Which Venture Capital Firms Invest in Online Marketplaces?

The rise of online marketplaces has transformed the way businesses and consumers interact, creating vast opportunities for innovation and growth. As these platforms continue to dominate various industries, venture capital firms have taken notice, investing heavily in startups that promise scalability and disruption. Identifying which venture capital firms actively fund online marketplaces is crucial for entrepreneurs seeking funding and for investors looking to understand market trends. This article explores the key players in the venture capital space, their investment strategies, and the types of online marketplaces they are backing, providing valuable insights into the evolving landscape of digital commerce and startup financing.

-

Which Venture Capital Firms Invest in Online Marketplaces?

- 1. Top Venture Capital Firms Investing in Online Marketplaces

- 2. Criteria Venture Capital Firms Use to Evaluate Online Marketplaces

- 3. Notable Investments by Venture Capital Firms in Online Marketplaces

- 4. Emerging Trends in Online Marketplace Investments

- 5. Challenges Faced by Venture Capital Firms in Online Marketplace Investments

-

Key Venture Capital Firms Backing Online Marketplaces

- Why Do Venture Capital Firms Invest in Online Marketplaces?

- Top Venture Capital Firms Specializing in Online Marketplaces

- What Criteria Do Venture Capital Firms Use to Evaluate Online Marketplaces?

- Emerging Trends in Venture Capital Investments for Online Marketplaces

- Challenges Faced by Venture Capital Firms Investing in Online Marketplaces

-

Frequently Asked Questions (FAQs)

- What types of online marketplaces do venture capital firms typically invest in?

- Which venture capital firms are known for investing in online marketplaces?

- What criteria do venture capital firms use to evaluate online marketplace investments?

- How do venture capital firms support online marketplace startups beyond funding?

Which Venture Capital Firms Invest in Online Marketplaces?

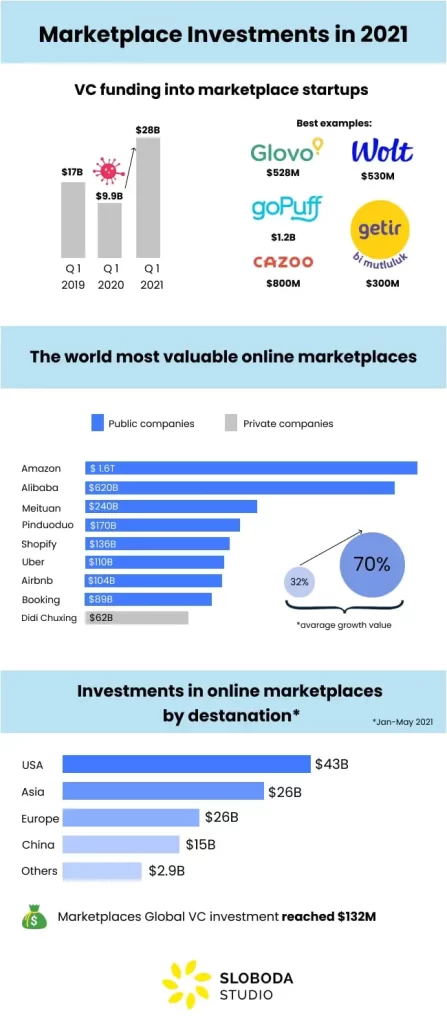

Online marketplaces have become a cornerstone of the digital economy, connecting buyers and sellers across various industries. Venture capital (VC) firms play a crucial role in funding these platforms, enabling them to scale and innovate. Below, we explore the key VC firms that invest in online marketplaces and provide detailed insights into their strategies and notable investments.

See Also Which Venture Capitalist Firms Offer Analyst Internship Positions for Undergraduates

Which Venture Capitalist Firms Offer Analyst Internship Positions for Undergraduates1. Top Venture Capital Firms Investing in Online Marketplaces

Several prominent VC firms have shown a strong interest in online marketplaces. These firms typically focus on platforms that demonstrate high growth potential, scalability, and innovative business models. Some of the leading VC firms include Andreessen Horowitz, Sequoia Capital, Accel, Benchmark, and Tiger Global Management. These firms have a track record of investing in successful marketplace startups such as Airbnb, Etsy, and Fiverr.

