How Will Venture Capital Change in the Next Decade?

The venture capital (VC) landscape has undergone significant transformations over the past decade, driven by technological advancements, shifting market dynamics, and evolving investor priorities. As we look ahead, the next ten years promise to bring even more profound changes to the industry. Emerging technologies, such as artificial intelligence and blockchain, are reshaping industries and creating new investment opportunities. Meanwhile, global economic shifts and increasing emphasis on sustainability are influencing how venture capitalists allocate capital. This article explores the key trends and forces that are likely to redefine venture capital in the coming decade, offering insights into how investors, startups, and ecosystems must adapt to thrive in this rapidly evolving environment.

How Will Venture Capital Change in the Next Decade?

The Rise of Decentralized Funding Models

The next decade will likely see a significant shift towards decentralized funding models, such as blockchain-based crowdfunding and tokenization. These models allow startups to raise capital directly from a global pool of investors, bypassing traditional venture capital firms. This democratization of funding could reduce barriers to entry for entrepreneurs and increase competition among investors.

See Also Which Venture Capitalists Tend to Like Investing in Music Related Startups

Which Venture Capitalists Tend to Like Investing in Music Related StartupsIncreased Focus on ESG Investments

Environmental, Social, and Governance (ESG) criteria will play a more prominent role in venture capital decisions. Investors are increasingly prioritizing startups that demonstrate sustainability, social responsibility, and ethical governance. This trend is driven by both regulatory pressures and growing consumer demand for responsible business practices.

Expansion of AI-Driven Investment Strategies

Artificial Intelligence (AI) will revolutionize how venture capital firms identify and evaluate investment opportunities. Machine learning algorithms can analyze vast amounts of data to predict startup success, assess market trends, and optimize portfolio management. This will lead to more data-driven and efficient investment processes.

See Also Was the Moon Landing Actually a Waste of Money?

Was the Moon Landing Actually a Waste of Money?Geographic Diversification of Venture Capital

The next decade will witness a broader geographic distribution of venture capital investments. Emerging markets in Asia, Africa, and Latin America are expected to attract more attention as they offer high-growth potential and untapped opportunities. This shift will require venture capitalists to adapt to diverse regulatory environments and cultural landscapes.

Impact of Regulatory Changes on Venture Capital

Regulatory frameworks governing venture capital are likely to evolve, particularly in areas such as data privacy, taxation, and cross-border investments. These changes could either facilitate or hinder the flow of capital, depending on how they are implemented. Venture capitalists will need to stay informed and agile to navigate these regulatory shifts effectively.

See Also What Are Differences Between Venture Series a B C D and Seed Rounds

What Are Differences Between Venture Series a B C D and Seed Rounds| Trend | Description | Impact |

|---|---|---|

| Decentralized Funding | Blockchain-based crowdfunding and tokenization | Democratizes access to capital |

| ESG Investments | Focus on sustainability and ethical governance | Aligns investments with societal values |

| AI-Driven Strategies | Use of machine learning for investment decisions | Enhances efficiency and accuracy |

| Geographic Diversification | Expansion into emerging markets | Unlocks new growth opportunities |

| Regulatory Changes | Evolving data privacy and taxation laws | Requires adaptability from investors |

What are the venture capital trends in 2025?

Increased Focus on Sustainability and Green Technologies

In 2025, venture capital is expected to heavily invest in sustainability and green technologies. This trend is driven by global climate concerns and regulatory pressures. Key areas of investment include:

- Renewable energy solutions such as solar, wind, and hydrogen power.

- Carbon capture and storage technologies to reduce greenhouse gas emissions.

- Sustainable agriculture innovations, including vertical farming and lab-grown meat.

Rise of Artificial Intelligence and Machine Learning Startups

Artificial Intelligence (AI) and Machine Learning (ML) will continue to dominate venture capital investments in 2025. These technologies are transforming industries and creating new opportunities. Key areas include:

- AI-driven healthcare solutions for diagnostics and personalized medicine.

- Automation tools for industries like manufacturing, logistics, and customer service.

- Generative AI applications in content creation, design, and software development.

Expansion of Fintech Innovations

The fintech sector will see significant growth in 2025, with venture capital flowing into innovative financial solutions. Key trends include:

- Decentralized finance (DeFi) platforms offering alternatives to traditional banking.

- Digital payment systems and blockchain-based solutions for secure transactions.

- AI-powered financial advisors and wealth management tools.

Growth in Healthtech and Biotech

Healthtech and biotech startups will attract substantial venture capital in 2025, driven by advancements in medical research and technology. Key areas of focus include:

- Telemedicine platforms for remote healthcare delivery.

- Gene editing technologies like CRISPR for treating genetic disorders.

- Wearable health devices for continuous monitoring and diagnostics.

Emergence of Space Tech and Exploration

Space technology is becoming a new frontier for venture capital, with 2025 expected to bring significant investments. Key areas include:

- Satellite technology for global connectivity and data collection.

- Space tourism and commercial spaceflight ventures.

- Lunar and Martian exploration technologies for future colonization.

What is the 2 6 2 rule of venture capital?

