with VCs during the event and follow up with them afterward.

3. Utilize Online Platforms and Direct Outreach

Online platforms can be a valuable resource for connecting with venture capitalists. Many VCs are active on social media and professional networks. Here’s how to approach them:

- Use platforms like LinkedIn, AngelList, or Crunchbase to identify and research VCs.

- Send a personalized and concise email explaining your startup and why it aligns with their investment focus.

- Engage with their content on social media to build familiarity before reaching out.

4. Partner with Accelerators and Incubators

Accelerators and incubators often have strong ties to venture capitalists. Joining one can provide direct access to VCs. Here’s how to benefit from these programs:

- Apply to reputable accelerators like Y Combinator, 500 Startups, or Techstars.

- Take advantage of demo days and networking events organized by the accelerator.

- Leverage the mentorship and resources provided to refine your pitch and business model.

5. Build a Strong Online Presence and Pitch Deck

A strong online presence and a well-crafted pitch deck are essential for attracting venture capitalists. Here’s how to create a compelling impression:

- Develop a professional website that clearly communicates your startup’s mission and traction.

- Create a concise and visually appealing pitch deck that covers key aspects like problem, solution, market size, and team.

- Share your progress and milestones on social media to demonstrate momentum and credibility.

How to connect with venture capitalists?

1. Build a Strong Network

Connecting with venture capitalists often starts with building a robust professional network. Attend industry events, conferences, and meetups where VCs are likely to be present. Leverage platforms like LinkedIn to connect with investors and engage with their content. Additionally, seek introductions from mutual contacts, such as entrepreneurs, advisors, or mentors who have existing relationships with VCs.

- Attend startup events and pitch competitions.

- Use LinkedIn to connect and engage with VCs.

- Ask for warm introductions from trusted contacts.

2. Perfect Your Pitch Deck

A compelling pitch deck is essential to capture the attention of venture capitalists. Ensure your deck clearly outlines your business model, market opportunity, competitive advantage, and financial projections. Keep it concise, visually appealing, and tailored to the specific VC's investment focus. Practice delivering your pitch confidently and be prepared to answer tough questions.

- Highlight your unique value proposition.

- Include data-driven market analysis.

- Tailor the deck to the VC's investment thesis.

3. Research and Target the Right VCs

Not all venture capitalists invest in the same industries or stages. Research VCs who have a history of funding companies in your sector and at your stage of growth. Review their portfolio companies, investment criteria, and recent activity to ensure alignment. This targeted approach increases your chances of securing a meeting and demonstrates that you've done your homework.

- Identify VCs with a focus on your industry.

- Check their portfolio for alignment with your business.

- Understand their investment stage preferences.

4. Leverage Accelerators and Incubators

Joining a reputable accelerator or incubator can provide direct access to venture capitalists. These programs often include demo days where you can pitch to a room full of investors. Additionally, they offer mentorship, resources, and credibility, making your startup more attractive to VCs. Research programs that align with your goals and apply strategically.

- Participate in demo days to showcase your startup.

- Gain mentorship and credibility through the program.

- Use the program's network to connect with VCs.

5. Follow Up and Build Relationships

After initial contact, follow up with venture capitalists to keep the conversation going. Share updates on your progress, milestones, or new developments in your business. Building a relationship over time can increase your chances of securing funding. Be persistent but respectful, and avoid being overly aggressive in your communications.

- Send regular updates on your startup's progress.

- Engage with VCs on social media or through email.

- Be patient and focus on building trust.

How to approach a VC firm?

Understanding the VC Firm's Investment Focus

Before approaching a venture capital (VC) firm, it is crucial to understand their investment focus. Research the firm's portfolio to identify their preferred industries, stages of investment, and geographic preferences. This ensures that your startup aligns with their interests and increases the likelihood of securing a meeting.

- Review their portfolio companies to gauge their investment patterns.

- Analyze their investment thesis to understand their strategic goals.

- Check their geographic focus to ensure they invest in your region.

Preparing a Compelling Pitch Deck

A well-crafted pitch deck is essential when approaching a VC firm. It should clearly communicate your business model, market opportunity, competitive advantage, and financial projections. Keep it concise, visually appealing, and focused on key metrics that demonstrate growth potential.

- Highlight the problem your product or service solves.

- Showcase your traction with metrics like revenue, user growth, or partnerships.

- Include a clear ask for funding and how it will be utilized.

Building a Strong Network and Warm Introductions

VC firms often prioritize startups that come through warm introductions from trusted sources. Leverage your network to connect with founders, advisors, or industry experts who can introduce you to the VC firm. This adds credibility and increases your chances of getting noticed.

