How Much Do Analysts Senior Analysts at Vc Firms Make How is Compensation Structured

Senior analysts at venture capital (VC) firms play a critical role in evaluating investment opportunities, conducting market research, and supporting portfolio companies. Their compensation reflects the demanding nature of the job and the high-stakes environment of the VC industry. Typically, senior analyst pay is structured as a combination of base salary, performance bonuses, and sometimes carried interest, which aligns their incentives with the firm’s success. Compensation can vary significantly based on factors such as firm size, location, and individual performance. This article explores the earning potential of senior analysts at VC firms, breaks down the components of their compensation, and highlights key factors influencing their pay structure.

- How Much Do Senior Analysts at VC Firms Make? How is Compensation Structured?

- What is the compensation model for venture capital?

-

How much do senior associates make at VC firms?

- What is the Average Salary of a Senior Associate at VC Firms?

- How Does Location Impact Senior Associate Salaries in VC?

- What Factors Influence Senior Associate Compensation in VC?

- How Does Firm Size Affect Senior Associate Salaries in VC?

- What Are the Career Growth Opportunities for Senior Associates in VC?

- How much does a VC analyst make?

- Frequently Asked Questions by our Community

How Much Do Senior Analysts at VC Firms Make? How is Compensation Structured?

1. What is the Average Salary for Senior Analysts at VC Firms?

Senior Analysts at venture capital (VC) firms typically earn a base salary ranging from $100,000 to $150,000 annually, depending on the firm's size, location, and the individual's experience. In addition to the base salary, they often receive performance-based bonuses, which can significantly increase their total compensation. Bonuses are usually tied to the firm's overall performance and the analyst's contribution to successful investments.

See Also Do Venture Capitalists Reimburse Travel Expenses for Out of Town Entrepreneurs

Do Venture Capitalists Reimburse Travel Expenses for Out of Town Entrepreneurs2. How Do Bonuses and Carry Impact Compensation?

Bonuses for Senior Analysts can range from 20% to 50% of their base salary, depending on the firm's success and the analyst's role in sourcing or managing profitable deals. Additionally, some VC firms offer carry (carried interest), which is a share of the profits from successful investments. However, carry is more commonly reserved for Partners and Senior Associates, with Senior Analysts rarely receiving a significant portion.

3. What Role Does Firm Size Play in Compensation?

The size of the VC firm plays a crucial role in determining compensation. At larger, well-established firms, Senior Analysts may earn higher salaries and bonuses due to the firm's greater resources and deal flow. In contrast, smaller or emerging firms may offer lower base salaries but provide more opportunities for equity or carry as the firm grows.

See Also How Does One Become an Entrepreneur in Residence at a Venture Capital Firm

How Does One Become an Entrepreneur in Residence at a Venture Capital Firm4. How Does Geographic Location Affect Earnings?

Geographic location significantly impacts compensation. Senior Analysts working in major tech hubs like Silicon Valley, New York, or Boston tend to earn higher salaries due to the higher cost of living and the concentration of top-tier VC firms. For example, a Senior Analyst in San Francisco might earn 10-20% more than someone in a smaller city.

5. What Are the Long-Term Career Earnings Prospects?

Long-term career earnings for Senior Analysts can be substantial, especially if they advance to roles like Vice President (VP) or Partner. These positions often come with higher base salaries, larger bonuses, and a more significant share of carry. Additionally, Senior Analysts who transition to entrepreneurship or corporate leadership roles can leverage their VC experience to achieve even greater financial success.

See Also What Does an Mba Summer Intern Typically Do at a Venture Capital Firm

What Does an Mba Summer Intern Typically Do at a Venture Capital Firm| Component | Details |

|---|---|

| Base Salary | $100,000 - $150,000 |

| Bonuses | 20% - 50% of base salary |

| Carry | Rare for Senior Analysts |

| Firm Size Impact | Larger firms pay more |

| Location Impact | Higher pay in major tech hubs |

What is the compensation model for venture capital?

Understanding the Venture Capital Compensation Structure

The compensation model for venture capital (VC) firms typically revolves around two main components: management fees and carried interest. These elements ensure that VC firms are compensated for their efforts in managing investments and generating returns for their investors.

- Management Fees: These are annual fees, usually around 2% of the total committed capital, paid by limited partners (LPs) to cover operational costs.

- Carried Interest: This is a performance-based fee, typically 20% of the profits, earned by the VC firm after returning the initial capital to investors.

- Hurdle Rate: Some VC agreements include a minimum return threshold (hurdle rate) that must be met before carried interest is applied.

How Management Fees Work in Venture Capital

Management fees are a critical part of the VC compensation model, providing the firm with the necessary resources to operate effectively. These fees are calculated as a percentage of the total fund size and are paid annually.

- Calculation Basis: Typically, management fees are 2% of the committed capital, though this can vary depending on the firm and fund size.

