How is Carry or Carried Interest Split Between Employees and General Partners in a Vc Firm

In venture capital (VC) firms, the distribution of carried interest, or carry, is a critical component of compensation structures, aligning the interests of employees and general partners (GPs). Carry represents a share of the profits earned from successful investments, typically ranging from 20% to 30% of the fund's returns. While GPs often receive the majority of this incentive, employees may also participate through various mechanisms, such as profit-sharing pools or individual allocations. The specific split depends on the firm's structure, seniority levels, and contribution to investment outcomes. Understanding how carry is divided provides insight into the dynamics of VC compensation and the motivations driving key stakeholders.

How is Carry or Carried Interest Split Between Employees and General Partners in a VC Firm?

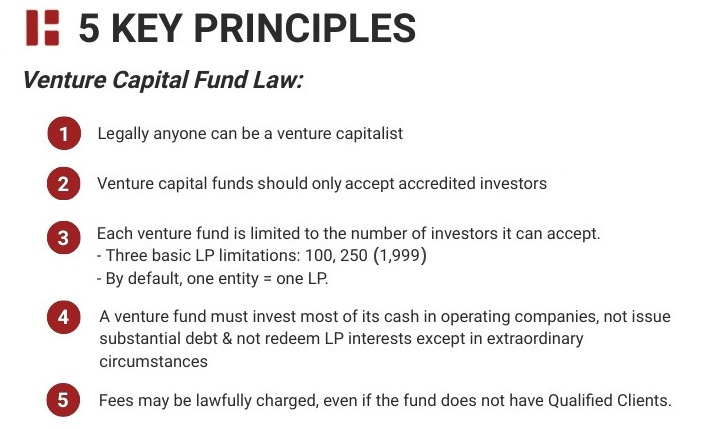

Carry, or carried interest, is a critical component of compensation in venture capital (VC) firms. It represents the share of profits that General Partners (GPs) and, in some cases, employees receive from successful investments. The split of carry between employees and GPs varies depending on the firm's structure, agreements, and hierarchy. Typically, GPs receive the majority of the carry, while employees may receive a smaller portion based on their role, seniority, and contribution to the firm's success.

See Also How Does Carry in a Vc Partnership Vest

How Does Carry in a Vc Partnership VestWhat is Carried Interest in a VC Firm?

Carried interest, often referred to as carry, is the share of profits that GPs and employees earn from the fund's investments after returning the initial capital to limited partners (LPs). It is typically calculated as a percentage of the fund's profits, usually around 20%, while the remaining 80% goes to LPs. Carry serves as a performance incentive, aligning the interests of GPs and employees with those of the investors.

How is Carry Allocated Between General Partners and Employees?

The allocation of carry between GPs and employees depends on the firm's internal agreements. GPs usually receive the largest portion, often 60-80% of the total carry pool, while employees share the remaining 20-40%. Senior employees, such as partners or principals, may receive a larger share compared to junior staff. The exact split is determined by factors like seniority, contribution to deal sourcing, and overall performance.

See Also What is the Standard Carry Bonus Given to an Associate or Principal at a Vc Firm

What is the Standard Carry Bonus Given to an Associate or Principal at a Vc Firm| Role | Typical Carry Allocation |

|---|---|

| General Partners (GPs) | 60-80% |

| Senior Employees (Partners/Principals) | 10-20% |

| Junior Employees (Associates/Analysts) | 5-10% |

What Factors Influence Carry Distribution?

Several factors influence how carry is distributed within a VC firm:

- Seniority: Higher-ranking employees typically receive a larger share.

- Contribution: Employees who play a significant role in sourcing deals or managing investments may receive more carry.

- Firm Policy: Each VC firm has its own policies and agreements governing carry distribution.

- Performance: Exceptional performance can lead to increased carry allocations.

How is Carry Vesting Structured?

Carry is often subject to a vesting schedule to ensure long-term commitment. A common vesting period is 4-6 years, with a 1-year cliff. This means employees must remain with the firm for at least a year to receive any carry, and the remainder vests gradually over the following years. Vesting schedules help retain talent and align employee interests with the firm's long-term success.

See Also How Do Venture Capital Firms Work?

How Do Venture Capital Firms Work?What are the Tax Implications of Carry?

Carry is typically taxed as long-term capital gains, provided the investments are held for more than one year. This tax treatment is favorable compared to ordinary income tax rates. However, tax regulations can vary by jurisdiction, and employees should consult tax professionals to understand their specific obligations.

How Do VC Firms Ensure Fair Carry Distribution?

