How to Dissolve an LLC in Oregon

Dissolving a limited liability company (LLC) in Oregon involves a structured legal process to ensure compliance with state regulations and avoid future liabilities. Whether closing due to business restructuring, financial challenges, or retirement, properly winding down an LLC requires careful attention to statutory requirements. Key steps include obtaining member approval, settling outstanding debts, filing formal dissolution documents with the Oregon Secretary of State, and addressing tax obligations. Failure to complete these steps thoroughly may result in penalties, continued fees, or legal complications. This guide outlines the essential procedures and considerations for dissolving an LLC in Oregon, providing clarity for business owners navigating this critical transition.

Steps to Dissolve an LLC in Oregon

1. Understanding Member Approval Requirements

To dissolve an LLC in Oregon, members must first agree to dissolution. If the LLC’s operating agreement specifies dissolution procedures, follow those terms. Otherwise, Oregon law requires majority approval from members (unless otherwise stated in the agreement). Document the decision via meeting minutes or a written consent form signed by approving members.

See AlsoHow Much Does Liability Insurance for Assisted Living Facilities Cost?| Step | Action |

| 1 | Review the LLC’s Operating Agreement |

| 2 | Hold a formal vote (if required) |

| 3 | Record the decision in writing |

2. Filing Articles of Dissolution with the Oregon Secretary of State

Submit Articles of Dissolution to the Oregon Secretary of State to formally terminate the LLC. The form requires basic details like the LLC name, dissolution date, and member approval confirmation. A $100 filing fee applies. Expedited processing is available for an additional cost.

| Requirement | Details |

| Form | Complete Form 105 (Articles of Dissolution) |

| Fee | $100 (standard filing) |

| Processing Time | 5-7 business days (standard) |

3. Settling Debts and Distributing Assets

Before dissolving, Oregon requires LLCs to settle outstanding debts and obligations. Liquidate assets to pay creditors, and distribute remaining assets to members according to ownership percentages or the operating agreement. Keep records of all transactions for tax and legal purposes.

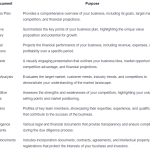

See Also What Are the Documents I Need to Present to a Potential Angel Investor to Get Funded Besides My Business Plan

What Are the Documents I Need to Present to a Potential Angel Investor to Get Funded Besides My Business Plan| Task | Key Considerations |

| Notify Creditors | Send written notices to known creditors |

| Liquidate Assets | Sell property or transfer ownership |

| Distribute Funds | Follow the LLC’s distribution plan |

4. Notifying Creditors and Handling Claims

Oregon law mandates LLCs to notify creditors of dissolution via written notice and publish a public announcement in a newspaper (if required). Creditors typically have 120 days to submit claims. Dispute or settle claims before finalizing dissolution.

| Action | Timeline |

| Publish Notice | Once in a newspaper for consecutive weeks |

| Claims Period | 120 days from notice publication |

| Resolve Claims | Before filing final tax returns |

5. Final Tax and Regulatory Obligations

Close all tax accounts with the Oregon Department of Revenue and IRS. File a final tax return and pay outstanding taxes. Cancel the LLC’s business license and other permits. Retain records for at least 7 years post-dissolution.

See AlsoSuccessful Businesses in Small Towns| Requirement | Agency |

| Cancel Business License | Local city/county office |

| File Final Taxes | IRS and Oregon DOR |

| Close EIN | Notify the IRS in writing |

Should I dissolve my LLC or leave it as inactive?

Legal and Financial Implications of Dissolving vs. Inactive LLC

Deciding whether to dissolve your LLC or leave it inactive depends on legal obligations and financial commitments. Dissolving terminates the LLC legally, ending all compliance requirements, while an inactive LLC may still incur fees or tax filings.

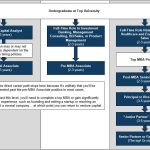

See Also What is It Like to Be an Analyst at a Venture Capital Firm?

