Where Do Venture Capital Firms Get Their Money?

Venture capital firms play a pivotal role in fueling innovation by investing in high-potential startups and emerging businesses. But where do these firms source the funds they deploy? Unlike traditional financial institutions, venture capital firms typically raise their capital from institutional investors, such as pension funds, endowments, and insurance companies, as well as high-net-worth individuals and family offices. These investors commit capital to venture funds, which are then managed by venture capitalists who identify and invest in promising ventures. Understanding the origins of venture capital funding provides insight into the ecosystem that drives technological advancements and economic growth, shaping industries and transforming ideas into reality.

- Where Do Venture Capital Firms Get Their Money?

- Where do venture capital firms get their money from?

- Where do the funds for venture capital typically come from?

-

Who funds venture capital firms?

- Who Funds Venture Capital Firms?

- What Role Do Pension Funds Play in Funding Venture Capital?

- How Do Endowments and Foundations Contribute to Venture Capital Funding?

- Why Do Family Offices Invest in Venture Capital Firms?

- What Is the Role of Corporations in Funding Venture Capital?

- How Do Sovereign Wealth Funds Support Venture Capital Firms?

- How are venture capital funds funded?

- Frequently Asked Questions (FAQs)

Where Do Venture Capital Firms Get Their Money?

Venture capital firms are essential players in the startup ecosystem, providing funding to early-stage and high-growth companies. But where do these firms get their money? The answer lies in their funding sources, which typically include institutional investors, high-net-worth individuals, and other entities. Below, we explore the primary sources of capital for venture capital firms and how they operate.

See Also How Do Vc Firms Raise Their Funds?

How Do Vc Firms Raise Their Funds?1. Institutional Investors

Institutional investors are the backbone of venture capital funding. These include pension funds, endowments, insurance companies, and sovereign wealth funds. These entities allocate a portion of their portfolios to alternative investments like venture capital to achieve higher returns. For example, a pension fund might invest in a venture capital firm to diversify its investments and potentially earn significant profits from successful startups.

2. High-Net-Worth Individuals (HNWIs)

High-net-worth individuals, often referred to as angel investors, also contribute significantly to venture capital funds. These individuals have substantial personal wealth and are willing to take risks for potentially high rewards. They may invest directly in startups or through venture capital firms that pool their money with other investors.

See AlsoWhat Are Some Good Methods for Finding Venture Capital Vc Funding for Startups What Should One Do Right at the Beginning of Their Search So That Its Not All for Naught if No Investor Bites3. Corporate Investors

Many large corporations have their own venture capital arms, known as corporate venture capital (CVC). Companies like Google (through GV) and Intel (through Intel Capital) invest in startups that align with their strategic goals. These investments not only provide financial returns but also offer access to innovative technologies and new markets.

