Do Small Venture Funds 10m Also Follow the 2 20 Model or Do They Follow Other Models to Make the Economics Work at Small Fund Sizes

Small venture funds, particularly those managing around $10 million, face unique challenges in aligning their economic models with traditional structures like the 2 and 20 fee arrangement. While larger funds often rely on management fees and carried interest to sustain operations, smaller funds must adapt to limited capital bases and higher operational constraints. This raises the question: do these smaller funds adhere to the conventional 2% management fee and 20% carried interest model, or do they employ alternative strategies to ensure viability? Exploring this dynamic reveals how fund managers innovate to balance investor expectations, operational costs, and long-term sustainability in a competitive venture capital landscape.

-

Do Small Venture Funds (M) Follow the 2/20 Model or Adapt Other Models to Make Economics Work?

- What is the Traditional 2/20 Model in Venture Capital?

- Why Might the 2/20 Model Be Challenging for Small Venture Funds?

- What Alternative Models Do Small Venture Funds Use?

- How Do Small Funds Balance Investor Expectations and Operational Needs?

- What Are the Pros and Cons of Alternative Models for Small Venture Funds?

- What is considered a small VC fund?

- What is the financial model of a venture capital fund?

- What is the 2 6 2 rule of venture capital?

-

Frequently Asked Questions (FAQs)

- Do small venture funds with M in assets typically follow the 2% management fee and 20% carried interest model?

- How do small venture funds make their economics work if they deviate from the 2 and 20 model?

- Are there alternative models that small venture funds use instead of the 2 and 20 model?

- What factors influence the fee structure of small venture funds?

Do Small Venture Funds ($10M) Follow the 2/20 Model or Adapt Other Models to Make Economics Work?

Small venture funds, particularly those with a size of around $10 million, often face unique challenges when it comes to making their economics work. While the traditional 2/20 model (2% management fee and 20% carried interest) is widely used in larger funds, smaller funds may need to adapt or adopt alternative models to ensure sustainability and profitability. Below, we explore this topic in detail.

See Also How Are Advisors to a Vc Firm Compensated?

How Are Advisors to a Vc Firm Compensated?What is the Traditional 2/20 Model in Venture Capital?

