What Are the Best Mba Programs to Learn About Venture Capital

Venture capital (VC) is a dynamic and high-stakes field that plays a critical role in fueling innovation and entrepreneurship. For aspiring professionals looking to dive into this competitive industry, pursuing an MBA with a focus on venture capital can provide the necessary skills, networks, and insights. The best MBA programs for learning about venture capital combine rigorous academic coursework with hands-on experience, access to industry leaders, and strong ties to startup ecosystems. This article explores top MBA programs globally that stand out for their venture capital offerings, helping prospective students identify the ideal path to launch or advance their careers in this exciting and impactful sector.

- What Are the Best MBA Programs to Learn About Venture Capital?

-

Is an MBA worth it for venture capital?

- What Skills Does an MBA Provide for Venture Capital?

- How Does an MBA Enhance Career Prospects in Venture Capital?

- What Are the Financial Implications of Pursuing an MBA for Venture Capital?

- What Are the Alternatives to an MBA for Entering Venture Capital?

- How Do Top Venture Capital Firms View MBA Graduates?

-

What is the best masters degree for venture capital?

- What is the Best Master's Degree for Venture Capital?

- Why is an MBA Considered the Top Choice for Venture Capital?

- How Does a Master of Finance Prepare You for Venture Capital?

- What Role Does a Master of Science in Entrepreneurship Play in Venture Capital?

- Why is Data Science Important for Venture Capital?

- How Does a Master in Engineering or Technology Management Benefit Venture Capitalists?

-

Which degree is best for venture capital?

- What Are the Most Relevant Degrees for Venture Capital?

- How Does a Degree in Finance Help in Venture Capital?

- Why is a Business Administration Degree Useful for Venture Capital?

- What Role Does an Economics Degree Play in Venture Capital?

- Are There Other Degrees That Can Be Beneficial for Venture Capital?

- Which MBA is best for startups?

- Frequently Asked Questions by our Community

What Are the Best MBA Programs to Learn About Venture Capital?

1. Why Pursue an MBA for Venture Capital?

Pursuing an MBA with a focus on venture capital provides students with the skills, networks, and knowledge necessary to excel in the competitive world of startup investing. MBA programs often offer specialized courses in entrepreneurship, private equity, and venture capital, along with opportunities to connect with industry leaders and participate in startup incubators. This combination of academic rigor and practical experience makes an MBA a valuable stepping stone for aspiring venture capitalists.

See Also What is a Good Path to Transition From a Life Science Phd to the Venture Capital Industry

What is a Good Path to Transition From a Life Science Phd to the Venture Capital Industry2. Top MBA Programs for Venture Capital

Several MBA programs stand out for their strong focus on venture capital and entrepreneurship. These include:

