What are Techstars convertible notes terms?

Techstars convertible notes terms are a critical aspect of startup financing, offering a flexible and efficient way for early-stage companies to secure funding. These notes function as a form of debt that converts into equity during a future financing round, typically at a discounted rate. Designed to simplify the investment process, Techstars' terms often include specific provisions such as valuation caps, interest rates, and maturity dates, which protect both investors and founders. Understanding these terms is essential for entrepreneurs seeking funding through Techstars, as they directly impact ownership stakes and future financial obligations. This article explores the key components of Techstars convertible notes and their implications for startups.

What Are Techstars Convertible Notes Terms?

Techstars convertible notes are a form of short-term debt that converts into equity, typically during a startup's next funding round. These notes are commonly used in early-stage investments, allowing investors to support startups without immediately determining the company's valuation. Techstars, a renowned startup accelerator, often utilizes convertible notes to fund its portfolio companies. Below, we explore the key terms and details of Techstars convertible notes.

See Also What is Equity Financing and What Are Its Major Sources?

What is Equity Financing and What Are Its Major Sources?1. What Is a Convertible Note?

A convertible note is a type of debt that converts into equity under specific conditions, usually during a future financing round. It is a popular instrument for early-stage startups because it delays the valuation discussion until the company has more traction. Techstars uses convertible notes to provide funding to startups in its accelerator program, offering flexibility for both the investor and the startup.

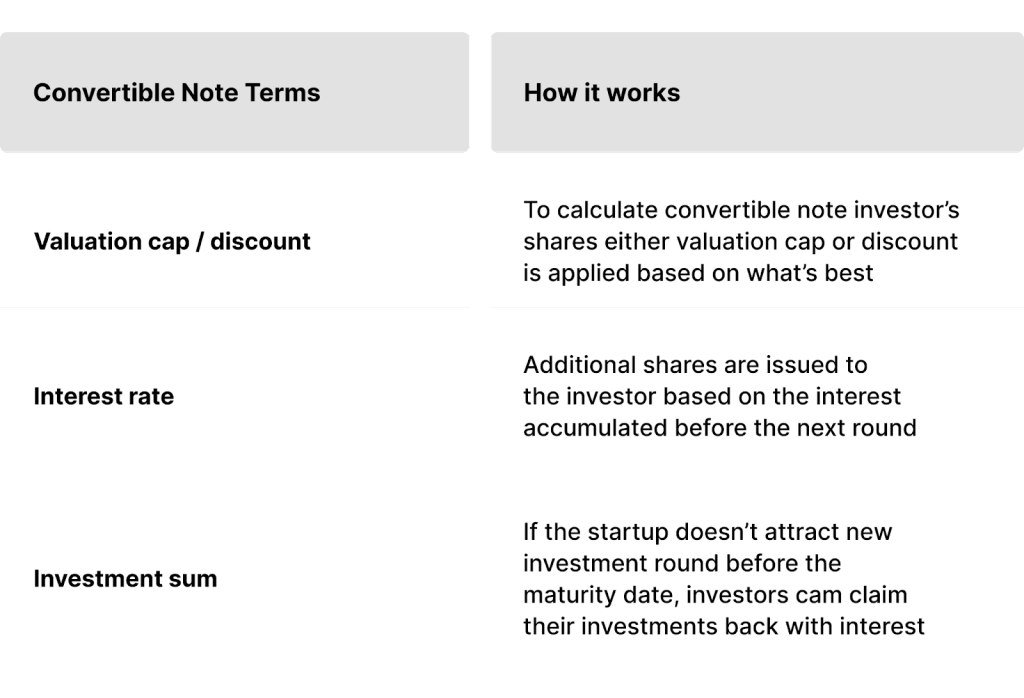

2. Key Terms in Techstars Convertible Notes

Techstars convertible notes include several critical terms that define the agreement between the investor and the startup. These terms include the discount rate, interest rate, maturity date, and valuation cap. The discount rate provides investors with a reduced price per share during the equity conversion, while the valuation cap sets a maximum valuation for conversion, ensuring investors receive a fair share of equity.

See AlsoHow Does the Enfp Personality Type Respond to Being Micromanaged3. How Does the Discount Rate Work?

