Wisconsin LLC Filing Fee

When forming a limited liability company (LLC) in Wisconsin, understanding the associated filing fees is crucial for entrepreneurs and business owners. The state requires a one-time fee to officially register your LLC, which covers the processing of your Articles of Organization by the Wisconsin Department of Financial Institutions (DFI). As of the latest update, the standard filing fee is $130 for online submissions and $170 for paper filings, with additional costs possible for expedited processing or optional services like name reservation. These fees ensure compliance with state regulations and secure your business’s legal standing. Budgeting for these expenses early helps streamline the setup process and avoids unexpected delays.

Understanding the Wisconsin LLC Filing Fee: Costs and Requirements

What Is the Wisconsin LLC Filing Fee?

The Wisconsin LLC filing fee is the mandatory payment required to officially register your Limited Liability Company (LLC) with the Wisconsin Department of Financial Institutions (DFI). As of 2023, the standard fee for filing the Articles of Organization is $130. This fee applies whether you file online, by mail, or in person. The payment covers the state’s processing costs and legally establishes your LLC’s existence in Wisconsin.

See AlsoArizona LLC Filing Fee| Fee Type | Amount |

| Articles of Organization | $130 |

| Online Submission | $130 |

| Mail/In-Person Submission | $130 |

| Processing Time | 7-10 business days |

Are There Additional Costs Beyond the Initial Wisconsin LLC Filing Fee?

Yes, forming an LLC in Wisconsin may involve additional costs beyond the $130 filing fee. These can include name reservation fees ($15), expedited processing fees ($25 for 24-hour service), and annual report fees ($25). You may also need to pay for business licenses or registered agent services, depending on your LLC’s requirements.

| Additional Fee | Amount |

| Name Reservation | $15 |

| Expedited Processing | $25 |

| Annual Report | $25 |

| Registered Agent (Third-Party) | $50-$300/year |

How to Pay the Wisconsin LLC Filing Fee

You can pay the Wisconsin LLC filing fee online, by mail, or in person. The online method is the fastest and requires a credit/debit card or pre-authorized bank account. For mail submissions, include a check or money order payable to the “Wisconsin Department of Financial Institutions.” In-person payments are accepted at the DFI office in Madison.

See Also What is the Business Model of Venture Capital Firms?

What is the Business Model of Venture Capital Firms?| Payment Method | Details |

| Online | Credit/Debit Card or E-Check |

| Check or Money Order | |

| In-Person | Cash, Check, or Card |

| Processing Time | Varies by method |

Can the Wisconsin LLC Filing Fee Be Waived or Reduced?

The Wisconsin LLC filing fee cannot be waived or reduced for standard LLC formations. However, certain nonprofit organizations or entities qualifying for specific state programs may receive exemptions. Always verify eligibility with the DFI or a legal advisor before applying.

| Eligibility | Fee Adjustment |

| Standard LLCs | No waiver |

| Nonprofits | Possible exemption |

| State Programs | Case-by-case basis |

What Happens If You Don’t Pay the Wisconsin LLC Filing Fee?

Failing to pay the Wisconsin LLC filing fee will result in your LLC’s formation documents being rejected by the state. Without payment, your business will not be legally recognized, and you cannot operate under the LLC structure. Late payments for annual reports incur a $50 penalty, and prolonged non-compliance may lead to administrative dissolution.

See AlsoColorado LLC Filing Fee| Consequence | Details |

| Formation Rejection | No LLC approval |

| Annual Report Penalty | $50 late fee |

| Dissolution Risk | After prolonged non-payment |

How much does it cost to file for an LLC in Wisconsin?

State Filing Fees for Forming an LLC in Wisconsin

The primary cost to file an LLC in Wisconsin is the state filing fee for the Articles of Organization. This fee is mandatory and must be submitted to the Wisconsin Department of Financial Institutions (DFI).

See Also Are There Any Venture Capital Firms That Invest in Retail Businesses

Are There Any Venture Capital Firms That Invest in Retail Businesses- $130: Standard filing fee for submitting the Articles of Organization online or by mail.

- $0: No additional fee for a Certificate of Status (good standing) at the time of formation.

- $0: No initial franchise tax or fee for LLCs in Wisconsin.

Optional Costs for LLC Formation in Wisconsin

Additional expenses may apply depending on specific business needs or preferences during the LLC formation process.

- $15: Fee to reserve an LLC name for 120 days before filing.

- $35–$50: Cost for a Registered Agent service (if not acting as your own agent).

- $20–$100: Optional fees for certified copies or expedited document processing.

Annual Report and Ongoing Costs for Wisconsin LLCs

Wisconsin LLCs must comply with annual requirements to maintain active status, incurring recurring fees.

