What is the Difference Between an Angel Series a and B Round of Funding

In the world of startup financing, understanding the nuances of funding rounds is crucial for entrepreneurs and investors alike. Angel funding, often the first external capital a startup secures, can be divided into Series A and Series B rounds, each serving distinct purposes and stages of growth. Series A funding typically focuses on scaling operations and refining the business model, while Series B aims to accelerate market expansion and strengthen the company's position. This article explores the key differences between these two rounds, shedding light on their objectives, investor expectations, and the strategic implications for startups navigating the complex landscape of early-stage funding.

- What is the Difference Between an Angel Series A and B Round of Funding?

-

Is series B better than Series A?

- What are the key differences between Series A and Series B?

- How does the risk profile differ between Series A and Series B?

- What are the typical funding amounts for Series A and Series B?

- How do investor expectations change from Series A to Series B?

- What are the strategic goals for companies in Series A versus Series B?

- What is an angel round of funding?

- What is the difference between Series A and Series B fundraising?

- What is the Series B round of funding?

-

Frequently Asked Questions (FAQs)

- What is the main difference between Angel Series A and Series B funding rounds?

- How do the investment amounts differ between Angel, Series A, and Series B funding?

- What types of investors are involved in Angel, Series A, and Series B funding?

- What are the key milestones a company should achieve before moving from Angel to Series A or Series B funding?

What is the Difference Between an Angel Series A and B Round of Funding?

1. What is Angel Funding?

Angel funding refers to the initial capital provided by individual investors, known as angel investors, to startups in their early stages. These investors typically offer funding in exchange for equity or convertible debt. Angel funding is crucial for startups to develop their product, build a team, and validate their business model before seeking larger investments.

See Also What Are Differences Between Venture Series a B C D and Seed Rounds

What Are Differences Between Venture Series a B C D and Seed Rounds2. What is Series A Funding?

Series A funding is the first significant round of venture capital financing. At this stage, startups have usually demonstrated some level of market traction, such as a working product, initial customers, or consistent revenue growth. Investors in Series A rounds are often venture capital firms, and the funds are used to scale operations, expand the team, and refine the business model.

3. What is Series B Funding?

Series B funding is the next stage of financing after Series A. By this point, startups have achieved significant growth and are looking to expand their market reach, enhance their product offerings, or enter new markets. Series B investors often include venture capital firms, private equity investors, and sometimes even hedge funds. The focus is on scaling the business to achieve profitability or prepare for an IPO.

See Also What Are the Different Types of Venture Capital Firms?

What Are the Different Types of Venture Capital Firms?4. Key Differences Between Angel, Series A, and Series B Funding

