What is a Waterfall in Private Equity?

A waterfall in private equity refers to the structured process by which profits and returns are distributed among investors and fund managers. This mechanism ensures that cash flows are allocated in a specific order, typically prioritizing limited partners (investors) before general partners (fund managers). The waterfall structure is designed to align interests, incentivize performance, and provide transparency in profit-sharing. It often includes multiple tiers, such as the return of capital, preferred returns, and carried interest. Understanding the waterfall model is crucial for investors and fund managers alike, as it directly impacts how returns are calculated and distributed throughout the life of a private equity fund.

What is a Waterfall in Private Equity?

In private equity, a waterfall refers to the method by which profits and returns are distributed among investors and fund managers. This structured process ensures that all parties receive their share of the proceeds in a predefined order, typically outlined in the fund's Limited Partnership Agreement (LPA). The waterfall mechanism is crucial for maintaining transparency and fairness in profit distribution, especially in complex investment structures.

See Also How Do Vc Firms Raise Their Funds?

How Do Vc Firms Raise Their Funds?How Does the Waterfall Structure Work?

The waterfall structure operates in a sequential manner, prioritizing certain stakeholders over others. Typically, the first step involves returning the initial capital contributions to the investors. Once this is achieved, the remaining profits are distributed according to the agreed-upon terms, which often include preferred returns for investors before the fund manager (or general partner) receives their share, known as the carried interest.

Key Components of a Waterfall

The waterfall structure consists of several key components:

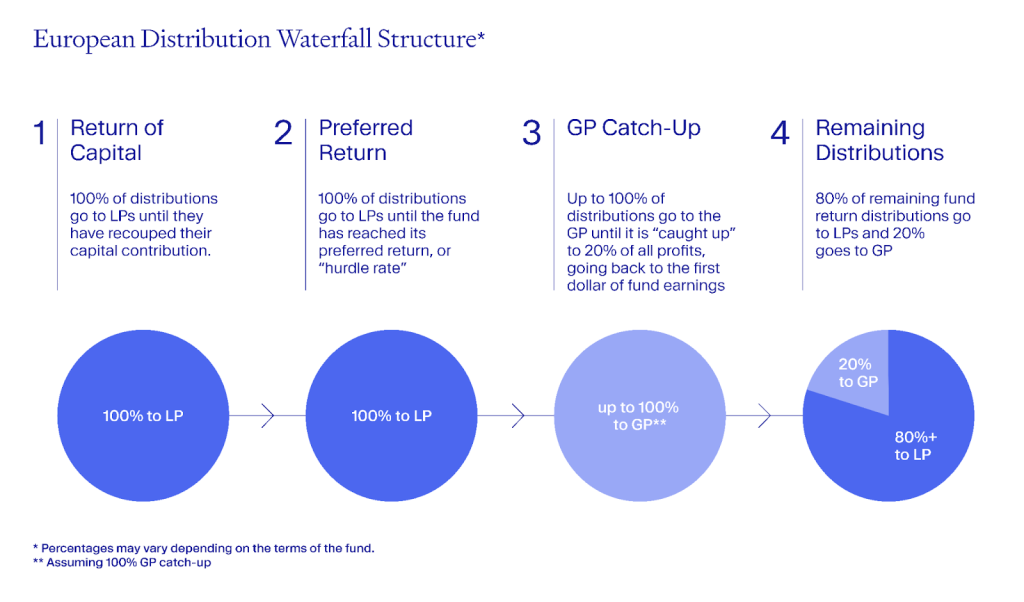

1. Return of Capital: Investors receive their initial investment back.

2. Preferred Return: Investors earn a predetermined rate of return (e.g., 8%) before the fund manager participates.

3. Catch-Up: The fund manager receives a portion of the profits to catch up to their agreed share.

4. Carried Interest: The fund manager earns a percentage (typically 20%) of the remaining profits.

How Much Do Analysts Senior Analysts at Vc Firms Make How is Compensation Structured

How Much Do Analysts Senior Analysts at Vc Firms Make How is Compensation StructuredTypes of Waterfall Structures

There are two primary types of waterfall structures in private equity:

1. American Waterfall (Deal-by-Deal): Profits are distributed after each individual investment is realized.

2. European Waterfall (Whole Fund): Profits are distributed only after the entire fund's investments are realized.

Why is the Waterfall Important?

The waterfall ensures that all parties are aligned in terms of financial incentives. It protects investors by prioritizing their returns and rewards the fund manager for generating profits. This alignment of interests is critical for the long-term success of private equity funds.

See Also Whats a Better Way to Structure a Vc Fund Evergreen or Regular Vc

Whats a Better Way to Structure a Vc Fund Evergreen or Regular VcExample of a Waterfall Distribution

Below is an example of how a waterfall distribution might work in practice:

| Step | Description | Amount |

|---|---|---|

| 1 | Return of Capital | $10,000,000 |

| 2 | Preferred Return (8%) | $800,000 |

| 3 | Catch-Up (Fund Manager) | $200,000 |

| 4 | Carried Interest (20%) | $1,800,000 |

What is the waterfall effect in private equity?

