Do Financial Marketers Like Michael Robinsons Strategic Tech Investor or Money Map Report Actually Live Up to Their Hype

In the world of financial marketing, names like Michael Robinson’s Strategic Tech Investor and Money Map Report often dominate headlines, promising groundbreaking insights and lucrative investment opportunities. These platforms claim to offer exclusive strategies, expert analysis, and the potential to outperform the market. But do they truly deliver on their bold promises, or are they simply leveraging hype to attract subscribers? This article delves into the credibility and effectiveness of such financial marketing tools, examining whether they provide genuine value to investors or fall short of expectations. By exploring their track records, methodologies, and user experiences, we aim to uncover whether these services are worth the investment or merely well-packaged marketing campaigns.

- Do Financial Marketers Like Michael Robinson's Strategic Tech Investor or Money Map Report Actually Live Up to Their Hype?

- Who is the most accurate investor?

- What type of investor is Peter Lynch?

- How to find where the big players are investing in the market?

- What do investors do for a living?

-

Frequently Asked Questions (FAQs)

- What is the credibility of financial marketers like Michael Robinson and their publications such as Strategic Tech Investor or Money Map Report?

- Do the investment strategies recommended by Strategic Tech Investor or Money Map Report consistently deliver high returns?

- Are the claims made by Michael Robinson and similar financial marketers backed by verifiable data?

- How do financial marketers like Michael Robinson differentiate their services from other investment newsletters?

Do Financial Marketers Like Michael Robinson's Strategic Tech Investor or Money Map Report Actually Live Up to Their Hype?

Financial marketers such as Michael Robinson, through platforms like Strategic Tech Investor and Money Map Report, often promise lucrative investment opportunities and cutting-edge financial insights. However, the question remains: do these services truly deliver on their promises? This analysis explores the effectiveness, credibility, and value of these financial marketing tools, helping investors make informed decisions.

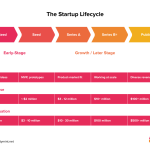

See Also What is the Difference Between an Angel Series a and B Round of Funding

What is the Difference Between an Angel Series a and B Round of FundingWhat Are Strategic Tech Investor and Money Map Report?

Strategic Tech Investor and Money Map Report are financial newsletters created by Michael Robinson and his team. These platforms aim to provide subscribers with investment recommendations, market analysis, and strategic insights into technology and other high-growth sectors. They often highlight emerging trends and undervalued stocks, promising significant returns for their readers.

| Feature | Strategic Tech Investor | Money Map Report |

|---|---|---|

| Focus | Technology and innovation | Broad market opportunities |

| Frequency | Weekly updates | Monthly reports |

| Target Audience | Tech-savvy investors | General investors |

How Credible Are the Investment Recommendations?

The credibility of investment recommendations from Strategic Tech Investor and Money Map Report largely depends on the track record of Michael Robinson and his team. While they often highlight past successes, it’s essential to scrutinize their claims. Independent reviews and user feedback suggest mixed results, with some subscribers reporting significant gains, while others express dissatisfaction with the accuracy and timeliness of the advice.

See Also How Many Universities Have Venture Capital Funds and Which Ones Are Most Prominent

How Many Universities Have Venture Capital Funds and Which Ones Are Most ProminentWhat Are the Costs and Subscription Models?

Both platforms operate on a subscription-based model, with varying costs depending on the level of access. Strategic Tech Investor typically offers a yearly subscription with additional bonuses, while Money Map Report provides a monthly option. Potential subscribers should weigh the costs against the potential benefits and consider whether the investment aligns with their financial goals.

| Service | Subscription Cost | Additional Features |

|---|---|---|

| Strategic Tech Investor | $49/year | Exclusive reports, bonus content |

| Money Map Report | $5/month | Market alerts, premium insights |

What Do Users Say About These Services?

User reviews of Strategic Tech Investor and Money Map Report are polarized. Some subscribers praise the detailed analysis and actionable insights, while others criticize the overhyped promises and lack of consistent results. It’s crucial for potential users to read unbiased reviews and consider their own investment strategies before subscribing.

See Also What is the Best Software for Vc Fund Management?

What is the Best Software for Vc Fund Management?For investors seeking alternatives, there are numerous financial newsletters and investment platforms available. Options like Morningstar, Seeking Alpha, and The Motley Fool offer comprehensive market analysis and diverse investment strategies. Comparing these alternatives can help investors find a service that better aligns with their needs and expectations.

| Alternative | Focus | Cost |

|---|---|---|

| Morningstar | Fund and stock analysis | $199/year |

| Seeking Alpha | Crowdsourced investment ideas | $239/year |

| The Motley Fool | Stock recommendations | $99/year |

Who is the most accurate investor?

:max_bytes(150000):strip_icc()/benjamin_graham-5bfc3a3a46e0fb00511dabca.jpg)

What Defines an Accurate Investor?

An accurate investor is someone who consistently makes decisions that yield positive returns over time. This involves a combination of skills, strategies, and traits, including:

- Analytical skills: The ability to interpret data and market trends effectively.

- Risk management: Balancing potential rewards with acceptable levels of risk.