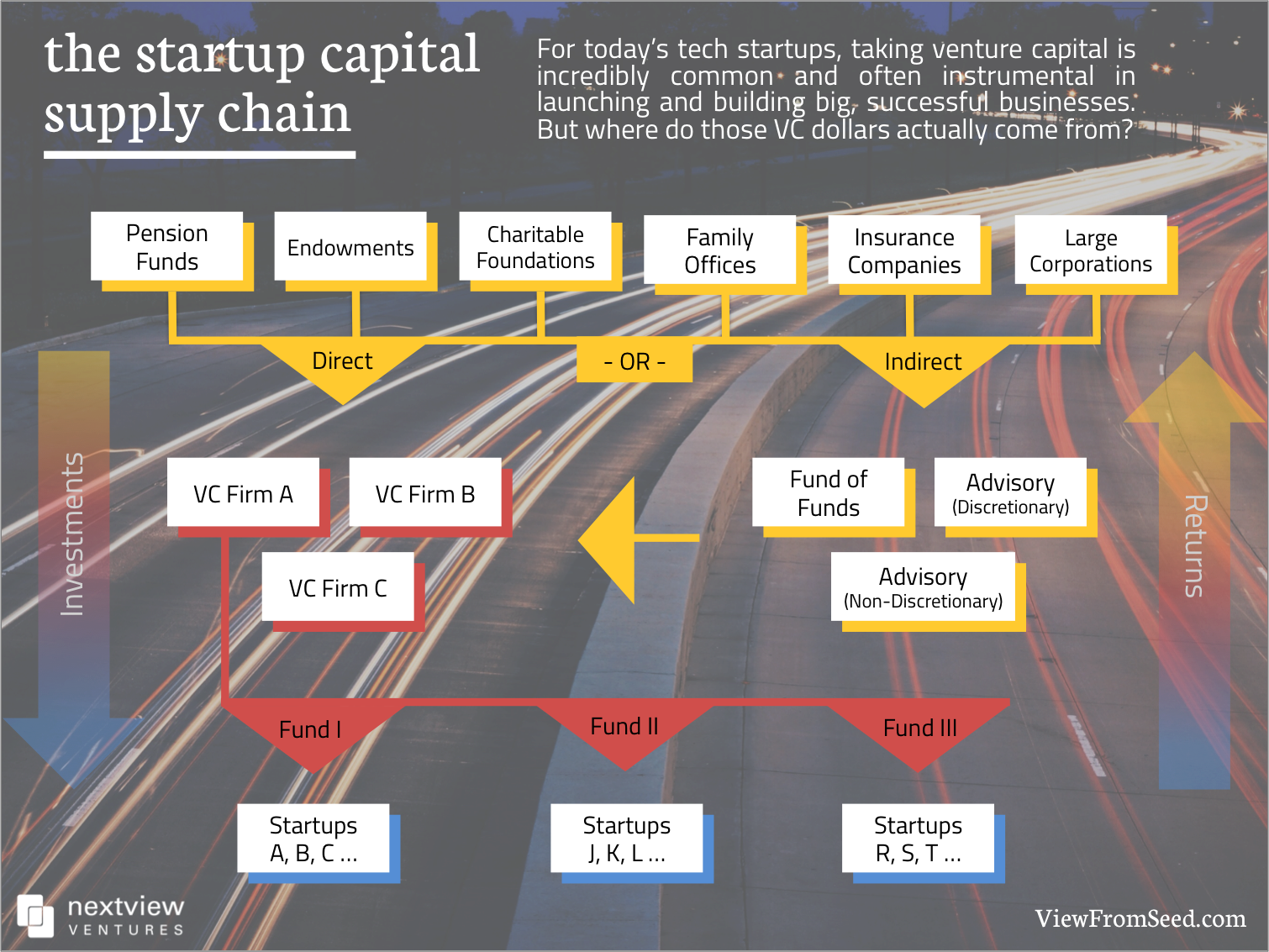

4. Fund-of-Funds

A fund-of-funds is an investment vehicle that pools capital from multiple investors to invest in other venture capital funds. This approach allows smaller investors to gain exposure to venture capital without needing to commit large amounts of capital. Fund-of-funds managers carefully select venture capital firms with strong track records to maximize returns.

See Also How to Become a Vc Without Money of My Own to Invest

How to Become a Vc Without Money of My Own to Invest5. Government and Public Entities

In some cases, government agencies and public entities provide funding to venture capital firms, especially those focused on specific sectors like clean energy, healthcare, or technology. These investments are often aimed at fostering innovation and economic growth within a region or industry.

| Source | Description |

|---|---|

| Institutional Investors | Pension funds, endowments, insurance companies, and sovereign wealth funds. |

| High-Net-Worth Individuals | Wealthy individuals who invest directly or through venture capital firms. |

| Corporate Investors | Large corporations with venture capital arms for strategic investments. |

| Fund-of-Funds | Investment vehicles that pool capital to invest in multiple venture capital funds. |

| Government and Public Entities | Public funding aimed at fostering innovation and economic growth. |

Where do venture capital firms get their money from?

1. Institutional Investors

Venture capital firms primarily receive their funding from institutional investors. These include:

- Pension funds: Large pools of retirement savings that allocate a portion of their capital to high-risk, high-reward investments.