How Are Advisors to a Vc Firm Compensated?

How Are Advisors to a Vc Firm Compensated?What is the Waterfall Effect in Private Equity?

The waterfall effect in private equity refers to the structured process of distributing profits and returns among investors and fund managers. This method ensures that payouts occur in a specific order, prioritizing certain stakeholders over others. The term waterfall is used because the distribution flows downward, much like a waterfall, through a series of tiers or levels.

- Priority to Limited Partners (LPs): Initial returns are distributed to limited partners until they receive their initial capital back.

- Preferred Return: After the return of capital, LPs receive a preferred return, often referred to as a hurdle rate.

- General Partner (GP) Catch-Up: Once LPs receive their preferred return, the general partner may receive a portion of the profits to catch up to their agreed share.

- Profit Sharing: Remaining profits are then split between LPs and GPs according to the agreed-upon ratio, typically 80/20.

How Does the Waterfall Structure Work?

The waterfall structure is a predefined sequence that dictates how cash flows are distributed. It ensures transparency and fairness in profit allocation, which is crucial for maintaining trust between investors and fund managers.

- Initial Capital Return: Investors receive their initial investment back before any profits are distributed.

- Hurdle Rate: Investors are then entitled to a predetermined rate of return, often around 8%.

- Catch-Up Clause: Fund managers receive a portion of the profits to align their interests with investors.

- Profit Split: The remaining profits are divided between investors and fund managers, typically in an 80/20 ratio.

Why is the Waterfall Effect Important in Private Equity?

The waterfall effect is crucial because it aligns the interests of all parties involved. It ensures that investors are prioritized while also incentivizing fund managers to perform well.

- Investor Protection: Ensures that investors recover their initial investment and preferred returns before fund managers receive any profits.

- Performance Incentive: Encourages fund managers to maximize returns to benefit from the profit-sharing phase.

- Transparency: Provides a clear and structured method for profit distribution, reducing potential conflicts.

Key Components of the Waterfall Structure

The waterfall structure consists of several key components that define how profits are distributed. These components ensure that the distribution process is both fair and efficient.

- Return of Capital: Investors receive their initial investment back first.

- Preferred Return: Investors are entitled to a predetermined rate of return before any profits are shared.

- Catch-Up Provision: Fund managers receive a portion of the profits to align their interests with investors.

- Profit Sharing: The remaining profits are split between investors and fund managers, typically in an 80/20 ratio.

Challenges Associated with the Waterfall Effect

While the waterfall effect offers many benefits, it also presents certain challenges that need to be carefully managed.

- Complexity: The structure can be complex and difficult to understand, especially for new investors.

- Negotiation: Terms of the waterfall structure often require extensive negotiation between investors and fund managers.

- Potential Conflicts: Misalignment of interests can lead to conflicts if not properly managed.

What is the waterfall mechanism in PE?

What is the Waterfall Mechanism in Private Equity?

The waterfall mechanism in private equity refers to the structured process by which profits and returns are distributed among investors and fund managers. This mechanism ensures that distributions are made in a specific order, prioritizing certain stakeholders over others. It is a critical component of private equity fund agreements, as it outlines how cash flows are allocated after an investment generates returns.

How Does the Waterfall Mechanism Work?

The waterfall mechanism operates in a sequential manner, ensuring that each tier of stakeholders receives their share before the next tier is addressed. Below is the typical order of distribution:

- Return of Capital: Investors first receive their initial capital contributions back.

- Preferred Return: Investors are then entitled to a predetermined rate of return, often referred to as the hurdle rate.

- Catch-Up Clause: Fund managers may receive a portion of the profits to catch up to their agreed share.

- Profit Sharing: Remaining profits are split between investors and fund managers, typically following an 80/20 split (80% to investors, 20% to managers).

Why is the Waterfall Mechanism Important?

The waterfall mechanism is crucial for maintaining fairness and transparency in private equity funds. It ensures that:

- Investors are Protected: By prioritizing the return of capital and preferred returns, investors are safeguarded against losses.

- Alignment of Interests: The mechanism aligns the interests of fund managers and investors, as managers only receive significant profits after investors achieve their returns.

- Clear Distribution Rules: It provides a clear framework for profit distribution, reducing potential conflicts.

Key Components of the Waterfall Mechanism

The waterfall mechanism consists of several key components that define its structure and functionality:

- Hurdle Rate: The minimum rate of return that must be achieved before fund managers can participate in profits.

- Catch-Up Provision: A clause that allows fund managers to receive a larger share of profits until they reach their agreed percentage.

- Carried Interest: The share of profits that fund managers receive, typically 20%, after investors have been compensated.