- Attend industry events to meet potential connectors.

- Engage with alumni networks or startup communities.

- Ask for introductions from mutual connections on LinkedIn.

Tailoring Your Approach to the VC Firm

Each VC firm has a unique culture and decision-making process. Tailor your approach by understanding their specific preferences, such as whether they prefer email pitches, in-person meetings, or initial calls. Personalizing your approach demonstrates professionalism and respect for their time.

- Research the firm's preferred communication channels.

- Customize your pitch to align with their investment criteria.

- Follow up respectfully if you don’t receive an immediate response.

Demonstrating Traction and Scalability

VC firms are primarily interested in startups that show traction and the potential for scalability. Provide evidence of market validation, such as customer testimonials, partnerships, or revenue growth. Highlight how your business can scale to capture a significant market share.

- Present data on customer acquisition and retention rates.

- Showcase partnerships or collaborations that validate your business model.

- Explain your scalability strategy and long-term vision.

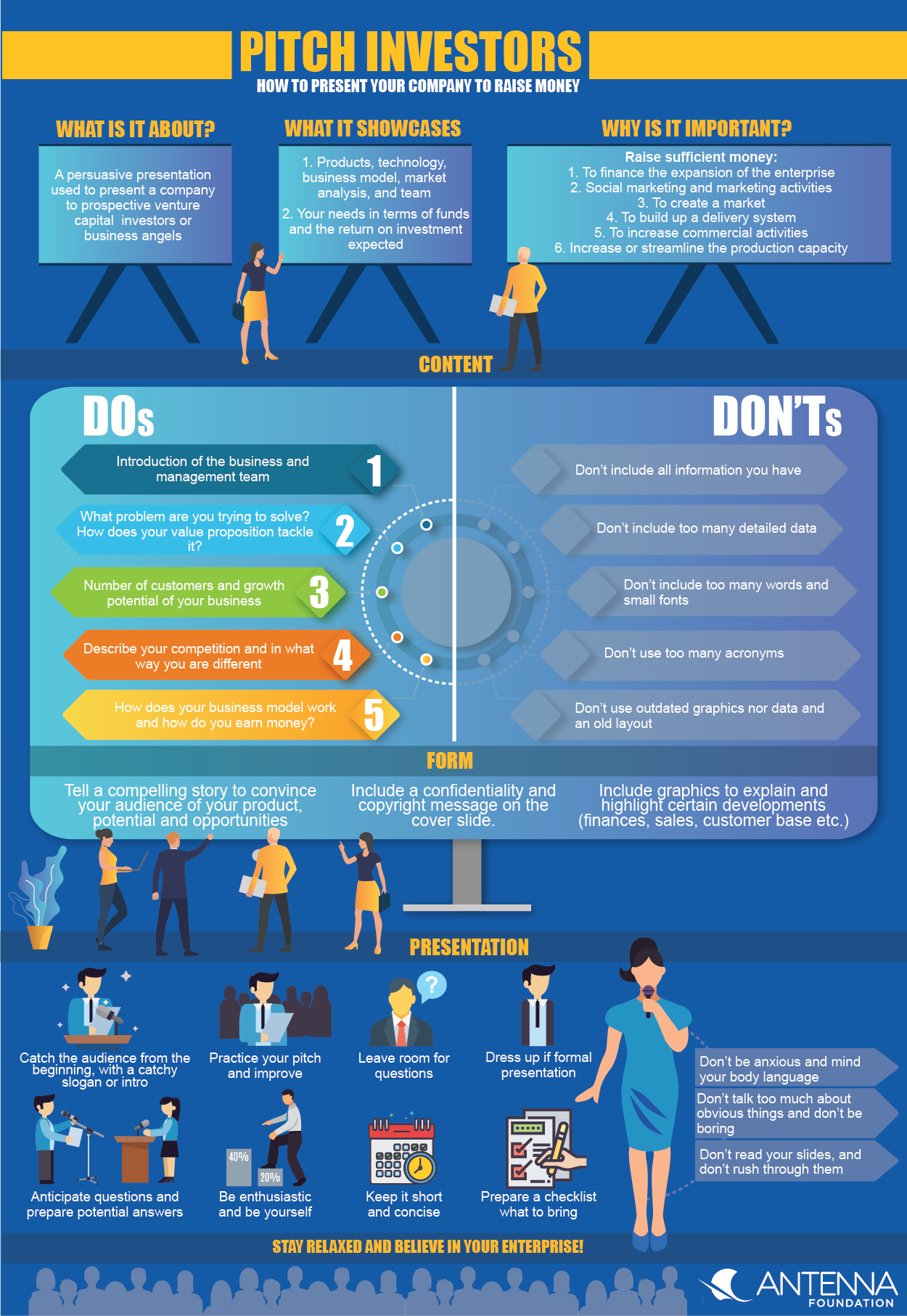

How do you pitch to venture capitalists?