- Duration: Fees are usually charged during the investment period (5-7 years) and may decrease during the fund's later stages.

- Purpose: These fees cover salaries, office expenses, due diligence costs, and other operational needs.

The Role of Carried Interest in VC Compensation

Carried interest is the share of profits that VC firms earn after returning the initial investment to their limited partners. It aligns the interests of the VC firm with those of the investors.

- Profit Sharing: Typically, 20% of the fund's profits go to the VC firm as carried interest.

- Vesting Period: Carried interest often vests over several years to ensure long-term commitment.

- Tax Treatment: In many jurisdictions, carried interest is taxed at a lower capital gains rate, making it a lucrative incentive.

Key Factors Influencing VC Compensation Models

Several factors influence how venture capital compensation is structured, including fund size, investment strategy, and market conditions.

- Fund Size: Larger funds may negotiate lower management fees due to economies of scale.

- Investment Strategy: Early-stage funds might charge higher fees due to the increased risk and effort involved.

- Market Competition: In competitive markets, VC firms may adjust their fee structures to attract investors.

Comparing VC Compensation to Other Investment Models

The compensation model in venture capital differs significantly from other investment models like private equity or hedge funds, primarily due to the high-risk, high-reward nature of VC investments.

- Fee Structure: VC firms typically charge lower management fees compared to hedge funds but higher than mutual funds.

- Profit Sharing: Carried interest is more prominent in VC, reflecting the higher potential returns.

- Risk Alignment: The VC model ensures that firms are incentivized to maximize returns, aligning their goals with those of the investors.

How much do senior associates make at VC firms?

What is the Average Salary of a Senior Associate at VC Firms?

The average salary for a senior associate at venture capital (VC) firms typically ranges between $150,000 and $200,000 per year. This figure can vary depending on factors such as the firm's size, location, and performance. In addition to the base salary, senior associates often receive bonuses and carried interest, which can significantly increase their total compensation.

- Base Salary: Typically between $120,000 and $160,000 annually.

- Bonuses: Can range from $30,000 to $60,000, depending on firm performance.

- Carried Interest: A share of the profits from successful investments, which can add substantial value over time.

How Does Location Impact Senior Associate Salaries in VC?

Location plays a significant role in determining the salary of a senior associate at VC firms. For example, senior associates working in major financial hubs like San Francisco or New York City tend to earn higher salaries compared to those in smaller markets. This is due to the higher cost of living and the concentration of top-tier VC firms in these areas.

- San Francisco: Salaries often exceed $200,000 due to the high cost of living and competitive market.

- New York City: Similar to San Francisco, with salaries ranging between $180,000 and $220,000.

- Emerging Markets: Salaries may be lower, typically between $120,000 and $160,000, but offer growth potential.

What Factors Influence Senior Associate Compensation in VC?

Several factors influence the compensation of a senior associate at VC firms, including the firm's reputation, the associate's experience, and the overall performance of the fund. Additionally, the stage of the firm (early-stage vs. late-stage) and the geographic focus can also impact earnings.

- Firm Reputation: Top-tier firms often offer higher salaries and bonuses.

- Experience: Senior associates with more years in the industry or a strong track record may command higher pay.

- Fund Performance: Successful funds can lead to larger bonuses and carried interest.

How Does Firm Size Affect Senior Associate Salaries in VC?

The size of the VC firm can significantly impact the salary of a senior associate. Larger firms with more assets under management (AUM) typically offer higher compensation packages compared to smaller or boutique firms. However, smaller firms may provide other benefits, such as greater responsibility and equity stakes.

- Large Firms: Salaries can exceed $200,000, with substantial bonuses and carried interest.

- Mid-Sized Firms: Salaries range between $150,000 and $180,000, with moderate bonuses.

- Boutique Firms: Salaries may be lower, but opportunities for equity and leadership roles are more common.

What Are the Career Growth Opportunities for Senior Associates in VC?

Career growth for senior associates in VC firms often involves progressing to roles such as principal or partner. These roles come with increased responsibilities and higher compensation. Additionally, senior associates may transition to roles in portfolio companies or start their own ventures, leveraging their experience and network.

- Principal Role: Typically involves higher compensation and more decision-making authority.

- Partner Role: Offers significant equity stakes and leadership responsibilities.

- Entrepreneurship: Some senior associates use their experience to launch their own startups or join early-stage companies.

How much does a VC analyst make?