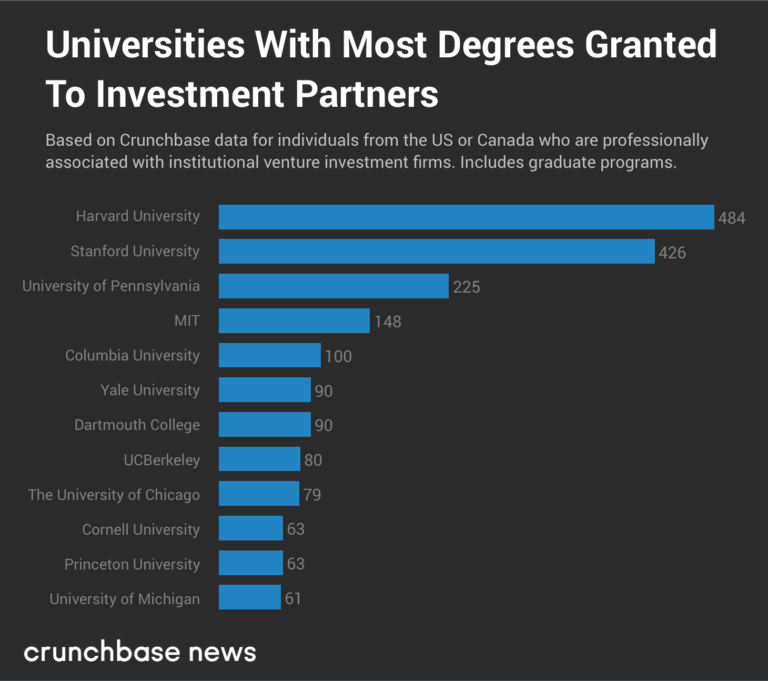

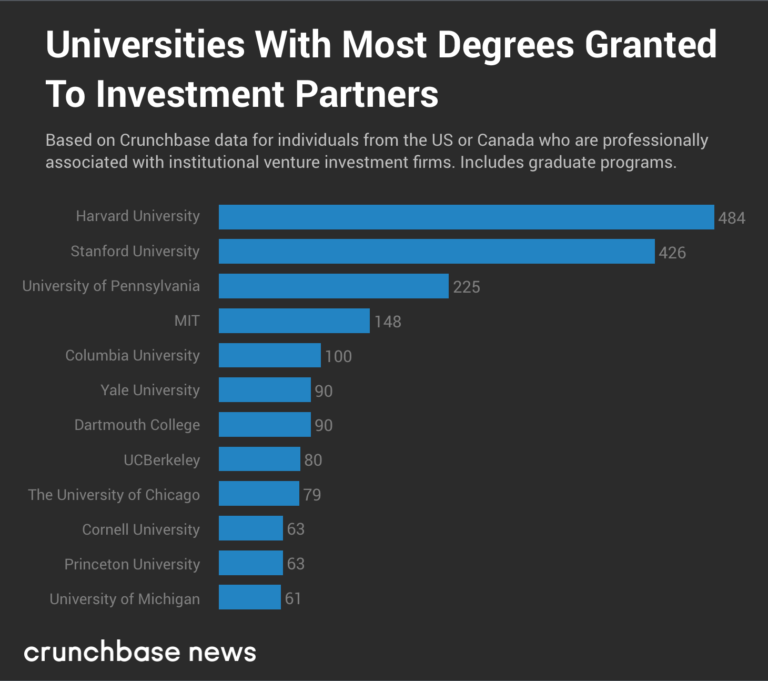

- Stanford Graduate School of Business: Known for its proximity to Silicon Valley and its emphasis on innovation.

- Harvard Business School: Offers a robust curriculum and access to a vast alumni network in venture capital.

- Wharton School of the University of Pennsylvania: Renowned for its finance and entrepreneurship programs.

- MIT Sloan School of Management: Focuses on technology-driven entrepreneurship and venture capital.

- UC Berkeley Haas School of Business: Strong ties to the Bay Area startup ecosystem.

| School | Location | Key Features |

|---|---|---|

| Stanford GSB | California | Silicon Valley connections, entrepreneurship focus |

| Harvard Business School | Massachusetts | Alumni network, venture capital clubs |

| Wharton School | Pennsylvania | Finance expertise, private equity courses |

| MIT Sloan | Massachusetts | Tech-driven entrepreneurship, innovation labs |

| UC Berkeley Haas | California | Bay Area startup ecosystem, venture capital competitions |

3. Key Courses in Venture Capital-Focused MBA Programs

MBA programs with a venture capital focus typically include courses such as:

- Venture Capital and Private Equity: Covers the fundamentals of investing in startups.

- Entrepreneurial Finance: Focuses on funding strategies for early-stage companies.

- Startup Strategy: Explores how to build and scale successful startups.

- Innovation and Disruption: Examines how new technologies and business models impact industries.

- Negotiation and Deal Structuring: Teaches the art of structuring investment deals.

Are there any reasons why a startup would not want to go through TechStars?

Are there any reasons why a startup would not want to go through TechStars?4. Networking Opportunities in Venture Capital MBA Programs

Networking is a critical component of any MBA program, especially for those interested in venture capital. Top programs offer:

- Alumni Networks: Access to successful venture capitalists and entrepreneurs.

