What Do Associates Do at Venture Capital Firms?

Venture capital firms play a pivotal role in shaping the future of innovative startups and high-growth companies. Within these firms, associates are key contributors who bridge the gap between senior leadership and portfolio companies. Their responsibilities span a wide range of tasks, from conducting market research and analyzing investment opportunities to supporting due diligence processes and assisting with deal execution. Associates often act as the backbone of venture capital operations, leveraging their analytical skills and industry knowledge to identify promising ventures. This article explores the multifaceted role of associates in venture capital firms, shedding light on their day-to-day activities and the impact they have on the investment ecosystem.

- What Do Associates Do at Venture Capital Firms?

- What does an associate at a VC firm do?

-

How much does a venture capitalist associate make?

- What is the Average Salary of a Venture Capitalist Associate?

- How Does Location Impact a Venture Capitalist Associate's Salary?

- What Factors Influence a Venture Capitalist Associate's Earnings?

- What Are the Additional Benefits for Venture Capitalist Associates?

- How Does Career Progression Affect a Venture Capitalist Associate's Salary?

- What is the difference between principal and associate in VC?

- How many hours do VC associates work?

- Frequently Asked Questions by our Community

What Do Associates Do at Venture Capital Firms?

Associates at venture capital (VC) firms play a critical role in the investment process, acting as the backbone of deal sourcing, due diligence, and portfolio management. They are typically early-career professionals who work closely with partners and senior team members to identify promising startups, evaluate their potential, and support the growth of portfolio companies. Their responsibilities are diverse, ranging from market research to financial analysis, and they often serve as a bridge between startups and the firm's decision-makers.

See Also How Does a Product Manager Get Into Venture Capital?

How Does a Product Manager Get Into Venture Capital?1. Sourcing and Evaluating Investment Opportunities

Associates are responsible for sourcing potential investment opportunities by networking, attending industry events, and leveraging their research skills. They evaluate startups by analyzing their business models, market potential, and competitive landscape. This involves creating detailed reports and presenting findings to senior team members to help inform investment decisions.

2. Conducting Due Diligence

A significant part of an associate's role is conducting due diligence on potential investments. This includes reviewing financial statements, assessing market trends, and evaluating the startup's team and technology. Associates often collaborate with external experts to ensure a thorough analysis of the investment opportunity.

See Also What Do Operations Roles Look Like at a Venture Capital Firm?

What Do Operations Roles Look Like at a Venture Capital Firm?3. Supporting Portfolio Companies

Once an investment is made, associates provide ongoing support to portfolio companies. This may involve assisting with strategic planning, connecting startups with industry experts, or helping them secure additional funding. Their goal is to ensure the success of the portfolio companies and maximize returns for the VC firm.

4. Financial Modeling and Analysis

Associates are heavily involved in financial modeling and analysis. They create detailed financial projections to assess the potential return on investment (ROI) and evaluate the risks associated with a startup. This requires strong analytical skills and a deep understanding of financial metrics.

See Also Do Any Venture Capital Companies Offer Summer Internships for Undergraduates

Do Any Venture Capital Companies Offer Summer Internships for Undergraduates5. Preparing Investment Memorandums

Associates prepare investment memorandums that summarize key findings and recommendations for potential investments. These documents are presented to the firm's investment committee and play a crucial role in the decision-making process. The memorandums include detailed analyses of the startup's market, team, financials, and growth potential.

| Key Responsibilities | Description |

|---|---|

| Sourcing | Identifying and evaluating potential investment opportunities. |

| Due Diligence | Conducting thorough analysis of startups before investment. |

| Portfolio Support | Assisting portfolio companies with growth and strategy. |

| Financial Modeling | Creating financial projections to assess ROI and risks. |

| Investment Memorandums | Preparing detailed reports for investment decisions. |

What does an associate at a VC firm do?

