Louisiana LLC Operating Agreement

A Louisiana LLC Operating Agreement is a crucial document that outlines the structure, management, and operational guidelines for a limited liability company (LLC) within the state. While Louisiana law does not legally require LLCs to adopt an operating agreement, creating one provides clarity, protects members’ rights, and helps prevent disputes by establishing clear rules for governance, profit distribution, and decision-making processes. This customizable agreement allows business owners to define roles, responsibilities, and procedures tailored to their specific needs, ensuring compliance with state regulations while safeguarding the LLC’s limited liability status. Understanding and drafting a comprehensive operating agreement is essential for fostering transparency and long-term stability in any Louisiana-based LLC.

-

Understanding the Louisiana LLC Operating Agreement: Key Components and Requirements

- What Is a Louisiana LLC Operating Agreement and Why Is It Important?

- Steps to Draft a Compliant Louisiana LLC Operating Agreement

- Mandatory Clauses in a Louisiana LLC Operating Agreement

- Tax Implications of a Louisiana LLC Operating Agreement

- Amending a Louisiana LLC Operating Agreement: Process and Considerations

-

Is an operating agreement required for an LLC in Louisiana?

- Is an Operating Agreement Legally Required for an LLC in Louisiana?

- Benefits of Creating an Operating Agreement for a Louisiana LLC

- Consequences of Not Having an Operating Agreement in Louisiana

- Key Elements to Include in a Louisiana LLC Operating Agreement

- How to Draft an Operating Agreement for a Louisiana LLC

- Can I write my own operating agreement for my LLC?

- Does an LLC always have an operating agreement?

- Does an LLC operating agreement need to be notarized?

- Frequently Asked Questions About LLCs (FAQs)

Understanding the Louisiana LLC Operating Agreement: Key Components and Requirements

What Is a Louisiana LLC Operating Agreement and Why Is It Important?

A Louisiana LLC Operating Agreement is a legal document outlining the ownership structure, management, and operational rules for a Limited Liability Company (LLC) in Louisiana. Though not legally required by the state, it is critical for defining member roles, profit distribution, and dispute resolution. Without it, the LLC defaults to state laws, which may not align with members' intentions. This agreement also reinforces the LLC’s liability protection, ensuring personal assets remain separate from business obligations.

See AlsoTennessee LLC Operating Agreement| Key Component | Purpose |

| Management Structure | Defines if the LLC is member-managed or manager-managed |

