What is the Future of Venture Capital?

The future of venture capital (VC) is poised for transformation as the industry adapts to evolving market dynamics, technological advancements, and shifting investor expectations. Traditional VC models, built on high-risk, high-reward investments in startups, are being challenged by emerging trends such as decentralized finance, artificial intelligence, and sustainability-focused funding. Additionally, the rise of alternative funding mechanisms, including crowdfunding and revenue-based financing, is reshaping how startups access capital. As global economic uncertainties persist, venture capitalists are increasingly prioritizing diversification, impact investing, and data-driven decision-making. This article explores the key forces shaping the future of venture capital and how the industry is navigating an increasingly complex and competitive landscape.

What is the Future of Venture Capital?

The future of venture capital (VC) is poised for significant transformation as the industry adapts to emerging trends, technological advancements, and evolving market dynamics. With the rise of artificial intelligence (AI), blockchain, and sustainability-focused investments, venture capitalists are rethinking traditional models to stay competitive and relevant. Additionally, the increasing participation of non-traditional investors and the globalization of startups are reshaping the VC landscape. Below, we explore key aspects of the future of venture capital.

See Also Are There Historical Returns Comparing Pe and Vc?

Are There Historical Returns Comparing Pe and Vc?1. The Role of Artificial Intelligence in Venture Capital

Artificial intelligence is revolutionizing the way venture capitalists identify, evaluate, and manage investments. AI-powered tools enable data-driven decision-making by analyzing vast amounts of information to predict startup success, assess market trends, and identify high-potential opportunities. This reduces reliance on gut instincts and enhances the precision of investment strategies. Furthermore, AI can streamline due diligence processes, saving time and resources for VC firms.

2. The Rise of Blockchain and Decentralized Finance (DeFi)

Blockchain technology and decentralized finance (DeFi) are creating new opportunities for venture capital. Startups leveraging blockchain for smart contracts, tokenization, and decentralized applications (dApps) are attracting significant VC interest. DeFi platforms are also enabling peer-to-peer investments, reducing the need for traditional intermediaries. This shift is democratizing access to capital and fostering innovation in the financial sector.

See AlsoWhat Are the Requirements to Be Considered a Venture Capitalist3. Sustainability and Impact Investing

Sustainability is becoming a cornerstone of venture capital as investors prioritize environmental, social, and governance (ESG) criteria. Startups focused on clean energy, circular economies, and social impact are gaining traction. VC firms are increasingly aligning their portfolios with global sustainability goals, recognizing that responsible investing not only benefits the planet but also generates long-term financial returns.

4. Globalization of Startups and Venture Capital

The future of venture capital is increasingly global, with startups emerging from emerging markets and tech hubs worldwide. VC firms are expanding their reach to tap into untapped markets and diverse talent pools. This globalization is facilitated by digital communication tools and remote work trends, enabling investors to connect with entrepreneurs across borders. As a result, the VC ecosystem is becoming more inclusive and dynamic.

See Also Where Can I Find a List of Vc Firms in China?

Where Can I Find a List of Vc Firms in China?5. Non-Traditional Investors Entering the VC Space

The venture capital landscape is witnessing the entry of non-traditional investors, such as corporations, family offices, and crowdfunding platforms. These players bring fresh perspectives and resources, challenging traditional VC models. For instance, corporate venture capital (CVC) arms are investing in startups that align with their strategic goals, while crowdfunding platforms are enabling retail investors to participate in early-stage funding rounds.

| Trend | Impact on Venture Capital |

|---|---|

| Artificial Intelligence | Enhances decision-making and streamlines due diligence. |

| Blockchain and DeFi | Democratizes access to capital and fosters innovation. |

| Sustainability | Drives investments in ESG-focused startups. |

| Globalization | Expands opportunities in emerging markets. |

| Non-Traditional Investors | Introduces new funding sources and perspectives. |

Does venture capital have a future?

