Where Can You Find Reviews and Ratings for Angel Investors and Venture Capital Firms

When seeking funding for a startup, understanding the reputation and performance of angel investors and venture capital firms is crucial. Reviews and ratings provide valuable insights into their investment strategies, reliability, and support for entrepreneurs. Numerous platforms and resources are available to help founders evaluate potential investors. From specialized websites and industry forums to social media and professional networks, these tools offer firsthand accounts and data-driven assessments. This article explores the best places to find reviews and ratings for angel investors and venture capital firms, empowering entrepreneurs to make informed decisions and build successful partnerships in the competitive world of startup financing.

- Where Can You Find Reviews and Ratings for Angel Investors and Venture Capital Firms?

- What is the best website for angel investors?

- What is the most prestigious venture capital firm?

- Who is the most successful angel investor?

- Who are the Tier 1 VCs?

-

Frequently Asked Questions (FAQs)

- Where can I find reliable reviews and ratings for angel investors?

- Are there specialized websites for venture capital firm reviews?

- How can I verify the credibility of reviews for angel investors and venture capital firms?

- What should I look for in reviews of angel investors and venture capital firms?

Where Can You Find Reviews and Ratings for Angel Investors and Venture Capital Firms?

1. Online Platforms Specializing in Investor Reviews

There are several online platforms dedicated to providing reviews and ratings for angel investors and venture capital firms. Websites like AngelList, Crunchbase, and Gust offer comprehensive profiles of investors, including feedback from entrepreneurs who have worked with them. These platforms allow users to filter investors by industry, investment size, and location, making it easier to find the right match for your startup.

See Also What is the Difference Between Angel Investors Venture Capitalists and Silent Partner Investors

What is the Difference Between Angel Investors Venture Capitalists and Silent Partner InvestorsSocial media platforms such as LinkedIn and Twitter can be valuable resources for finding reviews and ratings. Many entrepreneurs share their experiences with investors on these platforms, providing insights into their professionalism, responsiveness, and overall effectiveness. Additionally, professional networks like LinkedIn Groups often have discussions and threads where members share their experiences with various investors.

3. Industry-Specific Forums and Communities

Industry-specific forums and communities are another excellent source of information. Websites like Reddit (e.g., r/startups) and Quora have active communities where entrepreneurs discuss their experiences with different investors. These platforms often provide candid feedback and can help you gauge the reputation of an investor within your specific industry.

See Also Who Are the Top Vc Investors in Cyber Security Startups?

Who Are the Top Vc Investors in Cyber Security Startups?4. Startup Accelerators and Incubators

Startup accelerators and incubators often have extensive networks of investors and can provide valuable insights into their performance. Many accelerators, such as Y Combinator and Techstars, maintain databases of investors and their track records. Additionally, alumni from these programs often share their experiences with specific investors, which can be a reliable source of information.

5. Direct Feedback from Entrepreneurs

One of the most reliable ways to get reviews and ratings is by speaking directly with entrepreneurs who have worked with the investors you are considering. Networking events, pitch competitions, and industry conferences are great places to meet other founders and gather firsthand accounts of their experiences. This direct feedback can provide a more nuanced understanding of an investor's strengths and weaknesses.

See Also What Are the Top Vc Funds for Societal Impact?

What Are the Top Vc Funds for Societal Impact?| Platform | Type of Information | User Base |

|---|---|---|

| AngelList | Investor profiles, reviews, ratings | Startups, Investors |

| Crunchbase | Investment history, reviews | Entrepreneurs, Investors |

| Gust | Investor reviews, ratings | Startups, Angel Investors |

| Professional feedback, discussions | Professionals, Entrepreneurs | |

| Candid feedback, community discussions | Entrepreneurs, Investors |

What is the best website for angel investors?

What is AngelList and Why is it Popular Among Angel Investors?

AngelList is one of the most popular platforms for angel investors due to its extensive network and user-friendly interface. It connects startups with investors, offering a streamlined process for funding and collaboration. Here are some key features:

- Startup Profiles: Detailed information about startups, including their pitch, team, and traction.

- Syndicates: Allows investors to pool resources and invest collectively in promising startups.

- Job Board: Helps startups find talent, which is crucial for their growth and success.

How Does Gust Facilitate Angel Investments?

Gust is another leading platform designed to connect angel investors with startups. It provides a comprehensive ecosystem for investment activities. Key aspects include:

- Deal Flow Management: Tools to manage and track potential investment opportunities.