| Profit/Loss Distribution | Outlines how earnings and losses are allocated |

| Voting Rights | Clarifies decision-making authority among members |

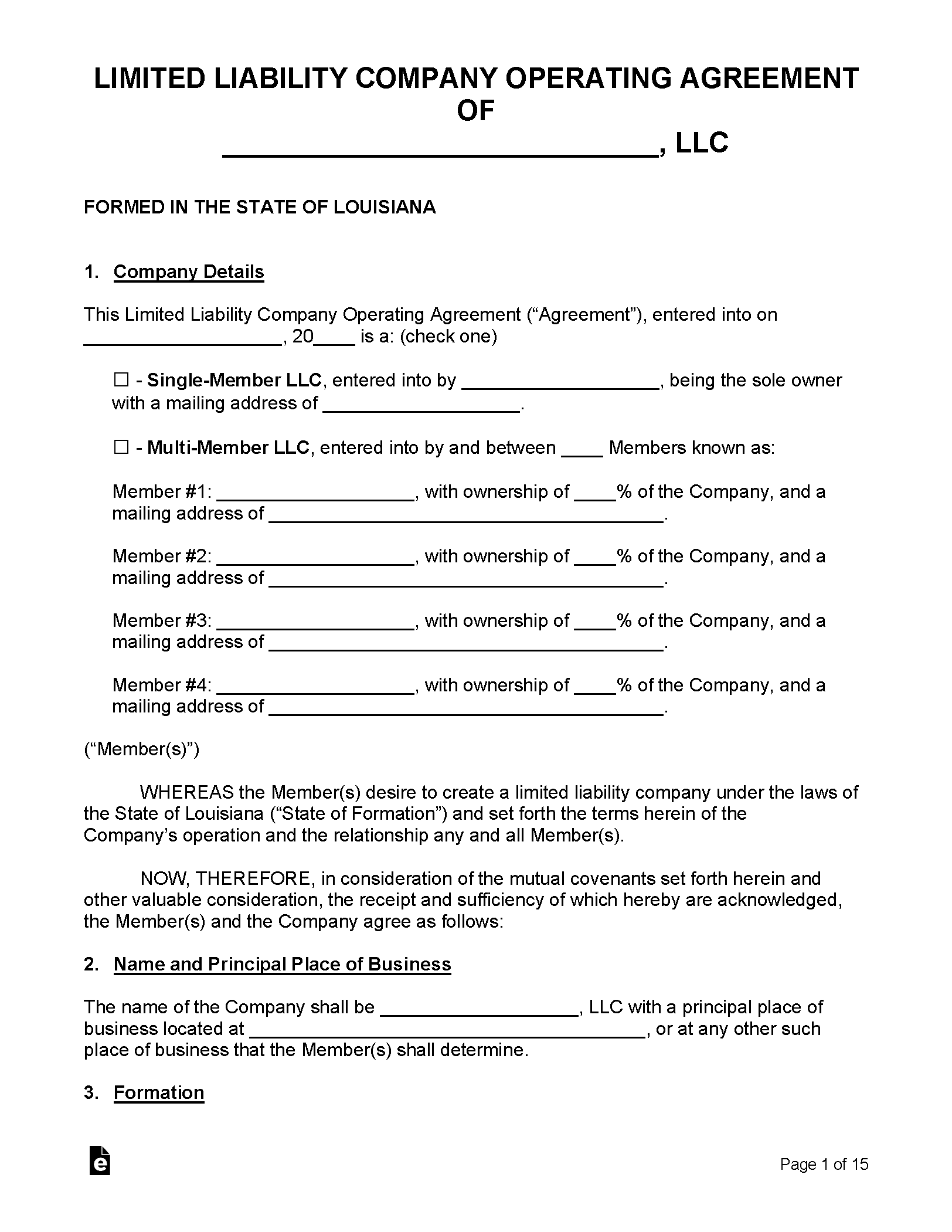

