What Are the Top Vc Firms With a Dedicated Nyc Office?

New York City, a global hub for innovation and entrepreneurship, is home to some of the most influential venture capital (VC) firms in the world. These firms play a pivotal role in shaping the startup ecosystem by providing funding, mentorship, and strategic guidance to emerging businesses. For founders seeking investment, understanding which top VC firms maintain a dedicated presence in NYC is crucial. This article explores the leading venture capital firms with offices in the city, highlighting their investment focus, notable portfolio companies, and contributions to the thriving tech and startup landscape. Whether you're an entrepreneur or an investor, this guide offers valuable insights into NYC's VC powerhouses.

-

What Are the Top VC Firms With a Dedicated NYC Office?

- 1. Why NYC is a Hub for Venture Capital Firms

- 2. Top VC Firms with a Dedicated NYC Office

- 3. Union Square Ventures: A Pioneer in NYC's VC Scene

- 4. Lux Capital: Investing in the Future of Science and Technology

- 5. Insight Partners: Scaling Software Companies Globally

- 6. Bessemer Venture Partners: A Legacy of Successful Investments

- What are the most active VCs in NYC?

- What is the largest VC company in NYC?

- Who are tier 1 VCs?

- What is the most prestigious VC firm?

- Frequently Asked Questions by our Community

What Are the Top VC Firms With a Dedicated NYC Office?

1. Why NYC is a Hub for Venture Capital Firms

New York City has emerged as a global hub for venture capital due to its diverse economy, access to talent, and proximity to major industries like finance, media, and technology. The city's vibrant startup ecosystem attracts top-tier VC firms looking to invest in innovative companies. Additionally, NYC's networking opportunities and cultural diversity make it an ideal location for venture capital offices.

See Also What's the Reputation of Dcm Venture Capital?

What's the Reputation of Dcm Venture Capital?2. Top VC Firms with a Dedicated NYC Office

Several leading venture capital firms have established dedicated offices in NYC to tap into the city's thriving startup scene. These firms are known for their strategic investments, strong portfolios, and industry expertise. Below is a table highlighting some of the top VC firms with a presence in NYC:

| VC Firm | Focus Area | Notable Investments |

|---|---|---|

| Union Square Ventures | Technology, Internet | Twitter, Etsy, Coinbase |

| Lux Capital | Deep Tech, Science | Anduril, Desktop Metal |

| FirstMark Capital | Tech, SaaS | Pinterest, Shopify |

| Insight Partners | Software, Enterprise | Twitter, Shopify |

| Bessemer Venture Partners | Tech, Healthcare | LinkedIn, Pinterest |

3. Union Square Ventures: A Pioneer in NYC's VC Scene

Union Square Ventures (USV) is one of the most influential VC firms in NYC, known for its early-stage investments in disruptive technologies. With a focus on internet-based companies, USV has backed iconic startups like Twitter, Etsy, and Coinbase. Their hands-on approach and deep industry knowledge make them a key player in the NYC venture capital landscape.

See Also Do Many Venture Capital Firms Sponsor H1 B Visas?

Do Many Venture Capital Firms Sponsor H1 B Visas?4. Lux Capital: Investing in the Future of Science and Technology

Lux Capital stands out for its focus on deep tech and scientific innovation. With a dedicated NYC office, Lux Capital invests in cutting-edge technologies such as artificial intelligence, robotics, and biotechnology. Their portfolio includes high-growth companies like Anduril and Desktop Metal, showcasing their commitment to transforming industries through groundbreaking innovations.

5. Insight Partners: Scaling Software Companies Globally

Insight Partners is a leading VC firm specializing in software and enterprise solutions. Their NYC office plays a crucial role in identifying and scaling high-potential startups. With investments in companies like Twitter and Shopify, Insight Partners has a proven track record of driving growth and creating value for their portfolio companies. Their scale-up strategy focuses on operational support and global expansion.

See Also What Happened to Benchmark's Website?

What Happened to Benchmark's Website?6. Bessemer Venture Partners: A Legacy of Successful Investments

Bessemer Venture Partners is one of the oldest and most respected VC firms with a strong presence in NYC. They have a diverse portfolio spanning technology, healthcare, and consumer industries. Bessemer's investments in companies like LinkedIn and Pinterest highlight their ability to identify market leaders early on. Their experienced team and global network make them a trusted partner for startups.

What are the most active VCs in NYC?

Why Are Venture Capital Funds Mostly for Tech Startups?

