What is the Best Software for Vc Fund Management?

Venture capital (VC) fund management is a complex process that requires precision, transparency, and efficiency. With the growing number of startups and investment opportunities, VC firms need robust software solutions to streamline operations, track investments, and manage portfolios effectively. Choosing the right software can significantly impact a firm’s ability to make data-driven decisions, maintain compliance, and foster investor relationships. This article explores the best software options for VC fund management, highlighting key features, benefits, and considerations to help firms select the ideal tool for their needs. Whether you’re a seasoned investor or a new fund manager, the right software can transform your workflow and drive success.

What is the Best Software for VC Fund Management?

When it comes to managing venture capital (VC) funds, having the right software is crucial for streamlining operations, improving decision-making, and ensuring compliance. The best software for VC fund management typically offers features like portfolio tracking, investor reporting, deal flow management, and financial analytics. Below, we explore the key aspects of selecting the best software for VC fund management.

See Also Who Are the Best Angel Investors in Minnesota?

Who Are the Best Angel Investors in Minnesota?1. Key Features to Look for in VC Fund Management Software

The ideal VC fund management software should include portfolio tracking, investor relations management, deal flow organization, and financial reporting. These features help fund managers monitor investments, communicate with stakeholders, and make data-driven decisions. Additionally, integration capabilities with other tools and customizable dashboards are essential for a seamless experience.

2. Top VC Fund Management Software Options

Some of the top software options for VC fund management include eFront, Carta, Allvue, Visible.vc, and DealCloud. Each of these platforms offers unique features tailored to the needs of venture capital firms. For example, eFront is known for its robust analytics, while Carta excels in cap table management and compliance.

See Also What Advice Would You Give a Former Startup Product Manager and Product Designer Looking to Get Into Venture Capital as an Associate

What Advice Would You Give a Former Startup Product Manager and Product Designer Looking to Get Into Venture Capital as an Associate3. Benefits of Using Specialized VC Fund Management Software

Using specialized software for VC fund management provides improved efficiency, better data accuracy, and enhanced investor communication. It also reduces the risk of errors and ensures compliance with regulatory requirements. Moreover, these tools often come with automated workflows that save time and resources.

4. How to Choose the Right Software for Your VC Firm

Choosing the right software depends on factors like firm size, investment focus, and budget. Smaller firms may prioritize user-friendly interfaces and affordable pricing, while larger firms might need advanced analytics and scalability. It's also important to consider customer support and training resources when making a decision.

See Also How to Start a Micro Vc Fund

How to Start a Micro Vc Fund5. Comparison of Popular VC Fund Management Software

Below is a comparison table of some of the most popular VC fund management software options:

| Software | Key Features | Pricing |

|---|---|---|

| eFront | Portfolio tracking, analytics, compliance | Custom pricing |

| Carta | Cap table management, investor reporting | Starts at $2,500/year |

| Allvue | Deal flow management, financial reporting | Custom pricing |

| Visible.vc | Investor updates, portfolio tracking | Starts at $49/month |

| DealCloud | CRM, deal management, analytics | Custom pricing |

What is the top VC CRM?

Is There a Broker for Venture Capitalist?

Is There a Broker for Venture Capitalist?What is the Top VC CRM?

The top Venture Capital (VC) CRM is Affinity, a platform specifically designed for relationship intelligence in the venture capital and private equity industries. It stands out due to its ability to automate data entry, track investor relationships, and provide actionable insights through its advanced AI-driven features. Affinity helps VC firms manage their deal flow, maintain strong investor relations, and streamline communication across teams.

Why is Affinity Considered the Best VC CRM?

Affinity is considered the best VC CRM for several reasons:

See AlsoWhat is Considered a Good Roi in Vc?- Automated Relationship Tracking: It uses AI to automatically update contact and interaction data, saving time and reducing manual errors.

- Deal Flow Management: It offers robust tools to track and prioritize deals, ensuring no opportunity is missed.

- Collaboration Features: Teams can work seamlessly with shared pipelines, notes, and updates in real-time.

Key Features of Affinity for VC Firms

Affinity provides a range of features tailored for VC firms:

- Relationship Mapping: Visualize connections between investors, founders, and other stakeholders.

- Email Integration: Syncs with email platforms to track communications and interactions automatically.

- Customizable Dashboards: Tailor the interface to focus on key metrics and data points relevant to your firm.

How Does Affinity Compare to Other VC CRMs?

Affinity outperforms other VC CRMs like Salesforce and HubSpot in several ways:

- Specialization: Unlike generic CRMs, Affinity is built specifically for venture capital and private equity.

- AI-Powered Insights: Its AI capabilities provide deeper insights into relationships and deal opportunities.

- Ease of Use: Its intuitive interface reduces the learning curve for new users.

