What Are Examples of Corporate Venture Capital Cvc Firms Worldwide

Corporate Venture Capital (CVC) firms have become a pivotal force in the global business landscape, bridging the gap between innovation and established corporations. These entities, often subsidiaries of large companies, invest in startups and emerging technologies to drive growth, foster innovation, and gain competitive advantages. From Silicon Valley to Asia and Europe, CVC firms operate across diverse industries, including technology, healthcare, and energy. This article explores prominent examples of CVC firms worldwide, highlighting their strategies, investments, and impact on the entrepreneurial ecosystem. By examining these players, we gain insight into how corporations leverage venture capital to stay ahead in an ever-evolving market.

- What Are Examples of Corporate Venture Capital (CVC) Firms Worldwide?

- What is a CVC in corporate venture capital?

- Who is the largest VC company in the world?

- Who are CVC Capital Partners?

- What is the difference between a VC and a corporate VC?

-

Frequently Asked Questions (FAQs)

- What are some well-known Corporate Venture Capital (CVC) firms in the United States?

- Which European Corporate Venture Capital firms are leading the market?

- What are some examples of Corporate Venture Capital firms in Asia?

- How do Corporate Venture Capital firms in emerging markets contribute to innovation?

What Are Examples of Corporate Venture Capital (CVC) Firms Worldwide?

Corporate Venture Capital (CVC) refers to the investment of corporate funds directly into external startup companies. These investments are typically made by established companies to gain strategic advantages, such as access to new technologies, markets, or innovative business models. Below, we explore some prominent examples of CVC firms worldwide and their impact on the global startup ecosystem.

See AlsoWhere Do Venture Capitalists Eat in the Bay Area/silicon Valley?1. Google Ventures (GV)

Google Ventures, now known as GV, is the venture capital arm of Alphabet Inc., Google's parent company. Established in 2009, GV focuses on investing in startups across various sectors, including artificial intelligence, healthcare, and consumer technology. Some notable investments include Uber, Slack, and Nest Labs. GV provides not only capital but also access to Google's vast resources and expertise.

2. Intel Capital

Intel Capital is the investment arm of Intel Corporation, one of the world's largest semiconductor chip manufacturers. Since its inception in 1991, Intel Capital has invested in over 1,500 companies across 57 countries. The firm focuses on emerging technologies such as 5G, AI, and autonomous vehicles. Notable investments include VMware, DocuSign, and Cloudera.

See Also What Are Some Tokyo Based Venture Capital Firms?

What Are Some Tokyo Based Venture Capital Firms?3. Salesforce Ventures

Salesforce Ventures is the corporate venture capital division of Salesforce, a leader in customer relationship management (CRM) software. Launched in 2009, Salesforce Ventures invests in cloud computing, SaaS, and enterprise software startups. Some of its prominent investments include Zoom, Dropbox, and Twilio. The firm also offers portfolio companies access to Salesforce's extensive customer base and ecosystem.

4. BMW i Ventures

BMW i Ventures is the venture capital arm of BMW Group, focusing on mobility, automotive technology, and sustainability. Established in 2011, the firm invests in startups that align with BMW's vision of the future of transportation. Notable investments include ChargePoint, Proterra, and Mapillary. BMW i Ventures plays a crucial role in driving innovation within the automotive industry.

See Also How long does it take from finalists to actual notification of acceptance at the TechStars incubator?

How long does it take from finalists to actual notification of acceptance at the TechStars incubator?5. SoftBank Vision Fund

The SoftBank Vision Fund is one of the largest corporate venture capital funds globally, backed by SoftBank Group. With over $100 billion in capital, the fund invests in technology-driven companies across various sectors, including AI, robotics, and e-commerce. Some of its high-profile investments include WeWork, Uber, and ByteDance. The fund aims to accelerate the growth of companies that are shaping the future of technology.

| CVC Firm | Parent Company | Focus Areas | Notable Investments |

|---|---|---|---|

| GV | Alphabet Inc. | AI, Healthcare, Consumer Tech | Uber, Slack, Nest Labs |

| Intel Capital | Intel Corporation | 5G, AI, Autonomous Vehicles | VMware, DocuSign, Cloudera |

| Salesforce Ventures | Salesforce | Cloud Computing, SaaS | Zoom, Dropbox, Twilio |

| BMW i Ventures | BMW Group | Mobility, Automotive Tech | ChargePoint, Proterra, Mapillary |

| SoftBank Vision Fund | SoftBank Group | AI, Robotics, E-commerce | WeWork, Uber, ByteDance |

What is a CVC in corporate venture capital?

