What Advice Would You Give a Former Startup Product Manager and Product Designer Looking to Get Into Venture Capital as an Associate

Transitioning from a role as a startup product manager and product designer to venture capital (VC) as an associate can be both exciting and challenging. With a background in building and scaling products, you bring a unique perspective to the table, but breaking into VC requires a strategic approach. This article explores actionable advice for leveraging your product expertise, building relevant networks, and developing the financial acumen needed to thrive in the venture capital world. Whether it’s understanding deal flow, honing your investment thesis, or showcasing your value to VC firms, these insights will help you navigate this career shift effectively.

- What Advice Would You Give a Former Startup Product Manager and Product Designer Looking to Get Into Venture Capital as an Associate

-

Can you go from product management to venture capital?

- Understanding the Transition from Product Management to Venture Capital

- Key Skills Product Managers Bring to Venture Capital

- Steps to Transition from Product Management to Venture Capital

- Challenges Faced When Moving from Product Management to Venture Capital

- How to Leverage Product Management Experience in Venture Capital

- What is the 2 6 2 rule of venture capital?

- How to answer why you are interested in venture capital?

- What is the best way to approach venture capitalists?

-

Frequently Asked Questions (FAQs)

- What skills should a former startup product manager and product designer highlight when transitioning into venture capital?

- How can networking help a former product manager and designer break into venture capital?

- What steps can a former product manager and designer take to gain relevant venture capital experience?

- What should a former product manager and designer include in their resume when applying for a venture capital associate role?

What Advice Would You Give a Former Startup Product Manager and Product Designer Looking to Get Into Venture Capital as an Associate

1. Leverage Your Product Management and Design Experience

Transitioning from a product management or product design role into venture capital (VC) can be a strategic move. Your experience in building and scaling products gives you a unique perspective on what makes a startup successful. Highlight your ability to understand customer needs, market fit, and product scalability. These skills are highly valued in VC, as they allow you to assess potential investments more effectively.

See Also How Does a Product Manager Get Into Venture Capital?

How Does a Product Manager Get Into Venture Capital?2. Build a Strong Network in the VC Ecosystem

Networking is crucial in the VC world. Start by connecting with venture capitalists, founders, and industry experts. Attend startup events, pitch nights, and VC conferences to meet key players. Use platforms like LinkedIn to build relationships and seek mentorship. A strong network can open doors to associate roles and provide insights into the industry.

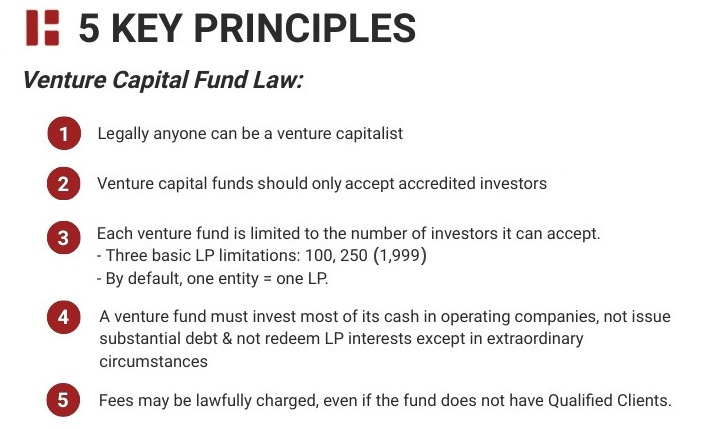

3. Develop a Deep Understanding of the VC Industry

To succeed in VC, you need to understand how the industry operates. Study investment strategies, fund structures, and portfolio management. Familiarize yourself with key metrics like IRR (Internal Rate of Return) and MOIC (Multiple on Invested Capital). Reading books, following VC blogs, and listening to podcasts can help you gain this knowledge.

See Also Are Moic and Irr the Most Important Financial Metrics to Track in a Venture Capital Portfolio

Are Moic and Irr the Most Important Financial Metrics to Track in a Venture Capital Portfolio4. Showcase Your Analytical and Financial Skills

VC associates need strong analytical and financial skills. If you lack experience in financial modeling or valuation techniques, consider taking courses or certifications. Being able to analyze financial statements, market trends, and investment opportunities will make you a more competitive candidate.

