Illinois LLC Annual Report

Filing an annual report is a critical requirement for maintaining compliance and good standing for limited liability companies (LLCs) in Illinois. The Illinois LLC Annual Report serves as a yearly update to the state, ensuring that key business information—such as registered agent details, principal office address, and member/manager listings—remains current. Submitted to the Illinois Secretary of State, this report is due by the first day of the anniversary month of the LLC’s formation. Failure to file on time may result in penalties or administrative dissolution of the business. Understanding the process, deadlines, and necessary documentation helps LLC owners avoid disruptions and uphold their company’s legal protections.

- Understanding the Illinois LLC Annual Report Requirements

-

Does an LLC need to file an annual report in Illinois?

- What Is the Deadline for Filing an LLC Annual Report in Illinois?

- What Happens If an LLC Fails to File Its Annual Report in Illinois?

- How to File an LLC Annual Report in Illinois

- What Information Is Required in an Illinois LLC Annual Report?

- Can an LLC Update Its Information When Filing the Annual Report?

- Do I have to renew my LLC every year in Illinois?

- Is there an annual fee for an LLC in Illinois?

- What is the due date for Illinois annual report?

- Frequently Asked Questions About LLCs (FAQs)

Understanding the Illinois LLC Annual Report Requirements

What Is the Illinois LLC Annual Report?

The Illinois LLC Annual Report is a mandatory filing submitted to the Illinois Secretary of State to keep your LLC in good standing. It updates essential business details, such as the LLC’s address, registered agent information, and management structure. Failure to file this report can result in penalties or even administrative dissolution of the LLC.

See AlsoHow to Dissolve an LLC in Utah| Purpose | Maintain compliance and update business information |

| Governing Body | Illinois Secretary of State |

| Frequency | Annually |

When Is the Illinois LLC Annual Report Due?

The due date for the Illinois LLC Annual Report is the first day of the month in which your LLC was originally formed. For example, if your LLC was formed on June 15, the report is due by June 1 every subsequent year. Late filings incur a $100 penalty, and prolonged delays risk administrative dissolution.