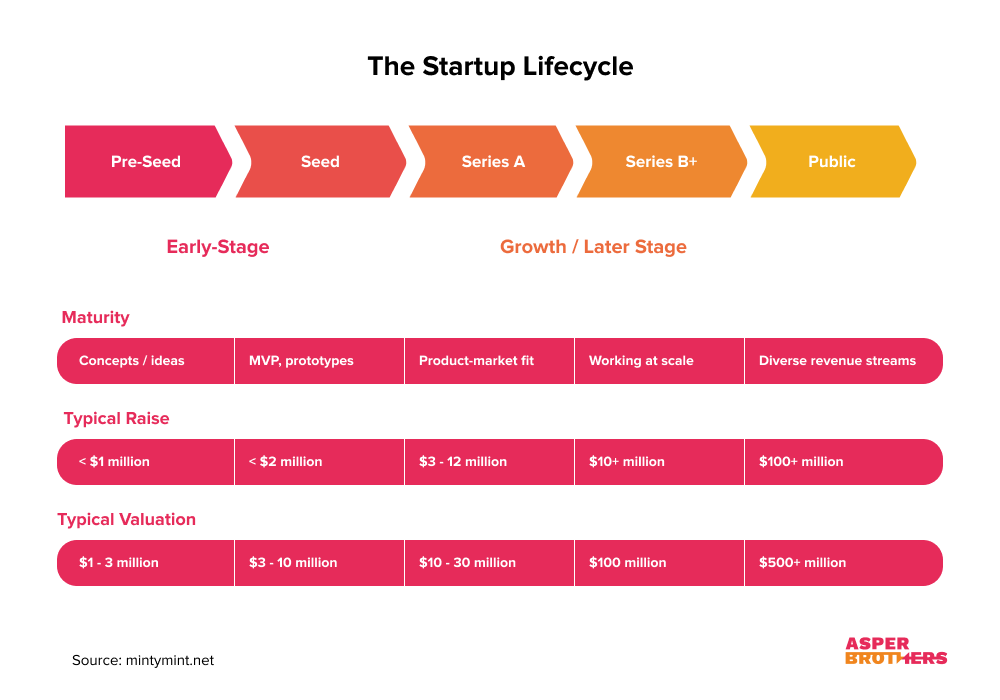

The primary differences lie in the stage of the company, the amount of funding, and the type of investors involved. Angel funding is for early-stage startups with little to no revenue, Series A is for companies with proven traction, and Series B is for businesses ready to scale significantly.

5. How Do Valuation and Equity Differ Across Funding Rounds?

Valuation and equity stakes vary significantly across funding rounds. In angel funding, valuations are typically lower, and investors may receive a larger equity stake. In Series A, valuations increase as the company demonstrates growth potential, and equity stakes are smaller. By Series B, valuations are much higher, and equity stakes are further diluted, reflecting the company's increased value and reduced risk.

See Also How much money does a techstar mentor make?

How much money does a techstar mentor make?| Funding Round | Stage | Typical Investors | Purpose | Valuation |

|---|---|---|---|---|

| Angel Funding | Early-stage | Angel Investors | Product development, team building | Low |

| Series A | Growth-stage | Venture Capital Firms | Scaling operations, market expansion | Moderate |

| Series B | Expansion-stage | VCs, Private Equity, Hedge Funds | Market reach, product enhancement | High |

Is series B better than Series A?

What are the key differences between Series A and Series B?

When comparing Series A and Series B, several key differences stand out:

- Funding Stage: Series A is typically the first significant round of venture capital funding, while Series B is the next stage, aimed at scaling the business.

- Valuation: Companies in Series B usually have a higher valuation compared to Series A due to proven growth and market traction.

- Investor Expectations: Series B investors often expect more concrete results and a clearer path to profitability than Series A investors.

How does the risk profile differ between Series A and Series B?

The risk profile between Series A and Series B varies significantly:

- Early-Stage Risk: Series A involves higher risk as the company is still validating its business model and market fit.

- Growth Risk: Series B carries less risk in terms of market validation but introduces risks related to scaling operations and competition.

- Investor Confidence: Series B investors are more confident in the company's potential, reducing some of the inherent risks seen in Series A.

What are the typical funding amounts for Series A and Series B?

Funding amounts for Series A and Series B can vary widely:

- Series A: Typically ranges from $2 million to $15 million, depending on the industry and the company's potential.

- Series B: Usually ranges from $10 million to $50 million, reflecting the company's growth and scalability.

- Investor Involvement: Series B often involves more institutional investors compared to Series A, which may include more angel investors.

How do investor expectations change from Series A to Series B?

Investor expectations evolve significantly from Series A to Series B:

- Proof of Concept: Series A investors look for a viable product and initial market traction, while Series B investors expect a proven business model.

- Revenue Growth: Series B investors demand stronger revenue growth and a clearer path to profitability compared to Series A.

- Scalability: Series B investors focus on the company's ability to scale operations and capture a larger market share.

What are the strategic goals for companies in Series A versus Series B?

The strategic goals for companies in Series A and Series B differ based on their growth stage:

- Series A: Focuses on product development, market validation, and building a customer base.

- Series B: Aims to scale operations, expand market reach, and optimize the business model for profitability.

- Team Expansion: Series B often involves hiring key personnel to manage growth, whereas Series A may focus on building the core team.

What is an angel round of funding?

:max_bytes(150000):strip_icc()/angelinvestor-f8192cd6f9184e998ddb7addb7ce4384.jpg)

What is an Angel Round of Funding?

An angel round of funding refers to the initial stage of financing for a startup, typically provided by angel investors. These investors are high-net-worth individuals who offer capital in exchange for equity or convertible debt. This funding is crucial for startups in their early stages, as it helps them develop their product, conduct market research, and build a team before seeking larger investments from venture capitalists.

