Why is Ltv Supposed to Be at Least 3x of Cac Wouldnt Ltv of 1 5x Cac Mean 50 Irr for the Investor Assuming Lifetime is 12 Months

Understanding the relationship between Lifetime Value (LTV) and Customer Acquisition Cost (CAC) is crucial for evaluating business sustainability and investor returns. A common benchmark suggests that LTV should be at least 3x CAC to ensure profitability and scalability. However, the question arises: wouldn’t an LTV of 1.5x CAC still yield a 50% Internal Rate of Return (IRR) for investors, assuming a 12-month customer lifetime? This article explores the rationale behind the 3x rule, examines the implications of a lower LTV-to-CAC ratio, and analyzes how such metrics impact investor returns and long-term business viability.

- Why is LTV Supposed to Be at Least 3x of CAC? Wouldn’t LTV of 1.5x CAC Mean 50% IRR for the Investor Assuming a Lifetime of 12 Months?

- Why is 3x LTV CAC good?

- What is the LTV CAC lifetime value?

- What is the relationship between LTV and CAC?

- What is the golden ratio for LTV CAC?

- Frequently Asked Questions (FAQs)

Why is LTV Supposed to Be at Least 3x of CAC? Wouldn’t LTV of 1.5x CAC Mean 50% IRR for the Investor Assuming a Lifetime of 12 Months?

