What Degree is Most Useful to Get Into Venture Capital or Investment Banking

Entering the competitive fields of venture capital (VC) or investment banking (IB) requires a strong educational foundation, strategic thinking, and a deep understanding of finance and business dynamics. While these industries value diverse skill sets and experiences, the choice of degree can significantly influence one’s career trajectory. Degrees in finance, economics, or business administration are often considered the most relevant, providing essential knowledge in financial modeling, market analysis, and corporate strategy. However, fields like engineering, computer science, or even liberal arts can also offer unique perspectives. This article explores which degrees are most advantageous for aspiring professionals aiming to break into VC or IB, highlighting the skills and knowledge each path brings.

- What Degree is Most Useful to Get Into Venture Capital or Investment Banking?

- Which degree is best for venture capital?

- What degree do I need to become a venture capitalist?

- What are the best degrees to get into investment banking?

- Is CFA needed for venture capital?

-

Frequently Asked Questions by our Community

- What Degree is Most Useful to Get Into Venture Capital or Investment Banking?

- Is an MBA Necessary for a Career in Venture Capital or Investment Banking?

- Can a Degree in a Non-Finance Field Help in Venture Capital or Investment Banking?

- How Important is Networking in Securing a Role in Venture Capital or Investment Banking?

What Degree is Most Useful to Get Into Venture Capital or Investment Banking?

Entering the fields of venture capital (VC) or investment banking (IB) requires a strong educational foundation. While there is no single perfect degree, certain academic backgrounds are more aligned with the skills and knowledge needed in these industries. Below, we explore the most relevant degrees and how they can help you break into these competitive fields.

See Also Why is Ltv Supposed to Be at Least 3x of Cac Wouldnt Ltv of 1 5x Cac Mean 50 Irr for the Investor Assuming Lifetime is 12 Months

Why is Ltv Supposed to Be at Least 3x of Cac Wouldnt Ltv of 1 5x Cac Mean 50 Irr for the Investor Assuming Lifetime is 12 Months1. Finance or Economics Degrees

A degree in Finance or Economics is one of the most common and practical choices for aspiring venture capitalists or investment bankers. These programs provide a deep understanding of financial markets, valuation techniques, and economic principles, which are critical for analyzing investments or managing financial transactions. Courses in corporate finance, portfolio management, and econometrics are particularly valuable.

2. Business Administration (MBA)

An MBA is highly regarded in both venture capital and investment banking. It offers a comprehensive understanding of business operations, strategy, and leadership. Many professionals in these fields pursue an MBA to enhance their analytical skills, expand their professional network, and gain access to top-tier internships and job opportunities. Specializations in finance or entrepreneurship are especially beneficial.

See Also Is Goldman Sachs or Venture Capital a Better Career Starter?

Is Goldman Sachs or Venture Capital a Better Career Starter?3. Accounting or Mathematics Degrees

Degrees in Accounting or Mathematics are also advantageous. Accounting provides a solid foundation in financial reporting and analysis, which is essential for evaluating company performance. Mathematics, particularly with a focus on statistics or quantitative analysis, is useful for modeling financial scenarios and assessing risk, a key component of both VC and IB roles.

4. Engineering or Computer Science Degrees

For those interested in venture capital, especially in tech-focused investments, a degree in Engineering or Computer Science can be highly valuable. These degrees provide technical expertise that helps in evaluating startups in sectors like software, hardware, or biotech. Understanding the technical aspects of a product can give you an edge in making informed investment decisions.

See AlsoWhy Doesn't Amazon Have a Venture Fund?5. Law Degrees (JD)

A Juris Doctor (JD) degree can be beneficial, particularly in venture capital, where legal expertise is crucial for structuring deals, understanding intellectual property, and navigating regulatory environments. While not as common as finance or MBA degrees, a legal background can set you apart in complex negotiations and compliance matters.

| Degree | Relevance to VC | Relevance to IB |

|---|---|---|

| Finance/Economics | High | Very High |

| MBA | Very High | Very High |

| Accounting/Mathematics | Moderate | High |

| Engineering/Computer Science | High | Moderate |

| Law (JD) | Moderate | Low |

Which degree is best for venture capital?