The Evolution of Venture Capital in a Changing Economy

The venture capital (VC) industry is undergoing significant transformation as the global economy evolves. The rise of emerging markets, advancements in technology, and shifts in consumer behavior are reshaping how VCs operate. Key factors influencing this evolution include:

- Globalization: Venture capital is no longer confined to Silicon Valley. Emerging markets like Southeast Asia and Africa are becoming hotspots for innovation and investment.

- Technological Disruption: Technologies such as artificial intelligence, blockchain, and biotechnology are creating new opportunities for startups, attracting VC interest.

- Regulatory Changes: Governments worldwide are introducing policies to encourage startup ecosystems, which could either boost or hinder VC activity.

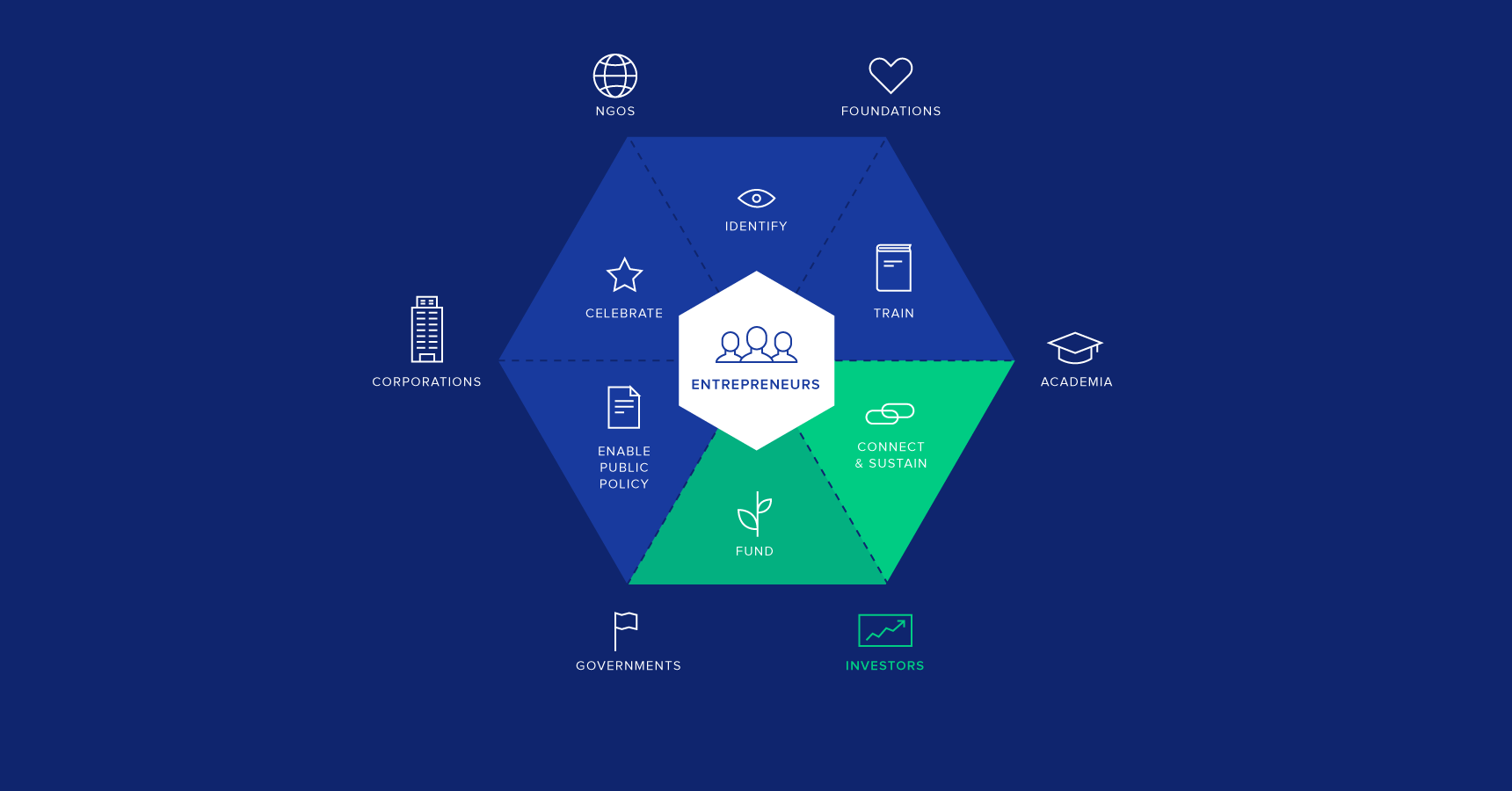

The Role of Venture Capital in Startup Ecosystems

Venture capital plays a critical role in fostering innovation by providing funding, mentorship, and networking opportunities to startups. However, its future depends on its ability to adapt to the changing needs of entrepreneurs. Key aspects include:

- Early-Stage Funding: VCs are increasingly focusing on seed and Series A rounds to identify high-potential startups early.

- Diverse Portfolios: Investors are diversifying their portfolios to include startups from underrepresented sectors and regions.

- Corporate Partnerships: Collaborations between VCs and corporations are becoming more common, providing startups with additional resources and market access.

Challenges Facing the Venture Capital Industry

Despite its potential, the VC industry faces several challenges that could impact its future. These include market saturation, high competition, and economic uncertainties. Key challenges are:

- Overvaluation of Startups: The influx of capital has led to inflated valuations, making it harder for VCs to achieve high returns.

- Regulatory Hurdles: Stricter regulations in some regions are complicating cross-border investments.

- Economic Downturns: Recessions and market volatility can reduce investor confidence and limit funding availability.

The Impact of Technology on Venture Capital

Technology is revolutionizing the way venture capital operates, from deal sourcing to portfolio management. Innovations like data analytics and AI are enabling VCs to make more informed decisions. Key impacts include:

- Data-Driven Decisions: VCs are leveraging big data to identify trends and assess startup potential more accurately.