Understanding the LTV to CAC Ratio

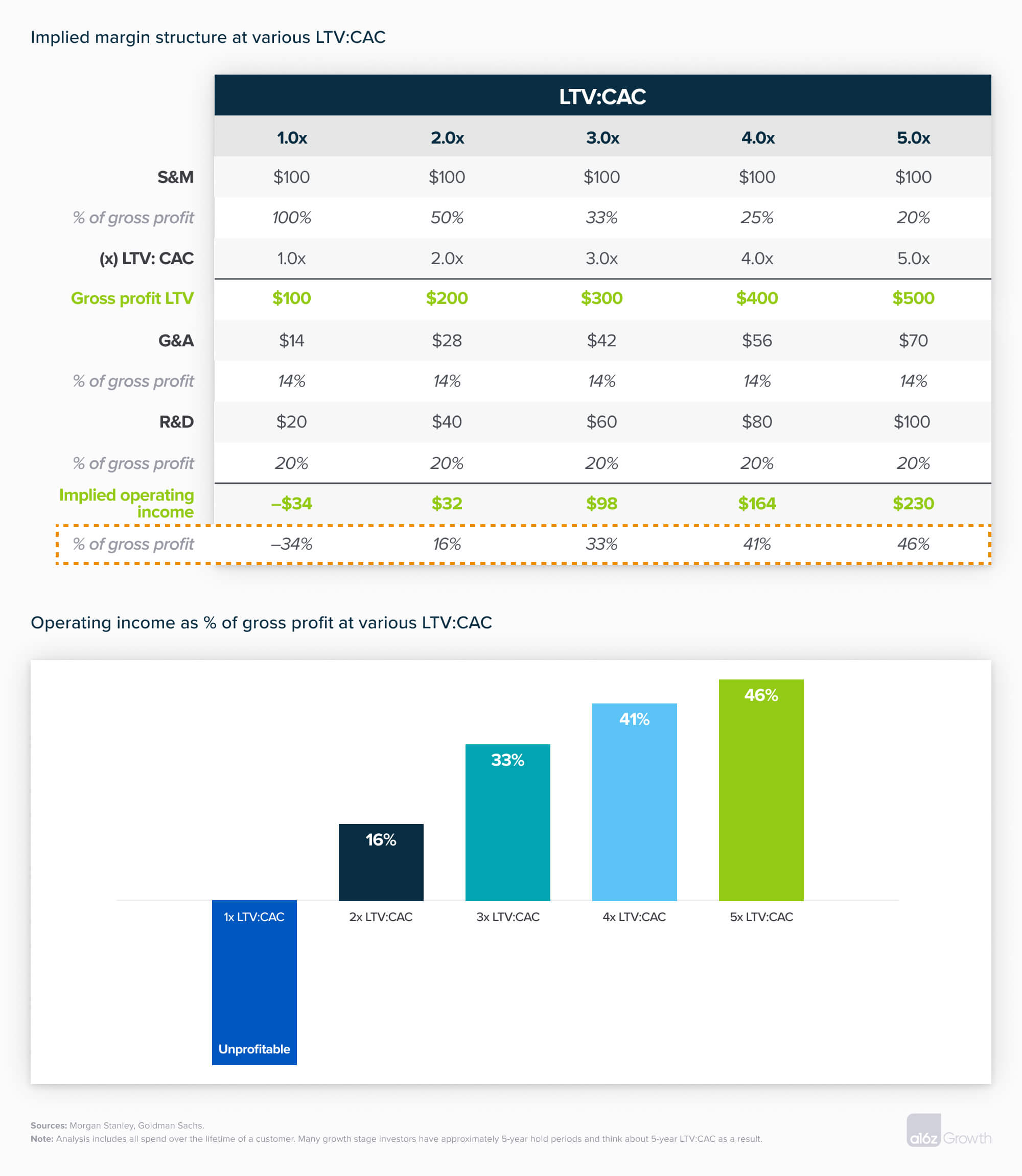

The LTV (Lifetime Value) to CAC (Customer Acquisition Cost) ratio is a critical metric for evaluating the sustainability and profitability of a business. A ratio of 3:1 is often considered the benchmark because it ensures that the revenue generated from a customer significantly outweighs the cost of acquiring them. This ratio accounts for operational costs, profit margins, and scalability. A lower ratio, such as 1.5:1, might seem profitable at first glance, but it often fails to cover hidden costs and leaves little room for growth or reinvestment.

See Also What are the pros and cons of going through accelerator programs like TechStars and Y Combinator?

What are the pros and cons of going through accelerator programs like TechStars and Y Combinator?Why 3x LTV to CAC is the Industry Standard

A 3x LTV to CAC ratio is widely accepted because it provides a safety net for businesses. It ensures that after covering the CAC, there is enough revenue left to fund marketing, product development, and operational expenses. Additionally, it allows businesses to scale efficiently without compromising profitability. A lower ratio, like 1.5x, might indicate that the business is spending too much on acquiring customers relative to the revenue they generate, which can lead to cash flow issues and unsustainable growth.

Calculating IRR with a 1.5x LTV to CAC Ratio

Assuming a 12-month customer lifetime, a 1.5x LTV to CAC ratio might suggest a 50% IRR (Internal Rate of Return) for the investor. However, this calculation often overlooks operational inefficiencies, churn rates, and scaling challenges. While the IRR might appear attractive, the long-term sustainability of the business could be at risk. Investors typically prefer a higher LTV to CAC ratio to ensure consistent returns and lower risk.

See AlsoHow Was Peter Thiel Able to Become a Venture Capitalist if He Had No Money to Invest to Begin WithThe Impact of Customer Lifetime on LTV and CAC

The customer lifetime plays a significant role in determining the LTV to CAC ratio. A shorter lifetime, such as 12 months, increases the pressure to achieve a higher LTV to CAC ratio. This is because the business has less time to recoup the CAC and generate profit. A 3x ratio ensures that even with a shorter lifetime, the business remains profitable and scalable.

Risks of a 1.5x LTV to CAC Ratio

A 1.5x LTV to CAC ratio poses several risks, including limited profitability, higher churn sensitivity, and reduced ability to scale. Businesses operating at this ratio may struggle to cover fixed costs and unexpected expenses, making them vulnerable to market fluctuations. Investors often view such ratios as high-risk, as they leave little margin for error.

See Also What Kind of Consultants Do Venture Capital Firms Use

What Kind of Consultants Do Venture Capital Firms Use| Metric | 1.5x LTV to CAC | 3x LTV to CAC |

|---|---|---|

| Profit Margin | Low | High |

| Scalability | Limited | Strong |

| Risk Level | High | Low |

| Investor Appeal | Low | High |

Why is 3x LTV CAC good?

What Does 3x LTV CAC Mean?

The term 3x LTV CAC refers to a business metric where the Lifetime Value (LTV) of a customer is three times the Customer Acquisition Cost (CAC). This ratio indicates that for every dollar spent on acquiring a customer, the business generates three dollars in revenue over the customer's lifetime. A 3x LTV CAC is considered a healthy benchmark because it ensures that the business is not overspending on customer acquisition while maintaining profitability.