- Venture Capital Clubs: Student-led organizations that host events and pitch competitions.

- Industry Conferences: Opportunities to meet investors and founders.

- Mentorship Programs: Guidance from experienced professionals in the field.

- Internships: Hands-on experience at venture capital firms or startups.

5. How to Choose the Right MBA Program for Venture Capital

When selecting an MBA program for venture capital, consider the following factors:

- Curriculum: Look for programs with a strong focus on entrepreneurship and finance.

- Location: Proximity to startup hubs like Silicon Valley or Boston can provide networking advantages.

- Reputation: Choose schools with a track record of producing successful venture capitalists.

- Career Services: Evaluate the support offered for internships and job placements in venture capital.

- Alumni Success: Research the career paths of alumni to gauge the program's effectiveness in the venture capital space.

How Do Junior Lawyers Make the Transition to Venture Capital?

How Do Junior Lawyers Make the Transition to Venture Capital?Is an MBA worth it for venture capital?

What Skills Does an MBA Provide for Venture Capital?

An MBA equips individuals with a range of skills that are highly valuable in venture capital. These include:

- Financial Analysis: Understanding complex financial models and valuation techniques is crucial for evaluating startups.

- Strategic Thinking: MBA programs emphasize strategic planning, which helps in assessing market opportunities and competitive landscapes.

- Networking: MBA programs often provide access to a vast network of alumni and industry professionals, which can be beneficial for deal sourcing and partnerships.

How Does an MBA Enhance Career Prospects in Venture Capital?

An MBA can significantly enhance career prospects in venture capital by:

- Credibility: Holding an MBA from a reputable institution can add credibility and open doors to top-tier VC firms.

- Career Transition: For those transitioning from other industries, an MBA provides the necessary knowledge and skills to enter the VC field.

- Leadership Roles: MBA graduates are often considered for leadership positions due to their advanced training in management and strategy.

What Are the Financial Implications of Pursuing an MBA for Venture Capital?

Pursuing an MBA involves significant financial considerations, including:

- Tuition Costs: MBA programs can be expensive, with tuition fees ranging from $50,000 to over $100,000.

- Opportunity Cost: Taking time off work to pursue an MBA means losing potential earnings and career progression during that period.

- Return on Investment: The potential increase in salary and career advancement opportunities must be weighed against the costs.

What Are the Alternatives to an MBA for Entering Venture Capital?

There are several alternatives to an MBA for those interested in venture capital, such as:

- Industry Experience: Gaining direct experience in startups or related fields can provide practical knowledge and insights.

- Specialized Courses: Enrolling in specialized courses or certifications in finance, entrepreneurship, or technology can be beneficial.

- Networking: Building a strong professional network through industry events, conferences, and online platforms can open doors to VC opportunities.

How Do Top Venture Capital Firms View MBA Graduates?

Top venture capital firms often have specific views on MBA graduates, including:

- Preference for MBAs: Some top-tier VC firms prefer candidates with MBAs due to their advanced training and analytical skills.

- Diverse Backgrounds: While MBAs are valued, many firms also appreciate diverse backgrounds and unique experiences that candidates bring.

- Performance-Based: Ultimately, performance, deal-making ability, and industry knowledge are critical factors, regardless of educational background.

What is the best masters degree for venture capital?

What is the Best Master's Degree for Venture Capital?

The best master's degree for venture capital typically depends on your career goals and interests. However, certain degrees are highly valued in the venture capital industry due to their focus on finance, entrepreneurship, and strategic thinking. Below are some of the most relevant degrees:

- Master of Business Administration (MBA): An MBA is one of the most popular choices for aspiring venture capitalists. It provides a comprehensive understanding of business operations, financial analysis, and strategic decision-making.

- Master of Finance (MFin): This degree focuses on advanced financial concepts, investment strategies, and risk management, which are crucial for evaluating startups and managing portfolios.

- Master of Science in Entrepreneurship: This degree is ideal for those interested in understanding the startup ecosystem, innovation, and how to identify high-potential businesses.

