How Do Venture Capital Firms Work?

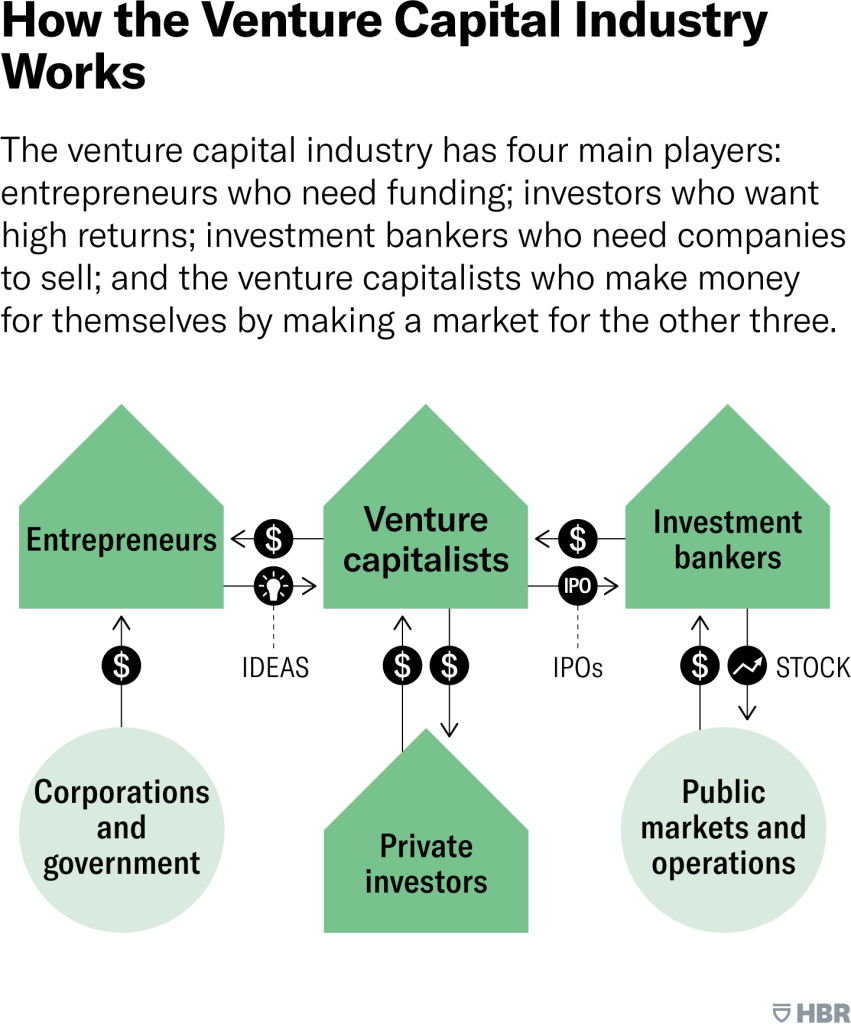

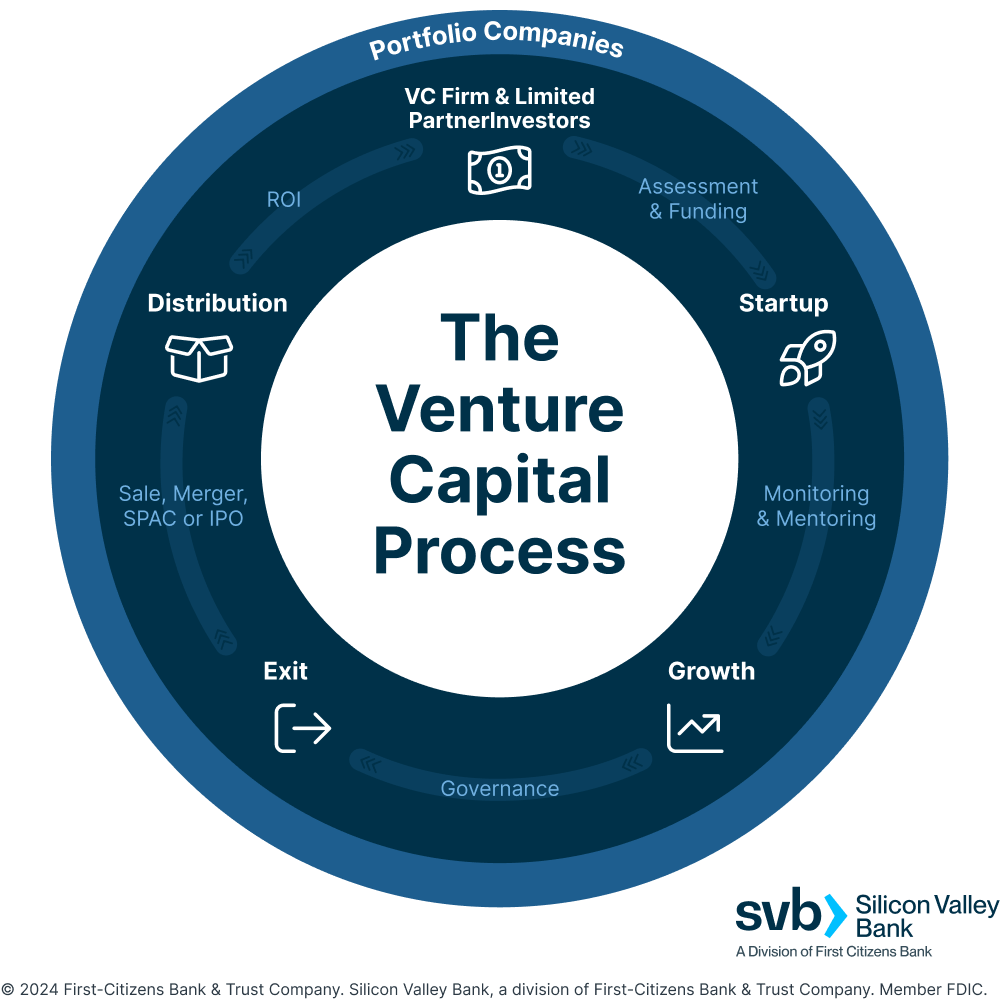

Venture capital firms play a pivotal role in fueling innovation and supporting startups with high growth potential. These firms pool funds from investors, such as institutional investors and high-net-worth individuals, to invest in early-stage or emerging companies. In exchange for capital, venture capitalists typically acquire equity stakes and actively participate in shaping the company’s strategy. Their goal is to achieve substantial returns by helping these businesses scale and eventually exit through acquisitions or public offerings. Understanding how venture capital firms operate provides insight into the dynamics of startup financing, risk management, and the broader ecosystem of entrepreneurship and innovation.

How Do Venture Capital Firms Work?

Venture capital (VC) firms are specialized financial institutions that invest in early-stage, high-potential startups and small businesses with the aim of achieving significant returns. These firms pool money from various investors, such as wealthy individuals, pension funds, and corporations, to create a fund. The fund is then used to invest in companies that show strong growth potential but may lack access to traditional financing methods like bank loans. Venture capital firms not only provide capital but also offer mentorship, strategic guidance, and access to their network to help these companies succeed.

See AlsoHow Do Venture Capitalists Actually Work?What Is the Structure of a Venture Capital Firm?

A venture capital firm typically operates as a partnership, with general partners (GPs) managing the fund and limited partners (LPs) providing the capital. The GPs are responsible for identifying investment opportunities, conducting due diligence, and managing the portfolio companies. In return, they earn management fees (usually 2% of the fund) and a share of the profits (typically 20%). LPs, on the other hand, are passive investors who contribute capital but do not participate in the day-to-day operations.