What is the Best Deal Flow Management Tool for Venture Capital Firms

What is the Best Deal Flow Management Tool for Venture Capital FirmsWhy a Finance Degree is Ideal for Venture Capital

A finance degree is one of the most relevant degrees for venture capital because it provides a strong foundation in financial analysis, investment strategies, and risk management. Here’s why:

- Financial Modeling: Learn to create and interpret financial models, which are essential for evaluating startups.

- Valuation Techniques: Gain expertise in valuing companies, a critical skill for making investment decisions.

- Market Analysis: Understand how to analyze market trends and identify lucrative opportunities.

The Role of a Business Administration Degree in Venture Capital

A business administration degree offers a broad understanding of business operations, making it highly valuable for venture capital professionals. Key benefits include:

See Also Do Vcs Fund Nonprofits if Not How Else Could They Get Funded From Private Investors

Do Vcs Fund Nonprofits if Not How Else Could They Get Funded From Private Investors- Strategic Thinking: Develop the ability to assess business strategies and scalability.

- Leadership Skills: Learn how to manage teams and guide portfolio companies.

- Entrepreneurial Insight: Gain firsthand knowledge of what makes startups successful.

How an Economics Degree Prepares You for Venture Capital

An economics degree equips you with analytical tools to understand market dynamics and economic trends, which are crucial in venture capital. Key advantages include:

- Macroeconomic Analysis: Understand how global economic trends impact startups.

- Behavioral Economics: Learn to predict consumer and investor behavior.

- Resource Allocation: Master the principles of efficient capital distribution.

The Importance of a Computer Science Degree in Venture Capital

With the rise of tech startups, a computer science degree is increasingly valuable in venture capital. Here’s why:

- Technical Due Diligence: Evaluate the technical feasibility of startup products.

- Emerging Technologies: Stay ahead of trends like AI, blockchain, and machine learning.

- Product Development: Understand the challenges and timelines of building tech solutions.

Why an MBA is a Popular Choice for Venture Capitalists

An MBA is a common path for aspiring venture capitalists due to its comprehensive curriculum and networking opportunities. Key reasons include:

- Networking: Build connections with industry leaders and potential co-investors.

- Case Studies: Analyze real-world business scenarios to hone decision-making skills.

- Specializations: Tailor your MBA with concentrations in entrepreneurship or finance.

What degree do I need to become a venture capitalist?

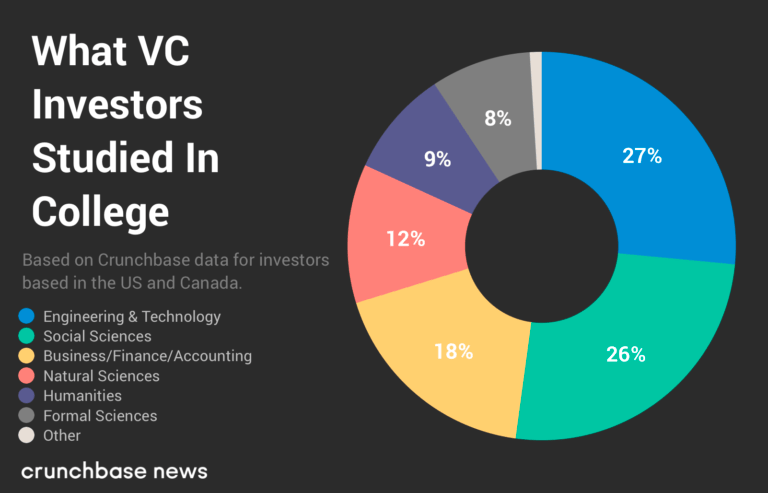

What Degree is Most Common for Venture Capitalists?

While there is no specific degree required to become a venture capitalist, many professionals in this field hold advanced degrees. The most common degrees include:

- MBA (Master of Business Administration): This is the most popular degree among venture capitalists, as it provides a strong foundation in business strategy, finance, and management.