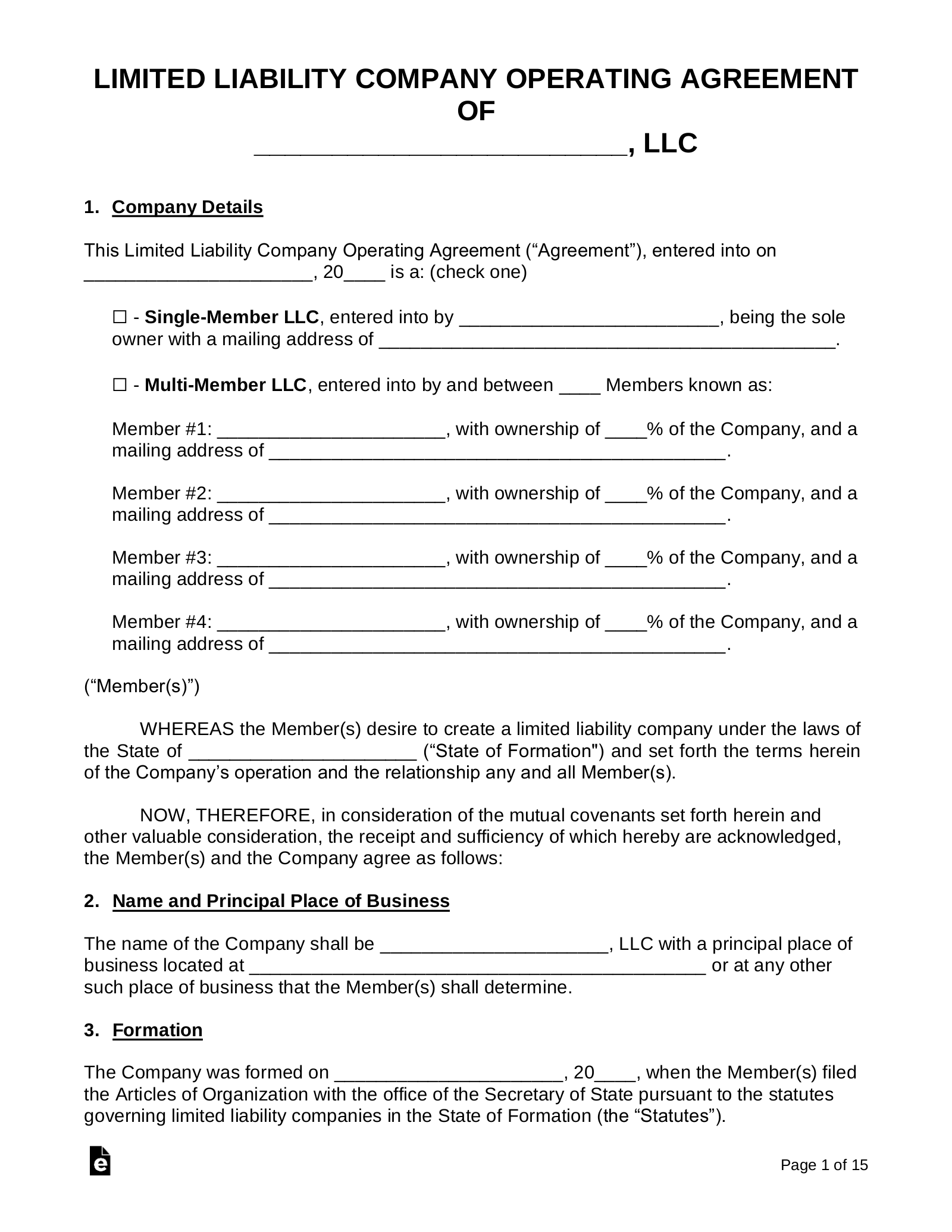

Steps to Draft a Compliant Louisiana LLC Operating Agreement

To draft a compliant Louisiana LLC Operating Agreement, follow these steps:

1. Research state laws: Louisiana’s LLC statutes (RS 12:1301-1367) provide baseline rules.

2. Define membership structure: Specify member contributions, ownership percentages, and roles.

3. Outline management procedures: Detail voting processes, meeting frequency, and managerial duties.

4. Include dissolution terms: Explain how the LLC will dissolve if necessary.

5. Review with legal counsel: Ensure compliance and avoid ambiguities.

| Step | Action |

| 1 | Outline member roles and capital contributions |

| 2 | Specify profit-sharing ratios |

| 3 | Include dispute resolution mechanisms |

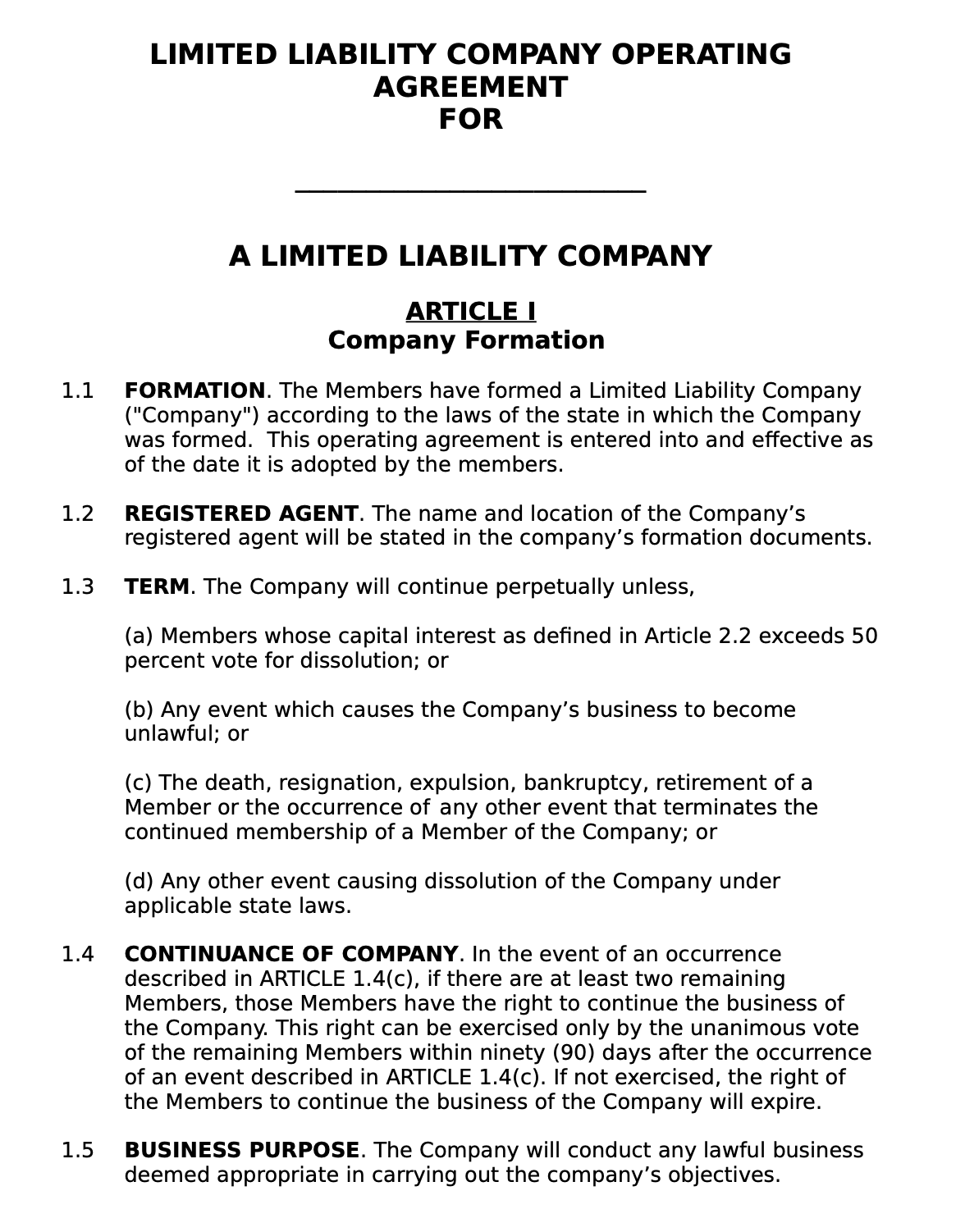

Mandatory Clauses in a Louisiana LLC Operating Agreement

Louisiana does not mandate specific clauses, but including these essential provisions is advisable:

- Management structure: Member-managed vs. manager-managed.

- Capital contributions: Initial investments and future funding obligations.

- Dissolution process: Conditions for winding down the LLC.

- Transfer restrictions: Rules for selling or transferring membership interests.

Omitting these may lead to conflicts or unintended legal consequences.

| Clause | Purpose |

| Capital Contributions | Clarifies financial obligations |

| Voting Procedures | Prevents deadlock in decision-making |

| Dissolution Terms | Guides orderly closure of the LLC |

Tax Implications of a Louisiana LLC Operating Agreement

A Louisiana LLC Operating Agreement impacts tax treatment by defaulting to pass-through taxation unless members elect corporate tax status. The agreement should specify how profits/losses are reported to the IRS and Louisiana Department of Revenue. Proper documentation ensures compliance with state franchise taxes and federal obligations.

| Tax Type | Description |

| Pass-Through Taxation | Profits taxed on members' personal returns |

| Franchise Tax | Louisiana’s annual tax based on LLC capital |

| Federal Self-Employment Tax | Applies to active members' distributive shares |

Amending a Louisiana LLC Operating Agreement: Process and Considerations

Amending a Louisiana LLC Operating Agreement requires member approval, as outlined in the original agreement. Common reasons for amendments include adding members, changing profit splits, or updating management roles. Ensure amendments comply with Louisiana law and are documented in writing.

See AlsoHow to Start a Tech Company With No Experience| Step | Requirement |

| 1 | Review amendment clauses in the original agreement |

| 2 | Obtain required member votes (e.g., majority or unanimous) |

| 3 | File updates with Louisiana Secretary of State if needed |

Is an operating agreement required for an LLC in Louisiana?

Is an Operating Agreement Legally Required for an LLC in Louisiana?

While Louisiana does not legally require an LLC to have an operating agreement, it is highly recommended. State law governs LLCs by default under the Louisiana Revised Statutes, but an operating agreement allows members to customize rules for management, profit distribution, and dispute resolution. Without one, the LLC is subject to generic statutory provisions, which may not align with members’ intentions.

- Louisiana law does not mandate an operating agreement for LLC formation.

- An agreement provides legal clarity and avoids ambiguity in operations.

- Default state rules apply if no agreement exists, potentially leading to unintended outcomes.

Benefits of Creating an Operating Agreement for a Louisiana LLC

An operating agreement offers legal and operational advantages, even if not required. It establishes clear guidelines for member roles, financial contributions, and decision-making processes. This document can also strengthen the LLC’s liability protection by demonstrating a separation between personal and business affairs.

- Defines member responsibilities and voting rights explicitly.

- Protects the LLC’s limited liability status in legal disputes.

- Facilitates smoother conflict resolution by outlining procedures.

