How to Dissolve an LLC in South Carolina

Dissolving a limited liability company (LLC) in South Carolina involves a structured legal process to ensure compliance with state regulations and avoid potential liabilities. Whether due to business closure, restructuring, or other reasons, properly winding down an LLC requires careful attention to detail. Key steps include obtaining member approval as outlined in the operating agreement, settling outstanding debts, filing formal dissolution documents with the South Carolina Secretary of State, and addressing tax obligations. Understanding these requirements helps streamline the process and minimizes risks of fines or legal complications. This guide outlines the essential procedures to dissolve an LLC in South Carolina efficiently and in accordance with state law.

Steps to Dissolve an LLC in South Carolina

Understanding the Legal Requirements for Dissolution

To dissolve an LLC in South Carolina, you must comply with state laws outlined in the South Carolina Code of Laws (Title 33, Chapter 44). First, review your LLC’s operating agreement for specific dissolution procedures. If the agreement is silent, state law requires a majority vote of LLC members. Ensure all tax obligations and annual report filings are up-to-date before proceeding.

See AlsoHow to Dissolve an LLC in CT| Key Requirement | Details |

| Member Approval | A majority vote is required unless the operating agreement specifies otherwise. |

| Tax Compliance | Resolve all state taxes and file final returns with the SC Department of Revenue. |

| Documentation | Prepare meeting minutes or written consent documenting the dissolution decision. |

Filing the Articles of Dissolution

Submit Articles of Dissolution to the South Carolina Secretary of State. This form requires your LLC’s name, dissolution effective date, and confirmation that debts and obligations are settled. A $10 filing fee applies. Expedited processing is available for an additional cost.

| Form Component | Description |

| LLC Name | Must match the name on file with the Secretary of State. |

| Effective Date | Choose a future date or default to the filing date. |

| Signature | Must be signed by an authorized LLC member or manager. |

Settling Debts and Obligations

Before dissolving, pay all outstanding debts and liabilities. Distribute remaining assets to members according to the operating agreement. Failure to settle debts may result in personal liability for members.

See AlsoHow to Dissolve an LLC in Minnesota| Step | Action |

| Debt Notification | Notify creditors in writing about the dissolution. |

| Asset Distribution | Follow the operating agreement or state law if no agreement exists. |

| Tax Clearance | Obtain a Certificate of Tax Compliance from the SC Department of Revenue. |

Notifying Creditors and Claimants

South Carolina law requires written notice to known creditors and a newspaper publication for unknown claimants. The notice must include a mailing address and a 120-day deadline to submit claims.

| Notification Method | Requirements |

| Direct Notice | Send via certified mail to known creditors. |

| Publication | Publish once a week for three weeks in a local newspaper. |

| Claim Deadline | Claims must be submitted within 120 days of notice. |

Closing Business Accounts and Licenses

Cancel business licenses, permits, and EIN with the IRS. Close bank accounts and settle payroll taxes. Terminate leases or contracts to avoid ongoing liabilities.

See AlsoHow to Dissolve an LLC in Oregon| Account/License | Closing Process |

| EIN | Notify the IRS via letter or Form 966. |

| Business Licenses | Contact local and state licensing agencies. |

| Bank Accounts | Withdraw funds and submit closure requests in writing. |

How much does it cost to dissolve an LLC in South Carolina?

Filing Fees for Dissolving an LLC in South Carolina

The primary cost to dissolve an LLC in South Carolina is the state filing fee for submitting the Articles of Dissolution.

- Articles of Dissolution filing fee: $10 (mandatory for formal dissolution).

- Late fees or penalties: If annual reports or taxes are overdue, additional charges may apply.

- Expedited processing: Optional $25 fee for faster processing (within 24 hours).

Outstanding Obligations and Associated Costs

Before dissolving, an LLC must settle outstanding debts, taxes, and legal obligations, which may incur additional expenses.

- Debt settlement: Costs depend on unpaid loans, contracts, or creditor claims.

- Tax liabilities: Unpaid state or federal taxes may require resolution, including penalties.

- Member notifications: Legal fees for formally notifying LLC members of dissolution.

Tax Clearance Requirements and Fees

South Carolina requires LLCs to resolve all tax obligations before dissolution, which may involve fees.

- Tax compliance certificate: Free from the SC Department of Revenue if taxes are current.

- Unpaid tax resolution: Penalties or interest for overdue taxes increase dissolution costs.

- Annual report fees: Ensure all reports are filed ($0 fee for SC LLCs starting in 2023).

Legal and Professional Service Costs

Hiring attorneys or accountants to handle dissolution may add to expenses.

- Attorney fees: $200–$1,000+ depending on complexity (e.g., unresolved contracts).

- Accountant fees: $100–$500 for final tax filings or financial audits.

