Are There Historical Returns Comparing Pe and Vc?

Private equity (PE) and venture capital (VC) are two prominent investment strategies that have shaped the financial landscape for decades. Both asset classes target high-growth opportunities, yet they differ in their approaches, risk profiles, and target companies. Investors often seek to understand their historical performance to make informed decisions. This article explores whether there are reliable historical returns comparing PE and VC, examining key metrics such as internal rates of return (IRR) and cash-on-cash multiples. By analyzing available data and trends, we aim to provide insights into how these asset classes have performed over time and what factors have influenced their respective outcomes.

- Are There Historical Returns Comparing PE and VC?

- Has private equity historically outperformed public markets?

- What are the historical returns of VC funds?

- What is the 2 6 2 rule of venture capital?

- What is the 80 20 rule in private equity?

-

Frequently Asked Questions (FAQs)

- What are the historical returns of Private Equity (PE) compared to Venture Capital (VC)?

- How do the risk profiles of PE and VC investments differ historically?

- What factors have historically influenced the performance of PE and VC?

- Can historical returns of PE and VC be used to predict future performance?

Are There Historical Returns Comparing PE and VC?

When comparing Private Equity (PE) and Venture Capital (VC), historical returns provide valuable insights into their performance. Both asset classes have distinct risk-return profiles, investment strategies, and target markets. Understanding their historical performance helps investors make informed decisions based on their risk tolerance and investment goals.

See Also Is It Possible From Someone Who is Working in Private Equity to Switch to Venture Capital and Vice Versa

Is It Possible From Someone Who is Working in Private Equity to Switch to Venture Capital and Vice Versa1. What Are the Key Differences Between PE and VC?

Private Equity (PE) typically invests in mature companies, often through leveraged buyouts, with the goal of improving operations and selling them at a profit. Venture Capital (VC), on the other hand, focuses on early-stage or high-growth startups, providing capital in exchange for equity. The risk in VC is higher due to the uncertainty of startup success, but the potential returns can be substantial if the company thrives.

2. How Do Historical Returns Compare Between PE and VC?

Historically, PE has delivered more consistent returns, often in the range of 10-15% annually, due to its focus on established companies. VC, while riskier, has the potential for higher returns, sometimes exceeding 20% annually, especially when investing in successful startups like those in the tech industry. However, VC returns are more volatile and dependent on a few high-performing investments.

See AlsoWhat Are the Best Newsletters Related to Venture Capital?3. What Factors Influence PE and VC Returns?

Several factors influence the returns of PE and VC:

- Market Conditions: Economic cycles impact both asset classes, but VC is more sensitive to market sentiment.

- Sector Focus: PE often targets stable industries, while VC invests in high-growth sectors like technology and biotech.

- Fund Management: The expertise of fund managers plays a critical role in identifying and managing investments.

4. What Are the Risks Associated with PE and VC Investments?

PE risks include overpaying for acquisitions, operational challenges, and economic downturns. VC risks are higher, as most startups fail, and only a small percentage achieve significant success. Diversification is crucial in VC to mitigate these risks.

See Also How Do Investment Banking Venture Capital and Private Equity Differ in Terms of Prestige

How Do Investment Banking Venture Capital and Private Equity Differ in Terms of Prestige5. How Do PE and VC Perform in Different Economic Environments?

PE tends to perform better in stable or growing economies, where operational improvements can drive returns. VC thrives in innovation-driven environments, such as tech booms, but struggles during economic downturns when funding dries up.

| Metric | Private Equity (PE) | Venture Capital (VC) |

|---|---|---|

| Average Annual Return | 10-15% | 20%+ (highly variable) |

| Risk Level | Moderate | High |

| Investment Stage | Mature Companies | Early-Stage Startups |

| Economic Sensitivity | Moderate | High |

Has private equity historically outperformed public markets?

Do Multi Billionaires Like Bill Gates Have the Financial Pontential to Eliminate Poverty in Small Countries in the Twinkling of an Eye

Do Multi Billionaires Like Bill Gates Have the Financial Pontential to Eliminate Poverty in Small Countries in the Twinkling of an EyeHistorical Performance of Private Equity vs. Public Markets

Historically, private equity has often outperformed public markets, particularly over long-term horizons. This is attributed to several factors:

- Illiquidity Premium: Investors are compensated for the lack of liquidity in private equity investments, which typically require longer holding periods.

- Active Management: Private equity firms actively manage portfolio companies, driving operational improvements and strategic growth.

- Access to Non-Public Opportunities: Private equity invests in companies not available on public markets, often capturing higher growth potential.