Consequences of Not Having an Operating Agreement in Louisiana

Without an operating agreement, Louisiana LLCs default to state-mandated rules, which may not suit the members’ needs. Disputes over profit splits, management authority, or dissolution could become contentious and costly. Additionally, courts may intervene, applying generic laws that disregard the LLC’s unique structure.

- Members risk unclear profit-sharing and decision-making processes.

- Potential loss of personal asset protection in litigation.

- Increased likelihood of internal conflicts due to undefined roles.

Key Elements to Include in a Louisiana LLC Operating Agreement

A well-drafted operating agreement should address ownership percentages, management structure, and procedures for adding or removing members. It should also outline financial contributions, profit distribution methods, and dissolution protocols. Tailoring these elements ensures the LLC operates smoothly under member-defined terms.

- Specify member ownership stakes and capital contributions.

- Detail management roles (member-managed vs. manager-managed).

- Include buyout clauses and procedures for member exit.

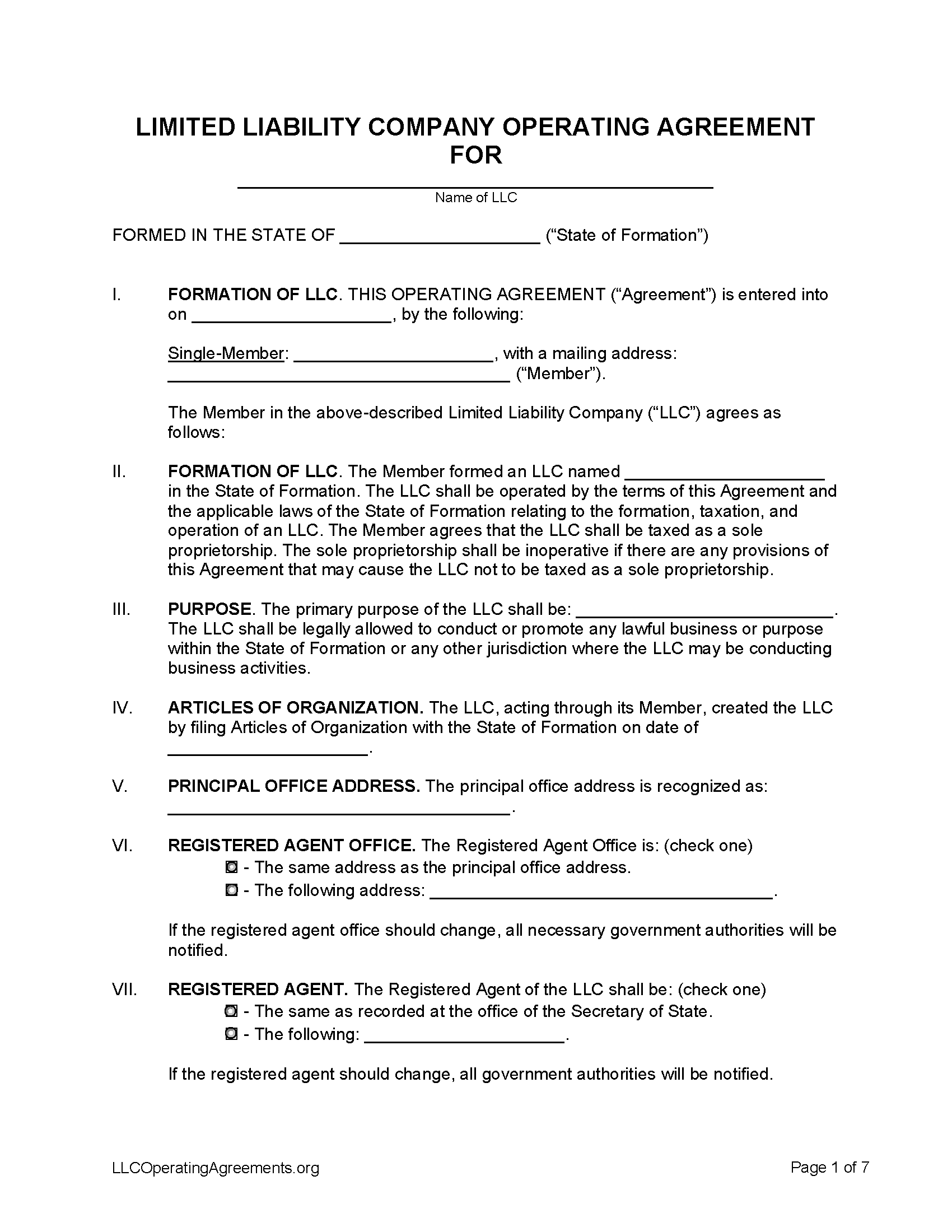

How to Draft an Operating Agreement for a Louisiana LLC

Members can draft an operating agreement independently, use online templates, or consult a business attorney. While Louisiana does not require the agreement to be filed with the state, it should be signed by all members and stored securely. Legal review ensures compliance with state laws and alignment with the LLC’s goals.

