How to Dissolve an LLC in Iowa

Dissolving a limited liability company (LLC) in Iowa involves a structured process to ensure legal compliance and avoid potential liabilities. Whether closing due to business restructuring, financial challenges, or a shift in priorities, properly terminating an LLC requires careful attention to state-specific regulations. Iowa mandates specific steps, including member approval, settling debts, filing dissolution documents, and notifying relevant parties. Failing to follow these procedures may result in ongoing fees, tax obligations, or legal complications. This guide outlines the essential actions to dissolve an LLC in Iowa, from drafting a resolution to submitting final paperwork with the Iowa Secretary of State, ensuring a smooth and legally sound conclusion to your business operations.

Steps to Dissolve an LLC in Iowa

1. Understanding Voluntary Dissolution in Iowa

To dissolve an Iowa LLC voluntarily, members must follow state-specific procedures. First, review the LLC’s operating agreement for dissolution guidelines. If the agreement is silent, Iowa law requires majority approval from members. Next, settle outstanding debts, notify creditors, and file Articles of Dissolution with the Iowa Secretary of State. Ensure all tax obligations are resolved to avoid penalties.

See AlsoHow to Dissolve an LLC in Maryland| Step | Requirement | Deadline |

|---|---|---|

| Member Approval | Majority vote required | Before filing |

| Debt Settlement | Clear all liabilities | Prior to dissolution |

| Filing | Submit Articles of Dissolution | No strict deadline |

2. Obtaining Tax Clearance from the Iowa Department of Revenue

Before dissolving, LLCs must settle all state tax obligations. File final tax returns and pay outstanding taxes, including sales, income, and payroll taxes. Request a tax clearance certificate from the Iowa Department of Revenue to confirm compliance. This certificate is not mandatory but recommended to avoid future liabilities.

| Action | Agency | Key Document |

|---|---|---|

| File Final Returns | Iowa Department of Revenue | Final tax returns |

| Request Clearance | Same | Tax clearance certificate |

3. Filing Articles of Dissolution with the Iowa Secretary of State

Submit the Articles of Dissolution (Form LLC 4.2) to formally terminate the LLC. Include the LLC’s name, dissolution date, and member approval details. The filing fee is $5. Processing typically takes 7–10 business days. Expedited service is available for an additional fee.

See AlsoHow to Dissolve an LLC in Nevada| Form | Fee | Processing Time |

|---|---|---|

| Articles of Dissolution | $5 | 7–10 days |

4. Notifying Creditors and Settling Claims

Iowa law requires dissolving LLCs to notify creditors and settle claims. Send written notices to known creditors and publish a dissolution announcement in a newspaper in the LLC’s county. Claims must be resolved or funds set aside before distributing remaining assets to members.

| Action | Method | Timeframe |

|---|---|---|

| Notify Creditors | Written notice | Before asset distribution |

| Publish Notice | Newspaper publication | Once |

5. Reinstating a Dissolved LLC in Iowa

If an LLC is dissolved accidentally or needs revival, file an Application for Reinstatement with the Iowa Secretary of State. Pay a $10 fee and resolve any compliance issues (e.g., unpaid taxes). Reinstatement restores the LLC’s active status retroactively.

See AlsoHow to Dissolve an LLC in Oklahoma| Document | Fee | Condition |

|---|---|---|

| Application for Reinstatement | $10 | Compliance with state requirements |

How much does it cost to dissolve an LLC in Iowa?

State Filing Fees for Dissolving an LLC in Iowa

The primary cost to dissolve an LLC in Iowa is the state filing fee for submitting the Articles of Dissolution. This fee is typically $5 when filed by mail or in person. However, additional costs may apply depending on administrative requirements.

See AlsoHow to Dissolve an LLC in Wisconsin- $5 filing fee for the Articles of Dissolution form (PDF).

- Optional expedited processing fees ($20–$50) for faster approval.

- Potential charges for Certified Copies ($5 per copy) if needed for legal purposes.

Outstanding Taxes and Penalties

Before dissolving an LLC in Iowa, owners must settle outstanding taxes and resolve any penalties. Failure to do so may delay dissolution or result in fines.