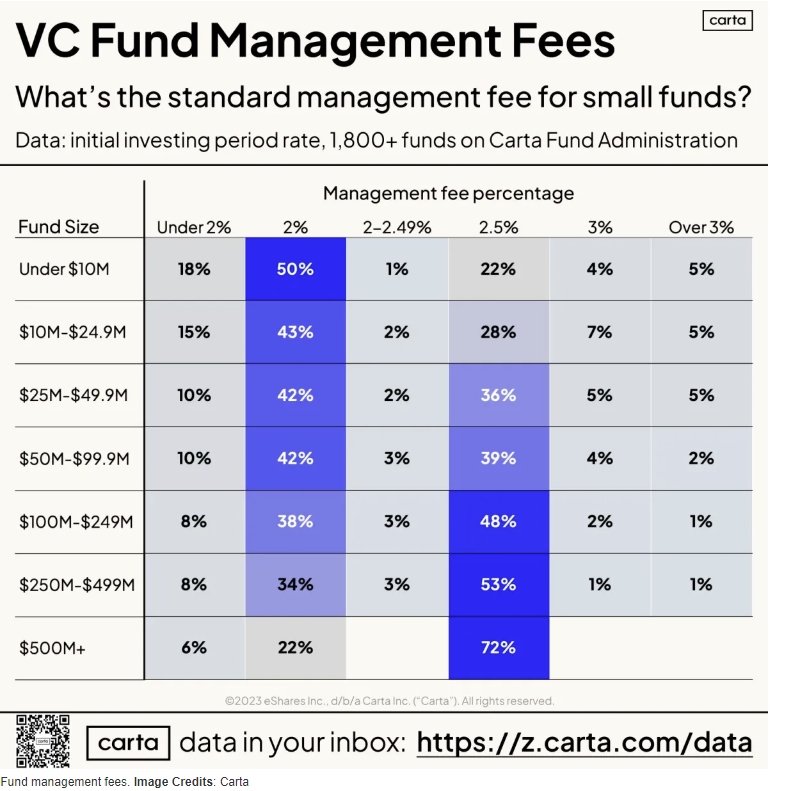

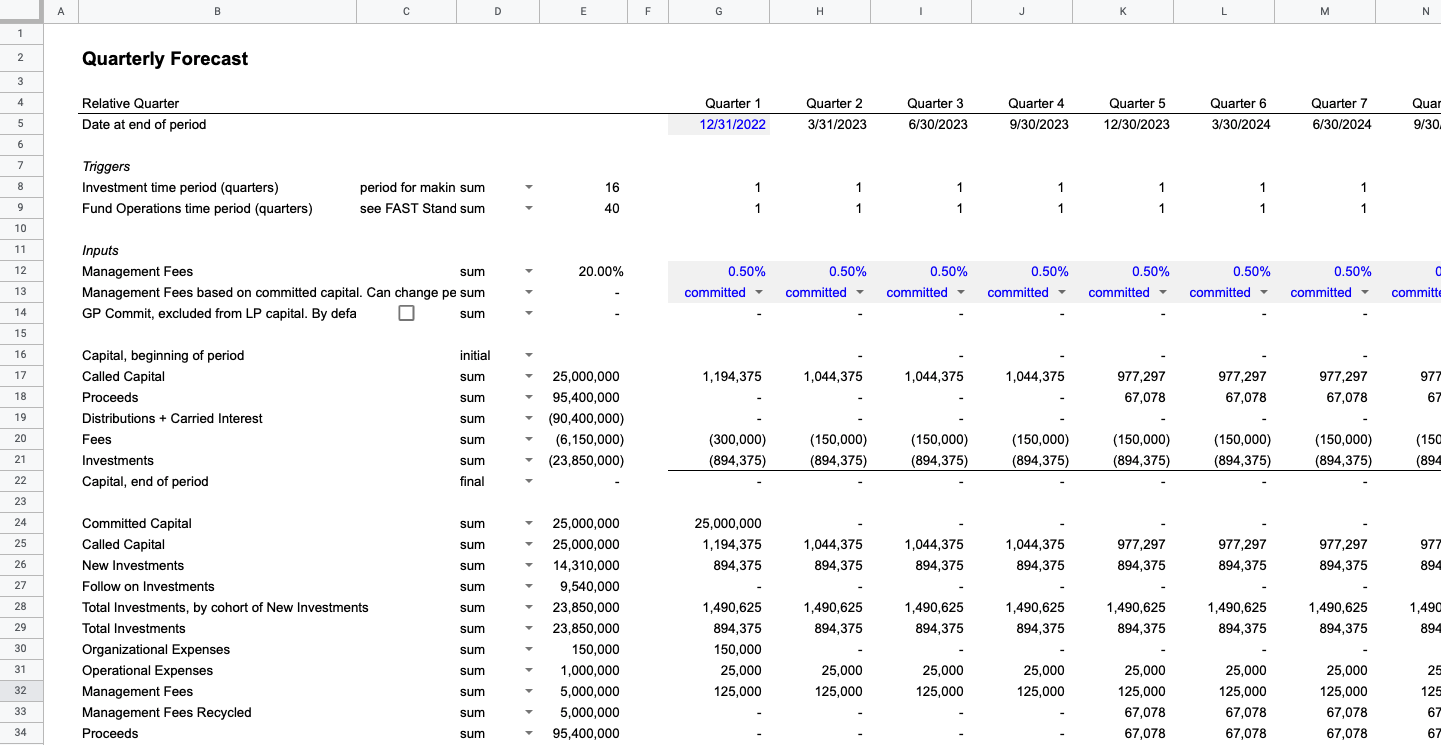

The 2/20 model is a standard fee structure in venture capital, where fund managers charge a 2% management fee on the total fund size annually and take 20% of the profits (carried interest) after returning the initial capital to investors. This model works well for larger funds due to their scale, but smaller funds may struggle to cover operational costs with just a 2% fee on a $10 million fund.

