PA LLC Filing Fee

When forming a Limited Liability Company (LLC) in Pennsylvania, understanding the associated filing fees is crucial for entrepreneurs and business owners. The state-mandated PA LLC filing fee covers the cost of processing formation documents, officially establishing the business entity under state law. While the base fee is standardized, additional costs may arise depending on factors like expedited processing, name reservations, or optional services. This fee structure ensures compliance with Pennsylvania’s legal requirements and grants businesses the liability protection and operational flexibility inherent to the LLC model. By budgeting for these expenses upfront, founders can streamline the registration process and focus on building a strong foundation for their venture.

Understanding the PA LLC Filing Fee: Costs and Requirements

The PA LLC filing fee is the mandatory payment required to formally register a Limited Liability Company (LLC) in Pennsylvania. As of 2023, the standard fee is $125, paid to the Pennsylvania Department of State when submitting the Certificate of Organization (Form DSCB:15-8821). This fee covers basic processing, which typically takes 7–10 business days. Additional costs may apply for expedited services, name reservations, or third-party assistance. Understanding these fees ensures compliance and avoids delays in establishing your LLC.

See AlsoMA LLC Filing FeePA LLC Filing Fee: Cost Breakdown and Payment Methods

The PA LLC filing fee includes a base cost of $125 for standard processing. Expedited services are available for $100 (3-day processing) or $300 (same-day service). Payments can be made via check, money order, or credit card (with a 1.75% convenience fee). The Pennsylvania Department of State’s online portal, Pennsylvania Business One-Stop Shop, also accepts electronic submissions.

| Standard Filing Fee | $125 |

| Expedited Processing (3-day) | $100 |

| Same-Day Processing | $300 |

| Accepted Payment Methods | Check, Money Order, Credit Card |

| Processing Time (Standard) | 7–10 Business Days |

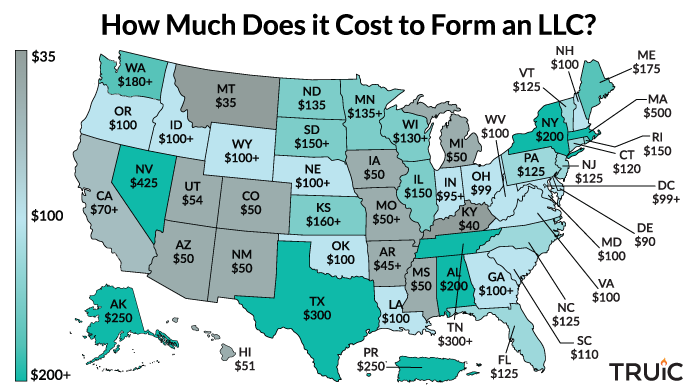

How PA LLC Filing Fees Compare to Other States

Pennsylvania’s $125 LLC filing fee is moderately priced compared to other states. For example, neighboring states like New York ($200) and Delaware ($90) have varying rates. Nationally, the average LLC filing fee ranges between $50–$500, depending on state-specific requirements. Pennsylvania’s lack of annual report fees for LLCs offsets its mid-range formation cost, making it a cost-effective option long-term.

See AlsoHow Much Does Liability Insurance for Assisted Living Facilities Cost?| Pennsylvania | $125 |

| New York | $200 |

| Delaware | $90 |

| California | $70 |

| National Average | $50–$500 |

Steps to Pay the PA LLC Filing Fee Online

To pay the PA LLC filing fee online, visit the Pennsylvania Business One-Stop Shop portal. Follow these steps:

1. Prepare your Certificate of Organization (Form DSCB:15-8821).

2. Create an account or log in to the portal.

3. Upload your form and enter business details.

4. Select processing speed and payment method.

5. Submit payment and receive a confirmation email.

| Step 1 | Prepare Documentation |

| Step 2 | Access Online Portal |

| Step 3 | Enter Business Information |

| Step 4 | Choose Processing Speed |

| Step 5 | Submit Payment |

Factors That Influence the Total Cost of Forming a PA LLC

Beyond the $125 filing fee, additional costs may include:

- Expedited processing fees ($100–$300)

- Name reservation fee ($70)

- Registered agent fees ($50–$300 annually)

- Licensing or permits (industry-dependent)

- Annual tax obligations (e.g., PA Corporate Net Income Tax)

| Expedited Processing | $100–$300 |

| Name Reservation | $70 |

| Registered Agent | $50–$300/year |

| Licensing/Permits | Varies |

Common Mistakes to Avoid When Paying the PA LLC Filing Fee

Common errors include:

- Incorrect payment amount (e.g., missing expedited fees).

- Using an unaccepted payment method (e.g., cash).

- Misspelled business names on forms.

- Missing signatures or documentation.

- Failing to retain a payment receipt for records.

| Incorrect Payment | Delays or Rejections |

| Unaccepted Method | Returned Application |

| Misspelled Name | Legal Complications |

| Missing Signature | Processing Halt |

How much does it cost to form an LLC in PA?

Filing Fees for Forming an LLC in Pennsylvania

The primary cost to form an LLC in Pennsylvania is the Certificate of Organization filing fee, paid to the Pennsylvania Department of State.

- $125: Fee for filing the Certificate of Organization online or by mail.

- $70: Expedited processing fee (optional) for 24-hour turnaround.