- Final income tax returns must be filed with the Iowa Department of Revenue.

- Unpaid sales tax, withholding tax, or franchise tax obligations must be cleared.

- Penalties for late tax payments or unfiled returns may apply.

Legal and Professional Service Costs

Hiring an attorney or business service provider can add to dissolution costs but ensures compliance with state regulations.

See AlsoHow to Dissolve an LLC in Massachusetts- Legal fees range from $200–$500+ depending on complexity.

- Online legal services (e.g., LegalZoom) charge $150–$300+ for dissolution assistance.

- Accountant fees for final tax filings may cost $100–$400.

Closing Business Accounts and Contracts

Dissolving an LLC may involve costs tied to terminating leases, contracts, or financial accounts.

- Early termination fees for leases or service contracts.

- Bank account closure fees, if applicable.

- Costs to notify creditors and settle outstanding debts.

Publication Requirements and Associated Costs

While Iowa does not mandate publication of dissolution notices, other obligations may apply.

- No statutory requirement for newspaper publication in Iowa.

- Potential costs if third-party contracts require formal dissolution notices.

- Fees for mailing notifications to creditors or members.

How do I close an LLC in Iowa?

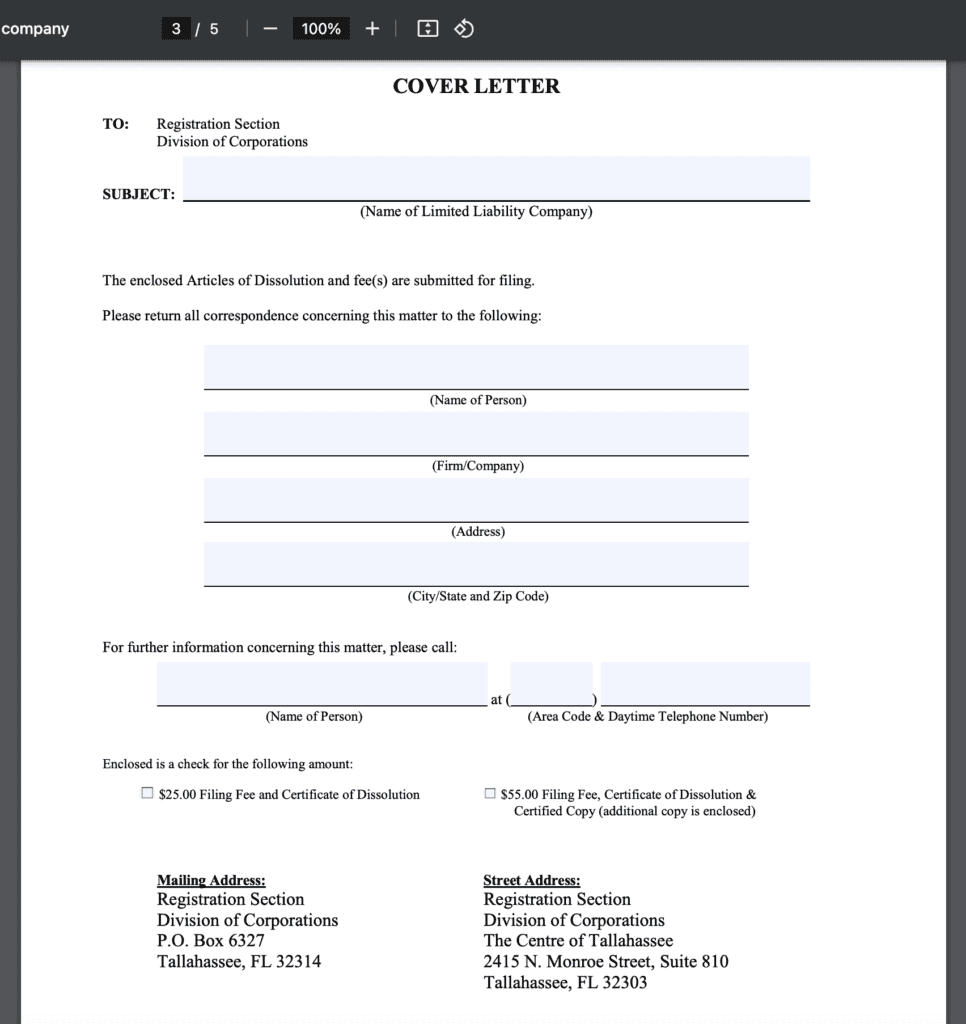

How to File Articles of Dissolution in Iowa

To formally close an LLC in Iowa, you must file Articles of Dissolution with the Iowa Secretary of State. This document legally terminates your LLC’s existence.

