In Private Equity and Venture Capital is Dry Powder the Difference Between Committed Capital and Paid in Capital

In the world of private equity and venture capital, the term dry powder refers to the uninvested capital that firms hold, ready to deploy into new opportunities. This concept is closely tied to two key financial metrics: committed capital and paid-in capital. Committed capital represents the total amount investors have pledged to a fund, while paid-in capital reflects the portion already contributed and used for investments or fees. Dry powder, therefore, is the difference between these two figures, representing the untapped resources available for future deals. Understanding this distinction is crucial for assessing a fund's capacity to act on emerging opportunities and sustain growth.

- Understanding Dry Powder: The Difference Between Committed Capital and Paid-in Capital in Private Equity and Venture Capital

- Is paid in capital the same as committed capital?

- Is dry powder the same as uncalled capital?

- What are the three types of venture capital funds?

- Frequently Asked Questions (FAQs)

Understanding Dry Powder: The Difference Between Committed Capital and Paid-in Capital in Private Equity and Venture Capital

What is Dry Powder in Private Equity and Venture Capital?

Dry powder refers to the amount of committed capital that has not yet been deployed or invested by private equity (PE) or venture capital (VC) firms. It represents the available funds that these firms can use to make new investments or support existing portfolio companies. The term originates from the idea of having powder dry and ready for use, symbolizing preparedness for future opportunities.

See Also What Are the Key Differences Between Private Equity and Venture Capital

What Are the Key Differences Between Private Equity and Venture CapitalCommitted Capital vs. Paid-in Capital: Key Differences

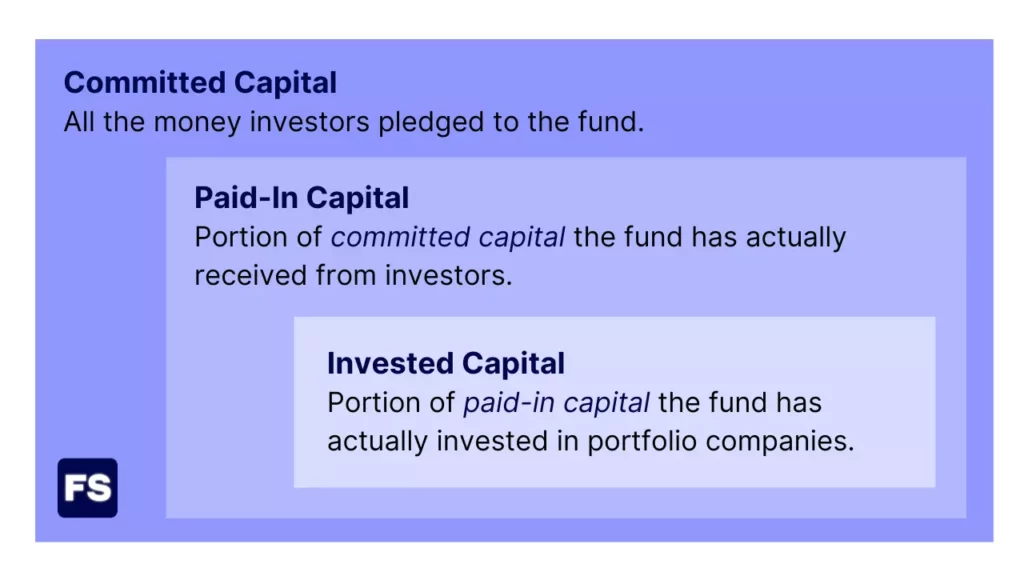

Committed capital is the total amount of money that investors (limited partners) have pledged to a fund. On the other hand, paid-in capital is the portion of committed capital that has actually been transferred to the fund and is available for investment. The difference between these two amounts is often referred to as dry powder. For example, if a fund has $100 million in committed capital but only $60 million has been paid in, the dry powder is $40 million.

| Term | Definition |

|---|---|

| Committed Capital | Total amount pledged by investors to a fund. |

| Paid-in Capital | Portion of committed capital actually transferred to the fund. |

| Dry Powder | Difference between committed and paid-in capital. |

Why is Dry Powder Important for PE and VC Firms?

Dry powder is crucial because it provides flexibility and liquidity to PE and VC firms. It allows them to seize investment opportunities quickly, especially in competitive markets. Additionally, having significant dry powder can signal to the market that a firm is well-positioned to make strategic investments, which can enhance its reputation and attract more investors.

See Also Whats a Better Way to Structure a Vc Fund Evergreen or Regular Vc

Whats a Better Way to Structure a Vc Fund Evergreen or Regular VcHow Do Firms Manage Dry Powder?

