What Vcs or Angel Investors Are Interested in the Food Industry

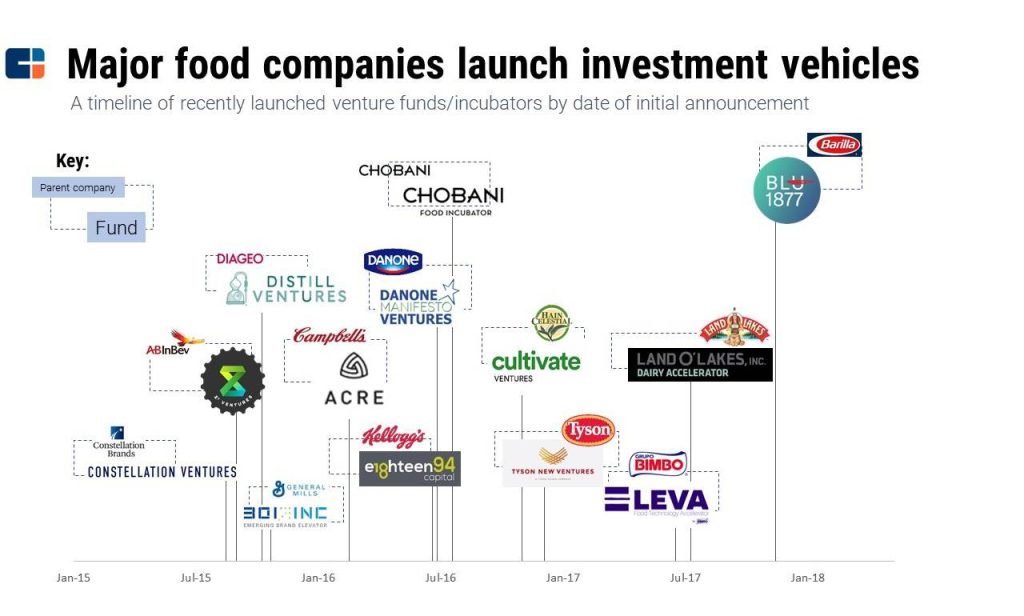

The food industry has become a hotbed for innovation, attracting significant attention from venture capitalists (VCs) and angel investors. As consumer preferences shift toward healthier, sustainable, and tech-driven food solutions, startups in this space are capturing investor interest. VCs and angel investors are particularly drawn to companies that leverage cutting-edge technologies, such as plant-based alternatives, lab-grown proteins, and AI-driven supply chain optimization. Additionally, businesses addressing sustainability, food waste reduction, and personalized nutrition are gaining traction. With the global food market evolving rapidly, investors are eager to back ventures that promise scalability, profitability, and a positive impact on both people and the planet.

What VCs or Angel Investors Are Interested in the Food Industry

The food industry has become a hotbed for innovation, attracting significant attention from venture capitalists (VCs) and angel investors. These investors are particularly drawn to startups and businesses that address emerging trends, such as sustainability, health-conscious eating, and technological advancements. Below, we explore the key areas that capture their interest.

See Also How Do You Calculate the Pro Rata Entitlement for an Existing Investor in a Company as the Company Raises a New Round of Funding

How Do You Calculate the Pro Rata Entitlement for an Existing Investor in a Company as the Company Raises a New Round of Funding1. Sustainable and Eco-Friendly Food Solutions

Investors are increasingly focused on sustainability in the food industry. Startups that offer eco-friendly packaging, plant-based alternatives, or zero-waste solutions are highly attractive. These businesses align with global efforts to reduce environmental impact and cater to the growing demand for ethical consumption. For example, companies like Beyond Meat and Impossible Foods have successfully secured funding by addressing these concerns.

| Key Focus | Examples |

|---|---|

| Eco-friendly packaging | Notpla, Loop |

| Plant-based alternatives | Beyond Meat, Impossible Foods |

| Zero-waste solutions | Too Good To Go, Olio |

2. Health and Wellness-Focused Products

The rise of health-conscious consumers has led investors to prioritize startups offering nutritious, functional, and clean-label products. Businesses that cater to specific dietary needs, such as gluten-free, keto-friendly, or probiotic-rich foods, are particularly appealing. Investors see long-term potential in brands that promote wellness and preventative health.

