What Does a Series 1 Financing/funding Mean?

Series 1 financing, often referred to as Series A in some contexts, represents a critical stage in a startup's growth journey. It is typically the first significant round of venture capital funding, aimed at scaling operations, expanding the team, and accelerating product development. At this stage, investors evaluate the company's potential based on its initial traction, market opportunity, and team capabilities. Unlike seed funding, which focuses on validating ideas, Series 1 financing is about turning a promising concept into a sustainable business. This funding round often sets the foundation for future growth, making it a pivotal moment for startups aiming to establish themselves in competitive markets.

What Does a Series 1 Financing/ Funding Mean?

Series 1 financing, also known as Series A funding, is a critical stage in the growth of a startup. It typically represents the first significant round of venture capital financing after the initial seed funding. At this stage, startups have usually developed a minimum viable product (MVP), demonstrated some market traction, and are seeking capital to scale their operations, expand their team, and further develop their product or service. Investors in Series 1 financing are often venture capital firms or angel investors who believe in the startup's potential for long-term growth and profitability.

See Also What Are the Top Vc Firms and Angel Groups in Seattle Portland Vancouver or Pac Nw Area

What Are the Top Vc Firms and Angel Groups in Seattle Portland Vancouver or Pac Nw Area1. What Is the Purpose of Series 1 Financing?

The primary purpose of Series 1 financing is to provide startups with the necessary capital to scale their operations and achieve significant growth milestones. This funding is often used to hire key talent, invest in marketing and sales efforts, improve the product or service offering, and expand into new markets. Additionally, Series 1 financing helps startups establish a stronger market presence and build credibility with potential customers, partners, and future investors.

2. Who Participates in Series 1 Financing?

Series 1 financing typically involves venture capital firms, angel investors, and sometimes corporate investors. These participants provide the necessary capital in exchange for equity stakes in the company. Venture capital firms often take a more active role by offering strategic guidance and leveraging their networks to help the startup grow. Angel investors, on the other hand, may contribute smaller amounts of capital but can still provide valuable mentorship and industry connections.

See Also Can Founders of a Failed Startup Be Sued Individually by Their Angel or Vc Investors

Can Founders of a Failed Startup Be Sued Individually by Their Angel or Vc Investors3. How Is the Valuation Determined in Series 1 Financing?

The valuation of a startup during Series 1 financing is determined through negotiations between the founders and investors. Factors influencing the valuation include the startup's revenue growth, market potential, competitive landscape, and the strength of the founding team. Investors often use discounted cash flow (DCF) analysis or comparable company analysis to estimate the startup's worth. A higher valuation can result in less equity dilution for the founders, while a lower valuation may attract more investors.

4. What Are the Key Terms in Series 1 Financing?

Series 1 financing involves several key terms that both founders and investors should understand. These include equity stakes, liquidation preferences, anti-dilution provisions, and board seats. Equity stakes determine the percentage of ownership investors receive in exchange for their capital. Liquidation preferences ensure that investors are paid first in the event of a sale or liquidation. Anti-dilution provisions protect investors from future equity dilution, while board seats give investors a say in the company's strategic decisions.

See Also5. What Are the Risks and Rewards of Series 1 Financing?

Series 1 financing offers both risks and rewards for startups and investors. For startups, the primary risk is equity dilution, which reduces the founders' ownership stake. However, the rewards include access to capital, expertise, and networks that can accelerate growth. For investors, the risk lies in the uncertainty of the startup's success, as many early-stage companies fail. However, the potential rewards include high returns if the startup achieves significant growth or is acquired.

| Key Aspect | Description |

|---|---|

| Purpose | To scale operations and achieve growth milestones. |

| Participants | Venture capital firms, angel investors, and corporate investors. |

| Valuation | Determined by revenue growth, market potential, and team strength. |

| Key Terms | Equity stakes, liquidation preferences, anti-dilution provisions, and board seats. |

| Risks & Rewards | Equity dilution for startups; high returns or losses for investors. |

What is series 1 funding?

What is Series 1 Funding?

Series 1 funding, also known as Series A funding in some contexts, is the first significant round of venture capital financing for a startup. It typically occurs after the seed funding stage and is aimed at helping the company scale its operations, develop its product further, and expand its market reach. This stage is crucial for startups as it often determines their ability to grow and compete in the market.

Key Characteristics of Series 1 Funding

Series 1 funding has several defining characteristics that set it apart from earlier funding rounds:

- Investment Size: The funding amount is significantly larger than seed funding, often ranging from $2 million to $15 million, depending on the industry and the startup's potential.