Understanding the 2 6 2 Rule in Venture Capital

The 2 6 2 rule is a framework used in venture capital to categorize startups based on their potential for success. It divides startups into three groups:

- Top 20%: These are the high-performing startups expected to generate significant returns.

- Middle 60%: These startups show moderate potential but may require more time or resources to succeed.

- Bottom 20%: These are the underperforming startups likely to fail or provide minimal returns.

Why the 2 6 2 Rule Matters for Investors

The 2 6 2 rule helps investors allocate resources effectively by identifying which startups are worth focusing on. Key reasons include:

- Risk Management: It allows investors to minimize losses by identifying the bottom 20% early.

- Resource Allocation: Investors can prioritize the top 20% for maximum returns.

- Portfolio Balance: It ensures a diversified portfolio with a mix of high-risk and moderate-risk investments.

How the 2 6 2 Rule Impacts Startup Funding

Startups in different categories of the 2 6 2 rule receive varying levels of attention and funding:

- Top 20%: These startups often secure the majority of follow-on funding and mentorship.

- Middle 60%: They may receive incremental funding but are closely monitored for improvement.

- Bottom 20%: These startups are typically deprioritized or discontinued to cut losses.

Challenges of Applying the 2 6 2 Rule

While the 2 6 2 rule is useful, it comes with challenges:

- Subjectivity: Categorizing startups can be subjective and influenced by biases.

- Dynamic Nature: Startups can move between categories as they evolve.

- Overemphasis on Metrics: Relying solely on metrics may overlook qualitative factors like team dynamics.

Real-World Examples of the 2 6 2 Rule in Action

Many venture capital firms use the 2 6 2 rule to guide their investments:

- Top 20% Example: Companies like Uber and Airbnb were initially part of the top 20% due to their disruptive potential.

- Middle 60% Example: Startups in industries like fintech or healthtech often fall into this category as they scale.

- Bottom 20% Example: Failed startups like Juicero or Quibi were deprioritized after underperforming.

What is future now venture capital?

What is Future Now Venture Capital?

Future Now Venture Capital refers to a forward-thinking investment approach that focuses on funding innovative startups and businesses poised to shape the future. This type of venture capital emphasizes emerging technologies, sustainable solutions, and disruptive business models. Investors in this space aim to identify and support companies that have the potential to create significant impact in industries such as artificial intelligence, clean energy, biotechnology, and digital transformation.

Key Characteristics of Future Now Venture Capital

Future Now Venture Capital is defined by several key characteristics:

- Focus on Innovation: Investments are directed toward companies developing groundbreaking technologies or solutions.

- Long-Term Vision: Investors prioritize long-term growth and societal impact over short-term profits.

- Sustainability: A strong emphasis is placed on supporting businesses that promote environmental and social sustainability.

Industries Targeted by Future Now Venture Capital

Future Now Venture Capital targets a wide range of industries that are expected to drive future growth and innovation:

- Artificial Intelligence: Companies leveraging AI to solve complex problems and improve efficiency.

- Clean Energy: Startups focused on renewable energy sources and energy storage solutions.

- Biotechnology: Firms developing advanced medical treatments and healthcare technologies.

Benefits of Future Now Venture Capital

Investing in Future Now Venture Capital offers several advantages:

- High Growth Potential: Startups in emerging fields often experience rapid growth and scalability.

- Positive Impact: Investments contribute to solving global challenges like climate change and healthcare access.

- Diversification: Investors gain exposure to a variety of cutting-edge industries and technologies.

Challenges of Future Now Venture Capital

Despite its potential, Future Now Venture Capital comes with certain challenges:

- High Risk: Investing in unproven technologies or markets carries significant financial risk.

- Long Investment Horizons: Returns may take years to materialize, requiring patience and commitment.

- Regulatory Uncertainty: Emerging industries often face evolving regulations that can impact business operations.

What is the rule of 40 in venture capital?

What is the Rule of 40 in Venture Capital?

The Rule of 40 is a financial metric used in venture capital to evaluate the health and growth potential of a company, particularly in the software and SaaS (Software as a Service) industries. It states that a company's growth rate and profit margin should sum to at least 40%. For example, if a company is growing at 30% annually, it should have a profit margin of at least 10% to meet the Rule of 40. This rule helps investors balance the trade-off between growth and profitability.

Why is the Rule of 40 Important for Startups?

The Rule of 40 is crucial for startups because it provides a benchmark for sustainable growth. Here’s why it matters:

- Balances Growth and Profitability: It ensures that companies are not sacrificing profitability for rapid growth or vice versa.

- Attracts Investors: Meeting the Rule of 40 makes a company more attractive to venture capitalists and other investors.

- Indicates Financial Health: It signals that a company is managing its resources effectively and has a clear path to scalability.

How to Calculate the Rule of 40

Calculating the Rule of 40 is straightforward. Follow these steps:

- Determine Revenue Growth Rate: Calculate the percentage increase in revenue over a specific period (e.g., year-over-year).

- Calculate Profit Margin: Determine the company’s profit margin by dividing net income by total revenue.

- Add the Two Metrics: Sum the revenue growth rate and profit margin. If the total is 40% or higher, the company meets the Rule of 40.