Deal Sourcing and Evaluation

An associate at a venture capital (VC) firm plays a critical role in identifying and evaluating potential investment opportunities. This involves:

- Researching industries and markets to identify emerging trends and high-growth sectors.

- Networking with entrepreneurs, startups, and other stakeholders to source deals.

- Analyzing business models, financials, and growth potential of startups to assess viability.

Due Diligence and Investment Analysis

Once a potential investment is identified, the associate conducts thorough due diligence. This includes:

- Reviewing financial statements and projections to evaluate the startup's financial health.

- Assessing market size and competitive landscape to determine scalability.

- Collaborating with experts to validate the startup's technology or product.

Portfolio Management and Support

After an investment is made, the associate helps manage the portfolio by:

- Monitoring performance of portfolio companies and tracking key metrics.

- Providing strategic guidance to startups, such as introductions to potential partners or customers.

- Assisting with follow-on funding rounds or exit strategies like acquisitions or IPOs.

Market Research and Reporting

Associates are responsible for staying informed about market trends and reporting insights to the team. This involves:

- Conducting market research to identify new opportunities or threats.

- Preparing reports and presentations for internal stakeholders and investors.

- Tracking competitor activity and industry developments to inform investment decisions.

Internal Operations and Fund Management

Associates also contribute to the internal operations of the VC firm by:

- Assisting with fundraising efforts for new funds or capital commitments.

- Managing administrative tasks such as maintaining deal flow databases.

- Supporting senior partners in decision-making processes and strategic planning.

How much does a venture capitalist associate make?