2. Criteria Venture Capital Firms Use to Evaluate Online Marketplaces

VC firms evaluate online marketplaces based on several key criteria. These include market size, growth potential, unit economics, competitive advantage, and team expertise. A marketplace with a large addressable market, strong network effects, and a scalable business model is more likely to attract VC funding. Additionally, firms look for platforms that can achieve profitability while maintaining rapid growth.

See Also Which Vc Firms Are the Best to Work With?

Which Vc Firms Are the Best to Work With?3. Notable Investments by Venture Capital Firms in Online Marketplaces

Many VC firms have made significant investments in online marketplaces. For example, Andreessen Horowitz invested in OfferUp, a peer-to-peer marketplace for buying and selling goods locally. Sequoia Capital backed DoorDash, a food delivery marketplace, while Accel supported Etsy, a global marketplace for handmade and vintage items. These investments highlight the diverse sectors within the online marketplace ecosystem.

4. Emerging Trends in Online Marketplace Investments

VC firms are increasingly focusing on niche and vertical marketplaces that cater to specific industries or demographics. Examples include Faire, a wholesale marketplace for retailers, and Depop, a fashion resale marketplace. Additionally, there is growing interest in blockchain-based marketplaces and decentralized platforms, which offer transparency and reduced transaction costs.

See Also What Are the Best Performing Venture Capital Funds of All Time

What Are the Best Performing Venture Capital Funds of All Time5. Challenges Faced by Venture Capital Firms in Online Marketplace Investments

Investing in online marketplaces comes with its own set of challenges. These include high competition, regulatory hurdles, and customer acquisition costs. VC firms must also navigate the risks associated with market saturation and platform dependency. Despite these challenges, the potential for high returns continues to drive investment in this sector.

| VC Firm | Notable Marketplace Investment | Sector |

|---|---|---|

| Andreessen Horowitz | OfferUp | Peer-to-Peer |

| Sequoia Capital | DoorDash | Food Delivery |

| Accel | Etsy | Handmade Goods |

| Benchmark | Uber | Ride-Sharing |

| Tiger Global Management | Fiverr | Freelance Services |

Key Venture Capital Firms Backing Online Marketplaces

Online marketplaces have become a cornerstone of the digital economy, connecting buyers and sellers across the globe. Venture capital firms play a pivotal role in fueling the growth of these platforms by providing the necessary funding and strategic guidance. Some of the most prominent venture capital firms investing in online marketplaces include Andreessen Horowitz, Sequoia Capital, Accel, Bessemer Venture Partners, and Tiger Global Management. These firms have a proven track record of identifying high-potential startups and helping them scale into global leaders. Their investments often focus on platforms that demonstrate strong unit economics, innovative technology, and the ability to disrupt traditional industries.

See Also How much does a corporation pay to have TechStars power a custom accelerator program?

How much does a corporation pay to have TechStars power a custom accelerator program?Why Do Venture Capital Firms Invest in Online Marketplaces?

Venture capital firms are drawn to online marketplaces because of their scalability and network effects. Unlike traditional businesses, online marketplaces can grow exponentially with minimal incremental costs. As more users join the platform, the value of the marketplace increases for all participants, creating a virtuous cycle. Additionally, these platforms often generate recurring revenue streams through transaction fees, subscriptions, or advertising, making them attractive investment opportunities. Venture capitalists also see the potential for online marketplaces to disrupt traditional industries by offering more efficient, transparent, and user-friendly alternatives.