The discount rate is a percentage reduction offered to investors when the convertible note converts into equity. For example, if the discount rate is 20%, investors can convert their debt into equity at 80% of the price per share paid by new investors in the next funding round. This incentivizes early investment by rewarding investors for taking on higher risk.

4. What Is a Valuation Cap?

A valuation cap is the maximum valuation at which the convertible note can convert into equity. If the startup's valuation exceeds the cap during the next funding round, the investor's conversion price is based on the cap rather than the higher valuation. This ensures that early investors receive a larger equity stake, reflecting their early support.

See Also What is the Future of Venture Capital?

What is the Future of Venture Capital?5. What Happens at the Maturity Date?

The maturity date is the deadline by which the convertible note must either be repaid or converted into equity. If the startup has not raised a new funding round by this date, the investor and startup may negotiate an extension, repayment, or conversion at a pre-agreed valuation. This term protects investors by ensuring a clear timeline for their investment.

| Term | Description |

|---|---|

| Discount Rate | Percentage reduction on the price per share during conversion. |

| Valuation Cap | Maximum valuation for conversion, protecting early investors. |

| Interest Rate | Accrued interest on the debt until conversion. |

| Maturity Date | Deadline for repayment or conversion of the note. |

What are the key terms of a convertible note?

What is an Entrepreneur in Residence Eir What Do They Do How Does It Work

What is an Entrepreneur in Residence Eir What Do They Do How Does It WorkWhat is a Convertible Note?

A convertible note is a form of short-term debt that converts into equity, typically in conjunction with a future financing round. It is commonly used by startups to raise initial funding without immediately determining the company's valuation. Key aspects include:

- Debt Instrument: Initially, it functions as a loan with an interest rate.

- Conversion to Equity: The note converts into equity (usually preferred stock) during a subsequent financing round.

- Maturity Date: The date by which the note must either be repaid or converted.

What is the Interest Rate on a Convertible Note?

The interest rate on a convertible note accrues over time and is typically added to the principal amount before conversion. Key points include:

See Also How to Find a Vc in Dubai

How to Find a Vc in Dubai- Accrual: Interest accumulates until the note converts or matures.

- Typical Range: Rates usually range between 2% and 8% annually.

- Impact on Conversion: Higher interest rates increase the total amount converted into equity.

What is a Discount Rate in a Convertible Note?

The discount rate provides early investors with a reduced price per share compared to later investors in the next funding round. Important details include:

- Purpose: Rewards early investors for taking on higher risk.

- Typical Range: Discount rates usually range from 10% to 30%.

- Calculation: Applied to the price per share in the next round to determine the conversion price.

What is a Valuation Cap in a Convertible Note?

A valuation cap sets a maximum valuation at which the note can convert into equity, protecting investors from excessive dilution. Key aspects include:

- Protection: Ensures investors receive a fair share of equity even if the company's valuation skyrockets.

- Negotiation: Often a point of negotiation between founders and investors.

- Impact: A lower cap benefits investors, while a higher cap favors founders.

What Happens at Maturity if the Note Doesn’t Convert?

If the convertible note does not convert by the maturity date, the company must either repay the debt or negotiate an extension. Key considerations include:

- Repayment: The company may need to repay the principal plus accrued interest.

- Extension: Investors and founders can agree to extend the maturity date.

- Conversion: In some cases, the note may automatically convert at a predetermined valuation.

What are the rules for convertible notes?

What is a Convertible Note?

A convertible note is a form of short-term debt that converts into equity, typically in conjunction with a future financing round. It is commonly used by startups to raise initial funding without immediately determining the company's valuation. The key features include:

- Debt Instrument: Initially, it functions as a loan with an interest rate.

- Conversion Trigger: Converts into equity during a specified event, such as a Series A funding round.

- Maturity Date: The date by which the note must either be repaid or converted.

Key Terms in Convertible Notes

Understanding the terms of a convertible note is crucial for both investors and startups. The most important terms include:

- Discount Rate: A percentage reduction offered to investors when the note converts into equity.

- Valuation Cap: The maximum valuation at which the note can convert into equity.

- Interest Rate: The rate at which the debt accrues interest until conversion or repayment.

How Does Conversion Work?

Conversion occurs when specific conditions are met, such as a subsequent funding round. The process involves:

- Triggering Event: Typically, a qualified financing round exceeding a certain amount.