Why Are Venture Capital Funds Mostly for Tech Startups?Top Venture Capital Firms in NYC

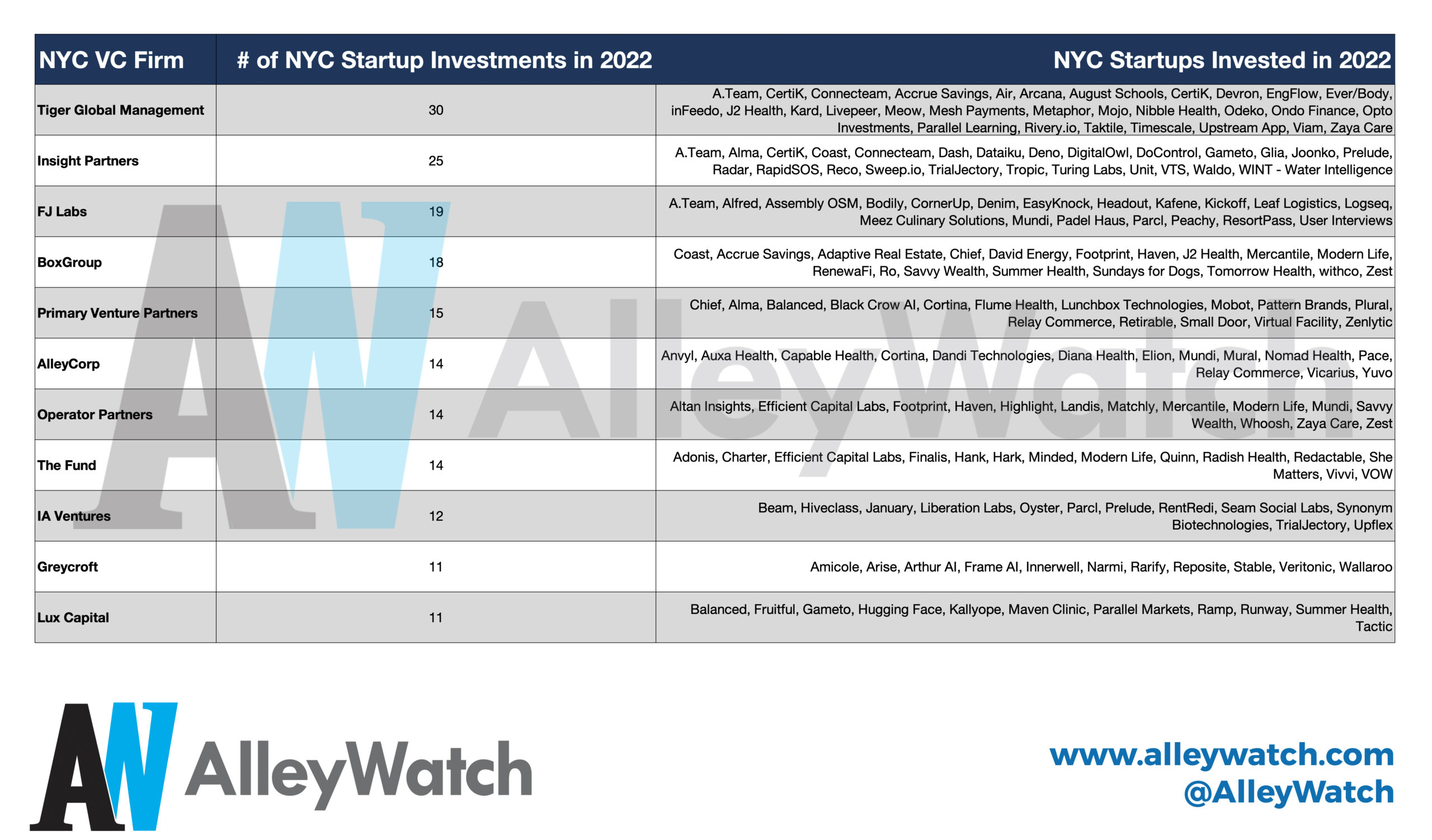

New York City is home to some of the most active and influential venture capital firms in the world. These firms are known for their strategic investments in startups across various industries, including technology, healthcare, and fintech. Below is a list of the most active VCs in NYC:

- Union Square Ventures: Known for early-stage investments in companies like Twitter and Etsy.

- Lux Capital: Focuses on emerging technologies and science-driven startups.

- FirstMark Capital: Invests in transformative companies such as Pinterest and Shopify.

- Insight Partners: Specializes in growth-stage investments, particularly in software companies.

- Thrive Capital: Led by Joshua Kushner, it focuses on consumer internet and software startups.

Key Industries Targeted by NYC VCs

Venture capital firms in NYC are particularly active in specific industries that align with the city's economic strengths. These industries include:

- Fintech: NYC is a global financial hub, making fintech a prime focus for VCs like Bessemer Venture Partners.

- Healthtech: Firms such as OrbiMed invest heavily in healthcare innovation and biotechnology.

- E-commerce: With the rise of online shopping, VCs like Forerunner Ventures are backing disruptive e-commerce platforms.