What Are the Top Vc Firms in Israel?

What Are the Top Vc Firms in Israel?What is a CVC in Corporate Venture Capital?

A CVC (Corporate Venture Capital) refers to the investment of corporate funds directly into external startup companies. Unlike traditional venture capital, which is managed by independent firms, CVC is operated by established corporations aiming to achieve strategic goals alongside financial returns. These investments often focus on startups that align with the corporation's industry or innovation objectives, providing the corporation with access to new technologies, markets, and talent.

How Does CVC Differ from Traditional Venture Capital?

Corporate Venture Capital differs from traditional venture capital in several key ways:

- Strategic Focus: CVC investments are often driven by strategic goals, such as gaining access to new technologies or markets, rather than purely financial returns.

- Funding Source: CVC is funded by the corporation's balance sheet, whereas traditional VC is funded by limited partners like institutional investors.

- Decision-Making: CVC decisions may involve corporate stakeholders, making the process more complex compared to traditional VC.

What Are the Benefits of Corporate Venture Capital?

Corporate Venture Capital offers several advantages to both the investing corporation and the startup:

- Innovation Access: Corporations gain early access to cutting-edge technologies and innovative business models.

- Market Expansion: Startups benefit from the corporation's resources, networks, and market reach.

- Strategic Partnerships: CVC can lead to long-term partnerships, joint ventures, or acquisitions.

What Are the Challenges of CVC?

Despite its benefits, Corporate Venture Capital also faces several challenges:

- Alignment of Interests: Balancing corporate strategic goals with the startup's vision can be difficult.

- Bureaucracy: Corporate decision-making processes can be slower and more rigid compared to traditional VC.

- Risk of Failure: Startups are inherently risky, and not all CVC investments yield positive returns.

What Are Some Examples of Successful CVC Programs?

Several corporations have established successful CVC programs:

- Google Ventures (GV): Known for investing in high-growth tech startups like Uber and Slack.

- Intel Capital: Focuses on startups in AI, IoT, and cloud computing, with notable investments in Cloudera and DocuSign.

- Salesforce Ventures: Invests in enterprise software startups, including Zoom and Dropbox.

How to Start a Corporate Venture Capital Program?

Launching a CVC program requires careful planning and execution:

- Define Objectives: Clearly outline the strategic and financial goals of the CVC program.

- Assemble a Team: Build a team with expertise in venture capital, corporate strategy, and the relevant industry.

- Establish Processes: Develop clear investment criteria, decision-making processes, and governance structures.

Who is the largest VC company in the world?

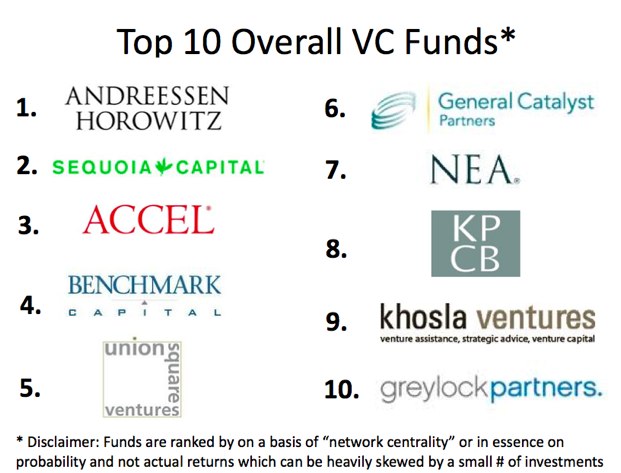

The largest venture capital (VC) company in the world is Sequoia Capital. Known for its extensive portfolio and significant investments in some of the most successful tech companies globally, Sequoia Capital has established itself as a leader in the venture capital industry. With offices in the United States, China, India, and Southeast Asia, the firm has backed companies like Apple, Google, Airbnb, and WhatsApp, among many others. Its ability to identify and nurture high-growth startups has made it a dominant force in the VC space.

What Makes Sequoia Capital the Largest VC Company?

Sequoia Capital's dominance in the venture capital industry can be attributed to several key factors:

- Global Presence: With offices in major tech hubs like Silicon Valley, China, and India, Sequoia has a vast network that allows it to identify and invest in promising startups worldwide.

- Track Record: The firm has a history of investing in companies that have become industry leaders, such as Google, Apple, and Airbnb, which have delivered massive returns.

- Expertise: Sequoia's team consists of seasoned investors and advisors who provide startups with not only funding but also strategic guidance to scale their businesses.

