What is Considered a Good Roi in Vc?

In the world of venture capital (VC), understanding what constitutes a good return on investment (ROI) is crucial for both investors and startups. ROI serves as a key metric to evaluate the success of an investment, but determining what qualifies as good can vary significantly depending on the context. Factors such as industry trends, risk tolerance, and the stage of investment all play a role in shaping expectations. While some investors may consider a 3x return satisfactory, others might aim for 10x or more. This article explores the benchmarks for a good ROI in VC, shedding light on the factors that influence these expectations and how they align with broader investment strategies.

What is Considered a Good ROI in Venture Capital?

Venture Capital (VC) is a high-risk, high-reward investment strategy where investors provide funding to startups and early-stage companies with significant growth potential. A good ROI (Return on Investment) in VC is typically much higher than in traditional investments due to the inherent risks involved. While a 10% annual return might be considered solid in other investment sectors, VC investors often aim for 20-30% or more annually. However, the definition of a good ROI can vary depending on the fund's strategy, the stage of investment, and market conditions.

See AlsoWhat is the Average Irr Achieved by Venture Capital Funds?Understanding ROI in Venture Capital

ROI in VC is calculated by dividing the net profit from an investment by the initial cost of the investment. For example, if a VC firm invests $1 million in a startup and later sells its stake for $5 million, the ROI would be 400%. However, this calculation doesn't account for the time it takes to achieve this return, which is why Internal Rate of Return (IRR) is often used to measure performance over time.

Factors Influencing a Good ROI in VC

Several factors determine what constitutes a good ROI in VC:

- Stage of Investment: Early-stage investments (seed or Series A) typically require higher returns to justify the risk.

- Industry Trends: Sectors like tech and biotech often yield higher ROIs due to rapid innovation and scalability.

- Exit Strategy: The success of an IPO or acquisition significantly impacts ROI.

- Fund Size: Smaller funds may achieve higher ROIs due to concentrated investments in high-growth startups.

How Did Benchmark Capital Come to Be?

How Did Benchmark Capital Come to Be?Benchmarks for VC ROI

VC funds often compare their performance to benchmarks like the Cambridge Associates VC Index or public market equivalents. A top-quartile VC fund might aim for an IRR of 20-30%, while average funds might target 10-15%. Below is a table summarizing typical VC ROI benchmarks:

| Fund Performance | Target IRR |

|---|---|

| Top-Quartile Fund | 20-30% |

| Average Fund | 10-15% |

| Underperforming Fund | <10% |

Risks and Realities of VC ROI

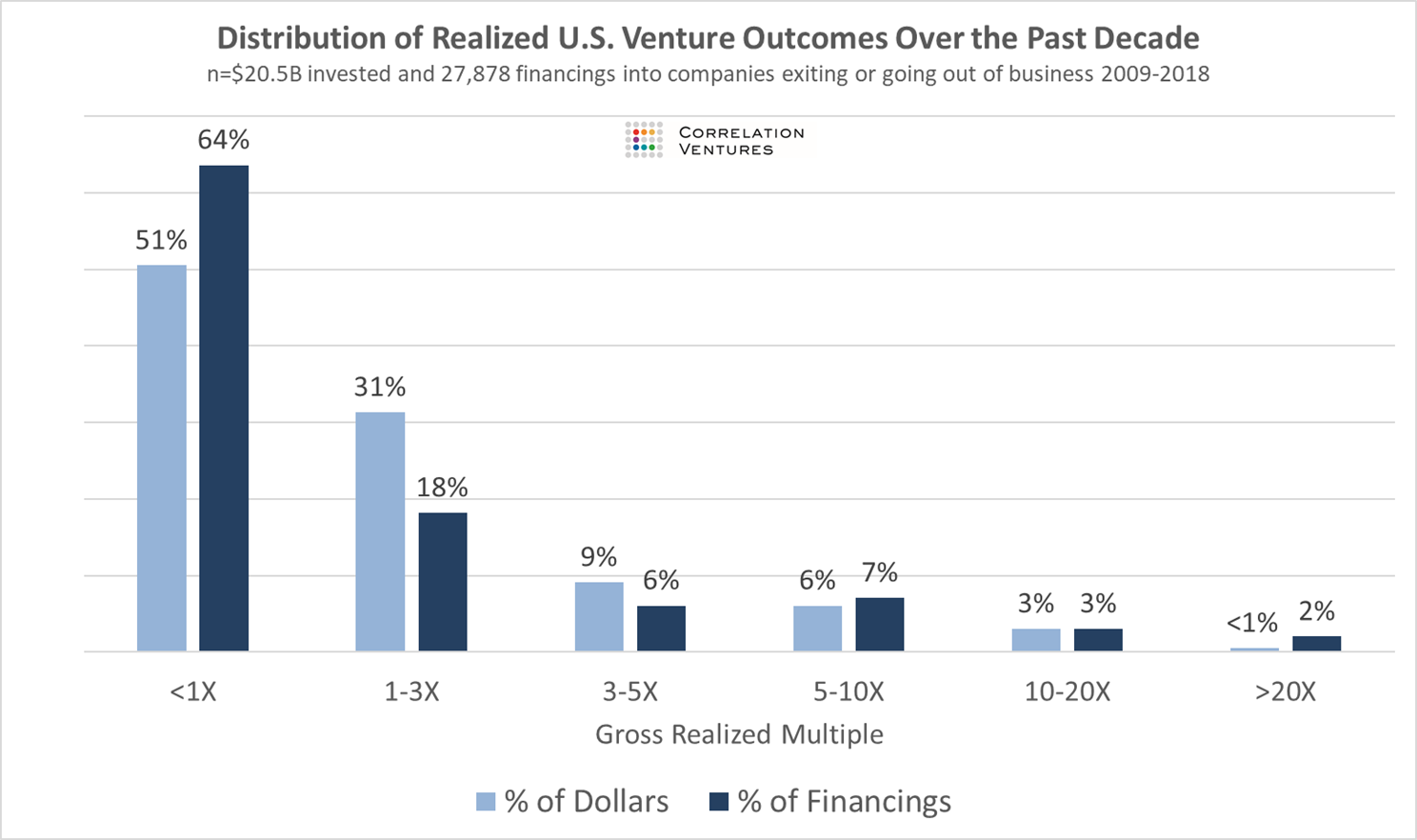

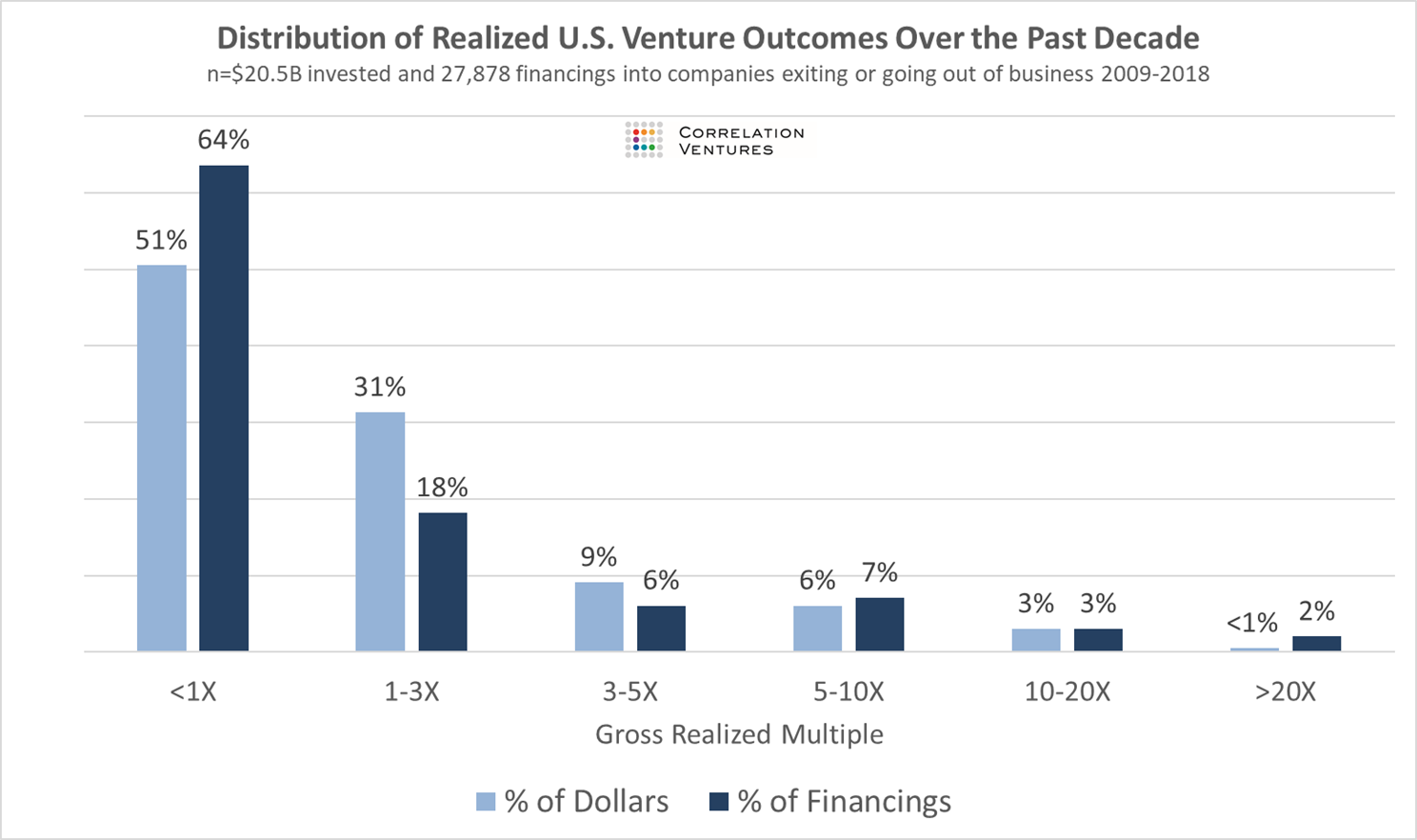

VC investments are inherently risky, with a high likelihood of failure. Studies show that 60-70% of startups fail, and only a small percentage generate outsized returns. This means that a VC portfolio often relies on a few home runs to achieve a good overall ROI. Diversification and due diligence are critical to mitigating risks.

See AlsoHow Much Irr Does a Vc Fund Typically Target?How to Maximize ROI in VC

To maximize ROI, VC investors should:

- Focus on high-growth sectors with scalable business models.

- Conduct thorough due diligence to identify promising startups.

- Build a diversified portfolio to spread risk.

- Actively support portfolio companies through mentorship and networking.

By understanding these factors, investors can better navigate the complexities of VC and aim for a good ROI.

What is a good ROI for a VC?

What is a Good ROI for a Venture Capitalist?

A good Return on Investment (ROI) for a venture capitalist typically ranges between 20% to 30% annually. However, this can vary depending on the stage of investment, industry, and risk tolerance. Venture capitalists often aim for higher returns to compensate for the high risk associated with early-stage startups.

- Early-stage investments may require a higher ROI, often exceeding 30%, due to the increased risk of failure.

- Later-stage investments might yield a lower ROI, around 15% to 20%, as the companies are more established and less risky.

- Industry benchmarks suggest that top-performing VC funds aim for an internal rate of return (IRR) of at least 25%.

Factors Influencing a Good ROI in Venture Capital

Several factors influence what constitutes a good ROI for a venture capitalist. These include the stage of the company, the sector, and the economic environment.

- Stage of the company: Early-stage companies are riskier but offer higher potential returns.

- Sector: High-growth sectors like technology and biotech often provide higher ROIs.

- Economic environment: During economic downturns, achieving a high ROI can be more challenging.

How to Calculate ROI in Venture Capital

Calculating ROI in venture capital involves understanding the initial investment, the exit value, and the time period of the investment.

- Initial investment: The amount of money invested in the startup.

- Exit value: The value of the investment at the time of exit, such as through an IPO or acquisition.

- Time period: The duration of the investment, which affects the annualized ROI.

Comparing ROI Across Different Investment Stages

ROI can vary significantly across different stages of investment, from seed rounds to late-stage funding.

- Seed rounds: Typically offer the highest potential ROI but come with the highest risk.

- Series A and B: These rounds offer a balanced risk-reward ratio, with moderate ROI expectations.