What is It Like to Be an Analyst at a Venture Capital Firm?- Dissolution costs: One-time fees for filing dissolution paperwork with the state.

- Ongoing fees: Inactive LLCs may still require annual report fees or franchise taxes.

- Legal protection: An inactive LLC retains liability protection, whereas dissolving removes it.

Tax Considerations for Inactive LLCs

Even if your LLC is inactive, tax obligations might persist. Consult a tax professional to avoid penalties or unexpected liabilities.

- Federal taxes: Inactive LLCs may still need to file informational returns, depending on structure.

- State taxes: Some states impose minimum taxes regardless of activity.

- Late fees: Failure to file returns for inactive LLCs could lead to penalties.

Future Business Opportunities and Reactivation

Leaving an LLC inactive preserves the option to reactivate it later, avoiding the hassle of re-registration.

See AlsoMA LLC Filing Fee- Brand preservation: Retain business name and branding assets.

- Faster restart: Reactivation is often simpler than forming a new LLC.

- Contractual obligations: Existing contracts or licenses might remain valid if reactivated.

Administrative Burden of Maintaining an Inactive LLC

An inactive LLC still requires compliance, which may demand time and resources.

- Annual reports: Many states mandate filings even for inactive entities.

- Registered agent fees: Costs for maintaining a registered agent continue.

- Recordkeeping: Financial and operational records must still be maintained.

State-Specific Rules for Dissolution and Inactive Status

State laws vary significantly, affecting the decision to dissolve or retain an inactive LLC.

- Dissolution processes: Some states require creditor notifications or tax clearance.

- Inactivity definitions: States may have specific criteria for inactive status.

- Reinstatement requirements: Fees or penalties may apply if reactivating after non-compliance.

Is dissolving an LLC hard?

Dissolving an LLC varies in complexity depending on the state, business structure, and outstanding obligations. While the process is generally straightforward, it requires meticulous attention to legal and financial steps to avoid penalties or lingering liabilities. Key steps include settling debts, filing dissolution documents, notifying stakeholders, and complying with tax requirements.

Understanding State-Specific Dissolution Requirements

Each state has unique regulations for dissolving an LLC. Failure to follow these rules can lead to penalties or unintended legal obligations.

- Review your state’s LLC dissolution guidelines, often found on the Secretary of State website.

- Check for mandatory waiting periods or publication requirements (e.g., announcing dissolution in a local newspaper).

- Confirm if your state requires final tax clearance before approving dissolution.

Settling Debts and Financial Obligations

Clearing debts is critical to avoid personal liability and ensure a clean dissolution.

- Notify creditors and settle outstanding loans, invoices, or contracts.

- Distribute remaining assets to members after paying debts, following the LLC operating agreement.

- Maintain records of all payments to prevent future disputes.

Filing Articles of Dissolution

Formally terminating an LLC requires submitting dissolution paperwork to the state.

- Complete the Articles of Dissolution or Certificate of Termination form.

- Include filing fees, which range from $50 to $200+ depending on the state.

- Submit the form to the appropriate agency, often the Secretary of State.

Notifying Stakeholders and Closing Accounts

Proper communication ensures a smooth transition and avoids lingering responsibilities.

- Inform employees, clients, and vendors about the LLC’s closure.

- Cancel business licenses, permits, and tax registrations (e.g., EIN, sales tax IDs).

- Close bank accounts and credit lines tied to the LLC.

Handling Tax Compliance and Final Filings

Tax obligations must be resolved to prevent audits or fines.

- File a final federal and state tax return, marking it as “final.”

- Pay any outstanding payroll, sales, or income taxes.

- Issue K-1 forms to members if required by the IRS.

Can one person dissolve an LLC?

Can a Single Member Legally Dissolve an LLC?

Yes, a single member of an LLC can dissolve the business, provided they follow the legal procedures outlined in their state’s regulations and the LLC’s operating agreement. In most jurisdictions, a sole owner has the authority to initiate dissolution without requiring approval from other parties, as they hold full ownership.

