Wyoming LLC Annual Report

Filing an annual report is a critical requirement for maintaining compliance and good standing for any limited liability company (LLC) registered in Wyoming. This mandatory document, submitted to the Wyoming Secretary of State, ensures the state has up-to-date information about the business, including its principal office address, registered agent, and member or manager details. The report is due annually by the first day of the LLC’s formation anniversary month, accompanied by a modest filing fee. Timely submission helps avoid penalties, dissolution, or loss of liability protections. This article outlines the essentials of Wyoming’s LLC annual report, including deadlines, filing procedures, and best practices for seamless compliance.

- Understanding the Wyoming LLC Annual Report Requirements

- Do I have to file an annual report for my LLC in Wyoming?

- How much is the annual report fee for a LLC in Wyoming?

-

How do I check the status of my Wyoming LLC?

- How to Check Your Wyoming LLC Status Through the Wyoming Secretary of State Website

- Contacting the Wyoming Secretary of State Directly

- Using Third-Party Services to Monitor Your Wyoming LLC Status

- Reviewing Annual Report and Tax Filing Compliance

- Verifying LLC Status Through Professional Registered Agents

- Checking for Pending or Past-Due Filings Affecting LLC Status

- Understanding the Importance of a Certificate of Good Standing

- Identifying Common Issues That Affect Wyoming LLC Status

- Utilizing the Wyoming Business Center Portal for Detailed Status Reports

- Steps to Reinstate a Delinquent or Dissolved Wyoming LLC

- What happens if I don't file an annual report for my LLC?

- Frequently Asked Questions About LLCs (FAQs)

Understanding the Wyoming LLC Annual Report Requirements

To maintain compliance with state regulations, a Wyoming LLC must file an Annual Report each year. This report ensures the state has up-to-date information about the LLC, including its registered agent and principal office address. The report is filed with the Wyoming Secretary of State and requires a $60 filing fee. Failure to submit the report by the deadline can result in penalties or even administrative dissolution of the LLC. Timely filing helps preserve the LLC’s good standing and legal protections.

See AlsoIllinois LLC Annual ReportKey Deadlines and Due Dates for Wyoming LLC Annual Reports

Wyoming LLCs must file their Annual Report by the first day of the LLC’s anniversary month each year. For example, if your LLC was formed on June 15th, the report is due by June 1st of every subsequent year. Late filings incur a $50 penalty if submitted within 60 days of the deadline. After 60 days, the LLC risks administrative dissolution.