See Also In Private Equity and Venture Capital is Dry Powder the Difference Between Committed Capital and Paid in Capital

In Private Equity and Venture Capital is Dry Powder the Difference Between Committed Capital and Paid in Capital| Key Focus | Examples |

|---|---|

| Functional foods | KIND Snacks, RXBAR |

| Clean-label products | Siete Foods, Thrive Market |

| Diet-specific options | Keto Krisp, Gluten-Free Orchard |

3. Food Technology and Innovation

Food tech is a major area of interest for investors, particularly startups leveraging artificial intelligence (AI), blockchain, or biotechnology to improve food production, distribution, and safety. Companies that develop lab-grown meat, precision fermentation, or smart kitchen appliances are gaining traction. These innovations not only enhance efficiency but also address global challenges like food security.

| Key Focus | Examples |

|---|---|

| Lab-grown meat | Memphis Meats, Mosa Meat |

| Precision fermentation | Perfect Day, Geltor |

| Smart kitchen appliances | June Oven, Tovala |

4. Direct-to-Consumer (DTC) Food Brands

The DTC model has revolutionized the food industry, allowing brands to build direct relationships with consumers. Investors are drawn to startups that leverage e-commerce platforms, subscription services, and social media marketing to scale quickly. Companies like Daily Harvest and ButcherBox have demonstrated the potential of this model.

See Also What Vc Firms Invest in the Aviation and Aerospace Industry?

What Vc Firms Invest in the Aviation and Aerospace Industry?| Key Focus | Examples |

|---|---|

| E-commerce platforms | Thrive Market, Hungryroot |

| Subscription services | Daily Harvest, ButcherBox |

| Social media marketing | Oatly, Magic Spoon |

5. Alternative Protein Sources

With the growing demand for sustainable protein, investors are keen on startups exploring alternative protein sources. This includes insect-based proteins, algae-based products, and cultured meat. These innovations not only reduce reliance on traditional livestock but also offer environmental benefits.

| Key Focus | Examples |

|---|---|

| Insect-based proteins | Ÿnsect, Entomo Farms |

| Algae-based products | Algenuity, Triton Algae Innovations |

| Cultured meat | Eat Just, Aleph Farms |

Can you invest in the food industry?

:max_bytes(150000):strip_icc()/Food-industry-etf_final-b830a8bad5084bd29db3806e97121474.png)

Venture Capital: Who Are the Recent New Vc Firms in Fintech?

Venture Capital: Who Are the Recent New Vc Firms in Fintech?Why Invest in the Food Industry?

The food industry is one of the most stable and resilient sectors globally, as food is a basic necessity. Investing in this industry offers several advantages:

- Consistent demand: People will always need food, making it a reliable investment.

- Diverse opportunities: From agriculture to food processing and retail, there are multiple entry points for investors.

- Innovation potential: Trends like plant-based foods and sustainable packaging create new investment opportunities.

What Are the Key Sectors in the Food Industry?

The food industry is vast and includes several key sectors that investors can explore:

See AlsoWhat is the Difference Between Kickstarter and Vc Funding?- Agriculture: Investing in farming, crop production, or livestock.

- Food processing: Companies that transform raw ingredients into consumable products.

- Retail and distribution: Supermarkets, online grocery platforms, and food delivery services.

What Are the Risks of Investing in the Food Industry?

While the food industry is generally stable, it is not without risks. Investors should be aware of the following:

- Market fluctuations: Changes in commodity prices can impact profitability.

- Regulatory challenges: Strict food safety and labeling regulations can increase costs.

- Supply chain disruptions: Natural disasters or geopolitical issues can affect production and distribution.

How Can You Start Investing in the Food Industry?

To begin investing in the food industry, follow these steps:

- Research: Understand the market trends and identify promising sectors.

- Choose your investment method: Options include stocks, ETFs, or direct investments in food companies.

- Diversify: Spread your investments across different sectors to minimize risk.

What Are the Emerging Trends in the Food Industry?

The food industry is evolving rapidly, and investors should keep an eye on these trends:

- Plant-based foods: Growing demand for vegan and vegetarian options.

- Sustainability: Focus on eco-friendly packaging and reducing food waste.

- Technology integration: Use of AI and blockchain for supply chain transparency and efficiency.