| Due Date | Anniversary month’s first day |

| Late Penalty | $100 |

| Grace Period | No official grace period |

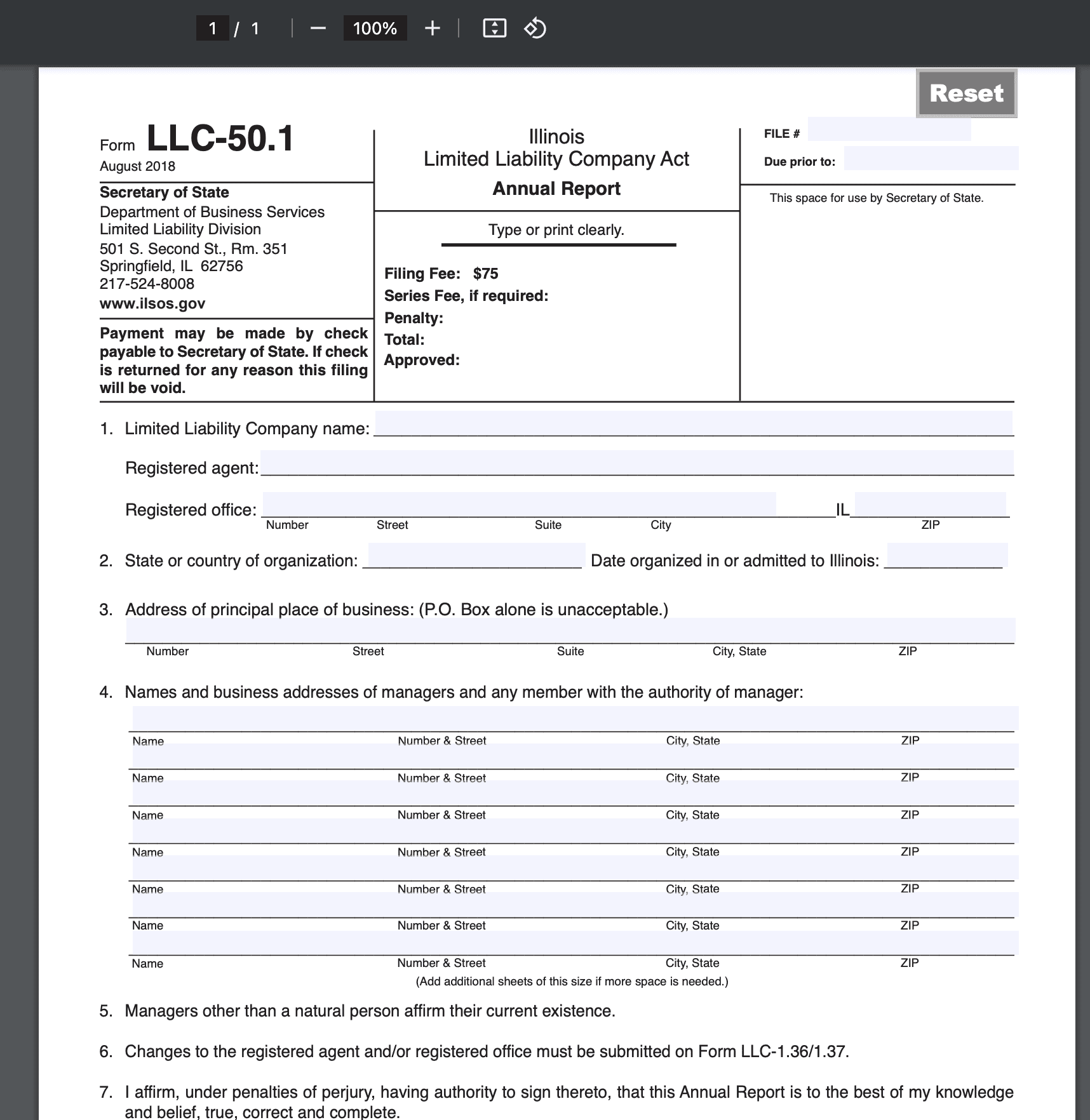

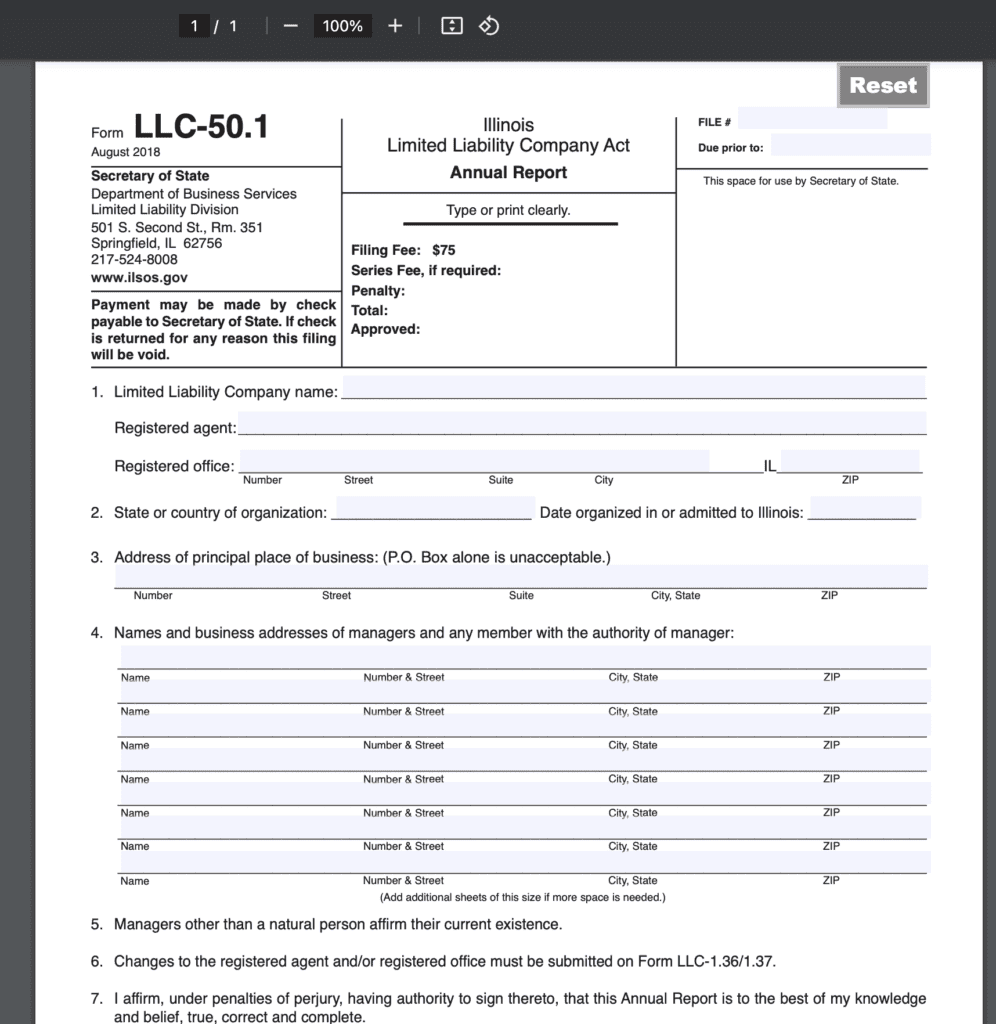

How to File an Illinois LLC Annual Report

Filing is done online through the Illinois Secretary of State’s website. You’ll need your LLC’s File Number and access to a credit card for the $75 filing fee. After submitting, you’ll receive a confirmation email. Paper filings are not accepted for annual reports.

See Also What Kinds of Returns Are Limited Partners Seeking From a Vc Fund Are There Term Sheets Agreements Between Lps and Vc General Partners on What Terms

What Kinds of Returns Are Limited Partners Seeking From a Vc Fund Are There Term Sheets Agreements Between Lps and Vc General Partners on What Terms| Filing Method | Online only |

| Filing Fee | $75 |

| Required Information | File Number, registered agent details, business address |

What Information Is Required in the Annual Report?

The report requires updated details about your LLC, including the principal office address, registered agent’s name and address, and a list of members/managers. Ensure all information matches existing state records to avoid processing delays.

| Principal Address | Current business location |

| Registered Agent | Name and Illinois address |

| Management | List of members or managers |

Consequences of Not Filing the Illinois LLC Annual Report

Missing the deadline leads to a $100 penalty, and continued non-compliance may result in administrative dissolution. A dissolved LLC loses its legal protections and cannot conduct business in Illinois until reinstated, which requires additional fees and paperwork.

See Also How Do I Pitch an Idea to a Seed Fund or a Vc?

How Do I Pitch an Idea to a Seed Fund or a Vc?| Initial Penalty | $100 |

| Dissolution | After 60 days of non-compliance |