See Also Do Financial Marketers Like Michael Robinsons Strategic Tech Investor or Money Map Report Actually Live Up to Their Hype

Do Financial Marketers Like Michael Robinsons Strategic Tech Investor or Money Map Report Actually Live Up to Their Hype- LTV measures the total revenue a business can expect from a single customer over their lifetime.

- CAC represents the total cost of acquiring a new customer, including marketing and sales expenses.

- A 3x ratio ensures that the business has enough revenue to cover acquisition costs and still generate profit.

Why Is a 3x LTV CAC Ratio Considered Optimal?

A 3x LTV CAC ratio is considered optimal because it strikes a balance between growth and sustainability. It ensures that the business is not overspending on customer acquisition while still allowing for reinvestment in growth initiatives. This ratio is particularly important for startups and scaling businesses, as it provides a clear indicator of financial health.

- It allows for sustainable growth without depleting resources.

- It provides a buffer for unexpected costs or market fluctuations.

- It ensures that the business can reinvest in marketing, product development, and other growth areas.

How Does 3x LTV CAC Impact Profitability?

A 3x LTV CAC ratio directly impacts profitability by ensuring that the revenue generated from customers significantly outweighs the cost of acquiring them. This ratio helps businesses avoid the pitfall of spending more on acquisition than they earn from customers, which can lead to financial instability.

See AlsoWhich Venture Capital Firms Have Major Offices in Chicago?- It ensures that the business maintains a positive cash flow.

- It allows for higher margins, which can be reinvested or distributed as profits.

- It reduces the risk of financial losses due to inefficient marketing strategies.

What Are the Risks of a Lower LTV CAC Ratio?

A lower LTV CAC ratio, such as 1x or 2x, can indicate that the business is spending too much on customer acquisition relative to the revenue generated. This can lead to financial strain and limit the company's ability to scale or invest in other critical areas.

- It may result in cash flow problems and difficulty covering operational costs.

- It limits the ability to reinvest in growth initiatives or innovation.

- It increases the risk of business failure if acquisition costs continue to rise.

How Can Businesses Achieve a 3x LTV CAC Ratio?

Businesses can achieve a 3x LTV CAC ratio by optimizing their marketing strategies, improving customer retention, and increasing the average revenue per customer. This requires a focus on both reducing acquisition costs and maximizing the value derived from each customer.

- Implement data-driven marketing to target high-value customers efficiently.

- Focus on customer retention strategies to increase LTV, such as loyalty programs or upselling.

- Regularly analyze and adjust CAC to ensure it remains within the target ratio.

What is the LTV CAC lifetime value?

What is LTV (Lifetime Value)?

LTV (Lifetime Value) is a metric that estimates the total revenue a business can expect from a single customer over the entire duration of their relationship. It helps businesses understand the long-term value of acquiring and retaining customers. Key factors influencing LTV include:

- Average Purchase Value: The average amount a customer spends per transaction.

- Purchase Frequency: How often a customer makes a purchase within a specific time frame.

- Customer Lifespan: The average duration of a customer's relationship with the business.

