How Do Junior Lawyers Make the Transition to Venture Capital?

The transition from practicing law to entering the world of venture capital (VC) is an increasingly popular career move for junior lawyers seeking new challenges and opportunities. While the legal profession provides a strong foundation in analytical thinking, contract negotiation, and risk assessment, the VC landscape demands a unique blend of financial acumen, strategic vision, and entrepreneurial mindset. For junior lawyers, this shift requires not only a deep understanding of startup ecosystems and investment strategies but also the ability to adapt to a fast-paced, results-driven environment. This article explores the key steps, skills, and mindset shifts necessary for junior lawyers to successfully navigate this career transition.

How Do Junior Lawyers Make the Transition to Venture Capital?

Understanding the Role of Lawyers in Venture Capital

Junior lawyers transitioning to venture capital must first understand the key responsibilities of legal professionals in this field. In venture capital, lawyers often handle due diligence, contract negotiations, and regulatory compliance. These tasks require a deep understanding of corporate law, intellectual property, and securities regulations. By mastering these areas, junior lawyers can position themselves as valuable assets to venture capital firms.

See Also What is a Good Path to Transition From a Life Science Phd to the Venture Capital Industry

What is a Good Path to Transition From a Life Science Phd to the Venture Capital IndustryBuilding a Strong Network in the Venture Capital Industry

Networking is crucial for junior lawyers aiming to transition into venture capital. Attending industry events, joining professional associations, and connecting with venture capitalists on platforms like LinkedIn can open doors. Additionally, seeking mentorship from experienced professionals in the field can provide insights and guidance on navigating the transition successfully.

Developing Financial and Business Acumen

Venture capital is not just about legal expertise; it also requires a solid understanding of financial modeling, valuation techniques, and business strategy. Junior lawyers should consider taking courses or earning certifications in finance and business to bridge the gap between legal knowledge and venture capital requirements. This dual expertise can make them more attractive to potential employers.

See Also What is an Entrepreneur in Residence Eir What Do They Do How Does It Work

What is an Entrepreneur in Residence Eir What Do They Do How Does It WorkGaining Relevant Experience Through Internships or Side Projects

Practical experience is invaluable. Junior lawyers can seek internships or freelance projects with venture capital firms or startups to gain hands-on experience. Working on term sheets, investment agreements, and fund formation documents can provide a realistic understanding of the venture capital ecosystem and enhance their skill set.

Leveraging Transferable Skills from Legal Practice

Junior lawyers already possess many transferable skills that are highly valued in venture capital. These include analytical thinking, attention to detail, and strong communication skills. By highlighting these abilities and demonstrating how they apply to venture capital, junior lawyers can effectively market themselves to firms looking for legal expertise combined with business insight.

See Also Do Vc Firms Have Structured Mba Internships Hiring Processes and How Does One Go About Securing a Summer Internship

Do Vc Firms Have Structured Mba Internships Hiring Processes and How Does One Go About Securing a Summer Internship| Key Skill | Relevance in Venture Capital |

|---|---|

| Analytical Thinking | Essential for evaluating investment opportunities and risks. |

| Attention to Detail | Crucial for drafting and reviewing legal documents accurately. |

| Communication Skills | Important for negotiating deals and building relationships with stakeholders. |

| Regulatory Knowledge | Necessary for ensuring compliance with laws and regulations. |

| Business Acumen | Helps in understanding the financial and strategic aspects of investments. |

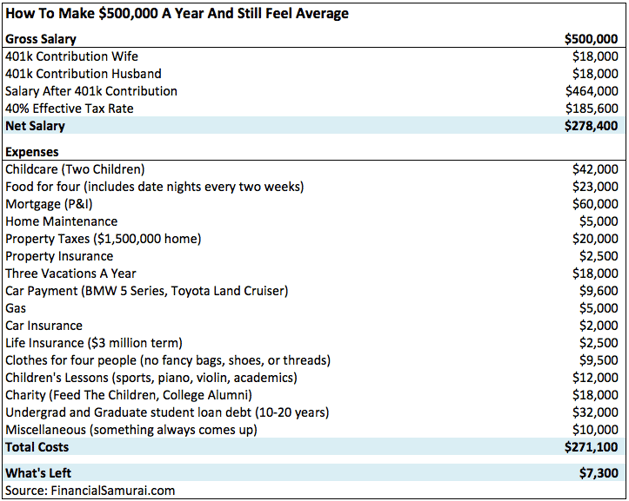

How to make $500,000 a year as a lawyer?

Specialize in a High-Demand Legal Area

To earn $500,000 a year as a lawyer, specializing in a high-demand legal area is crucial. Certain fields of law are more lucrative due to their complexity and the high stakes involved. Consider the following steps:

- Corporate Law: Focus on mergers, acquisitions, and corporate governance. Large corporations are willing to pay top dollar for expert legal advice.