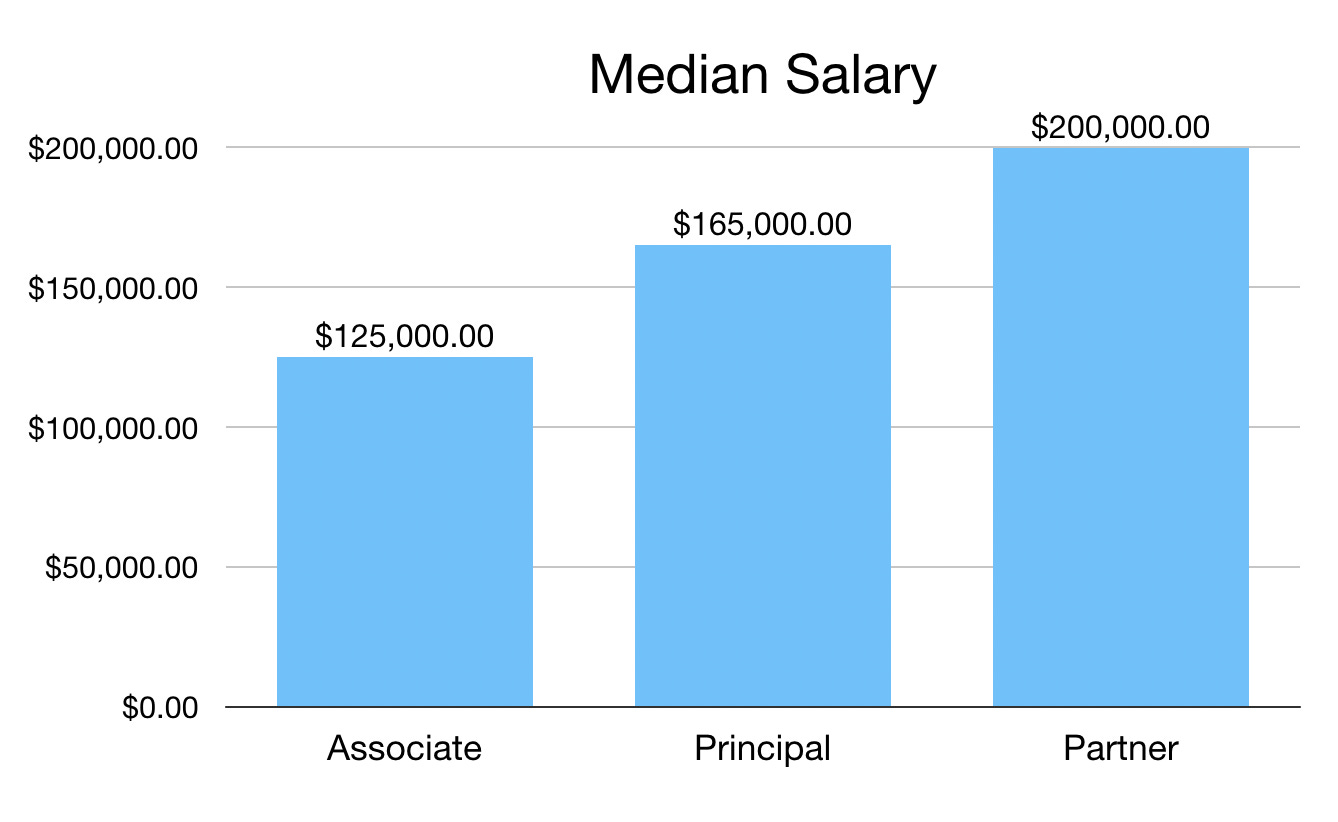

What is the Average Salary of a Venture Capitalist Associate?

The average salary for a venture capitalist associate typically ranges between $80,000 and $150,000 per year, depending on factors such as location, firm size, and experience. In addition to the base salary, associates often receive bonuses and profit-sharing incentives, which can significantly increase total compensation.

- Base Salary: The primary component of compensation, usually between $80,000 and $120,000.

- Bonuses: Performance-based bonuses can add $20,000 to $50,000 annually.

- Carried Interest: Some associates may receive a share of the fund's profits, though this is less common at the associate level.

How Does Location Impact a Venture Capitalist Associate's Salary?

Location plays a significant role in determining a venture capitalist associate's salary. Associates working in major financial hubs like San Francisco, New York, or Boston tend to earn higher salaries due to the higher cost of living and the concentration of venture capital firms in these areas.

- San Francisco: Salaries often exceed $130,000 due to the high demand for talent.

- New York: Associates can expect salaries ranging from $110,000 to $140,000.

- Other Cities: In smaller markets, salaries may range from $80,000 to $100,000.

What Factors Influence a Venture Capitalist Associate's Earnings?

Several factors influence how much a venture capitalist associate earns, including experience, education, firm reputation, and performance. Associates with advanced degrees or prior experience in finance or consulting often command higher salaries.

- Experience: More experienced associates earn significantly more than entry-level professionals.

- Education: An MBA or other advanced degree can boost earning potential.

- Firm Reputation: Top-tier firms typically offer higher compensation packages.

What Are the Additional Benefits for Venture Capitalist Associates?

Beyond the base salary, venture capitalist associates often receive additional benefits such as health insurance, retirement plans, and networking opportunities. These perks can add substantial value to the overall compensation package.

- Health Insurance: Comprehensive medical, dental, and vision coverage.

- Retirement Plans: 401(k) matching and other retirement benefits.

- Networking Opportunities: Access to exclusive industry events and connections.

How Does Career Progression Affect a Venture Capitalist Associate's Salary?

As a venture capitalist associate gains experience and moves up the career ladder, their salary increases significantly. Promotions to roles like senior associate or principal can lead to substantial pay raises and additional benefits.

- Senior Associate: Salaries can range from $150,000 to $200,000.

- Principal: Compensation often exceeds $250,000, including bonuses and carried interest.

- Partner: At this level, earnings can reach $500,000 or more annually.