PE and VC firms manage dry powder by carefully balancing their investment pace and fundraising cycles. They must ensure they have enough capital to meet their investment objectives while avoiding holding too much dry powder, which could lead to underperformance due to idle funds. Effective management involves aligning investment strategies with market conditions and investor expectations.

What Are the Risks Associated with Dry Powder?

While dry powder is beneficial, it also comes with risks. Holding too much dry powder for extended periods can lead to pressure to deploy capital quickly, potentially resulting in suboptimal investments. Additionally, if market conditions deteriorate, firms may struggle to find suitable opportunities, leading to lower returns for investors.

See Also What Career is More Lucrative; Private Equity or Venture Capital?

What Career is More Lucrative; Private Equity or Venture Capital?How Does Dry Powder Impact the Broader Market?

The accumulation of dry powder in the PE and VC industries can influence the broader market by driving up asset prices due to increased competition for deals. It can also lead to more innovative financing structures as firms seek to deploy their capital efficiently. However, excessive dry powder can create market imbalances, making it harder for firms to achieve their target returns.

| Impact | Description |

|---|---|

| Asset Prices | Increased competition can drive up prices. |

| Financing Structures | Firms may innovate to deploy capital effectively. |

| Market Imbalances | Excessive dry powder can lead to imbalances. |

Is paid in capital the same as committed capital?

What is Paid-in Capital?

Paid-in capital refers to the amount of money that shareholders have invested in a company in exchange for equity. This capital is recorded on the company's balance sheet and represents the funds received from issuing shares. Key points include:

- Source: It comes directly from investors purchasing shares.

- Purpose: Used to fund operations, growth, or other corporate activities.

- Accounting: Recorded under shareholders' equity on the balance sheet.

What is Committed Capital?

Committed capital is the total amount of money that investors have pledged to contribute to a private equity or venture capital fund. This capital is not immediately paid but is called upon as needed by the fund. Key points include:

- Source: Pledged by limited partners (investors) in a fund.

- Purpose: Used for investments in startups, acquisitions, or other ventures.

- Timing: Drawn down over time as the fund requires capital.

Key Differences Between Paid-in Capital and Committed Capital

While both terms relate to funding, they differ significantly in their application and context. Key differences include:

- Timing of Payment: Paid-in capital is received immediately, while committed capital is paid over time.

- Structure: Paid-in capital is tied to equity issuance, whereas committed capital is tied to fund commitments.

- Usage: Paid-in capital is used by companies, while committed capital is used by investment funds.

How Paid-in Capital is Recorded in Financial Statements

Paid-in capital is a critical component of a company's financial statements. It is recorded as follows:

- Balance Sheet: Listed under shareholders' equity.

- Components: Includes the par value of shares and additional paid-in capital (APIC).

- Impact: Reflects the company's ability to raise funds from investors.

How Committed Capital is Managed in Private Equity

Committed capital is a cornerstone of private equity and venture capital funds. Its management involves:

- Capital Calls: Funds request portions of committed capital as needed.

- Investor Obligations: Limited partners are legally bound to fulfill their commitments.

- Deployment: Used to acquire stakes in companies or other investments.

Is dry powder the same as uncalled capital?

What is Dry Powder in Finance?

Dry powder refers to the cash reserves or liquid assets that investors or firms hold to take advantage of future investment opportunities. It is often used in the context of private equity, venture capital, and hedge funds. The term emphasizes the readiness to deploy funds when the right opportunity arises. Key points include:

- Liquidity: Dry powder is highly liquid, meaning it can be quickly converted into investments.

- Strategic Use: It is held strategically to capitalize on market downturns or undervalued assets.

- Market Timing: Investors use dry powder to time their entry into the market effectively.

What is Uncalled Capital?

Uncalled capital refers to the portion of committed capital that investors have pledged to a fund but have not yet been asked to contribute. It represents a future obligation rather than an immediate resource. Key aspects include:

- Commitment: Investors are legally bound to provide uncalled capital when the fund calls for it.

- Flexibility: Funds use uncalled capital to manage cash flow and avoid holding excess liquidity.

- Risk Management: It allows funds to minimize risk by only calling capital when needed.

Key Differences Between Dry Powder and Uncalled Capital

While both terms relate to funds available for investment, they are not the same. Key differences include:

- Liquidity Status: Dry powder is already liquid and available, while uncalled capital is not yet accessible.

- Ownership: Dry powder is owned by the fund or investor, whereas uncalled capital is a future obligation.

- Usage Timing: Dry powder can be deployed immediately, while uncalled capital requires a formal call notice.