Who Should Use Affinity as a VC CRM?

Affinity is ideal for:

- Venture Capital Firms: Managing deal flow and investor relations efficiently.

- Private Equity Firms: Tracking portfolio companies and investor communications.

- Startups: Building and maintaining relationships with potential investors.

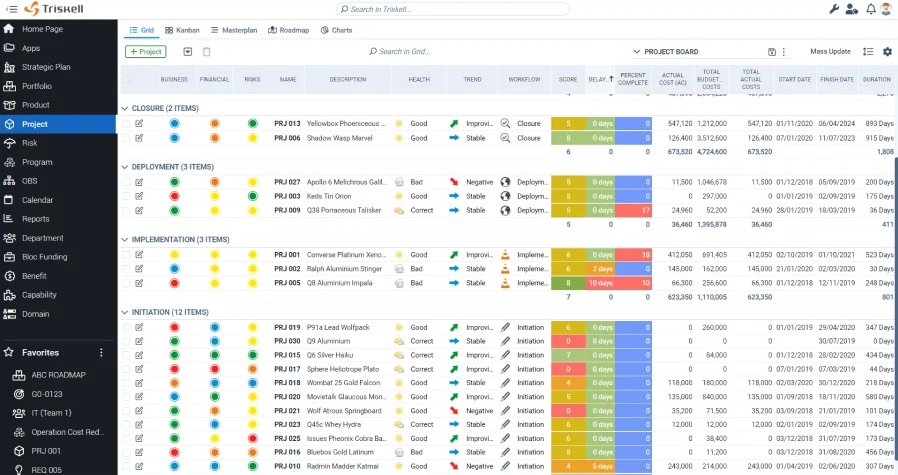

What is the best software for portfolio management?

What is Portfolio Management Software?

Portfolio management software is a tool designed to help individuals and organizations manage their investments, assets, and financial portfolios efficiently. It provides features such as real-time tracking, performance analysis, and risk assessment to ensure optimal decision-making. These tools are essential for investors, financial advisors, and businesses looking to streamline their investment strategies.

- Real-time tracking: Monitor investments and market changes instantly.

- Performance analysis: Evaluate the success of your portfolio over time.

- Risk assessment: Identify and mitigate potential risks in your investments.

Key Features to Look for in Portfolio Management Software

When selecting the best portfolio management software, it is crucial to consider specific features that align with your needs. Look for tools that offer customizable dashboards, integration with financial institutions, and advanced reporting capabilities. These features ensure a seamless and efficient portfolio management experience.

- Customizable dashboards: Tailor the interface to display relevant data.

- Integration with financial institutions: Sync accounts for real-time updates.

- Advanced reporting: Generate detailed reports for better insights.

Top Portfolio Management Software Options

Several software options stand out for portfolio management, including Morningstar, Personal Capital, and eMoney. These platforms are known for their user-friendly interfaces, comprehensive tools, and reliable customer support, making them ideal for both beginners and experienced investors.

- Morningstar: Offers in-depth research and analysis tools.

- Personal Capital: Combines budgeting and investment tracking.

- eMoney: Provides advanced financial planning features.

Benefits of Using Portfolio Management Software

Using portfolio management software offers numerous benefits, such as improved decision-making, time savings, and enhanced accuracy. These tools automate complex tasks, allowing users to focus on strategic planning and achieving their financial goals.

- Improved decision-making: Access to real-time data and insights.

- Time savings: Automate repetitive tasks and calculations.

- Enhanced accuracy: Reduce errors with automated tracking and reporting.

How to Choose the Right Portfolio Management Software

Choosing the right portfolio management software depends on factors such as your investment goals, budget, and technical expertise. Evaluate the software's features, scalability, and customer reviews to ensure it meets your specific requirements.

- Investment goals: Align the software with your financial objectives.

- Budget: Consider pricing plans and subscription models.

- Technical expertise: Choose a platform that matches your skill level.