Notable Investments by NYC VCs

NYC-based venture capital firms have made notable investments in some of the most successful startups globally. Here are a few examples:

- Union Square Ventures: Invested in Twitter during its early stages, leading to significant returns.

- Insight Partners: Backed Shopify, which has become a leading e-commerce platform.

- Thrive Capital: Invested in Instagram before its acquisition by Facebook.

Emerging Trends in NYC's VC Ecosystem

The venture capital landscape in NYC is constantly evolving, with new trends shaping the industry. Some of these trends include:

- Climate Tech: Increasing investments in startups focused on sustainability and renewable energy.

- Web3 and Blockchain: Growing interest in decentralized technologies and cryptocurrency startups.

- AI and Machine Learning: VCs are funding startups that leverage artificial intelligence for innovative solutions.

How NYC VCs Support Startups Beyond Funding

Beyond providing capital, NYC venture capital firms offer extensive support to startups. This includes:

- Mentorship: Experienced partners provide guidance on scaling and strategy.

- Networking: Access to a vast network of industry experts and potential partners.

- Operational Support: Assistance with hiring, marketing, and product development.

What is the largest VC company in NYC?

The largest venture capital (VC) company in New York City is Andreessen Horowitz (a16z), which has a significant presence in the city. Known for its extensive portfolio and high-profile investments, a16z has established itself as a dominant player in the VC landscape, particularly in NYC's thriving tech and startup ecosystem.

What Makes Andreessen Horowitz the Largest VC in NYC?

Andreessen Horowitz stands out as the largest VC in NYC due to several key factors:

- Massive Fund Size: The firm manages billions of dollars in assets, allowing it to make substantial investments across various stages of startup growth.

- Diverse Portfolio: a16z invests in a wide range of industries, including fintech, biotech, crypto, and AI, making it a versatile player in the market.

- Strategic Presence: With offices in NYC, a16z leverages the city's status as a global financial and tech hub to identify and support innovative startups.

How Does Andreessen Horowitz Operate in NYC?

Andreessen Horowitz operates in NYC through a combination of strategic initiatives and partnerships:

- Local Networking: The firm actively engages with NYC's startup community through events, mentorship programs, and collaborations with local accelerators.

- Focus on Emerging Markets: a16z prioritizes investments in NYC-based startups that are disrupting traditional industries, such as real estate tech and healthtech.

- Global Reach: While based in NYC, the firm also connects its portfolio companies to international markets, enhancing their growth potential.

What Are the Key Investments of Andreessen Horowitz in NYC?

Andreessen Horowitz has made several notable investments in NYC-based companies:

- Coinbase: A leading cryptocurrency exchange that has revolutionized the digital asset space.

- Better.com: A fintech company specializing in online mortgage lending, headquartered in NYC.

- Opendoor: A proptech startup transforming the real estate market with its innovative platform.

Why Is NYC a Hub for Venture Capital Firms Like Andreessen Horowitz?

NYC's status as a global financial and tech hub makes it an ideal location for VC firms:

- Access to Talent: The city is home to top-tier universities and a diverse workforce, providing a steady pipeline of skilled professionals.

- Proximity to Markets: NYC's central location offers easy access to major financial institutions and global markets.

- Thriving Startup Ecosystem: The city's vibrant startup scene attracts investors and entrepreneurs alike, fostering innovation and collaboration.

How Does Andreessen Horowitz Compare to Other NYC-Based VC Firms?

Andreessen Horowitz distinguishes itself from other NYC-based VC firms through its unique approach:

- Scale of Investments: a16z often leads funding rounds with larger capital commitments compared to its peers.

- Focus on Disruption: The firm prioritizes startups that challenge traditional business models, setting it apart from more conservative investors.

- Global Influence: With a presence in multiple cities worldwide, a16z offers its portfolio companies unparalleled access to international resources and networks.

Who are tier 1 VCs?

What Defines Tier 1 Venture Capital Firms?

Tier 1 venture capital (VC) firms are the most prestigious and influential investors in the startup ecosystem. They are characterized by their ability to consistently identify and fund high-potential startups, often leading to significant returns. These firms typically have:

- Proven track records of successful investments in unicorn companies (startups valued at over $1 billion).

- Extensive networks of industry experts, founders, and co-investors.

- Large fund sizes, often managing billions of dollars in assets.

Top Tier 1 VC Firms in the Industry

Some of the most well-known Tier 1 VC firms include:

- Sequoia Capital: Known for early investments in companies like Apple, Google, and Airbnb.

- Andreessen Horowitz (a16z): A leader in tech investments, backing companies like Facebook and Coinbase.

- Accel: Famous for its early investment in Facebook and other tech giants.

Why Startups Seek Tier 1 VC Funding

Startups often prioritize Tier 1 VC funding because these firms offer more than just capital. They provide:

- Credibility and validation in the market, attracting other investors and talent.