How Do Venture Capital Firms Select Investments?

Venture capital firms use a rigorous selection process to identify promising startups. They evaluate factors such as the market size, team expertise, product uniqueness, and scalability. The due diligence process involves analyzing financial projections, conducting market research, and assessing the competitive landscape. Only a small percentage of startups that pitch to VC firms receive funding, as the firms aim to minimize risk and maximize returns.

See Also How Do the Different Types of Partners in a Venture Capital Firm Differ General Partner Operating Partner Investment Partner Etc

How Do the Different Types of Partners in a Venture Capital Firm Differ General Partner Operating Partner Investment Partner EtcWhat Are the Stages of Venture Capital Funding?

Venture capital funding is typically divided into several stages:

- Seed Stage: Initial funding to develop a prototype or proof of concept.

- Series A: Funding to scale the product and build a customer base.

- Series B: Expansion funding to grow the business and enter new markets.

- Series C and Beyond: Later-stage funding for further scaling or preparing for an IPO.

What Role Do Venture Capital Firms Play in Portfolio Companies?

Beyond providing capital, venture capital firms actively support their portfolio companies. They often take a seat on the board of directors to influence strategic decisions. Additionally, they provide mentorship, introduce startups to potential customers and partners, and help with hiring key talent. This hands-on approach increases the likelihood of success for the invested companies.

See Also What Are the Positions at Vc Firms?