- Investor Involvement: Investors in this round are typically venture capital firms, and they often take an active role in guiding the company's strategy and operations.

- Equity Exchange: In exchange for their investment, investors receive equity in the company, which means they own a portion of the business.

How Series 1 Funding Works

The process of securing Series 1 funding involves several steps:

- Preparation: Startups must prepare a detailed business plan, financial projections, and a pitch deck to present to potential investors.

- Valuation: The company's valuation is determined, which will influence how much equity is given to investors in exchange for their funding.

- Negotiation: Terms of the investment, including the amount of funding, equity stake, and any conditions, are negotiated between the startup and the investors.

Benefits of Series 1 Funding

Securing Series 1 funding offers several advantages to startups:

- Scalability: The funds allow the company to scale its operations, hire more staff, and expand into new markets.

- Credibility: Successfully raising Series 1 funding can enhance the company's credibility and attract further investment.

- Strategic Support: Investors often provide valuable mentorship and strategic guidance, helping the company navigate challenges and grow effectively.

Challenges in Securing Series 1 Funding

While Series 1 funding is beneficial, it comes with its own set of challenges:

- High Expectations: Investors have high expectations for growth and returns, which can put pressure on the startup to perform.

- Dilution of Ownership: Founders may have to give up a significant portion of their equity, reducing their control over the company.

- Competition: The competition for Series 1 funding is intense, and not all startups succeed in securing the necessary investment.

Is Series A or B better?

What is Series A and Series B Funding?