| Reinstatement | Requires $300 fee + past-due reports |

Does an LLC need to file an annual report in Illinois?

Yes, a Limited Liability Company (LLC) in Illinois is required to file an annual report with the Illinois Secretary of State. This report ensures the state has up-to-date information about the LLC, such as its principal office address, registered agent details, and member/manager names. Failure to file the report by the deadline may result in penalties or administrative dissolution of the LLC.

See Also How to Start or Launch a Venture Capital Firm or Vc Fund

How to Start or Launch a Venture Capital Firm or Vc FundWhat Is the Deadline for Filing an LLC Annual Report in Illinois?

The annual report for an Illinois LLC must be filed by the first day of the month marking the anniversary of the LLC's formation. For example, if your LLC was formed on June 15, the report is due by June 1 each subsequent year.

- Timely filing avoids late fees and compliance issues.

- The filing fee is $75 for domestic LLCs and $100 for foreign LLCs.

- Reminders are typically sent via email or mail to the LLC’s registered agent.

What Happens If an LLC Fails to File Its Annual Report in Illinois?

Failing to submit the annual report by the deadline can lead to serious consequences.

- A $100 late fee is added to the original filing fee after the due date.

- Persistent non-compliance may result in administrative dissolution, stripping the LLC of its legal status.

- Reinstatement after dissolution requires filing all overdue reports and paying reinstatement fees.

How to File an LLC Annual Report in Illinois

The process for filing an LLC’s annual report in Illinois is streamlined through online and mail-in options.

- Visit the Illinois Secretary of State website and use the File Annual Report portal.

- Verify and update the LLC’s registered agent, principal office address, and member/manager details.