What Are the Positions at Vc Firms?How Do Venture Capital Firms Exit Investments?

Venture capital firms aim to exit their investments through acquisitions or initial public offerings (IPOs). These exits allow them to realize returns on their investments. The most common exit strategy is an acquisition, where a larger company buys the startup. IPOs, though less common, offer significant returns if the company performs well in the public market.

| Key Term | Description |

|---|---|

| General Partners (GPs) | Manage the fund and make investment decisions. |

| Limited Partners (LPs) | Provide capital but do not participate in management. |

| Due Diligence | Thorough evaluation of a startup before investment. |

| Exit Strategy | Methods to realize returns, such as acquisitions or IPOs. |

| Portfolio Companies | Startups or businesses in which the VC firm has invested. |

How does a venture capital firm operate?

Which Venture Capitalists Make Investments in Fashion Tech Ventures and Are Fashion Savvy Themselves

Which Venture Capitalists Make Investments in Fashion Tech Ventures and Are Fashion Savvy ThemselvesWhat is the Structure of a Venture Capital Firm?

A venture capital (VC) firm is typically structured as a partnership between general partners (GPs) and limited partners (LPs). The GPs manage the firm's operations, including sourcing deals, making investment decisions, and supporting portfolio companies. The LPs, on the other hand, provide the capital but have limited involvement in day-to-day operations. The firm raises funds from LPs, such as institutional investors, pension funds, and high-net-worth individuals, and invests this capital in high-growth startups.

- General Partners (GPs): Responsible for managing the fund and making investment decisions.

- Limited Partners (LPs): Provide the capital but do not participate in operational decisions.

- Fund Lifecycle: Typically lasts 10 years, with an initial investment period followed by a focus on exits.

How Do Venture Capital Firms Source Deals?

Venture capital firms actively seek out high-potential startups through various channels. These include networking events, referrals from trusted sources, startup pitch competitions, and partnerships with accelerators or incubators. Additionally, many VC firms have a strong online presence and use platforms like LinkedIn or AngelList to identify promising companies. Once a potential deal is identified, the firm conducts thorough due diligence to assess the startup's viability.

See Also What is a Waterfall in Private Equity?

What is a Waterfall in Private Equity?- Networking: Attending industry events and conferences to meet entrepreneurs.

- Referrals: Leveraging connections with other investors or entrepreneurs.

- Online Platforms: Using tools like AngelList to discover startups.

