How to Dissolve an LLC in North Carolina

Dissolving a limited liability company (LLC) in North Carolina involves a series of legal and administrative steps to ensure compliance with state regulations and avoid future liabilities. Whether closing due to business restructuring, financial challenges, or retirement, properly winding down operations is essential. This process typically includes obtaining member approval, settling outstanding debts, filing formal dissolution documents with the North Carolina Secretary of State, and addressing tax obligations. Failing to complete these steps correctly may result in continued fees, penalties, or legal complications. This guide outlines the key requirements and procedures for dissolving an LLC in North Carolina, helping business owners navigate the process efficiently and responsibly.

Steps to Dissolve an LLC in North Carolina

1. Review the LLC Operating Agreement

Before initiating dissolution, review your LLC’s Operating Agreement for specific provisions about winding up the business. Many agreements outline procedures for member voting, asset distribution, and debt settlement. If no agreement exists, follow North Carolina’s default state laws under the North Carolina Limited Liability Company Act.

See AlsoHow to Dissolve an LLC in Maryland| Key Action | Details |

|---|---|

| Member Approval | Most LLCs require majority or unanimous member consent. |

| Voting Process | Document votes via meeting minutes or written consent. |

2. File Articles of Dissolution

To formally dissolve your LLC, file Articles of Dissolution with the North Carolina Secretary of State. This document legally terminates the LLC’s existence. Include the LLC name, dissolution date, and confirmation that dissolution was approved by members.

| Filing Requirement | Details |

|---|---|

| Filing Fee | $30 (online) or $40 (mail). |

| Processing Time | 1-2 business days online; longer by mail. |

3. Settle Debts and Liabilities

North Carolina requires LLCs to resolve all outstanding debts before dissolution. Notify creditors, pay final bills, and distribute remaining assets to members according to ownership percentages or the Operating Agreement.

See AlsoHow to Dissolve an LLC in Texas| Debt Settlement Step | Details |

|---|---|

| Creditor Notices | Send written notices via certified mail. |

| Asset Distribution | Prioritize debts over member payouts. |

4. Notify State and Federal Agencies

Close tax accounts with the North Carolina Department of Revenue and the IRS. File final state and federal tax returns, marking them as “final.” Cancel business licenses and permits.

| Agency | Action Required |

|---|---|

| NC DOR | File final tax return (Form CD-405). |

| IRS | Submit Form 966 if applicable. |

5. Maintain Records Post-Dissolution

North Carolina law requires retaining business records for at least 3 years after dissolution. This includes tax filings, financial statements, and dissolution documents in case of audits or legal disputes.

See AlsoHow to Dissolve an LLC in Missouri| Record Type | Retention Period |

|---|---|

| Tax Documents | 7 years (recommended). |

| Dissolution Proof | Permanently. |

Can you dissolve an LLC in NC online?

Can You Dissolve an LLC in North Carolina Online?

Yes, you can dissolve an LLC in North Carolina online through the North Carolina Secretary of State’s Business Registration Division. The process involves submitting the Articles of Dissolution electronically via the state’s online filing portal. Here’s how:

See AlsoHow to Dissolve an LLC in Nevada- Visit the NC Secretary of State’s website and log into your business account.

- Complete the Articles of Dissolution form (Form L-13) with required details, including LLC name and dissolution date.

- Pay the $30 filing fee using a credit/debit card or electronic check.

- Submit the form and await confirmation via email or portal notification.

What Are the Steps to Dissolve an LLC in NC Online?

Dissolving an LLC in North Carolina online requires following specific steps to ensure compliance with state regulations:

- File Articles of Dissolution: Submit Form L-13 electronically through the Secretary of State’s portal.

- Settle debts and obligations: Ensure all LLC liabilities, taxes, and fees are paid before dissolution.

- Notify creditors and members: Inform stakeholders about the dissolution to avoid legal disputes.

- Cancel business licenses: Terminate permits or licenses tied to the LLC.

What Documents Are Required to Dissolve an LLC in NC?

To dissolve an LLC in North Carolina, you’ll need the following documents and information:

See AlsoHow to Dissolve an LLC in Iowa- Articles of Dissolution (Form L-13): Must include the LLC’s name, dissolution date, and member approval.

- Tax clearance (if applicable): Confirm all state taxes are paid via the NC Department of Revenue.

- Certificate of Authority cancellation (for foreign LLCs): Required if the LLC operated outside NC.

- Member consent records: Documentation proving member approval for dissolution.

How to Handle Tax Obligations When Dissolving an LLC in NC

Before dissolving an LLC in North Carolina, ensure all tax obligations are resolved:

- File final tax returns: Submit federal, state, and local tax forms, marking them as “final.”