- Intellectual Property Law: Protect patents, trademarks, and copyrights. This field is highly profitable, especially in tech and entertainment industries.

- Tax Law: Specialize in tax planning and litigation. High-net-worth individuals and businesses often require sophisticated tax strategies.

Build a Strong Professional Network

A robust professional network can significantly boost your earning potential. Networking helps you gain referrals, partnerships, and high-profile clients. Here’s how to build one:

- Attend Industry Events: Participate in legal conferences, seminars, and workshops to meet influential professionals.

- Join Professional Associations: Become a member of organizations like the American Bar Association to connect with peers.

- Leverage Social Media: Use platforms like LinkedIn to showcase your expertise and connect with potential clients.

Work at a Top-Tier Law Firm

Securing a position at a top-tier law firm is one of the most straightforward ways to achieve a high income. These firms handle high-value cases and offer substantial compensation. Consider the following:

- Target Prestigious Firms: Apply to firms known for their high salaries, such as those in the Big Law category.

- Excel in Your Role: Demonstrate exceptional skills and dedication to climb the ranks and earn bonuses.

- Negotiate Your Salary: Use your experience and track record to negotiate a higher compensation package.

Develop a Niche Practice

Creating a niche practice can set you apart from competitors and attract high-paying clients. Specializing in a unique area of law allows you to charge premium rates. Here’s how:

- Identify Market Gaps: Research underserved areas in the legal market where demand exceeds supply.

- Market Your Expertise: Use content marketing, speaking engagements, and publications to establish yourself as an authority.

- Offer Tailored Services: Provide customized solutions that address specific client needs, justifying higher fees.

Leverage Technology and Efficiency

Incorporating technology and improving efficiency can help you handle more cases and increase your income. Streamlining processes allows you to focus on high-value tasks. Follow these steps:

- Adopt Legal Tech Tools: Use software for document management, billing, and case tracking to save time.

- Automate Routine Tasks: Implement automation for repetitive tasks like contract drafting and client communication.

- Outsource When Necessary: Delegate administrative tasks to virtual assistants or paralegals to free up your time for billable work.

How much do junior partners make in VC?

What is the Average Salary of a Junior Partner in VC?

The average salary for a junior partner in venture capital (VC) typically ranges between $150,000 and $250,000 per year. This figure can vary depending on factors such as the size of the firm, geographic location, and the individual's experience. In addition to the base salary, junior partners often receive bonuses and carried interest, which can significantly increase their total compensation.

- Base Salary: Typically ranges from $150,000 to $200,000.

- Bonuses: Can add an additional $50,000 to $100,000 annually.

- Carried Interest: A share of the profits from successful investments, which can be substantial over time.

How Does Experience Impact a Junior Partner's Earnings?

Experience plays a crucial role in determining the earnings of a junior partner in VC. Those with more years in the industry or a proven track record of successful investments can command higher salaries and bonuses. Additionally, experienced junior partners are more likely to receive a larger share of carried interest, which can significantly boost their overall compensation.

- Entry-Level: Junior partners with less than 3 years of experience may earn closer to the lower end of the salary range.

- Mid-Level: Those with 3-5 years of experience can expect to earn towards the middle or higher end of the range.

- Senior-Level: Junior partners with over 5 years of experience or a strong investment track record may earn at the top of the range or even higher.

What Role Does Firm Size Play in Compensation?

The size of the VC firm is a significant factor in determining a junior partner's compensation. Larger, more established firms tend to offer higher salaries and more substantial bonuses compared to smaller or newer firms. Additionally, larger firms often have more resources to invest in their employees, including better benefits and opportunities for carried interest.

- Large Firms: Typically offer higher base salaries and larger bonuses.

- Mid-Sized Firms: May offer competitive salaries but with smaller bonuses and less carried interest.

- Small Firms: Often have lower base salaries but may offer more significant equity stakes or carried interest as compensation.

How Does Geographic Location Affect Earnings?

Geographic location can have a significant impact on the earnings of a junior partner in VC. Cities with a high cost of living, such as San Francisco or New York, tend to offer higher salaries to compensate for the increased expenses. In contrast, junior partners in smaller cities or regions with a lower cost of living may earn less, but their overall compensation may still be competitive when adjusted for living costs.

- High Cost of Living Areas: Salaries are often higher to offset living expenses.

- Low Cost of Living Areas: Salaries may be lower, but the overall compensation can still be attractive when considering lower living costs.

- Emerging Markets: Compensation may vary widely, with some firms offering competitive packages to attract talent.