- Obtain the dissolution form from the Iowa Secretary of State’s website or request it by mail.

- Complete the form with details like LLC name, date of dissolution, and reason for closing.

- Pay the $5 filing fee and submit the form online, by mail, or in person.

Settling Taxes and Financial Obligations

Before dissolving your LLC, ensure all taxes and debts are settled to avoid penalties.

- File a final tax return with the Iowa Department of Revenue and the IRS, marking it as “Final.”

- Request a tax clearance certificate from the Iowa Department of Revenue to confirm no outstanding taxes.

- Resolve unpaid debts, loans, or invoices to creditors and vendors.

Notifying Creditors and Distributing Assets

Legally inform creditors and handle remaining assets according to Iowa law.

- Send written notices to all creditors and publish a dissolution notice in a local newspaper if required.

- Liquidate assets to pay off debts, following the priority order outlined in Iowa’s LLC Act.

- Distribute remaining assets to members as per the operating agreement or ownership percentages.

Canceling Licenses, Permits, and Registrations

Terminate all business-related licenses to avoid future liabilities.

- Cancel state and local business licenses, permits, and registrations (e.g., sales tax permits).

- Close the LLC’s Employer Identification Number (EIN) account with the IRS.

- Withdraw from foreign jurisdictions if your LLC was registered outside Iowa.

Maintaining Records After Dissolution

Iowa requires retaining business documents even after dissolution.

- Keep financial records, tax filings, and dissolution paperwork for at least 5 years.

- Store copies of the Articles of Dissolution, member meeting minutes, and asset distribution records.

- Ensure former members can access documents if needed for legal or tax purposes.

How do I officially close an LLC?

Steps to Dissolve an LLC Legally

To officially close an LLC, you must follow a structured legal process. Begin by reviewing your operating agreement for dissolution guidelines. Most states require a formal vote by LLC members to approve dissolution. After approval, file Articles of Dissolution (or a similar document) with your state’s business division. Ensure all state fees are paid, and confirm compliance with local regulations.

- Review the LLC’s operating agreement for dissolution procedures.

- Hold a formal vote to dissolve the LLC, documenting the decision.

- File Articles of Dissolution with the state and settle associated fees.

Settling Debts and Tax Obligations

Before closing, resolve all outstanding debts and tax liabilities. Notify creditors, settle claims, and file final federal, state, and local tax returns. Obtain a tax clearance certificate if required by your state to confirm all taxes are paid.

- Notify creditors and settle outstanding debts or negotiate payment plans.

- File final federal tax returns (Form 1065 or 1120-S) and state returns.

- Request a tax clearance certificate or confirmation from tax agencies.

Terminating Business Licenses and Permits

Cancel all business licenses, permits, and registrations to avoid future fees or penalties. Contact issuing agencies at the federal, state, and local levels to formally terminate authorizations tied to the LLC.

- Identify all active licenses and permits associated with the LLC.

- Submit cancellation requests to relevant agencies (e.g., IRS, state tax office).

- Confirm termination in writing and retain records as proof.

Distributing Remaining Assets to Members

After settling debts, distribute remaining LLC assets to members according to ownership percentages or the operating agreement. Document these distributions to ensure transparency and compliance with state laws.

- Calculate each member’s share based on the operating agreement.

- Transfer ownership of assets or liquidate them for cash distribution.

- File a final financial statement detailing asset distribution.

Notifying Stakeholders and Closing Accounts

Inform employees, clients, vendors, and financial institutions about the LLC’s closure. Close business bank accounts, cancel insurance policies, and terminate leases or contracts.

- Notify employees and fulfill final payroll obligations.

