Arizona LLC Operating Agreement

An Arizona LLC Operating Agreement serves as the foundational document outlining the internal structure, management, and operational guidelines for a limited liability company (LLC) within the state. While Arizona does not legally require LLCs to adopt this agreement, establishing one is strongly recommended to clarify member roles, profit-sharing arrangements, voting rights, and dispute-resolution procedures. A well-drafted operating agreement not only reinforces the LLC’s legal separation from its owners but also ensures compliance with state laws while providing flexibility to tailor rules to the business’s unique needs. This article explores essential components, legal considerations, and best practices for creating an effective Arizona LLC Operating Agreement.

Understanding the Importance of an Arizona LLC Operating Agreement

An Arizona LLC Operating Agreement is a critical legal document that outlines the ownership structure, management protocols, and operational rules for a limited liability company (LLC) in Arizona. While Arizona state law does not legally require LLCs to have an operating agreement, creating one is highly recommended to establish clear guidelines, protect members' limited liability status, and prevent internal disputes. This document customizes the LLC’s framework, ensuring compliance with state regulations while addressing the unique needs of the business and its members.

See Also What Are Examples of Vc Due Diligence Check Lists?

What Are Examples of Vc Due Diligence Check Lists?Key Components of an Arizona LLC Operating Agreement

The operating agreement should include essential elements such as member ownership percentages, voting rights, profit and loss distribution, and management structure (member-managed vs. manager-managed). It also outlines procedures for adding or removing members, dispute resolution, and dissolution of the LLC. Clarity in these areas ensures smooth operations and legal protection.

| Component | Description |

| Member Information | Details about members, contributions, and ownership stakes. |

| Management Structure | Defines roles (member-managed or manager-managed). |

| Profit Distribution | Rules for allocating profits and losses among members. |

| Dissolution Process | Steps to terminate the LLC. |

Legal Requirements for Arizona LLC Operating Agreements

Arizona law (Title 29, Arizona Revised Statutes) does not mandate filing the operating agreement with the state, but it must be retained internally. The agreement should comply with statutory guidelines, such as allowing flexibility in management and including clauses for dissolution and indemnification. Non-compliance could jeopardize liability protection.

See AlsoSingle Member LLC: Illinois| Requirement | Details |

| Not Filed Publicly | Kept internally by the LLC. |

| Mandatory Clauses | Dissolution terms, indemnification of members/managers. |

| Flexibility | Allows customization of management and profit-sharing rules. |

Amending an Arizona LLC Operating Agreement

Changes to the operating agreement typically require member approval, as specified in the original document. Amendments should be documented in writing and signed by all members. Common reasons for amendments include adding members, altering profit distributions, or updating management roles.

| Amendment Process | Details |

| Member Approval | Percentage required varies per agreement. |

| Documentation | Written amendments signed by members. |

| Common Reasons | Structural changes, new members, tax updates. |

Member-Managed vs. Manager-Managed Arizona LLCs

Arizona LLCs can choose between member-managed (all members participate in decisions) or manager-managed (appointed managers handle operations). The choice affects daily operations, liability, and decision-making authority, and must be clearly stated in the operating agreement.

See AlsoLouisiana LLC Operating Agreement| Management Type | Key Features |

| Member-Managed | All members vote on decisions; common in small LLCs. |

| Manager-Managed | Delegates authority to managers; ideal for passive investors. |

Tax Implications and Arizona LLC Operating Agreements

The operating agreement influences tax treatment by specifying profit allocation and tax classifications (e.g., partnership, S-corp). Arizona LLCs benefit from pass-through taxation, but the agreement should align with federal and state tax rules to avoid disputes.

| Tax Aspect | Impact |

| Pass-Through Taxation | Profits taxed at member level, not entity level. |

| Federal Election | Operating agreement should reflect S-corp or partnership status. |

| State Compliance | Aligns with Arizona tax regulations. |

Is an operating agreement required for an LLC in Arizona?

Is an Operating Agreement Legally Required for Arizona LLCs?

