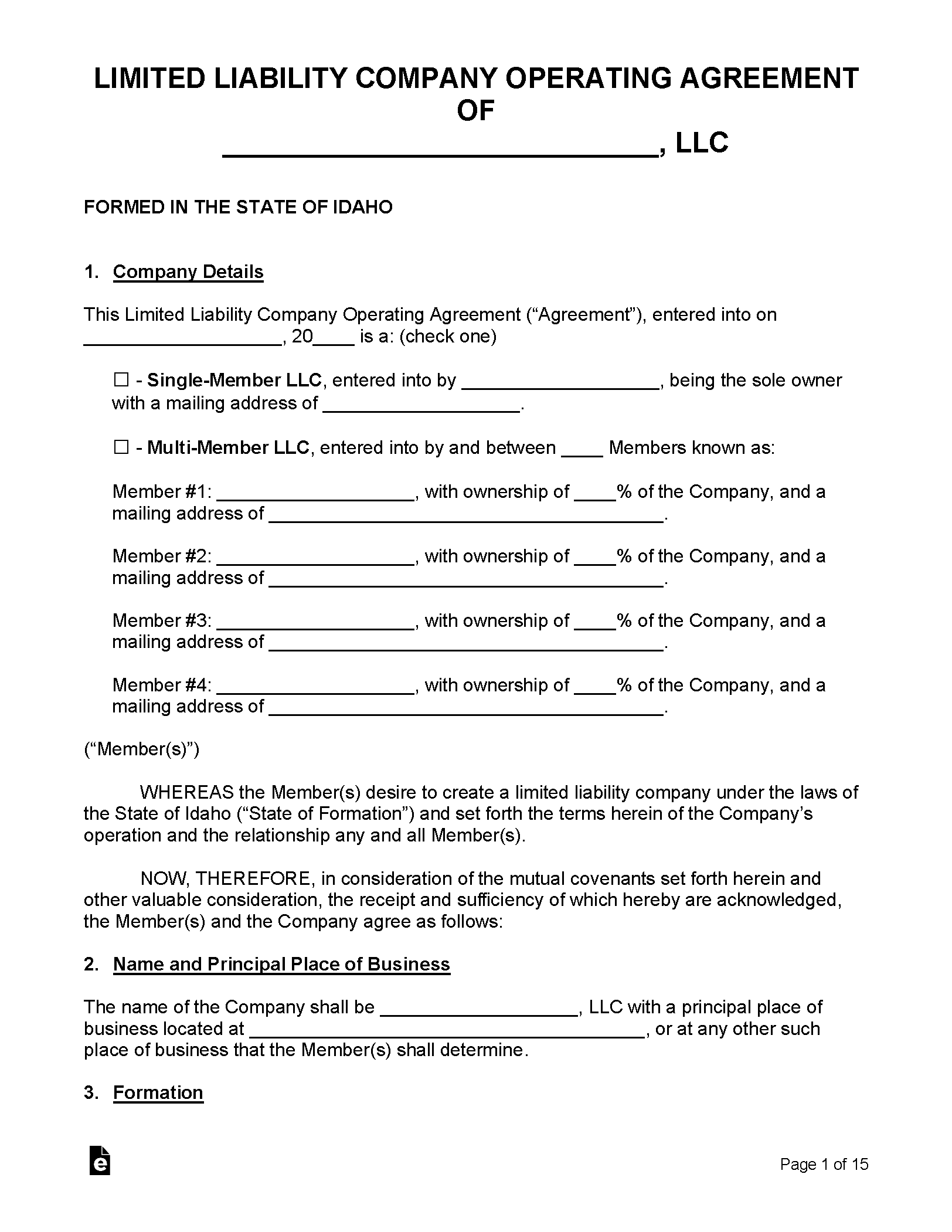

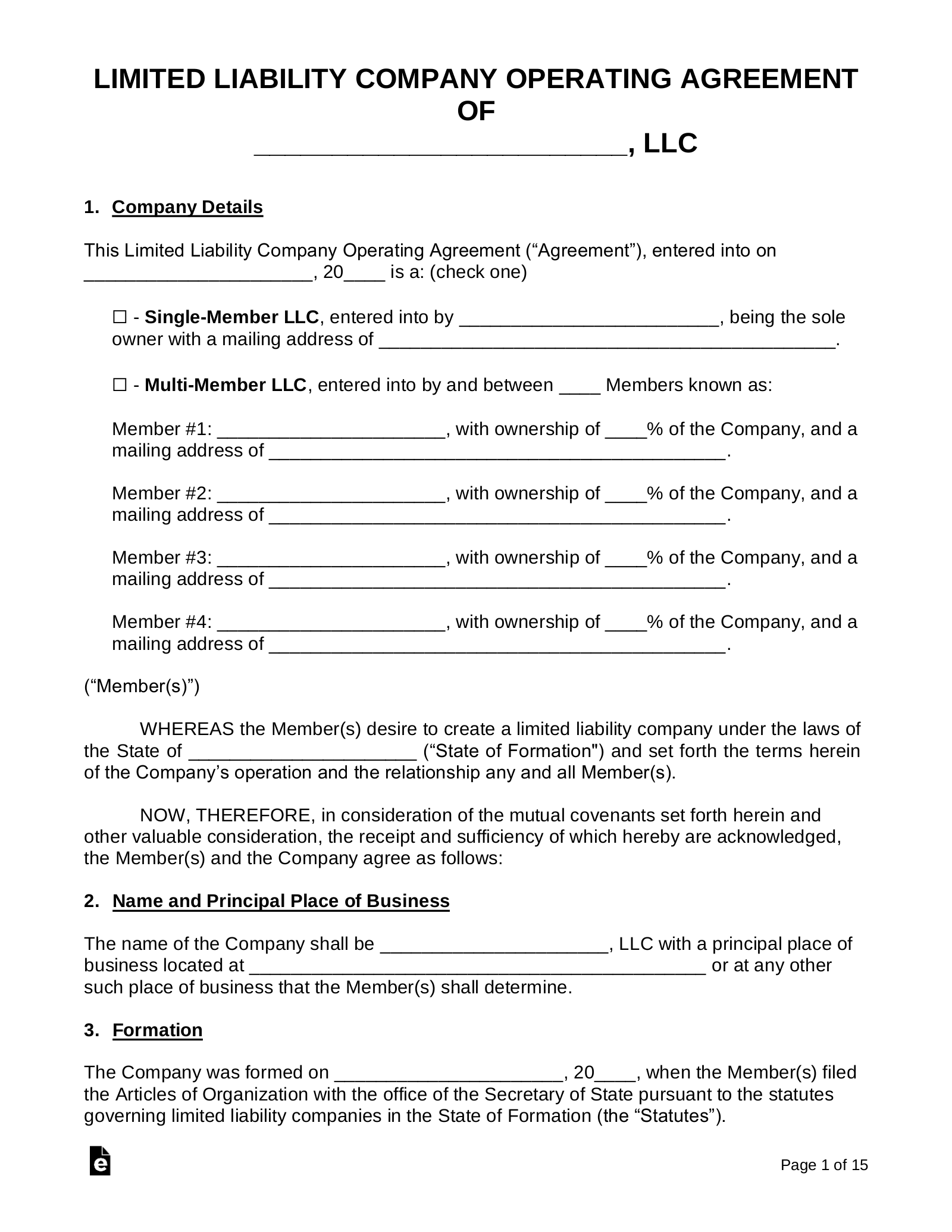

Idaho LLC Operating Agreement

When forming a limited liability company (LLC) in Idaho, drafting a comprehensive operating agreement is a critical step to establish clarity and structure for your business. Though not legally required by the state, this document serves as the foundation for internal governance, outlining members' roles, rights, and responsibilities. It addresses profit distribution, decision-making processes, and procedures for adding or removing members, ensuring all parties align on operational expectations. Additionally, a well-crafted Idaho LLC operating agreement helps safeguard limited liability protections, mitigates disputes, and provides a framework for resolving unforeseen challenges. By customizing this agreement to your business’s unique needs, you reinforce professionalism and legal compliance from inception.

- Key Components of an Idaho LLC Operating Agreement

- Does Idaho require an operating agreement for LLC?

-

Can I write my own operating agreement for my LLC?

- Can I Write My Own Operating Agreement for My LLC?

- What Are the Benefits of Drafting Your Own Operating Agreement?

- What Risks Are Involved in Writing Your Own Operating Agreement?

- What Key Clauses Should a Self-Written Operating Agreement Include?

- How to Ensure Legal Validity When Writing Your Own Operating Agreement?

