I Have an Interview in Venture Capital What Are All the Things I Should Know for Modeling

Preparing for a venture capital (VC) interview, especially when it involves financial modeling, requires a solid understanding of both the technical and strategic aspects of the role. Venture capital firms seek candidates who can analyze investment opportunities, assess risks, and project financial outcomes with precision. This article provides a comprehensive guide to mastering the key elements of VC modeling, from understanding valuation techniques and cap table management to analyzing term sheets and exit scenarios. Whether you're new to the industry or looking to refine your skills, this resource will equip you with the knowledge and confidence needed to excel in your VC interview and beyond.

- Preparing for a Venture Capital Interview: Key Modeling Insights

- How to prepare for a venture capital interview?

- What are the top skills needed for venture capital?

- What is the first round interview for VC?

- Why work in venture capital interview answer?

-

Frequently Asked Questions (FAQs)

- What are the key components of financial modeling for a venture capital interview?

- How should I approach building a financial model for a startup?

- What are common pitfalls to avoid in financial modeling for venture capital?

- How can I effectively present my financial model during a venture capital interview?

Preparing for a Venture Capital Interview: Key Modeling Insights

Understanding the Basics of Financial Modeling

Financial modeling is a critical skill in venture capital (VC) interviews. It involves creating a mathematical representation of a company's financial performance. You should be familiar with building models that project revenue, expenses, and cash flow. Key components include income statements, balance sheets, and cash flow statements. Practice creating models from scratch and be ready to explain your assumptions clearly.

See AlsoWhat is Considered a Good Roi in Vc?Key Metrics to Focus On

In VC, certain metrics are more important than others. These include Customer Acquisition Cost (CAC), Lifetime Value (LTV), burn rate, and runway. Understanding how these metrics interact and impact a startup's growth is crucial. Be prepared to discuss how changes in these metrics can affect a company's valuation and funding needs.

| Metric | Description |

|---|---|

| CAC | Cost to acquire a new customer |

| LTV | Total revenue expected from a customer over their lifetime |

| Burn Rate | Rate at which a company spends money |

| Runway | Time until a company runs out of cash |

Scenario Analysis and Sensitivity Testing

VCs often want to see how a startup performs under different scenarios. Be ready to create scenario analyses that show best-case, worst-case, and base-case outcomes. Sensitivity testing is also important, as it helps identify which variables have the most significant impact on the model. Practice adjusting key inputs like growth rates, pricing, and costs to see how they affect the overall financial health of the company.

See Also How Does a Product Manager Get Into Venture Capital?

How Does a Product Manager Get Into Venture Capital?Valuation Techniques

Understanding how to value a startup is essential. Common methods include Discounted Cash Flow (DCF), Comparable Company Analysis, and Precedent Transactions. Be prepared to explain why you chose a particular method and how you arrived at your valuation. Remember, startups often lack historical data, so your assumptions will play a significant role.

| Method | Description |

|---|---|

| DCF | Projects future cash flows and discounts them to present value |

| Comparable Company Analysis | Uses valuation multiples from similar companies |

| Precedent Transactions | Looks at past M&A deals in the same industry |

Common Pitfalls to Avoid

When building financial models, avoid common mistakes such as overcomplicating the model, ignoring key assumptions, or failing to validate data. Ensure your model is clean, easy to follow, and well-documented. Be ready to defend your assumptions and show how you arrived at your conclusions. VCs will appreciate a model that is both robust and transparent.

See AlsoWhat Documents Do I Need When I Pitch Venture Capitalists or Angel InvestorsPractice and Preparation Tips

Finally, practice is key. Work on case studies, build models for different industries, and get feedback from peers or mentors. Familiarize yourself with tools like Excel or Google Sheets, as these are commonly used in VC interviews. The more you practice, the more confident you'll be in presenting your models during the interview.

How to prepare for a venture capital interview?

What Advice Would You Give a Former Startup Product Manager and Product Designer Looking to Get Into Venture Capital as an Associate

What Advice Would You Give a Former Startup Product Manager and Product Designer Looking to Get Into Venture Capital as an AssociateResearch the Venture Capital Firm

Before your interview, it is crucial to thoroughly research the venture capital firm you are interviewing with. This will help you understand their investment philosophy, portfolio companies, and the industries they focus on. Here’s how you can prepare:

- Visit the firm’s website and review their investment thesis and recent news.