5. Tailor Your Resume and Pitch for VC Roles

When applying for VC roles, tailor your resume to highlight relevant skills and experiences. Emphasize your startup background, product expertise, and any investment-related activities. Prepare a compelling pitch that explains why your unique background makes you a great fit for a VC associate role.

See Also What Degree is Most Useful to Get Into Venture Capital or Investment Banking

What Degree is Most Useful to Get Into Venture Capital or Investment Banking| Key Skill | Why It Matters |

|---|---|

| Product Management | Understanding product-market fit and scalability is crucial for evaluating startups. |

| Networking | Building relationships in the VC ecosystem can lead to job opportunities and mentorship. |

| Financial Analysis | Strong financial skills are essential for assessing investment opportunities. |

| Industry Knowledge | Understanding VC operations and metrics helps you make informed decisions. |

| Resume Tailoring | Highlighting relevant experiences increases your chances of landing a VC role. |

Can you go from product management to venture capital?

Understanding the Transition from Product Management to Venture Capital

Transitioning from product management to venture capital is possible but requires a strategic approach. Product managers often possess skills that are highly valuable in venture capital, such as understanding market needs, evaluating product-market fit, and working closely with startups. However, the transition involves acquiring new skills and building a network in the investment world.

See Also Where Can I Find a Searchable Database of Venture Capital Investments by Industry

Where Can I Find a Searchable Database of Venture Capital Investments by Industry- Leverage your product expertise: Use your deep understanding of product development and customer needs to evaluate potential investments.

- Learn financial modeling: Gain proficiency in financial analysis to assess the viability of startups.

- Network with investors: Build relationships with venture capitalists and attend industry events to gain insights and opportunities.

Key Skills Product Managers Bring to Venture Capital

Product managers bring a unique set of skills to venture capital, making them valuable assets in evaluating and supporting startups. Their ability to analyze markets, understand customer pain points, and drive product success aligns well with the needs of venture capital firms.

- Market analysis: Ability to identify trends and assess market opportunities.

- Product-market fit: Expertise in determining whether a product meets customer needs.

- Cross-functional collaboration: Experience working with engineering, marketing, and sales teams to bring products to market.

Steps to Transition from Product Management to Venture Capital

Making the move from product management to venture capital requires careful planning and execution. Here are actionable steps to facilitate the transition:

See Also What Are the Exit Opportunities After Working as an Analyst at a Vc Firm

What Are the Exit Opportunities After Working as an Analyst at a Vc Firm- Gain investment knowledge: Take courses or certifications in venture capital, private equity, or finance.

- Build a track record: Showcase your ability to identify successful products or startups through side projects or angel investing.

- Join a VC firm in a non-investment role: Start in roles like venture partner or analyst to gain experience and credibility.

Challenges Faced When Moving from Product Management to Venture Capital

While the transition is achievable, it comes with its own set of challenges. Product managers must adapt to a new mindset and overcome hurdles to succeed in venture capital.

- Lack of financial expertise: Many product managers lack formal training in finance or investment analysis.

- Networking barriers: Breaking into the tight-knit venture capital community can be difficult without prior connections.

- Different success metrics: Shifting from product success to investment returns requires a new perspective.

How to Leverage Product Management Experience in Venture Capital

Product management experience can be a significant advantage in venture capital if leveraged effectively. Here’s how to make the most of your background:

- Evaluate startups through a product lens: Assess the scalability and feasibility of a startup’s product.

- Mentor portfolio companies: Use your expertise to guide startups in refining their products and strategies.

- Identify emerging trends: Apply your market insights to spot innovative startups early.

What is the 2 6 2 rule of venture capital?

Understanding the 2 6 2 Rule in Venture Capital

The 2 6 2 rule is a framework used in venture capital to evaluate the potential success of a startup portfolio. It suggests that out of every 10 investments:

- 2 investments will yield significant returns, often referred to as home runs.

- 6 investments will either break even or result in moderate returns.

- 2 investments will fail completely, resulting in a total loss.