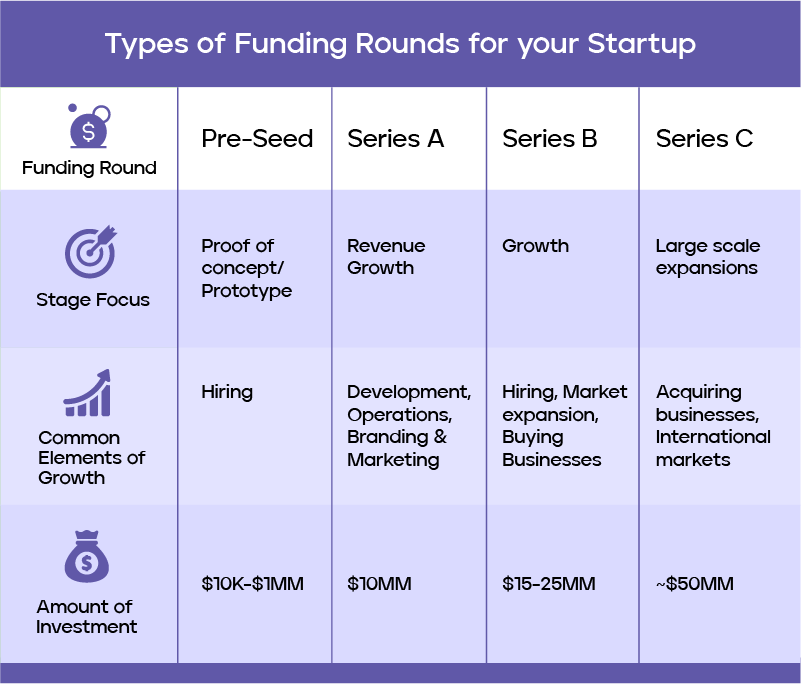

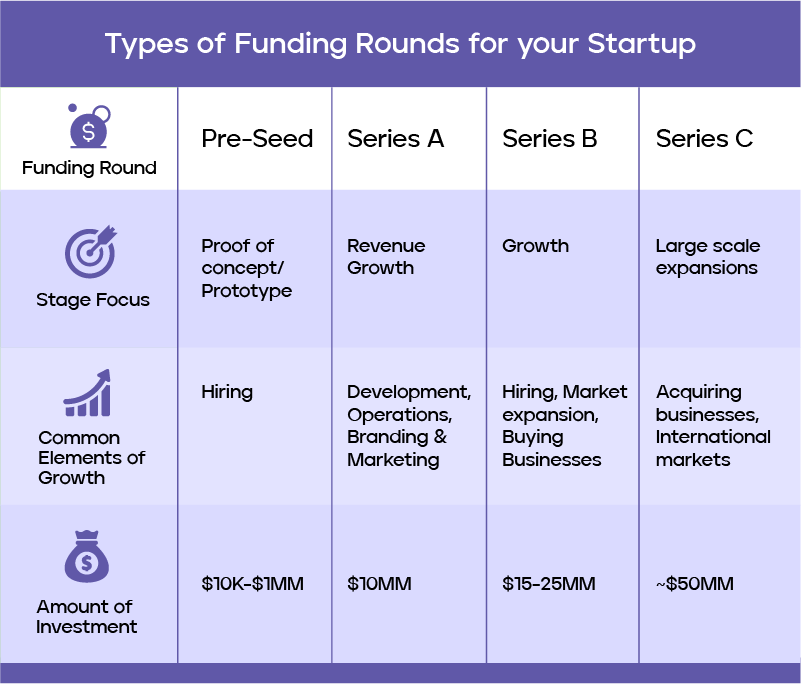

Series A and Series B are stages of venture capital funding that startups go through to raise capital. Series A is typically the first significant round of funding after the seed stage, where investors provide capital to help a startup grow its operations, product development, and market reach. Series B, on the other hand, is the next stage, where companies that have already demonstrated growth and market traction seek additional funding to scale further.

- Series A focuses on proving the business model and achieving product-market fit.

- Series B is about scaling the business and expanding into new markets.

- Both stages involve significant investor involvement and due diligence.

Key Differences Between Series A and Series B

The primary differences between Series A and Series B lie in the company's stage of development and the purpose of the funding. Series A is often used to refine the product, build a customer base, and establish a sustainable business model. In contrast, Series B is aimed at accelerating growth, increasing market share, and optimizing operations.

- Series A is riskier for investors as the company is still in its early stages.

- Series B involves less risk since the company has already shown some success.

- Series B funding amounts are generally larger than Series A.

Which Stage is More Challenging for Startups?

Both Series A and Series B present unique challenges for startups. Series A is often considered more challenging because the company must prove its viability and attract investors with limited data. In Series B, the challenge shifts to meeting higher expectations, such as achieving significant growth metrics and demonstrating scalability.

- Series A requires a strong pitch and a clear vision to secure funding.

- Series B demands proven results and a solid growth strategy.

- Both stages require effective communication with investors and stakeholders.

Investor Expectations in Series A vs. Series B

Investors have different expectations at each funding stage. In Series A, they look for a promising team, a scalable idea, and a clear path to profitability. In Series B, investors focus on measurable growth, market traction, and the ability to scale operations efficiently.

- Series A investors prioritize potential over proven results.

- Series B investors seek evidence of success and scalability.

- Both stages require startups to demonstrate strong leadership and execution.

Is Series A or Series B Better for Startups?

Whether Series A or Series B is better depends on the startup's goals and stage of development. Series A is crucial for startups looking to establish themselves and secure initial funding. Series B is ideal for companies ready to scale and expand their operations. Both stages are essential for long-term success.

- Series A is better for early-stage startups needing foundational support.

- Series B is better for growth-stage companies aiming to scale.

- The choice depends on the startup's specific needs and objectives.

Frequently Asked Questions (FAQs)

What is Series 1 Financing?

Series 1 Financing, also known as Series A Financing in some contexts, refers to the first significant round of venture capital funding for a startup. At this stage, the company has typically moved beyond the initial seed funding phase and has demonstrated some level of market validation, such as a working product, early customer traction, or a proven business model. The primary goal of Series 1 Financing is to scale operations, expand the team, and accelerate growth. Investors in this round often include venture capital firms, angel investors, or institutional investors who provide capital in exchange for equity in the company.

How does Series 1 Financing differ from Seed Funding?

While Seed Funding is typically used to get a startup off the ground, covering initial costs like product development and market research, Series 1 Financing is aimed at scaling the business. Seed funding is often smaller in amount and comes from individual investors, friends, or family. In contrast, Series 1 Financing involves larger sums of money and is usually led by professional investors who expect a higher level of business maturity. The company must show clear potential for growth and profitability to attract Series 1 investors.

What are the typical terms of Series 1 Financing?

The terms of Series 1 Financing can vary widely depending on the startup's industry, growth potential, and negotiation with investors. However, common elements include equity stakes, where investors receive shares in the company, and valuation caps, which set a maximum valuation for the company during the investment. Investors may also require board seats or other forms of control to protect their investment. Additionally, the funding round may include liquidation preferences, ensuring investors are paid first in the event of a sale or liquidation.

What should startups prepare before seeking Series 1 Financing?

Before pursuing Series 1 Financing, startups should ensure they have a solid foundation. This includes a clear business plan, a scalable product or service, and evidence of market demand, such as customer testimonials or revenue growth. Startups should also have a strong management team in place and be prepared to present detailed financial projections. Additionally, having a well-defined use of funds is crucial, as investors will want to know exactly how the capital will be deployed to drive growth and achieve milestones.

Leave a Reply

Our Recommended Articles