- Study their portfolio companies to identify patterns in their investments.

- Understand the backgrounds of the partners and associates to tailor your responses.

Understand the Venture Capital Process

Familiarize yourself with the venture capital process, from deal sourcing to exit strategies. This knowledge will demonstrate your understanding of the industry. Key points to focus on include:

See Also Is There a Broker for Venture Capitalist?

Is There a Broker for Venture Capitalist?- Learn about the stages of funding: seed, Series A, B, C, etc.

- Understand how VCs evaluate startups, including metrics like ARR, CAC, and LTV.

- Research common exit strategies such as IPOs and acquisitions.

Prepare for Behavioral and Technical Questions

Venture capital interviews often include both behavioral and technical questions. To prepare effectively, consider the following:

- Practice answering questions about your investment philosophy and decision-making process.

- Be ready to discuss your experience with financial modeling and valuation techniques.

- Prepare examples of how you’ve analyzed companies or industries in the past.

Develop a Strong Investment Thesis

Having a well-defined investment thesis is essential for a venture capital interview. This shows that you can think critically about potential investments. Steps to develop your thesis include:

- Identify industries or sectors you believe have high growth potential.

- Explain why these areas are attractive and how you would evaluate opportunities within them.

- Provide examples of companies that align with your thesis and why they are promising.

Practice Case Studies and Pitch Evaluations

Many venture capital interviews include case studies or pitch evaluations to assess your analytical skills. To excel in this area, follow these steps:

- Practice analyzing startup pitches and identifying their strengths and weaknesses.

- Be prepared to discuss how you would improve a pitch or business model.

- Use frameworks like TAM, SAM, SOM to evaluate market opportunities.

What are the top skills needed for venture capital?

Analytical and Financial Skills

Venture capital professionals require strong analytical and financial skills to evaluate potential investments. This involves:

- Conducting due diligence on startups to assess their viability.

- Analyzing financial statements and projections to understand growth potential.

- Using valuation techniques to determine the worth of a company.

Industry Knowledge and Market Insight

Having deep industry knowledge and market insight is crucial for identifying trends and opportunities. Key aspects include:

- Staying updated on emerging technologies and market shifts.

- Understanding competitive landscapes to spot unique value propositions.

- Leveraging networks to gain insider perspectives on industries.

Negotiation and Deal Structuring

Effective negotiation and deal structuring skills are essential for securing favorable terms. This involves:

- Negotiating equity stakes and investment terms with founders.

- Structuring deals to balance risk and reward for all parties.

- Ensuring alignment of interests through contractual agreements.

Networking and Relationship Building

Building and maintaining relationships is a cornerstone of venture capital success. Key skills include:

- Connecting with entrepreneurs, co-investors, and industry experts.

- Leveraging networks to source high-quality deals.

- Fostering trust and collaboration with portfolio companies.

Risk Management and Decision-Making

Venture capitalists must excel in risk management and decision-making to navigate uncertainties. This includes:

- Assessing risk factors associated with startups and markets.

- Making data-driven decisions while balancing intuition and experience.

- Developing strategies to mitigate potential losses.

What is the first round interview for VC?

Understanding the Purpose of the First Round VC Interview

The first round interview for a venture capital (VC) position is typically designed to assess a candidate's foundational knowledge, skills, and cultural fit within the firm. This stage often involves a mix of technical and behavioral questions to evaluate the candidate's ability to analyze startups, understand market trends, and contribute to the firm's investment decisions. Key objectives include:

- Assessing analytical skills: Candidates are often tested on their ability to evaluate business models, financial statements, and market opportunities.

- Evaluating industry knowledge: A deep understanding of the startup ecosystem, emerging technologies, and competitive landscapes is crucial.

- Determining cultural fit: VC firms place a high emphasis on teamwork and alignment with the firm's values and investment philosophy.