- Automation: Tools for due diligence and financial modeling are streamlining processes, reducing costs, and improving efficiency.

- Blockchain: Blockchain technology is being explored for transparent and secure investment transactions.

Alternative Funding Models and Their Influence on Venture Capital

The rise of alternative funding models, such as crowdfunding and revenue-based financing, is challenging the traditional VC model. These alternatives offer startups more flexibility and control. Key influences include:

- Crowdfunding Platforms: Platforms like Kickstarter and Indiegogo allow startups to raise funds directly from the public, bypassing traditional VCs.

- Revenue-Based Financing: This model provides funding in exchange for a percentage of future revenue, appealing to startups wary of equity dilution.

- Angel Investors: Individual investors are playing a larger role in early-stage funding, often providing more favorable terms than VCs.

What is future now venture capital?

What is Future Now Venture Capital?

Future Now Venture Capital is a forward-thinking investment firm focused on identifying and supporting innovative startups and emerging technologies that have the potential to shape the future. This venture capital firm prioritizes disruptive ideas in sectors such as artificial intelligence, clean energy, biotechnology, and fintech. By providing funding, mentorship, and strategic guidance, Future Now Venture Capital aims to accelerate the growth of companies that are solving global challenges and creating sustainable value.

How Does Future Now Venture Capital Operate?

Future Now Venture Capital operates by leveraging a data-driven approach to identify high-potential startups. The firm follows a structured process:

- Deal Sourcing: Actively scouting for startups through networks, accelerators, and industry events.

- Due Diligence: Conducting thorough research and analysis to assess the viability and scalability of the business model.

- Investment: Providing capital in exchange for equity, often in early-stage or growth-stage companies.

- Support: Offering mentorship, access to networks, and operational expertise to help startups scale.

What Industries Does Future Now Venture Capital Focus On?

Future Now Venture Capital focuses on industries that are transforming the global economy and addressing critical challenges. Key sectors include:

- Artificial Intelligence: Startups developing AI-driven solutions for automation, data analysis, and decision-making.

- Clean Energy: Companies innovating in renewable energy, energy storage, and sustainability.

