How to Start a Micro Vc Fund

Starting a micro VC fund is an exciting venture for those looking to invest in early-stage startups and support innovation. Unlike traditional venture capital, micro VC funds focus on smaller investments, often targeting niche markets or underrepresented founders. This approach allows for greater flexibility and the potential to make a significant impact with limited capital. However, launching a micro VC fund requires careful planning, a clear investment thesis, and a strong network within the startup ecosystem. In this article, we’ll explore the essential steps to establish a micro VC fund, from defining your strategy to raising capital and building a portfolio of promising startups.

How to Start a Micro VC Fund: A Comprehensive Guide

Understanding the Basics of a Micro VC Fund

A Micro VC Fund is a smaller-scale venture capital fund that typically invests in early-stage startups. Unlike traditional VC funds, which may manage hundreds of millions or even billions of dollars, micro VC funds usually manage between $1 million to $50 million. These funds are often started by experienced entrepreneurs or angel investors who want to support startups in their early stages. The key to success in this space is identifying high-potential startups and providing them with not just capital, but also mentorship and strategic guidance.

See Also How Much Do Analysts Senior Analysts at Vc Firms Make How is Compensation Structured

How Much Do Analysts Senior Analysts at Vc Firms Make How is Compensation StructuredDefining Your Investment Thesis

Before starting a micro VC fund, it's crucial to define your investment thesis. This involves deciding on the industries, geographies, and stages of startups you want to invest in. For example, you might focus on tech startups in emerging markets or healthtech companies in the U.S. Your investment thesis will guide your decision-making process and help you attract Limited Partners (LPs) who share your vision. A well-defined thesis also helps in building a strong portfolio that aligns with your expertise and interests.

Raising Capital from Limited Partners

Raising capital is one of the most challenging aspects of starting a micro VC fund. You'll need to pitch your fund to potential LPs, such as high-net-worth individuals, family offices, and institutional investors. It's essential to have a solid track record or a compelling story that demonstrates your ability to generate returns. Be prepared to answer tough questions about your investment strategy, risk management, and expected returns. Building trust with your LPs is critical, as they will be the backbone of your fund.

See Also How Do Vc Firms Raise Their Funds?

How Do Vc Firms Raise Their Funds?Building a Strong Network and Deal Flow

A successful micro VC fund relies heavily on a strong network and consistent deal flow. This means building relationships with entrepreneurs, other investors, and industry experts. Attending startup events, pitch competitions, and networking sessions can help you discover promising startups. Additionally, leveraging online platforms like AngelList or Crunchbase can provide access to a broader range of opportunities. The more robust your network, the better your chances of finding high-quality deals.

Legal and Regulatory Considerations

Starting a micro VC fund involves navigating a complex legal and regulatory landscape. You'll need to set up a legal entity, such as a Limited Partnership (LP) or a Limited Liability Company (LLC), and comply with securities laws in your jurisdiction. It's advisable to consult with legal and financial advisors to ensure that your fund is structured correctly and that you meet all regulatory requirements. Additionally, you'll need to draft Limited Partnership Agreements (LPAs) and other legal documents to formalize your relationships with LPs.

See Also How Do the Different Types of Partners in a Venture Capital Firm Differ General Partner Operating Partner Investment Partner Etc

How Do the Different Types of Partners in a Venture Capital Firm Differ General Partner Operating Partner Investment Partner Etc| Key Aspect | Description |

|---|---|

| Fund Size | Typically between $1 million to $50 million |

| Investment Focus | Early-stage startups in specific industries or geographies |

| Capital Sources | High-net-worth individuals, family offices, institutional investors |

| Legal Structure | Limited Partnership (LP) or Limited Liability Company (LLC) |

| Regulatory Compliance | Must adhere to securities laws and draft LPAs |

How much money is needed to start a VC fund?

Minimum Capital Requirements for Starting a VC Fund

Starting a venture capital (VC) fund typically requires a significant amount of capital. The minimum amount needed can vary widely depending on the fund's focus, size, and target market. However, most VC funds start with at least $10 million to $20 million in committed capital. This amount is necessary to:

See Also What Are the Positions at Vc Firms?

What Are the Positions at Vc Firms?- Cover initial operational costs, such as legal fees, office space, and salaries.

- Make initial investments in startups, which usually range from $500,000 to $2 million per deal.