- Review the operating agreement for dissolution clauses or required steps.

- Confirm state-specific requirements, such as filing Articles of Dissolution.

- Ensure all debts, taxes, and obligations are settled before finalizing dissolution.

Steps to Dissolve a Single-Member LLC

Dissolving a single-member LLC involves a structured process to avoid legal or financial complications. The steps typically align with state laws but often include formal documentation and financial clearance.

- Formally vote to dissolve the LLC (as the sole member, this is a personal decision).

- File Articles of Dissolution or a similar form with the state.

- Notify creditors, settle debts, and distribute remaining assets.

Role of the Operating Agreement in Dissolving an LLC

The operating agreement often dictates dissolution procedures, even for single-member LLCs. If the agreement includes dissolution terms, the member must adhere to them.

- Check for clauses about notice periods, asset distribution, or voting requirements.

- If no agreement exists, follow default state dissolution laws.

- Update the agreement (if applicable) to reflect dissolution intentions.

Tax and Compliance Obligations When Dissolving an LLC

Dissolving an LLC requires fulfilling final tax obligations and compliance tasks to avoid penalties. This includes federal, state, and local tax filings.

- File a final tax return with the IRS and state agencies.

- Cancel the LLC’s EIN and close business tax accounts.

- Obtain tax clearance certificates if required by the state.

Common Challenges in Dissolving a Single-Member LLC

Even for a single owner, dissolving an LLC can pose challenges, such as unresolved liabilities or administrative oversights.

- Ensuring debts and lawsuits are resolved to prevent personal liability.

- Properly notifying state agencies, creditors, and clients.

- Maintaining records for the legally required period post-dissolution.

Frequently Asked Questions About LLCs (FAQs)

What Are the Steps to Dissolve an LLC in Oregon?

To dissolve an LLC in Oregon, you must follow a formal process to ensure legal compliance. First, members or managers must vote to dissolve the LLC as outlined in the operating agreement. Next, file Articles of Dissolution (Form 09) with the Oregon Secretary of State, which officially terminates the LLC’s existence. You must also settle all debts, notify creditors, and distribute remaining assets to members. Additionally, ensure all state and federal taxes are paid, and file a final tax return with the Oregon Department of Revenue. Proper documentation and adherence to deadlines are critical to avoid penalties.

Is Tax Clearance Required to Dissolve an LLC in Oregon?

Oregon does not require a specific tax clearance certificate to dissolve an LLC. However, you must settle all outstanding tax obligations, including income, payroll, and annual report fees, before filing dissolution paperwork. The Oregon Department of Revenue may audit your LLC to confirm compliance. Failure to resolve tax liabilities could result in delays, penalties, or even reinstatement of the LLC. Keep records of tax payments and communications with state agencies as proof of compliance during the dissolution process.

How Long Does It Take to Dissolve an LLC in Oregon?

The timeline to dissolve an LLC in Oregon varies but typically takes 4–6 weeks after filing the Articles of Dissolution. Processing times depend on the Oregon Secretary of State’s workload and whether your paperwork is error-free. Expedited processing is available for an additional fee, reducing the timeline to 1–2 business days. Delays often occur if taxes are unpaid, creditors are not notified, or dissolution documents are incomplete. Plan ahead to address these requirements and ensure a smooth dissolution.

What Happens If You Don’t Formally Dissolve an LLC in Oregon?

If an LLC is not formally dissolved, it remains active in state records, requiring ongoing compliance with annual report filings and fees. The LLC may also face penalties, tax liabilities, or legal action from creditors. Members could remain personally liable for unresolved debts or obligations. To avoid these risks, follow the statutory dissolution process, even if the LLC is inactive. Reinstating a dissolved LLC is possible but involves additional paperwork and fees, making timely dissolution the most efficient option.

Leave a Reply

Our Recommended Articles