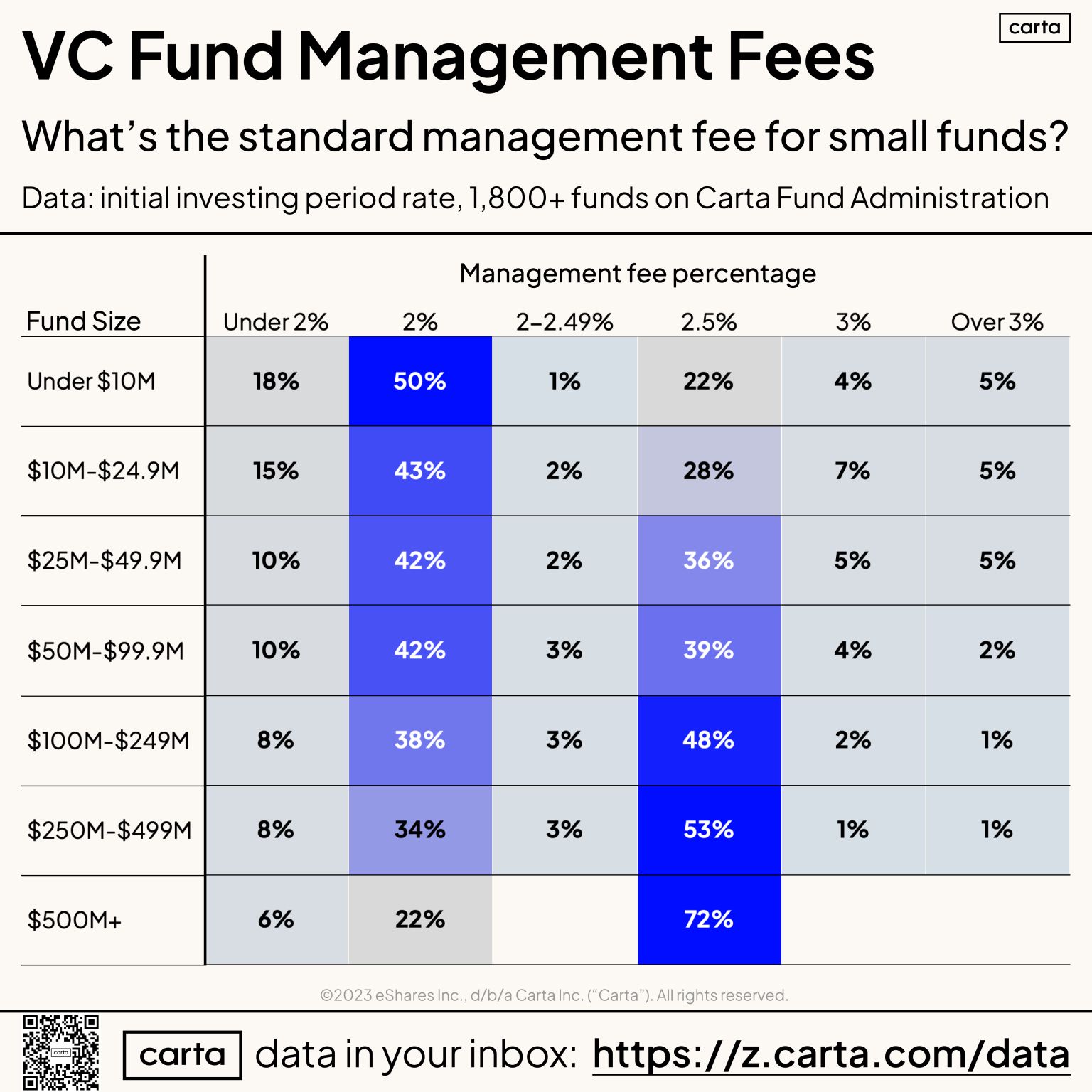

What is the typical VC management fee?

What is the Typical VC Management Fee?

The typical venture capital (VC) management fee ranges between 1.5% to 2.5% of the total committed capital per year. This fee is charged by the VC firm to cover operational costs, such as salaries, office expenses, and due diligence activities. The percentage may vary depending on the size of the fund, the stage of investment, and the firm's reputation.

- Management fees are calculated annually and are usually based on the total amount of capital committed by limited partners (LPs).

- Larger funds may charge a lower percentage, while smaller or early-stage funds might charge closer to the 2.5% range.

- Fees often decrease after the investment period (typically 5-7 years) as the focus shifts from deploying capital to managing existing investments.

How is the VC Management Fee Structured?

The VC management fee structure is designed to align the interests of the general partners (GPs) and limited partners (LPs). It is typically calculated as a percentage of the committed capital and is paid annually. Over time, the fee structure may evolve to reflect the fund's lifecycle.

- During the investment period, fees are often based on the total committed capital.

- After the investment period, fees may shift to a percentage of the invested capital or net asset value (NAV).

- Some funds implement a step-down structure, reducing fees as the fund matures.

Factors Influencing VC Management Fees

Several factors influence the VC management fee, including the fund's size, stage, and the firm's track record. Larger funds or those with a strong reputation may negotiate lower fees due to economies of scale and investor confidence.

- Fund size: Larger funds often charge lower fees as a percentage of committed capital.

- Investment stage: Early-stage funds may charge higher fees due to the increased workload and risk.

- Firm reputation: Established firms with a proven track record may command higher fees.

How Do VC Management Fees Compare to Other Investment Funds?

Compared to other investment funds, such as private equity (PE) or hedge funds, VC management fees are generally similar but can vary based on the fund's focus and strategy. PE funds often charge fees closer to 2%, while hedge funds may charge a 2% management fee plus a performance fee.

