Who Are the Top Venture Capital Firms in the Biotech Industry?

The biotechnology industry is a cornerstone of innovation, driving advancements in healthcare, agriculture, and environmental sustainability. As biotech startups push the boundaries of science, venture capital (VC) firms play a pivotal role in fueling their growth. These firms provide not only financial backing but also strategic guidance, industry expertise, and access to networks that help startups scale. Identifying the top venture capital firms in biotech is crucial for entrepreneurs seeking funding and for investors looking to understand the landscape. This article explores the leading VC firms shaping the biotech sector, highlighting their investment strategies, notable portfolios, and contributions to groundbreaking discoveries.

- Who Are the Top Venture Capital Firms in the Biotech Industry?

- What are the top 5 venture capital firms?

- Who are tier 1 VCs?

-

What are the top biotech hedge funds?

- What makes Baker Bros. Advisors a top biotech hedge fund?

- Why is Perceptive Advisors highly regarded in the biotech space?

- What sets RA Capital Management apart in biotech investing?

- How does Deerfield Management contribute to the biotech sector?

- What is Casdin Capital’s approach to biotech investing?

- Frequently Asked Questions by our Community

Who Are the Top Venture Capital Firms in the Biotech Industry?

The biotech industry is one of the most innovative and rapidly evolving sectors, attracting significant investment from venture capital (VC) firms. These firms play a crucial role in funding groundbreaking research, development, and commercialization of biotechnological advancements. Below, we explore the top venture capital firms in the biotech industry, their investment strategies, and their impact on the sector.

See AlsoWho Are the Biggest Vc Firms in Agriculture?1. What Defines a Top Venture Capital Firm in Biotech?

A top venture capital firm in the biotech industry is characterized by its ability to identify and invest in high-potential startups and companies that are developing cutting-edge technologies or therapies. These firms typically have a strong track record of successful exits, such as IPOs or acquisitions, and possess deep expertise in the life sciences. They also provide strategic guidance to portfolio companies, helping them navigate regulatory challenges and scale their operations.

2. Which Venture Capital Firms Lead in Biotech Investments?

Several venture capital firms have established themselves as leaders in biotech investments. Some of the most prominent include:

- Flagship Pioneering: Known for creating and funding companies like Moderna.

- Andreessen Horowitz (a16z): A major player in tech and biotech investments.

- ARCH Venture Partners: Focused on early-stage biotech and life sciences companies.

- OrbiMed: One of the largest healthcare-dedicated investment firms globally.

- Third Rock Ventures: Specializes in launching and building biotech companies.

Who Are the Most Active Vcs in Dallas, Texas?

Who Are the Most Active Vcs in Dallas, Texas?3. How Do These Firms Choose Their Investments?

Top biotech VC firms employ rigorous due diligence processes to select investments. They evaluate factors such as the scientific validity of the technology, the experience of the founding team, market potential, and regulatory pathways. Additionally, they often look for companies addressing unmet medical needs or those with the potential to disrupt existing markets.

4. What Are the Key Trends in Biotech Venture Capital?

The biotech VC landscape is shaped by several key trends:

- Gene and Cell Therapy: Significant investments in companies developing gene-editing technologies like CRISPR.

- Artificial Intelligence in Drug Discovery: AI-driven platforms are attracting substantial funding.

- Personalized Medicine: Tailored treatments based on genetic profiles are a growing focus.

- Digital Health: Integration of technology and healthcare is gaining traction.

- Sustainability in Biotech: Firms are increasingly supporting environmentally sustainable biotech solutions.

Do Small Venture Funds 10m Also Follow the 2 20 Model or Do They Follow Other Models to Make the Economics Work at Small Fund Sizes

Do Small Venture Funds 10m Also Follow the 2 20 Model or Do They Follow Other Models to Make the Economics Work at Small Fund Sizes5. What Challenges Do Biotech VC Firms Face?

Despite the opportunities, biotech VC firms face several challenges:

- High Risk: Biotech investments often involve long development timelines and high failure rates.

- Regulatory Hurdles: Navigating complex regulatory environments can be time-consuming and costly.

- Capital Intensity: Biotech startups require significant funding for R&D and clinical trials.

- Market Competition: The sector is highly competitive, with many firms vying for the same opportunities.

| Firm | Focus Area | Notable Investments |

|---|---|---|

| Flagship Pioneering | Biotech Innovation | Moderna, Indigo Agriculture |

| Andreessen Horowitz | Tech & Biotech | Freenome, Sana Biotechnology |

| ARCH Venture Partners | Early-Stage Biotech | Juno Therapeutics, Illumina |

| OrbiMed | Healthcare & Biotech | Intarcia Therapeutics, BeiGene |

| Third Rock Ventures | Biotech Startups | Editas Medicine, Blueprint Medicines |

What are the top 5 venture capital firms?