Challenges Associated with the Waterfall Mechanism

While the waterfall mechanism is widely used, it is not without challenges:

- Complexity: The structure can be complex, requiring detailed legal agreements and calculations.

- Potential for Disputes: Misunderstandings or disagreements over distribution terms can arise between investors and fund managers.

- Regulatory Scrutiny: The mechanism may attract regulatory attention, especially if it is perceived as favoring fund managers excessively.

Examples of Waterfall Mechanism in Practice

In real-world private equity scenarios, the waterfall mechanism is applied as follows:

- Real Estate Funds: Profits from property sales are distributed first to investors, then to fund managers.

- Venture Capital: Returns from successful exits are allocated according to the waterfall structure.

- Buyout Funds: Proceeds from the sale of portfolio companies follow the waterfall sequence.

What is a waterfall in the stock market?

What is a Waterfall in the Stock Market?

A waterfall in the stock market refers to a structured process of distributing payments or cash flows in a specific order, typically seen in financial instruments like structured products, collateralized debt obligations (CDOs), or investment funds. This method ensures that certain stakeholders or investors receive payments before others, based on predefined priorities. The term waterfall is used because the flow of funds cascades down from the highest priority to the lowest, similar to how water flows down a waterfall.

How Does a Waterfall Structure Work?

The waterfall structure operates by following a hierarchical order of payments. Here’s how it typically works:

- Senior Tranches: The highest priority investors, such as bondholders or senior debt holders, receive payments first.

- Mezzanine Tranches: After senior tranches are paid, the next layer of investors, often holding riskier debt, receives their share.

- Equity Tranches: The lowest priority investors, such as equity holders, receive payments last, if any funds remain.

Why is the Waterfall Model Used in Finance?

The waterfall model is used to manage risk and ensure fairness in payment distribution. Key reasons include:

- Risk Allocation: It allocates risk by prioritizing payments to less risky investors first.

- Investor Confidence: It provides clarity and predictability, increasing investor confidence in structured products.

- Regulatory Compliance: It helps financial institutions comply with regulations by ensuring transparent payment hierarchies.

Examples of Waterfall Structures in Financial Products

Waterfall structures are commonly found in various financial products, such as:

- Collateralized Debt Obligations (CDOs): Payments are distributed to investors based on their tranche priority.

- Real Estate Investment Trusts (REITs): Cash flows from property rentals are distributed in a specific order.

- Private Equity Funds: Profits are distributed to limited partners before general partners.

Advantages and Disadvantages of Waterfall Structures

The waterfall structure has both benefits and drawbacks:

- Advantages:

- Provides clear payment priorities, reducing disputes.

- Attracts risk-averse investors to senior tranches.

- Disadvantages:

- Lower priority investors may receive little or no returns.

- Complexity can make it difficult for investors to understand.

Key Considerations for Investors in Waterfall Structures

Investors should evaluate the following when dealing with waterfall structures:

- Risk Tolerance: Assess whether the tranche aligns with their risk appetite.

- Payment Priority: Understand their position in the payment hierarchy.

- Transparency: Ensure the structure is clearly defined and transparent.

Frequently Asked Questions (FAQs)

What is a waterfall structure in private equity?

A waterfall structure in private equity refers to the method by which profits from an investment are distributed among the stakeholders, typically the limited partners (LPs) and the general partners (GPs). This structure ensures that profits are allocated in a specific order, often starting with the return of initial capital to investors, followed by preferred returns, and finally, any remaining profits being split according to a predetermined ratio. The term waterfall is used because the distribution flows downward through these tiers, much like water cascading down a series of steps.

Why is the waterfall structure important in private equity?

The waterfall structure is crucial in private equity because it aligns the interests of the general partners and the limited partners. By ensuring that LPs receive their initial investment and a preferred return before GPs can share in the profits, it incentivizes GPs to maximize returns. This structure also provides transparency and clarity in profit distribution, reducing potential conflicts and ensuring that all parties understand how and when they will receive their share of the profits.

What are the key components of a waterfall structure?

The key components of a waterfall structure typically include the return of capital, the preferred return (also known as the hurdle rate), and the profit split. First, the initial capital invested by the LPs is returned. Once the capital is repaid, the next tier ensures that LPs receive a preferred return, which is usually a fixed percentage (e.g., 8%). After these two tiers are satisfied, any remaining profits are split between the LPs and GPs, often in a ratio such as 80/20, where the GPs receive 20% of the profits as a performance fee, also known as carried interest.

How does the waterfall structure impact investor returns?

The waterfall structure directly impacts investor returns by prioritizing the distribution of profits in a specific order. This ensures that limited partners receive their initial investment and a preferred return before the general partners can participate in the profits. As a result, LPs are protected from losing their capital and are guaranteed a minimum return before GPs can benefit. This structure can also enhance returns for LPs if the investment performs exceptionally well, as the profit split typically favors them in the final tier of the waterfall.

Leave a Reply

Our Recommended Articles