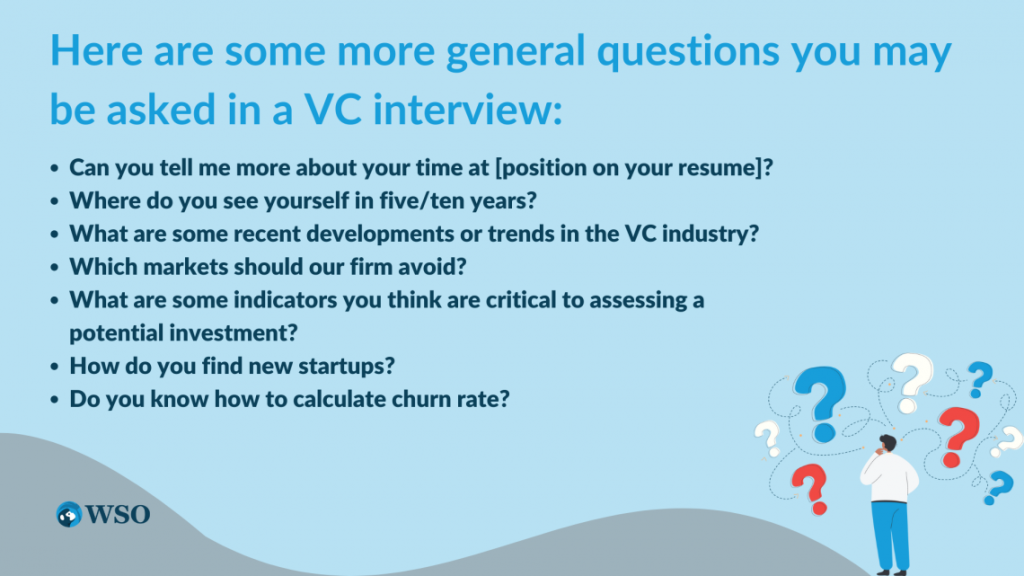

Common Questions in a First Round VC Interview

During the first round interview, candidates can expect a variety of questions aimed at gauging their expertise and thought process. These questions often fall into three main categories:

- Technical questions: These may include analyzing a startup's pitch deck, calculating key financial metrics, or discussing valuation methods.

- Behavioral questions: Candidates might be asked about past experiences, such as how they handled a challenging situation or worked in a team.

- Hypothetical scenarios: Interviewers often present hypothetical investment opportunities to assess the candidate's decision-making and critical thinking skills.

Preparing for the First Round VC Interview

Preparation is key to succeeding in the first round interview. Candidates should focus on the following areas to ensure they are well-prepared:

- Research the firm: Understand the VC firm's portfolio, investment thesis, and recent deals to demonstrate genuine interest and alignment.

- Brush up on technical skills: Review financial modeling, valuation techniques, and industry-specific metrics.

- Practice case studies: Familiarize yourself with analyzing startups and presenting investment recommendations.

Key Skills Evaluated in the First Round VC Interview

The first round interview focuses on evaluating a candidate's core competencies, which are essential for success in venture capital. These skills include:

- Analytical thinking: The ability to dissect complex problems and make data-driven decisions.

- Communication skills: Clear and concise articulation of ideas, both verbally and in writing.

- Networking and relationship-building: Demonstrating the ability to connect with founders and other stakeholders in the ecosystem.

What to Expect After the First Round VC Interview

After completing the first round interview, candidates should be aware of the next steps in the hiring process. Typically, this includes:

- Feedback and follow-up: The firm may provide feedback or request additional information to further evaluate the candidate.

- Second round interviews: Successful candidates are often invited to meet with senior team members or participate in more in-depth case studies.

- Reference checks: Some firms may conduct reference checks to validate the candidate's qualifications and experience.

Why work in venture capital interview answer?

Why Work in Venture Capital?

Working in venture capital offers a unique opportunity to be at the forefront of innovation and entrepreneurship. It allows individuals to identify, invest in, and support early-stage companies with high growth potential. This role combines financial analysis, strategic thinking, and relationship-building, making it both intellectually stimulating and impactful.

- Exposure to cutting-edge technologies and disruptive business models.