Why the 2 6 2 Rule is Important for Investors

The 2 6 2 rule helps investors manage expectations and risks. By understanding that only a small percentage of investments will generate substantial returns, investors can:

- Diversify their portfolio to mitigate risks.

- Focus on high-potential startups that align with their investment strategy.

- Prepare for potential losses and allocate resources accordingly.

How the 2 6 2 Rule Applies to Startup Success

For startups, the 2 6 2 rule highlights the competitive nature of venture capital. It emphasizes that:

- Only a few startups will achieve exponential growth.

- Most startups will struggle to deliver significant returns.

- Failure is a common outcome, and startups must be resilient and adaptable.

Challenges of Implementing the 2 6 2 Rule

While the 2 6 2 rule provides a useful framework, it comes with challenges such as:

- Identifying high-potential startups early in their lifecycle.

- Balancing risk and reward across a diverse portfolio.

- Managing investor expectations when most investments do not yield significant returns.

Real-World Examples of the 2 6 2 Rule in Action

Many venture capital firms have experienced the 2 6 2 rule in practice. For instance:

- Sequoia Capital's investment in WhatsApp resulted in a massive return, exemplifying the 2 successful investments.

- Moderate returns from companies like Dropbox represent the 6 in the rule.

- Failures like Juicero highlight the 2 investments that result in total losses.

How to answer why you are interested in venture capital?

Understanding the Venture Capital Ecosystem

When explaining your interest in venture capital, it's crucial to demonstrate a deep understanding of the ecosystem. Venture capital is not just about funding startups; it's about fostering innovation and driving growth in emerging industries. Here are some key points to consider:

- Innovation: Venture capital plays a pivotal role in bringing groundbreaking ideas to life by providing the necessary resources and support.

- Risk and Reward: The high-risk, high-reward nature of venture capital is appealing to those who thrive in dynamic and uncertain environments.

- Networking: Being part of the venture capital ecosystem offers unparalleled opportunities to connect with visionary entrepreneurs and industry leaders.

Passion for Startups and Entrepreneurship

Your interest in venture capital should reflect a genuine passion for startups and entrepreneurship. This passion can be articulated through your desire to help new businesses succeed and grow. Consider the following aspects:

- Supporting Entrepreneurs: Venture capital allows you to support passionate entrepreneurs who are looking to make a significant impact in their respective fields.

- Building Businesses: The process of building a business from the ground up is both challenging and rewarding, and venture capital provides the means to do so.

- Learning Opportunities: Working with startups offers continuous learning opportunities, as each company presents unique challenges and solutions.

Interest in Financial Modeling and Analysis

Venture capital involves a significant amount of financial modeling and analysis to assess the viability of potential investments. If you have a strong interest in these areas, it's important to highlight them:

- Financial Acumen: A solid understanding of financial statements, valuation techniques, and investment strategies is essential in venture capital.

- Analytical Skills: The ability to analyze market trends, competitive landscapes, and financial projections is crucial for making informed investment decisions.

- Strategic Thinking: Venture capital requires strategic thinking to identify high-potential startups and develop investment theses that align with market opportunities.

Desire to Drive Impact and Innovation

Venture capital is not just about financial returns; it's also about driving impact and innovation. If you are motivated by the potential to make a difference, this is a key point to emphasize:

- Impact Investing: Many venture capitalists are drawn to the idea of investing in companies that can create positive social or environmental change.

- Technological Advancements: The opportunity to be at the forefront of technological advancements and disruptive innovations is a major draw for many in venture capital.

- Long-Term Vision: Venture capital allows you to think long-term and invest in ideas that have the potential to shape the future.

Commitment to Continuous Learning and Growth

The venture capital industry is constantly evolving, and a commitment to continuous learning and growth is essential. Highlight your willingness to adapt and grow within this dynamic field:

- Industry Trends: Staying updated with the latest industry trends and emerging technologies is crucial for success in venture capital.

- Professional Development: Continuous professional development through courses, certifications, and networking events can enhance your skills and knowledge.

- Adaptability: The ability to adapt to changing market conditions and investment landscapes is a key trait of successful venture capitalists.

What is the best way to approach venture capitalists?