Key Investments by Sequoia Capital

Sequoia Capital has made numerous high-profile investments that have shaped the tech industry:

- Google: Sequoia was an early investor in Google, contributing to its growth into one of the most valuable companies in the world.

- Apple: The firm invested in Apple during its early stages, playing a role in its transformation into a tech giant.

- WhatsApp: Sequoia was the sole institutional investor in WhatsApp, which was later acquired by Facebook for $19 billion.

Sequoia Capital's Investment Strategy

Sequoia Capital's investment strategy is a key factor in its success:

- Early-Stage Focus: The firm often invests in startups during their early stages, providing them with the capital and support needed to grow.

- Long-Term Vision: Sequoia takes a long-term approach, supporting companies through multiple funding rounds and helping them achieve sustainable growth.

- Diversified Portfolio: The firm invests across various sectors, including technology, healthcare, and consumer goods, reducing risk and maximizing returns.

Impact of Sequoia Capital on the Startup Ecosystem

Sequoia Capital has had a profound impact on the global startup ecosystem:

- Job Creation: By funding startups, Sequoia has contributed to the creation of thousands of jobs worldwide.

- Innovation: The firm's investments have driven innovation in industries like technology, healthcare, and e-commerce.

- Economic Growth: Successful companies backed by Sequoia have generated significant economic value, benefiting both local and global economies.

Challenges Faced by Sequoia Capital

Despite its success, Sequoia Capital faces several challenges:

- Market Competition: The venture capital industry is highly competitive, with many firms vying for the best investment opportunities.

- Regulatory Hurdles: Operating in multiple countries means navigating complex regulatory environments, which can impact investment decisions.

- Economic Uncertainty: Global economic fluctuations can affect the performance of portfolio companies and overall returns.

Who are CVC Capital Partners?

What is CVC Capital Partners?

CVC Capital Partners is one of the world's leading private equity and investment advisory firms. Established in 1981, the firm specializes in private equity, credit, and strategic opportunities across a wide range of industries. With a global presence, CVC manages assets worth billions of dollars and has a reputation for partnering with businesses to drive growth and create long-term value.

- Founded in 1981, CVC has over four decades of experience in the investment industry.

- The firm operates in 25 offices worldwide, spanning Europe, Asia, and the Americas.

- CVC manages a diverse portfolio, including investments in sectors like consumer goods, technology, healthcare, and financial services.

What are CVC Capital Partners' Core Services?

CVC Capital Partners offers a range of services, primarily focused on private equity investments. The firm provides capital, strategic guidance, and operational expertise to help businesses achieve sustainable growth. Additionally, CVC engages in credit investments and strategic opportunities to diversify its portfolio and maximize returns for its investors.

- Private Equity: CVC acquires stakes in companies to drive growth and operational improvements.

- Credit Investments: The firm invests in corporate credit, distressed debt, and other credit-related opportunities.

- Strategic Opportunities: CVC identifies and capitalizes on unique investment opportunities across various markets.

What is CVC Capital Partners' Investment Strategy?

CVC Capital Partners employs a disciplined and research-driven investment strategy. The firm focuses on identifying undervalued or high-potential companies, leveraging its global network and industry expertise to enhance value. CVC typically invests in businesses with strong fundamentals, aiming to improve their performance through strategic initiatives and operational efficiencies.

- Long-term Focus: CVC prioritizes sustainable growth over short-term gains.

- Global Reach: The firm leverages its international presence to identify cross-border opportunities.

- Operational Expertise: CVC provides hands-on support to portfolio companies to optimize performance.

What Industries Does CVC Capital Partners Focus On?

CVC Capital Partners invests in a wide range of industries, with a particular emphasis on sectors that demonstrate strong growth potential and resilience. The firm has a proven track record in industries such as consumer goods, technology, healthcare, and financial services, among others.

- Consumer Goods: CVC has invested in leading brands and retail businesses globally.

- Technology: The firm supports innovative tech companies with high growth potential.

- Healthcare: CVC invests in healthcare providers, pharmaceuticals, and medical technology firms.

What is CVC Capital Partners' Global Presence?

CVC Capital Partners has a significant global footprint, with offices in key financial hubs across Europe, Asia, and the Americas. This extensive network allows the firm to identify and capitalize on investment opportunities worldwide while providing localized support to its portfolio companies.

- Europe: CVC has a strong presence in major European cities like London, Paris, and Frankfurt.

- Asia: The firm operates in key Asian markets, including Hong Kong, Singapore, and Shanghai.

- Americas: CVC has offices in New York and other strategic locations in the Americas.

What is the difference between a VC and a corporate VC?

What is a Venture Capitalist (VC)?