See AlsoPA LLC Filing Fee- $25: Mandatory annual report fee, due by the end of the LLC’s formation anniversary month.

- $25–$50: Potential late fees for delayed annual report submissions.

- $0–$300+: Costs for business licenses or permits, depending on industry and location.

Expedited Processing and Additional Service Fees

Faster processing or specialized services may increase the total cost of forming an LLC in Wisconsin.

- $25: Expedited filing fee for processing Articles of Organization within 1–2 business days.

- $50: Fee for same-day in-person filing at the DFI office in Madison.

- $10–$20: Charges for notarization of documents (if required).

Legal and Professional Service Fees for LLC Formation

Hiring attorneys or online LLC formation services can simplify the process but adds to expenses.

- $200–$500+: Average cost for legal assistance to draft an operating agreement or handle compliance.

- $50–$400: Fees charged by online LLC services (e.g., LegalZoom, Northwest) for package deals.

- $0–$100: DIY tools for operating agreements or templates (optional but recommended).

What is the cheapest way to get an LLC in Wisconsin?

How to Form an LLC in Wisconsin at the Lowest Cost

To form an LLC in Wisconsin affordably, file the Articles of Organization directly through the Wisconsin Department of Financial Institutions (WDFI) website. The state filing fee is $130, which is the most cost-effective method if you avoid third-party services. Here’s how to minimize expenses:

- File online via the WDFI portal to skip mailing fees and expedite processing.

- Draft your own operating agreement using free templates instead of hiring a lawyer.

- Act as your own registered agent (if eligible) to avoid annual agent fees.

DIY vs. Using an LLC Formation Service in Wisconsin

Handling the process yourself is cheaper, but formation services offer convenience for a higher cost. Compare options:

- DIY filing costs $130 (state fee only).

- Budget services like Northwest Registered Agent or ZenBusiness charge $0–$50 + state fees.

- Avoid premium packages with unnecessary add-ons like expedited processing or compliance alerts.

Required Fees and Documents for a Wisconsin LLC

Wisconsin mandates minimal paperwork and fees for LLC formation:

- Articles of Organization ($130 filing fee).

- Registered agent’s name and address (free if you serve as your own agent).

- Annual reports ($25 every year, filed online to maintain good standing).

Avoid unexpected expenses by:

- Declining optional services like certified copies ($10–$20 each) during filing.

- Using free EIN registration directly via the IRS website.

- Filing annual reports on time to prevent late fees ($50 penalty).

Common Mistakes That Increase LLC Formation Costs

Errors can lead to fines or re-filing fees:

- Submitting incomplete forms, requiring corrections ($25 amendment fee).

- Hiring an expensive registered agent instead of choosing a free option.

- Missing the annual report deadline, incurring a $50 late fee.

How much does an LLC usually cost?

State Filing Fees for Forming an LLC

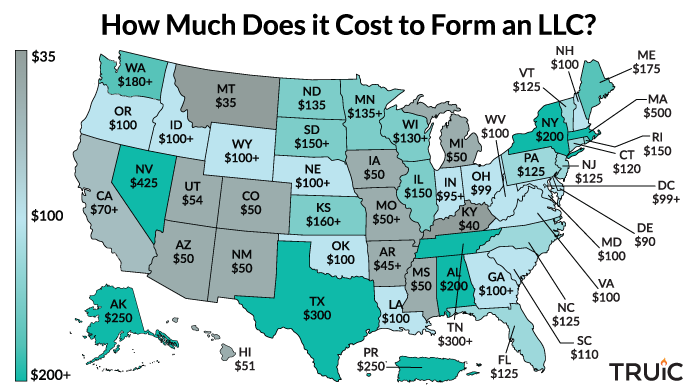

The state filing fee is the primary cost when forming an LLC, varying significantly by location. For example:

- Delaware charges $90, while California has a $70 fee plus an annual $800 franchise tax.

- New York requires a $200 filing fee and additional publication costs (up to $1,500).

- States like Kentucky and Colorado offer lower fees, ranging from $40 to $50.

Registered Agent Service Costs

Most states mandate a registered agent to receive legal documents. Costs include:

- Basic registered agent services typically cost $50–$150 annually.

- Premium services (e.g., compliance tracking) may exceed $300/year.

- Some LLC owners act as their own agent, but this risks privacy and compliance issues.

Legal and Professional Service Fees

Hiring professionals impacts total costs:

- Online formation services (e.g., LegalZoom) charge $0–$400, excluding state fees.

- Attorney fees range from $500–$2,000+ for customized operating agreements and compliance.

- Accountants may add $200–$500/year for tax filing and bookkeeping.