Who are Angel Investors?

Angel investors are individuals who provide early-stage capital to startups. They are often experienced entrepreneurs or business professionals who invest their personal funds. Key characteristics of angel investors include:

- High-net-worth individuals with disposable income to invest.

- They often seek equity stakes or convertible debt in return for their investment.

- They may offer mentorship and industry connections alongside financial support.

Why is Angel Funding Important for Startups?

Angel funding plays a critical role in the growth of startups. It provides the necessary resources to turn ideas into viable businesses. The importance of angel funding includes:

- It bridges the gap between self-funding and larger venture capital investments.

- It allows startups to validate their business models and achieve proof of concept.

- It helps attract additional investors by demonstrating early support and credibility.

How Does an Angel Round Work?

The process of securing an angel round involves several steps. Startups must prepare thoroughly to attract investors. The typical process includes:

- Developing a compelling pitch and business plan.

- Identifying and reaching out to potential angel investors through networks or platforms.

- Negotiating terms, such as equity stakes or convertible notes, and finalizing the deal.

What are the Risks and Rewards of Angel Investing?

Angel investing is inherently risky but can yield significant rewards. Both startups and investors must weigh the pros and cons. Key points include:

- High risk: Many startups fail, leading to potential loss of investment.

- High reward: Successful investments can result in substantial returns, often exceeding 10x the initial amount.

- Angel investors gain early access to innovative ideas and potential industry disruptors.

What is the difference between Series A and Series B fundraising?

What is Series A Fundraising?

Series A fundraising is the first significant round of venture capital financing for a startup. At this stage, the company has typically moved beyond the initial seed funding phase and has demonstrated some level of market validation. Investors in Series A rounds are usually venture capital firms, and the funds are used to scale the business, refine the product, and expand the team. Key characteristics include:

- Purpose: To scale operations and achieve significant growth milestones.

- Investors: Primarily venture capital firms, sometimes with participation from angel investors.

- Valuation: Higher than seed rounds, reflecting the company's progress and potential.

What is Series B Fundraising?

Series B fundraising occurs after a company has successfully navigated the Series A stage and is looking to expand further. This round is focused on scaling the business to meet increasing market demand, entering new markets, or enhancing the product line. Series B investors often include venture capital firms, private equity, and sometimes strategic investors. Key characteristics include:

- Purpose: To accelerate growth, expand market reach, and improve operational efficiency.

- Investors: Venture capital firms, private equity, and strategic investors.

- Valuation: Significantly higher than Series A, reflecting the company's proven track record and growth potential.

Key Differences in Funding Amounts

The funding amounts in Series A and Series B rounds differ significantly due to the stage of the company. Series A rounds typically raise between $2 million to $15 million, while Series B rounds can range from $10 million to $50 million or more. This difference is due to:

- Stage of Development: Series A companies are still proving their business model, while Series B companies have a proven track record.

- Risk Level: Series A is riskier, hence the lower funding amounts compared to Series B.

- Growth Potential: Series B companies have demonstrated growth potential, justifying larger investments.

Investor Expectations in Series A vs. Series B

Investor expectations differ between Series A and Series B rounds. In Series A, investors are looking for a viable business model and a clear path to growth. In Series B, the focus shifts to scaling the business and achieving profitability. Key differences include:

- Metrics: Series A investors focus on user growth and product-market fit, while Series B investors look at revenue growth and market expansion.

- Milestones: Series A companies aim to achieve initial growth milestones, whereas Series B companies aim for significant market penetration.

- Risk Tolerance: Series A investors accept higher risk for higher potential returns, while Series B investors seek more stable growth.

Use of Funds in Series A and Series B

The use of funds in Series A and Series B rounds varies based on the company's stage. Series A funds are typically used for product development, market validation, and initial scaling. Series B funds are allocated towards scaling operations, entering new markets, and enhancing the product line. Key differences include:

- Product Development: Series A focuses on refining the product, while Series B may involve expanding the product line.

- Market Expansion: Series A targets initial market penetration, whereas Series B aims for broader market reach.

- Operational Scaling: Series A funds are used to build the team and infrastructure, while Series B funds are used to optimize and scale operations.