- Late-stage funding: Generally offers lower ROI but with significantly reduced risk.

The Role of Diversification in Achieving a Good ROI

Diversification is a key strategy for venture capitalists to achieve a good ROI while managing risk.

- Portfolio diversification: Investing in a variety of sectors and stages can mitigate risk.

- Geographic diversification: Expanding investments across different regions can provide stability.

- Time diversification: Staggering investments over time can help balance market fluctuations.

What is a good return for VC?

What is Considered a Good Return for Venture Capital?

A good return for venture capital (VC) typically depends on the stage of investment and the risk involved. Generally, VCs aim for a 10x return on their investments over a 5-10 year period. This is because:

- High-risk investments require higher returns to justify the potential losses.

- Early-stage investments often have a high failure rate, so successful exits need to compensate for the losses.

- VCs target unicorn companies (startups valued at $1 billion or more) to achieve outsized returns.

How Do VCs Measure Returns?

VCs measure returns using metrics like Internal Rate of Return (IRR) and Multiple on Invested Capital (MOIC). These metrics help assess the performance of their portfolio:

- IRR calculates the annualized return, factoring in the time value of money.

- MOIC measures the total return relative to the initial investment, without considering time.

- A 20-30% IRR is often considered strong for VC funds.

What Factors Influence VC Returns?

Several factors influence the returns a VC can achieve, including:

- Market conditions: A booming market can lead to higher valuations and exits.

- Portfolio diversification: Investing in a mix of industries and stages reduces risk.

- Exit opportunities: IPOs and acquisitions are critical for realizing returns.

What Are the Risks of VC Investments?

VC investments are inherently risky due to:

- High failure rates: Many startups fail to achieve profitability.

- Illiquidity: Investments are locked in for years before an exit.

- Market volatility: Economic downturns can impact valuations and exits.

How Do VCs Achieve High Returns?

VCs achieve high returns by:

- Identifying disruptive startups with high growth potential.

- Providing mentorship and resources to help startups scale.

- Timing exits strategically to maximize valuation.

What is the 80 20 rule in venture capital?

The 80/20 rule in venture capital, also known as the Pareto Principle, suggests that 80% of returns in a venture capital portfolio typically come from 20% of the investments. This principle highlights the uneven distribution of outcomes, where a small number of high-performing startups generate the majority of the profits, while the rest either break even or result in losses. Venture capitalists rely on this rule to focus their efforts on identifying and nurturing the most promising startups, as these outliers often drive the overall success of their funds.

Understanding the 80/20 Rule in Venture Capital

The 80/20 rule is a statistical observation that applies to various fields, including venture capital. In this context, it emphasizes the importance of high-impact investments.

- Uneven returns: Most venture capital funds experience a skewed distribution of returns, with a few investments delivering outsized gains.

- Risk management: VCs accept that many startups will fail, but the success of a few can compensate for losses elsewhere.

- Focus on outliers: Identifying and supporting potential unicorns (startups valued at over $1 billion) is critical to achieving high returns.

Why the 80/20 Rule Matters in Venture Capital

The 80/20 rule is crucial for venture capitalists because it shapes their investment strategy and decision-making process.

- Portfolio construction: VCs build diversified portfolios to increase the chances of including high-performing startups.

- Resource allocation: More time and capital are directed toward startups with the highest growth potential.

- Performance metrics: The rule helps VCs evaluate the success of their investments and refine their strategies over time.

How Venture Capitalists Apply the 80/20 Rule

Venture capitalists use the 80/20 rule to guide their actions and maximize returns.

- Deal sourcing: VCs focus on sourcing deals in industries or sectors with high growth potential.

- Due diligence: Extensive research is conducted to identify startups with the potential to become market leaders.

- Post-investment support: VCs provide mentorship, resources, and networking opportunities to help their top-performing startups succeed.

Challenges of the 80/20 Rule in Venture Capital

While the 80/20 rule is a useful guideline, it also presents challenges for venture capitalists.

- Identifying outliers: Predicting which startups will succeed is inherently uncertain and requires expertise.

- High competition: Top-tier startups often attract multiple investors, driving up valuations and reducing potential returns.

- Portfolio management: Balancing a portfolio to include both high-risk, high-reward startups and safer bets is complex.

