What Does It Take to Get Vc Funding?

Securing venture capital (VC) funding is a pivotal milestone for many startups, yet the path to achieving it is often complex and competitive. VC funding provides not only financial resources but also strategic guidance, industry connections, and credibility. However, attracting investors requires more than just a promising idea. Startups must demonstrate a scalable business model, a strong team, and a clear market opportunity. Additionally, thorough preparation, including a compelling pitch deck and robust financial projections, is essential. Understanding what VCs look for and aligning your startup’s vision with their investment criteria can significantly increase your chances of success in this high-stakes arena.

What Does It Take to Get VC Funding?

1. Understanding the Basics of Venture Capital

Venture capital (VC) funding is a form of private equity financing that investors provide to early-stage, high-potential startups. To secure VC funding, entrepreneurs must first understand the basics of how venture capital works. VCs typically invest in companies with high growth potential in exchange for equity. They look for startups that can scale quickly and offer significant returns on investment. It's crucial to research the types of VCs, their investment criteria, and their preferred industries before approaching them.

See Also Do Vc Firms Invest in Start Up Retail Companies Looking to Franchise for Scalability

Do Vc Firms Invest in Start Up Retail Companies Looking to Franchise for Scalability2. Building a Strong Business Plan

A strong business plan is essential to attract VC funding. This document should clearly outline your business model, target market, revenue streams, and growth strategy. VCs want to see a well-thought-out plan that demonstrates how your startup will achieve scalability and profitability. Include detailed financial projections, competitive analysis, and a clear value proposition. A compelling business plan not only showcases your vision but also proves that you have a roadmap to success.

3. Demonstrating Market Potential

VCs are highly interested in startups that address large or rapidly growing markets. To secure funding, you must demonstrate the market potential of your product or service. Provide data-driven insights into market size, trends, and customer demand. Highlight how your solution solves a significant problem or fulfills an unmet need. VCs want to see evidence that your startup can capture a substantial share of the market and generate significant revenue.

See Also What Do Operations Roles Look Like at a Venture Capital Firm?

What Do Operations Roles Look Like at a Venture Capital Firm?4. Building a Skilled and Committed Team

A skilled and committed team is one of the most critical factors VCs consider when evaluating startups. Investors look for founders and team members with relevant expertise, a track record of success, and the ability to execute the business plan. Highlight the strengths of your team, including their experience, skills, and dedication. VCs are more likely to invest in startups with a team that demonstrates resilience, adaptability, and a shared vision for the company's future.

5. Preparing for Due Diligence and Negotiations

Once a VC shows interest, they will conduct due diligence to assess the viability of your startup. This process involves a thorough examination of your financials, legal documents, intellectual property, and market position. Be prepared to provide all necessary information and answer questions transparently. Additionally, be ready for negotiations regarding equity, valuation, and terms of the investment. It's essential to understand the terms and ensure they align with your long-term goals.

See Also What Are the Benefits of Venture Capital?

What Are the Benefits of Venture Capital?| Key Aspect | Description |

|---|---|

| Business Plan | A detailed document outlining the business model, market strategy, and financial projections. |

| Market Potential | Evidence of a large or growing market that the startup can capture. |

| Team Expertise | A skilled and committed team with relevant experience and a shared vision. |

| Due Diligence | A thorough evaluation of the startup's financials, legal standing, and market position. |

| Negotiations | Discussions around equity, valuation, and investment terms. |

What do you need to get VC funding?

1. A Strong and Scalable Business Idea

To secure VC funding, your business idea must be both innovative and scalable. Venture capitalists are looking for startups that can grow rapidly and generate significant returns. Your idea should address a large market opportunity and have a clear competitive advantage.

- Identify a pain point in the market and propose a unique solution.

- Ensure your product or service has the potential to scale across regions or industries.

- Demonstrate how your idea can achieve exponential growth with the right resources.

2. A Solid Business Plan

A well-structured business plan is essential to attract VC funding. It should outline your vision, mission, target market, revenue model, and growth strategy. VCs want to see a clear roadmap for how their investment will be used to achieve milestones.

- Include detailed financial projections, such as revenue forecasts and break-even analysis.

- Highlight your go-to-market strategy and customer acquisition plan.

- Provide a timeline for achieving key milestones, such as product launches or market expansion.