- Use state-specific templates to address Louisiana regulations.

- Ensure all members review and sign the finalized document.

- Update the agreement periodically to reflect changes in operations.

Can I write my own operating agreement for my LLC?

Can I Legally Draft My Own Operating Agreement for an LLC?

Yes, you can legally draft your own operating agreement for your LLC. Most states do not require operating agreements to be filed with the government, but having one is highly recommended to define ownership, management, and profit-sharing structures. However, ensure it complies with your state’s LLC laws and covers essential clauses.

- State-specific requirements: Research your state’s LLC statutes to avoid non-compliance.

- Mandatory clauses: Include dissolution terms, member roles, and voting rights.

- Enforceability: Have the document signed by all members to ensure legal validity.

What Should an Effective DIY Operating Agreement Include?

A well-crafted DIY operating agreement should outline key operational and financial protocols to prevent disputes. Focus on clarity and specificity to cover all aspects of your LLC’s management.

- Ownership percentages: Define each member’s stake in the LLC.

- Profit/loss distribution: Specify how earnings and losses are allocated.

- Decision-making processes: Outline voting rules and procedures for major decisions.

Pros and Cons of Writing Your Own Operating Agreement

Creating your own operating agreement offers cost savings and customization but carries risks if critical details are overlooked.

- Pros: Tailored to your business needs; avoids attorney fees.

- Cons: Potential for ambiguous language; incomplete compliance with laws.

- Mitigation: Use templates from reputable sources and review with a professional if needed.

Common Mistakes to Avoid in a Self-Drafted Operating Agreement

Avoiding errors in your operating agreement is crucial to prevent legal vulnerabilities or member conflicts.

- Vague dispute resolution terms: Clearly define mediation or buyout processes.

- Ignoring tax implications: Align profit distributions with IRS classification.

- Failing to update: Revise the agreement as the LLC evolves or laws change.

When Should You Consult a Lawyer Instead?

While DIY agreements work for simple LLCs, legal counsel is advisable in complex scenarios.

- Multi-member disputes: Lawyers can mediate and draft neutral terms.

- Unusual ownership structures: Ensures compliance with state and federal laws.

- High-risk industries: Custom clauses may be needed for liability protection.

Does an LLC always have an operating agreement?

Is an Operating Agreement Legally Required for an LLC?

An operating agreement is not universally mandated by law for LLCs in all U.S. states. However, some states, like California, New York, and Missouri, legally require LLCs to have one. Even in states where it’s optional, drafting an operating agreement is strongly recommended to avoid default state rules governing the LLC. Key points include:

- States like Delaware do not require an operating agreement but assume its existence under the LLC Act.

- Without an operating agreement, state default rules dictate profit sharing, management, and dissolution processes.

- Certain institutions (e.g., banks) may require an operating agreement to open business accounts.

What Are the Benefits of Having an Operating Agreement?

An operating agreement provides legal clarity and operational structure for LLC members. It safeguards the company’s limited liability status and ensures members’ intentions are legally enforceable. Advantages include:

- Protection against personal liability by reinforcing the LLC’s separate legal entity.

- Clear guidelines for profit distribution, voting rights, and dispute resolution.

- Customization of rules to fit the LLC’s needs, overriding restrictive state default provisions.

What Happens If an LLC Lacks an Operating Agreement?

Without an operating agreement, an LLC becomes subject to state default laws, which may not align with members’ goals. Risks include:

- Members losing control over decision-making processes, as state laws may impose majority rule.

- Potential internal disputes due to undefined roles, profit splits, or exit strategies.

- Difficulty proving the LLC’s legitimacy in legal or financial disputes, risking piercing the corporate veil.

Can an LLC Operate Effectively Without an Operating Agreement?