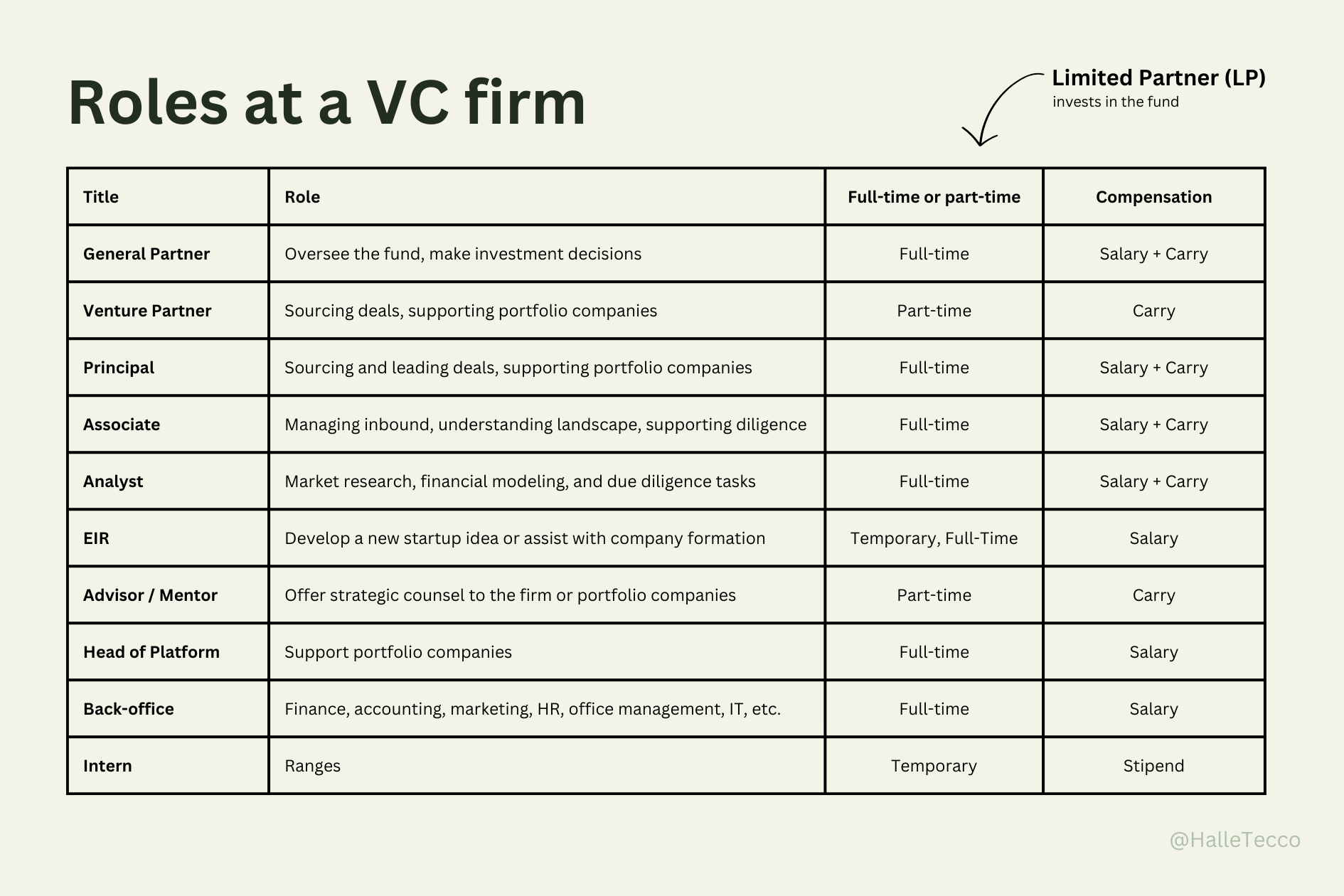

What is the difference between principal and associate in VC?

Roles and Responsibilities

The roles of a Principal and an Associate in venture capital (VC) differ significantly in terms of responsibilities and decision-making authority. A Principal typically has more experience and is involved in higher-level strategic decisions, while an Associate focuses on operational tasks and supporting the investment process.