- Legal Documentation: Streamlines the process of creating and signing investment agreements.

- Global Reach: Access to startups and investors from around the world, expanding opportunities.

What Makes SeedInvest a Top Choice for Angel Investors?

SeedInvest is renowned for its rigorous vetting process, ensuring that only high-quality startups are presented to angel investors. Its standout features include:

- Curated Deals: Only 1% of applicants are accepted, ensuring a high standard of investment opportunities.

- Equity Crowdfunding: Allows investors to participate in early-stage funding rounds with smaller amounts of capital.

- Transparency: Provides detailed information about each startup, including financials and business plans.

Why Should Angel Investors Consider FundersClub?

FundersClub is an online venture capital platform that offers angel investors access to vetted startups. Its unique features include:

- Vetted Opportunities: Startups are carefully selected by a team of experienced investors.

- Diverse Portfolio: Access to a wide range of industries and stages of startup development.

- Community Engagement: Opportunities to connect with other investors and share insights.

How Does MicroVentures Support Angel Investors?

MicroVentures is a platform that combines angel investing with equity crowdfunding, offering a unique approach to early-stage investments. Key features include:

- Diverse Investment Options: Access to startups, real estate, and other alternative investments.

- Low Minimum Investments: Allows investors to start with smaller amounts, making it accessible to more people.

- Secondary Market: Provides liquidity options for investors by allowing them to sell their shares.

What is the most prestigious venture capital firm?

What Defines a Prestigious Venture Capital Firm?

A prestigious venture capital firm is typically characterized by its track record of successful investments, reputation in the industry, and ability to attract top-tier startups. These firms often have a history of backing companies that have gone on to become market leaders or achieved significant exits, such as IPOs or acquisitions. Additionally, they are known for their strong networks, experienced partners, and strategic guidance that help startups scale effectively.

- Track Record: Consistently investing in high-growth companies that achieve notable success.

- Reputation: Recognized as a leader in the venture capital community.

- Network: Access to influential industry connections and resources.

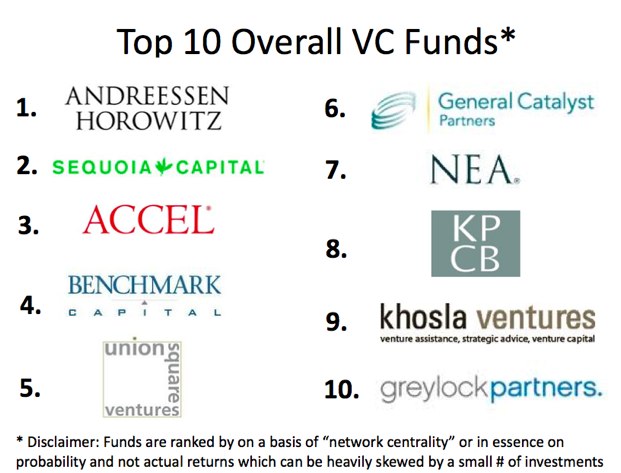

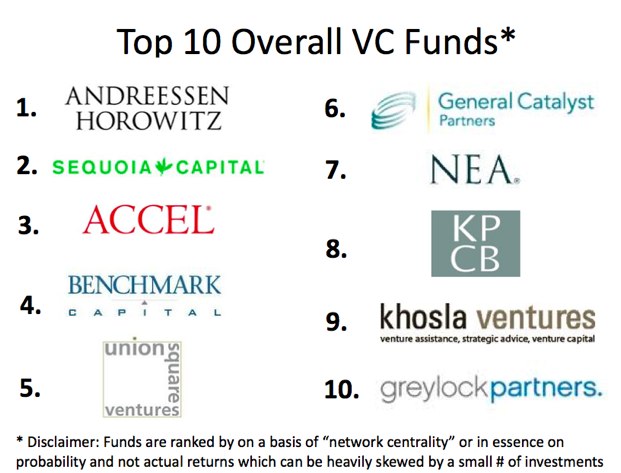

Top Contenders for the Most Prestigious Venture Capital Firm

Several venture capital firms are often cited as the most prestigious due to their history of successful investments and influence in the tech and startup ecosystems. Firms like Sequoia Capital, Andreessen Horowitz, and Accel are frequently mentioned. These firms have backed companies such as Apple, Google, Facebook, and Airbnb, which have become household names and transformed industries.