- Finance or Economics: A degree in finance or economics helps in understanding market trends, investment strategies, and financial modeling.

- Engineering or Computer Science: For those focusing on tech startups, a background in engineering or computer science can be highly beneficial.

Is an MBA Necessary to Become a Venture Capitalist?

An MBA is not strictly necessary, but it is highly advantageous. Here’s why:

- Networking Opportunities: MBA programs often provide access to a vast network of alumni and industry professionals.

- Business Acumen: The curriculum covers essential topics like venture capital, private equity, and entrepreneurship.

- Career Transition: An MBA can help individuals from non-finance backgrounds transition into venture capital.

Can I Become a Venture Capitalist with a STEM Degree?

Yes, a STEM degree can be a strong asset, especially in tech-focused venture capital firms. Consider the following:

- Technical Expertise: A STEM background allows you to evaluate the technical feasibility of startups.

- Industry Knowledge: Understanding emerging technologies can give you an edge in identifying promising investments.

- Complementary Skills: Pairing a STEM degree with business courses or certifications can enhance your profile.

What Other Qualifications Help in Becoming a Venture Capitalist?

Beyond degrees, certain qualifications and experiences can boost your chances of becoming a venture capitalist:

- Work Experience: Prior roles in investment banking, consulting, or startups are highly valued.

- Certifications: Certifications like the CFA (Chartered Financial Analyst) can demonstrate expertise in finance.

- Entrepreneurial Experience: Founding or working in a startup can provide firsthand insights into the challenges entrepreneurs face.

How Important is Networking in Venture Capital?

Networking is crucial in the venture capital industry. Here’s why:

- Deal Flow: Strong networks help you access high-quality investment opportunities.

- Mentorship: Experienced professionals can guide you through the complexities of the industry.

- Reputation Building: Building relationships with founders and investors can enhance your credibility and influence.

What are the best degrees to get into investment banking?

Finance and Accounting Degrees

Degrees in Finance and Accounting are among the most sought-after qualifications for investment banking roles. These degrees provide a strong foundation in financial analysis, corporate finance, and accounting principles, which are essential for understanding the complexities of investment banking. Key benefits include:

- Financial Modeling: Learn to build and interpret financial models, a critical skill in investment banking.

- Valuation Techniques: Gain expertise in valuing companies and assets, which is central to mergers and acquisitions.

- Regulatory Knowledge: Understand financial regulations and compliance, crucial for advising clients.

Economics Degrees

An Economics degree is highly valued in investment banking due to its focus on understanding market trends, economic policies, and global financial systems. This degree equips candidates with analytical skills and a macroeconomic perspective, which are vital for making informed investment decisions. Key advantages include:

- Market Analysis: Develop the ability to analyze market conditions and predict economic trends.

- Policy Impact: Understand how government policies affect financial markets and investment strategies.

- Quantitative Skills: Master statistical and econometric tools used in financial analysis.

Business Administration (MBA)

An MBA with a focus on finance or investment banking is one of the most prestigious degrees for entering this field. It provides a comprehensive understanding of business operations, strategic management, and financial decision-making. Key highlights include:

- Leadership Skills: Develop management and leadership abilities to lead teams and projects.

- Networking Opportunities: Access to a vast alumni network and industry connections.

- Case Study Experience: Gain practical insights through real-world case studies and simulations.

Mathematics and Statistics Degrees

Degrees in Mathematics and Statistics are highly regarded in investment banking due to their emphasis on quantitative analysis and problem-solving. These degrees are particularly useful for roles in risk management, trading, and financial engineering. Key benefits include:

- Quantitative Modeling: Learn advanced mathematical techniques for pricing derivatives and managing risk.

- Data Analysis: Develop skills to analyze large datasets and extract actionable insights.

- Algorithmic Trading: Understand the mathematical foundations of algorithmic trading strategies.