In Arizona, an operating agreement is not legally required to form or operate an LLC. The state does not mandate its creation under the Arizona Limited Liability Company Act. However, even though it is optional, drafting one is strongly recommended to avoid ambiguities and protect the business structure. Without it, the LLC defaults to state-mandated rules, which may not align with members’ intentions.

- No statutory requirement: Arizona law does not enforce an operating agreement.

- Default rules apply: State laws govern unresolved issues like profit-sharing or management.

- Customization: An agreement allows tailoring rules to the LLC’s needs.

Why Should an Arizona LLC Have an Operating Agreement?

While not mandatory, an operating agreement provides legal clarity and operational structure. It helps define roles, responsibilities, and procedures, reducing the risk of disputes. For multi-member LLCs, it is particularly crucial to outline ownership percentages, voting rights, and profit distribution.

- Member protection: Shields personal assets by reinforcing the LLC’s legal separation.

- Dispute resolution: Establishes processes for handling disagreements.

- Credibility: Enhances professionalism with banks, investors, or courts.

What Happens If an Arizona LLC Lacks an Operating Agreement?

Without an operating agreement, the LLC is governed by Arizona’s default statutes, which may lead to unintended outcomes. For example, profits and losses are split equally among members regardless of capital contributions, and major decisions may require unanimous consent, complicating operations.

- Equal profit splits: Regardless of individual investments.

- Management conflicts: No clear hierarchy for decision-making.

- Legal vulnerabilities: Courts may pierce the corporate veil without formal guidelines.

Key Provisions to Include in an Arizona LLC Operating Agreement

A well-drafted operating agreement should address critical aspects of the LLC’s operations. This includes ownership details, management structure, voting rights, and procedures for adding or removing members. Clarity in these areas minimizes future conflicts.

- Ownership percentages: Define capital contributions and profit shares.

- Management roles: Specify member-managed vs. manager-managed structures.

- Dissolution terms: Outline steps for winding down the LLC.