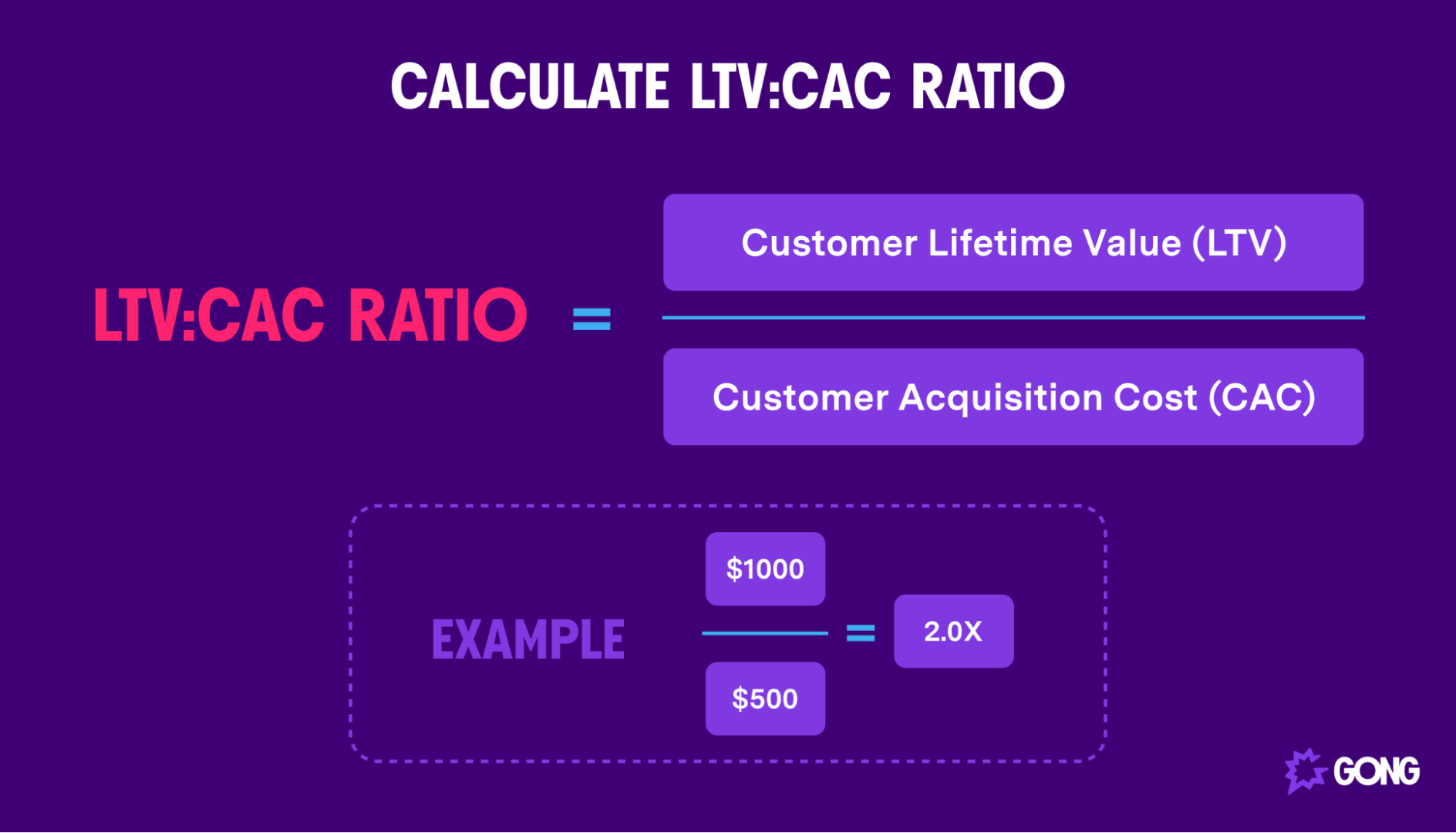

What is CAC (Customer Acquisition Cost)?

CAC (Customer Acquisition Cost) is the total cost a business incurs to acquire a new customer. This includes marketing, sales, and other related expenses. Calculating CAC is crucial for understanding the efficiency of a company's marketing efforts. Key components of CAC include:

- Marketing Expenses: Costs associated with advertising, campaigns, and promotions.

- Sales Team Costs: Salaries, commissions, and other expenses related to the sales team.

- Operational Costs: Overheads like software, tools, and infrastructure used in the acquisition process.

How is LTV CAC Ratio Calculated?

The LTV CAC Ratio is a critical metric that compares the lifetime value of a customer to the cost of acquiring them. A healthy ratio indicates sustainable growth. The formula for calculating the LTV CAC Ratio is:

- LTV ÷ CAC: Divide the Lifetime Value by the Customer Acquisition Cost.

- Ideal Ratio: A ratio of 3:1 is generally considered healthy, meaning the LTV is three times the CAC.

- Low Ratio: A ratio below 1:1 indicates that the cost of acquiring customers exceeds their value, signaling inefficiency.

Why is LTV CAC Important for Businesses?