Top Venture Capital Firms Specializing in Online Marketplaces

Several venture capital firms have established themselves as leaders in the online marketplace space. Andreessen Horowitz, for instance, has backed companies like Airbnb and Instacart, which have revolutionized their respective industries. Sequoia Capital is another major player, having invested in DoorDash and Gojek. Accel has a strong portfolio that includes Etsy and Flipkart, while Bessemer Venture Partners has supported LinkedIn and Shopify. These firms bring not only capital but also industry expertise, mentorship, and networking opportunities to help startups succeed.

See Also Which Are the Tier 1 Vc Firms in the Us?

Which Are the Tier 1 Vc Firms in the Us?What Criteria Do Venture Capital Firms Use to Evaluate Online Marketplaces?

When evaluating online marketplaces, venture capital firms consider several key factors. Market size is a critical determinant, as investors seek platforms that can tap into large, growing markets. Unit economics are also scrutinized to ensure the business can achieve profitability at scale. The strength of the founding team and their ability to execute the vision is another important consideration. Additionally, venture capitalists look for evidence of traction, such as user growth, engagement metrics, and revenue. Finally, the competitive landscape is assessed to determine whether the marketplace has a unique value proposition that sets it apart from rivals.

Emerging Trends in Venture Capital Investments for Online Marketplaces

The landscape of venture capital investments in online marketplaces is constantly evolving. One notable trend is the rise of niche marketplaces that cater to specific industries or demographics, such as Faire for wholesale goods or Depop for vintage fashion. Another trend is the increasing focus on sustainability and social impact, with investors backing platforms that promote ethical consumption or reduce waste. Additionally, geographic diversification is becoming more common, as venture capitalists seek opportunities in emerging markets where online marketplaces are still in their infancy. Finally, technology-driven innovations, such as AI-powered recommendation engines and blockchain-based payment systems, are attracting significant investment.

Challenges Faced by Venture Capital Firms Investing in Online Marketplaces

While online marketplaces offer immense potential, they also present unique challenges for venture capital firms. One major challenge is regulatory scrutiny, as governments around the world are increasingly scrutinizing the practices of digital platforms. Competition is another hurdle, as the barrier to entry for online marketplaces is relatively low, leading to crowded markets. Customer acquisition costs can also be high, especially in the early stages, making it difficult for startups to achieve profitability. Additionally, venture capitalists must navigate the complexities of scaling globally, which requires adapting to different cultures, regulations, and market conditions. Despite these challenges, the rewards of investing in successful online marketplaces can be substantial, making them a compelling opportunity for venture capital firms.

Frequently Asked Questions (FAQs)

What types of online marketplaces do venture capital firms typically invest in?

Venture capital firms often invest in a wide range of online marketplaces, including those focused on e-commerce, peer-to-peer services, B2B platforms, and niche markets. These firms look for platforms that demonstrate strong growth potential, scalability, and a unique value proposition. For example, marketplaces like Etsy (handmade goods) or Fiverr (freelance services) have attracted significant venture capital due to their innovative approaches and large addressable markets.

Which venture capital firms are known for investing in online marketplaces?

Several prominent venture capital firms are known for their investments in online marketplaces. Firms like Andreessen Horowitz, Sequoia Capital, Accel, and Bessemer Venture Partners have a strong track record of backing successful marketplace startups. These firms often seek out platforms with disruptive business models, strong unit economics, and the potential to dominate their respective markets.

What criteria do venture capital firms use to evaluate online marketplace investments?

Venture capital firms evaluate online marketplaces based on several key criteria, including market size, growth trajectory, user engagement, and competitive advantage. They also assess the strength of the founding team, the platform's ability to scale, and its monetization strategy. Additionally, firms look for marketplaces with strong network effects, where the value of the platform increases as more users join.

How do venture capital firms support online marketplace startups beyond funding?

Beyond providing capital, venture capital firms offer strategic guidance, industry connections, and operational expertise to help online marketplace startups succeed. They often assist with scaling operations, refining business models, and entering new markets. Additionally, firms may provide access to their network of mentors, advisors, and potential partners, which can be invaluable for early-stage companies looking to grow rapidly.

Leave a Reply

Our Recommended Articles