- When Should You Consult a Lawyer for an Operating Agreement?

- Does an LLC always have an operating agreement?

- What are the pitfalls of an LLC operating agreement?

- Frequently Asked Questions About LLCs (FAQs)

Key Components of an Idaho LLC Operating Agreement

Legal Requirements for an Idaho LLC Operating Agreement

An Idaho LLC Operating Agreement must outline the rights, responsibilities, and relationships between members. While Idaho does not legally require an LLC to have an operating agreement, creating one ensures clarity and legal protection. It should include the LLC’s name, purpose, management structure, and dissolution procedures. Without this document, the LLC defaults to Idaho’s state laws, which may not align with members’ preferences.

See AlsoLLC Operating Agreement: Colorado| Requirement | Description | Mandatory? |

|---|---|---|

| Member Information | Names, contributions, and ownership percentages | No |

| Management Structure | Member-managed vs. manager-managed | No |

| Dissolution Terms | Process for winding up the LLC | No |

Roles and Responsibilities of Members in an Idaho LLC

The operating agreement defines whether the LLC is member-managed or manager-managed. In a member-managed structure, all members participate in daily decisions. In a manager-managed setup, designated individuals handle operations. The agreement should specify voting rights, profit-sharing ratios, and conflict resolution processes.

| Role | Responsibilities | Example |

|---|---|---|

| Member | Vote on major decisions, share profits | Approving mergers |

| Manager | Oversee operations, sign contracts | Hiring employees |

Profit Distribution and Tax Considerations in Idaho LLCs

Idaho LLCs can allocate profits and losses flexibly, but the operating agreement must detail the distribution method. Default state rules split profits equally among members, but custom allocations are allowed. Tax-wise, Idaho LLCs are pass-through entities, meaning income flows to members’ personal tax returns.

See AlsoConnecticut LLC Operating Agreement| Factor | Details |

|---|---|

| Distribution Method | Percentage-based, capital contributions |

| Tax Filing | Form 568 (CA) / Federal Form 1065 |

Amending an Idaho LLC Operating Agreement

Changes to the operating agreement typically require member approval, as outlined in the original document. Common amendments include adding members, altering profit splits, or updating management roles. Idaho law does not prescribe amendment procedures, so the agreement should specify voting thresholds and documentation requirements.

| Amendment Type | Typical Voting Threshold |

|---|---|

| Adding Members | Majority or unanimous consent |

| Changing Profit Shares | Unanimous consent |

Dissolving an Idaho LLC: Steps Outlined in the Operating Agreement

The operating agreement should define trigger events for dissolution, such as member unanimity, bankruptcy, or expiration. Idaho requires filing Articles of Dissolution with the Secretary of State. Remaining assets are distributed per the agreement, prioritizing debts and member contributions.

See AlsoNew Jersey LLC Operating Agreement| Step | Description |

|---|---|

| Vote to Dissolve | Members approve dissolution |

| Asset Distribution | Settle debts, distribute leftovers |

Does Idaho require an operating agreement for LLC?

Is an Operating Agreement Legally Required for Idaho LLCs?

Idaho does not legally require LLCs to have an operating agreement under state law. However, while it is not mandatory, creating one is highly recommended to establish clear rules and protect the business structure. Key points include:

See AlsoArizona LLC Operating Agreement- Idaho Code § 30-25-107 allows LLCs to govern their operations through an operating agreement but does not enforce its creation.

- Without an operating agreement, the LLC defaults to Idaho’s default statutory rules, which may not align with members’ intentions.

- An operating agreement helps avoid ambiguity in management roles, profit distribution, and dispute resolution.

Benefits of Having an Operating Agreement for an Idaho LLC

An operating agreement provides legal and operational advantages, even if Idaho does not require it. Key benefits include:

- Clarifies ownership structure and member responsibilities, reducing potential conflicts.

- Protects limited liability status by demonstrating a separation between personal and business assets.

- Customizes governance rules instead of relying on default state laws that may not suit the LLC’s needs.

Consequences of Not Having an Operating Agreement in Idaho

Operating without an agreement exposes the LLC and its members to risks. Potential consequences include:

- Disputes among members over profit splits, management authority, or decision-making processes.

- Courts may apply Idaho’s default LLC statutes in legal conflicts, which could disadvantage certain members.

- Difficulty securing loans or investments due to a lack of formalized business structure documentation.

