How Do Associates at Venture Capital Firms Source Deals?

Venture capital (VC) associates play a pivotal role in identifying and sourcing investment opportunities for their firms. Their ability to uncover promising startups and innovative ideas is critical to the success of any VC fund. Sourcing deals involves a combination of proactive outreach, leveraging networks, and staying ahead of industry trends. Associates often rely on a mix of strategies, including attending industry events, building relationships with founders, and utilizing data-driven tools to scout potential investments. This article explores the various methods VC associates employ to source deals, highlighting the skills, tools, and networks that enable them to identify the next big opportunity in a competitive landscape.

How Do Associates at Venture Capital Firms Source Deals?

Venture capital (VC) associates play a critical role in identifying and sourcing potential investment opportunities for their firms. Their primary responsibility is to find startups and early-stage companies that align with the firm’s investment thesis and have the potential for high returns. This process involves a combination of networking, research, and outreach to build a pipeline of promising deals. Below, we explore the key methods and strategies used by VC associates to source deals effectively.

See AlsoWhat's the Best Database to Find Venture Capital Deals?1. Leveraging Professional Networks

VC associates often rely on their professional networks to source deals. This includes connections with entrepreneurs, angel investors, other venture capitalists, and industry experts. By attending industry events, conferences, and startup pitch competitions, associates can meet founders and learn about innovative companies. Additionally, they maintain relationships with accelerators and incubators, which are hubs for early-stage startups.

2. Conducting Market Research

Associates conduct extensive market research to identify emerging trends and industries with high growth potential. They analyze market reports, industry publications, and academic research to pinpoint sectors that align with their firm’s investment strategy. This research helps them identify startups that are addressing significant market gaps or leveraging disruptive technologies.

See Also What Do Associates Do at Venture Capital Firms?

What Do Associates Do at Venture Capital Firms?3. Utilizing Deal Flow Platforms

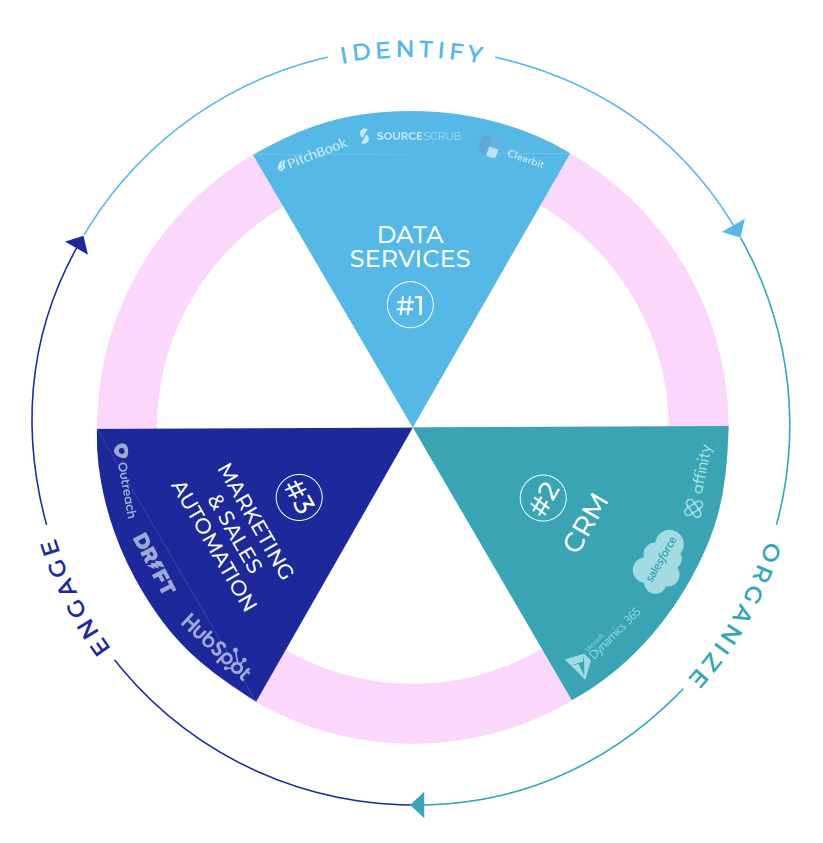

Many VC firms use deal flow platforms and databases to source deals. These platforms aggregate information about startups seeking funding, allowing associates to filter and evaluate opportunities based on criteria such as industry, stage, and geography. Examples of such platforms include Crunchbase, PitchBook, and AngelList.