Engineering Degrees

While not traditional, Engineering degrees are increasingly valued in investment banking, especially for roles in quantitative analysis and financial technology. Engineers bring strong problem-solving and technical skills to the table. Key advantages include:

- Technical Expertise: Apply engineering principles to solve complex financial problems.

- Innovation: Contribute to the development of new financial products and technologies.

- Analytical Thinking: Use logical and structured approaches to analyze financial data.

Is CFA needed for venture capital?

What is the CFA Charter?

The CFA (Chartered Financial Analyst) charter is a globally recognized professional designation offered by the CFA Institute. It is highly regarded in the fields of investment management, financial analysis, and portfolio management. The program covers a wide range of topics, including ethics, economics, financial reporting, equity analysis, and corporate finance. Earning the CFA charter requires passing three rigorous exams and gaining relevant work experience.

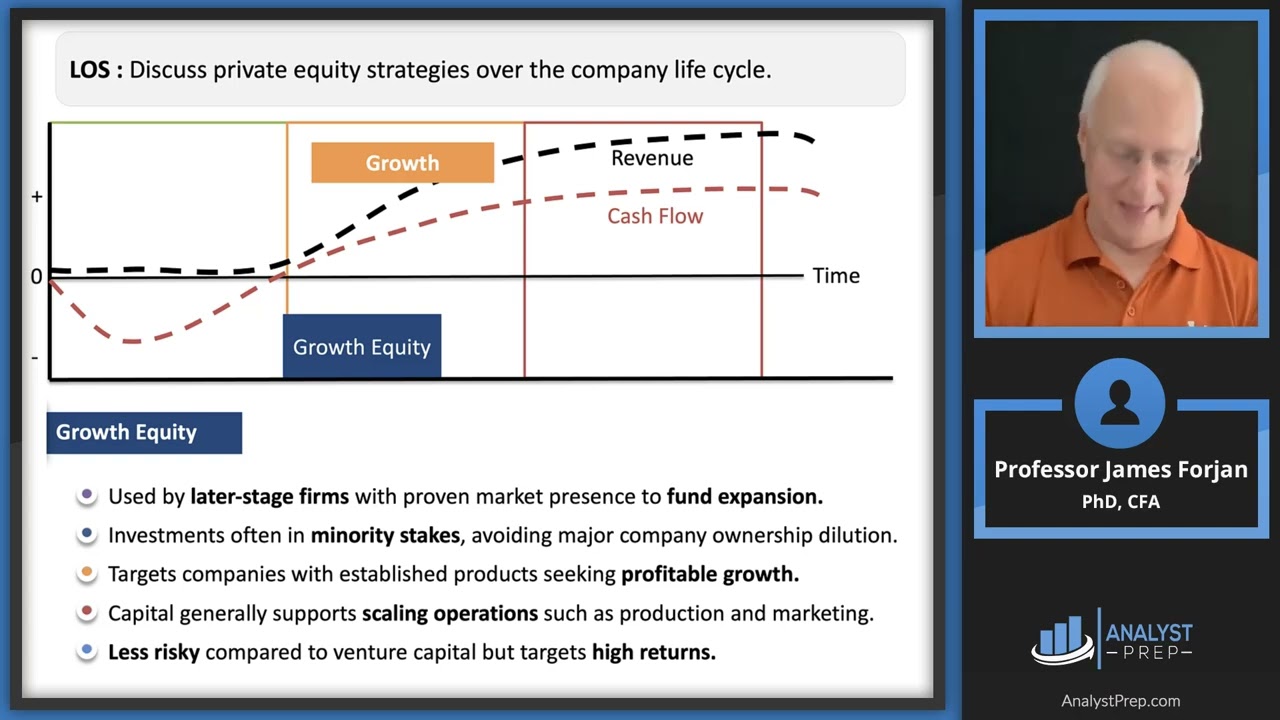

Is a CFA Required for Venture Capital?