- Conversion Calculation: The note converts into equity based on the discount rate or valuation cap, whichever is more favorable to the investor.

- Equity Issuance: Shares are issued to the note holders, diluting existing shareholders.

Advantages of Convertible Notes

Convertible notes offer several benefits for both startups and investors:

- Simplified Fundraising: Avoids the need for immediate valuation, saving time and legal costs.

- Flexibility: Provides a flexible financing option for early-stage companies.

- Investor Incentives: Offers discounts and caps to attract early investors.

Risks and Considerations

While convertible notes are advantageous, they also come with risks:

- Debt Obligations: If conversion does not occur, the startup must repay the debt with interest.

- Dilution: Conversion can lead to significant dilution for founders and early investors.

- Legal Complexity: Requires careful drafting to avoid disputes over terms and conditions.

What are the terms of convertible debt?

:max_bytes(150000):strip_icc()/convertiblebond.asp-Final2-181ede2ae1754cc4baa4bb628e7959a8.png)

What is Convertible Debt?

Convertible debt is a type of financing that starts as a loan but can be converted into equity, typically shares of the company, under specific conditions. It is often used by startups and early-stage companies to raise capital without immediately diluting ownership. The key terms of convertible debt include the interest rate, maturity date, conversion discount, and valuation cap.

Key Terms of Convertible Debt

The terms of convertible debt are crucial for both investors and companies. Below are the most important terms:

- Interest Rate: The rate at which the debt accrues interest until it is repaid or converted into equity.

- Maturity Date: The date by which the debt must be repaid or converted into equity.

- Conversion Discount: A discount offered to investors when converting debt into equity, typically ranging from 10% to 30%.

- Valuation Cap: The maximum valuation at which the debt can be converted into equity, protecting investors from overpaying.

- Conversion Trigger: The event that triggers the conversion, such as a future funding round or acquisition.

Interest Rate in Convertible Debt

The interest rate in convertible debt is the rate at which the loan accrues interest over time. This interest is typically not paid in cash but is added to the principal amount and converted into equity during the conversion event. The rate is usually lower than traditional loans, reflecting the higher risk taken by investors.

- Interest accrues until the debt is converted or repaid.

- It is often compounded annually or semi-annually.

- The rate is negotiated between the company and the investor.

Maturity Date in Convertible Debt

The maturity date is the deadline by which the convertible debt must either be repaid or converted into equity. If the company has not triggered a conversion event by this date, the investor may demand repayment of the principal plus accrued interest.

- Typically ranges from 12 to 36 months.

- Failure to repay can lead to legal action or renegotiation.

- Companies often aim to trigger conversion before the maturity date.

Conversion Discount and Valuation Cap

The conversion discount and valuation cap are mechanisms to reward early investors for taking on higher risk. The discount allows investors to convert debt into equity at a lower price than future investors, while the cap sets a maximum valuation for conversion, ensuring investors receive a fair share of equity.

- Discounts typically range from 10% to 30%.

- Valuation caps protect investors from dilution in high-valuation scenarios.

- Both terms are negotiated during the initial agreement.

Conversion Trigger Events

Conversion trigger events are specific milestones that allow the debt to be converted into equity. Common triggers include a qualified financing round, an acquisition, or the maturity date. These events ensure that conversion occurs under favorable conditions for both parties.

- Qualified financing rounds are the most common trigger.

- Acquisitions may force automatic conversion.

- Maturity date acts as a final trigger if no other event occurs.

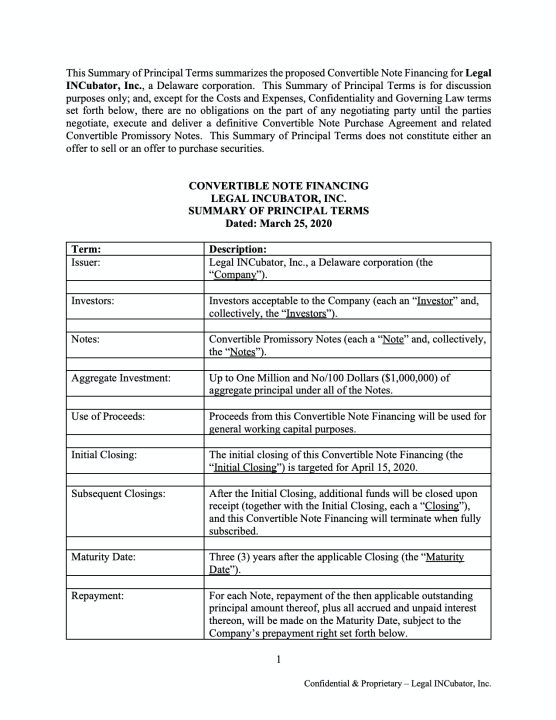

What percent does Techstars take?