| Due Date | First day of the LLC’s anniversary month |

| Late Penalty | $50 (within 60 days of deadline) |

| Final Deadline | 60 days past due date (avoid dissolution) |

Step-by-Step Guide to Filing a Wyoming LLC Annual Report

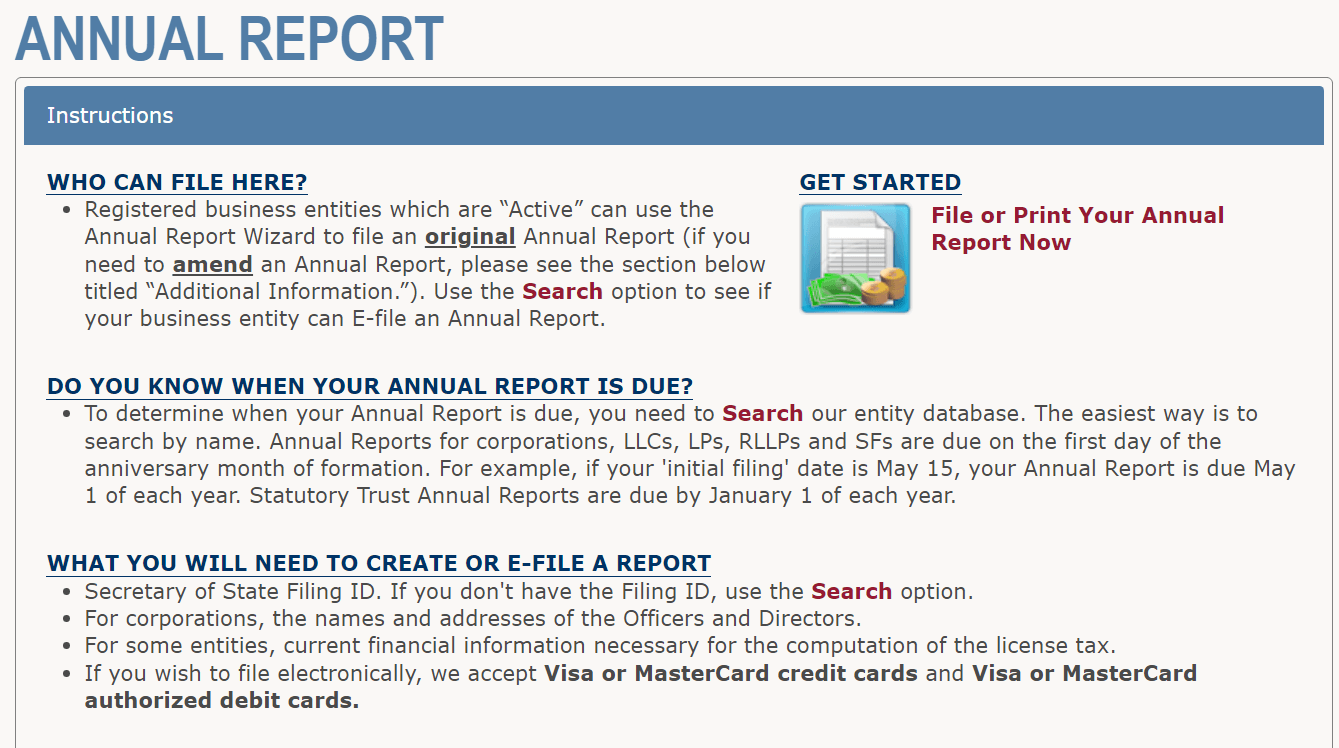

Filing the Wyoming LLC Annual Report is done online via the Wyoming Secretary of State’s website. Follow these steps:

1. Visit the state’s business filing portal.

2. Log in using your LLC’s registered agent credentials or entity ID.

3. Complete the report with updated business information.

4. Pay the $60 filing fee (plus penalties if applicable).

5. Receive a confirmation email or receipt.

| Step 1 | Access the Secretary of State’s online portal |

| Step 2 | Log in with LLC credentials |

| Step 3 | Update business details |

Fees and Penalties Associated with Late Filings

The standard Annual Report fee for Wyoming LLCs is $60. Late submissions incur a $50 penalty if filed within 60 days of the deadline. After 60 days, the LLC is marked as “non-compliant” and may face dissolution. To reinstate a dissolved LLC, a $300 reinstatement fee is required, along with overdue reports and penalties.

| Fee Type | Amount |

| Annual Report Filing | $60 |

| Late Penalty (≤60 days) | $50 |

| Reinstatement Fee | $300 |

Benefits of Timely Wyoming LLC Annual Report Submission

Filing the Annual Report on time ensures your LLC maintains its limited liability protection and good standing with the state. It also avoids costly penalties and prevents disruptions to business operations. Additionally, compliance helps build credibility with banks, clients, and potential investors.

See AlsoHow to Start a Tech Company With No Experience| Benefit | Description |

| Legal Protection | Preserves liability shield |

| Avoid Penalties | No late fees or dissolution risk |

| Business Credibility | Enhances trust with stakeholders |

Common Mistakes to Avoid When Filing Your Annual Report

Common errors include incorrect registered agent details, missing deadlines, and failing to update business addresses. Some LLCs also overlook paying the exact fee or forget to save their confirmation receipt. Double-check all information before submitting to avoid rejection or compliance issues.

| Mistake | Consequence |

| Incorrect Agent Details | Report rejection |

| Late Filing | Penalties or dissolution |

| Outdated Address | Non-compliance notice |

Do I have to file an annual report for my LLC in Wyoming?

What is It Like to Be an Analyst at a Venture Capital Firm?

What is It Like to Be an Analyst at a Venture Capital Firm?Yes, Wyoming LLCs must file an Annual License Fee Report instead of a traditional annual report. This requirement ensures your LLC remains in good standing. The report is due by January 1 of each year and requires a $60 fee (or $50 for LLCs formed after July 1). Failure to file may result in penalties or administrative dissolution.