- Build a diversified portfolio to mitigate risks and attract limited partners (LPs).

Costs Associated with Setting Up a VC Fund

Establishing a VC fund involves several upfront and ongoing costs. These include:

- Legal and regulatory fees: Setting up the fund structure, drafting partnership agreements, and complying with regulations can cost between $50,000 and $150,000.

- Operational expenses: Office space, software, and salaries for analysts and partners can add up to $500,000 to $1 million annually.

- Administrative costs: Fund accounting, audits, and compliance reporting may require an additional $50,000 to $100,000 per year.

Raising Capital from Limited Partners (LPs)

Raising capital from limited partners (LPs) is a critical step in starting a VC fund. LPs are typically institutional investors, family offices, or high-net-worth individuals. To attract LPs, you need:

- A compelling investment thesis that outlines your fund's strategy and target sectors.

- A strong track record or team with relevant experience in venture capital or entrepreneurship.

- Transparency in terms of fees, expected returns, and risk management.

Management Fees and Carry Structure

VC funds typically charge management fees and take a percentage of profits, known as carry. The standard structure includes:

- Management fees: Usually 2% of the committed capital annually, used to cover operational costs.

- Carry: Typically 20% of the profits, distributed to the fund managers after returning the initial capital to LPs.

- Hurdle rate: Some funds set a minimum return threshold (e.g., 8%) before carry is applied.

Factors Influencing the Size of a VC Fund

The size of a VC fund depends on several factors, including:

- Investment strategy: Early-stage funds may require less capital than growth-stage funds.

- Geographic focus: Funds targeting emerging markets may need more capital due to higher risks.

- Team expertise: Experienced teams with a proven track record can raise larger funds more easily.

How do I start a small venture capital fund?

Understanding the Basics of Venture Capital

Starting a small venture capital fund requires a solid understanding of how venture capital works. Venture capital involves investing in early-stage companies with high growth potential in exchange for equity. To begin:

- Research the venture capital industry to understand its dynamics, risks, and rewards.

- Identify your niche or focus area, such as tech startups, healthcare, or green energy.

- Learn about fund structures, including limited partnerships and management fees.

Building a Strong Network

A robust network is crucial for sourcing deals and attracting investors. To build your network:

- Attend industry events like startup pitch nights and venture capital conferences.

- Connect with entrepreneurs, angel investors, and other venture capitalists.

- Leverage social media platforms like LinkedIn to expand your reach.

Raising Capital for Your Fund

Raising capital is one of the most challenging aspects of starting a venture capital fund. To attract investors:

- Develop a compelling pitch that highlights your expertise and track record.

- Target high-net-worth individuals, family offices, and institutional investors.

- Offer clear terms and demonstrate how your fund will generate returns.

Structuring Your Venture Capital Fund

Proper fund structuring ensures legal compliance and operational efficiency. Key steps include:

- Choose a legal structure, such as a limited partnership (LP) or limited liability company (LLC).

- Draft a partnership agreement outlining roles, responsibilities, and profit-sharing.

- Set up a management company to handle day-to-day operations and decision-making.

Deal Sourcing and Investment Strategy

Your ability to source and evaluate deals will determine your fund's success. To refine your strategy:

- Develop a clear investment thesis that aligns with your fund's goals.

- Use data-driven tools to identify promising startups and market trends.

- Conduct thorough due diligence before making any investment decisions.

What is a micro VC fund?

What is a Micro VC Fund?

A micro VC fund is a type of venture capital fund that typically invests smaller amounts of capital, often ranging from $500,000 to $10 million, in early-stage startups. Unlike traditional VC funds, which may manage hundreds of millions or even billions of dollars, micro VC funds focus on seed-stage or pre-seed-stage companies. These funds are often managed by smaller teams or individual investors who have a deep understanding of niche markets or emerging technologies.

How Does a Micro VC Fund Operate?

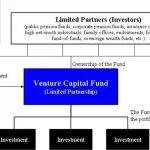

Micro VC funds operate by pooling capital from limited partners (LPs) and then deploying that capital into startups. The process typically involves:

- Fundraising: The fund manager raises capital from LPs, which can include high-net-worth individuals, family offices, or institutional investors.

- Deal Sourcing: The fund identifies promising startups through networking, pitch events, or referrals.

- Due Diligence: The fund conducts thorough research and analysis to assess the startup's potential for growth and return on investment.