Key Clauses to Include in an Idaho LLC Operating Agreement

A well-drafted operating agreement should address critical aspects of the LLC’s operations. Essential clauses include:

- Member roles and voting rights to define decision-making authority.

- Profit and loss allocation methods to ensure transparency.

- Procedures for admitting new members or handling member withdrawal or dissolution.

How to Create an Operating Agreement for an Idaho LLC

While Idaho does not mandate an operating agreement, drafting one involves strategic steps:

- Consult an attorney to ensure compliance with Idaho law and address unique business needs.

- Use customizable templates or online tools as a starting point, but tailor them to the LLC’s specifics.

- Review and update the agreement regularly to reflect changes in membership or business objectives.

Can I write my own operating agreement for my LLC?

Can I Write My Own Operating Agreement for My LLC?

Yes, you can write your own operating agreement for your LLC. Most states do not legally require an operating agreement, but drafting one is strongly recommended to define ownership structure, management roles, and profit-sharing rules. While templates are available, customizing the agreement to fit your business’s unique needs ensures clarity and legal protection. However, ensure compliance with your state’s LLC laws and consider consulting a legal professional for complex situations.

What Are the Benefits of Drafting Your Own Operating Agreement?

Creating a custom operating agreement allows you to tailor rules and procedures to your LLC’s specific requirements. Key benefits include:

- Cost savings: Avoiding legal fees by using templates or self-drafting.

- Flexibility: Defining customized processes for decision-making, member exits, or dispute resolution.

- Clarity: Establishing clear expectations among members to prevent misunderstandings.

What Risks Are Involved in Writing Your Own Operating Agreement?

While drafting your own agreement offers advantages, potential risks include:

- Legal oversights: Missing state-specific requirements or clauses that could invalidate the agreement.

- Ambiguity: Unclear language leading to disputes over interpretation.

- Non-compliance: Failing to address tax classifications or liability protections, risking legal vulnerabilities.

What Key Clauses Should a Self-Written Operating Agreement Include?

A comprehensive operating agreement must cover essential elements such as:

- Membership details: Names, ownership percentages, and capital contributions.

- Management structure: Roles of members vs. managers and voting rights.

- Dissolution terms: Procedures for closing the business or handling member departures.

How to Ensure Legal Validity When Writing Your Own Operating Agreement?

To validate your self-drafted agreement:

- Research state laws: Ensure compliance with your state’s LLC statutes.

- Review templates: Use reputable sources to identify standard clauses.

- Member consensus: Have all members sign and retain notarized copies.

When Should You Consult a Lawyer for an Operating Agreement?

Seek legal advice if:

- Complex ownership: Multiple members with unequal contributions or profit shares.

- State-specific nuances: Unfamiliarity with local LLC regulations.

- Dispute prevention: Anticipating potential conflicts requiring airtight clauses.

Does an LLC always have an operating agreement?

Is an Operating Agreement Legally Required for an LLC?

An operating agreement is not always legally mandated by state law for LLCs. However, requirements vary depending on the jurisdiction. For example:

- States like California, New York, and Missouri require LLCs to have an operating agreement.

- Other states, such as Texas or Florida, do not legally enforce this requirement.

- Even when not required, an operating agreement is strongly recommended to avoid relying on default state rules.

Why Should an LLC Have an Operating Agreement Even If Not Required?

An operating agreement provides clarity and structure for LLC operations, which is critical for resolving disputes. Key benefits include:

- Defining member roles, profit-sharing ratios, and decision-making processes.

- Protecting limited liability status by demonstrating a formal business structure.

- Outlining procedures for adding/removing members or dissolving the LLC.

What Risks Arise Without an Operating Agreement?

Operating without this document exposes the LLC to potential conflicts and legal vulnerabilities, such as:

- State default rules governing disputes, which may not align with members’ intentions.

- Unclear ownership stakes leading to member disagreements.

- Risk of personal liability if courts disregard the LLC’s separate legal entity status.

Are There Exceptions for Single-Member LLCs?

Single-member LLCs may assume an operating agreement is unnecessary, but it still serves critical purposes:

- Reinforcing the separation between personal and business assets to uphold liability protection.

- Providing a framework for future addition of members or sale of the business.

- Meeting requirements for banks or investors who may request the document.

How Does an Operating Agreement Affect LLC Enforcement?