- Pay the required fee using a credit/debit card or electronic check for online submissions.

What Information Is Required in an Illinois LLC Annual Report?

The annual report requires basic but critical information about the LLC’s operations and structure.

- Legal name of the LLC as registered with the state.

- Principal office address and mailing address (if different).

- Name and address of the registered agent in Illinois.

Can an LLC Update Its Information When Filing the Annual Report?

Yes, the annual report serves as an opportunity to update key details about the LLC.

- Changes to the registered agent or office address must be reported here.

- Updates to member or manager names and contact information can be included.

- Major structural changes (e.g., mergers) may require separate filings beyond the annual report.

Do I have to renew my LLC every year in Illinois?

Yes, Illinois requires annual reporting for LLCs. You must file an Annual Report with the Illinois Secretary of State each year to keep your LLC in compliance. The report is due by the first day of your LLC’s anniversary month (the month it was originally formed). Failure to file can result in penalties or administrative dissolution of your LLC.

Annual Report Requirements for Illinois LLCs

In Illinois, LLCs must file an Annual Report to maintain good standing. This report updates the state about your business’s basic information. Key details include:

- File the report online through the Illinois Secretary of State’s website.

- Due by the first day of your LLC’s formation anniversary month.

- Requires updated details like registered agent, principal office address, and member/manager names.

- A $75 filing fee is required with each Annual Report submission.

Consequences of Not Renewing Your LLC

Failing to file your Annual Report on time can lead to:

- Late fees: A $100 penalty if filed after the due date.

- Administrative dissolution: The state may dissolve your LLC if the report is overdue by more than 6 months.

- Loss of good standing, which affects your ability to conduct business, obtain financing, or enforce contracts in court.

How to File Your Illinois LLC Annual Report

Follow these steps to file your Annual Report:

- Visit the Illinois Secretary of State’s LLC Annual Report page.

- Log in using your LLC File Number (found on previous correspondence or your Certificate of Good Standing).

- Verify and update your LLC’s information.

- Pay the $75 fee via credit/debit card or electronic check.

- Save the confirmation receipt for your records.

Fees and Payment Methods for Annual Reports

Understanding the costs involved:

- $75 annual filing fee is mandatory for all Illinois LLCs.

- A $100 late fee applies if filed after the deadline.

- Payments accepted online via credit/debit card or electronic check.

- No prorated fees—full payment is required even if filing late.

Maintaining Compliance Beyond Annual Reports

Additional requirements to keep your Illinois LLC active:

- Update the state about changes to your registered agent or office address.

- Renew local business licenses and permits annually, if applicable.

- File federal and state taxes, including Illinois franchise tax (if applicable).

- Keep internal records, like operating agreements and meeting minutes, up to date.

Is there an annual fee for an LLC in Illinois?

What is the Annual Report Fee for an LLC in Illinois?

In Illinois, LLCs are required to file an Annual Report and pay a fee to maintain compliance. The annual report fee is $75 and must be submitted to the Illinois Secretary of State.

- The report is due every year by the first day of the LLC's anniversary month (the month it was originally formed).

- Failure to file may result in penalties or dissolution of the LLC.

- Payment can be made online through the Secretary of State’s website for convenience.

Are There Penalties for Late Annual Report Filing in Illinois?

Late submissions of the Annual Report incur additional penalties. If not filed on time, the LLC risks losing good standing.

- A $100 penalty is added if the report is filed after the due date.

- Persistent non-compliance may lead to the LLC being administratively dissolved.

- Reinstatement after dissolution requires paying back fees and penalties, plus a $100 reinstatement fee.

What Other Ongoing Costs Apply to Illinois LLCs?

Beyond the Annual Report fee, Illinois LLCs may face additional ongoing expenses depending on their operations.

- Franchise taxes are not levied on LLCs in Illinois, unlike corporations.

- LLCs with employees must pay employment taxes and unemployment insurance.

- Local business licenses or permits may require renewal fees annually or biennially.

How Does the Annual Fee Compare to Other States?

Illinois’ LLC annual fees are moderate compared to other states, though requirements vary widely.

- States like California charge an $800 annual franchise tax for LLCs, regardless of income.