Understanding Wyoming’s Annual License Fee for LLCs

Wyoming replaces the typical annual report with an Annual License Fee. This fee is mandatory for all LLCs, regardless of activity.

See Also What is the Business Model of Venture Capital Firms?

What is the Business Model of Venture Capital Firms?- The fee is $60 (or $50 for new LLCs formed after July 1).

- It must be paid by January 1 each year to avoid late penalties.

- Payments are submitted through the Wyoming Secretary of State’s online portal.

- No detailed business information (e.g., member names) is required—only payment.

Compliance Requirements for Wyoming LLCs

Beyond the Annual License Fee, Wyoming LLCs must meet other compliance obligations:

- Maintain a registered agent with a physical Wyoming address.

- Update the state about significant changes (e.g., registered agent or address).

- File amendments for structural changes (e.g., adding members).

- Renew any required business licenses or permits separately.

Penalties for Failing to File the Annual License Fee

Missing the deadline triggers consequences:

- A $50 late fee is added if unpaid by February 1.

- After 60 days of non-payment, the LLC enters “administrative dissolution” status.

- Reinstatement requires paying back fees, penalties, and a $300 reinstatement fee.

- Dissolution may affect banking, contracts, and legal protections.

How Wyoming’s Requirements Differ from Other States

Wyoming’s LLC rules are simpler compared to many states:

- No annual report with operational or financial details is required.

- Lower fees: $60 vs. higher costs in states like California ($800 franchise tax).

- No state income tax or corporate tax for LLCs.

- Privacy: No public disclosure of member or manager names.

Steps to File the Annual License Fee

Follow these steps to stay compliant:

- Visit the Wyoming Secretary of State’s website (sos.wyo.gov).

- Log into the online portal using your LLC’s credentials.

- Submit payment via credit card, check, or electronic transfer.

- Confirm receipt via email or the portal’s payment history.

- Update contact information if needed during the process.

How much is the annual report fee for a LLC in Wyoming?

What is the Annual Report Fee for a Wyoming LLC?

The annual report fee for a Wyoming LLC is $60. This fee must be submitted to the Wyoming Secretary of State every year by the first day of the LLC’s formation anniversary month.

- The base fee is $60, regardless of the LLC’s income or number of members.

- Wyoming does not charge additional franchise taxes or state income taxes for LLCs.

- Late filings incur a $50 penalty, and failure to file may lead to administrative dissolution.

How to Pay the Wyoming LLC Annual Report Fee?

Paying the annual report fee can be done online, by mail, or in person. The Wyoming Secretary of State’s website offers a streamlined online portal for submissions.

- Online payments are processed instantly via the Wyoming Business Center.

- Mail-in payments require a check payable to the Wyoming Secretary of State.

- In-person payments are accepted at the Secretary of State’s office in Cheyenne.

What Happens If You Miss the Annual Report Deadline?

Failing to file the annual report by the deadline results in a $50 late fee. Continued non-compliance risks administrative dissolution of the LLC.

- A 60-day grace period applies after the deadline, but the $50 penalty still applies.

- After 60 days, the LLC may be marked “non-compliant” and lose its good standing.

- Reinstatement requires paying back fees, penalties, and filing a reinstatement application.

Are There Additional Costs Beyond the Annual Report Fee?

While the annual report fee is $60, other costs may apply depending on the LLC’s operations.

- Registered agent fees (typically $50–$300/year) are mandatory for Wyoming LLCs.

- Optional services like expedited filing cost extra (e.g., $50 for same-day processing).

- Business licenses or permits may incur separate fees based on industry or location.

Why Wyoming LLCs Have Low Annual Fees Compared to Other States?

Wyoming is known for its business-friendly policies, including affordable annual fees and no corporate taxes.

- No state income tax or franchise tax reduces overall costs.

- The $60 annual fee is among the lowest in the U.S., attracting small businesses.

- Wyoming’s privacy laws and simplified compliance further enhance its appeal.

How do I check the status of my Wyoming LLC?