Where Can I Find a List of Vc Firms in China?

Where Can I Find a List of Vc Firms in China?1. Sequoia Capital

Sequoia Capital is one of the most renowned venture capital firms globally, known for its early investments in companies like Apple, Google, and Airbnb. The firm focuses on sectors such as technology, healthcare, and energy. Key highlights include:

- Global presence with offices in the U.S., China, India, and Israel.

- Investments in unicorn startups like WhatsApp, Stripe, and Zoom.

- A strong emphasis on long-term partnerships with founders.

2. Andreessen Horowitz (a16z)

Andreessen Horowitz, commonly referred to as a16z, is a leading venture capital firm specializing in technology startups. The firm has backed companies like Facebook, Twitter, and Coinbase. Key aspects include:

See Also Do Venture Capitalists Reimburse Travel Expenses for Out of Town Entrepreneurs

Do Venture Capitalists Reimburse Travel Expenses for Out of Town Entrepreneurs- Focus on emerging technologies such as blockchain, AI, and biotech.

- A unique operational support model for portfolio companies.

- Active involvement in policy and regulatory advocacy for tech innovation.

3. Accel

Accel is a prominent venture capital firm with a strong track record in early-stage investments. It is known for backing companies like Facebook, Slack, and Dropbox. Key features include:

- A global investment strategy with a focus on the U.S., Europe, and India.

- Specialization in software, SaaS, and consumer internet sectors.

- Commitment to founder-friendly practices and mentorship.

4. Kleiner Perkins

Kleiner Perkins is a legendary venture capital firm that has played a pivotal role in the growth of companies like Amazon, Google, and Genentech. The firm is known for:

- Investing in groundbreaking technologies and life sciences.

- A strong focus on sustainability and green tech initiatives.

- Building long-term value through strategic guidance.

5. Benchmark

Benchmark is a highly respected venture capital firm known for its early investments in companies like Uber, Twitter, and eBay. The firm stands out for:

- A flat partnership structure that ensures equal decision-making.

- Focus on early-stage investments in technology-driven startups.

- A reputation for high returns and successful exits.

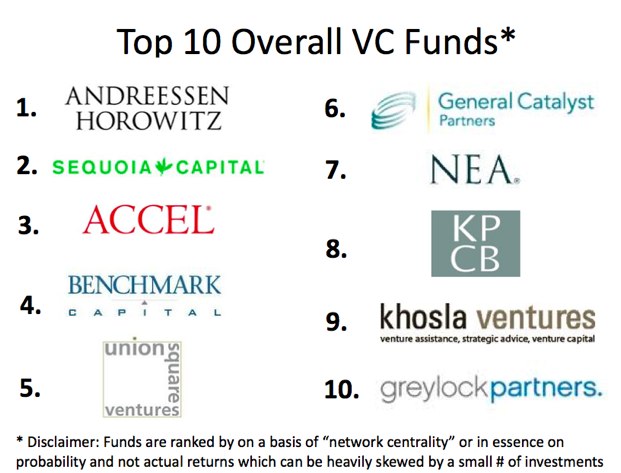

Who are tier 1 VCs?

What Defines Tier 1 Venture Capital Firms?

Tier 1 venture capital (VC) firms are the most prestigious and influential investors in the startup ecosystem. They are characterized by their ability to consistently identify and fund high-potential startups, often leading to significant returns. These firms typically have:

- Extensive track records of successful investments in unicorn companies.

- Large fund sizes, often exceeding billions of dollars, allowing them to make substantial investments.

- Global reach, with offices and networks spanning multiple continents.

Top Tier 1 Venture Capital Firms in the Industry

Some of the most well-known Tier 1 VCs include firms like Sequoia Capital, Andreessen Horowitz, and Accel. These firms are recognized for:

- Sequoia Capital: Known for early investments in Apple, Google, and Airbnb.

- Andreessen Horowitz: Famous for backing companies like Facebook, Twitter, and Slack.

- Accel: Notable for its investments in Facebook, Dropbox, and Atlassian.

How Tier 1 VCs Differ from Other Venture Capital Firms

Tier 1 VCs stand out due to their unique characteristics, which include:

- Access to top-tier deals: They often get first dibs on the most promising startups.