How Dry Powder and Uncalled Capital Are Used in Private Equity

In private equity, both dry powder and uncalled capital play critical roles in fund operations. Their uses include:

- Deal Execution: Dry powder is used to close deals quickly, while uncalled capital ensures long-term funding.

- Portfolio Management: Dry powder supports follow-on investments, and uncalled capital covers future commitments.

- Investor Relations: Managing both effectively builds trust with limited partners.

Why Understanding the Difference Matters for Investors

For investors, distinguishing between dry powder and uncalled capital is crucial for decision-making. Reasons include:

- Risk Assessment: Dry powder indicates immediate liquidity, while uncalled capital represents future liabilities.

- Investment Strategy: Knowing the difference helps align strategies with fund capabilities.

- Transparency: Clear understanding fosters better communication between investors and fund managers.

What are the three types of venture capital funds?

1. Early-Stage Venture Capital Funds

Early-stage venture capital funds focus on investing in startups during their initial phases. These funds are crucial for companies that are still developing their products or services and need capital to achieve market entry. Key characteristics include:

- Seed funding: Provides capital for product development and market research.

- High risk: Investments are made in unproven businesses with significant potential for failure.

- Equity stake: Investors often receive a significant ownership percentage in exchange for funding.

2. Expansion-Stage Venture Capital Funds

Expansion-stage venture capital funds target companies that have already established a market presence and are looking to scale their operations. These funds help businesses grow rapidly by providing the necessary resources. Key features include:

- Growth capital: Funds are used for scaling production, entering new markets, or increasing sales.

- Moderate risk: Companies at this stage have proven business models, reducing investment risk.

- Strategic support: Investors often provide mentorship and industry connections to accelerate growth.

3. Late-Stage Venture Capital Funds

Late-stage venture capital funds invest in mature companies that are preparing for an exit strategy, such as an IPO or acquisition. These funds aim to maximize returns by supporting companies in their final growth phase. Key aspects include:

- Pre-IPO funding: Capital is used to prepare the company for public listing or acquisition.

- Lower risk: Companies at this stage have stable revenue streams and proven profitability.

- Liquidity focus: Investors prioritize quick returns through exit strategies.

4. Sector-Specific Venture Capital Funds

Sector-specific venture capital funds specialize in investing in particular industries, such as technology, healthcare, or clean energy. These funds leverage industry expertise to identify high-potential opportunities. Key points include:

- Industry focus: Investments are concentrated in a single sector to maximize expertise and returns.

- Deep knowledge: Investors often have extensive experience in the targeted industry.

- Tailored support: Companies benefit from specialized guidance and resources.

5. Geographic-Specific Venture Capital Funds

Geographic-specific venture capital funds focus on investing in startups located in specific regions or countries. These funds aim to support local economies and capitalize on regional growth opportunities. Key highlights include:

- Regional focus: Investments are limited to startups within a defined geographic area.

- Local expertise: Investors understand the unique challenges and opportunities of the region.

- Community impact: These funds often contribute to the economic development of the area.

Frequently Asked Questions (FAQs)

What is dry powder in private equity and venture capital?

In the context of private equity and venture capital, dry powder refers to the amount of committed capital that has not yet been deployed or invested. It represents the funds that are available to be used for future investments, acquisitions, or other strategic opportunities. Essentially, dry powder is the difference between the total capital committed by investors and the amount that has already been paid in or invested. This liquidity is crucial for firms to act quickly when attractive opportunities arise.

How is dry powder calculated?

Dry powder is calculated by subtracting the paid-in capital from the total committed capital. For example, if a private equity fund has $500 million in committed capital from investors and has already invested $300 million, the remaining $200 million is considered dry powder. This calculation helps firms and investors understand how much capital is still available for deployment, which is critical for planning future investments and maintaining flexibility in a competitive market.

Why is dry powder important in private equity and venture capital?

Dry powder is a key metric in private equity and venture capital because it indicates the financial capacity of a fund to pursue new opportunities. Having a significant amount of dry powder allows firms to act swiftly when they identify promising investments, especially in volatile or fast-moving markets. Additionally, it provides a buffer during economic downturns, enabling firms to support their portfolio companies or acquire undervalued assets. For investors, the level of dry powder can signal the fund's ability to generate future returns and manage risk effectively.

What are the risks associated with high levels of dry powder?

While having a large amount of dry powder can be advantageous, it also comes with potential risks. One major concern is the pressure to deploy capital quickly, which may lead to overpaying for assets or making suboptimal investments. Additionally, if dry powder remains uninvested for too long, it can result in lower returns for investors, as the capital is not generating any income or growth. Firms must strike a balance between maintaining sufficient dry powder for opportunities and ensuring that the capital is deployed effectively to maximize returns.

Leave a Reply

Our Recommended Articles