3. A Proven Founding Team

VCs invest in teams as much as they invest in ideas. Your founding team should have a mix of skills, experience, and a track record of success. Demonstrating that your team can execute the business plan is critical.

- Showcase the relevant expertise of each team member.

- Highlight any previous entrepreneurial successes or industry experience.

- Emphasize the team's ability to adapt and overcome challenges.

4. Traction and Market Validation

Having traction in the market significantly increases your chances of securing VC funding. This could include early sales, user growth, partnerships, or positive customer feedback. VCs want to see evidence that your product or service is gaining momentum.

- Provide data on customer acquisition and retention rates.

- Showcase any partnerships or collaborations with established companies.

- Include testimonials or case studies that demonstrate market demand.

5. A Clear Exit Strategy

VCs are focused on achieving a high return on investment, so they need to see a clear exit strategy. This could involve an acquisition, merger, or initial public offering (IPO). Your plan should outline how and when investors can expect to realize their returns.

- Identify potential acquirers or partners in your industry.

- Outline the steps needed to prepare for an IPO or acquisition.

- Provide a timeline for achieving the exit and the expected valuation.

How difficult is it to get VC funding?

Understanding the VC Funding Landscape

Securing VC funding is a highly competitive process that requires a deep understanding of the venture capital ecosystem. Venture capitalists typically invest in startups with high growth potential, and they evaluate numerous factors before committing funds. Here are some key points to consider:

- Market Potential: VCs look for startups operating in large and growing markets.

- Team Expertise: A strong, experienced team increases the likelihood of securing funding.

- Innovation: Unique and scalable solutions are more attractive to investors.

Preparing a Compelling Pitch

A well-prepared pitch is crucial for attracting VC funding. The pitch should clearly articulate the business model, market opportunity, and competitive advantage. Here are some essential elements:

- Problem Statement: Clearly define the problem your startup is solving.

- Solution: Present your product or service as the ideal solution.

- Revenue Model: Explain how your startup will generate revenue.

Building a Strong Network

Networking plays a significant role in securing VC funding. Building relationships with investors, industry experts, and other entrepreneurs can open doors to funding opportunities. Consider the following steps:

- Attend Industry Events: Participate in conferences and meetups to connect with potential investors.

- Leverage Social Media: Use platforms like LinkedIn to engage with VCs and showcase your startup.

- Seek Introductions: Warm introductions from mutual connections can increase your chances of getting noticed.

Once a VC shows interest, they will conduct a thorough due diligence process to assess the viability of your startup. This process can be rigorous and time-consuming. Key areas of focus include:

- Financial Health: VCs will scrutinize your financial statements and projections.

- Legal Compliance: Ensure all legal documents and intellectual property rights are in order.

- Market Validation: Provide evidence of market demand and customer traction.

Overcoming Common Challenges

Securing VC funding is not without its challenges. Many startups face obstacles that can hinder their ability to attract investment. Here are some common challenges and how to address them:

- Lack of Traction: Demonstrate early customer adoption or partnerships to prove market interest.

- Weak Team: Strengthen your team by bringing in experienced advisors or co-founders.

- Unclear Value Proposition: Refine your messaging to clearly communicate the unique value of your startup.