- $0: No annual report fee in Pennsylvania, unlike many other states.

Name Reservation Costs

Reserving your LLC name in Pennsylvania is optional but recommended if you need time to prepare documents.

- $70: Fee to reserve a business name for 120 days.

- Online or mail submission: Both methods incur the same fee.

- Non-refundable: The fee is not refundable, even if the name is rejected.

Decennial Report Requirement

Pennsylvania requires LLCs to file a decennial report every 10 years to keep the business name active.

- $70: Fee for filing the decennial report.

- Due every 10 years: Next report is due in 2029 for filings between 2019–2028.

- Penalty: Failure to file may result in losing exclusive rights to the business name.

DBA (Doing Business As) Registration Costs

If your LLC operates under a name different from its legal name, a DBA registration is required.

- $70: Fee to register a DBA with the Pennsylvania Department of State.

- County-level fees: Additional fees may apply if filing in specific counties.

- Renewal: DBAs in Pennsylvania do not expire, so no renewal costs.

Additional Costs to Consider

Beyond state fees, forming an LLC in Pennsylvania may involve other expenses.

- Registered agent fee: $50–$300 annually if using a professional service.

- Business licenses: Costs vary by industry and location.

- Legal or formation service fees: $0–$500+ for assistance with paperwork.

How much does an LLC usually cost?

Initial Formation Costs of an LLC

The initial costs to form an LLC vary by state but typically include state filing fees, which range from $50 to $500. Additional expenses may involve legal or third-party services for document preparation.

- State filing fees: Required to legally establish the LLC (e.g., $100 in Texas, $200 in New York).

- Registered agent fees: Often $50–$300 annually if using a professional service.

- Name reservation: Optional in some states, costing $10–$50.

Ongoing Maintenance Expenses for an LLC

Beyond formation, LLCs incur annual fees, such as reporting requirements or franchise taxes, which vary by state. These costs ensure compliance and active status.

- Annual report fees: Ranging from $0 (no report) to $500+ in states like California.

- Franchise taxes: Some states charge a flat fee (e.g., Delaware’s $300) or income-based taxes.

- Registered agent renewal: Typically $50–$300 yearly.

Third-Party Service Costs for LLC Formation

Many entrepreneurs use online services or attorneys to simplify LLC setup. These services add to upfront costs but save time.

- Online LLC formation: $0–$400+ (e.g., LegalZoom charges $0 + state fees, while premium packages cost $300+).

- Legal fees: $500–$2,000+ for customized operating agreements or complex filings.

- Business licenses: Depending on industry and location, $50–$700 annually.

Optional Expenses to Enhance LLC Operations

Additional investments, like EIN registration or operating agreements, improve functionality but are not legally mandatory in all cases.

- Employer Identification Number (EIN): Free from the IRS but may require tax professional assistance ($50–$150).

- Operating agreement: $100–$500+ if drafted by a lawyer.

- Business bank account: Setup fees vary, but often $0–$50.

State-Specific Variations in LLC Costs

LLC expenses depend heavily on state regulations. For example, California imposes an $800 annual franchise tax, while Wyoming has no state income tax.

- High-cost states: California ($800 annual tax + $20 reporting fee), Massachusetts ($500 annual fee).

- Low-cost states: New Mexico ($50 filing fee, no annual report), Arizona ($50 filing fee).

- Unique requirements: New York mandates $200 formation fee + newspaper publication ($200–$1,500).

Frequently Asked Questions About LLCs (FAQs)

What is the current filing fee for forming a PA LLC?

The filing fee to form a Limited Liability Company (LLC) in Pennsylvania is $125 as of the latest update. This fee is paid to the Pennsylvania Department of State when submitting the Certificate of Organization (Form DSCB:15-8821). The payment can be made online via the PA Business One-Stop Shop portal or by mail with a check or money order. Expedited processing, if required, incurs an additional fee. Ensure your submission includes accurate details to avoid delays or rejection.

Are there additional costs beyond the PA LLC filing fee?

Yes, forming an LLC in Pennsylvania often involves additional costs beyond the $125 filing fee. For example, reserving a business name costs $70, and hiring a registered agent (if you don’t self-designate) may incur annual fees. You may also need to pay for local business licenses, permits, or a federal Employer Identification Number (EIN). Additionally, Pennsylvania requires LLCs to file a Decennial Report every 10 years, which costs $70. Always budget for these expenses to avoid surprises.

Can the PA LLC filing fee be refunded if my application is rejected?

No, the $125 filing fee for a Pennsylvania LLC is non-refundable, even if your application is rejected. The state does not issue refunds for errors, incomplete forms, or name conflicts. To minimize risks, verify your LLC’s name availability in advance using the Pennsylvania business name database and double-check all information on the Certificate of Organization. Consider consulting a legal professional or using an online service to ensure compliance with state requirements.

How long does it take to process a PA LLC filing after paying the fee?

Standard processing for a PA LLC filing takes 7–10 business days after submission. If you opt for expedited processing, you can reduce this timeframe to as little as 1–2 business days by paying an extra $100 fee. Processing times may vary during peak seasons or due to submission errors. Online filings are generally faster than mailed applications. Once approved, you’ll receive confirmation via email or mail, and your LLC becomes legally active.

Leave a Reply

Our Recommended Articles