A Venture Capitalist (VC) is an individual or firm that invests in early-stage, high-potential startups in exchange for equity. VCs typically raise funds from limited partners, such as institutional investors or high-net-worth individuals, and focus on generating high returns through successful exits like IPOs or acquisitions.

- Source of Funds: VCs raise capital from external investors.

- Investment Focus: They target high-growth startups with disruptive potential.

- Exit Strategy: VCs aim for profitable exits through IPOs or acquisitions.

What is a Corporate Venture Capital (CVC)?

Corporate Venture Capital (CVC) refers to investment arms of established corporations that invest in startups. Unlike traditional VCs, CVCs often prioritize strategic alignment with their parent company’s goals, such as gaining access to new technologies or markets, rather than purely financial returns.

- Source of Funds: CVCs are funded by their parent corporations.

- Investment Focus: They seek startups that align with their corporate strategy.

- Strategic Goals: CVCs aim to enhance their parent company’s innovation or market position.

Key Differences in Investment Objectives

The primary difference between VCs and CVCs lies in their investment objectives. While VCs focus on maximizing financial returns, CVCs often prioritize strategic benefits for their parent company, such as fostering innovation or entering new markets.

- Financial Returns: VCs prioritize high financial returns.

- Strategic Alignment: CVCs focus on aligning investments with corporate goals.

- Risk Tolerance: VCs may take higher risks for higher rewards, while CVCs may be more conservative.

Differences in Decision-Making Processes

The decision-making process in VCs is typically faster and more flexible, driven by financial metrics. In contrast, CVCs often involve multiple layers of corporate approval, as investments must align with the parent company’s long-term strategy.

- Speed: VCs make quicker investment decisions.

- Approval Process: CVCs require corporate-level approvals.

- Flexibility: VCs have more flexibility in investment choices.

Impact on Startups

Startups working with VCs often benefit from mentorship and a focus on rapid growth, while those partnering with CVCs gain access to corporate resources, networks, and potential strategic partnerships.

- Mentorship: VCs provide guidance for scaling businesses.

- Corporate Resources: CVCs offer access to technology, expertise, and networks.

- Partnership Opportunities: CVCs can facilitate collaborations with the parent company.

Frequently Asked Questions (FAQs)

What are some well-known Corporate Venture Capital (CVC) firms in the United States?

Corporate Venture Capital (CVC) firms in the United States include some of the most prominent names in the industry. For example, Google Ventures (GV), the venture capital arm of Alphabet Inc., is known for its investments in cutting-edge technology and healthcare startups. Another notable firm is Intel Capital, which focuses on innovations in artificial intelligence, cybersecurity, and the Internet of Things (IoT). Additionally, Salesforce Ventures invests in cloud-based software and enterprise solutions, while Microsoft Ventures supports startups in AI, machine learning, and productivity tools. These firms not only provide funding but also offer strategic support to help startups scale globally.

Which European Corporate Venture Capital firms are leading the market?

In Europe, several Corporate Venture Capital (CVC) firms have established themselves as key players. BP Ventures, the investment arm of BP, focuses on renewable energy and mobility solutions. Another major player is Volvo Group Venture Capital, which invests in transportation and logistics innovations. Siemens Next47 is another prominent CVC firm, specializing in industrial automation, AI, and IoT. Additionally, Orange Digital Ventures supports startups in digital transformation and telecommunications. These firms are instrumental in driving innovation across various industries in Europe.

What are some examples of Corporate Venture Capital firms in Asia?

Asia is home to several influential Corporate Venture Capital (CVC) firms. SoftBank Vision Fund, backed by SoftBank Group, is one of the largest CVC funds globally, investing in technology, AI, and robotics. Tencent Investment focuses on gaming, social media, and fintech startups, while Alibaba Entrepreneurs Fund supports e-commerce and digital innovation. Another key player is Samsung Ventures, which invests in semiconductors, biotech, and software. These firms play a crucial role in fostering innovation and entrepreneurship across Asia.

How do Corporate Venture Capital firms in emerging markets contribute to innovation?

In emerging markets, Corporate Venture Capital (CVC) firms are increasingly becoming catalysts for innovation. For instance, Naspers Foundry in South Africa invests in tech startups across Africa, focusing on e-commerce and fintech. In Latin America, Movile supports mobile and logistics startups, while Kaszek Ventures, backed by MercadoLibre, invests in digital transformation. These firms not only provide capital but also bring expertise and networks to help startups navigate local and global markets. Their contributions are vital in driving economic growth and technological advancement in these regions.

Leave a Reply

Our Recommended Articles