The LTV CAC metric is vital for businesses as it provides insights into profitability and sustainability. It helps in making informed decisions about marketing budgets, pricing strategies, and customer retention. Key reasons for its importance include:

- Profitability Analysis: Determines whether the revenue generated from customers justifies the acquisition costs.

- Resource Allocation: Guides businesses in allocating resources effectively to maximize ROI.

- Growth Strategy: Helps in identifying areas for improvement in customer acquisition and retention strategies.

How to Improve LTV CAC Ratio?

Improving the LTV CAC Ratio involves strategies to increase customer lifetime value while reducing acquisition costs. Effective methods include:

- Enhance Customer Retention: Implement loyalty programs and personalized experiences to increase customer lifespan.

- Optimize Marketing Channels: Focus on high-performing channels to reduce CAC.

- Upselling and Cross-Selling: Encourage customers to purchase higher-value products or additional services to boost LTV.

What is the relationship between LTV and CAC?

Understanding LTV and CAC

LTV (Lifetime Value) and CAC (Customer Acquisition Cost) are two critical metrics in business analytics. LTV represents the total revenue a business can expect from a single customer over the duration of their relationship. CAC, on the other hand, measures the total cost of acquiring a new customer, including marketing and sales expenses. The relationship between these two metrics is essential for evaluating the profitability and sustainability of a business model.

- LTV helps businesses understand the long-term value of their customers.

- CAC provides insight into the efficiency of marketing and sales strategies.

- A healthy business typically has an LTV:CAC ratio of 3:1 or higher, indicating that the revenue from a customer significantly outweighs the cost to acquire them.

Why the LTV:CAC Ratio Matters

The LTV:CAC ratio is a key indicator of a company's financial health. A high ratio suggests that the company is generating substantial revenue relative to its acquisition costs, while a low ratio may indicate inefficiencies or overspending in customer acquisition. Maintaining a balanced ratio is crucial for sustainable growth.

- A ratio below 1:1 means the company is spending more to acquire customers than they are worth.

- A ratio of 3:1 or higher is generally considered ideal, as it indicates profitability.

- An excessively high ratio (e.g., 5:1 or more) may suggest underinvestment in growth opportunities.

How to Calculate LTV and CAC

Calculating LTV involves estimating the average revenue per customer, the customer lifespan, and the gross margin. CAC is calculated by dividing the total acquisition costs by the number of new customers acquired during a specific period. Accurate calculations are vital for making informed business decisions.

- LTV Formula: (Average Revenue per Customer) x (Customer Lifespan) x (Gross Margin).

- CAC Formula: Total Acquisition Costs / Number of New Customers Acquired.

- Regularly updating these calculations ensures they reflect current business conditions.

Strategies to Improve LTV and Reduce CAC

Improving LTV and reducing CAC are essential for maximizing profitability. Strategies include enhancing customer retention, optimizing marketing campaigns, and leveraging data analytics to target high-value customers more effectively.

- Focus on customer retention to extend the customer lifespan and increase LTV.

- Optimize marketing channels to reduce acquisition costs and improve CAC efficiency.

- Use data-driven insights to identify and target the most profitable customer segments.

Common Mistakes in Managing LTV and CAC

Many businesses make errors when managing LTV and CAC, such as overestimating customer lifespan, underestimating acquisition costs, or failing to monitor these metrics regularly. Avoiding these mistakes is crucial for maintaining a healthy LTV:CAC ratio.

- Overestimating customer lifespan can lead to inflated LTV calculations.

- Underestimating acquisition costs can result in an inaccurate CAC.

- Neglecting to track and analyze these metrics regularly can lead to poor decision-making.

What is the golden ratio for LTV CAC?

What is the Golden Ratio for LTV CAC?

The golden ratio for LTV CAC refers to the ideal balance between a company's Customer Lifetime Value (LTV) and its Customer Acquisition Cost (CAC). A widely accepted benchmark is an LTV:CAC ratio of 3:1, meaning the lifetime value of a customer should be three times the cost of acquiring them. This ratio ensures profitability while allowing room for growth and reinvestment.

Why is the LTV CAC Ratio Important?