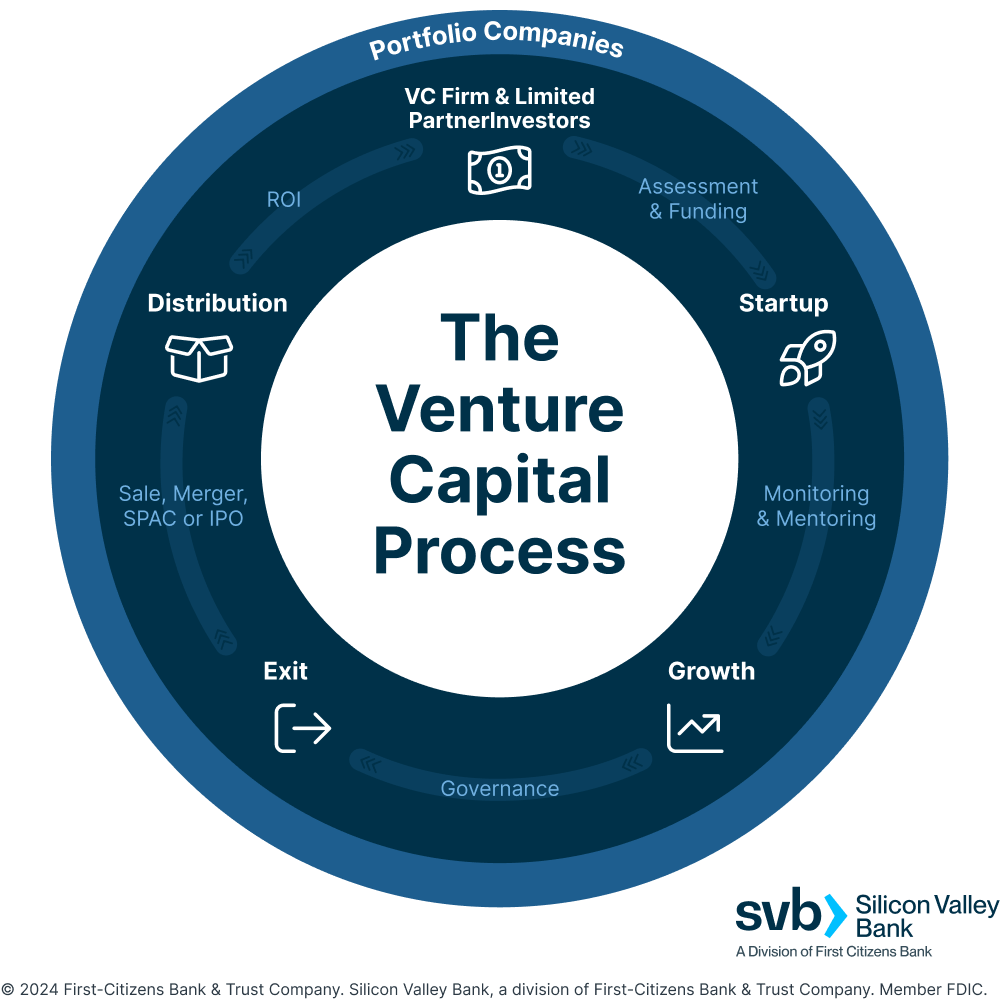

What is the Investment Process in Venture Capital?

The investment process in a venture capital firm involves several key steps. First, the firm evaluates the startup's business model, market potential, and team. If the startup passes the initial screening, the firm conducts due diligence, which includes financial analysis, market research, and legal reviews. Once satisfied, the firm negotiates the terms of the investment, often taking an equity stake in the company. The firm then provides ongoing support to the startup, helping it grow and scale.

- Screening: Evaluating the startup's potential based on pitch decks and initial meetings.

- Due Diligence: Conducting in-depth analysis of the startup's financials, market, and team.

- Term Sheet: Negotiating the terms of the investment, including equity and valuation.

How Do Venture Capital Firms Support Portfolio Companies?

Venture capital firms provide more than just capital to their portfolio companies. They offer strategic guidance, mentorship, and access to their network of industry experts, potential customers, and partners. Additionally, VC firms often assist with hiring key talent, refining business models, and preparing for future funding rounds. This hands-on approach helps startups navigate challenges and accelerate growth.

- Mentorship: Offering advice and expertise to founders.

- Networking: Connecting startups with potential partners, customers, and investors.

- Operational Support: Assisting with hiring, business strategy, and scaling operations.

How Do Venture Capital Firms Exit Investments?

Exits are a critical part of the venture capital process, as they allow the firm to realize returns on its investments. The most common exit strategies include initial public offerings (IPOs), acquisitions by larger companies, or secondary market sales. The firm works closely with the startup to prepare for the exit, ensuring that the company is positioned for maximum valuation. The returns from successful exits are then distributed to the LPs and GPs, with the GPs typically receiving a carried interest.

- IPOs: Taking the company public through a stock exchange listing.

- Acquisitions: Selling the company to a larger corporation.

- Secondary Sales: Selling equity stakes to other investors or private equity firms.

What is the 80/20 rule in venture capital?

The 80/20 rule in venture capital refers to the observation that a significant portion of returns in a venture capital portfolio often comes from a small fraction of investments. Specifically, it suggests that 80% of the returns are generated by 20% of the investments. This principle highlights the high-risk, high-reward nature of venture capital, where a few successful home runs can compensate for the losses or underperformance of the majority of investments.

Understanding the 80/20 Rule in Venture Capital

The 80/20 rule is a concept derived from the Pareto Principle, which states that roughly 80% of effects come from 20% of causes. In venture capital, this translates to:

- Concentration of Returns: A small number of investments generate the majority of the fund's profits.

- High Risk: Most startups fail, but the few that succeed can deliver outsized returns.

- Portfolio Strategy: VCs aim to identify and invest in potential unicorns to maximize returns.

Why the 80/20 Rule Matters in Venture Capital

The 80/20 rule is crucial because it shapes how venture capitalists approach their investment strategies:

- Focus on High-Potential Startups: VCs prioritize startups with the potential to disrupt markets or scale rapidly.

- Risk Management: Diversifying investments helps mitigate the risk of losses from underperforming startups.

- Long-Term Vision: VCs often wait years for their most successful investments to mature and deliver returns.

Examples of the 80/20 Rule in Action

Several real-world examples illustrate the 80/20 rule in venture capital:

- Sequoia Capital and Google: Sequoia's early investment in Google generated returns that far exceeded the rest of its portfolio.

- Accel and Facebook: Accel's $12.7 million investment in Facebook turned into billions, overshadowing other investments.