What Percentage Does Techstars Take in Equity?

Techstars typically takes 6% equity in the startups that participate in their accelerator programs. This percentage is standard across most of their programs and is part of the agreement when startups are accepted into the program. In exchange, Techstars provides funding, mentorship, and access to their extensive network.

- 6% equity is the standard amount taken by Techstars.

- This equity is exchanged for $20,000 in funding and a $100,000 convertible note.

- The equity stake is part of the terms and conditions of joining the program.

How Does Techstars' Equity Stake Compare to Other Accelerators?

Techstars' 6% equity stake is relatively standard when compared to other top-tier accelerators like Y Combinator, which also takes a similar percentage. However, the value provided by Techstars, including mentorship and network access, often justifies the equity taken.

- Techstars' equity stake is comparable to Y Combinator's 7%.

- Other accelerators may take higher or lower percentages depending on the program.

- The mentorship and network provided by Techstars are key differentiators.

What Does Techstars Offer in Exchange for Equity?

In exchange for the 6% equity, Techstars offers a comprehensive package that includes $20,000 in funding, a $100,000 convertible note, and access to their global network of mentors, investors, and alumni. Additionally, startups receive intensive mentorship and the opportunity to pitch to investors at the end of the program.

- $20,000 in funding is provided upfront.

- A $100,000 convertible note is offered as part of the deal.

- Access to a global network of mentors and investors is a significant benefit.

Is the Equity Stake Negotiable with Techstars?

The 6% equity stake is generally non-negotiable as it is a standard term across all Techstars programs. This consistency ensures fairness and transparency for all participating startups. However, the value provided by Techstars often outweighs the equity given up.

- The equity stake is non-negotiable in most cases.

- Standard terms ensure fairness and transparency for all startups.

- The value provided by Techstars often justifies the equity taken.

What Happens to the Equity if a Startup Fails?

If a startup fails after participating in the Techstars program, the 6% equity stake remains with Techstars. However, since the equity is tied to the startup's success, it becomes essentially worthless if the startup does not succeed. This is a risk that both the startup and Techstars take.

- The 6% equity stake remains with Techstars even if the startup fails.

- Equity becomes worthless if the startup does not succeed.

- Both parties share the risk associated with the startup's success or failure.

Frequently Asked Questions (FAQs)

What are Techstars convertible notes?

Techstars convertible notes are a form of short-term debt that converts into equity, typically during a future financing round. These notes are commonly used by startups in their early stages to raise capital without immediately determining a valuation. The Techstars program often provides funding through convertible notes to its participating startups, offering them flexibility and time to grow before establishing a formal valuation.

What are the typical terms of Techstars convertible notes?

The typical terms of Techstars convertible notes include a discount rate, which gives investors a reduced price compared to later investors in the next funding round, and a valuation cap, which sets a maximum valuation for conversion. Additionally, the notes may include an interest rate that accrues over time and is added to the principal amount when the note converts. These terms are designed to balance the interests of both the startup and the investors.

How does the valuation cap work in Techstars convertible notes?

The valuation cap in Techstars convertible notes is a mechanism to protect early investors by ensuring they receive a fair share of equity relative to their investment. If the startup's valuation at the next funding round exceeds the cap, the note converts at the capped valuation, allowing investors to benefit from the lower valuation. This incentivizes early investment while providing startups with the necessary funds to grow without immediate pressure to set a high valuation.

What happens if a Techstars startup fails to raise a subsequent funding round?

If a Techstars startup fails to raise a subsequent funding round, the convertible notes typically remain as debt until they reach their maturity date. At that point, the startup may need to repay the principal amount plus any accrued interest, unless both parties agree to extend the note or convert it into equity under revised terms. This scenario underscores the importance of startups achieving milestones to attract further investment and avoid financial strain.

Leave a Reply

Our Recommended Articles