The LTV CAC ratio is a critical metric for businesses because it measures the efficiency of their marketing and sales efforts. A balanced ratio indicates:

- Sustainable growth: Ensures that the cost of acquiring customers does not outweigh their long-term value.

- Profitability: A ratio of 3:1 or higher suggests that the business is generating enough revenue to cover costs and achieve profits.

- Investment readiness: Investors often look for a healthy LTV CAC ratio as a sign of a scalable and financially sound business model.

How to Calculate the LTV CAC Ratio

To calculate the LTV CAC ratio, follow these steps:

- Calculate LTV: Divide the average revenue per customer by the churn rate. For example, if a customer generates $100 annually and the churn rate is 10%, the LTV is $1,000.

- Calculate CAC: Divide the total marketing and sales expenses by the number of new customers acquired during the same period. For instance, if $10,000 was spent to acquire 100 customers, the CAC is $100.

- Determine the Ratio: Divide LTV by CAC. In this example, the ratio would be 10:1, which is above the ideal benchmark.

What Happens if the LTV CAC Ratio is Too High or Too Low?

An imbalanced LTV CAC ratio can signal underlying issues:

- Too High (e.g., 5:1 or more): Indicates underinvestment in marketing and sales, potentially missing growth opportunities.

- Too Low (e.g., 1:1 or less): Suggests that the cost of acquiring customers is too high, risking profitability.

- Ideal (3:1): Balances growth and profitability, allowing for reinvestment in customer acquisition and retention.

Strategies to Optimize the LTV CAC Ratio

Businesses can improve their LTV CAC ratio by implementing the following strategies:

- Increase Customer Retention: Focus on improving customer satisfaction and loyalty to extend the customer lifetime value.

- Reduce CAC: Optimize marketing campaigns, target high-converting audiences, and streamline sales processes.

- Upsell and Cross-Sell: Encourage existing customers to purchase additional products or services, boosting their lifetime value.

Frequently Asked Questions (FAQs)

Why is LTV supposed to be at least 3x of CAC?

LTV (Lifetime Value) is expected to be at least 3x CAC (Customer Acquisition Cost) to ensure a sustainable and profitable business model. This ratio indicates that the revenue generated from a customer over their lifetime should significantly outweigh the cost of acquiring them. A 3x LTV/CAC ratio provides a buffer to cover operational expenses, marketing costs, and other overheads while still generating a healthy profit margin. If the ratio is lower, the business may struggle to achieve profitability, especially when considering factors like churn rates and ongoing customer support costs.

Wouldn't an LTV of 1.5x CAC mean a 50% IRR for the investor?

An LTV of 1.5x CAC does not necessarily translate to a 50% IRR (Internal Rate of Return) for the investor. While a higher LTV/CAC ratio generally indicates better profitability, the IRR depends on multiple factors, including the timing of cash flows, the business's growth rate, and the lifetime of the customer. Assuming a 12-month customer lifetime, a 1.5x LTV/CAC ratio might not provide sufficient returns to justify the investment, as it leaves little room for reinvestment, scaling, or unexpected costs. Investors typically seek higher ratios to ensure a more attractive and predictable return on investment.

What assumptions are made when calculating IRR with LTV and CAC?

When calculating IRR using LTV and CAC, several assumptions are made. These include the customer lifetime (e.g., 12 months), the churn rate, the timing of revenue and costs, and the scalability of the business. For example, if the customer lifetime is short, the revenue generated may not be sufficient to cover the acquisition costs and other expenses, leading to a lower IRR. Additionally, the calculation assumes that the business can maintain its current margins and growth trajectory, which may not always be the case in a competitive or changing market environment.

How does a 12-month customer lifetime impact the LTV/CAC ratio?

A 12-month customer lifetime significantly impacts the LTV/CAC ratio because it limits the time frame over which revenue is generated. If the lifetime is short, the business must generate sufficient revenue within that period to cover the CAC and other costs. A higher LTV/CAC ratio, such as 3x, becomes even more critical in this scenario to ensure profitability. A lower ratio, like 1.5x, may not provide enough revenue to sustain the business, especially if there are delays in customer acquisition or unexpected increases in costs. This is why investors often prefer businesses with longer customer lifetimes or higher LTV/CAC ratios.

Leave a Reply

Our Recommended Articles