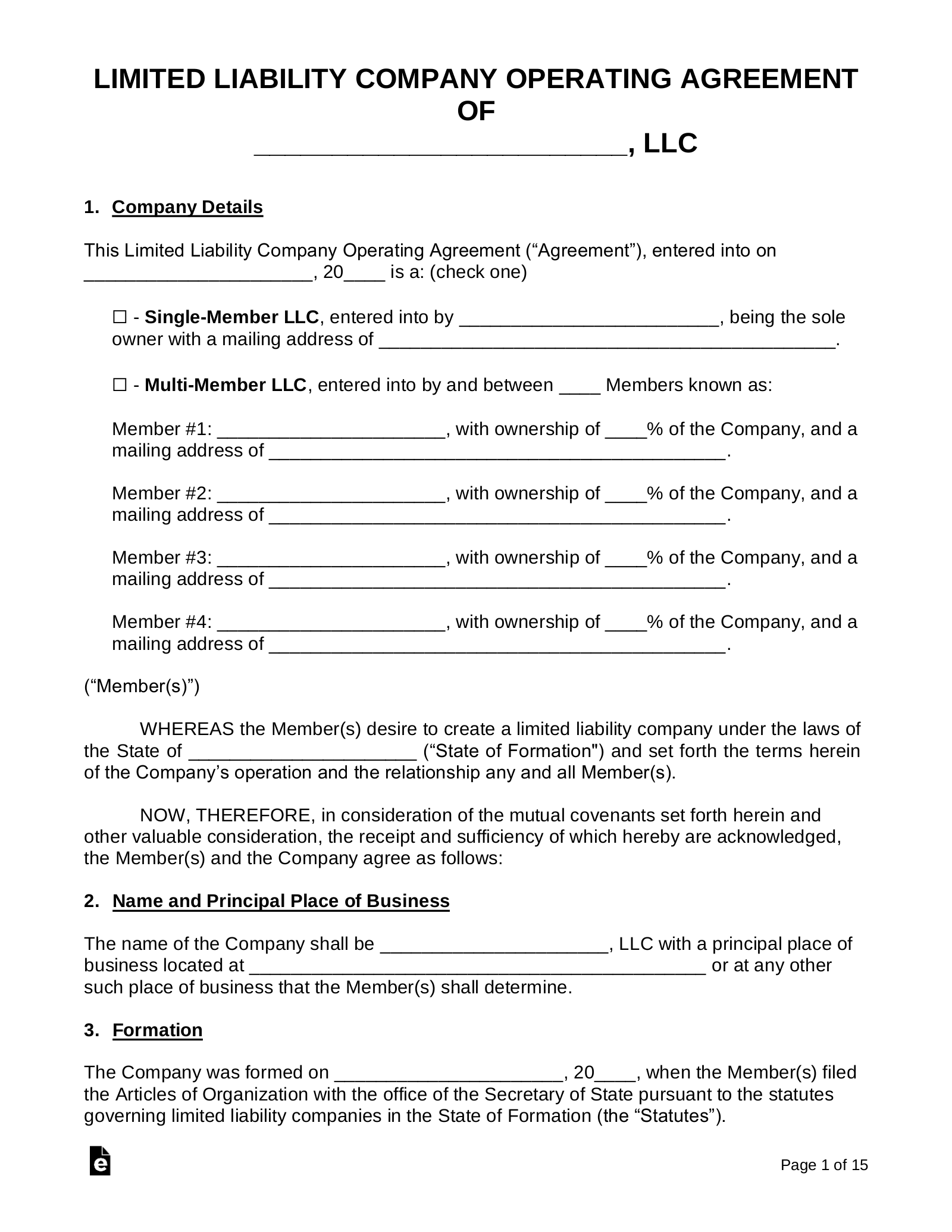

How to Create an Operating Agreement for an Arizona LLC

Drafting an operating agreement involves customizing templates or consulting a business attorney. While Arizona does not require filing the document, it should be signed by all members and stored with business records. Online legal services or LLC formation platforms often provide customizable templates.

- Use templates: Adapt state-specific templates to meet needs.

- Legal review: Ensure compliance with Arizona laws.

- Member approval: All members must sign to enforce terms.

What are the pitfalls of an LLC operating agreement?

1. Ambiguity in Roles and Responsibilities

A common pitfall in LLC operating agreements is unclear definitions of member roles, decision-making authority, or managerial duties. This can lead to conflicts, operational inefficiencies, or even legal disputes. Key issues include:

- Undefined voting rights: Failing to specify voting percentages or procedures for major decisions.

- Overlapping responsibilities: Members assuming conflicting roles without clear boundaries.

- Lack of leadership structure: No designated manager, causing delays in day-to-day operations.

2. Inadequate Profit and Loss Allocation Terms

Poorly drafted financial provisions can create inequities or tax complications. The agreement must align with IRS guidelines while reflecting members’ expectations. Common oversights include:

- Non-compliance with IRS rules: Profit splits that don’t match ownership percentages, risking audit triggers.

- Unclear capital contribution terms: Ambiguity about how funds are injected or repaid.

- Missing distribution schedules: No framework for timing or methods of profit payouts.

3. Failure to Address Dispute Resolution

Without a predefined mechanism to resolve conflicts, disagreements can escalate into costly litigation. Critical gaps often involve:

- No mediation or arbitration clauses: Forcing disputes into court instead of private resolution.

- Unclear exit strategies: No buyout terms for members wanting to leave or sell their stakes.

- Silence on deadlock procedures: No plan for resolving tied votes or stalemates in decision-making.

4. Non-Compliance with State-Specific Regulations

LLC laws vary by state, and generic operating agreements may overlook critical legal requirements. Risks include:

- Ignoring mandatory clauses: Some states require specific language about dissolution or member rights.

- Outdated provisions: Failing to update the agreement after law changes.

- Improper filing: Missing state-specific formatting or notarization rules, risking invalidation.

5. Lack of Succession Planning

Operating agreements often neglect scenarios like member death, disability, or retirement, leading to instability. Key omissions involve:

- No survivorship terms: Unclear inheritance processes for a member’s ownership stake.

- Absence of continuity clauses: No plan to keep the LLC operational during transitions.

- Failure to define valuation methods: Disputes over how to price a departing member’s shares.