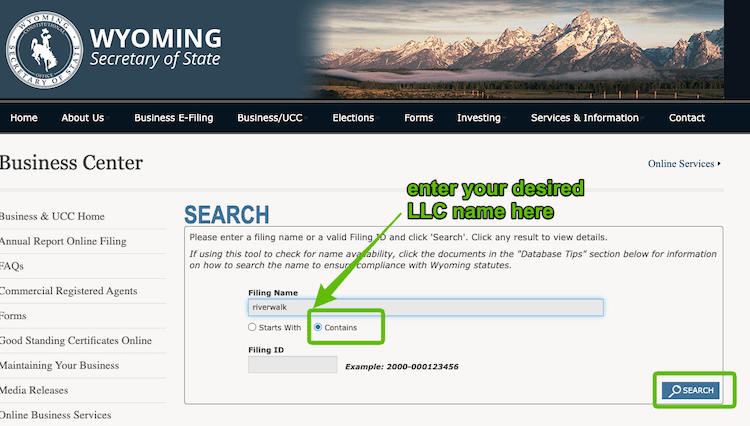

How to Check Your Wyoming LLC Status Through the Wyoming Secretary of State Website

To verify the status of your Wyoming LLC, visit the Wyoming Secretary of State’s official website. Use their Business Search tool to look up your LLC by name or filing number.

- Go to the Wyoming Secretary of State Business Center (https://wyobiz.wyo.gov/Business/FilingSearch.aspx).

- Enter your LLC’s name or filing number in the search bar.

- Review the search results for your LLC’s status (e.g., Active, Delinquent, or Dissolved).

Contacting the Wyoming Secretary of State Directly

If online methods are unclear, contact the Wyoming Secretary of State’s office for assistance. They can confirm your LLC’s status and compliance details.

- Call the office at (307) 777-7311 during business hours.

- Email inquiries to business@wyo.gov with your LLC’s details.

- Mail a written request to their office: Secretary of State, 2020 Carey Ave., Suite 700, Cheyenne, WY 82002.

Using Third-Party Services to Monitor Your Wyoming LLC Status

Third-party platforms like Northwest Registered Agent or Incfile can track your LLC’s compliance and status updates.

- Sign up for a compliance monitoring service with a registered agent.

- Receive automated alerts about annual report deadlines or status changes.

- Access detailed reports on your LLC’s good standing and filing history.

Reviewing Annual Report and Tax Filing Compliance

Wyoming LLCs must file an Annual Report and pay associated fees to maintain active status.

- Confirm your Annual Report is filed by the due date (typically the first day of your LLC’s formation month).

- Pay the $60 annual fee online via the Secretary of State’s portal.

- Check for any penalties or reinstatement requirements if filings are overdue.

Verifying LLC Status Through Professional Registered Agents

Your registered agent in Wyoming can provide updates on your LLC’s legal standing.

- Contact your registered agent to request a status certificate or good standing certificate.

- Ensure their contact information is current to avoid missing state correspondence.

- Ask them to verify compliance with all Wyoming LLC regulations.

Checking for Pending or Past-Due Filings Affecting LLC Status

A delayed or missing filing can change your LLC’s status to delinquent or administratively dissolved.

- Log into the Wyoming Secretary of State’s online portal to view filing history.

- Look for unresolved notices or deficiencies in your account.

- Resubmit any incomplete forms and settle outstanding fees to restore active status.

Understanding the Importance of a Certificate of Good Standing

A Certificate of Good Standing proves your Wyoming LLC is compliant with state requirements.

- Request the certificate online via the Secretary of State’s Business Center for a small fee.

- Use it to secure loans, attract investors, or register your LLC in other states.

- Ensure all taxes and annual reports are up to date before applying.

Identifying Common Issues That Affect Wyoming LLC Status

Common problems like missed deadlines or incorrect filings can jeopardize your LLC’s standing.

- Track annual report due dates using calendar reminders or compliance software.

- Double-check filings for errors in registered agent details or business addresses.

- Resolve tax liens or legal judgments promptly to avoid suspension.

Utilizing the Wyoming Business Center Portal for Detailed Status Reports

The Wyoming Business Center Portal offers comprehensive tools to manage and monitor your LLC.

- Create a free account on the portal for personalized access to your LLC’s records.

