What Are the Most Interesting Vc and Angel Investors Blogs?

Venture capital (VC) and angel investing are dynamic fields that shape the future of innovation and entrepreneurship. For those looking to stay informed, blogs written by industry leaders and investors offer invaluable insights into trends, strategies, and success stories. These platforms provide a behind-the-scenes look at deal-making, startup ecosystems, and emerging technologies. Whether you're an aspiring investor, a founder seeking funding, or simply curious about the startup world, following the right blogs can be a game-changer. This article highlights some of the most interesting VC and angel investor blogs, offering a curated list of resources to help you navigate this fast-paced and ever-evolving landscape.

- What Are the Most Interesting VC and Angel Investors Blogs?

-

Top Blogs by Venture Capitalists and Angel Investors You Should Follow

- 1. Why Venture Capital and Angel Investor Blogs Are Essential for Entrepreneurs

- 2. Key Blogs by Venture Capitalists Every Startup Founder Should Know

- 3. Angel Investor Blogs That Offer Unique Insights into Early-Stage Funding

- 4. How These Blogs Help Investors Stay Ahead in the Competitive Startup Ecosystem

- 5. The Role of Niche Blogs in Shaping the Future of Venture Capital and Angel Investing

- Frequently Asked Questions (FAQs)

What Are the Most Interesting VC and Angel Investors Blogs?

When it comes to staying updated on the latest trends, insights, and strategies in the world of venture capital (VC) and angel investing, blogs are an invaluable resource. These platforms offer a wealth of knowledge, from expert opinions to real-world case studies, making them essential for both seasoned investors and newcomers. Below, we explore some of the most interesting blogs in this space, along with key details about what makes them stand out.

See Also What accelerators have a specific, stated focus on Internet of Things (or IoT)?

What accelerators have a specific, stated focus on Internet of Things (or IoT)?1. Why Are VC and Angel Investor Blogs Important?

VC and angel investor blogs provide insights into the latest market trends, investment strategies, and startup success stories. They serve as a knowledge hub for investors looking to make informed decisions. These blogs often feature expert opinions, interviews with successful entrepreneurs, and analyses of emerging industries, making them a must-read for anyone involved in the startup ecosystem.

2. Top VC Blogs to Follow

Some of the most influential VC blogs include Andreessen Horowitz's blog, Fred Wilson's AVC, and Brad Feld's Feld Thoughts. These blogs are known for their in-depth analyses, thought leadership, and practical advice on venture capital. They cover topics ranging from fundraising tips to the future of technology, offering readers a comprehensive view of the industry.

See AlsoWhat Startups Has Ashton Kutcher Invested in?3. Must-Read Angel Investor Blogs

For angel investors, blogs like Jason Calacanis's Launch Ticker, Mark Suster's Both Sides of the Table, and AngelList's blog are highly recommended. These platforms focus on early-stage investing, startup valuation, and portfolio management. They also provide actionable tips for identifying high-potential startups and building a successful investment portfolio.

4. Blogs That Combine VC and Angel Investing Insights

Some blogs cater to both VC and angel investors, offering a holistic perspective on the investment landscape. Examples include TechCrunch's Startup Section, VentureBeat, and Crunchbase News. These platforms cover funding rounds, mergers and acquisitions, and industry disruptions, making them a one-stop resource for all things related to startup investing.

See Also What Are the Most Active Health Care Focused Vc Firms?

What Are the Most Active Health Care Focused Vc Firms?5. How to Choose the Right Blog for Your Needs

When selecting a blog to follow, consider factors such as the author's expertise, the frequency of updates, and the relevance of content to your investment goals. Look for blogs that align with your interests, whether it's early-stage investing, deep tech, or consumer startups. Additionally, prioritize blogs that offer practical advice and real-world examples to help you apply what you learn.

| Blog Name | Focus Area | Key Features |

|---|---|---|

| Andreessen Horowitz | Venture Capital | In-depth analyses, thought leadership |

| Fred Wilson's AVC | Venture Capital | Practical advice, industry trends |

| Jason Calacanis's Launch Ticker | Angel Investing | Early-stage investing, startup valuation |

| TechCrunch Startup Section | VC & Angel Investing | Funding rounds, industry disruptions |

| Crunchbase News | VC & Angel Investing | Mergers and acquisitions, startup ecosystem |

Top Blogs by Venture Capitalists and Angel Investors You Should Follow

1. Why Venture Capital and Angel Investor Blogs Are Essential for Entrepreneurs

Venture capital and angel investor blogs are invaluable resources for entrepreneurs looking to understand the nuances of fundraising, startup growth strategies, and industry trends. These blogs often provide insider perspectives from seasoned investors who have seen countless startups succeed and fail. By following these blogs, entrepreneurs can gain actionable insights into what investors are looking for, how to pitch effectively, and how to navigate the complexities of equity financing. Additionally, these blogs often highlight emerging trends in technology, business models, and market opportunities, helping startups stay ahead of the curve.