- Close business bank accounts and credit lines.

- Cancel insurance policies and terminate leases or service contracts.

Is dissolving an LLC hard?

Dissolving an LLC varies in complexity depending on state laws, the company’s structure, and unresolved obligations. While the process itself is straightforward if all requirements are met, complications can arise from unsettled debts, tax filings, or disputes among members. Properly following state-specific dissolution procedures is critical to avoid legal or financial penalties.

What Are the Basic Steps to Dissolve an LLC?

Dissolving an LLC typically involves a structured process to ensure legal compliance. Key steps include:

- Member approval: Most states require a formal vote or written consent from LLC members to dissolve.

- Filing Articles of Dissolution: Submit state-specific dissolution documents, often with fees, to terminate the LLC’s legal existence.

- Settling debts and obligations: Pay creditors, distribute remaining assets, and resolve tax liabilities to avoid future claims.

What Challenges Could Complicate Dissolving an LLC?

Several factors can make dissolving an LLC more difficult:

- Outstanding debts or lawsuits: Unresolved liabilities may delay dissolution or expose members to personal liability.

- State-specific requirements: Missing deadlines or paperwork errors can result in penalties or invalid dissolution.

- Member disputes: Disagreements over asset distribution or dissolution terms may require mediation or legal action.

How Do Tax Obligations Affect LLC Dissolution?

Tax compliance is critical during dissolution to avoid lingering liabilities:

- Final tax returns: File federal, state, and local tax returns, marking them as “final” to close accounts.

- Sales tax and payroll taxes: Settle unpaid taxes to prevent audits or penalties against members.

- IRS Form 966: Corporations (if applicable) must report dissolution to the IRS within 30 days.

What Legal Documents Are Required to Dissolve an LLC?

Proper documentation ensures a legally valid dissolution:

- Articles of Dissolution/Certificate of Termination: Filed with the state to formally dissolve the LLC.

- Operating Agreement: Review clauses about dissolution procedures and member obligations.

- Debt settlement agreements: Written proof of resolved liabilities to protect against future claims.

How Does the Operating Agreement Influence Dissolution?

The LLC’s operating agreement often dictates dissolution terms:

- Voting requirements: Specifies the majority needed to approve dissolution.

- Asset distribution: Outlines how remaining assets are divided among members.

- Dissolution triggers: May include events like member departure or business expiration that mandate dissolution.

Frequently Asked Questions About LLCs (FAQs)

What are the steps to dissolve an LLC in Iowa?

To dissolve an LLC in Iowa, you must follow a formal process. First, review your LLC’s operating agreement for dissolution requirements, such as obtaining member approval. Next, file Articles of Dissolution (Form 501/507) with the Iowa Secretary of State, either online or by mail. Ensure all taxes, fees, and outstanding debts are paid, and notify creditors to settle claims. Finally, distribute remaining assets to members and maintain records for at least five years post-dissolution.

Do I need tax clearance to dissolve an LLC in Iowa?

While Iowa does not require a formal tax clearance certificate to dissolve an LLC, you must settle all state tax obligations. This includes filing final income, sales, and payroll tax returns with the Iowa Department of Revenue. Unpaid taxes or penalties can delay dissolution or result in personal liability for members. Contact the Department of Revenue to confirm compliance before submitting dissolution documents.

How long does it take to dissolve an LLC in Iowa?

The timeline to dissolve an LLC in Iowa depends on several factors. Processing the Articles of Dissolution typically takes 7–10 business days if filed by mail, or 1–3 days online. Delays may occur if there are unresolved debts, tax issues, or errors in paperwork. To expedite the process, ensure all documentation is accurate and fees, such as the $5 filing fee for dissolution, are paid upfront.

What happens if I don’t formally dissolve my Iowa LLC?

Failing to formally dissolve your LLC in Iowa can lead to ongoing legal and financial obligations. The state will continue to charge annual report fees, and your LLC may face penalties for non-compliance. Additionally, members risk personal liability for unresolved debts or lawsuits. Proper dissolution protects you from future liabilities and ensures the business is legally terminated.

Leave a Reply

Our Recommended Articles