Which Venture Capitalists Make Investments in Fashion Tech Ventures and Are Fashion Savvy Themselves

The intersection of fashion and technology has given rise to a dynamic sector known as fashion tech, attracting significant interest from venture capitalists (VCs) who recognize its potential for innovation and growth. However, not all investors possess the unique blend of financial acumen and fashion sensibility required to navigate this niche market. This article explores the venture capitalists who stand out for their strategic investments in fashion tech ventures and their deep understanding of the fashion industry. By identifying these key players, we shed light on how their expertise and passion for fashion drive the evolution of this rapidly expanding sector.

Which Venture Capitalists Make Investments in Fashion Tech Ventures and Are Fashion Savvy Themselves?

1. Who Are the Leading Venture Capitalists in Fashion Tech?

The fashion tech industry has attracted a number of venture capitalists who specialize in blending technology with fashion. Some of the most prominent names include Index Ventures, Andreessen Horowitz, and LVMH Ventures. These firms have a proven track record of investing in innovative startups that are redefining the fashion landscape. For example, Index Ventures backed Farfetch, a global luxury fashion platform, while LVMH Ventures focuses on emerging brands that align with the luxury conglomerate's vision.

See Also Are There Any Venture Capital Funds in the Nutrition Natural Product and or Health Wellness Industry

Are There Any Venture Capital Funds in the Nutrition Natural Product and or Health Wellness Industry2. What Makes a Venture Capitalist Fashion Savvy?

A fashion-savvy venture capitalist is someone who not only understands the business of fashion but also has a keen eye for trends and consumer behavior. They often have a background in fashion, retail, or design, which allows them to identify startups with the potential to disrupt the industry. For instance, Julie Bornstein, co-founder of The Yes, has a deep understanding of fashion tech due to her previous roles at Stitch Fix and Sephora.

3. How Do Venture Capitalists Evaluate Fashion Tech Startups?

When evaluating fashion tech startups, venture capitalists look for innovation, scalability, and a strong business model. They also consider the team's expertise and the startup's ability to address a market gap. For example, Andreessen Horowitz invested in Rent the Runway because of its unique approach to sustainable fashion and its potential to scale globally.

See Also Are There Vc Firms That Invest in Sport Related Startups?

Are There Vc Firms That Invest in Sport Related Startups?4. What Are the Key Trends in Fashion Tech Investments?

Current trends in fashion tech investments include sustainability, personalization, and augmented reality (AR). Venture capitalists are particularly interested in startups that leverage AI and machine learning to enhance the shopping experience. For instance, LVMH Ventures has invested in Vestiaire Collective, a platform that promotes circular fashion by enabling consumers to buy and sell pre-owned luxury items.

5. Which Fashion Tech Startups Have Received Significant Funding?

Several fashion tech startups have received significant funding from venture capitalists. Below is a table highlighting some of the most notable investments:

See Also Whats the Difference Between a Venture Capitalist and an Entrepreneur

Whats the Difference Between a Venture Capitalist and an Entrepreneur| Startup | Venture Capitalist | Investment Focus |

|---|---|---|

| Farfetch | Index Ventures | Luxury Fashion Platform |

| Rent the Runway | Andreessen Horowitz | Sustainable Fashion |

| Vestiaire Collective | LVMH Ventures | Circular Fashion |

| The Yes | Forerunner Ventures | AI-Powered Shopping |

| Stitch Fix | Baseline Ventures | Personalized Styling |

What is a tech venture capitalist?

What is a Tech Venture Capitalist?

A tech venture capitalist is an investor who provides capital to early-stage, high-potential, and often high-risk technology startups in exchange for equity or ownership stakes. These investors focus on identifying innovative companies with the potential for significant growth and returns. They play a critical role in the tech ecosystem by funding startups that may not have access to traditional financing methods like bank loans.

See Also Which Venture Capitalists Tend to Like Investing in Music Related Startups

Which Venture Capitalists Tend to Like Investing in Music Related StartupsHow Do Tech Venture Capitalists Operate?