While an LLC can technically operate without an operating agreement, doing so exposes it to unnecessary risks. Functioning without one may lead to:

- Unclear management structure, causing confusion in daily operations.

- Dependence on generic state laws that may disadvantage certain members.

- Complications during audits or ownership transitions due to lack of documented procedures.

How to Draft a Compliant Operating Agreement?

Creating a compliant operating agreement involves outlining the LLC’s structure, roles, and rules. Steps include:

- Defining member contributions, ownership percentages, and profit-sharing ratios.

- Specifying management roles (member-managed vs. manager-managed) and voting procedures.

- Including clauses for dissolution, dispute resolution, and admission/removal of members.

Does an LLC operating agreement need to be notarized?

Is Notarization Legally Required for an LLC Operating Agreement?

In most U.S. states, an LLC operating agreement does not require notarization to be legally valid. The document typically becomes enforceable once all members sign it, unless state-specific laws dictate otherwise. However, notarizing the agreement can add an extra layer of authenticity, particularly in disputes.

- No universal requirement: Most states do not mandate notarization for LLC operating agreements.

- Internal validity: Signatures from members are usually sufficient for enforceability.

- State exceptions: A few states, like Florida or New York, may require notarization for specific clauses or filings.

Why Consider Notarizing an LLC Operating Agreement?

While not legally required, notarization can strengthen the agreement’s credibility. A notary public verifies the identities of signers and confirms they signed willingly, which may help prevent future disputes.

- Fraud prevention: Reduces the risk of forged signatures.

- Court admissibility: A notarized document is often considered self-authenticating in legal proceedings.

- Third-party recognition: Banks or lenders may request notarized agreements for compliance purposes.

State-Specific Rules for LLC Operating Agreements

Requirements vary by state, and while most do not demand notarization, certain filings (e.g., Articles of Organization) might. Always check local regulations.

- Florida: Requires notarization for operating agreements if they include real estate transactions.

- New York: May require notarized agreements for publication compliance.

- California: No notarization needed unless used for foreign LLC registration.

Steps to Execute an LLC Operating Agreement Without Notarization

To create a valid agreement without notarization, follow these steps:

- Draft the agreement: Outline roles, profit-sharing, and management structure.

- Review by members: Ensure all parties understand and agree to terms.

- Sign and date: Collect signatures from all members; witnesses are optional but recommended.

- Store securely: Keep copies with members and the LLC’s records.

Alternatives to Notarization for Enhancing Legal Validity

If notarization isn’t required, other methods can bolster the agreement’s enforceability:

- Attorney certification: Have a lawyer review and certify the document.

- Witness signatures: Include signatures from impartial witnesses.

- Digital signatures: Use compliant e-signature platforms (e.g., DocuSign) for traceability.

Frequently Asked Questions About LLCs (FAQs)

Is an Operating Agreement required for a Louisiana LLC?

Louisiana does not legally require LLCs to have an Operating Agreement, but it is highly recommended. While the state does not mandate filing this document, creating one establishes clear guidelines for management, profit distribution, and member roles. An Operating Agreement also helps protect the LLC’s limited liability status by demonstrating that the business operates separately from its owners, which can be critical in legal disputes or financial audits.

What key provisions should a Louisiana LLC Operating Agreement include?

A well-drafted Louisiana LLC Operating Agreement should outline member ownership percentages, voting rights, profit-sharing arrangements, and management structure (member-managed vs. manager-managed). It should also address procedures for adding or removing members, dissolving the LLC, and resolving disputes. Including Louisiana-specific clauses, such as compliance with state franchise tax requirements or rules for community property considerations, ensures alignment with local laws.

Can a Louisiana LLC Operating Agreement be amended after formation?

Yes, a Louisiana LLC Operating Agreement can be amended if members agree to the changes, typically through a majority or supermajority vote as outlined in the original agreement. Amendments should be documented in writing and signed by all members. It’s crucial to update the Operating Agreement when significant changes occur, such as new members joining, changes in ownership percentages, or shifts in management roles, to avoid future conflicts.

Does a Louisiana LLC Operating Agreement need to be filed with the state?

No, a Louisiana LLC Operating Agreement is an internal document and does not need to be filed with the Louisiana Secretary of State or any other government agency. However, it must be kept on record at the LLC’s principal place of business. While the state does not review the agreement, it must still comply with Louisiana LLC statutes, such as requirements for registered agents, business purpose statements, and annual reporting obligations.

Leave a Reply

Our Recommended Articles