Why Might the 2/20 Model Be Challenging for Small Venture Funds?

For a $10 million fund, a 2% management fee translates to $200,000 annually, which may not be sufficient to cover salaries, office expenses, due diligence costs, and other operational overheads. Additionally, smaller funds often have fewer portfolio companies, making it harder to generate significant carried interest. As a result, many small venture funds explore alternative models to ensure their economics are viable.

See Also How Much Do Analysts Senior Analysts at Vc Firms Make How is Compensation Structured

How Much Do Analysts Senior Analysts at Vc Firms Make How is Compensation StructuredWhat Alternative Models Do Small Venture Funds Use?

Small venture funds often adopt alternative fee structures or hybrid models to make their economics work. Some common approaches include:

- Higher Management Fees: Charging a higher percentage (e.g., 2.5%–3%) to cover operational costs.

- Performance-Based Fees: Reducing management fees but increasing carried interest (e.g., 25%–30%) to align incentives.

- Revenue Sharing: Partnering with startups to share revenue or equity in lieu of traditional fees.

- Hybrid Models: Combining elements of the 2/20 model with performance-based incentives.

How Do Small Funds Balance Investor Expectations and Operational Needs?

Balancing investor expectations with operational needs is critical for small venture funds. Investors in smaller funds often understand the challenges and may be open to alternative fee structures if they align incentives and demonstrate a clear path to profitability. Transparency and clear communication about the fund's strategy and economics are key to maintaining trust.

See Also How much money does a techstar mentor make?

How much money does a techstar mentor make?What Are the Pros and Cons of Alternative Models for Small Venture Funds?

Alternative models offer both advantages and disadvantages for small venture funds:

| Model | Pros | Cons |

|---|---|---|

| Higher Management Fees | Ensures sufficient operational funding | May reduce investor returns |

| Performance-Based Fees | Aligns incentives with investors | Higher risk for fund managers |

| Revenue Sharing | Diversifies income streams | Complex to implement and manage |

| Hybrid Models | Flexible and customizable | May lack clarity for investors |

Small venture funds must carefully evaluate these options to determine the best approach for their specific circumstances.

What is considered a small VC fund?

What is Considered a Small VC Fund?

A small VC fund typically refers to a venture capital fund with a total committed capital of less than $100 million. These funds are often managed by smaller firms or emerging managers and focus on early-stage investments in startups. Small VC funds are known for their agility and ability to take risks on innovative but unproven ideas. They often target niche markets or specific industries where they can leverage their expertise.

Key Characteristics of Small VC Funds

Small VC funds have distinct characteristics that set them apart from larger funds. These include:

- Limited Capital: They operate with smaller amounts of capital, usually under $100 million, which influences their investment strategy.

- Focus on Early-Stage Startups: They often invest in seed or Series A rounds, where the risk is higher but the potential for high returns exists.

- Niche Expertise: Many small VC funds specialize in specific sectors, such as fintech, healthtech, or edtech, allowing them to provide value beyond capital.

Advantages of Small VC Funds

Small VC funds offer several advantages to both investors and startups:

- Flexibility: They can make quicker decisions due to their smaller size and less bureaucratic structure.

- Personalized Attention: Startups often receive more hands-on support and mentorship from the fund's partners.

- Higher Risk Appetite: Small VC funds are more willing to invest in unconventional or high-risk ideas that larger funds might avoid.

Challenges Faced by Small VC Funds

Despite their advantages, small VC funds face unique challenges:

- Limited Resources: With smaller capital pools, they may struggle to compete with larger funds for high-profile deals.

- Fundraising Difficulties: Emerging managers often find it harder to attract limited partners due to lack of a proven track record.

- Portfolio Concentration: Smaller funds may have fewer investments, increasing the impact of any single failure.