Courts and external parties often rely on operating agreements to resolve disputes or validate the LLC’s legitimacy:

- Judges may reference the agreement in legal disputes to determine member obligations.

- Banks may require it to open a business bank account.

- It serves as proof of compliance during tax audits or regulatory reviews.

What are the pitfalls of an LLC operating agreement?

1. Ambiguous Management and Decision-Making Structure

A poorly defined management structure in an LLC operating agreement can lead to confusion, power struggles, and operational delays. Without clarity on roles, voting rights, or decision hierarchies, members may disagree on critical business actions, risking internal conflict.

- Failure to specify whether the LLC is member-managed or manager-managed.

- Unclear delineation of voting thresholds for major decisions (e.g., mergers, asset sales).

- Lack of protocols for resolving deadlocks in member voting.

2. Inadequate Profit and Loss Distribution Terms

Vague provisions about profit-sharing or loss allocation can create disputes, especially if members contribute unevenly or exit the LLC. Tax implications may also arise if distributions don’t align with IRS guidelines.

- Omitting percentage allocations tied to capital contributions or labor.

- Ignoring tax consequences of disproportionate distributions.

- Failing to outline reinvestment policies versus member payouts.

3. Poorly Defined Membership Changes and Exit Strategies

Without clear terms for adding or removing members, or handling departures, the LLC may face instability. Disputes often arise during buyouts, transfers, or deaths of members if procedures aren’t predefined.

- No buy-sell agreement to govern member exits or forced sales.

- Absence of right of first refusal clauses for membership transfers.

- Unaddressed valuation methods for member ownership stakes.

4. Overlooking State-Specific Compliance Requirements

LLC laws vary by state, and operating agreements that ignore jurisdictional rules risk legal vulnerabilities, such as losing liability protection or facing penalties.

- Noncompliance with annual reporting or fee obligations.

- Misaligned fiduciary duty definitions per state law.

- Failure to adhere to dissolution procedures mandated locally.

5. Insufficient Dispute Resolution Mechanisms

Conflicts are inevitable, but without predefined resolution methods, disagreements can escalate into costly litigation, damaging relationships and business continuity.

- No mediation or arbitration requirements before lawsuits.

- Unclear notice periods or communication protocols for disputes.

- Lack of confidentiality clauses to protect sensitive negotiations.

Frequently Asked Questions About LLCs (FAQs)

What is an Idaho LLC Operating Agreement and why is it important?

An Idaho LLC Operating Agreement is a legal document outlining the ownership structure, management roles, and operational rules for a limited liability company (LLC) in Idaho. While the state does not legally require LLCs to have one, it is critical for defining member responsibilities, profit-sharing arrangements, decision-making processes, and procedures for resolving disputes. Without this agreement, your LLC defaults to Idaho’s default LLC laws, which may not align with your business goals. The agreement also strengthens your LLC’s liability protection by proving your company operates separately from its members.

How do I create an Idaho LLC Operating Agreement?

To create an Idaho LLC Operating Agreement, start by outlining key details such as member ownership percentages, voting rights, management structure (member-managed or manager-managed), and profit distribution methods. You can use a template or consult a business attorney to ensure compliance with Idaho Code Title 30, Chapter 25. While the state does not require filing the agreement, all members should sign and retain a copy. Include clauses for dissolution, member withdrawal, and dispute resolution. Regularly review and update the agreement as your business evolves.

Can an Idaho LLC Operating Agreement be amended?

Yes, an Idaho LLC Operating Agreement can be amended if all members agree to the changes. The original agreement should specify the amendment process, such as requiring a majority or unanimous vote. Common reasons for amendments include adding or removing members, changing profit-sharing ratios, or updating management roles. Document amendments in writing, have all members sign the revised agreement, and store it with your LLC’s records. Ensure updates align with Idaho law and your LLC’s Articles of Organization to avoid conflicts.

What happens if my Idaho LLC doesn’t have an Operating Agreement?

If your Idaho LLC lacks an Operating Agreement, your business will be governed by default state laws under the Idaho Uniform Limited Liability Company Act. This could lead to unintended outcomes, such as equal profit distribution regardless of individual contributions or member-managed governance by default. Disputes may become harder to resolve without predefined rules, and your LLC’s liability protection could be weakened in legal challenges. Drafting an agreement ensures clarity, customization, and professionalism for your business operations.

Leave a Reply

Our Recommended Articles