- Endowments: Funds managed by universities and other institutions, often investing in venture capital to achieve long-term growth.

- Insurance companies: They invest in venture capital to diversify their portfolios and seek higher returns.

2. High-Net-Worth Individuals

Another significant source of funding for venture capital firms comes from high-net-worth individuals (HNWIs). These individuals:

- Have substantial personal wealth and are willing to take risks for potentially high returns.

- Often invest directly or through family offices that manage their wealth.

- Seek diversification beyond traditional investments like stocks and bonds.

3. Corporate Investors

Many venture capital firms also receive funding from corporate investors. These corporations:

- Invest in venture capital to gain access to innovative technologies and startups.

- Use venture capital as a strategic tool to stay competitive in their industries.

- Often establish their own corporate venture arms to manage these investments.

4. Sovereign Wealth Funds

Sovereign wealth funds are another key source of capital for venture capital firms. These funds:

- Are state-owned investment vehicles that manage a country’s surplus reserves.

- Invest in venture capital to achieve long-term financial growth and diversify their portfolios.

- Often target emerging markets and innovative sectors.

5. Fund-of-Funds and Other Financial Intermediaries

Venture capital firms also raise money from fund-of-funds and other financial intermediaries. These entities:

- Pool capital from multiple investors to invest in a diversified portfolio of venture capital funds.

- Provide access to venture capital for smaller investors who cannot commit large amounts individually.

- Help reduce risk by spreading investments across multiple funds and sectors.

Where do the funds for venture capital typically come from?

1. Institutional Investors

Institutional investors are one of the primary sources of venture capital funds. These include:

- Pension funds: Large pools of retirement savings that allocate a portion of their assets to high-risk, high-reward investments like venture capital.

- Endowments: Funds managed by universities and other institutions that invest in venture capital to achieve long-term growth.

- Insurance companies: They diversify their portfolios by investing in venture capital to balance risk and return.

2. High-Net-Worth Individuals (HNWIs)

High-net-worth individuals, often referred to as angel investors, play a significant role in venture capital funding. These individuals include:

- Entrepreneurs: Successful business owners who reinvest their wealth into startups.

- Executives: Senior corporate leaders who allocate personal funds to venture capital.

- Family offices: Wealth management firms that handle investments for affluent families.

3. Corporate Investors

Corporations often invest in venture capital to foster innovation and gain strategic advantages. Key examples include:

- Corporate venture capital (CVC) arms: Subsidiaries of large companies that invest in startups aligned with their business interests.

- Strategic partnerships: Corporations collaborate with startups to access new technologies or markets.

- Innovation funds: Dedicated funds established by corporations to support emerging technologies.

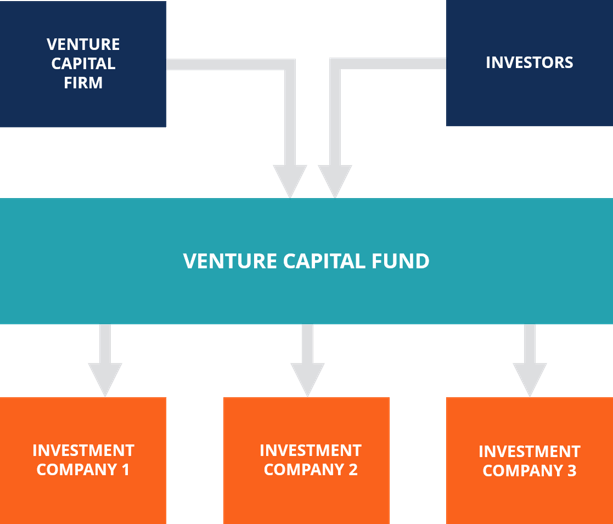

4. Venture Capital Firms

Venture capital firms themselves raise funds from various sources to invest in startups. These firms typically:

- Raise capital through limited partnerships: Investors commit funds to the firm, which then manages the investments.

- Pool resources from multiple investors: This allows for diversification and risk mitigation.

- Focus on specific industries or stages: Some firms specialize in early-stage startups, while others target growth-stage companies.