VC firms often establish clear carry allocation policies to ensure fairness and transparency. These policies outline how carry is distributed, the criteria for eligibility, and the vesting schedule. Regular reviews and adjustments may be made to reflect changes in employee roles, contributions, or firm performance. Open communication about carry distribution helps maintain trust and motivation among employees.

See AlsoWhat Are the Hours Like Working as a Vc Associate Pre and Post Mba at the Bigger FirmsHow much carry do VC partners get?

What is Carry in Venture Capital?

Carry, or carried interest, is the share of profits that venture capital (VC) partners receive from the funds they manage. It is typically a percentage of the profits earned by the fund after returning the initial capital to the investors. Carry serves as a performance incentive for VC partners, aligning their interests with those of the investors.

- Carry is usually 20% of the fund's profits, though it can vary between 15% and 25% depending on the fund's terms.

- It is distributed among the general partners (GPs) after the limited partners (LPs) receive their initial investment and a preferred return, often called the hurdle rate.

- The distribution of carry among partners depends on their seniority, contribution, and agreement within the firm.

How is Carry Distributed Among VC Partners?

The distribution of carry among VC partners is not uniform and depends on several factors. Senior partners or those with more significant roles in the firm typically receive a larger share of the carry.

- Senior partners may receive 50% or more of the total carry, while junior partners or associates get smaller portions.

- The allocation is often based on negotiated agreements and the perceived value each partner brings to the fund.

- Some firms use a tiered system, where carry is distributed in tiers based on seniority and contribution.

What Factors Influence Carry Allocation?

Several factors influence how carry is allocated among VC partners, including their role, experience, and the firm's structure.

- Role and responsibility: Partners who lead deals or manage key aspects of the fund often receive a larger share.

- Experience and track record: Partners with a proven history of successful investments may command a higher carry percentage.

- Firm policies: Each VC firm has its own policies and agreements that dictate carry distribution.

How Does Carry Compare to Management Fees?

Carry is distinct from management fees, which are typically a fixed percentage of the fund's total assets under management (AUM).

- Management fees are usually around 2% of AUM and cover operational costs, while carry is a share of the profits.

- Management fees are paid annually, whereas carry is only realized after the fund achieves profits and returns the initial capital to investors.

- Carry is often seen as the primary incentive for VC partners, as it directly ties their compensation to the fund's performance.

What Are the Challenges in Carry Distribution?

Distributing carry among VC partners can be complex and may lead to disputes if not managed properly.

- Fairness and transparency: Ensuring that carry distribution is perceived as fair can be challenging, especially in larger teams.

- Changing roles: As partners' roles evolve over time, adjusting carry allocations can be difficult.

- Long-term alignment: Balancing short-term contributions with long-term value creation is crucial for maintaining alignment within the team.

What is the 2 6 2 rule of venture capital?

Understanding the 2 6 2 Rule in Venture Capital

The 2 6 2 rule is a principle used in venture capital to categorize startups based on their potential for success. It divides a portfolio of investments into three distinct groups:

- Top 20% (2): These are the high-performing startups expected to generate significant returns, often referred to as the winners.

- Middle 60% (6): These startups show moderate performance and may break even or provide modest returns.

- Bottom 20% (2): These are the underperforming startups that are likely to fail or result in losses.

Why the 2 6 2 Rule Matters for Investors

The 2 6 2 rule helps investors manage risk and expectations by providing a framework to evaluate their portfolio. Key reasons include:

- Risk Diversification: By spreading investments across different categories, investors can mitigate potential losses.

- Focus on High Performers: Identifying the top 20% allows investors to allocate more resources to startups with the highest potential.

- Realistic Expectations: It prepares investors for the likelihood that not all startups will succeed, reducing over-optimism.

How the 2 6 2 Rule Applies to Startup Portfolios

In practice, the 2 6 2 rule is applied to assess the performance of a venture capital portfolio. Here’s how it works:

- Evaluation Phase: Investors analyze each startup's growth metrics, market potential, and financial health.

- Categorization: Startups are grouped into the top 20%, middle 60%, or bottom 20% based on their performance.

- Resource Allocation: More funding and support are directed toward the top 20% to maximize returns.

Challenges of Implementing the 2 6 2 Rule

While the 2 6 2 rule is a useful guideline, it comes with challenges:

- Subjectivity: Categorizing startups can be subjective and influenced by biases or incomplete data.

- Dynamic Markets: Market conditions can change rapidly, affecting the performance of startups unexpectedly.