- Biotechnology: Firms advancing healthcare through breakthroughs in genomics, drug discovery, and medical devices.

- Fintech: Businesses revolutionizing financial services with blockchain, digital payments, and decentralized finance.

What Are the Benefits of Partnering with Future Now Venture Capital?

Partnering with Future Now Venture Capital offers several advantages for startups:

- Access to Capital: Significant funding to fuel growth and innovation.

- Strategic Guidance: Expert advice on scaling operations, entering new markets, and refining business models.

- Network Access: Connections to industry leaders, potential partners, and customers.

- Credibility: Association with a reputable venture capital firm enhances a startup's reputation.

What Sets Future Now Venture Capital Apart from Other Firms?

Future Now Venture Capital distinguishes itself through its forward-looking vision and commitment to sustainability. Key differentiators include:

- Focus on Impact: Prioritizing investments that generate both financial returns and positive societal impact.

- Global Perspective: Supporting startups with scalable solutions that address global challenges.

- Innovative Approach: Utilizing advanced analytics and AI to identify trends and opportunities.

- Long-Term Partnerships: Building lasting relationships with portfolio companies to ensure sustained success.

Where is venture capital going in 2025?

Emerging Sectors Attracting Venture Capital in 2025

In 2025, venture capital is expected to flow heavily into emerging sectors that promise high growth and innovation. Key areas include:

- Artificial Intelligence (AI): AI-driven solutions across industries like healthcare, finance, and logistics are attracting significant investments.

- Climate Tech: Startups focused on renewable energy, carbon capture, and sustainable agriculture are gaining traction as climate concerns grow.

- Biotechnology: Advances in gene editing, personalized medicine, and drug discovery are drawing substantial funding.

Geographic Shifts in Venture Capital Investments

The geographic distribution of venture capital is evolving, with new hubs emerging alongside traditional ones. Key trends include:

- Asia-Pacific Growth: Countries like India, Indonesia, and Vietnam are becoming hotspots for venture capital due to their expanding tech ecosystems.

- European Innovation Hubs: Cities such as Berlin, Stockholm, and Lisbon are attracting more investments in fintech and deep tech.

- U.S. Diversification: While Silicon Valley remains dominant, secondary cities like Austin and Miami are gaining attention.

Impact of Regulatory Changes on Venture Capital

Regulatory shifts are influencing where and how venture capital is deployed in 2025. Key factors include:

- Data Privacy Laws: Stricter regulations are pushing investments into compliance-focused startups.

- Tax Incentives: Governments offering tax breaks for green investments are driving capital into climate tech.

- Cross-Border Investments: Easing of trade barriers is encouraging more international venture capital flows.

Role of Corporate Venture Capital in 2025

Corporate venture capital (CVC) is playing an increasingly significant role in shaping investment trends. Key developments include:

- Strategic Partnerships: Corporations are collaborating with startups to drive innovation in areas like AI and IoT.

- Focus on Sustainability: Many CVCs are prioritizing investments in ESG (Environmental, Social, Governance) aligned startups.

- Expansion into New Markets: Corporations are using CVC to enter emerging markets and diversify their portfolios.

Technological Advancements Driving Venture Capital Trends

Technological breakthroughs are a major driver of venture capital investments in 2025. Key technologies include:

- Quantum Computing: Startups working on quantum algorithms and hardware are attracting significant funding.

- Blockchain and Web3: Decentralized finance (DeFi) and blockchain infrastructure projects continue to draw interest.

- Advanced Robotics: Innovations in automation and robotics are reshaping industries like manufacturing and logistics.

What is the future VC program?

What is the Future VC Program?

The Future VC Program is an initiative designed to foster diversity and inclusion within the venture capital (VC) industry. It aims to provide underrepresented groups with the skills, networks, and opportunities needed to succeed in VC. The program typically includes mentorship, training, and hands-on experience in venture capital firms.

- Mentorship: Participants are paired with experienced VC professionals who guide them through the intricacies of the industry.

- Training: Comprehensive workshops and seminars are conducted to teach participants about deal sourcing, due diligence, and portfolio management.