What Additional Benefits Do Junior Partners Receive?

In addition to their base salary and bonuses, junior partners in VC often receive a range of additional benefits. These can include health insurance, retirement plans, and other perks such as gym memberships or transportation allowances. However, one of the most significant benefits is the potential for carried interest, which can provide substantial long-term financial rewards.

- Health Insurance: Comprehensive medical, dental, and vision coverage.

- Retirement Plans: 401(k) or similar plans with employer matching contributions.

- Carried Interest: A share of the profits from successful investments, which can be a significant long-term benefit.

What is the 10x rule for venture capital?

Understanding the 10x Rule in Venture Capital

The 10x rule in venture capital refers to the expectation that a startup should have the potential to return 10 times the initial investment to its investors. This rule is based on the high-risk nature of venture capital investments, where many startups fail, and only a few achieve significant success. Investors aim for a few home runs to compensate for the losses incurred by other investments.

- High-risk, high-reward: Venture capital investments are inherently risky, and the 10x rule ensures that successful investments can cover the losses from failed ones.

- Portfolio strategy: Investors diversify their portfolios, expecting that a small percentage of startups will achieve the 10x return.

- Long-term growth: The rule emphasizes the importance of startups with scalable business models capable of exponential growth.

Why the 10x Rule is Critical for Venture Capitalists

The 10x rule is critical for venture capitalists because it aligns with their investment strategy of seeking outsized returns. Given the high failure rate of startups, this rule ensures that the few successful investments generate enough returns to make the entire portfolio profitable.

- Risk mitigation: The rule helps investors manage the risk associated with early-stage investments.

- Focus on scalability: It encourages investors to prioritize startups with the potential for rapid and significant growth.

- Alignment with exit strategies: The 10x return is often realized through exits like IPOs or acquisitions.

How Startups Can Achieve the 10x Return

For startups to achieve the 10x return, they must focus on creating a scalable business model, addressing a large market, and demonstrating rapid growth potential. Execution, innovation, and strong leadership are key factors in meeting this expectation.

- Market size: Startups should target large or rapidly growing markets to achieve significant returns.

- Innovation: Unique products or services that solve critical problems can drive exponential growth.

- Execution: Strong leadership and efficient execution are essential to scaling the business effectively.

The Role of Valuation in the 10x Rule

Valuation plays a crucial role in the 10x rule. Investors assess a startup's potential based on its current valuation and projected growth. A lower initial valuation increases the likelihood of achieving a 10x return, while overvaluation can make it challenging to meet this benchmark.

- Realistic valuations: Startups should aim for valuations that reflect their current stage and potential.

- Growth projections: Investors evaluate whether the startup's growth trajectory aligns with the 10x return expectation.

- Dilution impact: Overvaluation can lead to excessive dilution, reducing the potential returns for investors.

Challenges in Applying the 10x Rule

Applying the 10x rule is not without challenges. Startups face intense competition, market uncertainties, and execution risks, which can hinder their ability to achieve the desired returns. Investors must carefully evaluate these factors before committing capital.

- Market competition: High competition can limit a startup's ability to capture market share and grow rapidly.

- Execution risks: Poor execution can derail even the most promising startups.

- Economic factors: External factors like economic downturns can impact a startup's growth potential.

How to get into VC with no experience?

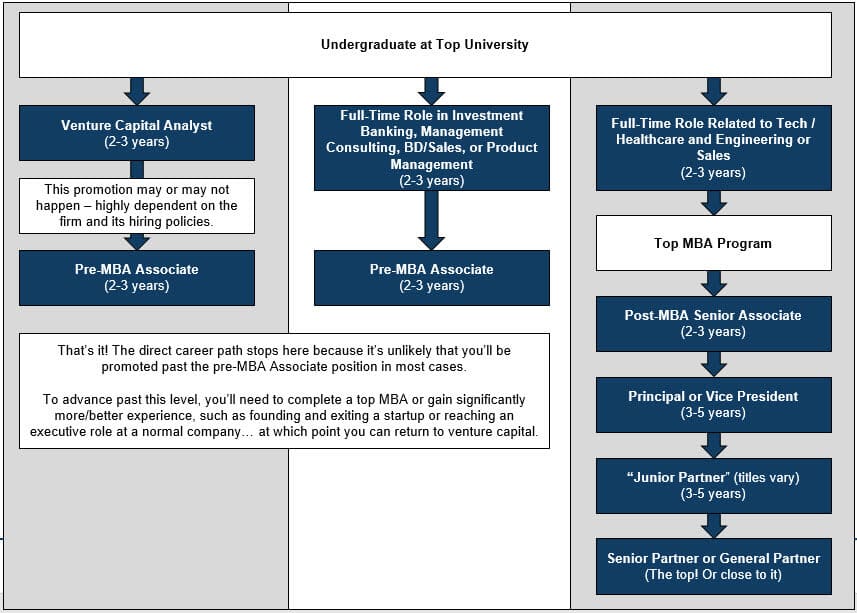

Understanding the Venture Capital Industry

To break into venture capital (VC) with no prior experience, it is crucial to first understand the industry thoroughly. Venture capital involves investing in early-stage companies with high growth potential. Start by researching how VC firms operate, their investment strategies, and the types of startups they typically fund. Here are some steps to build your knowledge:

- Read industry reports and follow reputable VC blogs to stay updated on trends.