- Master of Science in Data Science or Analytics: With the rise of data-driven decision-making, this degree helps in analyzing market trends, startup performance, and investment opportunities.

- Master of Science in Engineering or Technology Management: For those interested in tech-focused venture capital, this degree provides insights into emerging technologies and their commercial potential.

Why is an MBA Considered the Top Choice for Venture Capital?

An MBA is often considered the top choice for venture capital because it offers a well-rounded education in business and finance. Here are some reasons why:

- Networking Opportunities: MBA programs often provide access to a vast network of alumni, industry leaders, and potential investors.

- Case-Based Learning: The curriculum typically includes case studies that simulate real-world business challenges, preparing students for the complexities of venture capital.

- Leadership Skills: MBA programs emphasize leadership and management, which are essential for guiding startups and making strategic investment decisions.

How Does a Master of Finance Prepare You for Venture Capital?

A Master of Finance (MFin) equips you with specialized knowledge in financial analysis and investment strategies, which are critical for venture capital. Key benefits include:

- Advanced Financial Modeling: Learn to create detailed financial models to evaluate startup valuations and growth potential.

- Risk Assessment: Gain expertise in assessing and mitigating risks associated with early-stage investments.

- Portfolio Management: Understand how to diversify and manage investment portfolios effectively.

What Role Does a Master of Science in Entrepreneurship Play in Venture Capital?

A Master of Science in Entrepreneurship is particularly valuable for understanding the startup ecosystem. Here’s how it helps:

- Startup Evaluation: Learn to identify promising startups by analyzing their business models, market potential, and scalability.

- Innovation Insights: Gain a deep understanding of innovation processes and how to spot disruptive technologies.

- Entrepreneurial Mindset: Develop the ability to think like an entrepreneur, which is crucial for mentoring and supporting portfolio companies.

Why is Data Science Important for Venture Capital?

Data science is becoming increasingly important in venture capital due to the rise of data-driven decision-making. Here’s why:

- Market Analysis: Use data analytics to identify market trends and predict future opportunities.

- Performance Metrics: Analyze startup performance using key metrics and benchmarks.

- Investment Insights: Leverage data to make informed investment decisions and optimize portfolio performance.

How Does a Master in Engineering or Technology Management Benefit Venture Capitalists?

A Master in Engineering or Technology Management is particularly beneficial for venture capitalists focusing on tech startups. Key advantages include:

- Technical Expertise: Gain a deep understanding of emerging technologies and their commercial applications.

- Innovation Evaluation: Learn to assess the feasibility and potential impact of new technologies.

- Cross-Disciplinary Knowledge: Combine technical knowledge with business acumen to make well-rounded investment decisions.

Which degree is best for venture capital?

What Are the Most Relevant Degrees for Venture Capital?

When pursuing a career in venture capital, certain degrees provide a strong foundation. The most relevant degrees include:

- Finance: A degree in finance equips you with the skills to analyze investments, manage portfolios, and understand market trends.

- Business Administration: This degree offers a broad understanding of business operations, strategy, and management, which are crucial in venture capital.

- Economics: Understanding economic principles helps in assessing market conditions and making informed investment decisions.

How Does a Degree in Finance Help in Venture Capital?

A degree in finance is particularly beneficial for venture capital due to its focus on financial analysis and investment strategies. Key advantages include:

- Investment Analysis: Learn to evaluate the financial health and potential of startups.

- Risk Management: Understand how to mitigate risks associated with investments.

- Valuation Techniques: Gain expertise in valuing companies, which is critical for making investment decisions.

Why is a Business Administration Degree Useful for Venture Capital?

A business administration degree provides a comprehensive understanding of various business functions, making it highly useful for venture capital. Key benefits include:

- Strategic Thinking: Develop the ability to create and implement business strategies.

- Leadership Skills: Learn how to lead and manage teams effectively.

- Entrepreneurial Insight: Gain insights into the challenges and opportunities faced by startups.

What Role Does an Economics Degree Play in Venture Capital?