Examples of the 80/20 Rule in Venture Capital

The 80/20 rule is evident in the success stories of many venture capital funds.

- Sequoia Capital: Investments in companies like Apple, Google, and WhatsApp have driven the majority of their returns.

- Andreessen Horowitz: Their stakes in Facebook, Airbnb, and Slack have been key to their portfolio performance.

- Accel Partners: Early investments in Facebook and Slack have significantly contributed to their overall success.

What is the average return of a VC?

What is the Average Return of a Venture Capital (VC) Fund?

The average return of a venture capital (VC) fund typically varies depending on the stage of investment, industry, and market conditions. Historically, top-performing VC funds have delivered an average annual return of around 20-30%, while the median return for the industry is closer to 10-15%. However, these figures can fluctuate significantly due to the high-risk nature of early-stage investments.

Factors Influencing VC Returns

Several factors influence the returns of a venture capital fund:

- Stage of Investment: Early-stage investments (seed or Series A) often yield higher returns but come with greater risk.

- Industry Trends: Sectors like technology and biotech tend to offer higher returns due to rapid innovation.

- Fund Management: The expertise and track record of the VC firm play a critical role in achieving above-average returns.

Historical Performance of VC Funds

Historically, VC funds have outperformed traditional asset classes like stocks and bonds over the long term. For example:

- Top-quartile VC funds have achieved IRRs (Internal Rates of Return) exceeding 25%.

- Median-performing funds often deliver returns in the range of 10-15%.

- Lower-performing funds may struggle to break even, especially in challenging economic conditions.

Risks Associated with VC Investments

Investing in venture capital carries significant risks, which can impact returns:

- High Failure Rates: Many startups fail, leading to a total loss of invested capital.

- Illiquidity: VC investments are typically locked in for 7-10 years, making them illiquid.

- Market Volatility: Economic downturns can severely affect startup valuations and exit opportunities.

How VC Returns Compare to Other Investments

When compared to other investment vehicles, VC returns can be both higher and more volatile:

- Public Markets: The S&P 500 has an average annual return of around 8-10%, significantly lower than top-performing VC funds.

- Private Equity: PE funds often deliver 12-15% returns, but with lower risk compared to VC.

- Real Estate: Real estate investments typically yield 6-8% annually, with more stable cash flows.

Key Metrics for Evaluating VC Returns

To assess the performance of a VC fund, investors rely on several key metrics:

- IRR (Internal Rate of Return): Measures the annualized return over the life of the investment.

- TVPI (Total Value to Paid-In): Indicates the total value returned relative to the capital invested.

- DPI (Distributions to Paid-In): Reflects the actual cash returned to investors.

Frequently Asked Questions (FAQs)

What is considered a good ROI in venture capital?

A good ROI in venture capital typically ranges between 20% to 30% annually, though this can vary depending on the stage of investment and the risk profile of the startups. Early-stage investments, which carry higher risk, often aim for even higher returns to compensate for the increased likelihood of failure. However, achieving such returns is challenging, as many startups fail, and only a small percentage generate outsized returns that drive the overall portfolio performance.

How does ROI in venture capital compare to other investment types?

Venture capital ROI is generally higher than traditional investments like stocks or bonds, but it also comes with significantly higher risk. While the stock market might offer an average annual return of around 7% to 10%, venture capital targets much higher returns due to the illiquid and high-risk nature of startup investments. However, the variability in returns is much greater, with some investments yielding 10x or more and others resulting in total losses.

What factors influence a good ROI in venture capital?

Several factors influence a good ROI in venture capital, including the quality of the startup team, the size of the market opportunity, the startup's business model, and the stage of investment. Additionally, the exit strategy (e.g., IPO or acquisition) and the overall economic environment play significant roles. Diversification across multiple startups is also crucial, as it helps mitigate the risk of any single investment failing.

Why is ROI in venture capital so variable?

ROI in venture capital is highly variable because it depends on the success or failure of individual startups. Most startups fail, and only a small percentage achieve significant growth or successful exits. This power law distribution means that a few high-performing investments can generate the majority of returns for a venture capital fund, while many others may result in losses. This variability makes venture capital a high-risk, high-reward asset class.

Leave a Reply

Our Recommended Articles