- Private equity: Typically charges 1.5% to 2% management fees.

- Hedge funds: Often charge 2% management fees plus 20% performance fees.

- VC funds: Usually range between 1.5% to 2.5% management fees.

Are VC Management Fees Negotiable?

Yes, VC management fees can be negotiable, especially for large institutional investors or limited partners with significant bargaining power. Negotiations often focus on reducing the fee percentage or adjusting the fee structure to better align with the fund's performance.

- Institutional investors may negotiate lower fees due to their large commitments.

- Fee structures can be adjusted to include performance-based reductions.

- Early-stage funds may offer flexibility to attract high-profile investors.

What are VC tools?

What are VC Tools?

VC tools, or Version Control tools, are software applications designed to manage changes to source code, documents, or any collection of files over time. These tools help teams collaborate efficiently, track modifications, and maintain a history of changes, ensuring that everyone is working on the most up-to-date version of a project. They are essential for software development, but their use extends to other fields like data science, design, and content creation.

Key Features of VC Tools

VC tools come with a variety of features that make them indispensable for collaborative work. Below are some of the most important features:

- Branching and Merging: Allows developers to work on different versions of a project simultaneously and later merge changes seamlessly.

- Change Tracking: Keeps a detailed record of every modification, including who made the change and when.

- Conflict Resolution: Helps resolve discrepancies when multiple users edit the same file.

- Backup and Restore: Ensures that previous versions of files are stored securely and can be restored if needed.

- Collaboration: Facilitates teamwork by allowing multiple users to work on the same project without overwriting each other's work.

Popular VC Tools in the Industry

Several VC tools are widely used across industries due to their reliability and feature sets. Here are some of the most popular ones:

- Git: A distributed version control system known for its speed and flexibility.

- Subversion (SVN): A centralized version control system that is easy to use and widely adopted.

- Mercurial: A distributed system similar to Git but with a focus on simplicity.

- Perforce: A powerful tool often used in large-scale enterprise environments.

- Team Foundation Version Control (TFVC): A centralized system integrated with Microsoft's Azure DevOps.

Benefits of Using VC Tools

Using VC tools offers numerous advantages for both individuals and teams. Below are some of the key benefits:

- Improved Collaboration: Enables multiple team members to work on the same project without conflicts.

- Enhanced Productivity: Streamlines workflows by automating version tracking and merging.

- Error Reduction: Minimizes mistakes by providing a clear history of changes and the ability to revert to previous versions.

- Scalability: Supports projects of all sizes, from small teams to large enterprises.

- Security: Protects sensitive data by controlling access and maintaining backups.

How to Choose the Right VC Tool

Selecting the appropriate VC tool depends on various factors, including project requirements and team size. Consider the following points when making a decision:

- Project Complexity: For simple projects, lightweight tools like Git may suffice, while complex projects may require robust solutions like Perforce.

- Team Size: Larger teams may benefit from tools with advanced collaboration features.

- Integration: Ensure the tool integrates well with your existing software ecosystem.

- Learning Curve: Choose a tool that matches your team's technical expertise.

- Cost: Evaluate the pricing model to ensure it fits your budget.

Frequently Asked Questions (FAQs)

What features should I look for in VC fund management software?

When selecting the best software for VC fund management, it's crucial to consider features that streamline operations and enhance decision-making. Look for tools that offer portfolio tracking, deal flow management, and investor reporting. Additionally, ensure the software provides real-time analytics, customizable dashboards, and integration capabilities with other financial tools. These features will help you manage your fund efficiently and make data-driven decisions.

How does VC fund management software improve operational efficiency?

VC fund management software significantly improves operational efficiency by automating repetitive tasks and centralizing data. With tools like automated reporting and document management, you can save time and reduce errors. The software also facilitates collaboration among team members by providing a unified platform for communication and task management. By streamlining workflows, you can focus more on strategic activities like sourcing deals and building relationships with investors.

Is cloud-based VC fund management software secure?

Yes, most cloud-based VC fund management software is designed with robust security measures to protect sensitive data. These platforms typically use encryption, multi-factor authentication, and regular security audits to ensure data integrity. Additionally, they comply with industry standards and regulations, such as GDPR and SOC 2. However, it's essential to review the software provider's security policies and ensure they meet your fund's specific requirements.

Can VC fund management software help with investor relations?

Absolutely. VC fund management software plays a vital role in enhancing investor relations by providing transparent and timely updates. Features like customizable investor portals and automated reporting allow you to share performance metrics, financial statements, and other critical information effortlessly. This transparency builds trust and keeps investors informed, which is crucial for maintaining strong relationships and securing future funding.

Leave a Reply

Our Recommended Articles