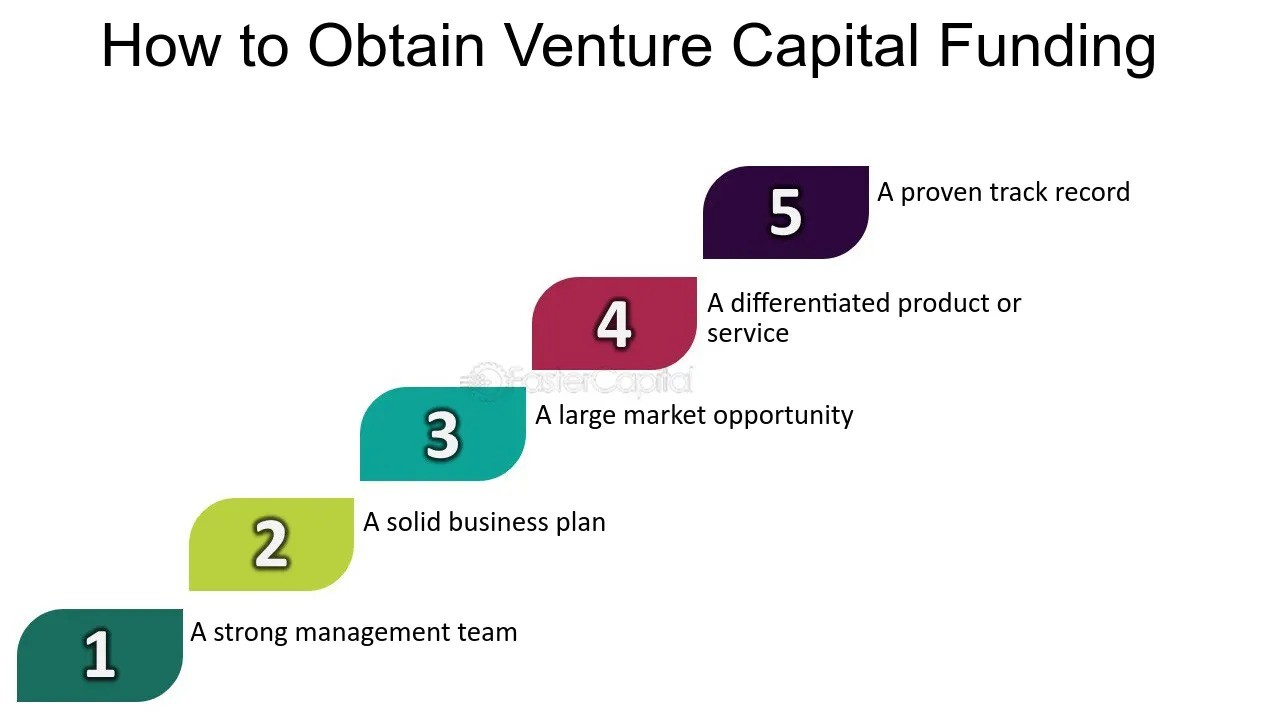

How do you qualify for a venture capital fund?

Understanding Venture Capital Requirements

To qualify for a venture capital fund, you must first understand the specific requirements that venture capitalists (VCs) look for in potential investments. VCs typically seek businesses with high growth potential, a scalable business model, and a strong management team. Additionally, they prefer companies operating in industries with significant market opportunities, such as technology, healthcare, or clean energy.

- High growth potential: Your business should demonstrate the ability to grow rapidly and generate substantial returns.

- Scalable business model: The model should allow for expansion without a proportional increase in costs.

- Strong management team: A capable and experienced team is crucial for executing the business plan.

Developing a Compelling Business Plan

A well-crafted business plan is essential to attract venture capital. This document should clearly outline your value proposition, market opportunity, revenue model, and growth strategy. It should also include detailed financial projections and a clear explanation of how the VC's investment will be utilized to achieve milestones.

- Value proposition: Clearly articulate what makes your product or service unique.

- Market opportunity: Provide data and analysis to show the size and potential of your target market.

- Revenue model: Explain how your business will generate income and achieve profitability.

Building a Strong Track Record

Venture capitalists often look for companies with a proven track record of success. This could include early traction, such as customer acquisition, revenue growth, or product development milestones. Demonstrating that your business has already achieved some level of success can significantly increase your chances of securing funding.

- Early traction: Show evidence of customer interest, sales, or partnerships.

- Revenue growth: Highlight consistent or accelerating revenue streams.

- Product development milestones: Showcase completed phases of product development or innovation.

Establishing a Network of Connections

Networking plays a critical role in qualifying for venture capital. Building relationships with industry experts, other entrepreneurs, and VC firms can provide valuable introductions and endorsements. Attending industry events, joining startup accelerators, and leveraging online platforms like LinkedIn can help you connect with potential investors.

- Industry experts: Seek advice and mentorship from seasoned professionals.

- Other entrepreneurs: Learn from peers who have successfully raised venture capital.

- VC firms: Research and target firms that align with your industry and stage of growth.

Preparing for Due Diligence

Once a VC expresses interest, they will conduct a thorough due diligence process. This involves evaluating your financial statements, legal documents, intellectual property, and market position. Being prepared with organized and transparent documentation will help streamline this process and build trust with potential investors.

- Financial statements: Ensure your financial records are accurate and up-to-date.

- Legal documents: Have all contracts, patents, and compliance documents ready for review.

- Intellectual property: Protect and document any proprietary technology or processes.