- Registered agent fees: If using a professional agent, ensure services cover dissolution notifications.

Additional Costs for Voluntary Dissolution

Non-mandatory expenses may arise during dissolution, depending on the LLC’s circumstances.

- Publication fees: Not required in SC but optional for public notice.

- Third-party filing services: $50–$150 for assistance with state paperwork.

- Reinstatement fees: If dissolution is incomplete, $25 fee to revive the LLC.

How do I shut down an LLC in SC?

Member Approval and Initiation of Dissolution Process

To dissolve an LLC in South Carolina, the first step involves obtaining member approval as outlined in the LLC’s operating agreement. If no specific dissolution procedure exists, state law requires a majority vote by members.

- Review the operating agreement for dissolution terms or voting requirements.

- Hold a formal vote and document the decision in meeting minutes or a written consent form.

- Ensure compliance with any state-specific rules for member notifications.

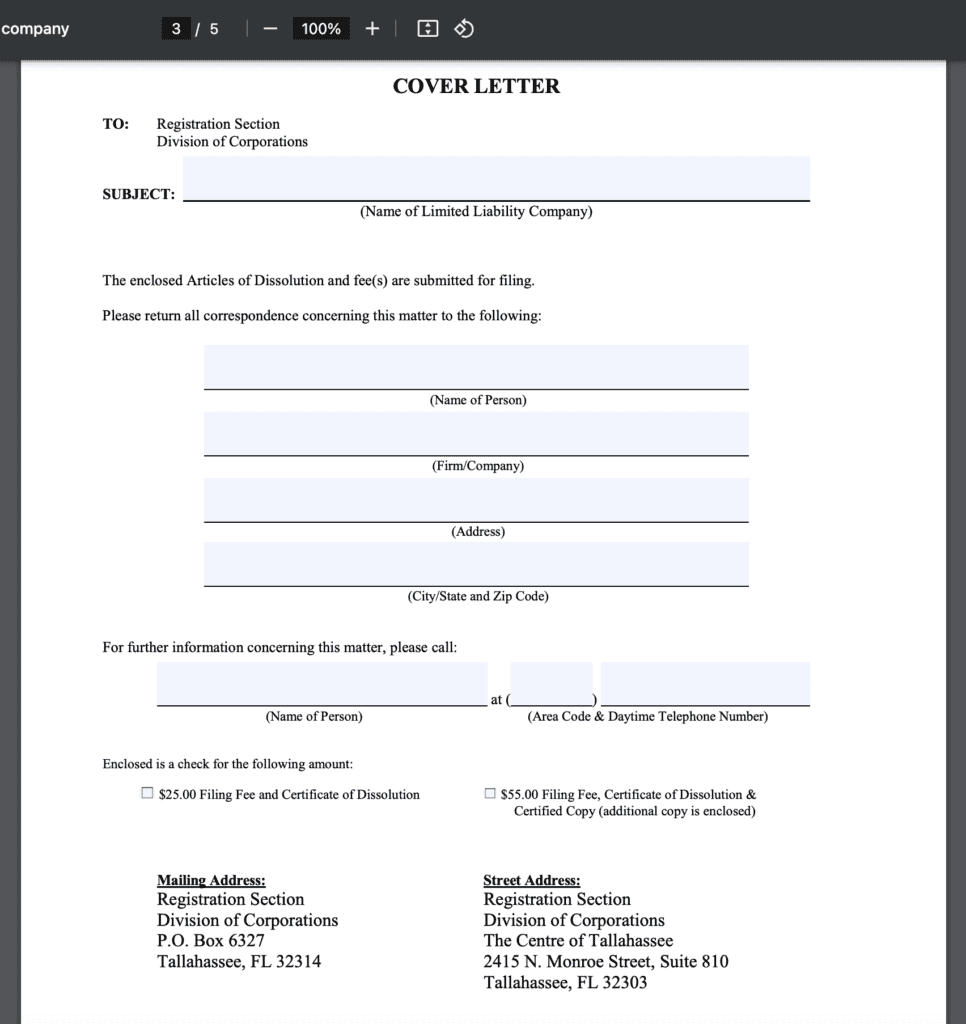

Filing Articles of Dissolution with the South Carolina Secretary of State

Submit Articles of Dissolution to the South Carolina Secretary of State to legally terminate the LLC. This form requires details like the LLC’s name, dissolution approval date, and a statement confirming debt settlement.

- Complete the Articles of Dissolution form (available online).

- Include a filing fee (currently $10 for online submissions).

- File electronically via the Secretary of State’s website or mail the form.

Settling Tax Obligations with the South Carolina Department of Revenue

Before dissolving, resolve all state tax liabilities. The South Carolina Department of Revenue (SCDOR) requires final tax returns and payment of outstanding taxes.