- Principal: Leads deal sourcing, evaluates investment opportunities, and negotiates terms. They often have a seat on the investment committee and influence final decisions.

- Associate: Conducts market research, performs due diligence, and prepares investment memos. They support senior team members and rarely have voting power in investment decisions.

- Key Difference: Principals drive strategy, while Associates execute tasks under supervision.

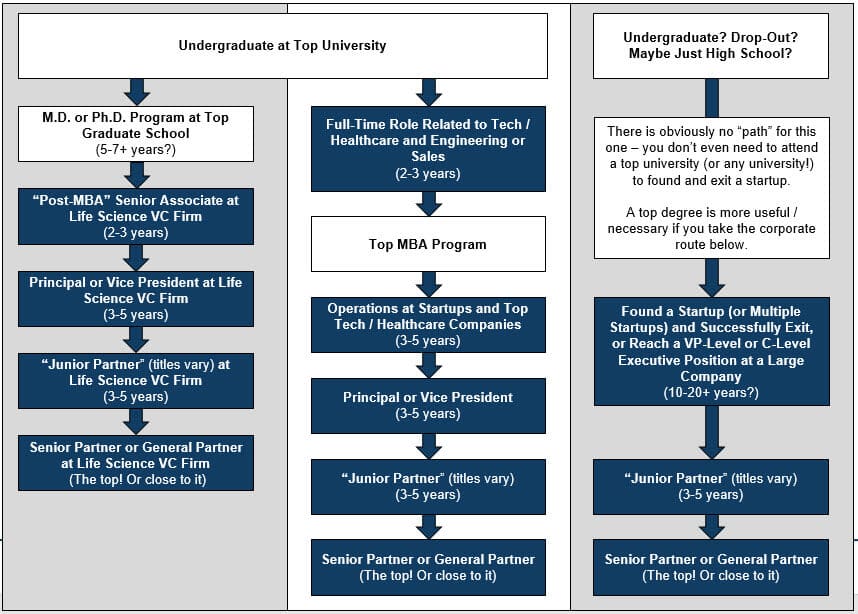

Experience and Career Progression

The career trajectory for a Principal and an Associate in VC varies based on experience and expertise. Principals are usually more seasoned professionals, while Associates are often earlier in their careers.

- Principal: Typically has 7-10+ years of experience in VC, startups, or related fields. They may have previously worked as Associates or in other senior roles.

- Associate: Usually has 2-5 years of experience, often coming from investment banking, consulting, or startup roles. This position is a stepping stone to more senior roles.

- Key Difference: Principals are experienced leaders, while Associates are building foundational skills.

Decision-making authority is a critical distinction between Principals and Associates in VC. Principals have a direct say in investment decisions, whereas Associates provide support and analysis.

- Principal: Has voting rights on the investment committee and can approve or reject deals. They also mentor junior team members.

- Associate: Lacks voting power but contributes insights and data to inform decisions. They rely on Principals to advocate for their recommendations.

- Key Difference: Principals make final decisions, while Associates influence them indirectly.

Compensation and Incentives

Compensation structures for Principals and Associates in VC reflect their differing levels of responsibility and experience. Principals generally earn higher salaries and carry more significant equity stakes.

- Principal: Receives a higher base salary, performance bonuses, and a share of carried interest (profits from investments).

- Associate: Earns a lower base salary with smaller bonuses and limited or no carried interest.

- Key Difference: Principals benefit more from successful investments due to their equity stakes.

Networking and Relationship Building

Networking and relationship-building responsibilities differ between Principals and Associates in VC. Principals focus on high-level connections, while Associates handle more operational networking tasks.

- Principal: Builds relationships with founders, co-investors, and industry leaders. They represent the firm at major events and conferences.

- Associate: Networks with junior professionals, attends industry meetups, and supports deal sourcing by identifying potential opportunities.

- Key Difference: Principals focus on strategic relationships, while Associates build foundational networks.

How many hours do VC associates work?