Key Drivers of Private Equity Outperformance

The outperformance of private equity can be linked to specific drivers that differentiate it from public markets:

See Also Who Are the Best Vc Investors in Luxury Goods and Premium Food Market

Who Are the Best Vc Investors in Luxury Goods and Premium Food Market- Leverage: Private equity often uses debt to amplify returns, a strategy less commonly employed in public markets.

- Alignment of Interests: General partners (GPs) and limited partners (LPs) share aligned incentives, focusing on long-term value creation.

- Flexibility: Private equity firms can make swift decisions without the regulatory scrutiny faced by public companies.

Challenges in Measuring Private Equity Performance

Comparing private equity to public markets is complex due to measurement challenges:

- Valuation Timing: Private equity valuations are infrequent, while public markets provide real-time pricing.

- Selection Bias: Only successful funds are often reported, skewing performance data.

- Benchmarking Issues: Public market indices may not fully capture the risk-adjusted returns of private equity.

Role of Economic Cycles in Private Equity Performance

Economic cycles significantly impact private equity performance relative to public markets:

- Recessions: Private equity can outperform during downturns by acquiring undervalued assets.

- Boom Periods: Public markets may outperform during economic expansions due to higher liquidity and investor optimism.

- Interest Rates: Rising rates can increase borrowing costs for private equity, potentially reducing returns.

Future Outlook for Private Equity vs. Public Markets

The future performance of private equity relative to public markets depends on several evolving factors:

- Regulatory Changes: Increased scrutiny could impact private equity strategies and returns.

- Market Saturation: High competition for deals may compress returns in the private equity space.

- Technological Advancements: Innovations in data analytics and AI could enhance private equity's ability to identify and manage investments.

What are the historical returns of VC funds?

What Are the Historical Returns of VC Funds?

Venture capital (VC) funds have historically delivered high returns, but with significant variability. On average, top-performing VC funds have achieved annualized returns of 20% to 30%, while the median returns are closer to 10% to 15%. However, these returns are highly dependent on the fund's focus, the stage of investments, and market conditions. Early-stage funds often see higher volatility but also the potential for outsized returns due to the exponential growth of successful startups.

How Do VC Fund Returns Compare to Other Asset Classes?

VC fund returns often outperform traditional asset classes like public equities and bonds over the long term. Here’s a comparison:

- Public Equities: Historically, the S&P 500 has returned about 8% to 10% annually, significantly lower than top VC funds.

- Bonds: Government and corporate bonds typically yield 3% to 5%, making them less attractive for high-growth investors.

- Real Estate: Real estate investments average 6% to 8% annually, lagging behind VC returns.

What Factors Influence VC Fund Returns?

Several factors impact the returns of VC funds, including:

- Fund Strategy: Early-stage funds often yield higher returns but carry more risk compared to late-stage funds.

- Portfolio Composition: A diversified portfolio with a mix of industries and geographies can mitigate risk and enhance returns.

- Market Timing: Investing during economic downturns or tech booms can significantly affect outcomes.

What Are the Risks Associated with VC Fund Returns?

While VC funds offer the potential for high returns, they come with substantial risks:

- Illiquidity: Investments in startups are not easily liquidated, often requiring a 7-10 year holding period.