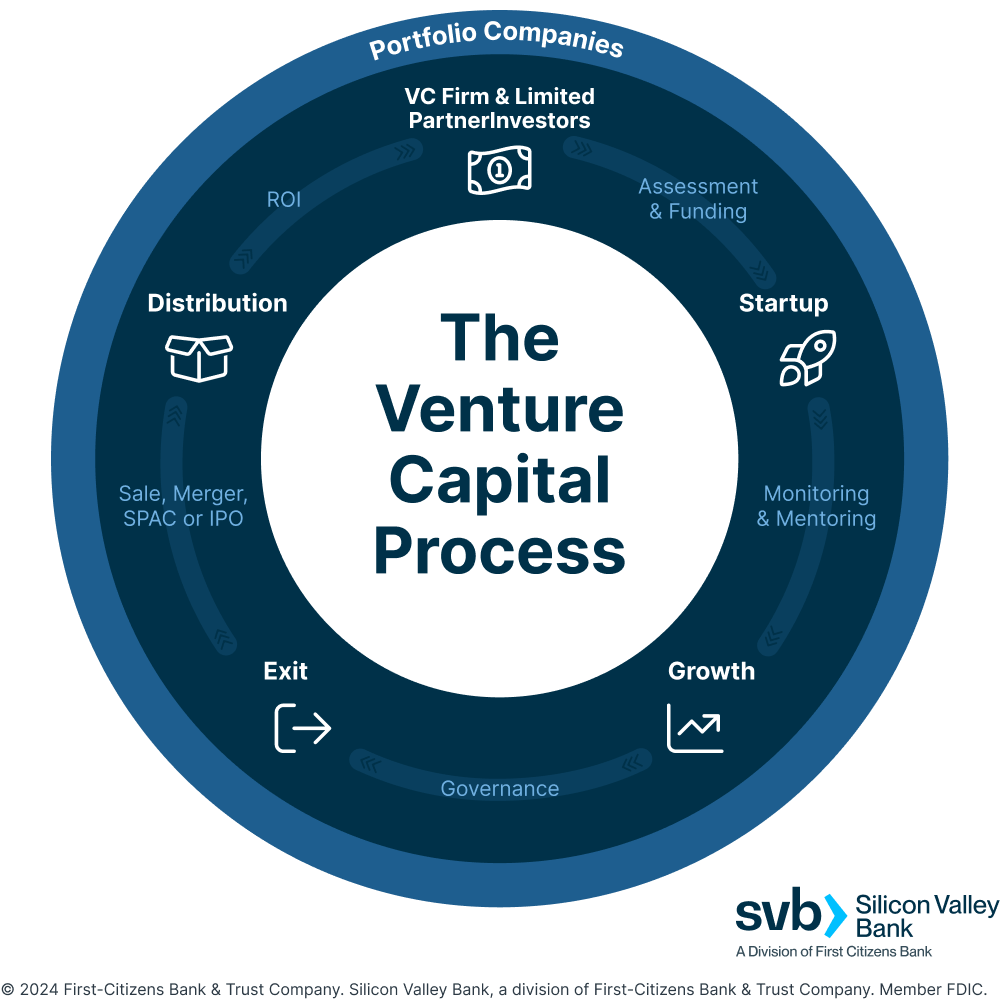

Tech venture capitalists operate by pooling funds from various sources, such as institutional investors, high-net-worth individuals, and corporations, to create a venture capital fund. They then:

- Source deals: Actively seek out promising tech startups through networking, pitch events, and referrals.

- Evaluate opportunities: Conduct thorough due diligence to assess the startup's business model, market potential, and team.

- Invest capital: Provide funding in exchange for equity, often in multiple rounds as the startup grows.

What Types of Startups Do Tech Venture Capitalists Invest In?

Tech venture capitalists typically invest in startups that operate in high-growth sectors such as:

- Artificial Intelligence (AI): Companies developing AI-driven solutions for industries like healthcare, finance, and logistics.

- Fintech: Startups revolutionizing financial services through technology, such as digital payments or blockchain.

- Biotech: Firms focused on innovative medical technologies or drug development.

What Are the Key Roles of a Tech Venture Capitalist?

Beyond providing funding, tech venture capitalists play several critical roles:

- Mentorship: Offering guidance and strategic advice to startup founders.

- Networking: Connecting startups with industry experts, potential partners, and customers.

- Exit strategy planning: Helping startups prepare for IPOs, acquisitions, or other liquidity events.

What Are the Risks and Rewards of Being a Tech Venture Capitalist?

Tech venture capitalists face both significant risks and potential rewards:

- High risk: Many startups fail, leading to a loss of invested capital.

- High reward: Successful investments can yield substantial returns, often multiples of the initial investment.

- Long-term commitment: Investments typically take years to mature, requiring patience and strategic planning.

How to find investors for a fashion brand?

1. Build a Strong Business Plan

To attract investors for your fashion brand, you need a comprehensive business plan that outlines your vision, mission, and financial projections. This document should include:

- Market analysis: Research your target audience, competitors, and industry trends.

- Revenue model: Clearly explain how your brand will generate income.

- Growth strategy: Detail your plans for scaling the business.

2. Network Within the Fashion Industry

Building connections is crucial for finding investors. Attend fashion events, trade shows, and industry conferences to meet potential investors. Consider:

- Joining fashion associations or groups to expand your network.

- Leveraging social media platforms like LinkedIn to connect with industry professionals.

- Collaborating with influencers or established brands to gain visibility.

3. Leverage Crowdfunding Platforms

Crowdfunding is an effective way to raise capital while validating your brand. Platforms like Kickstarter or Indiegogo allow you to showcase your brand to a global audience. Steps to succeed include:

- Creating a compelling campaign with high-quality visuals and a clear value proposition.

- Offering exclusive rewards to backers, such as early access to collections.

- Promoting your campaign through social media and email marketing.

4. Approach Angel Investors and Venture Capitalists

Angel investors and venture capitalists specialize in funding startups. To attract them:

- Identify investors with a history of supporting fashion or lifestyle brands.

- Prepare a pitch deck that highlights your brand’s unique selling points and growth potential.

- Be ready to negotiate terms and demonstrate a clear return on investment.