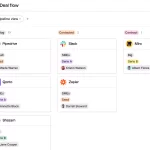

See Also What is the Best Crm for Venture/seed Capital Firms to Manage Deal Flow

What is the Best Crm for Venture/seed Capital Firms to Manage Deal Flow2. Key Blogs by Venture Capitalists Every Startup Founder Should Know

Some of the most influential venture capital blogs include Paul Graham's Essays, Andreessen Horowitz's blog, and Fred Wilson's AVC. Paul Graham, co-founder of Y Combinator, shares timeless advice on startup culture, product development, and scaling. Andreessen Horowitz's blog offers deep dives into tech trends, investment philosophies, and case studies of successful startups. Fred Wilson, a prominent VC at Union Square Ventures, provides thoughtful commentary on market dynamics, startup ecosystems, and the future of technology. These blogs are must-reads for any founder aiming to build a high-growth company.

3. Angel Investor Blogs That Offer Unique Insights into Early-Stage Funding

Angel investors often share practical advice and personal experiences through their blogs, making them a goldmine for early-stage founders. Blogs like Jason Calacanis's Launch Ticker, Mark Suster's Both Sides of the Table, and Naval Ravikant's writings are particularly noteworthy. Jason Calacanis focuses on startup fundraising tips, pitching strategies, and market trends. Mark Suster provides comprehensive guides on building relationships with investors and scaling startups. Naval Ravikant, co-founder of AngelList, shares philosophical insights on entrepreneurship, investing, and life, making his blog a unique blend of practical and inspirational content.

4. How These Blogs Help Investors Stay Ahead in the Competitive Startup Ecosystem

For investors, staying updated with the latest industry trends, investment strategies, and startup success stories is crucial. Blogs like Brad Feld's Feld Thoughts, Tomasz Tunguz's Redpoint Perspectives, and Hunter Walk's Homebrew offer data-driven analyses and forward-thinking perspectives. Brad Feld, a co-founder of Techstars, shares lessons learned from decades of investing and mentoring startups. Tomasz Tunguz provides quantitative insights into SaaS metrics, fundraising, and market opportunities. Hunter Walk, a partner at Homebrew, focuses on seed-stage investing and founder-friendly practices. These blogs help investors refine their strategies and identify high-potential opportunities.

5. The Role of Niche Blogs in Shaping the Future of Venture Capital and Angel Investing

Niche blogs like Female Founders Fund, Indie.vc, and First Round Review are shaping the future of venture capital and angel investing by addressing specific challenges and opportunities within the ecosystem. Female Founders Fund focuses on empowering women entrepreneurs and highlighting their success stories. Indie.vc explores alternative funding models that prioritize profitability over traditional equity financing. First Round Review offers in-depth interviews and case studies of successful startups, providing practical lessons for founders and investors alike. These niche blogs are pioneering new approaches to investing and entrepreneurship, making them essential reading for anyone in the startup world.

Frequently Asked Questions (FAQs)

What are some of the most popular VC and angel investor blogs to follow?

There are several highly regarded blogs in the venture capital and angel investing space. Some of the most popular include AVC by Fred Wilson, which offers insights into the VC world and startup ecosystem. Another notable blog is Both Sides of the Table by Mark Suster, which provides a balanced perspective on entrepreneurship and investing. Additionally, Paul Graham's essays on startups and investing are considered essential reading for anyone interested in the field. These blogs are known for their in-depth analysis and practical advice.

How can VC and angel investor blogs help entrepreneurs?

VC and angel investor blogs are invaluable resources for entrepreneurs looking to understand the mindset of investors. They often share practical tips on pitching, fundraising, and building scalable businesses. For example, blogs like Brad Feld's Feld Thoughts provide insights into term sheets and negotiation strategies. By following these blogs, entrepreneurs can gain a better understanding of what investors look for in startups, helping them refine their approach and increase their chances of securing funding.

Are there any blogs that focus specifically on early-stage investing?

Yes, several blogs focus specifically on early-stage investing. AngelList's blog is a great resource for understanding angel investing and syndicates. Another excellent option is Chris Dixon's blog, which often discusses trends in early-stage startups and emerging technologies. These blogs provide actionable insights for both new and experienced investors, covering topics like deal flow, due diligence, and portfolio management.

What makes a VC or angel investor blog stand out?

A standout VC or angel investor blog typically offers a combination of unique perspectives, timely insights, and practical advice. Blogs like Tomasz Tunguz's Redpoint Ventures blog stand out because they use data-driven analysis to explore trends in the startup ecosystem. Similarly, Sarah Tavel's blog is known for its thoughtful exploration of product-market fit and growth strategies. The best blogs not only share knowledge but also inspire readers to think differently about investing and entrepreneurship.

Leave a Reply

Our Recommended Articles