- Texas requires a $0 annual franchise tax for LLCs with revenue below $1.23 million.

- New York imposes a $9 biennial fee for LLCs but requires publishing formation notices, which can cost more.

How to File the Annual Report and Pay the Fee in Illinois?

The process for filing the Annual Report and paying the fee in Illinois is streamlined online.

- Visit the Illinois Secretary of State’s website and log into the LLC’s account.

- Complete the Annual Report form, ensuring all business details are up to date.

- Submit the $75 fee via credit card, check, or electronic payment.

What is the due date for Illinois annual report?

The Illinois annual report for corporations is typically due by the first day of the corporation’s anniversary month each year. For example, if your business was incorporated on June 15, the annual report deadline would be June 1 of every subsequent year. However, LLCs (Limited Liability Companies) in Illinois do not file annual reports but must instead submit an Annual Franchise Tax Report, which is due within 60 days before the first day of the anniversary month of the LLC’s formation. Always confirm exact dates with the Illinois Secretary of State to avoid penalties.

When Is the Illinois Annual Report Due for Corporations?

The Illinois annual report for corporations must be filed by the first day of the corporation’s incorporation anniversary month. For instance:

- If incorporated on March 10, the report is due by March 1 annually.

- Late submissions incur a $100 penalty plus franchise tax interest.

- Filing can be completed online via the Illinois Secretary of State website.

How Does the Deadline Differ for LLCs in Illinois?

LLCs in Illinois do not file annual reports but must submit an Annual Franchise Tax Report:

- Due 60 days before the first day of the LLC’s formation anniversary month.

- Example: An LLC formed on July 5 must file by May 1.

- Failure to file risks dissolution or administrative penalties.

What Are the Penalties for Late Filing?

Late submission of an Illinois annual report or franchise tax report triggers penalties:

- A $100 late fee for corporations, plus interest on unpaid franchise taxes.

- LLCs face $25 penalties for overdue franchise tax reports.

- Persistent non-compliance may lead to business dissolution.

How to File the Illinois Annual Report?

Filing methods include:

- Online submission via the Illinois Secretary of State’s CyberDriveILLINOIS portal.

- Mail-in forms with a check or money order for the filing fee.

- In-person filing at the Springfield or Chicago Secretary of State offices.

What Information Is Required for the Annual Report?

The Illinois annual report requires updated business details such as:

- Registered agent name and address.

- Principal office address.

- Officers, directors, or managers (depending on entity type).

Frequently Asked Questions About LLCs (FAQs)

What is an Illinois LLC Annual Report and why is it required?

The Illinois LLC Annual Report is a mandatory filing submitted to the Illinois Secretary of State to keep your LLC in good standing. This report updates or confirms your business’s current information, such as its registered agent, principal office address, and members or managers. Failing to file this report by the deadline can result in penalties, late fees, or even administrative dissolution of your LLC. The state uses this report to maintain accurate records and ensure your business complies with ongoing legal obligations.

When is the deadline to file an Illinois LLC Annual Report?

The deadline for filing an Illinois LLC Annual Report is typically the first day of the anniversary month of your LLC’s formation. For example, if your LLC was formed on July 15th, the report is due by July 1st of each subsequent year. However, many LLCs default to a standard deadline of November 15th if no specific anniversary month is assigned. Late filings incur a $100 penalty, and prolonged delays risk your LLC’s good standing status.

What information do I need to include in my Illinois LLC Annual Report?

The report requires basic details about your LLC, such as its legal name, principal business address, and the name and address of its registered agent. You must also list the names and addresses of all members or managers. Additionally, you’ll need your LLC’s state-assigned file number and may need to confirm your business’s NAICS code. Ensure all information matches existing state records to avoid processing delays or rejections.

How do I file an Illinois LLC Annual Report?

You can file your Illinois LLC Annual Report online through the Illinois Secretary of State’s website using their BizFile system. Alternatively, paper forms can be mailed or submitted in person. Online filing is recommended for instant confirmation and faster processing. You’ll need your LLC’s PIN (provided by the state) to access your account. The filing fee is $75 for most LLCs, plus additional fees for late submissions. Always retain a receipt or confirmation number after submission.

Leave a Reply

Our Recommended Articles