How Small VC Funds Differ from Larger Funds

Small VC funds differ from larger funds in several key ways:

- Investment Size: They typically write smaller checks, ranging from $100,000 to $2 million per deal.

- Deal Flow: They often source deals through personal networks or niche communities rather than relying on brand recognition.

- Exit Strategy: Small VC funds may focus on earlier exits, such as acquisitions, rather than waiting for IPOs.

Examples of Small VC Funds

Some well-known small VC funds include:

- Precursor Ventures: Focuses on pre-seed investments in underrepresented founders.

- Hustle Fund: Known for its small check sizes and high-volume investment strategy.

- Lerer Hippeau: Specializes in early-stage investments in the tech and media sectors.

What is the financial model of a venture capital fund?

What is the Structure of a Venture Capital Fund?

The financial model of a venture capital fund is built around a structured framework that involves multiple stakeholders and stages. The fund is typically structured as a limited partnership, where the general partners (GPs) manage the fund and make investment decisions, while the limited partners (LPs) provide the capital. The fund operates in cycles, usually lasting 10 years, with an initial investment period followed by a harvesting phase.

- Limited Partnership Agreement (LPA): Defines the roles, responsibilities, and profit-sharing between GPs and LPs.

- Management Fees: Typically 2% of the committed capital, used to cover operational costs.

- Carried Interest: GPs earn 20% of the profits after returning the initial capital to LPs.

How Do Venture Capital Funds Raise Capital?

Venture capital funds raise capital from limited partners, which include institutional investors, high-net-worth individuals, and family offices. The fundraising process involves pitching the fund's strategy, track record, and potential returns to attract commitments. Once the target amount is reached, the fund closes and begins deploying capital into startups.

- Institutional Investors: Pension funds, endowments, and insurance companies are common LPs.

- High-Net-Worth Individuals: Wealthy individuals seeking high-risk, high-reward investments.

- Fund Size: Typically ranges from $50 million to over $1 billion, depending on the fund's focus.

What is the Investment Strategy of a Venture Capital Fund?

The investment strategy of a venture capital fund focuses on identifying high-growth startups with the potential for significant returns. Funds typically invest in early-stage companies, although some may also participate in later-stage rounds. The strategy is driven by the fund's thesis, which outlines the industries, geographies, and stages of investment.

- Sector Focus: Funds may specialize in tech, healthcare, fintech, or other high-growth sectors.

- Stage Focus: Seed, Series A, or growth-stage investments, depending on the fund's mandate.

- Portfolio Diversification: Investing in 20-30 companies to spread risk and maximize returns.

How Do Venture Capital Funds Generate Returns?

Venture capital funds generate returns through exits, which occur when portfolio companies are sold or go public. The most common exit strategies include acquisitions by larger companies or initial public offerings (IPOs). Returns are distributed to LPs after deducting management fees and carried interest.

- Acquisitions: Portfolio companies are bought by larger firms, providing liquidity.

- IPOs: Companies go public, allowing the fund to sell shares on the stock market.

- Secondary Sales: Selling equity stakes to other investors before an exit.

What are the Risks in Venture Capital Funding?

Venture capital funding carries significant risks due to the high failure rate of startups. Funds must carefully evaluate potential investments and manage their portfolios to mitigate losses. Key risks include market volatility, regulatory changes, and competition.

- Startup Failure: Many startups fail to achieve profitability or scale.

- Market Risk: Economic downturns can reduce exit opportunities.

- Illiquidity: Investments are locked in for years, limiting access to capital.

What is the 2 6 2 rule of venture capital?

The 2 6 2 rule of venture capital is a framework used to evaluate the potential success of a startup portfolio. It suggests that out of 10 investments:

- 2 will be highly successful, generating significant returns.

- 6 will perform moderately, either breaking even or providing modest returns.

- 2 will fail, resulting in a total loss.

This rule helps venture capitalists manage expectations and allocate resources effectively, recognizing that not all investments will yield high returns.