- Sequoia Capital: Known for early investments in Apple, Google, and WhatsApp.

- Andreessen Horowitz: Backed companies like Facebook, Twitter, and Slack.

- Accel: Early investor in Facebook, Dropbox, and Slack.

Key Factors That Make a Venture Capital Firm Prestigious

The prestige of a venture capital firm is often determined by its ability to identify and nurture groundbreaking startups, generate high returns for investors, and maintain a strong brand presence. These firms are also known for their innovative investment strategies and commitment to supporting founders through mentorship and resources.

- Investment Strategy: Focus on disruptive technologies and high-growth sectors.

- Returns: Consistently delivering above-average returns to limited partners.

- Brand Presence: Recognized as a thought leader in the venture capital space.

How Prestigious Venture Capital Firms Impact the Startup Ecosystem

Prestigious venture capital firms play a crucial role in shaping the startup ecosystem by providing capital, mentorship, and access to networks. Their involvement often signals credibility to other investors and can help startups attract additional funding. Additionally, these firms contribute to innovation by supporting cutting-edge technologies and business models.

- Capital Injection: Enabling startups to scale operations and reach new markets.

- Mentorship: Offering guidance from experienced entrepreneurs and industry experts.

- Network Access: Connecting startups with potential partners, customers, and talent.

Examples of Prestigious Venture Capital Firm Investments

Prestigious venture capital firms are known for their high-profile investments in companies that have revolutionized industries. For instance, Sequoia Capital invested in Google during its early stages, while Andreessen Horowitz backed Facebook before it became a global social media giant. These investments not only yield significant returns but also solidify the firm's reputation.

- Google: Sequoia Capital's early investment helped shape the internet landscape.

- Facebook: Andreessen Horowitz's backing contributed to its rapid growth.

- Airbnb: Accel's investment supported its transformation of the hospitality industry.

Who is the most successful angel investor?

Who is Considered the Most Successful Angel Investor?

The most successful angel investor is widely regarded as Ron Conway. Known as the Godfather of Silicon Valley, Conway has invested in over 700 companies, including tech giants like Google, Facebook, and Twitter. His ability to identify and support startups with high growth potential has made him a legend in the venture capital world.

- Early Investments: Conway was one of the first investors in Google, which has become one of the most valuable companies globally.

- Diverse Portfolio: His portfolio includes a wide range of industries, from social media to e-commerce, showcasing his versatility.

- Mentorship: Beyond funding, Conway provides mentorship and strategic advice to founders, helping them scale their businesses.

What Makes Ron Conway Stand Out?

Ron Conway stands out due to his early-stage investments and his ability to build strong relationships with founders. He is known for his hands-on approach and his willingness to take risks on unproven ideas.

- Network: Conway has an extensive network in Silicon Valley, which he leverages to help startups succeed.

- Risk Tolerance: He is willing to invest in companies at their earliest stages, often before they have a proven business model.

- Reputation: His reputation as a successful investor attracts top talent and additional funding to the startups he backs.

Key Investments by Ron Conway

Ron Conway's key investments have had a significant impact on the tech industry. Some of his most notable investments include:

- Google: His early investment in Google yielded massive returns as the company grew into a global powerhouse.

- Facebook: Conway was an early backer of Facebook, which has become one of the most influential social media platforms.

- Twitter: His investment in Twitter helped the platform become a major player in the social media space.

Ron Conway's Investment Strategy

Ron Conway's investment strategy is centered around early-stage investments and building relationships with founders. He focuses on startups with high growth potential and provides them with the resources they need to succeed.

- Early-Stage Focus: Conway primarily invests in startups during their seed or Series A rounds.

- Founder Relationships: He places a strong emphasis on building trust and rapport with the founders he invests in.

- Value-Added Support: Beyond capital, Conway offers mentorship, strategic advice, and access to his network.

Impact of Ron Conway on the Startup Ecosystem

Ron Conway has had a profound impact on the startup ecosystem, particularly in Silicon Valley. His investments and mentorship have helped shape the tech industry as we know it today.

- Job Creation: The companies he has invested in have created thousands of jobs worldwide.

- Innovation: Conway's support has enabled startups to innovate and bring groundbreaking technologies to market.

- Ecosystem Growth: His influence has contributed to the growth and development of the broader startup ecosystem.

Who are the Tier 1 VCs?

What Defines a Tier 1 Venture Capital Firm?