- Patience: Avoiding impulsive decisions and waiting for the right opportunities.

Top Investors Known for Their Accuracy

Several investors have gained recognition for their precision and consistent success in the market. Some notable names include:

- Warren Buffett: Known for his value investing approach and long-term success.

- Ray Dalio: Founder of Bridgewater Associates, famous for his macroeconomic insights.

- Peter Lynch: Renowned for his ability to identify undervalued stocks during his tenure at Fidelity.

Key Strategies of Accurate Investors

Accurate investors often rely on specific strategies to maintain their success. These include:

- Diversification: Spreading investments across various sectors to minimize risk.

- Fundamental analysis: Evaluating a company's financial health before investing.

- Long-term focus: Prioritizing sustainable growth over short-term gains.

Common Traits Among Accurate Investors

Successful investors share certain characteristics that contribute to their accuracy. These traits include:

- Discipline: Sticking to a well-defined investment plan.

- Adaptability: Adjusting strategies based on changing market conditions.

- Continuous learning: Staying informed about market trends and new opportunities.

How to Measure Investment Accuracy

Measuring the accuracy of an investor involves evaluating their performance over time. Key metrics include:

- Return on Investment (ROI): The percentage gain or loss relative to the initial investment.

- Consistency: The ability to achieve positive returns across different market cycles.

- Risk-adjusted returns: Evaluating returns in the context of the risks taken.

What type of investor is Peter Lynch?

:max_bytes(150000):strip_icc()/peterlynch.asp-ADD-V1-728a9da54c314d4a9ce22f1b9980faaf.jpg)

Peter Lynch's Investment Philosophy

Peter Lynch is widely recognized as a growth investor who focuses on identifying companies with strong potential for expansion. His philosophy revolves around the idea of investing in what you know, which means looking for businesses that are understandable and have clear growth prospects. Lynch emphasizes the importance of thorough research and understanding the fundamentals of a company before investing.

- Growth Investing: Lynch seeks companies with high growth potential, often in emerging industries or those with innovative products.

- Fundamental Analysis: He relies heavily on analyzing financial statements, earnings reports, and other key metrics to assess a company's health.

- Long-Term Perspective: Lynch believes in holding investments for the long term to allow compounding to work in his favor.

Peter Lynch's Stock-Picking Strategy

Lynch's stock-picking strategy is rooted in his ability to identify undervalued companies with strong growth potential. He categorizes stocks into six types: slow growers, stalwarts, fast growers, cyclicals, turnarounds, and asset plays. This classification helps him tailor his investment approach based on the company's characteristics.

- Fast Growers: Companies with high earnings growth rates, often in rapidly expanding industries.

- Turnarounds: Businesses that are recovering from poor performance but have the potential to rebound.

- Asset Plays: Companies with undervalued assets that are not fully reflected in their stock price.

Peter Lynch's Approach to Market Research

Lynch is known for his hands-on approach to market research, often visiting companies and talking to management teams. He believes that personal observation and direct interaction can provide insights that are not evident in financial reports alone.

- On-Site Visits: Lynch frequently visits company facilities to assess operations and management quality.

- Management Interviews: He places significant importance on understanding the vision and competence of a company's leadership.

- Consumer Feedback: Lynch often gathers insights from customers to gauge a company's market position and product quality.

Peter Lynch's Risk Management Techniques

While Lynch is a growth investor, he is also mindful of risk. He advocates for diversification and thorough due diligence to minimize potential losses. Lynch believes that understanding a company's risks is as important as recognizing its growth potential.

- Diversification: Lynch spreads investments across various sectors to reduce exposure to any single industry.

- Risk Assessment: He evaluates potential risks, such as competition, market conditions, and regulatory changes, before investing.

- Exit Strategy: Lynch has clear criteria for selling a stock, such as when a company's fundamentals deteriorate or its growth prospects diminish.

Peter Lynch's Influence on Individual Investors

Peter Lynch has had a profound impact on individual investors by demystifying the stock market and encouraging a do-it-yourself approach. His books, such as One Up on Wall Street and Beating the Street, have inspired millions to take control of their investments.

- Educational Resources: Lynch's writings provide practical advice and strategies for retail investors.

- Empowerment: He encourages individuals to trust their own research and judgment rather than relying solely on Wall Street experts.

- Accessibility: Lynch's approach makes investing accessible to people without formal financial training.

How to find where the big players are investing in the market?

Analyzing Institutional Holdings

To identify where big players are investing, start by analyzing institutional holdings. Large institutions like mutual funds, pension funds, and hedge funds are required to disclose their holdings quarterly through 13F filings with the SEC. These filings provide a detailed breakdown of their investments. Here’s how to use this information:

- Access the SEC’s EDGAR database to review 13F filings.

- Look for trends in sectors or specific stocks that multiple institutions are buying.

- Use financial platforms like Bloomberg or Morningstar to analyze aggregated institutional data.

Tracking Insider Transactions

Another way to find where big players are investing is by tracking insider transactions. Executives and large shareholders often buy or sell shares based on their confidence in the company’s future. Here’s how to leverage this data:

- Monitor Form 4 filings with the SEC, which disclose insider trades.