Understanding the 2 6 2 Rule in Venture Capital

The 2 6 2 rule is a heuristic used by venture capitalists to assess the performance distribution of their investments. It highlights the inherent risk and uncertainty in startup investing. Key points include:

- High-risk, high-reward: Only 20% of investments are expected to deliver substantial returns.

- Moderate outcomes: The majority (60%) of investments will yield average or break-even results.

- Failure is inevitable: 20% of investments are likely to fail, emphasizing the importance of diversification.

Why the 2 6 2 Rule Matters for Investors

The 2 6 2 rule is crucial for venture capitalists because it provides a realistic framework for managing expectations. Key reasons include:

- Risk management: It helps investors prepare for potential losses and allocate capital wisely.

- Portfolio diversification: Encourages spreading investments across multiple startups to mitigate risk.

- Focus on high-potential startups: Highlights the importance of identifying and supporting the top 20% of performers.

How the 2 6 2 Rule Impacts Startup Funding

The 2 6 2 rule influences how venture capitalists approach startup funding. Key impacts include:

- Selective investment: Investors focus on startups with high growth potential to maximize the chances of success.

- Staged funding: Capital is often provided in stages, with further funding contingent on meeting milestones.

- Exit strategies: Investors prioritize startups with clear exit strategies, such as acquisitions or IPOs.

Applying the 2 6 2 Rule to Portfolio Management

Venture capitalists use the 2 6 2 rule to guide portfolio management decisions. Key applications include:

- Performance tracking: Regularly monitor the performance of each investment to identify high performers and underperformers.

- Resource allocation: Allocate more resources to the top 20% of startups to maximize returns.

- Learning from failures: Analyze failed investments to improve future decision-making.

Limitations of the 2 6 2 Rule in Venture Capital

While the 2 6 2 rule is a useful guideline, it has limitations. Key considerations include:

- Market variability: The rule may not account for changes in market conditions or industry trends.

- Overgeneralization: It simplifies the complexities of startup investing, which can vary widely.

- Investor bias: Over-reliance on the rule may lead to missed opportunities or misjudgments.

Frequently Asked Questions (FAQs)

Do small venture funds with $10M in assets typically follow the 2% management fee and 20% carried interest model?

Small venture funds, including those with $10M in assets, often adapt the traditional 2% management fee and 20% carried interest model to suit their specific needs. While the 2 and 20 model is widely recognized in the venture capital industry, smaller funds may adjust these percentages to ensure their economics remain viable. For example, they might charge a higher management fee initially to cover operational costs or negotiate a lower carried interest percentage to attract limited partners (LPs).

How do small venture funds make their economics work if they deviate from the 2 and 20 model?

Small venture funds often innovate their fee structures to make their economics work. They might implement a tiered fee system, where the management fee decreases as the fund grows, or they may charge a performance-based fee to align incentives with LPs. Additionally, some funds focus on operational efficiency by keeping team sizes small and leveraging technology to reduce costs. These adjustments help ensure that even with smaller fund sizes, the fund can sustain itself and deliver returns to investors.

Are there alternative models that small venture funds use instead of the 2 and 20 model?

Yes, small venture funds often explore alternative models to the traditional 2 and 20 structure. Some funds adopt a 1 and 30 model, where they charge a 1% management fee and take 30% carried interest, which can be more appealing to LPs. Others might use a revenue-sharing model or a hybrid approach that combines fixed fees with performance-based incentives. These alternatives allow small funds to remain competitive and flexible while addressing the unique challenges of managing smaller asset pools.

What factors influence the fee structure of small venture funds?

The fee structure of small venture funds is influenced by several factors, including the fund's size, the experience of the fund managers, and the expectations of LPs. Smaller funds may face higher operational costs relative to their size, prompting them to adjust fees accordingly. Additionally, the competitive landscape and the fund's investment strategy play a role in determining the fee structure. For instance, funds targeting niche markets or early-stage startups might adopt more flexible fee models to attract investors and align interests.

Leave a Reply

Our Recommended Articles