4. Engaging with Startup Communities

VC associates actively engage with startup communities both online and offline. They participate in online forums, social media groups, and startup-focused platforms like Reddit or LinkedIn. By being visible in these communities, associates can identify founders who are actively seeking funding and gain insights into their businesses.

See Also Is It Possible From Someone Who is Working in Private Equity to Switch to Venture Capital and Vice Versa

Is It Possible From Someone Who is Working in Private Equity to Switch to Venture Capital and Vice Versa5. Collaborating with Other Investors

Collaboration with other investors is another key strategy for sourcing deals. Associates often co-invest with angel investors, syndicates, or other VC firms to access high-quality deal flow. This collaborative approach not only diversifies the firm’s portfolio but also reduces risk by sharing due diligence efforts.

| Method | Description |

|---|---|

| Networking | Building relationships with entrepreneurs, investors, and industry experts. |

| Market Research | Analyzing trends and industries to identify high-potential startups. |

| Deal Flow Platforms | Using databases like Crunchbase and AngelList to find investment opportunities. |

| Startup Communities | Engaging with online and offline communities to discover founders. |

| Investor Collaboration | Partnering with other investors to access and evaluate deals. |

How do venture capital firms source deals?

Networking and Referrals

Venture capital firms often rely on their extensive networks to source deals. These networks include entrepreneurs, other investors, and industry experts who can refer promising startups. Key methods include:

- Attending industry events and conferences to meet founders and other investors.

- Building relationships with angel investors who often invest in early-stage companies.

- Leveraging alumni networks from universities or previous companies to identify potential opportunities.

Proactive Deal Sourcing

Many venture capital firms take a proactive approach to find deals by identifying high-potential startups before they seek funding. This involves:

- Conducting market research to identify emerging trends and industries.

- Using data analytics tools to track startup performance and growth metrics.

- Scouting startup incubators and accelerators for promising companies.

Partnerships with Accelerators and Incubators

Venture capital firms often collaborate with accelerators and incubators to access a pipeline of early-stage startups. These partnerships provide:

- Early access to vetted startups with high growth potential.

- Opportunities to mentor startups and build relationships with founders.

- Exclusive deal flow through demo days and pitch events.

Online Platforms and Databases

Venture capital firms use online platforms and databases to identify and evaluate startups. These tools include:

- Platforms like Crunchbase and AngelList to discover startups and track their progress.

- AI-driven tools to analyze startup data and predict success.

- Subscription-based services that provide curated deal flow based on specific criteria.

Cold Outreach and Direct Engagement

Some venture capital firms engage in cold outreach to startups they find interesting. This approach involves:

- Identifying startups through media coverage or industry reports.

- Reaching out directly to founders via email or social media platforms like LinkedIn.

- Building a reputation as a founder-friendly investor to attract inbound interest.

What does an associate do at a venture capital firm?

Deal Sourcing and Evaluation

An associate at a venture capital firm plays a critical role in identifying and evaluating potential investment opportunities. Their responsibilities include:

- Researching emerging markets and industries to identify high-potential startups.

- Networking with entrepreneurs, accelerators, and other stakeholders to source deals.

- Analyzing business models, financials, and market trends to assess the viability of startups.

Due Diligence and Analysis

Associates are heavily involved in the due diligence process, ensuring that investments are well-vetted. Key tasks include:

- Conducting in-depth financial analysis, including revenue projections and cash flow modeling.

- Evaluating the competitive landscape and market positioning of potential portfolio companies.

- Collaborating with legal teams to review contracts, intellectual property, and regulatory compliance.