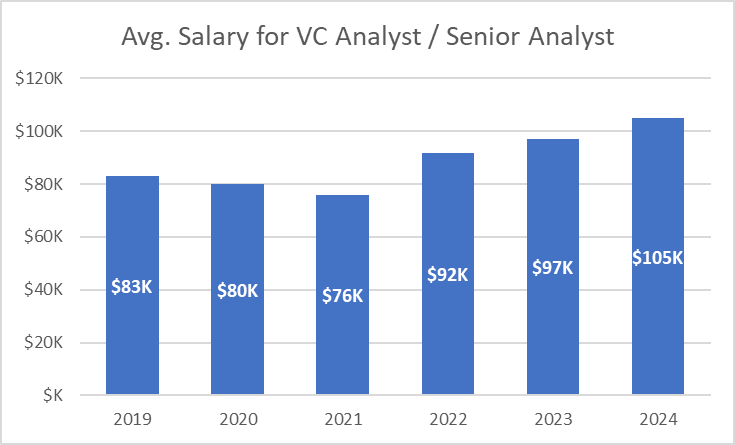

What is the Average Salary of a VC Analyst?

The average salary of a VC analyst typically ranges between $80,000 and $120,000 per year, depending on factors such as location, firm size, and experience. Entry-level analysts may start at the lower end of this range, while those with more experience or working in high-cost cities like San Francisco or New York may earn closer to the upper limit. Bonuses and profit-sharing can also significantly increase total compensation.

- Base Salary: Typically ranges from $80,000 to $100,000 annually.

- Bonuses: Can add $10,000 to $30,000, depending on firm performance.

- Profit-Sharing: Some firms offer additional compensation tied to fund performance.

How Does Location Impact a VC Analyst's Salary?

Location plays a significant role in determining a VC analyst's salary. Analysts working in major financial hubs like San Francisco, New York, or Boston tend to earn higher salaries due to the higher cost of living and the concentration of venture capital firms in these areas. In contrast, analysts in smaller markets may earn less.

- High-Cost Cities: Salaries can exceed $120,000 in cities like San Francisco.

- Mid-Tier Cities: Salaries may range between $70,000 and $90,000.

- Remote Roles: Some firms offer competitive salaries regardless of location.

What Factors Influence a VC Analyst's Compensation?

Several factors influence a VC analyst's compensation, including experience, education, firm size, and performance. Analysts with advanced degrees or prior experience in finance or consulting often command higher salaries. Additionally, working for a top-tier venture capital firm can lead to more lucrative compensation packages.

- Experience: More experienced analysts earn higher salaries.

- Education: Advanced degrees like an MBA can boost earnings.

- Firm Reputation: Prestigious firms often pay more.

What Are the Career Growth Opportunities for a VC Analyst?

A VC analyst role is often a stepping stone to more senior positions within the venture capital industry. With experience, analysts can advance to roles such as Associate, Principal, or Partner, which come with significantly higher compensation and greater responsibilities.

- Associate Role: Typically requires 2-3 years of experience.

- Principal Role: Involves more decision-making and higher pay.

- Partner Role: Offers equity stakes and leadership opportunities.

How Do Bonuses and Equity Impact Total Compensation?

Bonuses and equity can significantly enhance a VC analyst's total compensation. Many firms offer performance-based bonuses, and some may include equity or profit-sharing as part of the compensation package, especially at more senior levels.

- Performance Bonuses: Can range from 10% to 30% of base salary.

- Equity Stakes: More common at senior levels but can be lucrative.

- Profit-Sharing: Tied to the success of the firm's investments.

Frequently Asked Questions by our Community

What is the typical salary range for Senior Analysts at VC firms?

The salary range for Senior Analysts at VC firms can vary significantly depending on factors such as the firm's size, location, and the analyst's experience. On average, Senior Analysts can expect to earn between $100,000 and $150,000 annually in base salary. However, this figure can be higher in top-tier firms or in major financial hubs like New York or San Francisco. Additionally, bonuses and other forms of compensation can substantially increase total earnings.

How is compensation structured for Senior Analysts in VC firms?

Compensation for Senior Analysts at VC firms is typically structured into three main components: base salary, bonuses, and carried interest. The base salary provides a steady income, while bonuses are often tied to individual and firm performance. Carried interest, a share of the profits from successful investments, is less common for analysts but may be offered at more senior levels or in top-performing firms. This structure aligns the analyst's incentives with the firm's success.

Do Senior Analysts at VC firms receive equity or carried interest?

While equity or carried interest is more commonly associated with partners or senior members of VC firms, some Senior Analysts may receive a small share of carried interest, especially in smaller or more performance-driven firms. However, this is not guaranteed and often depends on the firm's policies and the analyst's contribution to deal sourcing and execution. In most cases, Senior Analysts rely more on their base salary and bonuses for compensation.

What factors influence the compensation of Senior Analysts at VC firms?

Several factors influence the compensation of Senior Analysts at VC firms, including geographic location, firm reputation, deal flow, and individual performance. Analysts working in major financial centers like Silicon Valley or New York often earn higher salaries due to the higher cost of living and competitive markets. Additionally, analysts at top-tier firms or those who contribute significantly to successful deals may receive larger bonuses or even a share of carried interest as a reward for their performance.

Leave a Reply

Our Recommended Articles