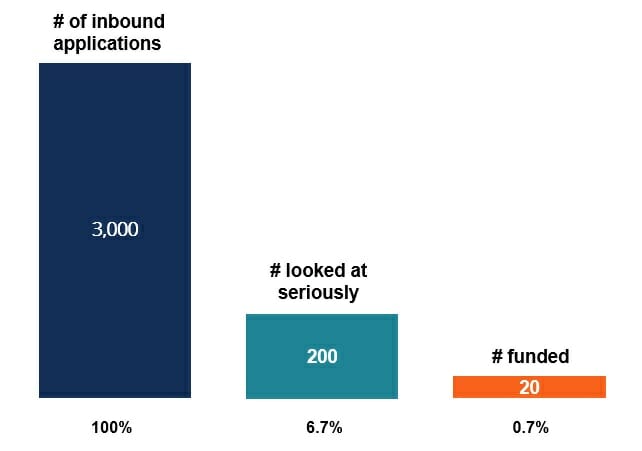

What are the odds of getting VC funding?

Understanding the Basics of VC Funding

The odds of securing VC funding depend on several factors, including the stage of your business, the industry you operate in, and the strength of your pitch. Venture capitalists typically invest in high-growth potential startups, and the competition is fierce. Here are some key points to consider:

- Stage of Business: Early-stage startups have lower odds compared to those with proven traction.

- Industry: Tech and biotech sectors often attract more VC interest.

- Pitch Quality: A compelling pitch can significantly improve your chances.

Factors Influencing VC Funding Success

Several factors can influence your likelihood of securing VC funding. Understanding these can help you better prepare for the process:

- Market Potential: VCs look for large, addressable markets.

- Team Expertise: A strong, experienced team increases credibility.

- Revenue Model: Clear, scalable revenue models are more attractive.

Common Challenges in Securing VC Funding

Securing VC funding is not without its challenges. Many startups face hurdles that can reduce their odds of success:

- Competition: High competition for limited VC funds.

- Valuation: Disagreements over company valuation can stall deals.

- Due Diligence: Extensive due diligence processes can be time-consuming.

Strategies to Improve Your Odds

There are several strategies you can employ to improve your odds of securing VC funding:

- Network: Build relationships with VCs and industry influencers.

- Proof of Concept: Demonstrate traction with a working prototype or early sales.

- Strong Financials: Present clear, realistic financial projections.

Alternative Funding Options

If VC funding proves elusive, there are alternative funding options to consider:

- Angel Investors: Individual investors who provide early-stage funding.

- Crowdfunding: Platforms like Kickstarter can help raise capital.

- Bootstrapping: Self-funding your startup to maintain control.

Frequently Asked Questions by our Community

What are the key factors investors look for in a startup seeking VC funding?

When seeking VC funding, investors primarily look for a combination of a strong business model, a scalable product or service, and a talented team. They want to see a clear value proposition that addresses a significant market need. Additionally, they evaluate the startup's traction, such as user growth, revenue, or partnerships, as proof of potential success. A well-defined go-to-market strategy and a competitive edge in the industry are also critical factors that can make a startup stand out.

How important is the pitch deck when applying for VC funding?

The pitch deck is one of the most crucial elements in securing VC funding. It serves as the first impression and must effectively communicate the startup's vision, mission, and potential. A compelling pitch deck should include a clear problem statement, the proposed solution, market size, business model, traction, and financial projections. Investors often decide within minutes whether to proceed, so the deck must be concise, visually appealing, and highlight the startup's unique selling points.

What role does the founding team play in attracting VC funding?

The founding team is a critical factor in attracting VC funding. Investors look for teams with a mix of technical expertise, industry experience, and a track record of success. A cohesive team with complementary skills demonstrates the ability to execute the business plan and overcome challenges. Additionally, the team's passion, resilience, and commitment to the startup's mission can significantly influence an investor's decision. A strong team can often compensate for early-stage gaps in traction or revenue.

How much equity should a startup be prepared to give up for VC funding?

The amount of equity a startup should give up for VC funding depends on factors such as the startup's valuation, the funding round, and the investor's expectations. Typically, early-stage startups may give up between 10% to 25% of their equity in a seed or Series A round. However, it's essential to strike a balance between securing the necessary capital and retaining enough equity to maintain control and motivation. Founders should carefully negotiate terms to ensure alignment with long-term goals and avoid excessive dilution in future funding rounds.

Leave a Reply

Our Recommended Articles