Understanding the Venture Capital Landscape

Before approaching venture capitalists, it is crucial to understand the venture capital landscape. This involves researching the types of investors, their investment focus, and the stages of funding they typically participate in. Here are some key steps:

- Identify the right VCs: Look for venture capitalists who have a history of investing in your industry or sector.

- Understand their investment thesis: Each VC firm has a specific investment thesis that guides their decisions. Make sure your business aligns with their goals.

- Know their portfolio: Review the companies they have invested in to gauge their interest and expertise in your field.

Preparing a Compelling Pitch Deck

A well-prepared pitch deck is essential when approaching venture capitalists. It should clearly communicate your business idea, market opportunity, and growth potential. Here are the key components to include:

- Problem and solution: Clearly define the problem your business solves and how your solution is unique.

- Market opportunity: Provide data on the size of the market and your target audience.

- Business model: Explain how your business will generate revenue and achieve profitability.

Building a Strong Network

Networking plays a significant role in getting the attention of venture capitalists. Building relationships with industry professionals and other entrepreneurs can open doors to introductions and recommendations. Here’s how to build a strong network:

- Attend industry events: Participate in conferences, meetups, and networking events to meet potential investors.

- Leverage LinkedIn: Connect with VCs and industry leaders on LinkedIn to stay on their radar.

- Seek warm introductions: Use your existing network to get introductions to venture capitalists through mutual connections.

Demonstrating Traction and Milestones

Venture capitalists are more likely to invest in startups that have demonstrated traction and achieved significant milestones. Here’s how to showcase your progress:

- Show user growth: Highlight metrics such as user acquisition, retention rates, and engagement.

- Revenue and profitability: Provide data on your revenue streams and any progress toward profitability.

- Partnerships and collaborations: Mention any strategic partnerships or collaborations that add value to your business.

Negotiating Terms and Closing the Deal

Once a venture capitalist shows interest, the next step is to negotiate the terms of the investment and close the deal. Here’s what to consider during this phase:

- Valuation: Agree on a fair valuation for your company based on its current stage and potential.

- Equity and control: Negotiate the equity stake the VC will receive and the level of control they will have in decision-making.

- Legal documentation: Ensure all legal documents, including term sheets and shareholder agreements, are reviewed by a qualified attorney.

Frequently Asked Questions (FAQs)

What skills should a former startup product manager and product designer highlight when transitioning into venture capital?

When transitioning into venture capital, it's crucial to emphasize your product management and design expertise, as these roles provide a deep understanding of product-market fit, user experience, and scaling strategies. Highlight your ability to analyze market trends, identify customer pain points, and evaluate startup viability. Additionally, showcase your collaboration skills with cross-functional teams, as venture capital associates often work closely with founders and other stakeholders. Demonstrating a strong grasp of financial metrics and business models will further strengthen your candidacy.

How can networking help a former product manager and designer break into venture capital?

Networking is a critical component of breaking into venture capital. Start by connecting with VC professionals through platforms like LinkedIn or attending industry events. Leverage your background in product management and design to build relationships with founders and investors who value your unique perspective. Consider reaching out to alumni networks or joining communities like AngelList or Product Hunt to engage with the startup ecosystem. Building a strong network can lead to referrals, mentorship, and even direct opportunities to join a venture capital firm.

What steps can a former product manager and designer take to gain relevant venture capital experience?

To gain relevant venture capital experience, consider starting with angel investing or joining a startup accelerator as a mentor. These roles allow you to evaluate early-stage companies and understand the investment process. You can also pursue freelance consulting for startups, helping them refine their product strategies while gaining exposure to their fundraising efforts. Additionally, taking courses or certifications in venture capital, private equity, or financial modeling can help bridge any knowledge gaps and demonstrate your commitment to the field.

What should a former product manager and designer include in their resume when applying for a venture capital associate role?

When applying for a venture capital associate role, tailor your resume to highlight transferable skills and relevant experiences. Include your achievements in product management and design, such as launching successful products, improving user engagement, or driving revenue growth. Emphasize any experience with market research, competitive analysis, or fundraising. If you've worked with startups, detail your contributions to their growth and scalability. Additionally, mention any investment-related activities, such as angel investing or participation in pitch competitions, to showcase your understanding of the venture capital landscape.

Leave a Reply

Our Recommended Articles