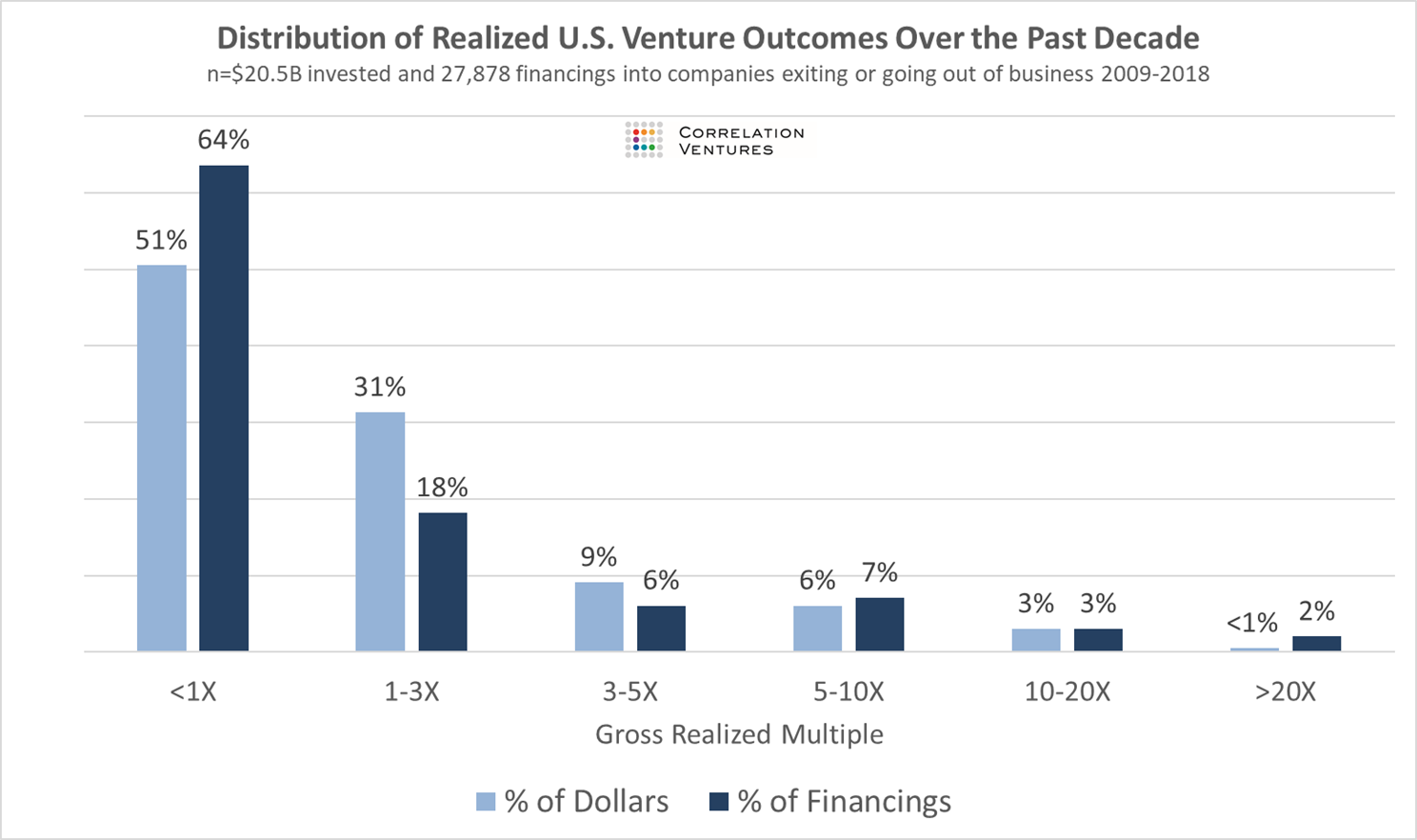

- High Failure Rates: A significant percentage of startups fail, leading to total loss of invested capital.

- Market Volatility: Economic downturns can disproportionately affect startups, reducing their valuation and exit opportunities.

How Do Top-Performing VC Funds Achieve High Returns?

Top-performing VC funds often employ specific strategies to maximize returns:

- Selective Deal Sourcing: They focus on high-potential startups with innovative solutions and strong teams.

- Active Involvement: Providing mentorship, resources, and strategic guidance to portfolio companies.

- Timely Exits: Successfully timing IPOs or acquisitions to maximize returns on investments.

What is the 2 6 2 rule of venture capital?

Understanding the 2 6 2 Rule in Venture Capital

The 2 6 2 rule is a framework used in venture capital to evaluate the potential success of a startup portfolio. It suggests that out of every 10 investments:

- 2 investments will yield significant returns, often referred to as home runs.

- 6 investments will either break even or result in moderate losses.

- 2 investments will fail completely, resulting in a total loss of capital.

Why the 2 6 2 Rule Matters for Investors

This rule highlights the high-risk, high-reward nature of venture capital. Investors rely on the 2 successful investments to generate enough returns to offset the losses from the other 8. Key points include:

- Diversification: Spreading investments across multiple startups reduces risk.

- Focus on outliers: Identifying startups with the potential for exponential growth is critical.

- Risk management: Accepting that failures are part of the process helps investors stay resilient.

How Startups Fit into the 2 6 2 Rule

For startups, understanding this rule can provide insight into investor expectations. Founders should aim to position their company as one of the 2 successful investments. This involves:

- Scalability: Demonstrating the potential for rapid growth.

- Innovation: Offering a unique solution to a significant problem.

- Strong team: Building a capable and experienced team to execute the vision.

Challenges of Applying the 2 6 2 Rule

While the rule provides a useful framework, it is not without challenges. These include:

- Unpredictability: Even with thorough due diligence, predicting success is difficult.

- Market volatility: External factors can impact the performance of startups.

- Resource allocation: Balancing time and capital across multiple investments can be demanding.

Real-World Examples of the 2 6 2 Rule

Many venture capital firms have experienced the 2 6 2 rule in action. For instance:

- Sequoia Capital: Their investment in WhatsApp yielded massive returns, offsetting other losses.

- Andreessen Horowitz: Successful bets on companies like Airbnb and Lyft exemplify the rule.