Tier 1 venture capital firms are distinguished by their reputation, track record, and influence in the startup ecosystem. These firms typically have a history of investing in highly successful companies, often referred to as unicorns, and have significant resources to support their portfolio companies. Key characteristics include:

- Proven Track Record: They have consistently backed startups that have achieved substantial exits, such as IPOs or acquisitions.

- Large Fund Sizes: They manage billions of dollars in assets, allowing them to make significant investments across various stages.

- Global Reach: They operate on an international scale, with offices in major tech hubs like Silicon Valley, New York, and London.

Top Tier 1 Venture Capital Firms in the Industry

Some of the most prominent Tier 1 VCs include firms like Sequoia Capital, Andreessen Horowitz, and Accel. These firms are known for their ability to identify and nurture high-potential startups early on. Notable examples include:

- Sequoia Capital: Known for investments in Apple, Google, and Airbnb.

- Andreessen Horowitz: Backed companies like Facebook, Twitter, and GitHub.

- Accel: Early investors in Facebook, Slack, and Dropbox.

How Tier 1 VCs Differ from Other Venture Capital Firms

Tier 1 VCs stand out due to their extensive networks, deep expertise, and ability to provide more than just capital. They offer strategic guidance, mentorship, and access to a vast network of industry leaders. Key differences include:

- Network Access: They provide startups with connections to top-tier talent, potential partners, and customers.

- Operational Support: They often have in-house teams to assist with marketing, recruiting, and scaling operations.

- Brand Prestige: Being backed by a Tier 1 VC can significantly enhance a startup's credibility and visibility.

The Investment Strategy of Tier 1 VCs

Tier 1 VCs typically focus on high-growth sectors such as technology, healthcare, and fintech. They invest across various stages, from seed to late-stage, but are particularly known for their early-stage investments. Their strategy includes:

- Early-Stage Focus: They often identify and invest in startups with disruptive potential before they gain widespread attention.

- Diversification: They spread their investments across multiple sectors and geographies to mitigate risk.

- Long-Term Vision: They are willing to support companies through multiple funding rounds, often holding investments for a decade or more.

Impact of Tier 1 VCs on the Startup Ecosystem

Tier 1 VCs play a crucial role in shaping the startup ecosystem by providing not only capital but also mentorship and strategic direction. Their influence extends beyond individual companies to entire industries. Key impacts include:

- Innovation Acceleration: They enable startups to scale rapidly, bringing innovative products and services to market faster.

- Job Creation: Successful portfolio companies often create thousands of jobs, contributing to economic growth.

- Ecosystem Development: They foster the growth of startup hubs by attracting talent and other investors to the region.

Frequently Asked Questions (FAQs)

Where can I find reliable reviews and ratings for angel investors?

You can find reliable reviews and ratings for angel investors on platforms like AngelList, Crunchbase, and Gust. These platforms provide detailed profiles of investors, including their investment history, portfolio companies, and feedback from entrepreneurs who have worked with them. Additionally, forums like Reddit and Quora often feature discussions where founders share their experiences with specific angel investors, offering valuable insights into their professionalism and support.

Are there specialized websites for venture capital firm reviews?

Yes, there are specialized websites where you can find reviews and ratings for venture capital firms. Platforms like PitchBook, CB Insights, and VentureDeal offer comprehensive data on VC firms, including their investment focus, performance metrics, and founder feedback. Additionally, The Funded is a community-driven site where entrepreneurs anonymously review and rate venture capital firms based on their experiences, providing an unfiltered perspective on their interactions.

How can I verify the credibility of reviews for angel investors and venture capital firms?

To verify the credibility of reviews, look for platforms that require verified profiles or have a moderation system in place to ensure authenticity. Cross-referencing reviews across multiple platforms, such as AngelList, Crunchbase, and The Funded, can also help you gauge consistency. Additionally, seek out personal recommendations from trusted entrepreneurs or industry professionals who have direct experience with the investors or firms in question.

What should I look for in reviews of angel investors and venture capital firms?

When reading reviews, focus on key aspects such as the investor's or firm's responsiveness, transparency, and value-added support. Look for comments about their ability to provide mentorship, networking opportunities, and strategic guidance. Pay attention to any recurring themes, such as communication issues or unreasonable demands, as these can indicate potential red flags. Reviews that highlight both positive and negative experiences can provide a balanced perspective to help you make an informed decision.

Leave a Reply

Our Recommended Articles