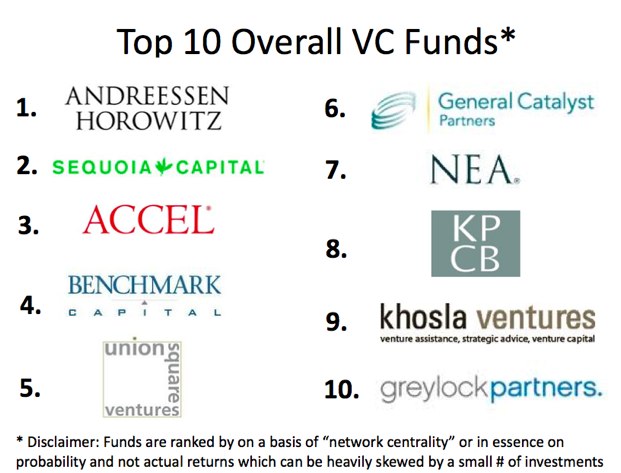

Who are the Tier 1 VCs?

What Defines a Tier 1 Venture Capital Firm?

Tier 1 venture capital firms are distinguished by their proven track record, significant capital under management, and high-profile investments in successful startups. These firms often lead funding rounds and have a reputation for backing companies that achieve substantial exits, such as IPOs or acquisitions. Key characteristics include:

- Global recognition and influence in the startup ecosystem.

- Access to top-tier entrepreneurs and deal flow.

- A history of high returns on investments.

Examples of Tier 1 Venture Capital Firms

Some of the most prominent Tier 1 VC firms include:

- Sequoia Capital: Known for early investments in companies like Apple, Google, and Airbnb.

- Andreessen Horowitz (a16z): Famous for backing Facebook, Twitter, and Coinbase.

- Accel: Early investor in Facebook, Slack, and Dropbox.

- Kleiner Perkins: Backed Amazon, Google, and Uber.

- Benchmark: Known for investments in eBay, Twitter, and Uber.

How Tier 1 VCs Differ from Other Investors

Tier 1 VCs stand out due to their strategic advantages and resources. Unlike smaller or newer firms, they offer:

- Extensive networks of industry experts and advisors.

- Operational support to help startups scale effectively.

- Brand credibility that attracts follow-on investors.

The Role of Tier 1 VCs in Startup Ecosystems

Tier 1 VCs play a pivotal role in shaping the startup landscape by:

- Providing early-stage funding to high-potential startups.

- Facilitating global expansion through their networks.

- Driving innovation by supporting disruptive technologies.

Challenges Faced by Tier 1 VCs

Despite their success, Tier 1 VCs face several challenges, including:

- Intense competition for top deals in saturated markets.

- High expectations from limited partners (LPs) for consistent returns.

- Market volatility impacting investment outcomes.

Who is the biggest angel investor?

Who is Considered the Biggest Angel Investor?

The title of the biggest angel investor is often attributed to Ron Conway, a prominent figure in Silicon Valley. Known as the Godfather of Silicon Valley, Conway has invested in over 1,000 startups, including major companies like Google, Facebook, and Twitter. His ability to identify and support groundbreaking startups early on has solidified his reputation as one of the most influential angel investors globally.

- Ron Conway has been active in angel investing since the 1990s.

- He is known for his hands-on approach, providing mentorship and networking opportunities to founders.

- Conway's investments span across various industries, including technology, social media, and e-commerce.

What Makes Ron Conway Stand Out as an Angel Investor?

Ron Conway stands out due to his extensive network, strategic investments, and mentorship. Unlike many investors who focus solely on financial returns, Conway emphasizes building long-term relationships with founders. His ability to connect startups with other investors, industry leaders, and potential partners has been a key factor in his success.

- Conway's network includes top executives and venture capitalists in Silicon Valley.

- He often invests in startups during their seed or early stages, providing crucial funding when it is most needed.

- His mentorship has helped numerous startups scale and achieve significant milestones.

Which Companies Has Ron Conway Invested In?

Ron Conway has invested in some of the most successful companies in the tech industry. His portfolio includes Google, Facebook, Twitter, PayPal, and Airbnb. These investments have not only generated substantial returns but have also shaped the modern tech landscape.

- Google: Conway invested in the search giant during its early days, contributing to its growth into a global powerhouse.

- Facebook: His early investment in the social media platform helped it become one of the most influential companies in the world.

- Twitter: Conway's support was instrumental in Twitter's rise as a leading social media platform.

How Does Ron Conway Choose His Investments?

Ron Conway's investment strategy focuses on founders and innovative ideas. He looks for passionate entrepreneurs with a clear vision and the potential to disrupt industries. Conway also prioritizes startups that can scale quickly and have a significant impact on their respective markets.