No, a CFA is not required to work in venture capital. Venture capital firms typically prioritize skills such as deal sourcing, negotiation, market analysis, and entrepreneurial experience over formal certifications. However, having a CFA can be beneficial in certain roles within venture capital, particularly those involving financial modeling, valuation, and due diligence.

- Deal Evaluation: A CFA can help in assessing the financial health and potential of startups.

- Valuation Expertise: The CFA curriculum provides in-depth knowledge of valuation techniques, which is useful in determining startup worth.

- Investor Relations: A CFA charterholder may be better equipped to communicate financial insights to investors.

Benefits of a CFA in Venture Capital

While not mandatory, the CFA charter can provide several advantages in the venture capital industry. It demonstrates a strong foundation in financial analysis, ethics, and investment management, which can enhance credibility and open doors to specialized roles.

- Enhanced Analytical Skills: The CFA program sharpens skills in financial modeling and data analysis.

- Global Recognition: The CFA charter is respected worldwide, which can be advantageous in cross-border investments.

- Networking Opportunities: CFA charterholders gain access to a global network of finance professionals.

Alternative Qualifications for Venture Capital

Venture capital firms often value practical experience, industry knowledge, and a strong network over formal certifications. Many professionals in this field come from diverse backgrounds, including entrepreneurship, consulting, and engineering.

- MBA Degree: An MBA with a focus on finance or entrepreneurship is a common alternative.

- Industry Experience: Hands-on experience in startups or tech industries is highly valued.

- Networking Skills: Building relationships with founders and investors is crucial in venture capital.

When Might a CFA Be Useful in Venture Capital?

A CFA can be particularly useful in venture capital when dealing with complex financial structures, fundraising, or portfolio management. It can also be advantageous for professionals aiming to transition into venture capital from other finance-related fields.

- Fund Management: CFA skills are valuable for managing venture capital funds and ensuring compliance.

- Due Diligence: The CFA curriculum provides tools for thorough financial analysis during investment evaluations.

- Career Transition: A CFA can help finance professionals pivot into venture capital roles.

Frequently Asked Questions by our Community

What Degree is Most Useful to Get Into Venture Capital or Investment Banking?

Finance, Economics, and Business Administration are among the most useful degrees for entering venture capital or investment banking. These fields provide a strong foundation in financial analysis, market trends, and business strategy, which are critical skills in both industries. Additionally, degrees in Mathematics, Accounting, or Engineering can also be advantageous, as they develop analytical and problem-solving abilities that are highly valued in these sectors. Many professionals in venture capital and investment banking also pursue advanced degrees like an MBA to further enhance their qualifications and career prospects.

Is an MBA Necessary for a Career in Venture Capital or Investment Banking?

While an MBA is not strictly necessary, it is highly beneficial for advancing in venture capital or investment banking. An MBA provides advanced knowledge in finance, strategy, and leadership, which are essential for higher-level roles. Many top firms prefer candidates with an MBA from a prestigious institution, as it demonstrates a commitment to professional development and a strong understanding of business principles. However, individuals with significant experience or exceptional performance in related fields may still succeed without an MBA.

Can a Degree in a Non-Finance Field Help in Venture Capital or Investment Banking?

Yes, a degree in a non-finance field can still be valuable in venture capital or investment banking, especially if it complements the industry's needs. For example, degrees in Computer Science, Biotechnology, or Engineering can be advantageous for venture capital firms focusing on tech or healthcare startups. Similarly, strong analytical skills from fields like Mathematics or Physics can be transferable to investment banking roles. The key is to demonstrate how your unique expertise can contribute to the firm's goals.

How Important is Networking in Securing a Role in Venture Capital or Investment Banking?

Networking is crucial for breaking into venture capital or investment banking. Building relationships with professionals in the industry can provide valuable insights, mentorship, and job opportunities. Attending industry events, joining finance-related clubs, and leveraging alumni networks are effective ways to connect with potential employers. Additionally, internships and informational interviews can help you gain practical experience and make a strong impression on hiring managers. While academic qualifications are important, personal connections often play a significant role in securing roles in these competitive fields.

Leave a Reply

Our Recommended Articles