- Investment: The fund invests in selected startups, often taking an equity stake in exchange for capital.

- Portfolio Management: The fund provides ongoing support to its portfolio companies, which may include mentorship, strategic guidance, and introductions to other investors or partners.

What Are the Key Characteristics of a Micro VC Fund?

Micro VC funds are distinguished by several key characteristics:

- Small Fund Size: Typically, these funds manage smaller amounts of capital compared to traditional VC funds.

- Early-Stage Focus: They primarily invest in seed or pre-seed-stage companies, which are often in the earliest phases of development.

- Niche Expertise: Many micro VC funds specialize in specific industries or technologies, allowing them to offer more targeted support to their portfolio companies.

- Flexible Investment Terms: They may offer more flexible terms compared to larger VC funds, such as smaller equity stakes or convertible notes.

- Active Involvement: Micro VC fund managers often take a hands-on approach, providing significant mentorship and guidance to their portfolio companies.

What Are the Advantages of Micro VC Funds?

Micro VC funds offer several advantages to both investors and startups:

- Access to Early-Stage Opportunities: Investors can gain exposure to high-potential startups at an early stage, which can lead to significant returns if the company succeeds.

- Diversification: By investing in multiple startups, micro VC funds can spread risk across a portfolio of companies.

- Specialized Knowledge: Many micro VC funds have deep expertise in specific sectors, which can be invaluable for startups in those industries.

- Mentorship and Support: Startups benefit from the hands-on involvement and guidance of experienced investors.

- Flexibility: Micro VC funds may offer more flexible investment terms, which can be attractive to early-stage companies.

What Are the Challenges of Micro VC Funds?

Despite their advantages, micro VC funds also face several challenges:

- Limited Capital: The smaller size of these funds means they have less capital to deploy, which can limit the number of investments they can make.

- High Risk: Early-stage investments are inherently risky, with a high likelihood of failure for many startups.

- Competition: Micro VC funds often compete with larger VC funds and angel investors for the best deals.

- Resource Constraints: Smaller teams may have limited resources for due diligence and portfolio management.

- Exit Challenges: Achieving a successful exit (e.g., through an IPO or acquisition) can be more difficult for early-stage companies, potentially impacting returns.

Do you need a license to start a VC?

What is a Venture Capital (VC) Firm?

A Venture Capital (VC) firm is an investment company that provides funding to startups and small businesses with high growth potential. These firms typically invest in exchange for equity or ownership stakes in the companies they fund. VC firms play a crucial role in fostering innovation and entrepreneurship by providing not only capital but also mentorship, industry connections, and strategic guidance.

- VC firms focus on high-risk, high-reward investments.

- They often invest in early-stage companies or those in the growth phase.

- VCs may specialize in specific industries, such as technology, healthcare, or clean energy.

Do You Need a License to Start a VC Firm?

Starting a Venture Capital firm does not always require a specific license, but it depends on the jurisdiction and the structure of the firm. In many countries, VC firms operate as private investment entities, which may not require a formal license. However, if the firm plans to manage funds from external investors, it may need to register with financial regulatory authorities.

- Check local regulations to determine if a license is required.

- If managing third-party funds, registration with a financial regulator may be mandatory.

- Consider consulting a legal expert to ensure compliance with all laws.

Key Regulatory Requirements for VC Firms

Regulatory requirements for VC firms vary by country and region. In the United States, for example, VC firms may need to register with the Securities and Exchange Commission (SEC) if they manage a certain amount of assets. Other countries may have similar regulatory bodies overseeing investment activities.

- Register with the SEC or equivalent regulatory body if required.

- Comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

- Ensure adherence to securities laws and investor protection rules.

Steps to Start a VC Firm Without a License

If a license is not required, starting a VC firm involves several key steps. These include forming a legal entity, raising capital, and building a network of investors and startups. While a license may not be necessary, proper legal and financial structuring is critical.

- Form a legal entity, such as an LLC or corporation.

- Raise capital from high-net-worth individuals or institutional investors.

- Develop a network of startups and industry experts.

When Is a License Mandatory for a VC Firm?

A license becomes mandatory for a VC firm when it engages in activities that fall under the jurisdiction of financial regulators. For example, if the firm plans to manage funds from public investors or operate as a registered investment advisor, it will likely need to obtain the necessary licenses and approvals.