5. Government and Public Funds

Governments and public entities also contribute to venture capital funding, often to stimulate economic growth. Examples include:

- Government-backed funds: Programs designed to support innovation and entrepreneurship.

- Public-private partnerships: Collaborative efforts between governments and private investors to fund startups.

- Economic development agencies: Organizations that invest in startups to create jobs and boost local economies.

Who funds venture capital firms?

Who Funds Venture Capital Firms?

Venture capital firms are primarily funded by a diverse group of institutional and individual investors. These investors, often referred to as limited partners (LPs), provide the capital that venture capital firms use to invest in startups and high-growth companies. The funding sources include:

- Pension Funds: Large institutional investors, such as public and private pension funds, allocate a portion of their portfolios to venture capital for higher returns.

- Endowments and Foundations: Universities, charitable foundations, and other nonprofit organizations invest in venture capital to grow their endowments over time.

- Family Offices: Wealthy families and individuals manage their investments through family offices, which often include venture capital as part of their diversified portfolios.

- Corporations: Some large corporations establish corporate venture capital arms or invest directly in venture capital firms to gain strategic insights and access to innovative technologies.

- Sovereign Wealth Funds: Government-owned investment funds from countries with significant financial reserves also invest in venture capital to diversify their holdings and achieve long-term growth.

What Role Do Pension Funds Play in Funding Venture Capital?

Pension funds are one of the largest sources of capital for venture capital firms. They allocate a portion of their assets to alternative investments, including venture capital, to achieve higher returns and diversify their portfolios. Key points include:

- Long-Term Investment Horizon: Pension funds have long-term liabilities, making venture capital an attractive option due to its potential for high returns over time.

- Diversification: By investing in venture capital, pension funds reduce their reliance on traditional asset classes like stocks and bonds.

- Risk Management: Although venture capital is high-risk, pension funds mitigate this by investing in multiple funds and startups.

How Do Endowments and Foundations Contribute to Venture Capital Funding?

Endowments and foundations are significant contributors to venture capital funding, as they seek to grow their assets to support their long-term missions. Their involvement includes:

- Mission Alignment: Some endowments and foundations invest in venture capital to support innovation in areas aligned with their goals, such as healthcare or education.

- High Returns: Venture capital offers the potential for substantial returns, which helps these organizations increase their financial resources.

- Diversification: Like pension funds, endowments and foundations diversify their portfolios by including venture capital investments.

Why Do Family Offices Invest in Venture Capital Firms?

Family offices, which manage the wealth of high-net-worth individuals and families, often invest in venture capital firms for several reasons:

- Wealth Preservation and Growth: Venture capital provides an opportunity to grow family wealth significantly over time.

- Access to Innovation: Investing in venture capital allows families to gain exposure to cutting-edge technologies and industries.

- Diversification: Family offices use venture capital to diversify their investment portfolios beyond traditional assets.

What Is the Role of Corporations in Funding Venture Capital?

Corporations play a unique role in funding venture capital firms, often driven by strategic objectives rather than purely financial returns. Their involvement includes:

- Strategic Investments: Corporations invest in venture capital to gain insights into emerging technologies and markets that align with their business goals.

- Corporate Venture Capital (CVC): Many corporations establish their own venture capital arms to directly invest in startups and foster innovation.

- Partnership Opportunities: Venture capital investments can lead to partnerships or acquisitions that benefit the corporation’s growth strategy.

How Do Sovereign Wealth Funds Support Venture Capital Firms?

Sovereign wealth funds, which manage a country’s financial reserves, are increasingly investing in venture capital firms to achieve long-term growth and diversification. Key aspects include:

- Economic Diversification: Sovereign wealth funds invest in venture capital to reduce their reliance on traditional industries and support innovation.

- Global Exposure: These funds often invest in international venture capital firms to gain exposure to global markets and technologies.

- Long-Term Growth: Venture capital aligns with the long-term investment horizons of sovereign wealth funds, offering the potential for significant returns over time.

How are venture capital funds funded?