- Listen to podcasts featuring successful venture capitalists to learn from their experiences.

- Attend webinars and conferences to network and gain insights from industry leaders.

Building a Strong Network in the VC Space

Networking is a critical component of entering the VC world. Building relationships with professionals in the industry can open doors to opportunities. Start by connecting with people who are already working in VC or related fields. Here’s how to get started:

- Leverage LinkedIn to connect with VC professionals and engage with their content.

- Join VC communities and forums where discussions about startups and investments take place.

- Attend startup events and pitch competitions to meet founders and investors.

Gaining Relevant Skills and Knowledge

While you may not have direct VC experience, acquiring relevant skills can make you a strong candidate. Focus on developing expertise in areas like financial analysis, market research, and startup evaluation. Here’s how to build these skills:

- Take online courses on venture capital, private equity, and startup financing.

- Learn financial modeling to analyze potential investments effectively.

- Study successful startups to understand what makes them attractive to investors.

Starting with Internships or Entry-Level Roles

One of the best ways to enter VC is by securing an internship or entry-level position at a venture capital firm. These roles often provide hands-on experience and exposure to the investment process. Here’s how to approach this:

- Research VC firms that offer internships or associate programs.

- Tailor your resume to highlight transferable skills like analytical thinking and teamwork.

- Reach out to alumni or connections who work in VC for referrals or advice.

Creating Your Own Investment Track Record

If traditional entry points are challenging, consider building your own track record by investing in startups or side projects. This demonstrates your ability to identify and support promising ventures. Here’s how to start:

- Join angel investor networks to co-invest in early-stage startups.

- Invest in crowdfunding platforms to gain experience in evaluating startups.

- Document your investment decisions and outcomes to showcase your analytical skills.

Frequently Asked Questions by our Community

What skills do junior lawyers need to transition into venture capital?

Junior lawyers looking to transition into venture capital should focus on developing a combination of legal expertise and business acumen. Key skills include a deep understanding of corporate law, contract negotiation, and regulatory compliance, which are essential for evaluating potential investments. Additionally, they should cultivate financial literacy, including the ability to analyze financial statements and understand valuation metrics. Soft skills like networking, communication, and critical thinking are equally important, as venture capital often involves building relationships with entrepreneurs and making strategic decisions under uncertainty.

How can junior lawyers gain relevant experience for venture capital?

To gain relevant experience, junior lawyers can start by working on startup-related legal matters, such as fundraising rounds, mergers and acquisitions, or intellectual property issues. This exposure helps them understand the challenges faced by startups and the role of venture capital in their growth. Additionally, they can seek out internships or part-time roles at venture capital firms to gain firsthand experience in deal sourcing, due diligence, and portfolio management. Building a professional network within the venture capital ecosystem, attending industry events, and pursuing certifications like the CFA or MBA can also enhance their qualifications.

What challenges do junior lawyers face when transitioning to venture capital?

One of the main challenges junior lawyers face is the shift from a legal mindset to a business-oriented perspective. While lawyers are trained to focus on risk mitigation and compliance, venture capital requires a focus on growth potential and strategic opportunities. Another challenge is the steep learning curve associated with understanding financial modeling, investment strategies, and market trends. Additionally, breaking into the venture capital industry can be difficult due to its competitive nature and the importance of personal connections. Junior lawyers may also need to overcome perceptions that their background is too narrow or specialized for the broader demands of venture capital.

What steps can junior lawyers take to build a network in venture capital?

Building a network in venture capital requires a proactive approach. Junior lawyers can start by attending industry conferences, startup pitch events, and networking meetups to connect with professionals in the field. Joining online communities and forums focused on venture capital can also provide valuable insights and connections. Leveraging existing relationships, such as colleagues or clients who work in venture capital or startups, can open doors to new opportunities. Additionally, junior lawyers should consider reaching out to mentors or alumni who have successfully transitioned into venture capital for guidance and introductions. Consistent engagement and demonstrating genuine interest in the industry are key to building a strong network.

Leave a Reply

Our Recommended Articles