5. Utilize Fashion Incubators and Accelerators

Fashion incubators and accelerators provide funding, mentorship, and resources to emerging brands. Benefits include:

- Access to industry experts who can guide your brand’s development.

- Opportunities to pitch to investors during demo days or networking events.

- Workshops and training programs to refine your business strategy.

Whose money are venture capitalists investing?

:max_bytes(150000):strip_icc()/venture-capitalist-4187107-1-279ebe8e1bb9410a9f8c3cf7dc47c7cb.jpg)

Who Provides the Funds for Venture Capital Investments?

Venture capitalists primarily invest money from limited partners (LPs), who are typically institutional investors or high-net-worth individuals. These LPs contribute to a venture capital fund, which is then managed by the venture capital firm. The sources of these funds include:

- Pension funds: Large institutional investors that allocate a portion of their assets to venture capital for higher returns.

- Endowments: Funds from universities or nonprofit organizations seeking long-term growth.

- Family offices: Wealth management firms that manage the financial affairs of affluent families.

- Corporations: Companies that invest in venture capital to gain strategic advantages or access to innovation.

- High-net-worth individuals: Wealthy individuals looking to diversify their investment portfolios.

How Do Venture Capital Funds Operate?

Venture capital funds operate by pooling money from various investors and deploying it into high-potential startups or growth-stage companies. The process involves:

- Fundraising: The venture capital firm raises capital from LPs to create a fund.

- Deal sourcing: Identifying and evaluating promising startups for investment.

- Due diligence: Conducting thorough research on the startup's business model, team, and market potential.

- Investment: Allocating funds to selected startups in exchange for equity.

- Portfolio management: Supporting the growth of portfolio companies through mentorship and strategic guidance.

What Are the Risks for Limited Partners?

Limited partners face several risks when investing in venture capital funds, including:

- Illiquidity: Venture capital investments are long-term and cannot be easily sold or liquidated.

- High failure rates: Many startups fail, leading to potential loss of invested capital.

- Market volatility: Economic downturns can negatively impact the performance of startups.

- Dependence on fund managers: The success of the investment relies heavily on the expertise of the venture capital firm.

- Dilution: Additional funding rounds may reduce the ownership percentage of earlier investors.

What Are the Benefits for Limited Partners?

Despite the risks, limited partners are attracted to venture capital due to the potential for high returns and other benefits, such as:

- High returns: Successful investments can yield significant profits, often outperforming traditional asset classes.

- Diversification: Venture capital provides exposure to innovative sectors and startups, diversifying an investment portfolio.

- Access to innovation: Investing in startups allows LPs to be part of cutting-edge technologies and business models.

- Tax advantages: Some jurisdictions offer tax incentives for venture capital investments.

- Strategic partnerships: Corporations and family offices can gain strategic insights or partnerships through venture capital investments.

How Do Venture Capitalists Generate Returns?

Venture capitalists generate returns through a combination of equity appreciation and successful exits. The process typically involves:

- Equity ownership: Acquiring a stake in startups with high growth potential.

- Value addition: Providing mentorship, resources, and networks to help startups scale.

- Exit strategies: Realizing returns through initial public offerings (IPOs), acquisitions, or mergers.

- Carried interest: Earning a share of the profits (usually 20%) after returning the initial capital to LPs.

- Reinvestment: Recycling returns into new funds or follow-on investments in successful portfolio companies.

Frequently Asked Questions (FAQs)

Which venture capitalists are known for investing in fashion tech ventures?

Venture capitalists such as Index Ventures, Andreessen Horowitz, and LVMH Ventures are well-known for their investments in fashion tech ventures. These firms have a strong track record of backing innovative startups that blend technology with fashion, such as Rent the Runway, Farfetch, and Stitch Fix. They are particularly interested in companies that leverage AI, AR/VR, and sustainable practices to disrupt the traditional fashion industry.

What makes a venture capitalist fashion-savvy?

A fashion-savvy venture capitalist is someone who not only understands the financial aspects of investing but also has a deep appreciation for the creative and cultural elements of the fashion industry. They often have a background in fashion, retail, or design, and they stay updated on trends, consumer behavior, and emerging technologies in the space. Their expertise allows them to identify startups with the potential to redefine the fashion landscape.

How do fashion-savvy venture capitalists evaluate fashion tech startups?

Fashion-savvy venture capitalists evaluate startups based on a combination of factors, including the strength of the founding team, the uniqueness of the technology, and the potential for market disruption. They also consider the startup's ability to address key challenges in the fashion industry, such as sustainability, supply chain efficiency, and personalization. Additionally, they look for startups with a clear brand identity and a strong understanding of their target audience.

What are some examples of successful fashion tech investments by venture capitalists?

Some notable examples of successful fashion tech investments include Index Ventures' investment in Farfetch, which revolutionized the luxury e-commerce space, and Andreessen Horowitz's backing of Rent the Runway, a pioneer in the clothing rental market. Another example is LVMH Ventures' investment in Vestiaire Collective, a leading platform for pre-owned luxury fashion. These investments highlight the potential for fashion tech to create new business models and reshape the industry.

Leave a Reply

Our Recommended Articles