Understanding the Venture Capitalist's Perspective

When pitching to venture capitalists, it's crucial to understand their perspective. Venture capitalists are looking for high-growth potential and a strong return on investment. They want to see that your business can scale quickly and generate significant revenue. To align with their goals, ensure your pitch addresses the following:

- Market Opportunity: Clearly define the size and growth potential of your target market.

- Unique Value Proposition: Highlight what makes your product or service unique and why it will succeed.

- Scalability: Demonstrate how your business can grow rapidly with the right resources.

Crafting a Compelling Story

A compelling story is essential to capture the interest of venture capitalists. Your pitch should tell a narrative that connects emotionally and logically. Focus on the problem you're solving and how your solution stands out. Key elements include:

- Problem Statement: Clearly articulate the pain point your target audience faces.

- Solution: Explain how your product or service effectively addresses the problem.

- Impact: Show the potential impact of your solution on the market and society.

Presenting a Strong Business Model

Venture capitalists need to see a viable business model that can generate sustainable revenue. Your pitch should outline how your business will make money and achieve profitability. Key points to cover:

- Revenue Streams: Detail your primary and secondary sources of income.

- Cost Structure: Explain your fixed and variable costs and how they will be managed.

- Profit Margins: Highlight your expected profit margins and how they compare to industry standards.

Showcasing a Talented Team

The strength of your team is a critical factor for venture capitalists. They want to invest in capable and experienced leaders who can execute the vision. Emphasize the following:

- Founder Expertise: Highlight the relevant experience and skills of the founding team.

- Key Hires: Mention any significant hires that bring additional expertise to the table.

- Advisors: Showcase any industry experts or mentors supporting your venture.

Preparing for Due Diligence

Venture capitalists will conduct thorough due diligence before making an investment. Be prepared to provide detailed information and answer tough questions. Key areas to focus on:

- Financial Projections: Present realistic and data-backed financial forecasts.

- Legal Documentation: Ensure all legal documents, such as patents and contracts, are in order.

- Customer Validation: Provide evidence of customer interest, such as testimonials or early sales.

Frequently Asked Questions by our Community

What Are the Best Ways to Contact Venture Capitalists?

One of the most effective ways to contact venture capitalists is through a warm introduction. This means getting introduced by a mutual connection, such as a fellow entrepreneur, advisor, or industry expert. Many venture capitalists prefer this method because it adds a layer of trust and credibility. Alternatively, you can reach out directly via email, but ensure your pitch is concise, compelling, and tailored to their investment focus. Attending industry events, conferences, or networking sessions where VCs are present can also provide opportunities to connect in person.

How Do You Prepare Before Reaching Out to Venture Capitalists?

Before contacting venture capitalists, it's crucial to prepare thoroughly. Start by researching the VC firm and the individual investor to understand their investment thesis, portfolio companies, and areas of interest. Craft a strong pitch deck that clearly outlines your business model, market opportunity, traction, and team. Additionally, ensure your financial projections and metrics are well-documented and realistic. Having a clear elevator pitch and being ready to answer tough questions about your business will significantly increase your chances of making a positive impression.

What Should You Include in Your Initial Email to a Venture Capitalist?

Your initial email to a venture capitalist should be short, professional, and impactful. Start with a compelling subject line that grabs their attention. In the body of the email, introduce yourself and your company in one or two sentences, highlighting your unique value proposition. Briefly mention any traction or milestones your business has achieved, such as revenue growth, user acquisition, or product launches. Include a link to your pitch deck and express your interest in discussing how your business aligns with their investment strategy. Always end with a clear call to action, such as requesting a meeting or call.

What Are Common Mistakes to Avoid When Contacting Venture Capitalists?

When reaching out to venture capitalists, avoid common mistakes like sending a generic email or failing to research the VC's focus areas. VCs can easily spot a lack of preparation, which can harm your credibility. Another mistake is being overly aggressive or pushy in your communication; instead, maintain a professional and respectful tone. Additionally, don't oversell your business or make unrealistic claims about your growth potential. Be honest about your challenges and how you plan to address them. Finally, avoid contacting multiple VCs at the same firm simultaneously, as this can create confusion and reduce your chances of securing a meeting.

Leave a Reply

Our Recommended Articles