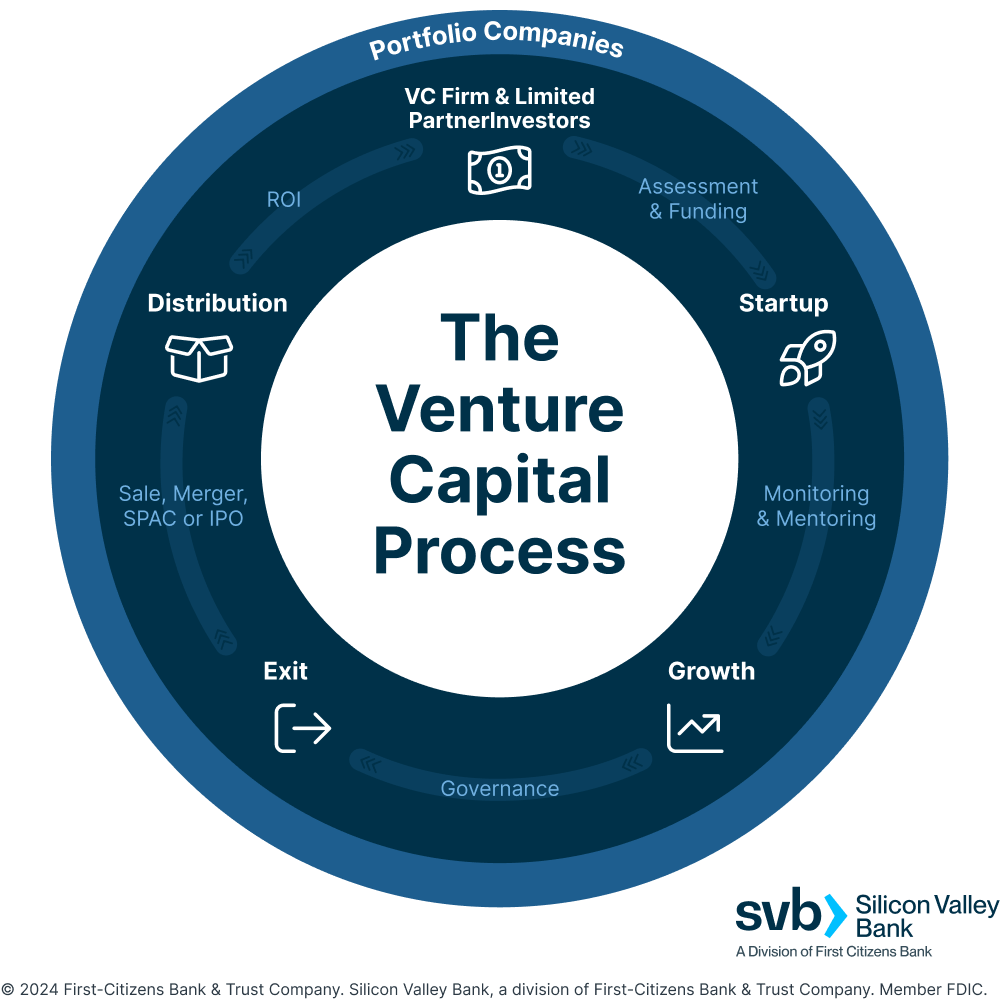

What Are the Primary Sources of Venture Capital Funding?

Venture capital funds are primarily funded through contributions from institutional investors, high-net-worth individuals, and corporations. These entities pool their resources to create a fund that is managed by venture capital firms. The funds are then used to invest in startups and high-growth companies with the potential for significant returns.

- Institutional Investors: These include pension funds, endowments, and insurance companies that allocate a portion of their portfolios to venture capital for higher returns.

- High-Net-Worth Individuals: Wealthy individuals often invest directly in venture capital funds to diversify their investment portfolios.

- Corporations: Some corporations establish their own venture capital arms to invest in startups that align with their strategic goals.

How Do Limited Partners Contribute to Venture Capital Funds?

Limited partners (LPs) are the primary contributors to venture capital funds. They provide the capital that venture capital firms use to make investments. In return, LPs receive a share of the profits generated by the fund, typically after the venture capital firm takes a management fee and carried interest.