- Strategic guidance from experienced partners with deep industry knowledge.

- Access to resources such as mentorship, partnerships, and operational support.

How Tier 1 VCs Differ from Other Investors

Tier 1 VCs stand out due to their:

- Selective investment approach, focusing on high-growth, scalable startups.

- Global presence, with offices and networks spanning multiple continents.

- Long-term vision, often supporting companies through multiple funding rounds and exits.

The Impact of Tier 1 VCs on the Startup Ecosystem

Tier 1 VCs play a crucial role in shaping the startup ecosystem by:

- Driving innovation by funding disruptive technologies and business models.

- Creating job opportunities through the growth of portfolio companies.

- Influencing market trends by setting investment standards and priorities.

What is the most prestigious VC firm?

What Defines a Prestigious VC Firm?

A prestigious venture capital (VC) firm is typically characterized by its track record of successful investments, influential portfolio companies, and a strong reputation within the industry. These firms often have access to top-tier deal flow, significant financial resources, and a network of experienced partners. Key factors that contribute to their prestige include:

- Historical performance: Consistently high returns on investments.

- Brand recognition: A well-known name in the startup and investment community.

- Influence: The ability to shape industries and trends through their investments.

Top Contenders for the Most Prestigious VC Firm

Several VC firms are often cited as the most prestigious due to their long-standing success and impact. These include:

- Sequoia Capital: Known for early investments in companies like Apple, Google, and Airbnb.

- Andreessen Horowitz: A leader in tech investments, backing companies like Facebook and Twitter.

- Accel: Early investor in Facebook and other high-growth startups.

Why Sequoia Capital Stands Out

Sequoia Capital is frequently regarded as the most prestigious VC firm due to its unparalleled track record. Key reasons include:

- Global presence: Offices in the U.S., China, India, and Southeast Asia.

- Iconic investments: Backed some of the most successful tech companies in history.

- Longevity: Over 50 years of experience in venture capital.

The Role of Andreessen Horowitz in Shaping Tech

Andreessen Horowitz has earned its prestige by focusing on transformative technologies and providing extensive support to its portfolio companies. Highlights include:

- Deep expertise: Founders with strong technical backgrounds.

- Operational support: Offers marketing, HR, and technical assistance to startups.

- Cultural influence: Known for thought leadership in the tech industry.

Accel’s Legacy in Venture Capital

Accel has built its reputation through early-stage investments in groundbreaking companies. Key aspects of its prestige include:

- Early-stage focus: Specializes in identifying high-potential startups.

- Global reach: Strong presence in both the U.S. and Europe.

- Successful exits: Multiple IPOs and acquisitions in its portfolio.

Frequently Asked Questions by our Community

What are the top venture capital firms with a dedicated NYC office?

New York City is home to several top-tier venture capital firms that have established dedicated offices in the area. Some of the most prominent include Union Square Ventures, known for its investments in companies like Twitter and Etsy, and Bessemer Venture Partners, which has a strong focus on early-stage startups. Other notable firms include Lux Capital, which specializes in deep tech and science-driven companies, and Insight Partners, a growth-stage investor with a significant presence in NYC. These firms are recognized for their expertise, extensive networks, and ability to support startups in scaling their operations.

Why do venture capital firms choose NYC for their offices?

Venture capital firms are drawn to NYC due to its vibrant startup ecosystem, access to top talent, and proximity to major industries like finance, media, and technology. The city offers a diverse pool of entrepreneurs and a robust infrastructure that supports innovation. Additionally, NYC's global connectivity and status as a financial hub make it an ideal location for VCs to identify and nurture high-potential startups. The presence of other investors, accelerators, and co-working spaces further enhances the appeal of NYC as a base for venture capital operations.

How do NYC-based VC firms support startups beyond funding?

NYC-based VC firms provide startups with more than just capital. They offer strategic guidance, mentorship, and access to their extensive networks of industry experts, potential partners, and customers. Many firms also assist with talent acquisition, helping startups recruit top-tier employees. Additionally, they often provide operational support, such as marketing, product development, and scaling strategies. Firms like FirstMark Capital and Thrive Capital are known for their hands-on approach, working closely with portfolio companies to ensure long-term success.

What industries do NYC-based VC firms typically invest in?

NYC-based VC firms invest in a wide range of industries, reflecting the city's diverse economy. Common sectors include fintech, healthtech, e-commerce, and media/entertainment. For example, RRE Ventures focuses on enterprise software and fintech, while Primary Venture Partners often invests in consumer-facing startups. The city's strong presence in industries like advertising, fashion, and real estate also attracts VCs looking to back innovative companies in these fields. This diversity allows NYC-based firms to support a broad spectrum of startups with high growth potential.

Leave a Reply

Our Recommended Articles