An economics degree is valuable in venture capital as it provides a deep understanding of market dynamics and economic principles. Key roles include:

- Market Analysis: Analyze market trends and economic conditions to identify investment opportunities.

- Policy Impact: Understand how government policies and regulations can affect investments.

- Economic Forecasting: Predict future economic trends to make informed investment decisions.

Are There Other Degrees That Can Be Beneficial for Venture Capital?

While finance, business administration, and economics are the most common, other degrees can also be beneficial for venture capital. These include:

- Computer Science: Understanding technology trends and innovations is crucial in today's tech-driven market.

- Engineering: Provides technical knowledge that can be useful in evaluating tech startups.

- Law: Knowledge of legal frameworks and intellectual property rights can be advantageous in deal structuring and negotiations.

Which MBA is best for startups?

What Makes an MBA Program Ideal for Startups?

An MBA program ideal for startups focuses on entrepreneurship, innovation, and practical skills. It should offer:

- Hands-on learning through real-world projects and case studies.

- Access to a strong alumni network of successful entrepreneurs.

- Courses in venture capital, scaling businesses, and product development.

Top MBA Programs for Aspiring Startup Founders

Some of the best MBA programs for startup founders include:

- Stanford Graduate School of Business: Known for its focus on innovation and proximity to Silicon Valley.

- Harvard Business School: Offers a strong emphasis on entrepreneurship and case-based learning.

- MIT Sloan School of Management: Renowned for its focus on technology and innovation.

Key Skills Gained from an MBA for Startups

An MBA tailored for startups equips students with essential skills such as:

- Leadership and team management.

- Financial modeling and fundraising strategies.

- Market analysis and customer acquisition techniques.

How to Choose the Right MBA Program for Your Startup Goals

When selecting an MBA program for startups, consider the following:

- Curriculum: Ensure it includes courses on entrepreneurship and innovation.

- Location: Proximity to startup hubs like Silicon Valley or Boston can be advantageous.

- Networking opportunities: Look for programs with strong ties to the startup ecosystem.

Benefits of an MBA for Startup Founders

Pursuing an MBA can provide startup founders with:

- Credibility when pitching to investors.

- Access to mentors and industry experts.

- Practical tools to navigate the challenges of scaling a business.

Frequently Asked Questions by our Community

What are the top MBA programs for learning about venture capital?

Stanford Graduate School of Business, Harvard Business School, and The Wharton School at the University of Pennsylvania are widely regarded as the top MBA programs for aspiring venture capitalists. These schools offer specialized courses, strong alumni networks in the venture capital industry, and proximity to major tech hubs like Silicon Valley. Additionally, programs like MIT Sloan and UC Berkeley Haas are also highly recommended due to their focus on entrepreneurship and innovation.

How do MBA programs prepare students for careers in venture capital?

MBA programs prepare students for venture capital careers by offering specialized courses in entrepreneurship, private equity, and startup financing. Many programs also provide hands-on experience through venture capital internships, startup incubators, and pitch competitions. Networking opportunities with industry professionals and access to alumni who are active in the venture capital space further enhance career readiness. Schools like Harvard and Stanford often host venture capital clubs and events to connect students with potential employers.

What should I look for in an MBA program if I want to focus on venture capital?

When choosing an MBA program for venture capital, look for schools with a strong focus on entrepreneurship and innovation. Key factors include access to venture capital firms, proximity to tech hubs, and a robust alumni network in the industry. Additionally, consider programs that offer elective courses in venture capital, private equity, and startup financing. Schools like Stanford, Harvard, and Wharton are known for their strong ties to the venture capital ecosystem.

Are there any online MBA programs that focus on venture capital?

Yes, some online MBA programs offer courses and specializations in venture capital. For example, Quantic School of Business and Technology and IE Business School provide online programs with a focus on entrepreneurship and venture capital. While online programs may lack the in-person networking opportunities of traditional MBAs, they often include virtual networking events, mentorship programs, and access to online communities of venture capital professionals. However, for those seeking the most direct path into venture capital, traditional programs like Stanford or Harvard remain the top choices.

Leave a Reply

Our Recommended Articles