- Strong brand reputation: Their involvement can significantly boost a startup's credibility.

- Value-added services: They provide mentorship, strategic guidance, and extensive networks.

The Investment Strategies of Tier 1 Venture Capital Firms

Tier 1 VCs employ sophisticated investment strategies that set them apart, such as:

- Focus on early-stage investments: They often invest in seed and Series A rounds to maximize returns.

- Diversification across sectors: They invest in a wide range of industries, from tech to healthcare.

- Long-term vision: They prioritize startups with the potential for exponential growth over decades.

Why Startups Seek Funding from Tier 1 VCs

Startups often aim to secure funding from Tier 1 VCs because of the numerous advantages, including:

- Access to capital: These firms provide substantial funding to fuel rapid growth.

- Strategic partnerships: Their networks can open doors to key industry players.

- Enhanced credibility: Being backed by a Tier 1 VC can attract additional investors and talent.

What are the top biotech hedge funds?

The top biotech hedge funds are known for their expertise in investing in biotechnology and pharmaceutical companies. These funds focus on identifying high-growth opportunities in the biotech sector, leveraging their deep understanding of science, medicine, and market trends. Below is a list of some of the most prominent biotech hedge funds:

- Baker Bros. Advisors: One of the most well-known biotech hedge funds, specializing in long-term investments in biotechnology and life sciences companies.

- Perceptive Advisors: Known for its focus on early-stage biotech companies and its ability to identify groundbreaking therapies.

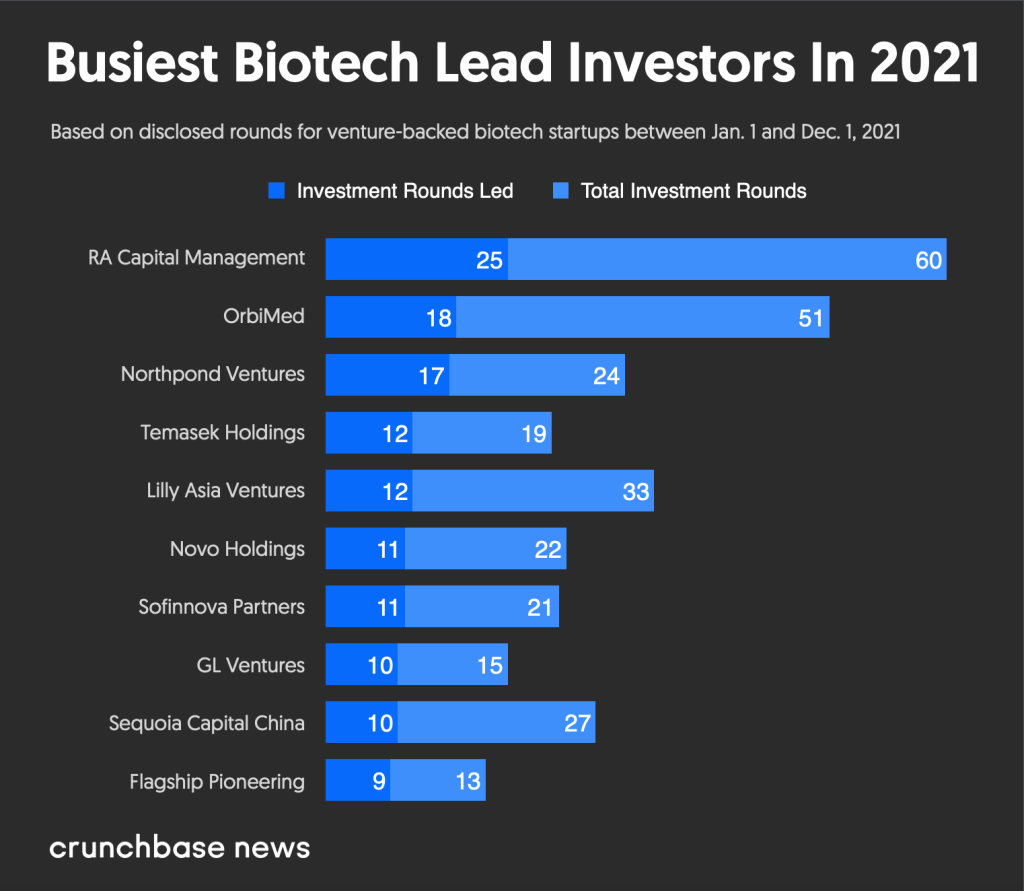

- RA Capital Management: A leading fund that invests in both public and private biotech companies, with a strong emphasis on innovative medical technologies.