Annual Compliance and Maintenance Costs

LLCs often face recurring expenses:

- Annual report fees (e.g., $50 in Texas, $10 in Missouri).

- States like California impose an $800 minimum franchise tax yearly.

- Penalties for late filings can exceed $100–$500.

Additional Startup and Operational Expenses

Beyond formation, consider:

- Employer Identification Number (EIN): Free from the IRS.

- Business licenses: Costs vary by industry ($50–$500+).

- Operating agreements: Drafting tools cost $20–$100, while legal drafting may exceed $300.

What is the LLC tax in Wisconsin?

What is the LLC Tax Structure in Wisconsin?

In Wisconsin, LLCs are not subject to a specific LLC tax. Instead, they are treated as pass-through entities by default, meaning profits and losses flow through to the owners' personal tax returns. The state imposes a 7.9% corporate income tax only if the LLC elects to be taxed as a C corporation or S corporation. Additionally, LLCs must file an annual report with a $25 fee.

- Pass-through taxation: Profits/losses reported on owners' personal tax returns.

- Corporate tax: Applies only if the LLC elects corporate tax status (7.9% rate).

- Annual report fee: $25 mandatory filing with the Wisconsin Department of Financial Institutions.

How Are Wisconsin LLCs Taxed at the Federal Level?

The IRS treats Wisconsin LLCs as disregarded entities or partnerships by default, aligning with state pass-through rules. Owners report income on Form 1040 (Schedule C, E, or F). If taxed as a corporation, the LLC files Form 1120 (C corp) or Form 1120-S (S corp).

- Default federal treatment: No separate federal tax filing for single-member LLCs.

- Self-employment taxes: Owners pay 15.3% on net earnings.

- Corporate election: Requires filing IRS Form 8832 or 2553.

What Are the Annual Reporting Requirements for Wisconsin LLCs?

Wisconsin LLCs must file an annual report by the end of their registration anniversary month. The $25 fee is mandatory, regardless of income or activity. Failure to file may result in administrative dissolution.

- Filing deadline: Due by the last day of the LLC’s formation month.

- Online filing: Submit via the Wisconsin Department of Financial Institutions website.

- Penalties: Late filings incur no fee, but dissolution risks increase after one year.

Does Wisconsin Impose Sales Tax on LLCs?

Wisconsin LLCs engaged in selling goods or certain services must collect and remit 6% sales tax. They must register for a Seller’s Permit with the Wisconsin Department of Revenue.

- Sales tax registration: Required for taxable goods/services.

- Filing frequency: Monthly, quarterly, or annual, based on sales volume.

- Exemptions: Certain items like groceries or prescription drugs are exempt.

Are There Withholding Taxes for Wisconsin LLC Employees?

Wisconsin LLCs with employees must withhold state income tax from wages (ranging from 3.54% to 7.65%) and remit it to the Department of Revenue. They must also pay unemployment insurance tax.

- Withholding registration: Obtain a Wisconsin Employer Account Number.

- Tax rates: Progressive income tax brackets apply to employee wages.

- Unemployment tax: Rates vary based on industry and employment history.

Frequently Asked Questions About LLCs (FAQs)

What is the cost to file an LLC in Wisconsin?

The filing fee to form an LLC in Wisconsin is $130 when submitting the Articles of Organization to the Wisconsin Department of Financial Institutions (WDFI). This fee applies to both online and paper filings. Additional costs may arise if you require expedited processing, certified copies, or optional services like name reservations ($15). It’s critical to ensure all information is accurate to avoid delays or rejection, which could lead to refiling fees.

Are there ongoing fees for maintaining a Wisconsin LLC?

Yes, Wisconsin requires LLCs to file an Annual Report with the WDFI, which costs $25. This report is due annually by the end of the quarter in which your LLC was originally formed. Failure to file on time may result in penalties or administrative dissolution. Additionally, businesses may need to pay state taxes, licenses, or local fees depending on their operations.

Can I expedite my Wisconsin LLC filing for an extra fee?

Wisconsin does not currently offer expedited processing for LLC formation filings. The standard processing time is approximately 7-10 business days for online submissions and slightly longer for mailed documents. If urgency is a concern, consider submitting your application early or using third-party services for preparatory assistance. Note that expedited options may exist for other business filings, like name reservations.

Is the Wisconsin LLC filing fee refundable if my application is rejected?

No, the $130 Wisconsin LLC filing fee is non-refundable, even if your application is rejected or withdrawn. The WDFI recommends thoroughly reviewing your Articles of Organization for errors before submission. Common issues include incorrect registered agent details, incomplete business purposes, or name conflicts. Rejected filings require corrections and resubmission with a new fee payment.

Leave a Reply

Our Recommended Articles