Portfolio Management and Support

Once investments are made, associates assist in managing and supporting portfolio companies. This involves:

- Monitoring the performance of portfolio companies and tracking key metrics.

- Providing strategic guidance and operational support to founders and management teams.

- Facilitating introductions to potential partners, customers, or follow-on investors.

Fund Operations and Reporting

Associates also contribute to the internal operations of the venture capital firm. Their duties include:

- Preparing reports and presentations for limited partners (LPs) and stakeholders.

- Assisting in fundraising efforts by creating pitch decks and financial models.

- Maintaining databases and tracking systems for deal flow and portfolio performance.

Market Research and Thought Leadership

Associates often engage in market research and contribute to the firm's thought leadership. This includes:

- Publishing industry insights, white papers, or blog posts on emerging trends.

- Attending conferences and events to stay updated on market developments.

- Collaborating with senior team members to develop investment theses and strategies.

What is the 10x rule for venture capital?

Understanding the 10x Rule in Venture Capital

The 10x rule in venture capital refers to the expectation that a startup should have the potential to return at least ten times the initial investment to the venture capital firm. This rule is based on the high-risk nature of venture capital investments, where many startups fail, and only a few achieve significant success. The 10x return compensates for the losses incurred from other investments.

- High-risk, high-reward: Venture capitalists invest in startups with the understanding that most will fail, but a few will succeed spectacularly.

- Portfolio strategy: By investing in multiple startups, VCs spread their risk, hoping that one or two will achieve the 10x return.

- Exit strategy: The 10x return is typically realized through an exit event, such as an IPO or acquisition.

Why the 10x Rule is Crucial for Venture Capitalists

The 10x rule is crucial because it ensures that venture capitalists can achieve significant returns despite the high failure rate of startups. This rule helps VCs justify the risk they take and ensures that their overall portfolio remains profitable.

- Risk mitigation: The 10x rule helps VCs mitigate the risk of losing money on most investments by aiming for substantial returns on a few.

- Fund performance: Achieving 10x returns on some investments can significantly boost the overall performance of a VC fund.

- Investor confidence: The 10x rule reassures limited partners (LPs) that the VC fund is capable of delivering high returns.

How Startups Can Achieve the 10x Return

For a startup to achieve a 10x return, it must demonstrate exceptional growth potential, a scalable business model, and a clear path to a lucrative exit. This often involves rapid market expansion, strong product-market fit, and a competitive advantage.

- Scalability: The startup must have a business model that can scale quickly and efficiently.

- Market opportunity: The startup should target a large and growing market to maximize its potential return.

- Execution: Strong execution by the founding team is critical to achieving the growth needed for a 10x return.

The Role of Valuation in the 10x Rule

Valuation plays a key role in the 10x rule because it determines the potential return on investment. A higher valuation at the time of investment means the startup needs to grow even more to achieve a 10x return.

- Pre-money valuation: The valuation of the startup before the investment is made affects the potential return.

- Post-money valuation: The valuation after the investment determines the equity stake the VC holds and the potential return.

- Exit valuation: The valuation at the time of exit (IPO or acquisition) is crucial for achieving the 10x return.

Challenges in Achieving the 10x Rule

While the 10x rule is a guiding principle, achieving it is challenging due to market uncertainties, competition, and execution risks. Many startups fail to reach this level of success, making it a high-stakes game for venture capitalists.

- Market risks: Changes in market conditions can impact a startup's growth potential.

- Competition: Intense competition can make it difficult for a startup to achieve a dominant market position.

- Execution risks: Poor execution by the founding team can derail even the most promising startups.

What is deal sourcing and screening in venture capital?

What is Deal Sourcing in Venture Capital?

Deal sourcing refers to the process of identifying and attracting potential investment opportunities for venture capital firms. It involves building a pipeline of startups or companies that align with the firm's investment thesis and criteria. This process is critical because the quality of deals sourced directly impacts the success of the venture capital portfolio. Deal sourcing can be achieved through various methods, including networking, referrals, industry events, and proprietary research.

- Networking: Building relationships with entrepreneurs, other investors, and industry experts to gain access to promising startups.