- Networking: Opportunities to connect with industry leaders, investors, and entrepreneurs are provided to build valuable relationships.

Why is the Future VC Program Important?

The Future VC Program is crucial for addressing the lack of diversity in the venture capital sector. By equipping underrepresented individuals with the necessary tools and knowledge, the program helps to create a more inclusive and equitable industry.

- Diversity: Promotes a broader range of perspectives and ideas within VC firms.

- Inclusion: Ensures that talent from all backgrounds has the opportunity to succeed in the industry.

- Innovation: Diverse teams are more likely to identify and invest in innovative startups.

Who Can Apply for the Future VC Program?

The Future VC Program is open to individuals from underrepresented groups who are passionate about venture capital. Applicants typically come from diverse backgrounds, including but not limited to, women, ethnic minorities, and individuals from non-traditional career paths.

- Eligibility: Open to individuals with a strong interest in VC, regardless of prior experience.

- Application Process: Involves submitting a resume, cover letter, and sometimes a video introduction.

- Selection Criteria: Based on potential, passion, and commitment to diversity in VC.

What are the Benefits of the Future VC Program?

Participants of the Future VC Program gain a wealth of benefits that can significantly enhance their careers in venture capital. These benefits include access to industry knowledge, professional networks, and practical experience.

- Knowledge: In-depth understanding of VC operations and investment strategies.

- Networks: Connections with top-tier VC professionals and entrepreneurs.

- Experience: Hands-on experience through internships or project-based work with VC firms.

How Does the Future VC Program Impact the VC Industry?

The Future VC Program has a profound impact on the venture capital industry by driving change towards greater diversity and inclusion. This, in turn, leads to more innovative investment strategies and better decision-making within VC firms.

- Change: Encourages VC firms to adopt more inclusive hiring practices.

- Innovation: Diverse teams bring fresh perspectives that can lead to more innovative investments.

- Performance: Studies show that diverse teams often outperform their peers, leading to better returns on investments.

Frequently Asked Questions (FAQs)

What trends are shaping the future of venture capital?

The future of venture capital is being shaped by several key trends. Artificial intelligence and machine learning are revolutionizing how investors identify and evaluate startups. Additionally, the rise of decentralized finance (DeFi) and blockchain technology is creating new opportunities for funding and liquidity. Another significant trend is the increasing focus on sustainability and impact investing, as more investors prioritize startups that address environmental and social challenges. Finally, the globalization of venture capital is expanding, with emerging markets gaining more attention from investors.

How is technology influencing venture capital investments?

Technology is playing a transformative role in the venture capital industry. Tools like data analytics and predictive modeling are enabling investors to make more informed decisions by analyzing vast amounts of data. Automation is streamlining processes such as due diligence and portfolio management, reducing costs and improving efficiency. Moreover, platforms leveraging blockchain are facilitating transparent and secure transactions, while crowdfunding and tokenization are democratizing access to venture capital investments.

What challenges does the venture capital industry face in the future?

The venture capital industry faces several challenges as it evolves. One major issue is the increasing competition for high-quality deals, which is driving up valuations and making it harder to achieve strong returns. Regulatory changes, particularly around cryptocurrencies and data privacy, could also impact investment strategies. Additionally, the industry must address concerns about diversity and inclusion, ensuring that funding is accessible to underrepresented founders. Lastly, economic uncertainties and market volatility pose risks to the stability of venture capital investments.

How will venture capital adapt to the rise of alternative funding methods?

As alternative funding methods like crowdfunding, revenue-based financing, and initial coin offerings (ICOs) gain popularity, venture capital firms are adapting to remain competitive. Many are incorporating these methods into their strategies, offering hybrid models that combine traditional equity investments with newer approaches. Additionally, venture capital firms are leveraging their expertise and networks to add value beyond just capital, helping startups navigate the complexities of alternative funding. This adaptability ensures that venture capital remains a vital part of the startup ecosystem, even as the landscape evolves.

Leave a Reply

Our Recommended Articles