- Pay outstanding taxes: Clear dues for income, sales, and employment taxes via the NC Department of Revenue.

- Request tax clearance: Obtain a Certificate of Tax Compliance to confirm no pending liabilities.

- Close EIN account: Notify the IRS to terminate the LLC’s Employer Identification Number.

Common Mistakes to Avoid When Dissolving an LLC in NC Online

Avoid these errors to ensure a smooth dissolution process:

- Incomplete filings: Double-check forms for accuracy to prevent delays or rejections.

- Unresolved debts: Failing to settle liabilities can lead to personal liability for members.

- Ignoring tax requirements: Overlooking tax clearance may result in penalties or dissolution denial.

- Missing publication requirements: Some states require public notices, though NC does not mandate this for LLCs.

How do I officially close an LLC?

Understanding Legal Requirements to Close an LLC

To officially close an LLC, you must comply with state-specific legal requirements. Begin by reviewing your LLC’s operating agreement for dissolution clauses. Most states require a formal vote by LLC members to dissolve the business.

- Check your state’s Secretary of State website for dissolution procedures.

- Hold a formal vote and document the decision in meeting minutes.

- Ensure compliance with any outstanding annual report or fee obligations.

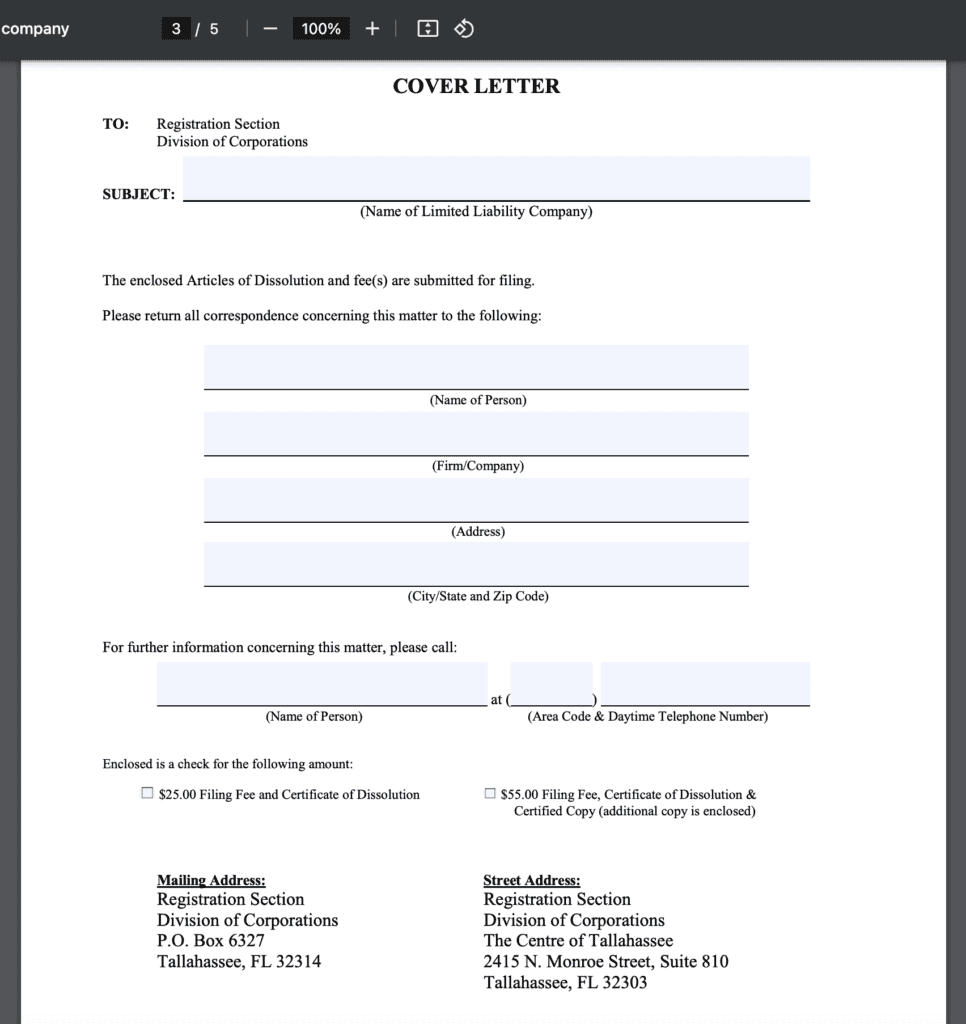

Filing Articles of Dissolution

The next step involves filing Articles of Dissolution (or a similar form) with your state. This legal document formally terminates the LLC’s existence.

- Complete the state-specific dissolution form, often available online.