- Deerfield Management: Focuses on healthcare and biotech investments, often supporting companies with transformative treatments.

- Casdin Capital: Specializes in life sciences and biotechnology, with a focus on companies driving innovation in genomics and personalized medicine.

What makes Baker Bros. Advisors a top biotech hedge fund?

Baker Bros. Advisors stands out due to its long-term investment strategy and deep expertise in the biotech sector. The fund is known for:

- Long-term holdings: They often hold positions in companies for many years, allowing them to benefit from significant growth.

- Scientific expertise: The team includes professionals with strong backgrounds in science and medicine, enabling them to evaluate complex biotech innovations.

- High-profile investments: They have invested in some of the most successful biotech companies, such as Seagen and Incyte.

Why is Perceptive Advisors highly regarded in the biotech space?

Perceptive Advisors is renowned for its ability to identify and invest in early-stage biotech companies with high potential. Key factors include:

- Early-stage focus: They specialize in investing in companies during their early development phases, often before they become widely recognized.

- Strong track record: Their portfolio includes successful investments in companies like Moderna and Beam Therapeutics.

- Deep industry knowledge: The fund’s team has extensive experience in biotech and healthcare, allowing them to make informed investment decisions.

What sets RA Capital Management apart in biotech investing?

RA Capital Management is distinguished by its unique approach to biotech investing, which includes:

- Public and private investments: They invest in both public and private biotech companies, providing flexibility and access to a wide range of opportunities.

- Focus on innovation: The fund prioritizes companies developing cutting-edge medical technologies and therapies.

- Active involvement: RA Capital often takes an active role in guiding the companies they invest in, helping them achieve their goals.

How does Deerfield Management contribute to the biotech sector?

Deerfield Management is known for its significant contributions to the biotech sector through:

- Transformative treatments: They focus on investing in companies that are developing treatments with the potential to revolutionize healthcare.

- Strategic partnerships: Deerfield often collaborates with academic institutions and research organizations to support innovation.

- Diverse portfolio: Their investments span a wide range of therapeutic areas, from oncology to rare diseases.

What is Casdin Capital’s approach to biotech investing?

Casdin Capital is recognized for its specialized focus on life sciences and biotechnology. Their approach includes:

- Genomics and personalized medicine: They invest heavily in companies advancing genomics and personalized medicine, such as CRISPR Therapeutics.

- Innovation-driven strategy: The fund seeks out companies that are pushing the boundaries of medical science.

- Expert team: Casdin Capital’s team includes professionals with deep expertise in both finance and biotechnology.

Frequently Asked Questions by our Community

What are the top venture capital firms investing in the biotech industry?

The top venture capital firms in the biotech industry include Andreessen Horowitz, Flagship Pioneering, ARCH Venture Partners, and Third Rock Ventures. These firms are known for their significant investments in innovative biotech startups and their ability to identify groundbreaking technologies. They often focus on areas such as gene therapy, precision medicine, and artificial intelligence in drug discovery. Their portfolios include some of the most promising companies in the biotech sector, making them key players in shaping the future of healthcare.

How do venture capital firms evaluate biotech startups for investment?

Venture capital firms evaluate biotech startups based on several critical factors. These include the scientific validity of the technology, the experience and expertise of the founding team, and the potential for market disruption. Additionally, they assess the intellectual property portfolio, the scalability of the solution, and the regulatory pathway. Firms like Flagship Pioneering and ARCH Venture Partners often collaborate with scientists and industry experts to conduct thorough due diligence before making investment decisions.

What role do venture capital firms play in the growth of biotech companies?

Venture capital firms play a pivotal role in the growth of biotech companies by providing not only financial support but also strategic guidance and access to a vast network of industry experts. They help startups navigate the complex regulatory landscape, connect with potential partners, and scale their operations. Firms like Third Rock Ventures are known for their hands-on approach, often taking an active role in shaping the company's direction and ensuring its long-term success.

What are the risks associated with venture capital investments in biotech?

Investing in biotech startups through venture capital comes with significant risks, primarily due to the high failure rate of early-stage companies. The lengthy and costly clinical trial process, regulatory hurdles, and the uncertainty of scientific breakthroughs are major challenges. Additionally, the volatility of the biotech market can impact returns. However, firms like Andreessen Horowitz mitigate these risks by diversifying their portfolios and investing in companies with strong scientific foundations and experienced management teams.

Leave a Reply

Our Recommended Articles