- Capital Commitment: LPs commit a certain amount of capital to the fund, which is drawn down over time as investments are made.

- Profit Sharing: LPs receive a percentage of the profits, usually around 80%, while the venture capital firm takes the remaining 20% as carried interest.

- Limited Liability: LPs have limited liability, meaning they are only liable for the amount they have invested in the fund.

What Role Do General Partners Play in Funding Venture Capital?

General partners (GPs) are the managers of the venture capital fund. They are responsible for making investment decisions, managing the fund, and ensuring that the fund meets its objectives. GPs also contribute a small portion of the fund's capital, typically around 1-2%, to align their interests with those of the LPs.

- Investment Decisions: GPs identify and evaluate potential investment opportunities, making decisions on which startups to fund.

- Fund Management: GPs oversee the day-to-day operations of the fund, including monitoring investments and providing guidance to portfolio companies.

- Capital Contribution: GPs invest their own money into the fund to demonstrate their commitment and align their interests with those of the LPs.

How Are Venture Capital Funds Structured?

Venture capital funds are typically structured as limited partnerships, with the venture capital firm acting as the general partner and the investors as limited partners. This structure provides a clear division of roles and responsibilities, as well as legal and financial protections for all parties involved.

- Limited Partnership Agreement: This legal document outlines the terms and conditions of the fund, including the roles of GPs and LPs, profit-sharing arrangements, and the fund's investment strategy.

- Fund Lifecycle: Venture capital funds usually have a lifecycle of 10 years, with an initial investment period of 3-5 years, followed by a period of managing and exiting investments.

- Management Fees: GPs charge an annual management fee, typically around 2% of the committed capital, to cover operational expenses.

What Are the Key Considerations for Investors in Venture Capital Funds?

Investors in venture capital funds must consider several factors before committing their capital. These include the fund's investment strategy, the track record of the venture capital firm, and the potential for high returns, balanced against the inherent risks of investing in startups.

- Investment Strategy: Investors should evaluate whether the fund's strategy aligns with their own investment goals and risk tolerance.

- Track Record: The past performance of the venture capital firm and its GPs is a critical factor in assessing the potential success of the fund.

- Risk and Return: Venture capital investments are high-risk but offer the potential for high returns, making them suitable for investors with a long-term horizon and a high risk tolerance.

Frequently Asked Questions (FAQs)

What are the primary sources of funding for venture capital firms?

Venture capital firms primarily obtain their funds from institutional investors, such as pension funds, university endowments, and insurance companies. These entities allocate a portion of their portfolios to alternative investments, including venture capital, to achieve higher returns. Additionally, high-net-worth individuals and family offices often contribute significant capital to venture capital funds. These investors are attracted by the potential for substantial returns, despite the higher risks associated with early-stage investments.

How do venture capital firms raise capital for their funds?

Venture capital firms raise capital through a process known as fundraising. They create a fund and pitch it to potential investors, outlining their investment strategy, target sectors, and expected returns. Once investors commit capital, the firm begins deploying it into startups and growth-stage companies. The fundraising process typically involves multiple rounds, with firms often raising new funds every few years to continue investing in promising opportunities.

Do venture capital firms use their own money to invest?

No, venture capital firms generally do not use their own money to invest. Instead, they act as intermediaries, managing funds provided by their investors, known as limited partners (LPs). The firm's partners may contribute a small percentage of the fund's total capital, but the majority comes from external sources. This structure allows venture capital firms to leverage larger amounts of capital while sharing the risks and rewards with their investors.

What role do returns play in attracting investors to venture capital firms?

Returns are a critical factor in attracting investors to venture capital firms. Investors expect high returns to compensate for the risks associated with investing in early-stage and high-growth companies. Successful exits, such as acquisitions or initial public offerings (IPOs), generate significant returns for both the venture capital firm and its investors. A strong track record of delivering above-average returns enhances a firm's reputation and makes it easier to raise future funds.

Leave a Reply

Our Recommended Articles