Typical Working Hours for VC Associates

Venture Capital (VC) associates typically work long hours, often ranging from 60 to 80 hours per week. This includes time spent in the office, attending meetings, conducting due diligence, and networking. The workload can vary depending on the stage of the investment cycle, with busier periods during deal sourcing and closing phases.

- Office Hours: Associates usually spend 10-12 hours per day in the office.

- Meetings: A significant portion of time is dedicated to internal and external meetings.

- Due Diligence: Extensive research and analysis are required for potential investments.

Factors Influencing VC Associates' Working Hours

Several factors can influence the number of hours a VC associate works, including the size of the firm, the stage of the fund, and the current deal flow. Associates at smaller firms or those in the early stages of a fund may work longer hours due to fewer resources and higher workloads.

- Firm Size: Smaller firms often require more hands-on involvement.

- Fund Stage: Early-stage funds may demand more time for sourcing and evaluating deals.

- Deal Flow: High deal flow periods can significantly increase working hours.

Work-Life Balance for VC Associates

Maintaining a work-life balance can be challenging for VC associates due to the demanding nature of the job. However, some firms are beginning to recognize the importance of work-life balance and are implementing policies to support their employees.

- Flexible Hours: Some firms offer flexible working hours to help manage personal commitments.

- Remote Work: The option to work remotely can provide more flexibility.

- Wellness Programs: Initiatives aimed at promoting mental and physical health are becoming more common.

Impact of Long Hours on VC Associates

Working long hours can have both positive and negative impacts on VC associates. While it can lead to rapid career advancement and valuable experience, it can also result in burnout and stress.

- Career Advancement: Long hours can accelerate learning and career progression.

- Burnout: Prolonged periods of high stress can lead to burnout.

- Stress Management: Effective stress management techniques are essential for long-term success.

Strategies to Manage Long Working Hours

VC associates can adopt various strategies to manage their long working hours effectively. These strategies can help maintain productivity and reduce the risk of burnout.

- Time Management: Prioritizing tasks and managing time efficiently can help reduce workload.

- Delegation: Delegating tasks when possible can free up time for more critical activities.

- Regular Breaks: Taking regular breaks can improve focus and productivity.

Frequently Asked Questions by our Community

What is the primary role of an associate at a venture capital firm?

An associate at a venture capital firm plays a crucial role in supporting the investment team. Their primary responsibilities include sourcing potential investment opportunities, conducting market research, and performing due diligence on startups. They often analyze financial statements, evaluate business models, and assess market trends to help the firm make informed investment decisions. Additionally, associates may assist in preparing investment memos and presentations for partners.

What skills are essential for an associate in venture capital?

To excel as an associate in venture capital, individuals need a combination of analytical, financial, and interpersonal skills. Strong financial modeling and valuation expertise are critical for evaluating startups. Additionally, associates must possess excellent communication skills to interact with entrepreneurs, investors, and team members. A deep understanding of industry trends and the ability to think critically are also vital for identifying promising investment opportunities.

How do associates contribute to the deal-making process?

Associates are integral to the deal-making process at venture capital firms. They help identify and evaluate potential investments by conducting initial screenings of startups. Once a promising opportunity is identified, associates perform in-depth due diligence, which includes analyzing financials, assessing market potential, and evaluating the founding team. They also assist in structuring deals, negotiating terms, and preparing investment memos for senior partners to review. Their work ensures that the firm makes well-informed and strategic investment decisions.

What career progression opportunities exist for associates in venture capital?

Associates in venture capital often have clear career progression paths. After gaining experience and demonstrating strong performance, they may advance to roles such as senior associate or principal. These positions involve greater responsibility, including leading deals and managing portfolio companies. Some associates eventually become partners, where they play a key role in shaping the firm's investment strategy and decision-making. Additionally, the skills and network gained in venture capital can open doors to roles in entrepreneurship, private equity, or corporate development.

Leave a Reply

Our Recommended Articles