What is the Series B round of funding?

What is the Series B Round of Funding?

The Series B round of funding is a stage in the financing process of a startup or growing company, typically following the Series A round. At this stage, the company has already demonstrated some level of success, such as a proven business model, a growing customer base, and consistent revenue streams. The primary goal of Series B funding is to scale the business further, expand market reach, and optimize operations to achieve profitability. Investors in this round often include venture capital firms, private equity investors, and sometimes strategic corporate investors.

Key Objectives of Series B Funding

The main objectives of Series B funding are to:

- Scale operations: Expand the company's infrastructure, workforce, and production capabilities to meet increasing demand.

- Enter new markets: Use the funds to explore and establish a presence in new geographic or demographic markets.

- Enhance product offerings: Invest in research and development to improve existing products or launch new ones.

Who Participates in Series B Funding?

Series B funding typically involves:

- Venture capital firms: These firms specialize in high-growth startups and provide significant capital in exchange for equity.

- Private equity investors: They may join at this stage to support the company's expansion plans.

- Existing investors: Early-stage investors from Series A may choose to reinvest to maintain their equity stake.

How is Series B Funding Different from Series A?

Series B funding differs from Series A in several ways:

- Company maturity: By Series B, the company has a proven track record, whereas Series A is often about validating the business model.

- Funding amount: Series B rounds usually involve larger sums of money compared to Series A.

- Investor expectations: Investors in Series B focus on scaling and profitability, while Series A investors are more concerned with growth potential.

What Are the Risks and Challenges in Series B Funding?

Series B funding comes with its own set of risks and challenges:

- High expectations: Investors expect significant returns, putting pressure on the company to perform.

- Market competition: Scaling in a competitive market can be difficult and costly.

- Operational complexity: Managing rapid growth requires strong leadership and efficient systems.

Frequently Asked Questions (FAQs)

What is the main difference between Angel Series A and Series B funding rounds?

The primary difference between Angel Series A and Series B funding rounds lies in the stage of the company's growth and the purpose of the funds. Angel funding typically occurs during the earliest stages of a startup, often when the company is still in the idea or prototype phase. This funding is usually provided by individual investors or angel groups who believe in the potential of the startup. On the other hand, Series A funding is the first significant round of venture capital financing, aimed at scaling the business after it has demonstrated some market traction. Series B funding follows Series A and is used to further expand the company's operations, often focusing on market penetration and scaling the business model.

How do the investment amounts differ between Angel, Series A, and Series B funding?

The investment amounts vary significantly between Angel, Series A, and Series B funding rounds. Angel investments are generally smaller, ranging from tens of thousands to a few hundred thousand dollars, as they are meant to support the initial development of the startup. Series A rounds typically involve larger sums, often ranging from $2 million to $15 million, as the company is expected to have a viable product and some market validation. Series B funding rounds are even larger, with investments often ranging from $10 million to $50 million or more, as the company is now focused on scaling its operations and increasing its market share.

What types of investors are involved in Angel, Series A, and Series B funding?

The types of investors involved in Angel, Series A, and Series B funding rounds differ based on the stage of the company. Angel investors are typically high-net-worth individuals or small groups who invest their own money in early-stage startups. They often provide not only capital but also mentorship and industry connections. In Series A funding, the investors are usually venture capital firms that specialize in early-stage investments. These firms provide larger amounts of capital and often take a more active role in guiding the company's strategy. Series B funding rounds attract more established venture capital firms, as well as private equity investors, who are looking to invest in companies that have already demonstrated significant growth potential.

What are the key milestones a company should achieve before moving from Angel to Series A or Series B funding?

Before moving from Angel to Series A funding, a company should achieve several key milestones, including developing a minimum viable product (MVP), gaining some initial market traction, and demonstrating a clear path to revenue generation. For Series A funding, the company should have a proven business model, a growing customer base, and a solid plan for scaling operations. Moving to Series B funding requires even more significant achievements, such as strong revenue growth, a well-established market presence, and a clear strategy for further expansion. Companies seeking Series B funding are often expected to have a track record of meeting or exceeding the goals set during their Series A round.

Leave a Reply

Our Recommended Articles