- Y Combinator: Their portfolio includes both high-profile successes and failures, aligning with the rule.

What is the 80 20 rule in private equity?

:max_bytes(150000):strip_icc()/Term-Definitions_80-20-rule-e0f7f05b70d5479d8d4f8fcfd6a5286b.jpg)

Understanding the 80 20 Rule in Private Equity

The 80 20 rule, also known as the Pareto Principle, is a concept widely applied in private equity. It suggests that 80% of outcomes often result from 20% of inputs. In private equity, this principle is used to identify the most impactful investments or strategies that drive the majority of returns. For example:

- Portfolio Performance: Typically, 20% of portfolio companies generate 80% of the fund's returns.

- Resource Allocation: Private equity firms focus 80% of their resources on the top 20% of high-potential investments.

- Decision-Making: The rule helps prioritize efforts on the most critical deals or operational improvements.

How the 80 20 Rule Influences Investment Strategies

Private equity firms leverage the 80 20 rule to refine their investment strategies. By identifying the 20% of opportunities that yield the highest returns, firms can optimize their decision-making processes. Key applications include:

- Deal Sourcing: Focusing on industries or geographies with the highest growth potential.

- Due Diligence: Allocating more time and resources to the most promising deals.

- Value Creation: Prioritizing operational improvements in portfolio companies with the greatest impact.

The Role of the 80 20 Rule in Portfolio Management

In portfolio management, the 80 20 rule helps private equity firms maximize returns by concentrating on the most profitable investments. This approach involves:

- Identifying Top Performers: Analyzing which companies contribute the most to overall returns.

- Exiting Underperformers: Divesting from companies that do not align with the 20% high-impact criteria.

- Rebalancing Portfolios: Shifting focus and resources to maintain a high-performing portfolio.

Applying the 80 20 Rule to Operational Improvements

Private equity firms use the 80 20 rule to drive operational efficiencies in portfolio companies. By targeting the 20% of processes that yield the most significant improvements, firms can enhance profitability. Key steps include:

- Process Optimization: Streamlining operations to reduce costs and increase efficiency.

- Revenue Growth: Focusing on the most profitable products or services.

- Resource Allocation: Directing investments toward areas with the highest return potential.

Challenges of Implementing the 80 20 Rule in Private Equity

While the 80 20 rule is a powerful tool, its application in private equity comes with challenges. These include:

- Data Accuracy: Ensuring reliable data to identify the top 20% of investments or processes.

- Over-Reliance: Avoiding the risk of neglecting other potentially valuable opportunities.

- Dynamic Markets: Adapting to changing market conditions that may shift the 20% high-impact criteria.

Frequently Asked Questions (FAQs)

What are the historical returns of Private Equity (PE) compared to Venture Capital (VC)?

Historical returns for Private Equity (PE) and Venture Capital (VC) have shown distinct trends over time. PE investments typically focus on established companies with steady cash flows, leading to more predictable and stable returns. On the other hand, VC investments target early-stage startups, which can yield significantly higher returns but come with greater risk. Historically, PE has delivered annualized returns in the range of 10-15%, while VC has seen returns varying widely, with top-performing funds achieving 20-30% or more, but many others underperforming or failing entirely.

How do the risk profiles of PE and VC investments differ historically?

The risk profiles of PE and VC investments are fundamentally different. Private Equity tends to invest in mature companies with proven business models, reducing the likelihood of failure but also capping the potential for outsized returns. In contrast, Venture Capital invests in high-growth, early-stage companies, which have a higher probability of failure but also the potential for exponential growth. Historically, VC has been associated with a higher risk of loss, as many startups fail to achieve profitability, while PE has demonstrated more consistent, albeit moderate, returns.

What factors have historically influenced the performance of PE and VC?

Several factors have historically influenced the performance of Private Equity and Venture Capital. For PE, key factors include the economic cycle, the ability to improve operational efficiency in portfolio companies, and the timing of exits. For VC, success has often been driven by the ability to identify and invest in disruptive technologies or markets, as well as the quality of the founding teams. Additionally, both asset classes are influenced by broader market conditions, such as interest rates and liquidity in the capital markets, which can impact fundraising and exit opportunities.

Can historical returns of PE and VC be used to predict future performance?

While historical returns provide valuable insights, they should not be solely relied upon to predict future performance. The performance of both Private Equity and Venture Capital is highly dependent on market conditions, the skill of the fund managers, and the specific strategies employed. For example, past success in VC may not guarantee future returns, as the competitive landscape and technological advancements evolve rapidly. Similarly, PE returns may be affected by changes in regulatory environments or shifts in industry dynamics. Investors should consider historical data as one of many factors when evaluating potential investments.

Leave a Reply

Our Recommended Articles