- Managing public funds often requires a license.

- Operating as a registered investment advisor may necessitate regulatory approval.

- Engaging in securities trading or other regulated activities may trigger licensing requirements.

Frequently Asked Questions (FAQs)

What is a Micro VC Fund and How Does It Work?

A Micro VC Fund is a smaller-scale venture capital fund that typically invests in early-stage startups, often at the seed or pre-seed stage. Unlike traditional VC funds, which may manage hundreds of millions or even billions of dollars, micro VC funds usually operate with a smaller pool of capital, often ranging from $1 million to $50 million. These funds focus on high-growth potential startups and aim to provide not only capital but also mentorship and strategic guidance. The fund generates returns by acquiring equity in these startups and exiting through events like acquisitions or IPOs.

What Are the Key Steps to Starting a Micro VC Fund?

Starting a Micro VC Fund involves several critical steps. First, you need to define your investment thesis, which outlines the types of startups you want to invest in and the industries you want to focus on. Next, you must raise capital from limited partners (LPs), such as high-net-worth individuals, family offices, or institutional investors. Once the capital is secured, you’ll need to set up the legal structure of the fund, typically as a limited partnership. Finally, you’ll need to build a pipeline of potential investments, conduct due diligence, and start deploying capital into promising startups.

How Much Capital Do You Need to Start a Micro VC Fund?

The amount of capital required to start a Micro VC Fund can vary widely depending on your goals and the size of the investments you plan to make. Typically, micro VC funds start with anywhere between $1 million and $50 million. However, it’s important to note that you don’t need to raise the entire amount upfront. Many fund managers start with a smaller amount and then raise additional capital as they demonstrate success. Additionally, you’ll need to budget for operational costs, such as legal fees, administrative expenses, and salaries for your team.

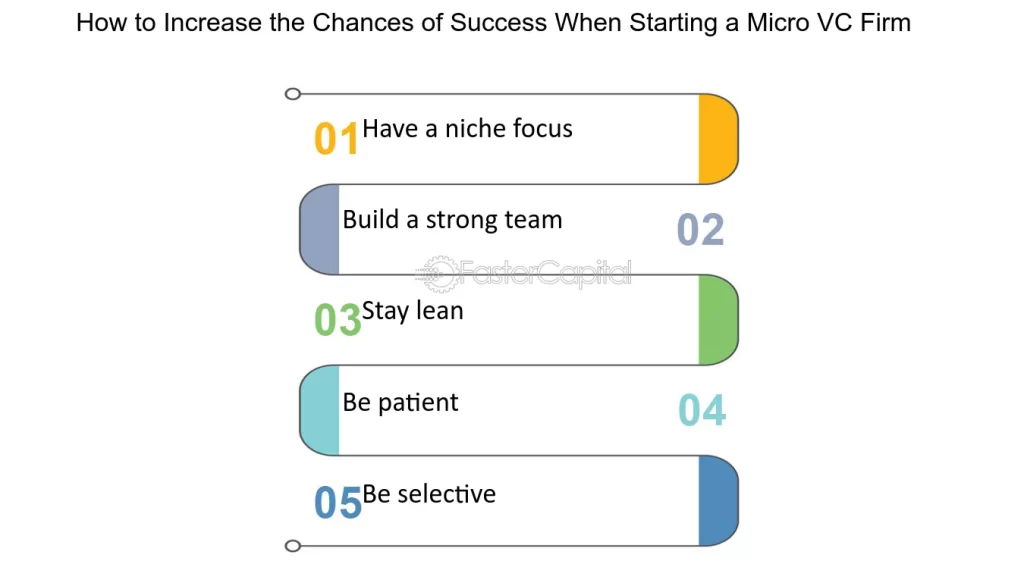

What Are the Challenges of Running a Micro VC Fund?

Running a Micro VC Fund comes with its own set of challenges. One of the primary challenges is deal sourcing, as you’ll need to consistently find high-quality startups to invest in. Another challenge is portfolio management, which involves not only selecting the right startups but also providing ongoing support to help them grow. Additionally, you’ll need to manage relationships with your limited partners (LPs), keeping them informed and satisfied with the fund’s performance. Finally, the competitive nature of the venture capital industry means you’ll need to differentiate your fund through a unique value proposition or niche focus.

Leave a Reply

Our Recommended Articles