- He evaluates the founder's passion, drive, and ability to execute their vision.

- Conway seeks startups with innovative solutions that address real-world problems.

- He prefers companies with the potential to scale globally and achieve rapid growth.

What is Ron Conway's Impact on the Startup Ecosystem?

Ron Conway's impact on the startup ecosystem is profound. Through his investments and mentorship, he has helped shape the trajectory of numerous companies and industries. His contributions have not only driven innovation but have also inspired a new generation of entrepreneurs and investors.

- Conway's investments have led to the creation of thousands of jobs worldwide.

- He has played a key role in fostering innovation in technology and beyond.

- His mentorship has empowered countless founders to achieve their goals and build successful companies.

What industries have the most VC funding?

Technology and Software Industry

The technology and software industry consistently attracts the most venture capital (VC) funding due to its rapid innovation and scalability. Key areas include:

- Artificial Intelligence (AI) and machine learning startups.

- SaaS (Software as a Service) platforms for businesses.

- Cybersecurity solutions to protect digital assets.

Healthcare and Biotech Industry

The healthcare and biotech industry is a major recipient of VC funding, driven by advancements in medical technology and treatments. Key areas include:

- Biopharmaceuticals for drug discovery and development.

- Telemedicine platforms for remote healthcare services.

- Medical devices and diagnostic tools.

Fintech Industry

The fintech industry has seen significant VC investment due to its disruption of traditional financial services. Key areas include:

- Digital payments and mobile banking solutions.

- Blockchain and cryptocurrency platforms.

- Personal finance and investment apps.

E-commerce and Retail Industry

The e-commerce and retail industry has experienced a surge in VC funding, especially with the rise of online shopping. Key areas include:

- Direct-to-consumer (DTC) brands.

- Marketplace platforms connecting buyers and sellers.

- Supply chain and logistics innovations.

Clean Energy and Sustainability Industry

The clean energy and sustainability industry is gaining traction in VC funding as the world shifts toward greener solutions. Key areas include:

- Renewable energy technologies like solar and wind.

- Electric vehicles (EVs) and battery storage.

- Waste management and recycling innovations.

Frequently Asked Questions (FAQs)

What types of food industry startups attract VC and angel investor interest?

Venture capitalists (VCs) and angel investors are particularly drawn to startups in the food industry that demonstrate innovation, scalability, and a strong market potential. This includes companies focused on plant-based foods, alternative proteins, sustainable packaging, and food tech solutions like meal kits or delivery platforms. Startups that address health and wellness trends, such as functional foods or personalized nutrition, also tend to attract significant attention. Additionally, businesses with a clear competitive advantage, such as proprietary technology or a unique supply chain, are more likely to secure funding.

How do VCs and angel investors evaluate food industry startups?

When evaluating food industry startups, VCs and angel investors focus on several key factors. These include the team's expertise and track record, the market size and growth potential, and the startup's ability to solve a real problem in the food industry. Investors also look for evidence of traction, such as early sales, partnerships, or customer feedback. Financial metrics like unit economics and profit margins are critical, as they indicate the startup's potential for long-term profitability. Finally, investors assess the startup's scalability and its ability to adapt to changing consumer preferences and market conditions.

What are the current trends in food industry investments?

Current trends in food industry investments reflect a growing interest in sustainability, health-conscious products, and technological innovation. Investors are increasingly funding startups that focus on plant-based and lab-grown meat alternatives, as well as those developing eco-friendly packaging solutions. There is also a surge in interest around functional foods that offer additional health benefits, such as immune support or gut health. Additionally, food delivery platforms and meal kit services continue to attract investment due to their convenience and alignment with modern consumer lifestyles. Startups leveraging AI and data analytics to optimize supply chains or personalize customer experiences are also gaining traction.

What challenges do food industry startups face when seeking funding?

Food industry startups often face several challenges when seeking funding from VCs and angel investors. One major hurdle is demonstrating scalability, as many food products require significant infrastructure and distribution networks. Startups must also prove their ability to achieve profitability in a highly competitive market. Another challenge is navigating regulatory requirements, particularly for novel food products like lab-grown meat or genetically modified ingredients. Additionally, investors may be cautious about startups with high capital expenditure needs or those operating in niche markets with limited growth potential. To overcome these challenges, startups need to present a clear business model, a strong value proposition, and a well-defined path to market success.

Leave a Reply

Our Recommended Articles