Examples of Companies Meeting the Rule of 40

Many successful companies adhere to the Rule of 40. Here are a few examples:

- Salesforce: Known for its consistent growth and profitability, Salesforce often exceeds the Rule of 40 benchmark.

- Shopify: During its high-growth phases, Shopify balanced its growth rate with profitability to meet the Rule of 40.

- Zoom: During the pandemic, Zoom’s rapid growth and strong margins made it a prime example of the Rule of 40 in action.

Limitations of the Rule of 40

While the Rule of 40 is a useful metric, it has some limitations:

- Not Universally Applicable: It is most relevant for SaaS and software companies and may not apply to other industries.

- Ignores Cash Flow: The rule focuses on profitability and growth but does not account for cash flow management.

- Short-Term Focus: It may encourage companies to prioritize short-term metrics over long-term strategic goals.

Frequently Asked Questions (FAQs)

What trends are expected to shape venture capital in the next decade?

Venture capital is poised to undergo significant changes driven by technological advancements, shifting market dynamics, and evolving investor preferences. One major trend is the rise of decentralized finance (DeFi) and blockchain technologies, which are expected to create new investment opportunities and disrupt traditional funding models. Additionally, the increasing focus on sustainability and impact investing will likely push venture capitalists to prioritize startups that align with environmental, social, and governance (ESG) principles. Another key trend is the growing importance of artificial intelligence (AI) and machine learning in identifying high-potential startups and optimizing investment strategies.

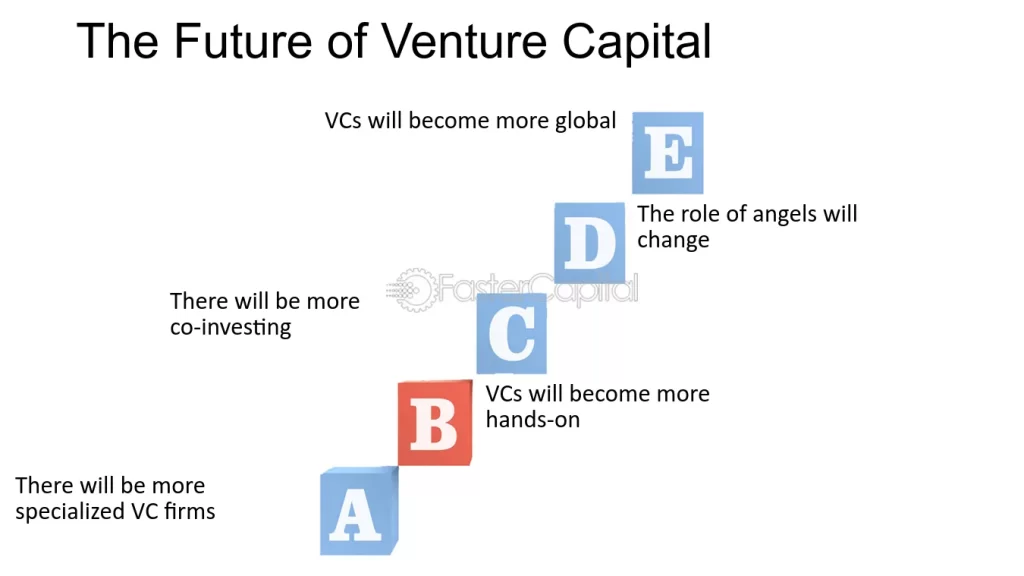

How will globalization impact venture capital in the coming years?

Globalization will continue to play a critical role in shaping the future of venture capital. As emerging markets gain momentum, venture capitalists are expected to expand their reach beyond traditional hubs like Silicon Valley. Countries in Asia, Africa, and Latin America are becoming hotspots for innovation, offering untapped potential for high-growth startups. This shift will require venture capitalists to adopt a more global perspective, understanding local markets, regulations, and cultural nuances. Moreover, cross-border collaborations and partnerships will become increasingly common, fostering a more interconnected and diverse investment landscape.

What role will diversity and inclusion play in venture capital over the next decade?

Diversity and inclusion are expected to become central themes in the venture capital industry over the next decade. Investors are recognizing the value of backing startups led by underrepresented founders, including women, minorities, and individuals from non-traditional backgrounds. Studies have shown that diverse teams often drive higher returns and greater innovation, prompting venture capital firms to prioritize inclusivity in their investment strategies. Additionally, there will likely be increased pressure from limited partners (LPs) and stakeholders to ensure that venture capital firms themselves reflect diverse leadership and decision-making teams.

How will technology-driven tools transform venture capital decision-making?

The next decade will see a significant transformation in how venture capitalists make investment decisions, thanks to technology-driven tools. Data analytics, AI-powered platforms, and predictive modeling will enable investors to assess startups with greater accuracy and efficiency. These tools will help identify patterns, evaluate market potential, and predict success rates, reducing reliance on gut instincts. Furthermore, blockchain technology may streamline due diligence processes and enhance transparency in funding rounds. As these tools become more sophisticated, venture capitalists will be better equipped to navigate the complexities of the startup ecosystem and make more informed decisions.

Leave a Reply

Our Recommended Articles