- Referrals: Leveraging existing portfolio companies or trusted contacts to recommend potential investment opportunities.

- Proprietary Research: Conducting in-depth market analysis to identify emerging trends and high-potential startups.

What is Deal Screening in Venture Capital?

Deal screening is the process of evaluating and filtering potential investment opportunities to determine which ones merit further due diligence. This step ensures that only the most promising deals move forward in the investment process. Screening typically involves assessing factors such as the startup's business model, market size, team expertise, and traction.

- Business Model: Evaluating the startup's revenue model, scalability, and sustainability.

- Market Size: Assessing the total addressable market (TAM) to ensure sufficient growth potential.

- Team Expertise: Analyzing the founders' and team's experience, skills, and ability to execute the business plan.

Key Methods for Effective Deal Sourcing

Effective deal sourcing requires a combination of proactive strategies and tools to identify high-quality investment opportunities. Venture capital firms often use a mix of traditional and modern approaches to stay ahead in a competitive market.

- Attending Industry Events: Participating in conferences, pitch days, and demo events to meet entrepreneurs.

- Leveraging Online Platforms: Using platforms like AngelList, Crunchbase, or LinkedIn to discover startups.

- Building a Strong Brand: Establishing a reputation as a supportive and knowledgeable investor to attract founders.

Criteria for Deal Screening in Venture Capital

During the deal screening process, venture capital firms apply specific criteria to evaluate whether a startup aligns with their investment goals. These criteria help filter out unsuitable opportunities and focus on those with the highest potential.

- Market Fit: Ensuring the product or service addresses a genuine market need.

- Competitive Advantage: Identifying unique differentiators that set the startup apart from competitors.

- Financial Metrics: Reviewing key financial indicators such as revenue growth, burn rate, and profitability potential.

Challenges in Deal Sourcing and Screening

While deal sourcing and screening are essential, they come with their own set of challenges. These challenges can impact the efficiency and effectiveness of the investment process.

- High Competition: Competing with other investors for access to top-tier startups.

- Information Asymmetry: Limited access to accurate or complete information about early-stage companies.

- Time Constraints: Balancing thorough evaluation with the need to act quickly on promising opportunities.

Frequently Asked Questions (FAQs)

What methods do venture capital associates use to source deals?

Venture capital associates employ a variety of methods to source deals, including networking within the startup ecosystem, attending industry conferences, and leveraging referrals from trusted sources such as other investors, entrepreneurs, and advisors. They also actively monitor startup accelerators and incubators, as these programs often produce high-potential companies. Additionally, associates may use online platforms like AngelList or Crunchbase to identify promising startups and track emerging trends in the market.

How important is networking in deal sourcing for venture capital associates?

Networking is a critical component of deal sourcing for venture capital associates. Building and maintaining relationships with entrepreneurs, angel investors, and other venture capitalists can lead to valuable introductions and early access to deals. Associates often attend pitch events, demo days, and industry meetups to connect with founders and stay informed about new opportunities. A strong network not only helps in discovering deals but also in conducting thorough due diligence by gathering insights from trusted contacts.

Do venture capital associates use technology to source deals?

Yes, venture capital associates increasingly rely on technology to source deals efficiently. Tools like data analytics platforms, artificial intelligence, and machine learning help identify startups with high growth potential by analyzing patterns and trends. Additionally, associates use CRM systems to manage relationships and track deal flow. Online platforms such as AngelList, Crunchbase, and PitchBook are also widely used to research startups, monitor funding rounds, and evaluate market opportunities.

What role do referrals play in deal sourcing for venture capital associates?

Referrals play a significant role in deal sourcing for venture capital associates. Many of the best investment opportunities come through trusted referrals from existing portfolio companies, other investors, or industry experts. These referrals often provide a level of credibility and validation that can expedite the due diligence process. Associates actively cultivate relationships with key players in the ecosystem to ensure a steady flow of high-quality referrals, which are often seen as a more reliable source of deals compared to cold outreach.

Leave a Reply

Our Recommended Articles