- Download filing receipts, certificates, and other official documents.

- Update member/manager information or registered agent details directly online.

Steps to Reinstate a Delinquent or Dissolved Wyoming LLC

If your LLC is delinquent or dissolved, follow state guidelines to reinstate it.

- File all overdue Annual Reports and pay associated fees plus penalties.

- Submit a Reinstatement Application (Form LLC-14) with the Secretary of State.

- Wait for confirmation of reinstatement and update your compliance records.

What happens if I don't file an annual report for my LLC?

Financial Penalties and Late Fees

If you fail to file your LLC’s annual report by the deadline, most states impose financial penalties or late fees. These fees accumulate over time, increasing the longer the report remains unfiled. For example:

- Late fees: Many states charge a fixed penalty (e.g., $50–$500) immediately after the due date.

- Interest charges: Some states add daily or monthly interest to unpaid fees.

- Increased reinstatement costs: If your LLC is dissolved, reinstating it often requires paying all outstanding fees plus additional penalties.

Administrative Dissolution of Your LLC

States may administratively dissolve your LLC if annual reports are not filed for an extended period. This means:

- Your LLC loses its legal status and cannot conduct business.

- Asset protection offered by the LLC structure may be voided, exposing personal assets to liabilities.

- Reinstatement becomes necessary to resume operations, which involves extra steps and costs.

Loss of Good Standing and Business Privileges

An unfiled annual report can cause your LLC to fall into bad standing with the state, leading to:

- Inability to obtain certificates of good standing, which are often required for loans, contracts, or licensing.

- Restrictions on expanding your business to other states.

- Suspension of business licenses or permits until compliance is restored.

Impact on Liability Protection

Failure to file may jeopardize the limited liability protection that an LLC provides. Consequences include:

- Personal liability for business debts or lawsuits if the LLC’s legal status is revoked.

- Difficulty defending the LLC’s separate legal identity in court.

- Creditors may target personal assets if the LLC’s protections are deemed invalid.

Complications with Reinstatement

Reinstating an LLC after dissolution due to missed filings is a lengthy and costly process:

- Back fees and penalties must be paid in full, often with interest.

- Updated annual reports for missed years may need to be filed simultaneously.

- Some states require new documentation, such as a reinstatement application or amended articles of organization.

Frequently Asked Questions About LLCs (FAQs)

What is the deadline for filing a Wyoming LLC Annual Report?

The deadline for submitting your Wyoming LLC Annual Report is November 15th of each year. If this date falls on a weekend or holiday, the deadline extends to the next business day. Late filings incur a $50 penalty, and failure to file may result in administrative dissolution of your LLC. Reports must be filed online through the Wyoming Secretary of State’s website, accompanied by a $60 filing fee. Timely compliance ensures your LLC remains in good standing.

What information is required to file a Wyoming LLC Annual Report?

The Wyoming LLC Annual Report requires basic business details, including the LLC’s principal office address, registered agent name and address, and the names and addresses of all members/managers. You must also confirm the LLC’s business purpose and ensure the $60 filing fee is paid. All information must match existing records on file with the state. Updates to company details, such as changes to the registered agent, should be filed separately before submitting the annual report.

What happens if I fail to file my Wyoming LLC Annual Report on time?

Missing the November 15th deadline triggers a $50 late penalty, and your LLC risks being marked as “non-compliant” by the state. After 60 days of non-compliance, the Wyoming Secretary of State may administratively dissolve your LLC, stripping it of legal protections and business privileges. To reinstate a dissolved LLC, you must file past-due reports, pay all penalties, and submit a reinstatement application with additional fees. Timely filing avoids operational disruptions and legal risks.

Can I file a Wyoming LLC Annual Report myself, or do I need a professional?

You can file the annual report yourself directly through the Wyoming Secretary of State’s online portal. The process is straightforward and requires no legal expertise. However, many LLC owners hire a registered agent service or business attorney to handle filings, ensure compliance, and avoid missed deadlines. Third-party services often provide reminders and streamline documentation but charge additional fees. Whether you file independently or use assistance, ensuring accurate and timely submission is critical for maintaining good standing.

Leave a Reply

Our Recommended Articles