- Opportunity to shape the future of industries by backing visionary founders.

- Chance to build a diverse portfolio of investments across various sectors.

What Skills Are Essential for Venture Capital?

To succeed in venture capital, certain skills are critical. These include analytical thinking, financial modeling, and the ability to assess market trends. Additionally, strong interpersonal skills are necessary to build relationships with founders and co-investors.

- Analytical skills to evaluate business models and financial projections.

- Networking abilities to connect with entrepreneurs and industry experts.

- Risk assessment to make informed investment decisions.

What Are the Challenges of Working in Venture Capital?

While venture capital is rewarding, it comes with its own set of challenges. These include high competition, long investment horizons, and the pressure to deliver returns to limited partners. Additionally, the industry requires constant learning to stay ahead of market trends.

- Competition for top deals can be intense.

- Patience is required as returns may take years to materialize.

- Adaptability to navigate rapidly changing industries.

How Does Venture Capital Impact Startups?

Venture capital plays a crucial role in the growth of startups by providing not only funding but also strategic guidance and industry connections. This support helps startups scale their operations, enter new markets, and achieve long-term success.

- Financial backing to fuel growth and innovation.

- Mentorship from experienced investors and advisors.

- Access to networks that can open doors to partnerships and customers.

What Are the Long-Term Benefits of a Career in Venture Capital?

A career in venture capital offers long-term benefits such as professional growth, financial rewards, and the satisfaction of contributing to the success of groundbreaking companies. It also provides a platform to build a strong personal brand in the business world.

- Career advancement through exposure to high-impact projects.

- Financial incentives from successful exits and carried interest.

- Legacy building by supporting transformative businesses.

Frequently Asked Questions (FAQs)

What are the key components of financial modeling for a venture capital interview?

When preparing for a venture capital interview, it's crucial to understand the key components of financial modeling. These include revenue projections, expense forecasts, cash flow analysis, and valuation techniques. Revenue projections should be based on realistic assumptions about market size, growth rates, and customer acquisition. Expense forecasts should account for both fixed and variable costs, including operational expenses and potential scaling costs. Cash flow analysis is essential to determine the company's liquidity and financial health. Finally, valuation techniques such as discounted cash flow (DCF) and comparable company analysis are used to estimate the company's worth. Mastery of these components will demonstrate your ability to assess a startup's financial viability and potential for growth.

How should I approach building a financial model for a startup?

Building a financial model for a startup requires a structured approach. Start by gathering all relevant data, including historical financials, market research, and industry benchmarks. Begin with the income statement, projecting revenues and expenses over a 3-5 year period. Next, create a balance sheet to track assets, liabilities, and equity. Finally, develop a cash flow statement to monitor the company's liquidity. It's important to use sensitivity analysis to test how changes in key assumptions impact the model. This approach will help you create a robust and flexible financial model that can adapt to different scenarios, showcasing your analytical skills during the interview.

What are common pitfalls to avoid in financial modeling for venture capital?

There are several common pitfalls to avoid when creating a financial model for a venture capital interview. One major mistake is relying on overly optimistic assumptions, which can lead to unrealistic projections. Another pitfall is neglecting to account for seasonality or market fluctuations, which can significantly impact a startup's performance. Additionally, failing to include a scenario analysis can make the model less robust and adaptable to changing conditions. Lastly, overlooking the importance of unit economics can result in a model that doesn't accurately reflect the startup's profitability. Avoiding these pitfalls will demonstrate your attention to detail and understanding of the complexities involved in financial modeling.

How can I effectively present my financial model during a venture capital interview?

Effectively presenting your financial model during a venture capital interview requires clarity, confidence, and a deep understanding of your assumptions. Start by providing a high-level overview of the model, explaining the key drivers and assumptions. Use visual aids such as charts and graphs to illustrate your points and make the data more accessible. Be prepared to defend your assumptions and explain how you arrived at your projections. It's also important to discuss the sensitivity analysis and how different scenarios could impact the model. Finally, highlight any unique insights or innovative approaches you took in building the model. A well-presented financial model will showcase your analytical skills and ability to communicate complex information effectively.

Leave a Reply

Our Recommended Articles