- Submit the form with the required filing fee (varies by state).

- Retain a copy of the filed document as proof of dissolution.

Settling Debts and Obligations

Before dissolving, the LLC must resolve all financial obligations to avoid legal complications.

- Notify creditors and settle outstanding debts or negotiate payment plans.

- Distribute remaining assets to members according to the operating agreement.

- Address any pending contracts or leases to prevent future liabilities.

Notifying Government Agencies and Stakeholders

Inform relevant agencies and parties about the LLC’s closure to avoid penalties.

- Notify the IRS by filing a final tax return and marking it as “final.”

- Cancel business licenses, permits, and registrations with local authorities.

- Inform employees, clients, and vendors about the dissolution.

Tax Clearance and Final Filings

Obtain tax clearance from state and federal agencies to confirm all obligations are met.

- File final federal, state, and local tax returns.

- Pay any remaining taxes, including sales tax or payroll tax.

- Close the LLC’s Employer Identification Number (EIN) with the IRS.

Should I dissolve my LLC or keep it?

Financial Considerations for Dissolving or Keeping Your LLC

Evaluating your LLC’s financial health is critical. If the business is unprofitable, has persistent cash flow issues, or requires excessive upkeep costs, dissolving might be practical. However, retaining it could be beneficial if:

- Tax advantages (e.g., pass-through taxation) outweigh annual fees.

- Future projects or partnerships could utilize the existing structure.

- Debt obligations tied to the LLC require ongoing management.

Current and Future Business Goals

Align your decision with long-term objectives. Dissolve the LLC if:

- Your industry focus has shifted irreversibly.

- Operational inactivity makes maintenance unnecessary.

- Rebranding or restructuring under a new entity is more strategic.

Keep it if the LLC’s brand equity, licenses, or contracts hold future value.

Legal and Tax Implications

Consult a tax professional or attorney to assess:

- Outstanding liabilities (e.g., lawsuits, debts) that dissolving may not resolve.

- State-specific dissolution fees versus annual report costs.

- Tax ramifications, such as final tax filings or asset distribution taxes.

Operational Burdens and Administrative Work

Maintaining an LLC involves ongoing compliance tasks. Consider dissolution if:

- Administrative tasks (e.g., filings, record-keeping) are overwhelming.

- No active income justifies the effort.

- Personal liability protection is no longer a priority.

Retain it if scalability or asset protection remains essential.

Market Conditions and Industry Trends

External factors may influence your choice. Dissolve the LLC if:

- Market demand has irreversibly declined.

- Industry regulations make operations unsustainable.

- Competition overshadows your capacity to compete.

Keep it if market recovery or emerging opportunities are foreseeable.

Frequently Asked Questions About LLCs (FAQs)

What are the steps to dissolve an LLC in North Carolina?

To dissolve an LLC in North Carolina, you must follow a formal process. First, members or managers must vote to dissolve the LLC, as outlined in the operating agreement. Next, file Articles of Dissolution with the North Carolina Secretary of State, either online or by mail. You must also settle all taxes and fees with the North Carolina Department of Revenue, including submitting final tax returns. Additionally, notify creditors, settle outstanding debts, and distribute remaining assets to members. Finally, ensure all business licenses and permits are canceled to avoid future liabilities.

Do I need tax clearance to dissolve an LLC in North Carolina?

Yes, tax clearance is required before dissolving an LLC in North Carolina. You must file a final tax return with the North Carolina Department of Revenue and pay any outstanding taxes, including franchise tax, sales tax, or payroll taxes. The Department will issue a Tax Compliance Form (TC-1) to confirm all obligations are met. Without this form, the Secretary of State may reject your dissolution filing. Ensure this step is completed early to avoid delays.

What happens if I don’t formally dissolve my LLC in North Carolina?

Failing to formally dissolve your LLC can lead to ongoing legal and financial risks. Even if the business is inactive, the state will still require annual reports and fees, accruing penalties for noncompliance. Creditors or former clients may also pursue claims against the LLC, and members could face personal liability if the LLC’s legal status is unclear. To avoid these issues, follow the official dissolution process to terminate the LLC’s existence properly.

How long does it take to dissolve an LLC in North Carolina?

The timeline for dissolving an LLC in North Carolina depends on several factors. Processing Articles of Dissolution typically takes 5–10 business days if filed online, or longer by mail. Delays may occur if tax clearance is pending or if the LLC has unresolved debts. Expedited processing is available for an additional fee. Overall, plan for 2–4 weeks to complete all steps, including tax compliance, creditor notifications, and asset distribution. Always confirm requirements with the Secretary of State to ensure a smooth process.

Leave a Reply

Our Recommended Articles