- Over-Reliance: Relying too heavily on this rule may lead to overlooking hidden gems in the middle or bottom categories.

Examples of the 2 6 2 Rule in Action

Real-world examples illustrate how the 2 6 2 rule operates in venture capital:

- Top 20%: Companies like Uber or Airbnb, which delivered exponential returns for early investors.

- Middle 60%: Startups that achieved moderate success, such as niche e-commerce platforms.

- Bottom 20%: Failed ventures like Juicero, which struggled to gain market traction.

How does carry work in a VC firm?

What is Carry in a Venture Capital Firm?

Carry, or carried interest, is the share of profits that venture capital (VC) firm partners receive from the returns generated by their investments. It is a key component of compensation for VC professionals, incentivizing them to maximize returns for their investors. Typically, carry is distributed after the fund's limited partners (LPs) have received their initial investment back and a predetermined hurdle rate has been met.

- Carry is usually a percentage of the fund's profits, often ranging from 20% to 25%.

- It is distributed among the general partners (GPs) of the VC firm.

- Carry is only realized after the fund's LPs have been repaid their principal investment and any agreed-upon returns.

How is Carry Calculated in a VC Firm?

Carry is calculated based on the net profits of the fund after deducting the initial capital invested by LPs and any management fees. The calculation typically follows a waterfall structure, ensuring that LPs receive their principal and preferred returns before GPs receive their carry.

- First, the fund repays the principal investment to LPs.

- Next, LPs receive a preferred return, often around 6% to 8% annually.

- Finally, the remaining profits are split between LPs and GPs, with GPs receiving their carry percentage.

When is Carry Distributed in a VC Firm?

Carry is distributed after the fund has exited its investments and generated profits. This process is often referred to as a liquidity event, such as an acquisition or IPO. The timing of carry distribution depends on the fund's performance and the terms outlined in the limited partnership agreement (LPA).

- Carry is distributed only after LPs have received their principal and preferred returns.

- Distributions may occur in tranches as investments are exited.

- Some funds may delay carry distribution until the entire fund is liquidated.

Who Receives Carry in a VC Firm?

Carry is primarily allocated to the general partners (GPs) of the VC firm, who are responsible for managing the fund and making investment decisions. However, carry distribution can vary depending on the firm's structure and agreements among partners.

- Senior partners typically receive the largest share of carry.

- Junior partners or associates may receive a smaller percentage or none at all, depending on their role and contribution.

- Some firms allocate carry to non-partner employees as part of their compensation package.

What are the Tax Implications of Carry in a VC Firm?

Carry is often subject to capital gains tax, which is generally lower than ordinary income tax rates. However, the tax treatment of carry can vary depending on the jurisdiction and the structure of the fund. In some cases, carry may be taxed as ordinary income if it does not meet specific criteria for capital gains treatment.

- Carry is typically taxed at the long-term capital gains rate if held for more than one year.

- In the U.S., carry may qualify for the qualified business income (QBI) deduction under certain conditions.

- Tax regulations on carry can be complex and may require consultation with a tax advisor.

Frequently Asked Questions (FAQs)

What is carry or carried interest in a VC firm?

Carry or carried interest refers to the share of profits that the general partners (GPs) and employees of a venture capital (VC) firm receive from the fund's investments. It is typically a percentage of the fund's profits, often around 20%, after the limited partners (LPs) have received their initial capital and a preferred return. This serves as a key incentive for the GPs and employees to maximize the fund's performance.

How is carried interest typically split between general partners and employees?

The split of carried interest between general partners and employees varies depending on the firm's structure and agreements. Generally, the general partners receive the majority of the carry, often between 60% to 80%, as they are responsible for managing the fund and making investment decisions. The remaining 20% to 40% is distributed among employees, such as junior partners, associates, and other key contributors, based on their roles and contributions to the fund's success.

What factors influence the distribution of carried interest?

Several factors influence how carried interest is distributed, including the seniority of the individual, their role in the firm, and their contribution to the fund's performance. Senior partners or founders often receive a larger share due to their leadership and decision-making responsibilities. Additionally, firms may use vesting schedules to ensure that employees remain committed to the firm over the long term, as carry is typically distributed over several years.

Yes, employees, especially those in senior or specialized roles, can often negotiate their share of carried interest during the hiring process or when taking on new responsibilities. However, the ability to negotiate depends on the firm's policies, the employee's leverage, and their perceived value to the firm. In some cases, employees may also receive co-investment opportunities or other incentives in addition to their share of carry.

Leave a Reply

Our Recommended Articles