- Focus on consistent buying patterns, as they may indicate strong confidence.

- Use tools like InsiderScore or OpenInsider to track and analyze insider activity.

Following Hedge Fund Activity

Hedge funds are often considered market movers. Tracking their activity can reveal where big players are investing. Here’s how to do it:

- Review quarterly 13F filings to see hedge fund positions.

- Pay attention to activist hedge funds, as they often drive significant changes in companies.

- Use platforms like WhaleWisdom to analyze hedge fund trends and portfolio changes.

Monitoring Private Equity Investments

Private equity firms invest in private companies or take public companies private. Their investments can signal emerging trends. Here’s how to track them:

- Research private equity firms’ portfolios on their websites or through PitchBook.

- Look for industries or sectors that are receiving significant funding.

- Analyze the exit strategies of private equity firms, such as IPOs or acquisitions, to gauge market interest.

Using Sentiment Analysis Tools

Sentiment analysis tools can help identify where big players are investing by analyzing market sentiment and news. Here’s how to use them:

- Utilize platforms like StockTwits or Seeking Alpha to gauge investor sentiment.

- Monitor news aggregators like Google News or Yahoo Finance for mentions of large investments.

- Use AI-driven tools like AlphaSense to analyze earnings calls and corporate announcements for investment clues.

What do investors do for a living?

:max_bytes(150000):strip_icc()/investor.asp-Final-091e7be05d3949fb9f007ef3948ba162.jpg)

What is the Role of an Investor?

Investors are individuals or entities that allocate capital with the expectation of generating a financial return. Their primary role involves analyzing opportunities, managing risks, and making decisions to grow their wealth. Here are some key responsibilities:

- Research and Analysis: Investors study market trends, financial statements, and economic indicators to identify profitable opportunities.

- Capital Allocation: They decide where to invest their money, whether in stocks, bonds, real estate, or startups.

- Risk Management: Investors assess potential risks and implement strategies to minimize losses.

How Do Investors Make Money?

Investors generate income through various methods, depending on their investment strategy. The most common ways include:

- Capital Gains: Profits earned by selling assets at a higher price than the purchase price.

- Dividends: Regular payments made by companies to shareholders from their profits.

- Interest Income: Earnings from bonds, savings accounts, or other interest-bearing investments.

What Types of Investors Exist?

There are several types of investors, each with unique goals and strategies. The main categories include:

- Retail Investors: Individuals who invest their personal funds in stocks, mutual funds, or other assets.

- Institutional Investors: Large organizations like pension funds, insurance companies, and hedge funds that manage significant amounts of capital.

- Angel Investors: Individuals who provide capital to startups in exchange for equity or convertible debt.

What Skills Do Investors Need?

Successful investors possess a combination of technical knowledge and soft skills. Key skills include:

- Financial Literacy: Understanding financial statements, market trends, and investment vehicles.

- Analytical Thinking: The ability to evaluate data and make informed decisions.

- Patience and Discipline: Staying committed to long-term goals despite market fluctuations.

What Tools Do Investors Use?

Investors rely on various tools and resources to make informed decisions. Some of the most commonly used tools are:

- Trading Platforms: Online platforms like Robinhood or ETRADE for buying and selling securities.

- Financial News: Sources like Bloomberg or CNBC to stay updated on market developments.

- Analytical Software: Tools like Excel or specialized software for financial modeling and analysis.

Frequently Asked Questions (FAQs)

What is the credibility of financial marketers like Michael Robinson and their publications such as Strategic Tech Investor or Money Map Report?

Financial marketers like Michael Robinson often claim to provide exclusive insights and high-return investment opportunities. However, the credibility of such publications depends on their track record and transparency. While some subscribers report success, others argue that the hype surrounding these services may not always match the actual results. It's essential to conduct independent research and consider the potential risks before relying solely on these recommendations.

Do the investment strategies recommended by Strategic Tech Investor or Money Map Report consistently deliver high returns?

The investment strategies promoted by publications like Strategic Tech Investor or Money Map Report often emphasize cutting-edge technologies and emerging markets. While some recommendations may yield significant returns, the volatility of these sectors can lead to inconsistent results. Investors should be cautious and understand that past performance does not guarantee future success. Diversification and a long-term perspective are crucial when following such strategies.

Are the claims made by Michael Robinson and similar financial marketers backed by verifiable data?

Many financial marketers, including Michael Robinson, use bold claims to attract subscribers. However, the extent to which these claims are supported by verifiable data varies. Some publications provide detailed analysis and case studies, while others rely on anecdotal evidence. Investors should scrutinize the sources and methodologies behind these claims to determine their validity. Transparency is key to building trust in any financial advice.

Financial marketers like Michael Robinson often differentiate their services by focusing on niche markets or specialized strategies, such as technology or energy investments. They may also emphasize their expertise and exclusive access to industry insights. However, the effectiveness of these differentiators depends on the quality of the research and the ability to adapt to changing market conditions. Investors should evaluate whether these unique offerings align with their own financial goals and risk tolerance.

Leave a Reply

Our Recommended Articles