Is an LLC operating agreement the same as an LLC agreement?

Terminology Variations in LLC Agreements

While LLC Operating Agreement and LLC Agreement are often used interchangeably, their usage may depend on regional preferences or legal jargon. Both refer to the same foundational document governing an LLC's operations. However, some states or legal professionals may favor one term over the other.

- Synonyms: Both terms describe the internal rules and ownership structure of the LLC.

- State-Specific Usage: For example, Delaware commonly uses LLC Agreement, while other states prefer Operating Agreement.

- Consistency: Regardless of the name, the document's purpose and enforceability remain consistent.

Purpose and Structure of LLC Operating Agreements

An LLC Operating Agreement outlines the financial, managerial, and operational framework of the business. It clarifies roles, profit-sharing, and decision-making processes to prevent disputes.

- Management Structure: Defines whether the LLC is member-managed or manager-managed.

- Profit Distribution: Details how profits and losses are allocated among members.

- Dissolution Rules: Specifies procedures for dissolving the LLC or handling member exits.

Legal Requirements for LLC Agreements

Most states do not legally require an LLC Operating Agreement, but having one is strongly advised to protect members' rights and limit liability.

- State Variations: A few states, like California, mandate disclosure of basic terms in formation documents.

- Liability Protection: Courts may disregard the LLC's liability shield if no formal agreement exists.

- Customization: Allows tailoring rules to the LLC’s needs, overriding default state statutes.

Key Components of an LLC Operating Agreement

A comprehensive LLC Agreement includes critical provisions to ensure smooth operations and legal compliance.

- Membership Details: Names, ownership percentages, and capital contributions of members.

- Voting Rights: Rules for decision-making, including majority vs. unanimous votes.

- Profit and Loss Allocation: Formulas for distributing financial outcomes.

- Amendment Process: Procedures for modifying the agreement.

Common Misconceptions About LLC Agreements

Misunderstandings about LLC Operating Agreements can lead to legal vulnerabilities or operational confusion.

- Not Required, Not Necessary: Even if not mandated, an agreement strengthens legal standing.

- Too Complex for Small LLCs: Even single-member LLCs benefit from formalizing structure.

- State Laws Are Sufficient: Relying solely on default statutes may lead to unintended governance issues.

- Set It and Forget It: Agreements should be updated as the business evolves.

Frequently Asked Questions About LLCs (FAQs)

Is an Operating Agreement Required for an LLC in Arizona?

An operating agreement is not legally required for Arizona LLCs, but it is highly recommended. While the state does not mandate filing this document, having one establishes clear rules for governance, member roles, profit distribution, and dispute resolution. Without it, your LLC defaults to Arizona’s default LLC statutes, which may not align with your business’s specific needs. Customizing an operating agreement ensures legal clarity and protects members’ personal liability protections.

What Should Be Included in an Arizona LLC Operating Agreement?

A comprehensive Arizona LLC operating agreement should outline ownership percentages, voting rights, management structure, and procedures for adding/removing members. It must also define profit and loss allocations, meeting protocols, dissolution terms, and rules for amending the agreement. Including buyout clauses and dispute resolution methods minimizes future conflicts. Tailoring these provisions to your LLC’s unique operations ensures compliance with state law and operational efficiency.

Can a Single-Member LLC in Arizona Have an Operating Agreement?

Yes, single-member LLCs in Arizona benefit significantly from an operating agreement. This document reinforces the separation between personal and business assets, strengthening liability protection. It also establishes formal business protocols, such as profit distribution and succession planning, which are crucial for credibility with lenders or investors. Even without partners, a single-member agreement provides legal structure and clarity for future growth or ownership changes.

How Do I Amend an Arizona LLC Operating Agreement?

To amend an Arizona LLC operating agreement, follow the amendment procedures outlined in the original document. Most agreements require a member vote or unanimous consent, depending on the change’s nature. Once approved, draft an amendment detailing the revisions, have all members sign it, and store it with your LLC records. While Arizona does not require amendments to be filed with the state, ensure updates comply with state law to maintain enforceability.

Leave a Reply

Our Recommended Articles