- File final state tax returns, including sales, payroll, and income taxes.

- Request a Tax Clearance Certificate from SCDOR to confirm no pending liabilities.

- Cancel the LLC’s sales tax license and other state permits.

Notifying Creditors and Settling Outstanding Debts

Legally notify creditors and settle all debts to avoid personal liability for members. South Carolina mandates a winding-up period to address financial obligations.

- Send written notices to creditors and publish a dissolution notice if required by the operating agreement.

- Pay or negotiate settlements for outstanding debts.

- Retain sufficient funds to cover unforeseen liabilities during the winding-up phase.

Final Steps: Asset Distribution and Recordkeeping

Distribute remaining assets to members and maintain records post-dissolution. South Carolina law requires LLCs to preserve business documents for at least five years.

- Distribute assets according to the operating agreement or state default rules.

- Close business bank accounts and cancel EIN with the IRS.

- Store records like tax filings, dissolution documents, and financial statements securely.

How do I officially close an LLC?

Reviewing the LLC Operating Agreement and Member Approval

To officially close an LLC, start by reviewing the LLC Operating Agreement, which often outlines dissolution procedures. If no agreement exists, follow state-specific default rules. Most states require member approval through a formal vote.

- Check the Operating Agreement for dissolution requirements.

- Hold a formal vote among members to approve closure, documenting the decision in writing.

- Ensure compliance with state laws if the LLC lacks a formal agreement.

Filing Articles of Dissolution with the State

The next step involves filing Articles of Dissolution (or a similar form) with the state agency that registered your LLC. This legally terminates the business entity.

- Obtain the correct dissolution form from your state’s Secretary of State website or office.

- Complete the form, including details like LLC name, reason for dissolution, and member signatures.

- Submit the form with any required filing fees to finalize the process.

Settling Debts, Taxes, and Financial Obligations

Before dissolving, settle all outstanding debts, taxes, and financial obligations to avoid personal liability or legal issues.

- Notify creditors, pay off loans, and resolve pending invoices.

- File a final federal and state tax return, marking it as “final” to inform the IRS.

- Cancel business-specific tax accounts, such as sales tax permits or payroll tax IDs.

Notifying Creditors, Clients, and Government Agencies

Formally notify stakeholders and agencies about the LLC’s closure to prevent future disputes or penalties.

- Send written notices to creditors and settle claims within state-mandated deadlines.

- Inform clients, vendors, and partners via email or formal letters.

- Cancel business licenses, permits, and registrations with local agencies.

Distributing Remaining Assets and Maintaining Records

After settling debts, distribute remaining assets to members according to ownership percentages or the Operating Agreement.

- Liquidate assets (if necessary) and divide proceeds as outlined in the agreement.

- Keep financial and dissolution records for 3–7 years for tax or legal purposes.

- Close business bank accounts and cancel insurance policies tied to the LLC.

Frequently Asked Questions About LLCs (FAQs)

What are the steps to dissolve an LLC in South Carolina?

To dissolve an LLC in South Carolina, you must follow a formal process. First, review your LLC’s operating agreement for dissolution procedures, such as obtaining member approval. Next, file Articles of Dissolution with the South Carolina Secretary of State, either online or by mail. Ensure all state taxes and fees are paid, including submitting a final tax return to the South Carolina Department of Revenue. Finally, notify creditors, settle debts, and distribute remaining assets to members according to ownership percentages or the operating agreement’s terms.

Is a tax clearance required to dissolve an LLC in South Carolina?

Yes, South Carolina requires LLCs to obtain a Certificate of Tax Clearance before dissolution. This document confirms that all state taxes, including sales tax, employee withholding tax, and annual license fees, are paid in full. Submit a request to the South Carolina Department of Revenue and include the certificate when filing your Articles of Dissolution. Failure to resolve tax obligations may delay or invalidate the dissolution process.

How long does it take to dissolve an LLC in South Carolina?

The timeline for dissolving an LLC in South Carolina varies. Filing Articles of Dissolution typically takes 5–10 business days if submitted by mail, or faster with online processing. However, delays may occur if tax clearance or creditor settlements are pending. Plan for at least 30–60 days to complete all steps, including closing accounts, settling debts, and notifying stakeholders. Expedited processing may be available for an additional fee.

Can a dissolved LLC be reinstated in South Carolina?

Yes, a dissolved LLC can be reinstated in South Carolina under certain conditions. If the LLC was administratively dissolved for non-compliance (e.g., missed annual reports), you must file a Application for Reinstatement with the Secretary of State, pay outstanding fees, and resolve compliance issues. If the LLC voluntarily dissolved but later wishes to resume operations, you may need to file new formation documents. Reinstatement does not revive pending legal claims or liabilities from the dissolution period.

Leave a Reply

Our Recommended Articles