- Benchmark and Uber: Benchmark's stake in Uber became one of the most profitable investments in venture capital history.

How Venture Capitalists Apply the 80/20 Rule

VCs use the 80/20 rule to guide their decision-making and portfolio construction:

- Deal Sourcing: VCs focus on sourcing deals with high growth potential, often in emerging markets or technologies.

- Due Diligence: Extensive research is conducted to identify startups with the highest likelihood of success.

- Follow-On Investments: VCs often double down on their most promising investments to maximize returns.

Challenges of the 80/20 Rule in Venture Capital

While the 80/20 rule is a guiding principle, it comes with challenges:

- Identifying Winners: Predicting which startups will succeed is inherently uncertain and difficult.

- Timing Exits: Knowing when to exit an investment to maximize returns requires skill and luck.

- Market Volatility: External factors like economic downturns can impact the success of even the most promising startups.

How is venture capital paid back?

How is Venture Capital Typically Repaid?

Venture capital is repaid through various exit strategies that allow investors to realize a return on their investment. The most common methods include:

- Initial Public Offering (IPO): The company goes public, and shares are sold on the stock market, allowing investors to sell their stakes at a profit.

- Acquisition or Merger: The company is sold to another business, and investors receive payment based on their equity stake.

- Secondary Market Sale: Investors sell their shares to other private investors or institutions before the company goes public or is acquired.

What Role Do Equity Stakes Play in Repayment?

Equity stakes are central to how venture capital is repaid. Investors receive ownership shares in the company in exchange for their funding, and repayment occurs when these shares increase in value. Key points include:

- Dilution: As more funding rounds occur, early investors may see their equity diluted, but the overall value of their stake can still grow.

- Valuation Growth: The company's valuation increases over time, making the equity stake more valuable.

- Liquidation Preferences: Investors often have preferred shares that guarantee them a specific return before other shareholders are paid.

How Do Dividends Factor into Venture Capital Repayment?

While less common, some venture capital agreements include dividends as a form of repayment. This typically applies to later-stage companies with steady cash flow. Key aspects include:

- Cumulative Dividends: Dividends accumulate over time and are paid out during an exit event.

- Preferred Dividends: Investors with preferred shares may receive dividends before common shareholders.

- Reinvestment: Dividends may be reinvested into the company to fuel further growth, delaying repayment but increasing future returns.

What Are the Risks in Venture Capital Repayment?

Repaying venture capital is not guaranteed and depends on the company's success. Risks include:

- Business Failure: If the company fails, investors may lose their entire investment.

- Market Conditions: Poor market conditions can reduce the value of an IPO or acquisition.

- Timing: Repayment can take years, and investors may need to wait for the right exit opportunity.

How Do Exit Strategies Influence Repayment?

Exit strategies are critical in determining how and when venture capital is repaid. Common strategies include:

- IPO: Provides liquidity but requires significant preparation and market conditions.

- Acquisition: Offers a quicker exit but may result in lower returns compared to an IPO.

- Buyback: The company repurchases shares from investors, often at a premium.

Frequently Asked Questions (FAQs)

What is the primary role of a venture capital firm?

Venture capital firms play a crucial role in the startup ecosystem by providing financial support to early-stage and high-growth companies. These firms invest in startups with the potential for significant growth, often in exchange for equity stakes. Beyond funding, they offer strategic guidance, mentorship, and access to their network of industry experts, helping startups scale and succeed in competitive markets.

How do venture capital firms make money?

Venture capital firms generate revenue primarily through capital gains and management fees. They earn profits when the startups they invest in are acquired or go public, allowing them to sell their equity stakes at a higher valuation. Additionally, they charge management fees, typically around 2% of the total fund, to cover operational costs. A portion of the profits, known as carried interest, is also distributed to the firm's partners as a performance incentive.

What criteria do venture capital firms use to select startups?

Venture capital firms evaluate startups based on several key factors, including the market potential, the strength of the founding team, and the uniqueness of the product or service. They look for businesses with a scalable model, a clear competitive advantage, and the potential to disrupt or dominate their industry. Additionally, they assess the startup's traction, such as customer growth, revenue, and partnerships, to gauge its likelihood of success.

What are the risks associated with venture capital investments?

Investing in startups through venture capital carries significant risks, as many early-stage companies fail to achieve profitability or scale. Venture capital firms face the possibility of losing their entire investment if a startup fails. Additionally, the illiquid nature of these investments means that funds are often tied up for several years before any returns are realized. Despite these risks, the potential for high returns from successful startups makes venture capital an attractive option for many investors.

Leave a Reply

Our Recommended Articles